Minimax Bundle

Who Really Owns Minimax?

Unraveling the Minimax SWOT Analysis is just the beginning; understanding the company's ownership structure is key to grasping its strategic moves. Discover the pivotal players and historical events that have shaped this global fire protection leader. This deep dive into Minimax's ownership unveils critical insights for investors and industry watchers alike.

The journey of "Who owns Minimax" is fascinating, especially considering its evolution since its founding in 1902. From its early beginnings to its merger with Viking Group in 2009, the Minimax company ownership story reveals a complex interplay of influence and strategic direction. This exploration of Minimax fire protection's history and background offers a comprehensive understanding of its current market position and future prospects. Understanding the Minimax owner is crucial if you are interested in Minimax fire protection systems manufacturer.

Who Founded Minimax?

The story of the Minimax company begins with Wilhelm Graaff, who founded it in 1902. His innovation, the 'Spitztüte' fire extinguisher, laid the foundation for the Minimax brand. This marked the start of Minimax's journey in fire protection.

Simultaneously, another entity named Minimax emerged in the mid-1970s, founded by Luigi Lazzari. This version focused on woodworking solutions and later became part of the SCM Group. This entity's success was driven by the C22, a combined solution for advanced DIY and small carpentry shops.

The evolution of Minimax involved significant ownership changes and strategic shifts. The fire protection-focused Minimax, which is the subject of this article, saw its reconstruction after 1945 in West Germany. In 1969, Preussag acquired Minimax, merging it with SFH.

Understanding the Minimax owner and the Minimax company ownership structure is crucial to understanding its trajectory. Here are some key facts:

- Wilhelm Graaff founded Minimax in 1902, focusing on fire protection.

- Luigi Lazzari founded a separate Minimax entity in the mid-1970s, which was later sold to SCM between 1985 and 1986.

- Preussag acquired Minimax in 1969 and merged it with SFH.

- SFH's plant operations moved to Bad Oldesloe in 1966, which now serves as the headquarters of the Minimax Viking Group.

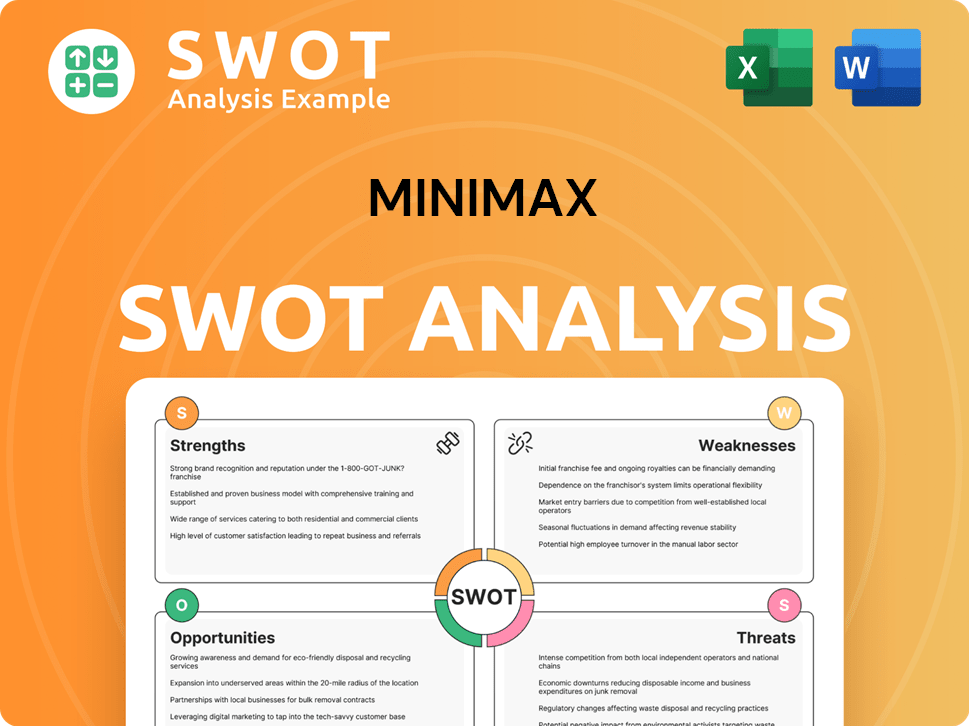

Minimax SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Minimax’s Ownership Changed Over Time?

The journey of the company's ownership has seen several key shifts. Initially, after Preussag's strategic pivot, Barclays Private Equity Germany became a shareholder. This was followed by Investcorp and later, IK Investment Partners, who acquired the company in 2006. A significant change occurred in 2009 when the company merged with Viking Group, a major player in the sprinkler systems industry, through a cash and stock transaction. IK Investment Partners maintained its position as the largest shareholder post-merger.

In 2014, KIRKBI A/S, associated with the LEGO brand, along with Intermediate Capital Group (ICG), the company's management, and the Groos family, acquired all shares from IK Investment Partners. ICG then became the majority shareholder in 2018. As of February 2025, ICG held approximately 90% ownership, with Klister holding about 2%, and the company's management holding the remainder. The ownership evolution reflects strategic investments and shifts in the fire protection market.

| Year | Ownership Change | Key Stakeholders |

|---|---|---|

| 2006 | IK Investment Partners acquired the company | IK Investment Partners |

| 2009 | Merger with Viking Group | IK Investment Partners, Viking Group Shareholders |

| 2014 | Acquisition by KIRKBI A/S and ICG | KIRKBI A/S, ICG, Groos family, Management |

| 2018 | ICG becomes majority shareholder | ICG |

| Feb 2025 | Current ownership structure | ICG (approximately 90%), Klister (approximately 2%), Management |

In April 2025, ICG Enterprise Trust announced the realization of the company, resulting in €53 million in cash proceeds to ICGT, highlighting the financial outcomes of its investment since 2018. For a deeper understanding of the company's background, consider reading Brief History of Minimax.

The ownership of the company has seen multiple changes over the years, reflecting strategic shifts and investment decisions. ICG's significant stake and the recent realization of the company highlight the financial dynamics.

- IK Investment Partners, KIRKBI A/S, and ICG have been key players.

- The merger with Viking Group was a pivotal moment.

- ICG's majority ownership reflects a long-term investment strategy.

- The fire protection market is dynamic.

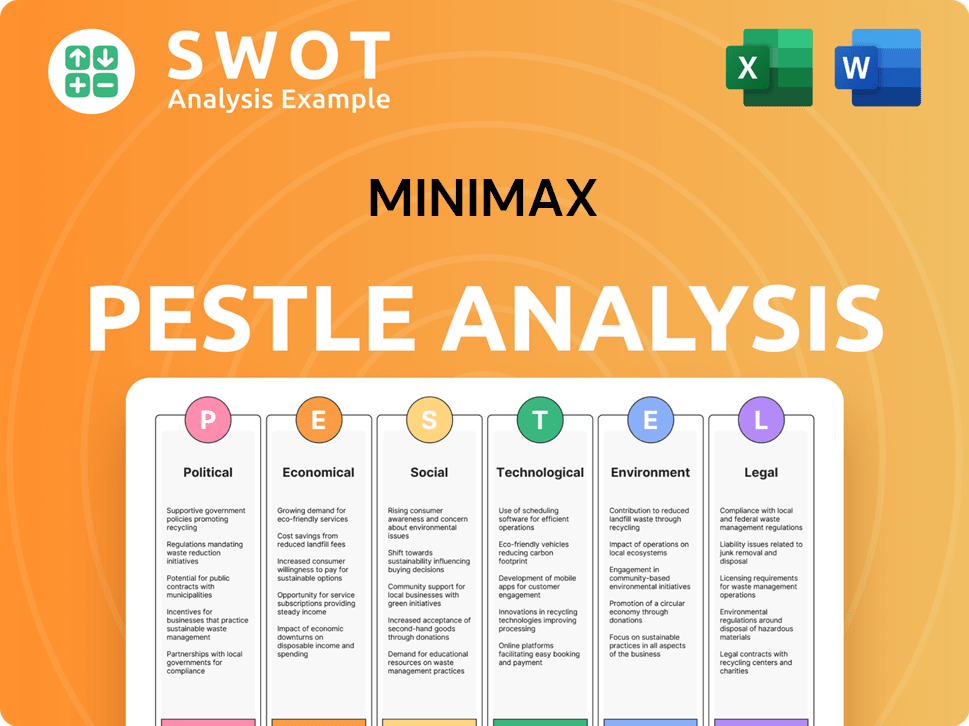

Minimax PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Minimax’s Board?

Determining the exact current composition of the board of directors for the Minimax company, or who owns Minimax, is challenging due to its private status. However, it's known that the Minimax Viking Group (MV Group) plays a significant role in the company's governance. Klaus Hofmann serves as the CEO of the MV Group, and the management's stake in the company increased following the 2014 ownership transition involving KIRKBI A/S and ICG.

The MV Group's board of directors, along with local boards, holds substantial decision-making power. They are responsible for reviewing investigation results from the whistleblowing system, deciding on internal sanctions, and implementing preventive measures. This structure highlights the board's critical role in maintaining ethical standards and overseeing the company's operations. The whistleblowing system is accessible to a wide range of stakeholders, including employees, managers, directors, customers, and suppliers, indicating a commitment to transparency and accountability. For more information on the company's strategic direction, you can explore the Growth Strategy of Minimax.

| Board Responsibility | Description | Stakeholders Involved |

|---|---|---|

| Reviewing Investigation Results | Evaluating findings from the whistleblowing system. | Group Employees, Managers, Directors, Customers, Suppliers, and other stakeholders |

| Deciding on Internal Sanctions | Determining appropriate consequences for misconduct. | Group Employees, Managers, Directors |

| Implementing Preventive Measures | Establishing and enforcing policies to prevent future issues. | All stakeholders |

The MV Group's structure is designed to ensure accountability and ethical conduct across its subsidiaries. Companies within the MV Group are those in which Minimax Viking GmbH directly or indirectly holds 50% or more of the shares or voting rights. This ownership structure gives the MV Group significant control and influence over these subsidiaries, ensuring consistent governance and operational standards across the group. While specific voting power details are not publicly available, the board's responsibilities suggest considerable influence in the company's strategic direction and operational oversight.

The board of directors plays a crucial role in Minimax's governance, overseeing investigations, sanctions, and preventive measures.

- The MV Group, led by CEO Klaus Hofmann, has a significant stake in the company.

- The whistleblowing system ensures transparency and accountability.

- The board's responsibilities highlight its influence in strategic decisions.

- The MV Group controls subsidiaries with 50% or more ownership.

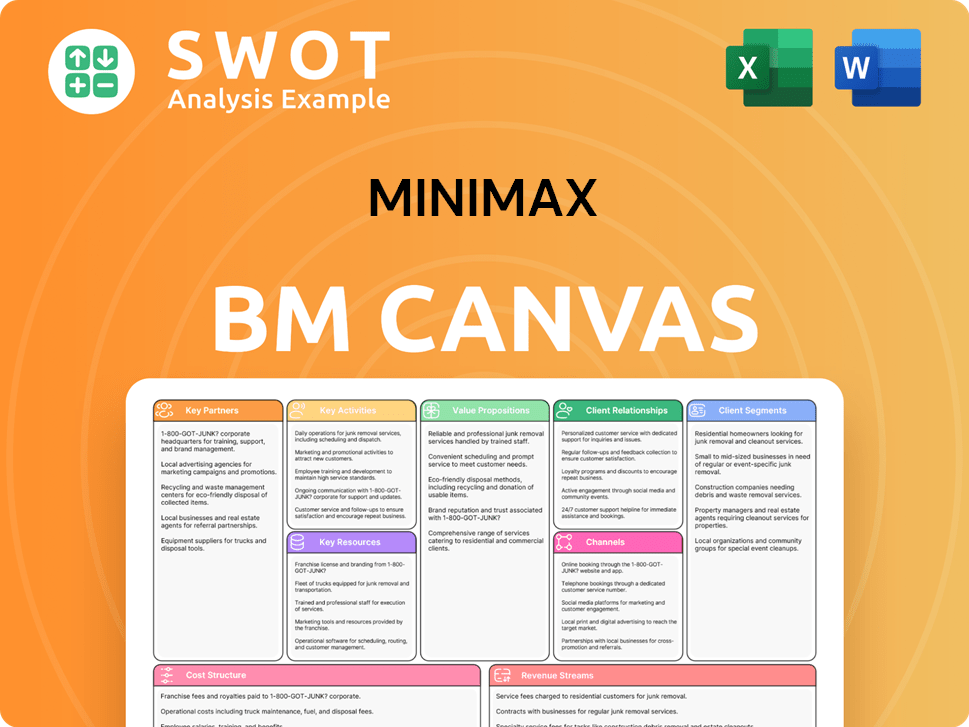

Minimax Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Minimax’s Ownership Landscape?

Over the last few years, the ownership of the fire protection systems manufacturer has been primarily held by Intermediate Capital Group (ICG). As of February 2025, ICG, the majority shareholder, planned to reinvest in the company through two new funds, showcasing a continued commitment to the business. This refinancing involved a new senior secured term loan B (TLB) with a €700 million tranche and a US dollar tranche equivalent to €1,000 million, both with seven-year maturities. This transaction was expected to increase the company's S&P Global Ratings-adjusted debt by approximately €684 million.

In April 2025, ICG Enterprise Trust, an investor since 2018, realized its investment, generating €53 million (£45m) in cash proceeds. A portion of these proceeds, €14 million, is being reinvested alongside management and other investors, including certain ICG funds. This action reflects the dynamic nature of private equity ownership and the ongoing management of investment portfolios. The fire safety sector is experiencing increased merger and acquisition (M&A) activity, driven by private equity firms pursuing pan-regional strategies.

| Metric | Value | Year |

|---|---|---|

| S&P Global Ratings-adjusted Debt Increase | €684 million | 2025 (Projected) |

| Debt to EBITDA Ratio | 4.8x | 2025 (Projected) |

| Debt to EBITDA Ratio | 4.5x | 2026 (Projected) |

| Free Operating Cash Flow (FOCF) | €195 million | 2024 (Estimated) |

| Free Operating Cash Flow (FOCF) | €185 - €195 million | 2025 (Forecast) |

| Recurring Revenue | 65% of Total Income | 2024 |

| International Sales Increase | 15% | 2024 |

| ICG Enterprise Trust Cash Proceeds | €53 million (£45m) | 2025 |

The company's integrated business model and global presence, along with its resilient structure, contributed to its success. The company's recurring revenue stream, which made up 65% of its total income in 2024, and its increase in international sales, are key strengths in the current market environment.

Intermediate Capital Group (ICG) is the primary Minimax owner, driving strategic decisions and financial restructuring. ICG's reinvestment reflects confidence in the company's future. The company's financial performance and strategic positioning are central to ICG's approach.

The recent refinancing includes a €700 million TLB and a US dollar tranche. The debt-to-EBITDA ratio is projected to decrease by 2026. Upsizing of revolving and guarantee facilities further supports the company's financial flexibility.

ICG Enterprise Trust's realization of its investment and reinvestment of a portion of the proceeds. Increased M&A activity in the fire safety sector. The company's integrated business model and global presence support the trend.

Strong free operating cash flow, estimated at €195 million in 2024. Recurring revenue accounted for 65% of total income in 2024. The company's global presence and increased international sales drive growth.

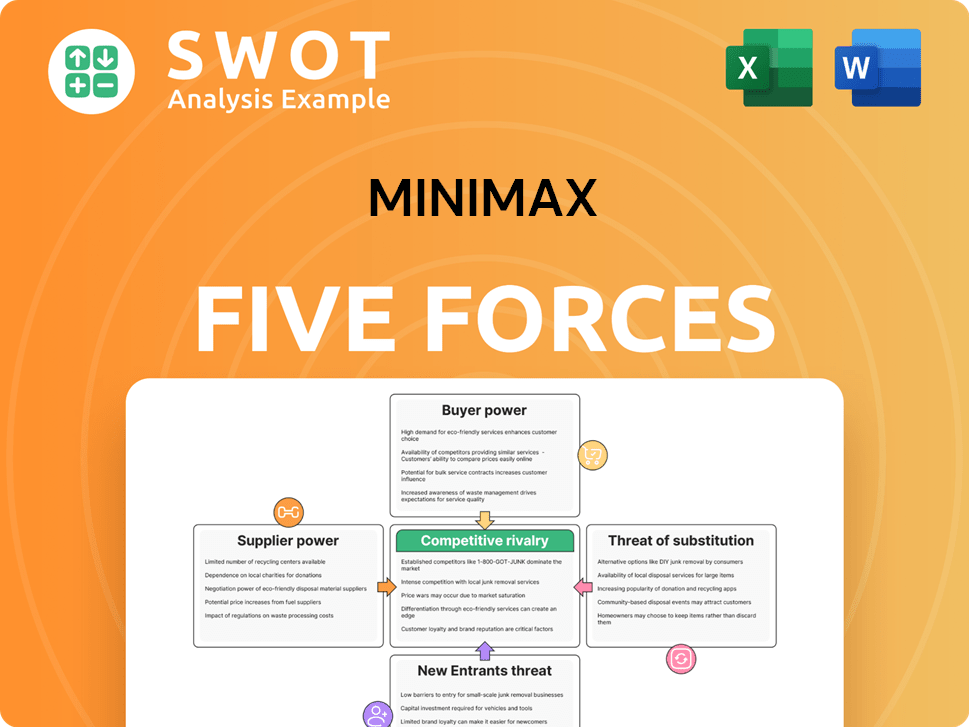

Minimax Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Minimax Company?

- What is Competitive Landscape of Minimax Company?

- What is Growth Strategy and Future Prospects of Minimax Company?

- How Does Minimax Company Work?

- What is Sales and Marketing Strategy of Minimax Company?

- What is Brief History of Minimax Company?

- What is Customer Demographics and Target Market of Minimax Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.