Nortech Bundle

Can Nortech Systems Thrive in Tomorrow's Markets?

Nortech Systems, a key player in engineering and manufacturing, is charting its course through a rapidly evolving landscape. With a market cap of $24.13 million as of May 2025, the company's strategic moves are critical. This analysis dives deep into Nortech's Nortech SWOT Analysis to uncover its path to future success.

This exploration of Nortech's growth strategy offers insights into its operational shifts and market challenges. We'll examine the company's future prospects, considering its market position and potential for expansion. Understanding Nortech's business strategy is crucial for investors and stakeholders alike, as we assess its financial performance and long-term growth potential within the tech industry and beyond, including renewable energy.

How Is Nortech Expanding Its Reach?

The company is actively pursuing expansion initiatives to strengthen its market position and diversify revenue streams. This strategic approach includes consolidating operations to boost efficiency and cut costs. These moves are crucial for the company's future prospects and overall business strategy. A detailed Owners & Shareholders of Nortech analysis provides further insights into the company's strategic direction.

One significant step involves consolidating its facilities. In December 2024, the company closed its facility in Blue Earth, Minnesota, and is in the process of selling it. Production is being shifted to the Bemidji facility. This consolidation is a key part of optimizing asset use and increasing profitability. The expected outcome is at least $1.6 million in annual savings.

Nortech is also focused on broadening and diversifying its customer base through enhanced sales and marketing efforts. The company's global manufacturing presence, with sites in the U.S., Latin America, and Asia, allows it to utilize near-shoring and global manufacturing flexibility. This strategy helps mitigate risks from trade policies and ensures faster delivery times. This is crucial for Nortech's growth strategy in the tech industry.

The company is strategically investing to capitalize on growth opportunities in the medical markets. This investment is part of a broader effort to improve Nortech's market position and financial performance. The company's commitment to 'built in-country, for-country' manufacturing, particularly through its Suzhou facility in China, helps reduce reliance on cross-border shipments and navigate tariff challenges.

- The company experienced delays in defense customer approvals for transfers from the Blue Earth facility to Bemidji.

- These delays are expected to be resolved in the second quarter of 2025.

- This resolution will allow the aerospace and defense business to regain momentum in the latter half of 2025.

- These initiatives are designed to support Nortech's long-term growth potential.

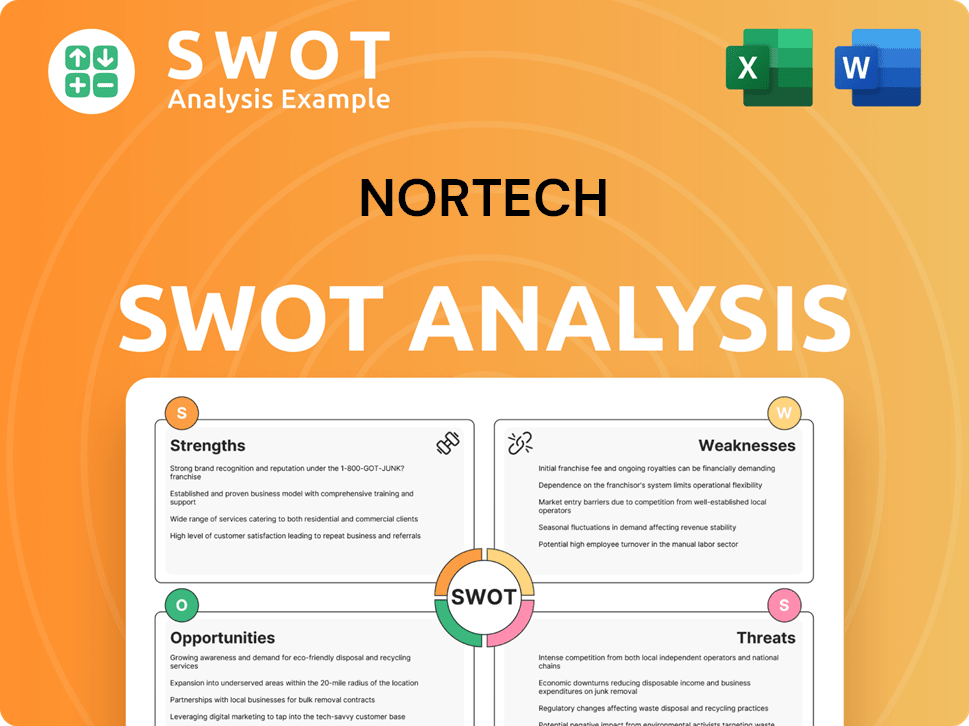

Nortech SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Nortech Invest in Innovation?

The company's growth strategy is heavily reliant on its innovation and technology initiatives. They focus on advanced connectivity solutions and data management engineering to drive sustained growth, particularly in sectors like medical, industrial, and aerospace & defense. This approach is crucial for maintaining a strong market position and capitalizing on future opportunities.

A key component of the company's strategy involves significant investment in research and development, especially in fiber optic technologies. This commitment has led to the development of groundbreaking innovations, such as the Expanded Beam Extreme Fiber-Optic Technology (EBX) and Active Optical Xtreme (AOX) for non-magnetic applications. These technologies are designed to meet evolving customer demands for lighter, faster, and more sustainable solutions.

The company's focus on secure, reliable digital connectivity and data management is critical for its business strategy. The exploration of AI and connectivity solutions further enhances its ability to meet future demands. The strategic expansion of fiber optic capabilities, including MT connectors, supports high-density data applications, particularly in aerospace and defense, contributing to the company's overall financial performance.

The company has developed advanced fiber optic technologies like EBX and AOX. These innovations offer improved speed, reliability, and security compared to traditional copper cables. They are particularly suited for high-performance data communications in magnetically sensitive environments.

In April 2025, the company announced a new patent for non-magnetic expanded beam fiber optic cables. This patent underscores its commitment to innovation and its ability to create proprietary technologies that offer competitive advantages.

The company is focused on secure, reliable digital connectivity and data management. This digital transformation is crucial for serving the medical, industrial, and aerospace & defense markets effectively. They are also exploring the integration of AI and connectivity solutions.

The primary markets for the company's technology solutions include medical, industrial, and aerospace & defense. These sectors require high-performance, reliable, and secure data transmission capabilities, which the company's innovations provide. This market focus is essential for its growth strategy.

The company has expanded its fiber optic capabilities to include MT connectors. These connectors support multiple fiber terminations in a compact form factor. They are ideal for high-density data applications, particularly in aerospace and defense.

These innovations contribute to growth objectives by providing advanced solutions that meet evolving customer demands. The company aims to provide lighter, faster, and more sustainable technologies to maintain its competitive edge and achieve its financial goals.

The company's strategic focus on innovation and technology positions it well for future growth. Its investments in R&D, particularly in fiber optic technologies, provide a competitive advantage. The company's ability to meet the evolving demands of its target markets, such as the aerospace and defense industries, is a key driver of its long-term success. For more insights, see Mission, Vision & Core Values of Nortech.

- Advanced Technologies: Development of EBX and AOX fiber optic technologies for improved data transmission.

- Market Focus: Targeting medical, industrial, and aerospace & defense markets for high-performance solutions.

- Patent Portfolio: Securing patents like the one for non-magnetic expanded beam fiber optic cables.

- Digital Transformation: Integrating AI and connectivity solutions for enhanced data management.

- Expansion: Expanding fiber optic capabilities with MT connectors for high-density applications.

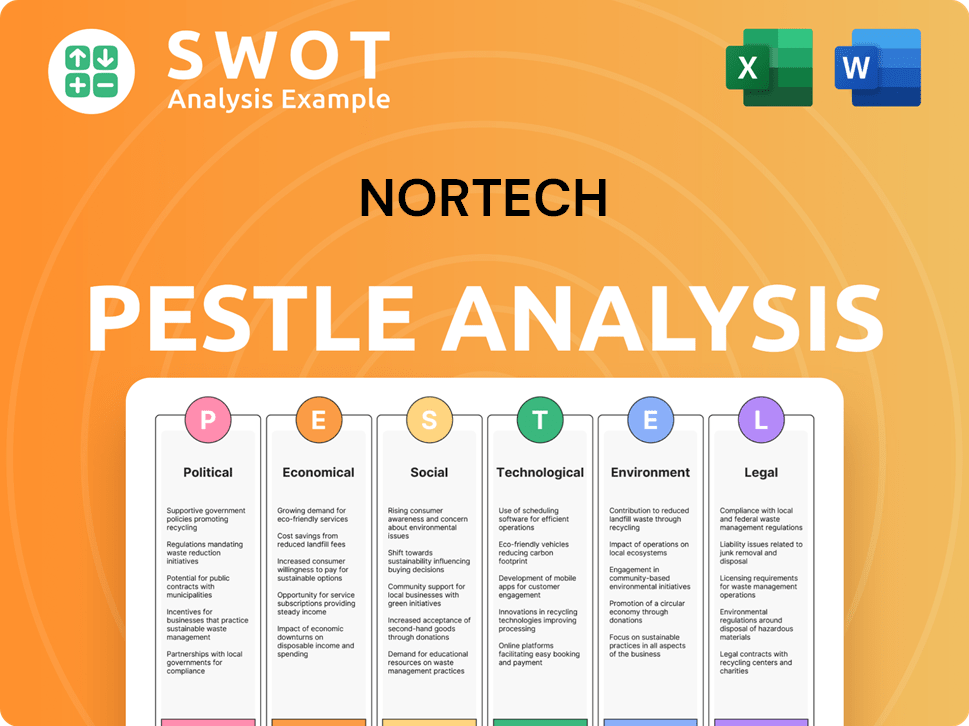

Nortech PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Nortech’s Growth Forecast?

The financial outlook for Nortech reflects a period of strategic recalibration, aiming to navigate recent market dynamics and position itself for sustained growth. The company's performance in 2024 and early 2025 indicates a focus on strengthening its financial foundation and streamlining operations. Understanding the Marketing Strategy of Nortech is crucial to grasping its financial trajectory.

For the year ended December 31, 2024, the company reported a decrease in net sales, alongside a decline in gross profit and a net loss. However, the company is taking measures to improve its financial health. These strategic adjustments are designed to address short-term challenges and support long-term objectives.

In the first quarter of 2025, the company's financial results reflected ongoing headwinds, including decreased net sales and a net loss. Despite these challenges, the company's cash balance increased. Management remains optimistic about the future, particularly regarding the resolution of operational hurdles.

Net sales for 2024 were $128.1 million, an 8.0% decrease from the previous year. Gross profit was $16.7 million, or 13.1% of net sales. The company reported a net loss of $1.3 million, or $0.47 per diluted share.

Net sales in Q1 2025 were $26.9 million, a 21.4% decrease from Q1 2024. The company reported a net loss of $1.3 million, or $0.48 per diluted share. Adjusted EBITDA was a negative $1.0 million.

The company is focused on strengthening its balance sheet and reducing inventory investments. It aims to maintain a leverage ratio of 3.5 times or less by Q3 2025 and 2.5 times or less thereafter. A minimum fixed charge coverage ratio of 1.25 times is also targeted.

Management anticipates resolving operational challenges related to customer approvals in Q2 2025. The company's long-term prospects are viewed positively, with continued efforts to improve financial performance and market position.

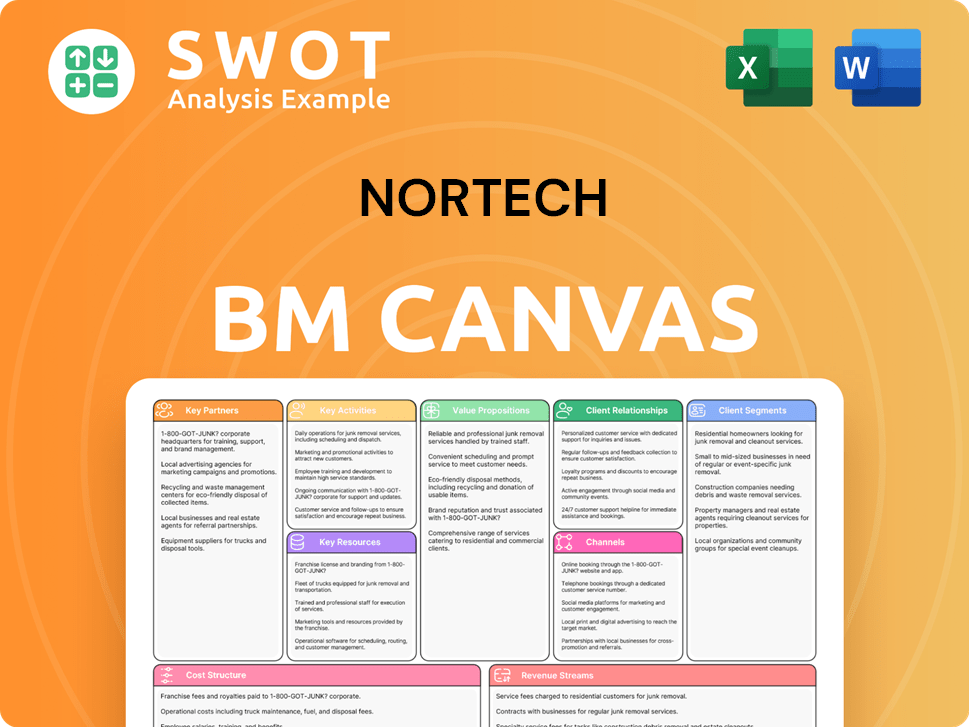

Nortech Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Nortech’s Growth?

The path forward for Nortech is not without its challenges. The company faces various risks and obstacles that could impact its ability to achieve its growth strategy and realize its future prospects. Understanding these potential pitfalls is crucial for a thorough Nortech company analysis.

Market competition, supply chain vulnerabilities, and operational restructuring are significant areas of concern. These factors, combined with broader economic and geopolitical uncertainties, create a complex landscape for the company. A detailed examination of these risks is essential for investors and stakeholders.

One of the primary challenges is the intense competition in the fiber optic technology sector, which could squeeze profit margins. Customer order delays, particularly in the aerospace and defense sectors, have also negatively affected recent financial performance. For example, in Q1 2025, net sales decreased by 21.4% compared to Q1 2024 due to customer order headwinds and supply chain issues.

Nortech is susceptible to supply chain disruptions. Dependence on suppliers for components and raw materials poses risks, including shortages, increased costs, and delays in shipments. These issues can directly impact production schedules and profitability.

Geopolitical factors add another layer of complexity. Potential tariff increases, such as those on Chinese imports, can impact sourcing strategies and customer pricing. The company is actively monitoring these changing regulatory environments and trade policies.

Operational changes, such as the closure of the Blue Earth facility and the transfer of production to Bemidji, have introduced operational challenges. Delays in customer approvals for these transfers negatively impacted the aerospace and defense market in Q4 2024 and Q1 2025. The company incurred $266,000 in restructuring charges in Q1 2025.

The competitive landscape in the fiber optic technology sector poses a constant threat. Competitors can erode market share and put pressure on margins, necessitating continuous innovation and strategic adaptation. This directly affects the Nortech market position.

Significant customer order delays, especially in the aerospace and defense sectors, have impacted sales. These delays can lead to revenue fluctuations and affect the company's ability to meet its financial targets. Addressing these issues is crucial for Nortech's financial performance.

To mitigate these risks, Nortech is focusing on operational consolidation to improve efficiency and reduce costs. The company is also leveraging its global manufacturing footprint to adapt to changing market demands. This strategic approach is essential for navigating the challenges and capitalizing on opportunities.

The company's ability to navigate these risks will determine its success. Nortech is focused on operational consolidation to boost efficiency and reduce costs. They are also using their global manufacturing presence to adapt to changing market demands. For more insights, consider reading about Nortech's strategic partnerships and collaborations.

Understanding and mitigating these risks is essential for Nortech's long-term success. The company must continue to adapt its business strategy to address market competition, supply chain vulnerabilities, and operational challenges. This proactive approach is key to achieving sustainable growth.

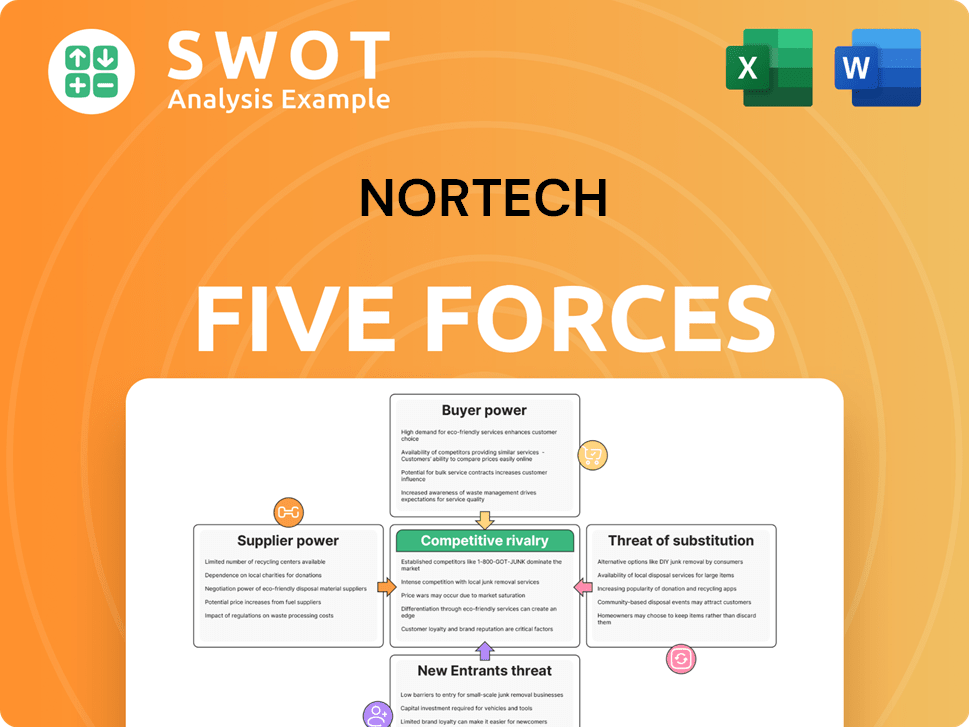

Nortech Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nortech Company?

- What is Competitive Landscape of Nortech Company?

- How Does Nortech Company Work?

- What is Sales and Marketing Strategy of Nortech Company?

- What is Brief History of Nortech Company?

- Who Owns Nortech Company?

- What is Customer Demographics and Target Market of Nortech Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.