Merz Pharma GmbH & Co. KGaA Bundle

Can Merz Pharma Continue Its Century-Long Legacy of Innovation and Growth?

Founded in 1908, Merz Pharma GmbH & Co. KGaA has a rich history of pioneering advancements in healthcare, particularly in aesthetics and neurotoxin therapies. The company's recent FDA approval of XEOMIN marks a significant milestone, strengthening its position in a rapidly expanding market. This report dives into the Merz Pharma GmbH & Co. KGaA SWOT Analysis to explore its growth strategy and future prospects.

As a leading Pharmaceutical Company, Merz Pharma is navigating a dynamic landscape, with substantial opportunities in aesthetics and neurotoxin treatments. The company's commitment to business development and strategic investments are crucial for sustaining its competitive edge. This analysis will explore Merz Pharma's market share, competitive landscape, and the potential impact of its innovative therapies and treatments on its long-term growth prospects, offering valuable insights for investors and industry professionals.

How Is Merz Pharma GmbH & Co. KGaA Expanding Its Reach?

Merz Pharma's Growth Strategy is significantly driven by its expansion initiatives, focusing on entering new markets, launching innovative products, and pursuing strategic mergers and acquisitions. The company, a significant player in the Pharmaceutical Company sector, is actively working to strengthen its market position and broaden its portfolio.

One of the key strategies for Merz Pharma Future includes strategic acquisitions to expand its product offerings and market reach. These initiatives are supported by substantial financial investments aimed at fostering long-term growth and market leadership. The company's approach is multifaceted, encompassing both organic growth through new product launches and inorganic growth via acquisitions.

In April 2024, Merz Therapeutics, a business of the Merz Group, entered into an Asset Purchase Agreement to acquire two commercial medicines from NASDAQ-listed Acorda Therapeutics for USD 185 million. This acquisition, completed in July 2024, included INBRIJA (levodopa inhalation powder) for Parkinson's disease and (F)AMPYRA (fampridine) for multiple sclerosis, significantly expanding Merz Therapeutics' specialty neurology portfolio and strengthening its market position in North America. This move is expected to immediately add to topline revenue, with the U.S. business forecasted to contribute over 75% of these products' total global revenues in the next decade.

The acquisition of INBRIJA and (F)AMPYRA from Acorda Therapeutics in July 2024 was a strategic move to bolster Merz Therapeutics' neurology portfolio. This acquisition not only expanded its product offerings but also strengthened its presence in the North American market. The deal is expected to yield immediate revenue gains.

Merz is actively expanding its product portfolio through new launches and approvals. In July 2024, Merz Aesthetics received FDA approval for XEOMIN for the simultaneous treatment of upper facial lines. The company also plans to launch new products in January 2025, anticipating a dynamic year with many new products.

Merz is focusing on international distribution to strengthen its global commercial infrastructure. This includes exploring further clinical development and extended indications for its newly acquired assets to broaden patient access and reinforce market leadership. The company aims to increase its global footprint.

The company's expansion includes a focus on international distribution and strengthening its global commercial infrastructure. Merz Therapeutics is also exploring further clinical development and extended indications for its newly acquired assets. The company's expansion also includes a focus on international distribution and strengthening its global commercial infrastructure.

Merz Pharma's Business Development strategy involves a combination of acquisitions, product launches, and market expansion. The company is focused on both organic and inorganic growth to enhance its market position. The company's commitment to innovation and strategic investments positions it for sustained growth.

- Acquisitions: Strategic acquisitions to expand the product portfolio, exemplified by the Acorda Therapeutics deal.

- Product Launches: Continuous introduction of new products, such as XEOMIN, and pipeline development.

- Market Expansion: Strengthening global commercial infrastructure and international distribution.

- Research and Development: Focus on clinical development and extended indications for acquired assets.

For more insights into the target market, explore Target Market of Merz Pharma GmbH & Co. KGaA.

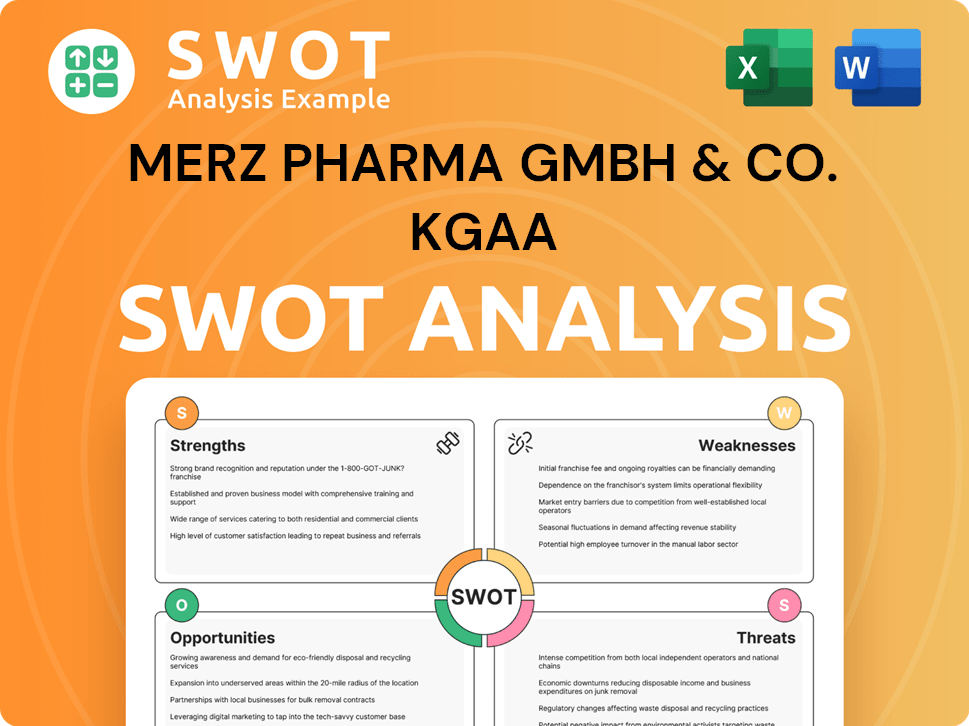

Merz Pharma GmbH & Co. KGaA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Merz Pharma GmbH & Co. KGaA Invest in Innovation?

The company's Growth Strategy is significantly driven by innovation and technological advancements. This approach is crucial for a Pharmaceutical Company like Merz Pharma to maintain its competitive edge and expand its market presence. The emphasis on research and development (R&D) and strategic partnerships underlines its commitment to future growth.

Merz Pharma's innovation strategy involves substantial investments and a focus on both internal development and external collaborations. This dual approach allows the company to explore new avenues for growth, particularly in areas like neurotoxins, combination products, and the application of artificial intelligence (AI) in diagnostics. The company's commitment to digital transformation and patient-centric solutions further demonstrates its forward-thinking approach.

The company's commitment to R&D is evident in its consistent reinvestment of a significant portion of its annual sales. This investment strategy has enabled the development and launch of key products. The opening of additional innovation centers and strategic collaborations further strengthens the company's ability to innovate and bring new products to market.

Merz Pharma allocates approximately 15-20% of its annual sales to R&D. This significant investment underscores the company's dedication to innovation and the development of new products.

Successful product launches have been a direct result of its R&D investments. These include products like Xeomin, Ulthera, Belotero, and Radiesse, which have contributed to the company's growth.

Merz Pharma has expanded its R&D footprint with an additional innovation center in Raleigh, USA, complementing its existing center in Frankfurt, Germany. This expansion supports its medical device R&D efforts.

The launch of iFlexo by Merz Therapeutics in November 2024, a digital solution developed in collaboration with S3 Connected Health, demonstrates its commitment to digital transformation. This platform supports rehabilitation for patients with post-stroke spasticity.

Merz Pharma is exploring the potential of artificial intelligence (AI) in diagnostics and other areas. This focus on advanced technologies positions the company for future innovations.

Collaborations, such as the one with S3 Connected Health for iFlexo, are a key part of Merz Pharma's innovation strategy. These partnerships enable the company to leverage external expertise and accelerate product development.

The Future of Merz Pharma in aesthetic medicine and other therapeutic areas will depend on its ability to sustain its innovation pipeline and adapt to emerging market trends. Recent initiatives, such as the iFlexo platform, highlight the company's commitment to improving patient outcomes through technology. The company’s strategic investments and acquisitions will play a crucial role in its long-term growth prospects. For a deeper dive into the company's strategies, you can read more about its Growth Strategy in this article.

Merz Pharma employs several key strategies to drive growth and maintain its competitive position.

- R&D Focus: Continuous investment in research and development to create new products and improve existing ones.

- Strategic Collaborations: Partnerships with other companies to leverage expertise and accelerate product development.

- Digital Transformation: Adoption of digital technologies, such as the iFlexo platform, to enhance patient care and improve treatment outcomes.

- Global Expansion: Extending its market reach through strategic investments and acquisitions.

- Product Pipeline Expansion: Developing and launching new products across various therapeutic areas.

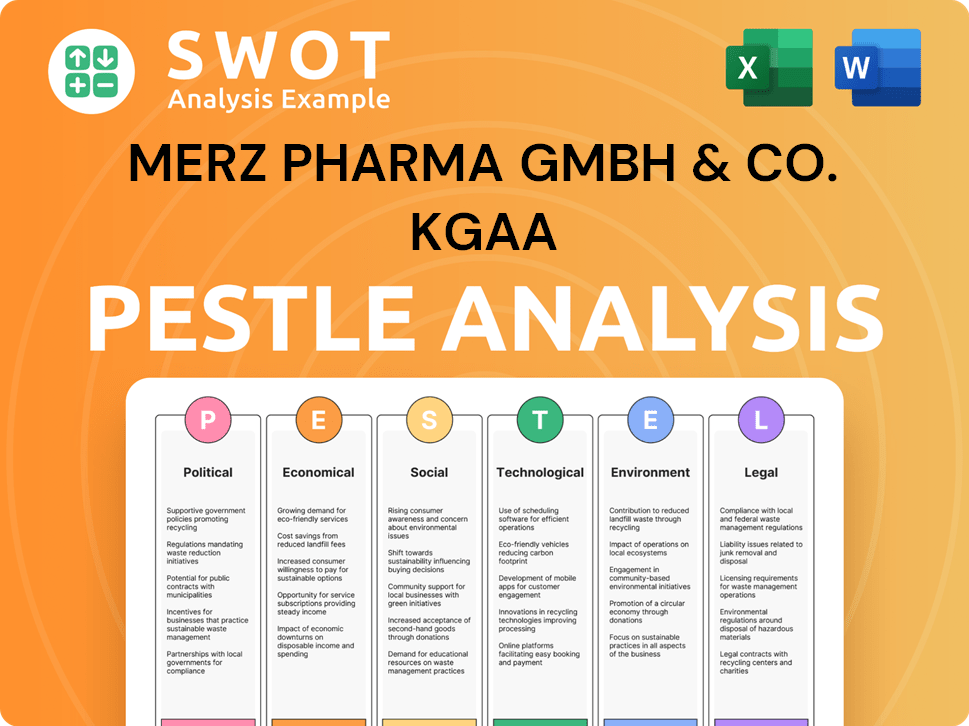

Merz Pharma GmbH & Co. KGaA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Merz Pharma GmbH & Co. KGaA’s Growth Forecast?

The financial outlook for Merz Pharma GmbH & Co. KGaA is promising, driven by its strategic positioning in high-growth markets and a commitment to innovation. While the company's financial details are not publicly available, an analysis of its market segments and strategic moves provides insight into its potential financial performance. The company's focus on aesthetic medicine and neurotoxins, coupled with strategic acquisitions, suggests a trajectory of sustained growth.

The global market for botulinum toxin, a key product for Merz, is expected to experience significant expansion. The market was valued at USD 12.24 billion in 2024 and is forecasted to reach USD 30.59 billion by 2034, with a compound annual growth rate (CAGR) of 9.84%. Similarly, the facial injectables market, where Merz is a significant player, is projected to grow from USD 8.93 billion in 2023 to USD 17.24 billion by 2032, with a CAGR of 7.7%. These market trends indicate substantial opportunities for Merz to increase its revenue and market share.

Merz's strategic investments also play a crucial role in its financial outlook. The acquisition of INBRIJA and (F)AMPYRA for USD 185 million in July 2024 is expected to immediately boost revenue. The U.S. business from this acquisition is projected to contribute over 75% of the total global revenues for these products over the next decade. Furthermore, Merz's consistent investment in research and development, allocating 15-20% of its annual sales, underscores its commitment to developing new products and expanding its portfolio, which is crucial for long-term financial success. For more insights into the company's foundational principles, consider reading about the Mission, Vision & Core Values of Merz Pharma GmbH & Co. KGaA.

The aesthetic medicine market, a core area for Merz, is experiencing rapid growth. The facial injectables market is expected to reach USD 17.24 billion by 2032. This expansion presents significant opportunities for Merz to increase its revenue and market share, driven by increasing consumer demand for aesthetic procedures.

Merz's acquisition of INBRIJA and (F)AMPYRA for USD 185 million in July 2024 is a key strategic move. This acquisition is projected to add to the company's revenue immediately. The U.S. business from this acquisition is expected to contribute over 75% of the total global revenues for these products over the next decade, demonstrating the importance of strategic investments in Merz's growth strategy.

Merz's commitment to research and development is a critical factor in its future financial performance. The company reinvests 15-20% of its annual sales into R&D. This investment supports the development of new products and therapies, ensuring a robust pipeline for future revenue generation and sustainable growth within the pharmaceutical company.

The global market for botulinum toxin is projected to reach USD 30.59 billion by 2034. This growth, coupled with the expansion of the facial injectables market, offers significant opportunities for Merz to expand its global presence. The company's strategic investments and product development initiatives are designed to capitalize on these market trends.

Merz's financial strategy includes strategic investments and consistent R&D spending. The company's proactive approach, including its third transaction in the U.S. in just over 10 years, supports its growth objectives. These strategies are designed to drive long-term financial performance and enhance its competitive position.

The acquisition of INBRIJA and (F)AMPYRA is expected to immediately add to Merz's topline revenue. The U.S. business from this acquisition is forecasted to contribute over 75% of the total global revenues for these products over the next decade. This revenue growth, combined with market expansion, supports a positive financial outlook for Merz.

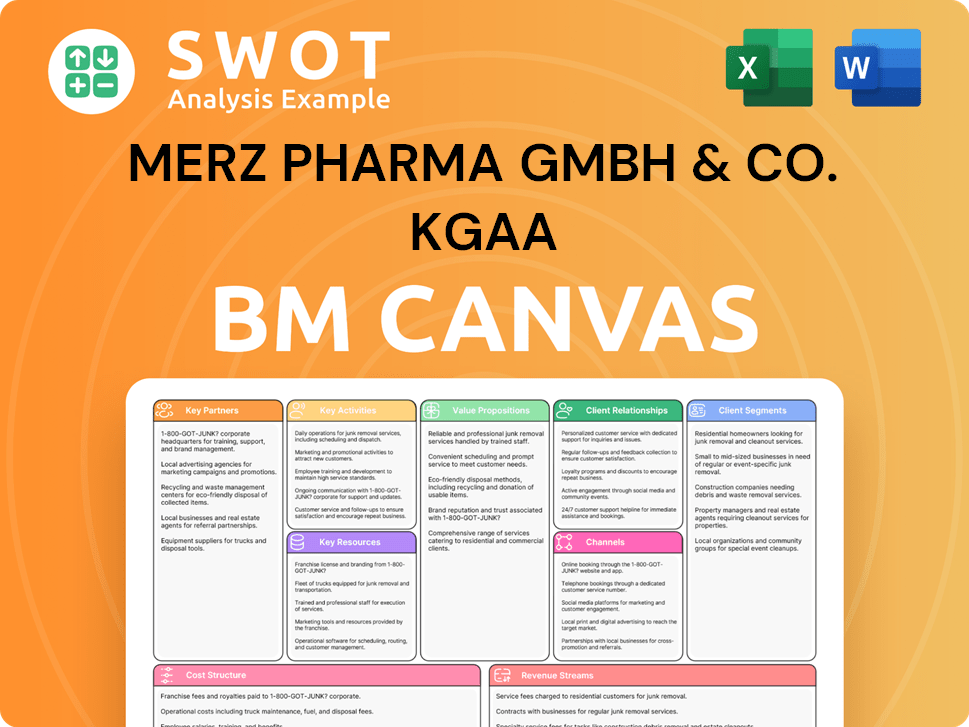

Merz Pharma GmbH & Co. KGaA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Merz Pharma GmbH & Co. KGaA’s Growth?

Navigating the complexities of the pharmaceutical and aesthetics markets, Merz Pharma faces various potential risks and obstacles that could influence its growth trajectory. These challenges span from intense competition and regulatory shifts to technological disruptions and internal resource constraints. Understanding these potential pitfalls is crucial for assessing Merz Pharma's future prospects and its ability to achieve sustainable growth.

The dynamic nature of the pharmaceutical industry, especially within aesthetic medicine, means that Merz Pharma must proactively address these risks. The company's strategic responses, including diversification and partnerships, are vital for mitigating potential negative impacts. These proactive measures are essential for maintaining a competitive edge and ensuring long-term success in a rapidly evolving market.

Market competition poses a significant challenge for Merz Pharma. The botulinum toxin market, for instance, is highly competitive, with established players like AbbVie (Allergan Aesthetics), and emerging firms vying for market share. The increasing demand for non-surgical cosmetic procedures further intensifies this competition. Merz Pharma's ability to differentiate its products and maintain a strong market position is crucial for its growth strategy.

Stricter regulations, particularly in regions like the UK, could increase compliance costs. These changes might also affect consumer prices. Merz Pharma needs to carefully manage these regulatory risks to maintain profitability and market access.

Global events can disrupt product availability. This can lead to shortages and impact customer satisfaction. Merz Pharma must build resilient supply chains to mitigate these risks effectively.

Advancements in aesthetic treatments and digital health solutions continuously reshape the industry. Investing in digital transformation and exploring AI applications is essential. The pace of technological change requires continuous adaptation and investment.

Constraints in workforce and infrastructure for digital health initiatives could hinder the adoption of new technologies. Addressing these limitations is critical for driving innovation and maintaining a competitive edge. Strategic allocation of resources is key to overcoming these challenges.

The aesthetic injectables market is highly competitive, with many firms vying for market share. The increasing demand for non-surgical cosmetic procedures intensifies competition. Merz Pharma needs to differentiate its products to maintain a strong market position.

Merz Pharma addresses these risks through portfolio diversification, such as its expansion into neurology. Strategic partnerships, like the collaboration between Merz Therapeutics and S3 Connected Health for the iFlexo app, help navigate digital health challenges. These strategies are crucial for long-term growth.

The botulinum toxin and aesthetic injectables markets are dominated by key competitors like AbbVie (Allergan Aesthetics), Ipsen Pharma, Galderma, Medytox, and Evolus. These companies continuously innovate and compete for market share. Merz Pharma must closely monitor these competitors and adapt its strategies to maintain a competitive edge.

Merz Therapeutics' collaboration with S3 Connected Health for the iFlexo app demonstrates its approach to navigating digital health challenges. This partnership highlights Merz Pharma's commitment to innovation and its efforts to integrate digital solutions into its product offerings. These initiatives are vital for future growth.

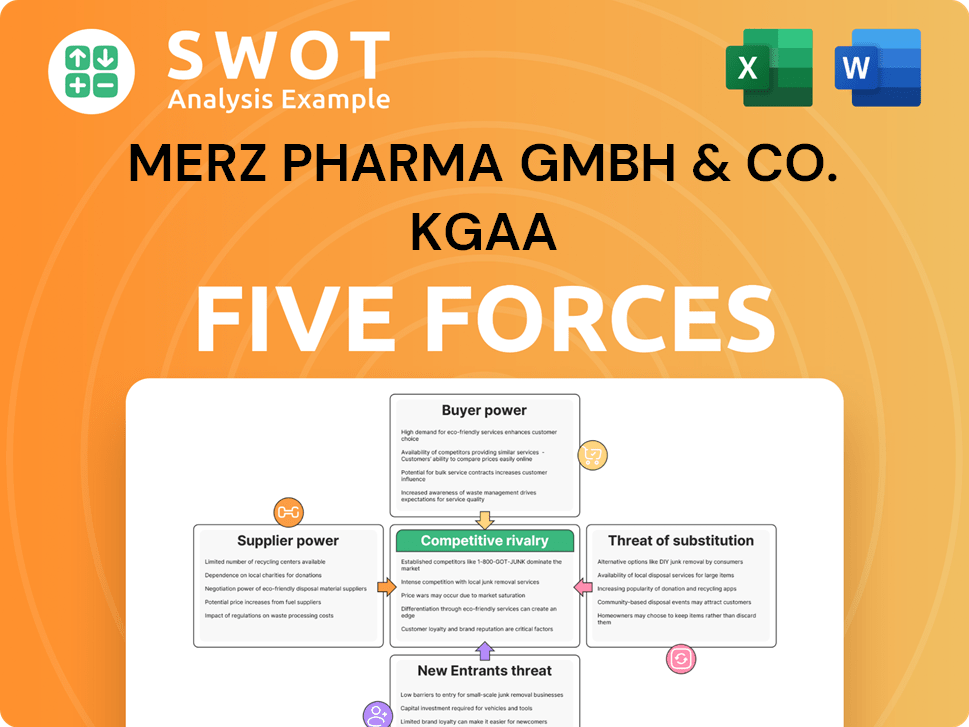

Merz Pharma GmbH & Co. KGaA Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Merz Pharma GmbH & Co. KGaA Company?

- What is Competitive Landscape of Merz Pharma GmbH & Co. KGaA Company?

- How Does Merz Pharma GmbH & Co. KGaA Company Work?

- What is Sales and Marketing Strategy of Merz Pharma GmbH & Co. KGaA Company?

- What is Brief History of Merz Pharma GmbH & Co. KGaA Company?

- Who Owns Merz Pharma GmbH & Co. KGaA Company?

- What is Customer Demographics and Target Market of Merz Pharma GmbH & Co. KGaA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.