Merz Pharma GmbH & Co. KGaA Bundle

How Does Merz Pharma GmbH & Co. KGaA Thrive in the Healthcare Industry?

Merz Pharma GmbH & Co. KGaA, a global pharmaceutical company with over a century of experience, is a major player in aesthetics and neurotoxins. From its inception in 1908, Merz has grown into a global leader, constantly innovating and prioritizing patient well-being. Its strategic focus spans aesthetic medicine, neurology, and consumer care, demonstrating a broad impact across the healthcare spectrum.

To truly grasp the company's potential, one must understand Merz Pharma GmbH & Co. KGaA SWOT Analysis. With a significant global presence and a robust investment in research and development, understanding How Merz Pharma Works and how it generates revenue is key. This analysis will explore the Merz Business Model, providing insights into its sustained growth and competitive strategies within the dynamic pharmaceutical landscape.

What Are the Key Operations Driving Merz Pharma GmbH & Co. KGaA’s Success?

Merz Pharma GmbH & Co. KGaA operates through three main divisions: Merz Aesthetics, Merz Therapeutics, and Merz Lifecare. This structure allows the company to focus on specific areas, including aesthetic medicine, neurological disorders, and consumer health and wellness. The company's value proposition centers on providing innovative products and solutions that improve patients' quality of life and well-being.

The core of How Merz Pharma Works involves a combination of research and development, manufacturing, and distribution. They invest heavily in R&D to create new products and improve existing ones. Their manufacturing processes are designed to meet growing global demand, particularly for products like botulinum neurotoxin-based treatments. Distribution networks ensure that their products reach healthcare professionals and consumers worldwide.

Merz Pharma focuses on creating and delivering value through its specialized divisions. Its strategy includes in-house research and development, strategic partnerships, and a strong focus on customer benefits. Their products are clinically proven, high-quality, and scientifically backed. The company's commitment to innovation and quality supports its position in the pharmaceutical industry.

Merz Aesthetics offers a wide range of products for aesthetic medicine, including dermal fillers and neurotoxins. These products are designed to address skin aging and improve patient confidence. The division focuses on minimally invasive and non-invasive treatments.

Merz Therapeutics concentrates on treating neurological disorders, with a focus on movement disorders. Their core product in this area is a highly purified botulinum neurotoxin. The R&D team includes 150 colleagues from nine nations working on innovative therapeutic solutions.

Merz Lifecare supports healthy living with products like tetesept, Merz Spezial, and Brooklyn Soap Company. It covers health, well-being, body care, and natural beauty. This division focuses on consumer health and wellness products.

Merz emphasizes in-house research and development to stay competitive and develop new products. They are expanding their production capacity for botulinum neurotoxin-based products. Strategic partnerships also play a key role in their operations.

Merz Pharma's operations are supported by robust manufacturing, technology development, and extensive distribution networks. The company focuses on in-house research and development, as well as strategic partnerships. These elements contribute to the company's ability to create and deliver value.

- Manufacturing Expansion: Significant investment in production capacity to meet growing demand.

- R&D Focus: A dedicated R&D team working on innovative therapeutic solutions.

- Strategic Partnerships: Collaborations to expand treatment options and innovation.

- Customer Benefits: Clinically proven, high-quality products.

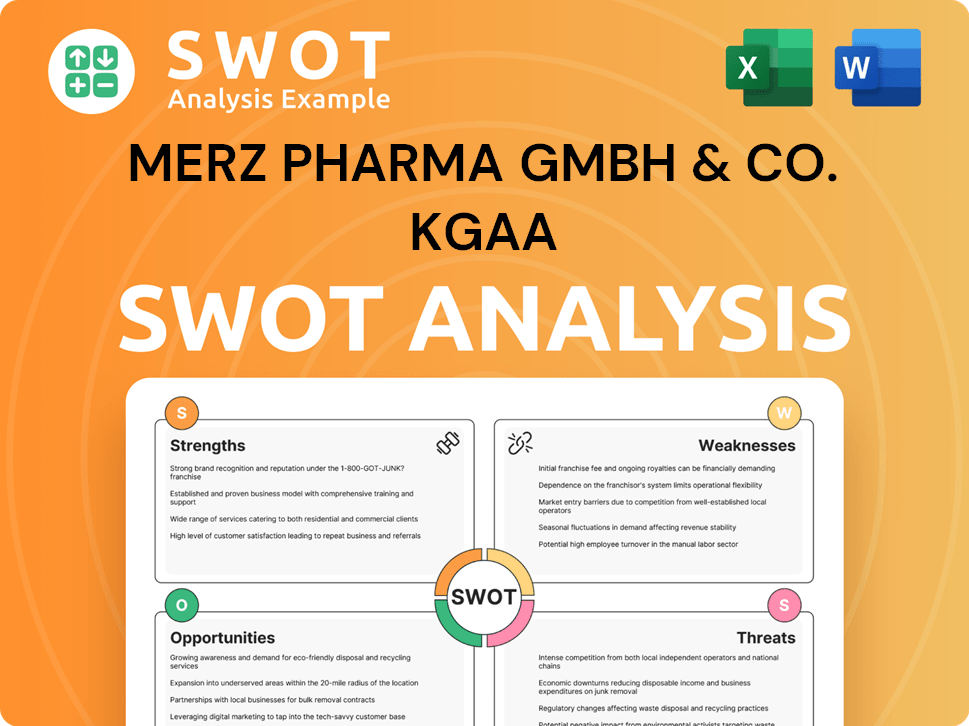

Merz Pharma GmbH & Co. KGaA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Merz Pharma GmbH & Co. KGaA Make Money?

The revenue streams and monetization strategies of Merz Pharma GmbH & Co. KGaA are centered around its core business segments: Merz Aesthetics, Merz Therapeutics, and Merz Lifecare. As a privately held Pharmaceutical Company, specific financial figures for 2024 or 2025 are not publicly available. However, the company's strategic focus on aesthetics and neurotoxins significantly contributes to its overall revenue.

Merz Pharma generates revenue primarily through direct product sales and strategic partnerships. The company's approach includes a focus on expanding into new markets and making strategic acquisitions to enhance its portfolio and market reach. This strategy is designed to secure future revenue streams and maintain a competitive edge in the pharmaceutical and medical aesthetics industries.

Merz Pharma operates within substantial markets. The global botulinum toxin market was valued at around $6.4 billion in 2024, while the global aesthetic devices market was at $17.7 billion in the same year. Furthermore, the global aesthetics market was valued at approximately $126.6 billion in 2024 and is projected to grow at a CAGR of 14.5% from 2024 to 2030.

Merz Pharma utilizes a multifaceted approach to generate revenue through its Merz Products. Key strategies include direct sales of products like Xeomin®, Ultherapy PRIME®, Radiesse®, and Belotero®. The company also employs licensing agreements, though these have decreased, with the aim to offset this through increased product sales. To learn more about the company's growth strategies, you can read the article: Growth Strategy of Merz Pharma GmbH & Co. KGaA.

- Direct Product Sales: Revenue from key products such as Xeomin®, Ultherapy PRIME®, Radiesse®, and Belotero®.

- Licensing Agreements: Although income from licensing has decreased, the company aims to offset this through increased product sales.

- Strategic Acquisitions: Acquisitions, such as the 2024 purchase of assets from a US-based biotech company and asset purchases to enhance Parkinson's disease treatments, expand the portfolio and market reach.

- Market Expansion: Entry into new markets to increase revenue streams.

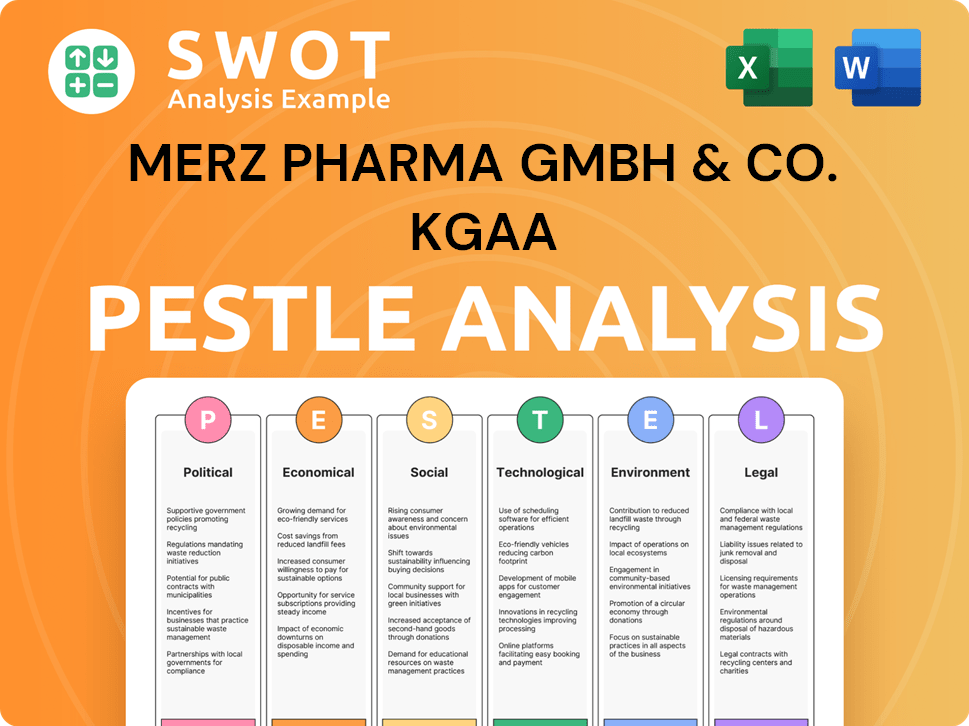

Merz Pharma GmbH & Co. KGaA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Merz Pharma GmbH & Co. KGaA’s Business Model?

The journey of Merz Pharma GmbH & Co. KGaA, a prominent Pharmaceutical Company, has been shaped by significant milestones and strategic decisions. A pivotal shift occurred around 2014, with a strategic focus on Aesthetics and Neurotoxins to drive growth, which successfully offset declining royalties. This strategic realignment involved expanding its product portfolio and concentrating on high-growth business areas, demonstrating the company's adaptability and forward-thinking approach.

In 2020, Merz restructured, establishing three independent businesses: Merz Aesthetics, Merz Therapeutics, and Merz Consumer Care (now Merz Lifecare). This reorganization aimed for specialized customer focus and increased operational agility. These moves reflect Merz's commitment to innovation, market responsiveness, and strategic growth. The company's ability to adapt to market changes and capitalize on emerging opportunities has been crucial to its sustained success.

Recent strategic initiatives include a generational transition in shareholder leadership in January 2025, ensuring continuity for the family-owned Merz Group. In April 2024, Merz entered an asset purchase agreement with a US-based biotech company, marking its second investment in a NASDAQ company in just over a decade. These actions highlight Merz's commitment to long-term growth and innovation within the pharmaceutical and aesthetics sectors.

Key milestones include the strategic shift towards Aesthetics and Neurotoxins around 2014 and the restructuring into three independent businesses in 2020. These moves reflect Merz's ability to adapt to market dynamics and focus on high-growth areas.

Recent strategic moves include the generational transition of shareholder leadership in January 2025 and an asset purchase agreement with a US-based biotech company in April 2024. Merz Therapeutics expanded its neurology portfolio through acquisitions.

Merz's competitive advantages stem from its strong R&D focus, with approximately 15% of sales allocated to R&D in 2024. This commitment fuels the development of new products and maintains a robust pipeline, with 30 ongoing projects in 2025.

Merz continues to innovate, as demonstrated by the launch of Ultherapy PRIME® in the EMEA region at the 2025 IMCAS World Congress. Strategic partnerships and acquisitions further strengthen its market presence.

Merz Pharma's success is underpinned by its robust research and development efforts, with a significant portion of its revenue reinvested into R&D. The company's long-standing industry presence and established distribution networks contribute to its competitive advantage. Merz leverages strategic partnerships and acquisitions to broaden its portfolio and strengthen its market position.

- R&D Investment: Approximately 15% of sales allocated to R&D in 2024.

- Product Pipeline: 30 ongoing projects in 2025.

- Market Presence: Over a century of industry experience.

- Strategic Initiatives: Focus on Aesthetics and Neurotoxins.

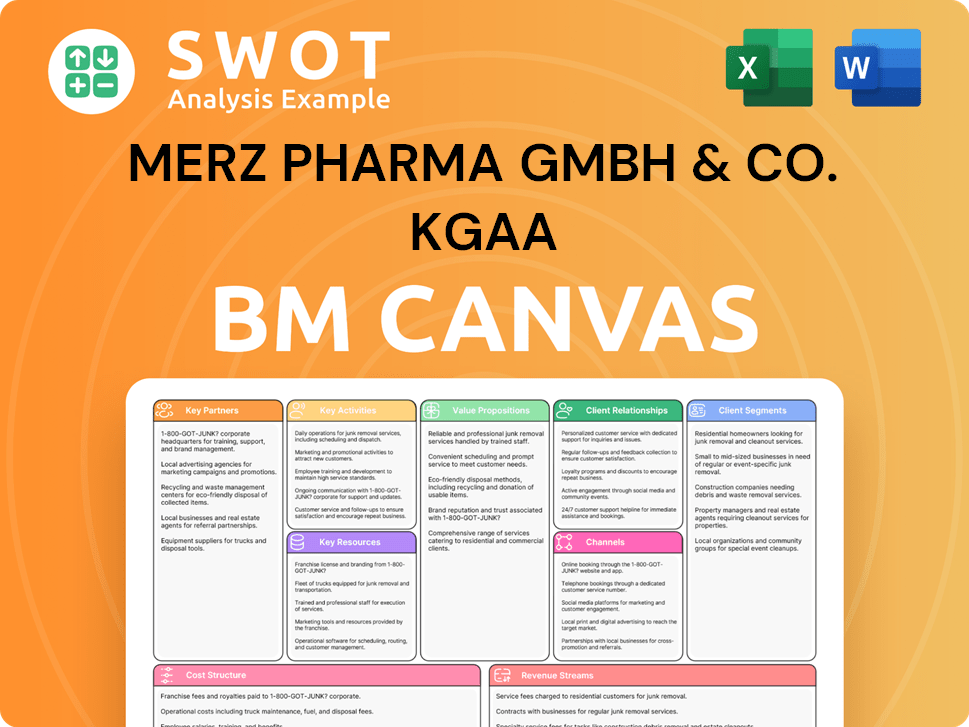

Merz Pharma GmbH & Co. KGaA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Merz Pharma GmbH & Co. KGaA Positioning Itself for Continued Success?

Understanding the operational dynamics of Merz Pharma GmbH & Co. KGaA involves examining its market position, the risks it faces, and its future prospects. As a global leader in the aesthetics and neurotoxins sectors, Merz Pharma leverages a diversified business model, encompassing aesthetics, therapeutics, and consumer care. This strategy allows the company to capitalize on opportunities within each segment, competing with established players like Allergan and Galderma, while maintaining market share through product efficacy and strategic investments.

However, Merz Pharma, like any major pharmaceutical company, navigates a complex landscape. It confronts supply chain disruptions, regulatory hurdles, and fierce competition. The company's future hinges on its ability to mitigate these risks and adapt to changes in the pharmaceutical industry. The company must also stay ahead of technological advancements and ensure patient-centric approaches to sustain revenue and market expansion.

Merz Pharma holds a strong position in the aesthetics and neurotoxins markets, recognized as a global leader. Its diverse portfolio includes products like Xeomin®, Ultherapy PRIME®, and Radiesse®, which compete with established brands. The company's global reach extends to over 80 countries, with operations in 12 countries, demonstrating a significant international presence.

Merz Pharma faces risks such as supply chain disruptions, which increased by 15% in 2024, potentially causing revenue losses. Negative publicity, including product safety concerns, poses a threat to brand reputation. The highly regulated pharmaceutical market requires continuous adaptation to new regulations and technological advancements, adding to the operational challenges.

The company is optimistic, with projected growth rates in key segments, especially in aesthetics, expected to exceed market averages. Strategic initiatives include a continued focus on R&D, with approximately 15% of sales dedicated to innovation. Merz Therapeutics is expanding operations in regions like the Nordics, establishing new affiliates.

Merz Pharma focuses on sustainable practices and enhancing brand loyalty. Strategic partnerships and acquisitions remain vital for portfolio enhancement. Commitment to innovation, patient-centric approaches, and digital health solutions are expected to drive future revenue and market expansion.

Merz Pharma's key strategies include a focus on R&D, with approximately 15% of sales dedicated to innovation, and expansion in key markets such as the Nordics. The company emphasizes sustainability and brand loyalty through various initiatives. Strategic partnerships and acquisitions are essential for portfolio enhancement and market strengthening.

- Investment in research and development to drive innovation.

- Expansion into new geographic markets to increase market presence.

- Focus on sustainable practices to improve brand image.

- Strategic partnerships to enhance the product portfolio.

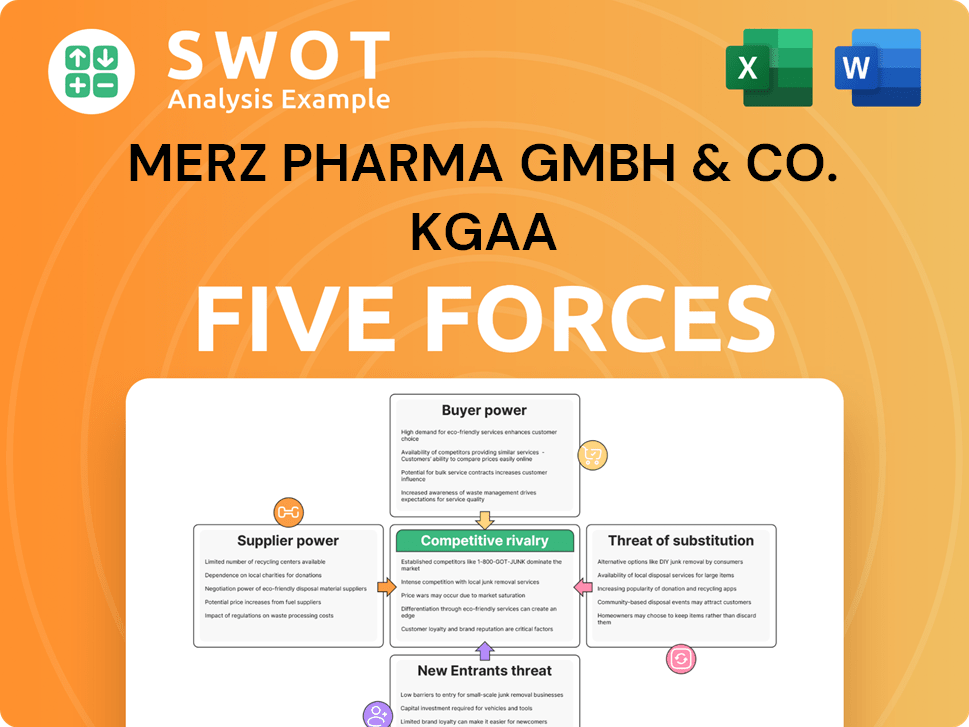

Merz Pharma GmbH & Co. KGaA Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Merz Pharma GmbH & Co. KGaA Company?

- What is Competitive Landscape of Merz Pharma GmbH & Co. KGaA Company?

- What is Growth Strategy and Future Prospects of Merz Pharma GmbH & Co. KGaA Company?

- What is Sales and Marketing Strategy of Merz Pharma GmbH & Co. KGaA Company?

- What is Brief History of Merz Pharma GmbH & Co. KGaA Company?

- Who Owns Merz Pharma GmbH & Co. KGaA Company?

- What is Customer Demographics and Target Market of Merz Pharma GmbH & Co. KGaA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.