LG Electronics Bundle

Can LG Electronics Redefine Its Future?

LG Electronics is undergoing a significant transformation, shifting its focus toward business-to-business (B2B) operations, particularly in high-growth sectors like automotive components and HVAC systems. This strategic pivot aims to bolster its structural competitiveness and drive qualitative growth beyond its traditional consumer electronics base. From its origins as GoldStar in 1958, the company has evolved into a global leader.

With a record revenue of 87.73 trillion South Korean won in 2024, and B2B already accounting for 35%, LG's LG Electronics SWOT Analysis reveals a dynamic landscape. The company's commitment to innovation and sustainability, developing technologies that enhance people's lives and reduce environmental impact, underpins its strategic direction. As LG navigates the ever-changing consumer electronics market, its future prospects hinge on continued expansion, innovation, and strategic planning.

How Is LG Electronics Expanding Its Reach?

LG Electronics is actively pursuing significant expansion initiatives to drive future growth, focusing on diversifying its business model beyond traditional consumer electronics. The company is strategically shifting towards high-growth B2B sectors, aiming to increase B2B sales and revenue significantly. This strategic pivot is central to LG's long-term vision, aiming to capture new market opportunities and enhance its overall financial performance.

A key aspect of LG's growth strategy involves accelerating its expansion in the B2B market. The company aims for B2B sales to exceed 20 trillion South Korean won (approximately $14.6 billion USD) in 2025 and to account for 45% of total revenue by 2030, up from 35% in 2024. This aggressive target highlights LG's commitment to becoming a major player in various business-to-business segments, including vehicle components, HVAC, and platform-based services. This diversification is designed to reduce reliance on the volatile consumer electronics market and create more stable revenue streams.

LG's expansion plans include strategic investments in emerging technologies and services, such as AI and smart home solutions. These initiatives are designed to enhance its product portfolio and create new revenue streams. By focusing on innovation and strategic partnerships, LG aims to strengthen its market position and achieve sustainable growth in the long term. For more insights on the company's marketing approach, you can explore the Marketing Strategy of LG Electronics.

The VS division achieved its best-ever quarterly results in Q1 2025, with revenue reaching 2.84 trillion won and an operating profit of 125.1 billion won. This success is backed by a substantial order backlog worth 100 trillion won, indicating strong future growth potential. The VS division provides in-vehicle infotainment systems, EV powertrains, and connectivity modules.

Managed under the new LG Eco Solution Company, this business is expanding rapidly, offering energy-efficient systems for residential and commercial use, and electric heating solutions. LG aims for over 60% growth in the U.S. B2B market for home appliances this year. LG leverages its product portfolio across home appliances and HVAC systems to provide comprehensive space solutions.

Revenue from subscription services rose over 75% year-over-year in 2024, approaching KRW 2 trillion. LG aims to triple this figure by 2030, intending for platform-based services to account for 20% of total operating profit. This growth is driven by the webOS smart TV operating system and subscription services.

LG is expanding its on-site care services to India, Singapore, and Hong Kong, building on successful launches in Malaysia, Thailand, and Taiwan. The company acquired an 80% stake in Homey, an app-based home automation solutions provider, in July 2024, and a controlling 51% stake in Bear Robotics, an AI-driven autonomous service robot startup, in January 2025, to strengthen its presence in robotics.

LG's expansion initiatives focus on several key areas to drive future growth and diversify its business. These initiatives include strategic investments in high-growth B2B sectors, platform-based services, and emerging technologies like robotics and AI. These strategic moves are designed to create new revenue streams and reduce reliance on the volatile consumer electronics market.

- Vehicle Component Solutions (VS) division, focusing on in-vehicle infotainment and EV components.

- HVAC business, expanding with energy-efficient systems and electric heating solutions.

- Platform-based services, particularly through webOS and subscription offerings.

- Expansion of on-site care services and investment in robotics and AI.

LG Electronics SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does LG Electronics Invest in Innovation?

LG Electronics is heavily invested in innovation and technology to fuel its growth strategy and secure its future prospects. The company's approach involves significant investments in research and development, digital transformation, and the integration of cutting-edge technologies across its diverse product portfolio. This strategic focus is designed to enhance its competitiveness in the consumer electronics market and beyond.

The company is strategically revamping its R&D efforts, with a substantial portion of its advanced R&D dedicated to strategic business technologies and future fields, including quantum computing. This forward-thinking approach underscores LG's commitment to staying at the forefront of technological advancements. LG is committed to investing over KRW 50 trillion by 2030 to secure qualitative growth and future business competitiveness.

A core element of LG's innovation strategy revolves around AI, IoT, and sustainability. The company is making substantial investments in AI-driven HVAC technologies and smart energy platforms, which are central to its strategy in the industrial landscape. These investments reflect LG's commitment to developing innovative solutions that meet evolving consumer needs while promoting environmental sustainability.

LG is transforming its webOS platform into an AI-powered ecosystem. This expansion goes beyond smart TVs to include IT products, vehicle infotainment systems, and AI-powered Digital Out of Home (DOOH) solutions. The goal is to create an 'integrated media advertising platform' to deliver diverse content experiences.

LG continues to lead in the OLED TV market, holding a dominant 52.4% global market share in 2024. These TVs are enhanced with AI-driven personalization and advanced audiovisual innovations, including wireless high-definition video transmission and improved display brightness in its latest 'LG OLED Evo' models.

Following its acquisition of a majority stake in Bear Robotics in January 2025, LG plans to integrate Bear Robotics' AI-driven indoor delivery robots with its 'LG CLOi Robots'. This expansion aims to broaden its commercial, home, and industrial robot solutions. LG also aims to leverage its AI expertise to create an integrated robotics software platform.

LG is focusing on developing software-defined vehicle capabilities for its Vehicle component Solutions (VS) Company, which achieved $8 billion in annual sales in 2024. This strategic move highlights LG's commitment to the automotive industry and its ability to adapt to evolving market demands.

LG's commitment to sustainability is evident through its 'Life's Good Deeds' initiative, which focuses on uplifting communities and championing environmental sustainability. This initiative reflects LG's broader commitment to corporate social responsibility and its efforts to make a positive impact on the world.

LG is allocating over 75% of its advanced R&D efforts to strategic business technologies and future fields, including quantum computing. This significant investment underscores the company's dedication to innovation and its long-term growth potential. For more insights into the company's core values, explore the Mission, Vision & Core Values of LG Electronics.

LG Electronics PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is LG Electronics’s Growth Forecast?

The financial outlook for LG Electronics is promising, driven by strategic shifts towards high-growth sectors and platform-based services. The company is focusing on expanding its presence in the B2B market and growing its platform-based service offerings. This strategic direction is expected to fuel significant revenue and profit growth in the coming years, solidifying its position in the consumer electronics market and beyond.

In 2024, LG reported a record annual revenue of 87.73 trillion South Korean won (approximately $66.7 billion USD). The company's B2B operations accounted for 35% of this total, with a target to increase this share to 45% by 2030. This expansion into B2B markets, along with the growth in platform services, is a key component of its long-term strategy.

LG's commitment to innovation and its focus on high-growth areas position it well for future success. For a deeper understanding of the company's origins and evolution, you can explore the Brief History of LG Electronics.

For 2025, LG Electronics expects its B2B sales to exceed 20 trillion South Korean won (approximately $14.6 billion USD). The Vehicle component Solutions (VS) division is a key driver, with a significant order backlog.

The VS division posted its best-ever quarterly results in Q1 2025, with revenue of 2.84 trillion won and an operating profit of 125.1 billion won. The order backlog is worth 100 trillion won.

The HVAC business, now managed by the LG Eco Solution Company, is projected to expand rapidly. This expansion is expected to contribute significantly to overall profitability.

Revenue from subscription services rose over 75% year-over-year in 2024, nearing KRW 2 trillion. LG aims to more than triple this figure by 2030.

The webOS-based advertising and content business exceeded its KRW 1 trillion revenue target in 2024. This segment is a key part of LG's platform-based service strategy.

LG aims for its platform-based services to account for 20% of its total operating profit by 2030. This highlights the importance of these services in the company's future.

In Q1 2025, LG Electronics announced consolidated revenue of KRW 22.74 trillion, its highest-ever first-quarter revenue. Operating profit was KRW 1.26 trillion.

Q1 2025 marked the sixth consecutive year operating profit surpassed KRW 1 trillion. This demonstrates a consistent ability to generate profits.

Overall operating profit in 2024 declined by 6.4% on-year to 3.42 trillion won. Net income decreased by 48.6% on-year to 591.4 billion won.

LG plans to invest more than KRW 50 trillion by 2030. This investment is aimed at securing qualitative growth and future business competitiveness.

LG Electronics Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow LG Electronics’s Growth?

The path forward for LG Electronics, a key player in the consumer electronics market, is not without its hurdles. Understanding these potential risks and obstacles is crucial for assessing the company's long-term growth potential and its ability to navigate the competitive landscape. Several factors could impact the company's strategic goals and financial performance.

One major challenge is the intensifying competition within the consumer electronics market, particularly in the premium TV segment. While LG has demonstrated strength in the OLED TV market, holding a 52.4% global market share in 2024, competitors are actively increasing their presence and integrating advanced technologies. Moreover, regulatory changes and geopolitical tensions pose further risks, potentially affecting global market recovery and trade policies. These challenges require careful consideration and proactive strategies.

Technological disruption and internal resource constraints also present significant obstacles. Rapid advancements in AI and other cutting-edge technologies necessitate continuous R&D investment and agile adaptation. Internal resource constraints, such as the need for skilled talent in emerging fields like AI and robotics, could also be an obstacle. To mitigate these risks, LG is focusing on business portfolio innovation and strengthening structural competitiveness.

Competitors like Samsung are expanding their OLED lineups and integrating AI. Chinese companies are increasing their presence in the LCD market with competitively priced offerings. This shift in the competitive landscape demands continuous innovation and strategic adaptation from LG Electronics.

Prolonged delays in global market recovery and shifts in trade policies pose emerging risks. Supply chain vulnerabilities, inherent in global manufacturing, could impact production and delivery. These factors can directly influence the company's operational efficiency and market access.

Rapid advancements in AI and other technologies require continuous R&D investment. LG is revamping its R&D portfolio, focusing over 75% on strategic business technologies. Keeping pace with technological changes is critical for maintaining a competitive edge.

The need for skilled talent in areas like AI and robotics could be an obstacle. LG is addressing this through acquisitions like Bear Robotics and by seeking top industry talent. This highlights the importance of strategic talent acquisition for future growth.

Supply chain disruptions can significantly impact production and delivery timelines. Mitigating these risks requires robust supply chain management strategies. This is a crucial factor for ensuring operational stability.

Economic recessions can lead to decreased consumer spending on discretionary items like electronics. This can negatively affect sales and profitability. Diversifying product offerings and markets can help mitigate the impact.

Focus on business portfolio innovation and diversify revenue streams. Strengthen structural competitiveness through a new CEO-led review system. Expand into B2B and platform-based services. These efforts are aimed at enhancing resilience and driving sustainable growth.

The consumer electronics market is highly competitive, with major players like Samsung and emerging Chinese brands. LG must consistently innovate and adapt to maintain its market share and profitability. Understanding the competitive dynamics is essential for strategic planning.

The global economy's performance directly influences consumer spending and market demand. Economic downturns can lead to decreased sales. LG must be prepared to navigate economic fluctuations. For further insights into LG Electronics' performance, check out the analysis for Owners & Shareholders of LG Electronics.

Continuous investment in R&D is critical for staying ahead in the rapidly evolving tech landscape. LG's focus on AI, quantum computing, and other future fields is a strategic response to technological disruption. Innovation drives product differentiation and market competitiveness.

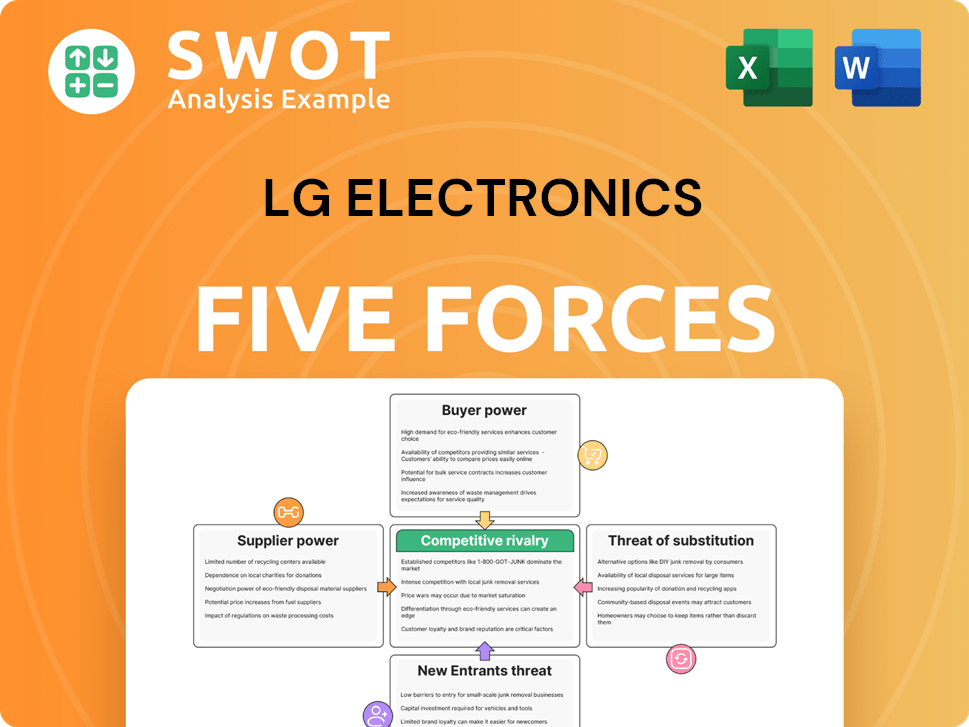

LG Electronics Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of LG Electronics Company?

- What is Competitive Landscape of LG Electronics Company?

- How Does LG Electronics Company Work?

- What is Sales and Marketing Strategy of LG Electronics Company?

- What is Brief History of LG Electronics Company?

- Who Owns LG Electronics Company?

- What is Customer Demographics and Target Market of LG Electronics Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.