Minimax Bundle

Can Minimax Company Continue to Lead in Fire Protection?

In an industry where safety and innovation are paramount, understanding the Minimax SWOT Analysis is crucial for any decision-maker. This article dives deep into the Growth strategy and Future prospects of the Minimax company, a global leader in fire protection, offering a comprehensive look at its strategic trajectory. We'll explore how this industry giant plans to maintain its market dominance.

From its inception in 1902, Minimax has consistently adapted and innovated, making it a fascinating case study in Business development. This analysis will examine the company's Strategic planning, including its expansion plans and how it navigates the competitive landscape. Through detailed Market analysis, we'll uncover the potential for innovation and the challenges Minimax faces in securing its Future growth.

How Is Minimax Expanding Its Reach?

The Marketing Strategy of Minimax is actively engaged in a multi-faceted expansion strategy. This strategy is designed to strengthen its global leadership position and diversify its offerings. A key part of this is penetrating international markets, especially in emerging economies. These economies are experiencing increased industrialization and stricter safety regulations, creating demand for advanced fire protection solutions.

The company focuses on expanding its presence in Asia and the Middle East. These regions are seeing significant construction and infrastructure development. This naturally drives the need for advanced fire protection solutions. In terms of product expansion, the company is continuously broadening its portfolio. This is to address evolving fire hazards and industry-specific needs. This includes developing specialized extinguishing agents and integrated safety management systems.

Furthermore, the company is exploring strategic partnerships. They are also considering potential mergers and acquisitions. This is to gain access to new technologies, expand its service network, and acquire complementary businesses. Recent reports suggest a strong interest in companies specializing in smart building technologies. They are also interested in IoT-enabled safety solutions, aligning with industry trends.

The focus is on emerging economies with growing industrialization and stricter safety regulations. Asia and the Middle East are key regions due to significant construction and infrastructure development. This drives demand for advanced fire protection solutions. The Asia-Pacific fire protection market is projected to reach $21.8 billion by 2029, growing at a CAGR of 7.1% from 2022 to 2029.

Continuous broadening of the product portfolio is essential. This addresses evolving fire hazards and industry-specific needs. This includes specialized extinguishing agents and integrated safety management systems. The global fire protection systems market is expected to reach $108.9 billion by 2028, with a CAGR of 6.8% from 2021 to 2028.

Exploring partnerships and acquisitions to access new technologies and expand the service network. Interest in smart building technologies and IoT-enabled safety solutions is increasing. The smart building market is anticipated to reach $136.2 billion by 2027, growing at a CAGR of 10.8% from 2020 to 2027.

The company aims to enhance its service offerings. This includes providing comprehensive lifecycle support for its systems. It covers initial consultation, design, and long-term maintenance. The global fire safety services market is estimated to reach $65.8 billion by 2029, with a CAGR of 6.5% from 2022 to 2029.

These initiatives aim to access new customer bases and revenue streams. They also help the company stay ahead of industry changes. This is driven by technological advancements and regulatory shifts. The focus is on creating a sustainable growth strategy for the future.

- International market expansion, particularly in Asia and the Middle East.

- Product portfolio diversification, including specialized extinguishing agents.

- Strategic partnerships and potential mergers and acquisitions.

- Enhancement of service offerings for comprehensive lifecycle support.

Minimax SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Minimax Invest in Innovation?

The Minimax company prioritizes innovation and technology to maintain its leadership in fire protection, driving its growth strategy. This approach involves significant investment in research and development (R&D), both internally and through collaborations. The focus is on digital transformation, integrating automation and advanced analytics to enhance systems and services.

A key element of the Minimax company's strategy is the use of Artificial Intelligence (AI) and the Internet of Things (IoT). This includes predictive maintenance, real-time monitoring of fire protection systems, and improved decision-making. For example, AI-powered fire detection systems are being developed to distinguish between different types of smoke, reducing false alarms and improving operational efficiency.

Sustainability is a core part of Minimax company's innovation strategy. The company is developing environmentally friendly extinguishing agents and energy-efficient systems. Recent breakthroughs include advancements in mist extinguishing technologies that use less water and cause minimal damage, making them suitable for sensitive environments. These new products and technical capabilities directly contribute to growth objectives by offering superior, more efficient, and eco-conscious solutions to customers.

The company allocates a significant portion of its resources to R&D, ensuring continuous innovation. This investment supports the development of advanced fire protection solutions and enhances the company's competitive edge. These investments are crucial for driving business development.

Digital transformation is central to the Minimax company's strategy, integrating AI and IoT. This includes predictive maintenance and real-time monitoring. This approach enhances the efficiency and reliability of fire protection systems.

The development of AI-powered fire detection systems is a key focus. These systems can differentiate between various types of smoke, reducing false alarms and improving operational efficiency. This technology is crucial for the future prospects of the company.

Sustainability is a core aspect of the company's innovation efforts. The company is developing environmentally friendly extinguishing agents and energy-efficient systems. This aligns with global efforts to reduce environmental impact.

Recent breakthroughs include advancements in mist extinguishing technologies. These technologies use less water and cause minimal damage, making them suitable for sensitive environments. This innovation enhances the company's product offerings.

The company has received industry awards for its innovative approaches. This includes recognition for smart fire suppression systems and contributions to safety standards. This recognition validates the effectiveness of its strategic planning.

The integration of advanced technologies, such as AI and IoT, is expected to significantly impact the Minimax company's growth. These technologies enhance the efficiency and effectiveness of fire protection systems, leading to increased market share and revenue. The company's focus on innovation is crucial for its long-term growth strategy.

- Increased Efficiency: AI-powered systems reduce false alarms, improving operational efficiency.

- Enhanced Reliability: Real-time monitoring and predictive maintenance ensure systems are always functioning correctly.

- Eco-Friendly Solutions: The development of sustainable products attracts environmentally conscious customers.

- Market Expansion: Innovative technologies allow the company to enter new markets and offer superior solutions.

Minimax PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Minimax’s Growth Forecast?

The financial outlook for the company appears promising, driven by its strategic expansion and innovation initiatives. While specific financial details like revenue targets and profit margins are not publicly available for a private entity, industry trends and the company's market position suggest a positive trajectory. The global fire protection systems market was valued at USD 71.3 billion in 2023 and is projected to reach USD 135.5 billion by 2033, with a compound annual growth rate (CAGR) of 6.6% from 2024 to 2033. As a key player, the company is well-positioned to capitalize on this growth.

The company's consistent investment in research and development (R&D) and market expansion indicates a commitment to long-term financial goals, likely aiming for increased market share and diversified revenue streams. The company's focus on comprehensive solutions, including maintenance and services, provides a stable recurring revenue base, complementing its system sales. The financial narrative underpinning the company's strategic plans is one of sustained investment in innovation and market reach, aiming to capture a significant portion of the expanding global fire safety market.

Industry reports and analyst forecasts for the broader fire protection sector indicate steady growth, fueled by stringent safety regulations, increasing industrialization, and infrastructure development globally. This creates favorable conditions for business development and strategic planning within the company. For a deeper understanding of the competitive environment, consider exploring the Competitors Landscape of Minimax.

The company's growth strategy is closely tied to market analysis, focusing on expanding its reach in the fire protection systems market. The company aims to leverage its existing market position to capture a larger share of the growing global market. This involves strategic planning for expansion and innovation to meet evolving industry demands.

While specific revenue projections are not publicly available, the company's future prospects are linked to the overall growth of the fire protection market. The company is likely aiming for significant revenue growth, driven by its strategic goals and expansion plans. This growth is supported by investments in technology and market development.

The company's expansion plans include both geographical and product-line growth strategies. These strategies involve entering new markets and developing innovative fire protection solutions. The company's focus on innovation and market reach is central to its long-term growth strategy.

The company has a strong potential for innovation, particularly in the areas of smart fire protection systems and sustainable solutions. Investments in research and development are crucial for maintaining a competitive edge. Innovation will play a key role in the company's future growth, aligning with the evolving demands of the market.

The company faces challenges common to the industry, including competition and the need to adapt to technological advancements. To maintain its position, the company must continually innovate and adapt its growth strategy. The company's ability to overcome these challenges will determine its long-term success.

- Intense Competition: Staying ahead of competitors requires continuous innovation and strategic market positioning.

- Technological Advancements: Adapting to new technologies, such as IoT and AI, is crucial for maintaining a competitive edge.

- Regulatory Compliance: Ensuring compliance with evolving safety standards and regulations is essential.

- Economic Fluctuations: Navigating economic downturns and market volatility requires financial resilience and strategic planning.

Minimax Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Minimax’s Growth?

The path to sustained growth for the Minimax company is not without its potential pitfalls. Several challenges could impede its progress and require careful navigation. Understanding these risks is crucial for effective strategic planning and ensuring the company's long-term success.

One significant hurdle is the competitive landscape within the fire protection industry. With numerous players vying for market share, pricing pressures and the need for continuous innovation are constant realities. Furthermore, evolving regulations and building codes across different regions demand ongoing adaptation and investment in research and development.

Supply chain vulnerabilities and technological disruptions also pose considerable risks. Geopolitical events, trade disputes, or natural disasters can disrupt supply chains, leading to project delays and increased costs. Rapid technological advancements could also render existing products obsolete if not proactively addressed.

The fire protection market is highly competitive, with many global and regional competitors. This intense competition can lead to pricing pressures, impacting profitability. Companies must continuously innovate and differentiate their offerings to stay ahead.

Fire safety standards and building codes vary significantly across different countries and are subject to frequent updates. Compliance requires continuous adaptation of products and services, incurring significant costs. The company must stay informed and adapt quickly.

Disruptions in the supply chain, particularly for critical components and specialized materials, can lead to delays and increased costs. Geopolitical events, trade disputes, or natural disasters can exacerbate these vulnerabilities. Diversification of suppliers is key.

Rapid technological advancements can pose a risk if the company fails to keep pace with emerging innovations. Competitors or new entrants may introduce superior technologies, requiring the company to invest in R&D and adapt its offerings to remain relevant.

Economic downturns can reduce construction activity and infrastructure spending, thereby decreasing demand for fire protection systems. This can lead to lower sales and reduced profitability. Economic diversification and robust financial planning are essential.

Geopolitical instability and trade disputes can disrupt supply chains, increase costs, and limit market access. The company must monitor global events and develop contingency plans to mitigate these risks. Diversification of markets can help.

To address these risks, the company employs several strategies, including diversification of its product portfolio and geographical markets. This reduces reliance on any single revenue stream or region. Furthermore, robust risk management frameworks, incorporating scenario planning and contingency measures, are in place to prepare for unforeseen challenges. These proactive measures are vital for navigating the complexities and ensuring sustained growth.

Robust financial planning, including stress tests and sensitivity analyses, is essential to prepare for economic downturns. Maintaining healthy cash reserves and diversifying revenue streams are crucial for weathering economic fluctuations. Strong financial planning is critical for long-term stability.

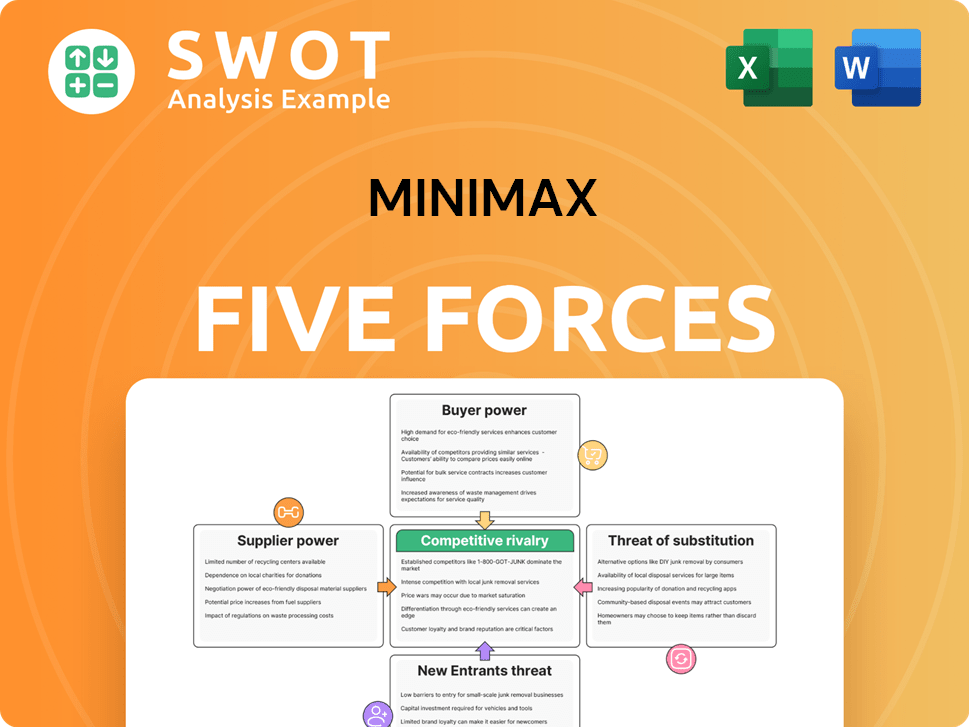

Minimax Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Minimax Company?

- What is Competitive Landscape of Minimax Company?

- How Does Minimax Company Work?

- What is Sales and Marketing Strategy of Minimax Company?

- What is Brief History of Minimax Company?

- Who Owns Minimax Company?

- What is Customer Demographics and Target Market of Minimax Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.