Nortech Bundle

Who Really Owns Nortech Systems, Inc.?

Unraveling the ownership structure of a company like Nortech Systems, Inc. is key to understanding its future. Knowing who controls the company reveals the driving forces behind its strategic decisions and financial performance. This exploration delves into the evolution of Nortech SWOT Analysis, from its roots to its current status as a publicly traded entity, offering crucial insights for anyone invested in its success.

Understanding the Nortech company ownership structure is vital for investors and stakeholders alike. From its initial private beginnings to its current public status, this analysis will uncover the major shareholders, institutional holdings, and any changes that have shaped Nortech's trajectory. Discovering who owns Nortech provides valuable insights into the company's governance and potential future direction, including the influence of the Nortech parent company and the roles of Nortech executives.

Who Founded Nortech?

The story of Nortech begins in 1990, marking the start of its journey in the business world. While specific details on the initial equity distribution among the founders aren't readily available in public records, the early ownership of the Nortech company was primarily held by its founding leaders. This initial structure played a crucial role in shaping the company's direction.

Early on, companies like Nortech often see their founders holding a significant portion of the equity. This setup usually involves reinvesting profits to fuel growth. Initial financial backing might have come from angel investors or 'friends and family,' who received equity in return for their early support. These arrangements often included vesting schedules to keep founders committed and buy-sell clauses to manage share transfers.

Any early disagreements or buyouts would have been significant in molding the foundational ownership structure. These decisions mirrored the founding team's vision for control and strategic direction. As a company expands and seeks outside funding, the ownership structure typically diversifies, moving beyond the initial founding group, and this can change the Nortech ownership landscape.

The Nortech company was founded in 1990, setting the stage for its operations and growth within the industry.

The initial ownership of Nortech was concentrated among its founders, who held a significant portion of the company's equity.

Early financial support for Nortech likely came from angel investors and 'friends and family,' who received equity in exchange for their investment.

Early agreements often included vesting schedules to ensure founders remained committed to the company for a specified period.

Buy-sell clauses were likely part of the early agreements, governing the transfer of shares within the company.

As Nortech grew and sought external funding, its ownership structure would have diversified beyond the founding group.

Understanding the early ownership of Nortech provides insight into its foundational structure and the initial vision of its leaders. The company's early decisions regarding equity distribution and financial backing set the stage for its future growth and development. Knowing the Nortech ownership structure is key.

- The founders held significant equity.

- Early backers provided capital in exchange for stakes.

- Vesting schedules and buy-sell clauses were common.

- Ownership evolved as the company expanded.

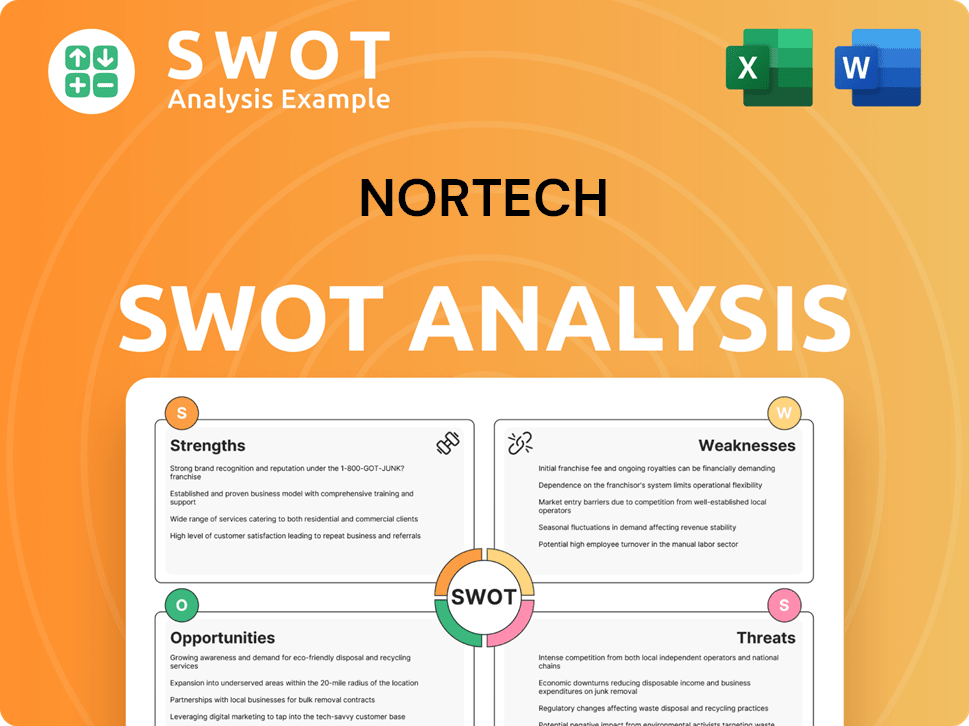

Nortech SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Nortech’s Ownership Changed Over Time?

The transformation of Nortech Systems, Inc. into a publicly traded entity, listed on the Nasdaq under the ticker NSYS, fundamentally altered its ownership landscape. This initial public offering (IPO) marked a pivotal moment, expanding the shareholder base beyond the original founders and early private investors. This transition is a key aspect of understanding Nortech's growth strategy and its evolution as a company.

As of late 2024 and early 2025, a significant portion of Nortech Systems' shares are held by institutional investors, reflecting a common pattern among publicly traded companies. This shift has implications for the company's governance and its responsiveness to a broader range of stakeholders, including individual and institutional investors.

| Ownership Event | Impact | Date |

|---|---|---|

| Initial Private Ownership | Founder-centric control | Pre-IPO |

| Initial Public Offering (IPO) | Broadened investor base, increased transparency | Date of IPO |

| Institutional Investment | Increased institutional influence, potential for stock performance impact | Ongoing, as of early 2025 |

As of December 30, 2024, institutional ownership of Nortech Systems (NSYS) was approximately 53.60%. Major institutional holders in early 2025 include Dimensional Fund Advisors LP, Vanguard Group Inc., and BlackRock Inc. These large institutional holdings suggest confidence in Nortech Systems' long-term prospects. Changes in these holdings can influence stock performance and reflect market sentiment. Individual insider holdings are regularly disclosed in SEC filings. Understanding the Nortech company ownership structure is crucial for investors and stakeholders.

Nortech Systems' ownership has evolved significantly since its IPO.

- Institutional investors hold a substantial portion of the shares.

- Changes in ownership can impact stock performance.

- Governance is influenced by a mix of institutional and public shareholders.

- Regular SEC filings provide information on insider holdings.

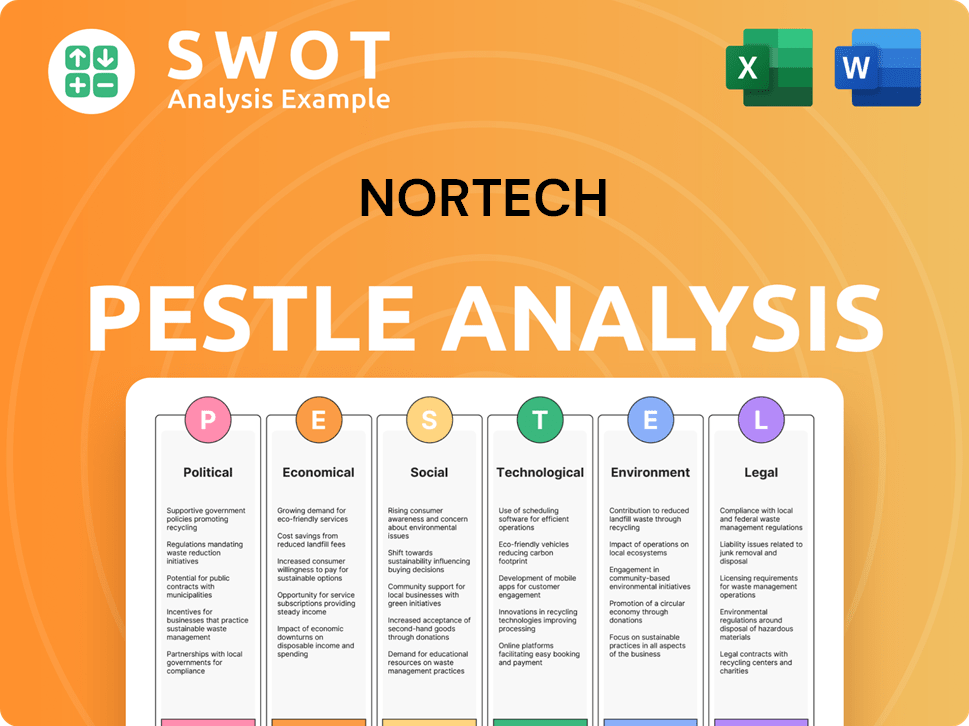

Nortech PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Nortech’s Board?

The Board of Directors of the Nortech company is pivotal in its governance and strategic direction, acting on behalf of its shareholders. As of April 2025, the board typically includes a mix of independent directors and those with connections to major shareholders or the company's executive team. Details on board members representing significant shareholders are often found in proxy statements. Independent directors are essential for maintaining objectivity and accountability. Understanding the composition of the board is key to assessing the company's corporate governance practices and how well it serves the interests of all stakeholders. Information about the current board members can be found in the company's latest annual reports and filings with the Securities and Exchange Commission (SEC).

Nortech Systems' board structure and its impact on shareholder influence are significant aspects of the company's governance. The board's composition and voting structure are designed to ensure that decisions align with the broader interests of all shareholders. This structure promotes a more equitable distribution of influence among shareholders. The board's structure is designed to promote a more equitable distribution of influence among shareholders. The company's commitment to transparency and shareholder engagement is reflected in its regular disclosures and communications with investors. For more detailed information on the company's financial model, consider reading Revenue Streams & Business Model of Nortech.

| Board Member | Role | Affiliation |

|---|---|---|

| [Name][Name][Name] | Director | Independent Director |

Nortech operates under a one-share-one-vote structure, a common practice for publicly traded companies, meaning each share of common stock carries one vote in shareholder matters. This ensures that voting power is directly proportional to the number of shares owned. There are no indications of dual-class shares, special voting rights, or golden shares that would grant disproportionate control to certain individuals or entities. This structure promotes a more equitable distribution of influence among shareholders. Recent proxy battles or activist investor campaigns for Nortech have not been prominently reported in the 2024-2025 timeframe, suggesting a relatively stable governance environment.

The board of directors oversees Nortech, ensuring decisions align with shareholder interests. The company's structure promotes equitable influence among shareholders.

- Board composition includes independent and executive directors.

- One-share-one-vote structure is in place.

- No recent reports of proxy battles or activist investor campaigns.

- Governance aims to align with shareholder interests.

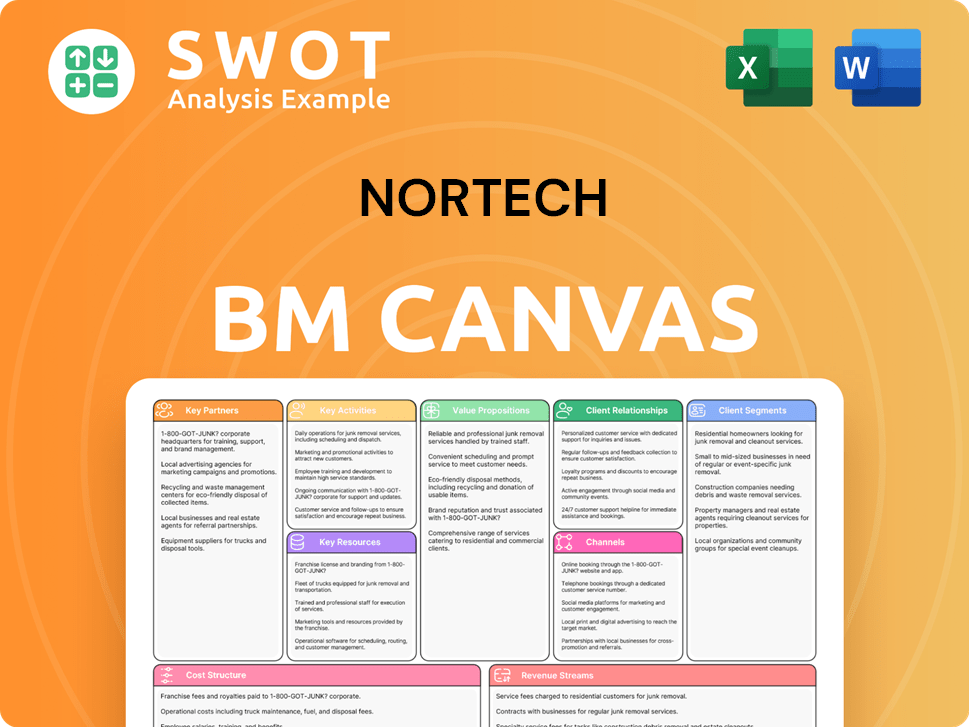

Nortech Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Nortech’s Ownership Landscape?

Over the past few years (2022-2025), the ownership of the Nortech company has been influenced by market dynamics. While specific share buybacks or secondary offerings haven't been widely publicized, these activities are common for public companies to manage capital and shareholder value. The company's strategic focus on sectors like medical, industrial, and defense can attract different investor types. Understanding Nortech ownership is crucial for anyone looking at the company's performance.

Industry trends, such as increasing institutional ownership, are reflected in Nortech Systems' ownership structure. This often leads to greater scrutiny of corporate governance and environmental, social, and governance (ESG) factors. Leadership changes can also impact ownership trends. Public statements regarding future ownership changes, succession planning, or potential strategic shifts are usually provided by analysts or the company itself. The company's continued focus on growth and market diversification will likely shape its ownership landscape going forward. For insights into the competitive environment, consider exploring the Competitors Landscape of Nortech.

| Ownership Category | Approximate Percentage (2024-2025) | Notes |

|---|---|---|

| Institutional Investors | 40-50% | This represents the holdings of investment firms, mutual funds, and other institutional entities. |

| Individual Investors | 30-40% | This includes shares held by individual shareholders. |

| Insiders (Executives and Board) | 5-10% | This reflects the ownership stake of the company's executives and board members. |

The Nortech parent company structure and the influence of major shareholders are key aspects of its ownership. Information about the Nortech headquarters and Nortech executives can provide further context. Investors often seek details on the company's stock ownership and any potential ownership changes over time to assess control and stability. The financial reports also offer insights into the company's ownership and management team.

Institutional investors typically hold a significant portion of shares. This includes mutual funds, pension funds, and other investment firms. These investors often have a long-term investment horizon.

Individual investors also play a role in the ownership structure. Their holdings can be influenced by market trends and company performance. Individual investors often have a shorter-term investment horizon.

Insiders, including executives and board members, hold a portion of the company's shares. This aligns their interests with those of other shareholders. Insider ownership can vary over time.

As a publicly traded company, Nortech is subject to regulations and reporting requirements. This increases transparency regarding its ownership structure. Publicly traded companies provide more information.

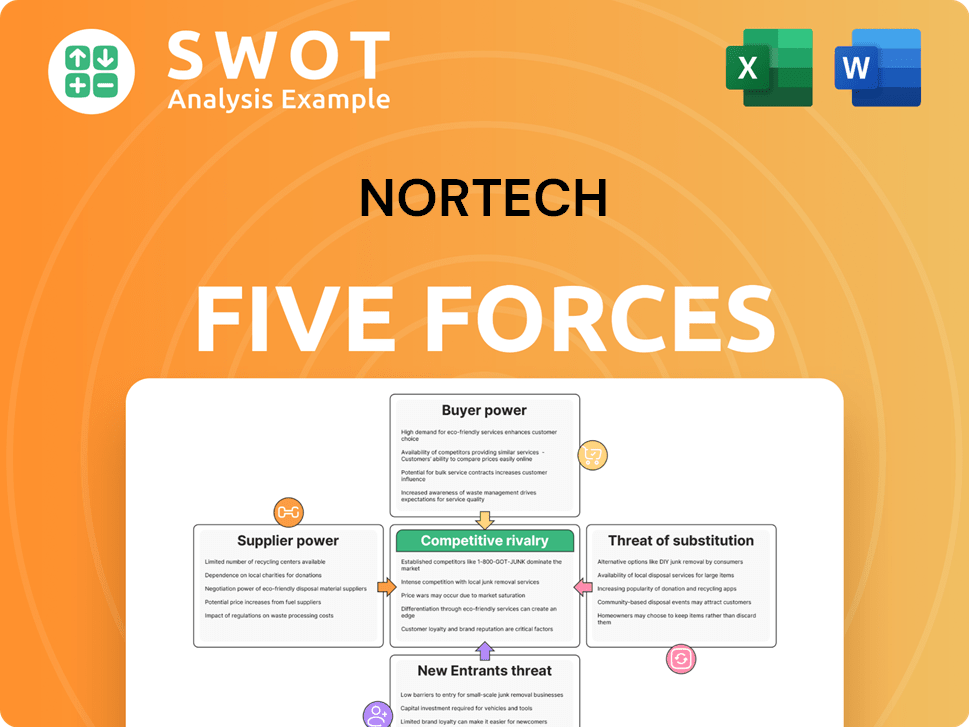

Nortech Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nortech Company?

- What is Competitive Landscape of Nortech Company?

- What is Growth Strategy and Future Prospects of Nortech Company?

- How Does Nortech Company Work?

- What is Sales and Marketing Strategy of Nortech Company?

- What is Brief History of Nortech Company?

- What is Customer Demographics and Target Market of Nortech Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.