OSI Group Bundle

Who Really Owns OSI Group?

Unraveling the ownership structure of a global food processing giant like OSI Group is crucial for understanding its strategic moves and market influence. From its humble beginnings as a family-run meat market to its current status as a multi-billion dollar international supplier, OSI Group's ownership has undergone a fascinating transformation. This deep dive explores the key players and pivotal moments that have shaped who controls this food industry powerhouse.

OSI Group's journey, starting in 1909 with Otto Kolschowsky, showcases a remarkable evolution in the food industry. With annual revenues nearing $10 billion in 2024, understanding the OSI Group SWOT Analysis is more critical than ever. This analysis will shed light on the OSI Group ownership and OSI Group parent company, offering insights into its operations, OSI Group subsidiaries, and overall OSI Group company structure. The exploration will also cover key aspects like OSI Group history, OSI Group headquarters, and OSI Group financial information to provide a comprehensive view of this major player.

Who Founded OSI Group?

The story of the OSI Group's ownership begins in 1909 with Otto Kolschowsky, a German immigrant who established a meat market and butcher shop in Oak Park, Illinois, originally called Otto & Sons. This marked the start of what would become a major player in the food industry. The business shifted into wholesale meat trading in 1917, moving to Maywood, Illinois, and gradually built a strong reputation for quality.

A pivotal moment came in 1955 when Ray Kroc, the founder of McDonald's, selected Otto & Sons as the initial supplier of fresh ground beef patties for the first McDonald's restaurant in Des Plaines, Illinois. This partnership was key to the company's growth. The Kolschowsky sons, Harold and Jerry, played important roles in the company's expansion alongside Sheldon Lavin.

In 1970, Otto & Sons needed capital to construct its first industrial processing plant, leading them to seek financial help from Sheldon Lavin, who was then a banker. Lavin secured the necessary funding and later joined the company full-time as a partner, acquiring a one-third stake at McDonald's urging when the senior Otto retired. Lavin eventually became the CEO, and the company changed its name to OSI. Over time, Lavin bought out the stakes of both Kolschowsky sons, ultimately becoming the sole owner of the OSI Group.

Otto Kolschowsky launched Otto & Sons in 1909, setting the foundation for the future OSI Group. The company's early focus was on providing quality meats, which helped establish its reputation.

The relationship with McDonald's, starting in 1955, was a major catalyst for OSI Group's growth. This partnership provided a consistent demand for their products.

Sheldon Lavin's involvement as a financier and later as a partner was critical to the company's expansion. He secured funding and eventually took over as CEO.

Lavin's acquisition of the Kolschowsky sons' stakes led to a privately held ownership structure. This structure has remained a defining characteristic of the company.

The company's evolution included a name change to OSI, reflecting its broader scope and growth beyond its initial roots. This change marked a new phase in its development.

The OSI Group has maintained a private ownership structure, which allows it to make long-term strategic decisions. This structure has been in place for many years.

The evolution of the OSI Group's ownership, from its family-owned origins to its current private structure, showcases its strategic adaptability and growth. Understanding the Brief History of OSI Group helps to clarify this evolution.

- OSI Group's ownership is currently held privately.

- Sheldon Lavin's role was crucial in the company's expansion and ownership transition.

- The company's long-term success is tied to its strategic partnerships and private ownership model.

- The company's history reflects a shift from a family business to a global food processing leader.

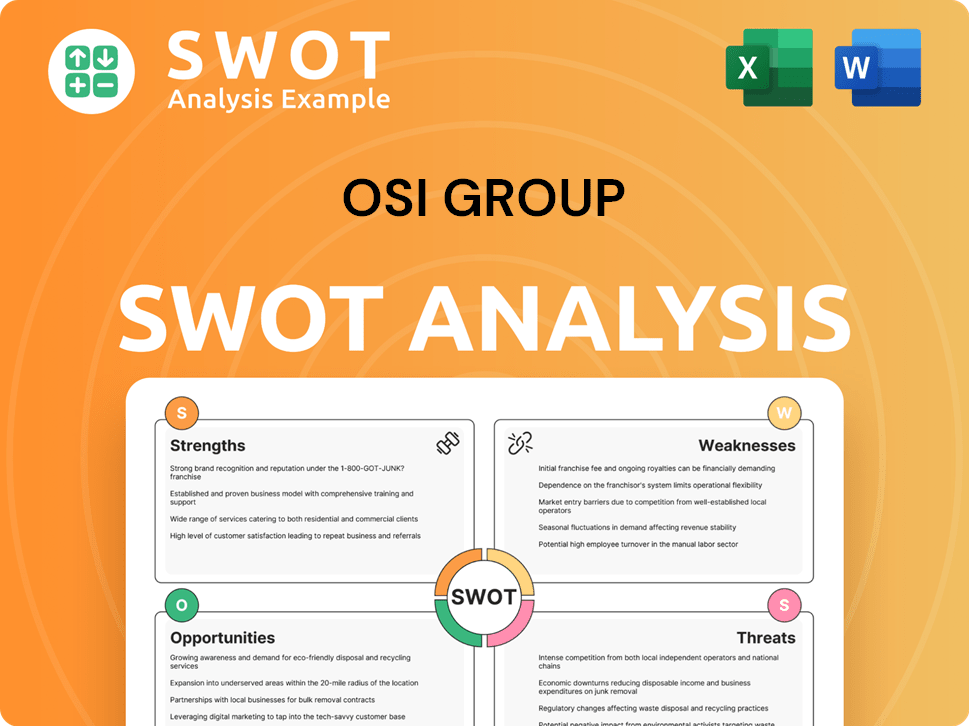

OSI Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has OSI Group’s Ownership Changed Over Time?

The OSI Group ownership structure has remained private since its inception. This means the company is not listed on any public stock exchanges. The primary ownership has evolved, with the Kolschowsky family being the initial founders. The most significant shift in ownership occurred with Sheldon Lavin, who served as the owner, CEO, and chairman until his passing in May 2023. His estimated net worth at the time of his death was US$3.1 billion.

The private ownership model has allowed the company to focus on long-term strategic decisions. This is without the pressures of quarterly reporting that public companies face. Recent acquisitions, such as Karnova Food Group in February 2025 and Park 100 Foods in October 2024, indicate the company’s continued growth through strategic investments. These moves highlight the impact of the private ownership structure on the company’s strategic direction and its ability to expand globally.

| Key Event | Impact on Ownership | Date |

|---|---|---|

| Founding of OSI Group | Initial ownership by the Kolschowsky family | Historical |

| Sheldon Lavin's Leadership | Lavin became the primary owner, CEO, and chairman | Ongoing until May 2023 |

| Sheldon Lavin's Death | Transition of ownership within the private structure | May 2023 |

| Acquisition of Karnova Food Group | Demonstrates continued strategic investment under private ownership | February 2025 |

| Acquisition of Park 100 Foods | Further strategic expansion under private ownership | October 2024 |

As of November 2024, OSI Group was listed as #64 on Forbes' America's Top Private Companies list, with a reported revenue of $8.2 billion in 2024. This underscores the financial strength and market position of the company. The company's financial status is described as 'Private Debt Financed,' with a latest deal amount of $850 million involving one investor. To understand more about the company's market, you can read this article about the Target Market of OSI Group.

OSI Group's ownership is privately held, which affects its strategic decisions and financial operations. The company's revenue reached $8.2 billion in 2024, showing significant financial performance. Recent acquisitions, like Karnova Food Group and Park 100 Foods, highlight its growth strategy.

- Private ownership allows for long-term strategic planning.

- Sheldon Lavin was a key figure in the company's ownership and leadership.

- The company's financial status is 'Private Debt Financed'.

- OSI Group continues to expand through strategic acquisitions.

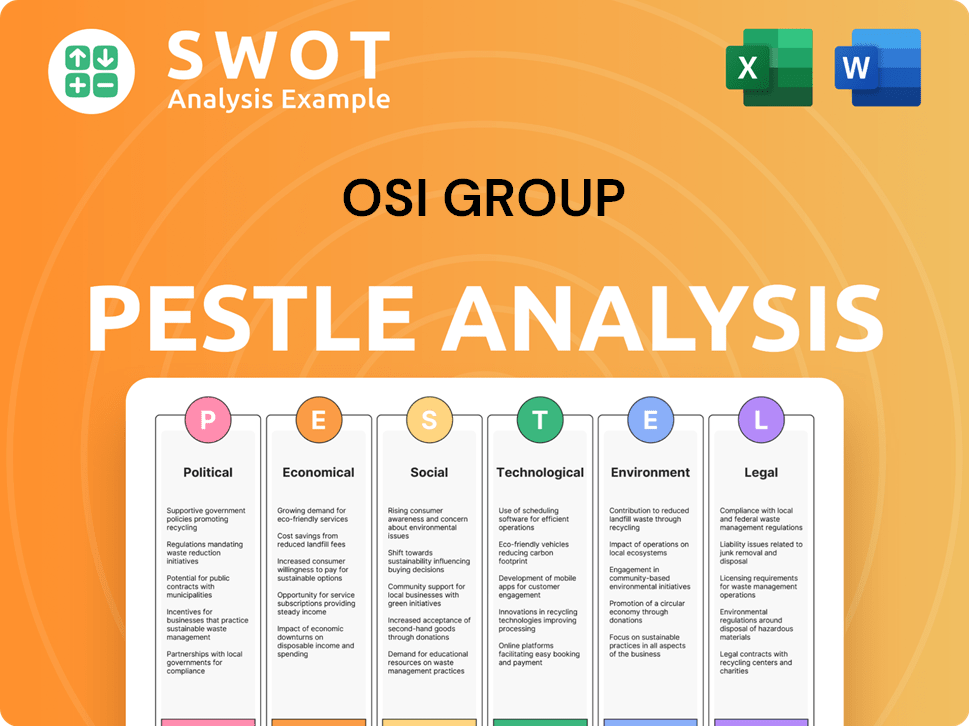

OSI Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on OSI Group’s Board?

As a privately held entity, details about the board of directors of the OSI Group ownership are not publicly available. However, based on the typical structure of private companies, the board likely includes family members, key executives, and potentially external advisors. Their main responsibility is to provide strategic direction and oversee the company's long-term vision. The exact composition and individual shareholdings remain confidential due to the private nature of the company.

Following the death of Sheldon Lavin in May 2023, Steve Lavin is listed as CEO. The OSI Group parent company structure implies that control and decision-making power are concentrated among the primary owners or a small group of owners, often through direct equity ownership. This structure ensures continuity in the company's strategic direction, contrasting with the more complex governance of public companies. The board's role is crucial in guiding the company's operations, especially considering its significant presence in the global food processing industry and its relationships with major clients like McDonald's. Understanding the company's structure is key to grasping its operational dynamics and strategic decisions.

| Aspect | Details | Notes |

|---|---|---|

| Ownership Structure | Private | Control concentrated among a few owners. |

| Board Composition | Likely includes family members, executives, and external advisors | Details not publicly disclosed. |

| CEO | Steve Lavin | Succeeded Sheldon Lavin. |

It's important to differentiate the OSI Group from other similarly named entities. For instance, the Optometric Services Inc. (OSI Group) in Canada has a board composed of eight independent owner-optometrists, with Dr. Karine Briand elected as the new chair in October 2024. Additionally, OSI Systems, a publicly traded company (NASDAQ: OSIS), operates under a completely separate board. These distinctions are crucial when researching the OSI Group company structure and its governance. For more information on the company's strategic direction, you can read the Growth Strategy of OSI Group.

The OSI Group operates under a private ownership structure, which influences its board composition and decision-making processes.

- The board likely includes family members, key executives, and potentially external advisors.

- Control is concentrated among the primary owners, ensuring strategic continuity.

- Distinguish the OSI Group from other similarly named entities to avoid confusion.

- Understanding the private structure is essential for grasping operational dynamics.

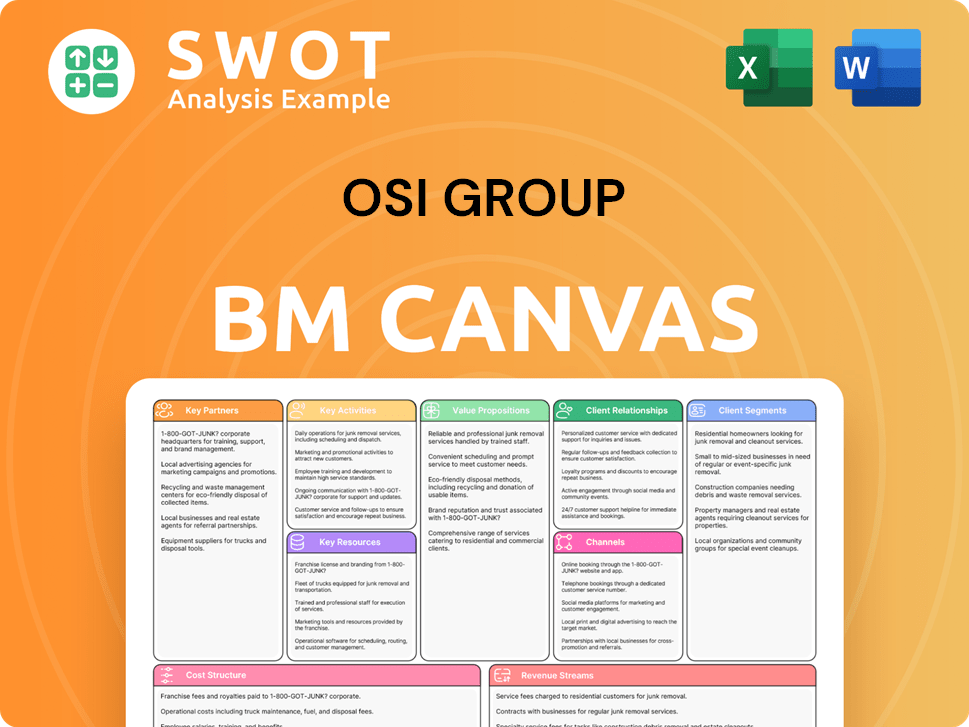

OSI Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped OSI Group’s Ownership Landscape?

Over the past few years, the OSI Group ownership structure has remained consistent, with a focus on strategic growth and expansion. The company, which is privately held, has continued to make strategic acquisitions to broaden its global footprint and enhance its capabilities. This approach is typical for privately-owned businesses that prioritize long-term growth over the short-term pressures often associated with public markets.

Recent developments in 2024 and early 2025 highlight this trend. In February 2025, OSI acquired Karnova Food Group, a U.K.-based protein supplier, to strengthen its supply chain. Earlier, in October 2024, the company acquired Park 100 Foods, expanding its offerings in the sauce, soup, and macaroni and cheese categories. These moves demonstrate the company's ongoing strategy to broaden its product offerings and geographical presence. The OSI Group parent company continues to invest in innovative solutions, including sustainability initiatives.

| Year | Revenue (USD) | Key Developments |

|---|---|---|

| 2024 (Projected) | $10 billion | Acquisition of Park 100 Foods, Continued global expansion. |

| 2024 | $8.2 billion | Strategic acquisitions and expansion efforts. |

| 2023 | N/A | Sheldon Lavin passed away in May. |

The company's leadership structure also reflects its private ownership. After the passing of founder Sheldon Lavin in May 2023, Steve Lavin, continues as CEO, indicating a continuity of leadership within the family or closely associated parties. This continuity is a common characteristic of successful private enterprises, supporting a consistent long-term vision. For more insights into the company's operations, consider reading Revenue Streams & Business Model of OSI Group.

Founded in 1909, OSI Group has a long history in the food industry. The company's early focus was on meat processing and supply. Over time, it expanded its operations globally. This history reflects a consistent growth strategy.

OSI Group ownership is privately held. The company is not publicly traded. The ownership structure is primarily within the Lavin family and related parties. This structure allows for long-term strategic planning.

OSI Group headquarters is located in Aurora, Illinois, USA. This location serves as the central hub for its global operations. The company has a significant presence in multiple countries worldwide.

OSI Group operates through various subsidiaries globally. These subsidiaries support its diverse product offerings and geographical reach. The company's structure allows for efficient management.

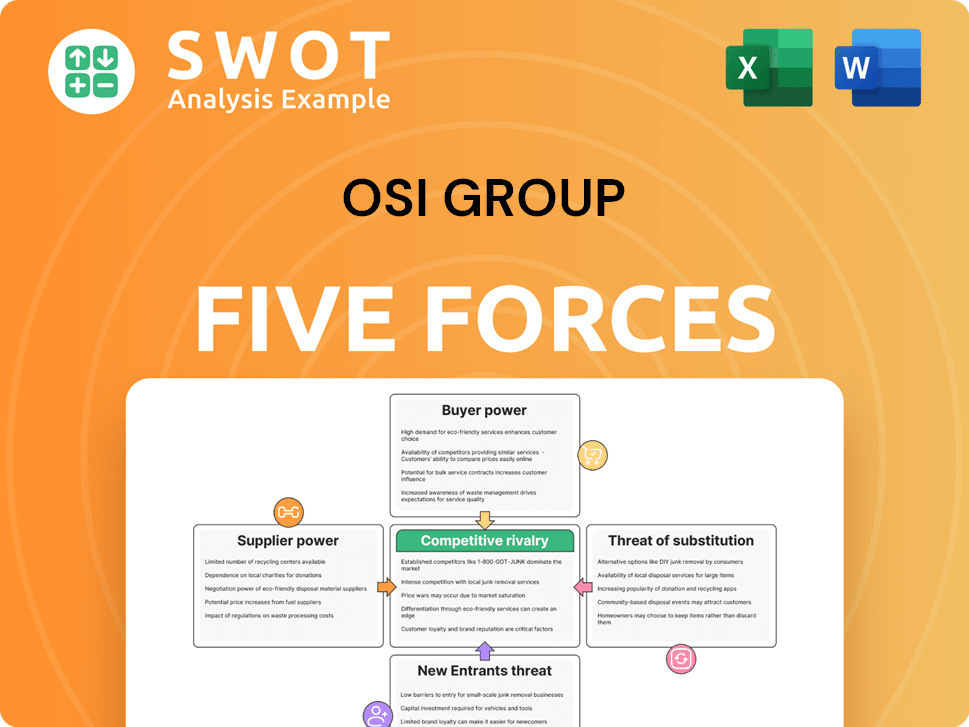

OSI Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of OSI Group Company?

- What is Competitive Landscape of OSI Group Company?

- What is Growth Strategy and Future Prospects of OSI Group Company?

- How Does OSI Group Company Work?

- What is Sales and Marketing Strategy of OSI Group Company?

- What is Brief History of OSI Group Company?

- What is Customer Demographics and Target Market of OSI Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.