OSI Group Bundle

Can OSI Group Continue Its Ascent in the Global Food Industry?

From a modest butcher shop to a global food processing titan, OSI Group's journey is a compelling case study in strategic growth. Founded in 1909, this company's evolution reveals the critical role of adaptability and foresight in today's dynamic market. This exploration delves into the OSI Group SWOT Analysis, examining its growth strategy and future prospects.

The OSI Group Company has consistently demonstrated its ability to navigate the complexities of the global food industry. Its strategic initiatives, including aggressive expansion and continuous innovation, are key to understanding its future trajectory. This deep dive into OSI Group's business explores its market analysis, strategic plans, and the drivers behind its anticipated growth in the coming years, offering valuable insights for investors and industry professionals alike. The future prospects of OSI Group are promising.

How Is OSI Group Expanding Its Reach?

The growth strategy of the company, known as OSI Group, is built on a multi-faceted expansion approach. This strategy focuses on both geographical reach and product diversification. It has historically emphasized international expansion, strategically establishing and acquiring processing facilities in key markets.

The company aims to better serve its global client base and mitigate regional supply chain risks. Recent reports show continued investment in expanding capacity in its European operations. This is to cater to the growing demand for prepared foods and private-label products in the region. In Asia, the company focuses on increasing its presence to tap into the burgeoning middle-class consumer base.

Beyond geographical expansion, the company is actively pursuing new product categories and value-added offerings. This includes a strong emphasis on plant-based protein alternatives, a rapidly growing segment within the food industry. The company has invested in R&D and production capabilities to develop and supply plant-based options, aligning with shifting consumer preferences towards healthier and more sustainable food choices. For a deeper understanding of the company's target market, you can refer to the Target Market of OSI Group.

The company's expansion strategy includes a strong focus on geographical reach. This involves establishing and acquiring processing facilities in key markets. The company has a significant presence in Asia, Europe, and North America. These strategic locations allow the company to serve its global client base effectively and manage supply chain risks.

OSI Group is actively diversifying its product offerings. This includes investing in new product categories and value-added offerings. A key area of focus is plant-based protein alternatives, which is a rapidly growing segment. The company is investing in R&D and production to meet changing consumer preferences.

The company explores strategic partnerships and potential mergers and acquisitions. These moves complement its existing portfolio. They also open doors to new customer segments or technological advancements. This approach supports the company's long-term growth and market penetration goals.

OSI Group consistently invests in research and development. This investment supports the development of new products and technologies. It also helps the company stay competitive in the evolving food industry. This commitment to innovation is a key part of the company's growth strategy.

The company's growth is driven by several key factors. These include geographical expansion, product diversification, and strategic investments. The company's focus on emerging markets, such as China, is a significant growth driver. The rising demand for high-quality food products in these regions supports the company's expansion.

- Expansion into Asia, especially China, to tap into the growing middle-class market.

- Investment in plant-based protein alternatives to meet changing consumer preferences.

- Strategic partnerships and acquisitions to expand its portfolio and market reach.

- Ongoing investments in R&D to drive innovation and product development.

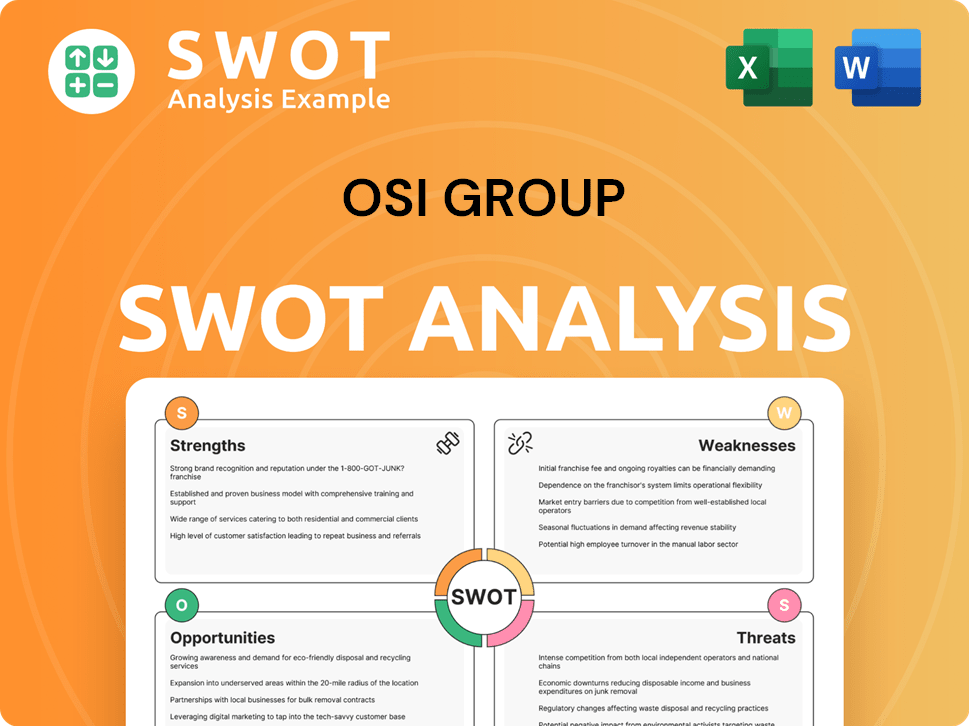

OSI Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does OSI Group Invest in Innovation?

The OSI Group Growth Strategy is heavily influenced by its dedication to innovation and technology. This approach is critical for maintaining a competitive edge in the dynamic food industry. The company continuously invests in research and development, which is a core element of its business model.

OSI Group's focus on technology allows it to improve food safety, make its processes more efficient, and create new products that meet what consumers want. Digital transformation plays a significant role, incorporating advanced analytics, automation, and potentially AI into its operations. This includes optimizing production and enhancing food traceability.

Sustainability is also a priority. OSI Group is exploring new technologies to reduce its environmental impact, focusing on waste reduction, water conservation, and sustainable sourcing. These initiatives are integral to the company's growth and its ability to address industry challenges.

OSI Group allocates resources to research and development to improve food safety and efficiency. While specific figures are confidential, the continuous product innovation and operational advancements suggest a substantial investment in R&D.

Digital transformation is a key area of focus for OSI Group. The company integrates advanced analytics and automation across its supply chain and manufacturing processes. This includes optimizing production lines and improving inventory management.

OSI Group is increasingly emphasizing sustainability. This involves exploring new technologies to reduce its environmental footprint. Efforts include waste reduction, water conservation, and sustainable sourcing of raw materials.

Enhancing the traceability of food products is a critical aspect of OSI Group’s technology strategy. This helps to ensure quality control and build consumer trust. Traceability extends from farm to fork.

The integration of cutting-edge technologies aims to improve operational efficiency and reduce costs. This positions OSI Group as a leader in providing innovative and sustainable food solutions. Advanced technologies are used to streamline processes.

OSI Group aims to maintain a competitive edge by continually innovating and adapting to industry changes. This proactive approach helps the company stay ahead. The company focuses on maintaining a strong market position.

OSI Group leverages technology to enhance its operations and meet evolving consumer demands. The company's strategy includes investments in research and development, digital transformation, and sustainability initiatives. These strategies are designed to drive OSI Group's Future Prospects.

- Research and Development: Continuous investment in R&D to improve food safety, processing efficiency, and product innovation. While specific figures are not available, the impact is evident in their new product launches and operational improvements.

- Digital Transformation: Implementation of advanced analytics, automation, and AI to optimize production, improve inventory management, and enhance food traceability. This strategy aims to streamline processes and improve efficiency across the supply chain.

- Sustainability Initiatives: Focus on reducing environmental impact through waste reduction, water conservation, and sustainable sourcing. This includes exploring new technologies and processes to minimize the company's ecological footprint.

- Market Analysis: OSI Group uses market analysis to understand consumer needs and preferences, guiding its product development and expansion strategies. This data-driven approach helps the company stay competitive.

- Expansion and Partnerships: Strategic expansion into new markets and collaborations to enhance its global presence and access new technologies. Partnerships are crucial for growth.

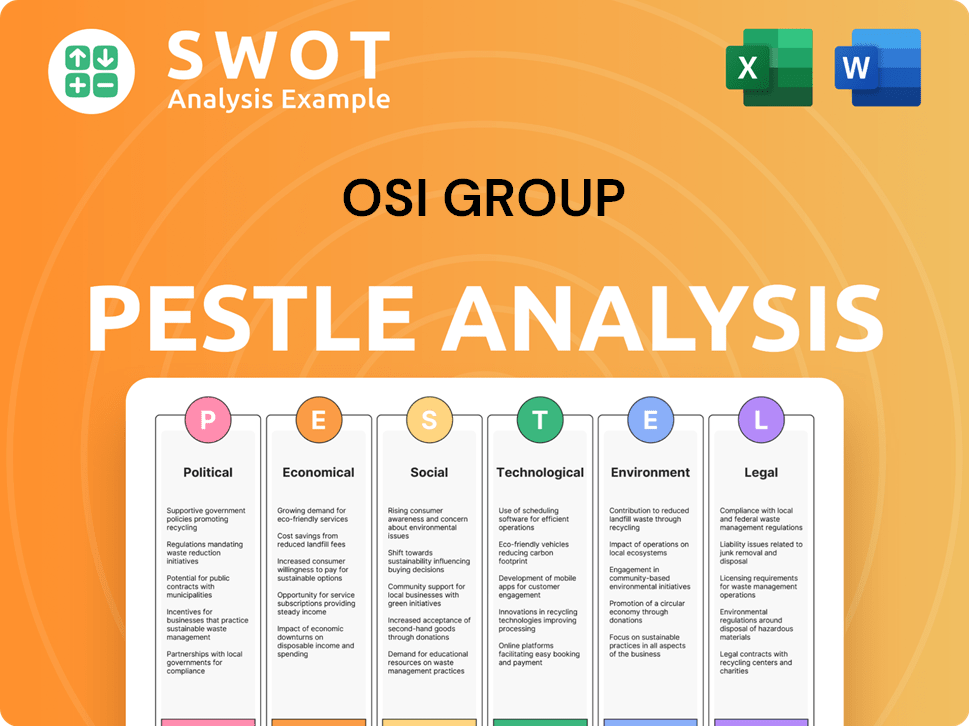

OSI Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is OSI Group’s Growth Forecast?

As a privately held entity, detailed financial disclosures for the OSI Group are not publicly available. However, the company's financial health is generally considered robust, supported by its consistent growth and strategic partnerships within the global food industry. The OSI Group's financial strategy emphasizes reinvestment in operational expansions, acquisitions, and market diversification, indicating a focus on long-term sustainability and market share growth.

Industry analysts project continued growth for the food processing sector in 2024 and 2025, driven by increasing global food consumption and the demand for value-added products. This positive outlook aligns with the OSI Group's expansion initiatives and its investments in new facilities and emerging markets. The company's financial strategy is geared towards leveraging its strong balance sheet to support significant capital expenditures, fueling future development and reinforcing its market position.

The OSI Group's approach to its financial outlook is centered on sustained growth through operational excellence and market diversification. This is supported by its long-standing relationships with major global food brands and its strategic investments in new facilities and emerging markets. For more insights into the company's origins and development, you can explore the Brief History of OSI Group.

The OSI Group's growth is driven by increasing global food consumption and the demand for value-added products. Strategic investments in new facilities and expansion into emerging markets also contribute to its growth. The company's focus on operational excellence and market diversification supports its financial performance.

The financial strategy involves reinvesting earnings to fuel further growth and market share expansion. This includes capital expenditures for future development. The company's strong balance sheet supports these investments, ensuring long-term sustainability.

OSI Group likely conducts thorough market analysis to identify growth opportunities and assess risks. This includes monitoring consumer trends, analyzing competitor activities, and evaluating the economic conditions in different regions. This data-driven approach helps inform strategic decisions.

The OSI Group's future prospects appear positive, supported by industry trends and its strategic initiatives. The company's continuous operational expansions and acquisitions imply a strategy focused on sustained growth. The company is well-positioned to capitalize on increasing global food consumption.

The OSI Group, like other companies in the food processing sector, may face various challenges. These include supply chain disruptions, fluctuating raw material costs, and increasing regulatory requirements. The company also needs to adapt to changing consumer preferences and maintain its competitive edge.

- Supply chain disruptions

- Fluctuating raw material costs

- Changing consumer preferences

- Increasing regulatory requirements

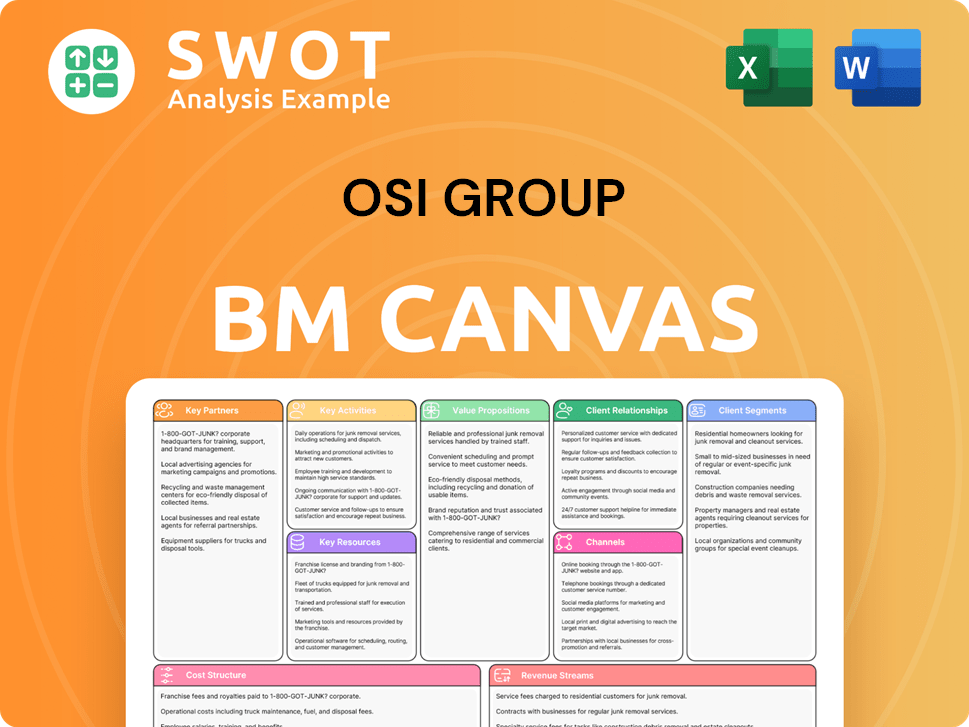

OSI Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow OSI Group’s Growth?

The future of the company, like any major player in the food industry, faces several potential risks and obstacles. These challenges range from intense competition and evolving consumer preferences to supply chain vulnerabilities and the impact of technological advancements. Understanding these risks is crucial for assessing the company's long-term viability and growth potential.

One of the primary hurdles involves navigating a highly competitive global food processing market. The company must continuously innovate and optimize costs to maintain its market position. Additionally, the company faces regulatory changes, particularly concerning food safety and international trade policies, which can impact operations and costs. Staying ahead in this dynamic environment requires proactive strategies and adaptability.

Supply chain disruptions and shifts in consumer demand also pose significant risks. Geopolitical events, climate change, and transportation issues can lead to raw material shortages and price fluctuations. Simultaneously, consumer preferences for transparency, sustainability, and specific dietary options are constantly evolving. Successfully addressing these challenges is vital for the company’s sustained success.

The global food processing industry is highly competitive, with numerous established and emerging players. This competition necessitates continuous innovation and cost-efficiency to maintain profitability and market share. The company must differentiate itself through product offerings and operational excellence.

Regulatory changes, especially concerning food safety, environmental standards, and international trade policies, pose significant challenges. Compliance with diverse and evolving regulations across multiple jurisdictions requires substantial resources. These changes can impact operational flexibility and increase costs.

Supply chain vulnerabilities, including geopolitical events, climate change impacts, and transportation disruptions, can lead to raw material shortages. These issues can cause price volatility and delays in product delivery. The company needs robust supply chain management.

Failing to keep pace with advancements in food processing, automation, and data analytics could be a risk. Competitors may adopt new technologies that offer efficiency gains. Staying updated with technological advancements is essential for maintaining a competitive edge.

Consumer preferences are constantly evolving, with increasing demand for transparency, sustainability, and specific dietary options. Failure to adapt product offerings to these changing demands could lead to a loss of market relevance. The company must stay attuned to these trends.

Geopolitical instability can disrupt supply chains and impact international trade, potentially affecting the availability of raw materials and increasing costs. The company must monitor global events. These risks underscore the need for diversified sourcing and robust risk management strategies.

To mitigate these risks, the company likely employs diversified sourcing strategies, robust supply chain management, and continuous market monitoring. Strategic diversification of its product portfolio and ongoing investments in risk management and scenario planning are also crucial. For further insights into the competitive landscape, consider exploring the Competitors Landscape of OSI Group.

Conducting thorough market analysis is essential for understanding consumer trends and competitive dynamics. This includes monitoring changes in consumer preferences, such as the rising demand for plant-based proteins, which grew by approximately 18% in 2024. The company's ability to adapt its product offerings to meet these evolving needs will be critical for future growth.

Robust supply chain management is vital to mitigate risks associated with raw material shortages and price volatility. Diversifying sourcing locations and building strong relationships with suppliers can help ensure a stable supply of ingredients. In 2024, supply chain disruptions cost the food industry an estimated $20 billion.

Implementing comprehensive risk management strategies, including scenario planning and stress testing, is crucial. This involves identifying potential threats, assessing their impact, and developing contingency plans. The food processing industry faces increasing risks, with cyberattacks causing an estimated $10 billion in losses annually.

Investing in technological advancements, such as automation and data analytics, is necessary to maintain a competitive edge. The adoption of artificial intelligence in food processing is projected to grow by 25% annually through 2025. Embracing these technologies can improve efficiency and reduce operational costs.

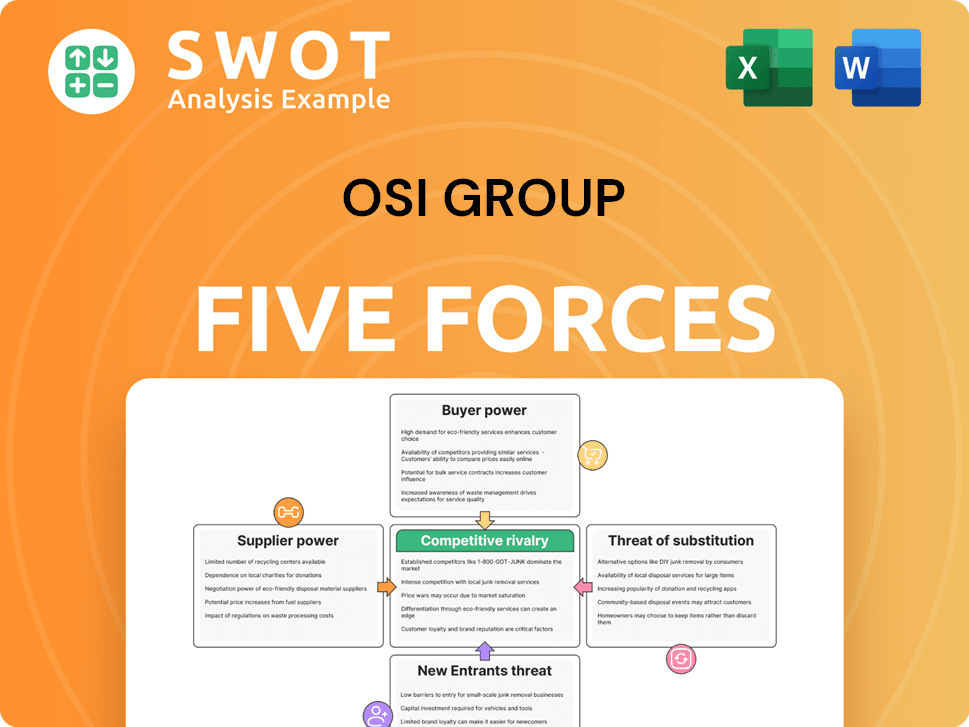

OSI Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of OSI Group Company?

- What is Competitive Landscape of OSI Group Company?

- How Does OSI Group Company Work?

- What is Sales and Marketing Strategy of OSI Group Company?

- What is Brief History of OSI Group Company?

- Who Owns OSI Group Company?

- What is Customer Demographics and Target Market of OSI Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.