Petsmart Bundle

Can PetSmart Maintain Its Dominance in the Evolving Pet Market?

PetSmart, a pioneer in the pet retail sector, has redefined how we care for our furry companions. From its humble beginnings as a warehouse-style pet food store, the company has transformed into a comprehensive provider of pet products and services. This evolution reflects a deep understanding of the Petsmart SWOT Analysis and the changing needs of pet owners.

This exploration delves into the Petsmart growth strategy, examining how the company plans to navigate the dynamic retail pet market and capitalize on emerging pet industry trends. We'll analyze the Petsmart business model, scrutinize its Petsmart future prospects, and assess its ability to maintain a competitive edge through innovation and strategic initiatives, including potential Petsmart expansion plans 2024 and its approach to Petsmart online sales strategy.

How Is Petsmart Expanding Its Reach?

The company is actively pursuing various initiatives to expand its business, focusing on both service enhancement and sustainable practices. This approach is crucial for maintaining its position in the competitive retail pet market. The company's growth strategy is heavily influenced by the evolving needs and preferences of pet owners.

The company views its service offerings, such as professional grooming, boarding, and training, as a key competitive strength. These services attract customers to its stores and encourage cross-shopping, contributing significantly to its financial performance. Focusing on services allows the company to differentiate itself from online retailers and build customer loyalty.

The company's future prospects are closely tied to its ability to adapt to pet industry trends and consumer demands. By expanding its service offerings and embracing sustainability, the company aims to capture a larger share of the growing pet market and enhance its overall value proposition. A detailed Petsmart company analysis reveals the intricacies of its business model and expansion plans.

The company is focusing on expanding its service offerings, including grooming, boarding, and training. The U.S. pet grooming and boarding market is projected to reach $15.8 billion by 2029. These services drive customer traffic and increase cross-shopping within the stores.

The company is expanding its range of purpose-driven and sustainable products. In 2024, it became the first national retailer to pilot a West Paw dog toy takeback program in over 75 stores. This aligns with growing consumer interest in eco-friendly actions, with nearly 70% of pet parents expressing such interest.

In collaboration with brands like Hill's Pet, Royal Canin, Canidae, and Tiki Cat, the company partnered with TerraCycle to launch an in-store recycling program for empty pet food, treat, and cat litter bags in 100 stores. Plans are in place for enterprise-wide expansion of this initiative.

PetSmart Charities, an independent non-profit organization, has facilitated over 11 million pet adoptions through in-store programs. In 2024, it invested over $11 million in low-cost veterinary clinics in the U.S. and Canada, addressing the need for affordable veterinary care.

The company's expansion strategy focuses on enhancing services, promoting sustainable products, and supporting pet welfare through its charitable arm. These initiatives are designed to strengthen its market position and cater to evolving consumer preferences. These actions are critical for the company's long-term success and are a key part of its business model.

- Expanding grooming, boarding, and training services.

- Introducing and expanding sustainable product lines.

- Investing in in-store recycling programs.

- Supporting pet adoption and affordable veterinary care through PetSmart Charities.

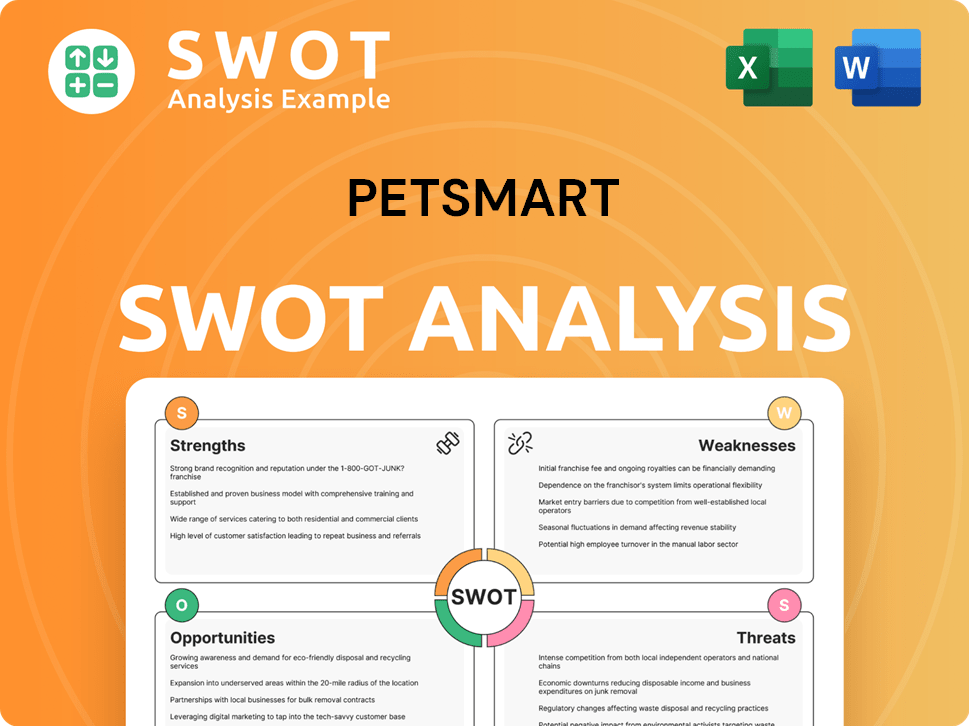

Petsmart SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Petsmart Invest in Innovation?

The company is actively employing innovation and technology to fuel its expansion, with a strong emphasis on digital transformation and AI-driven personalization. This strategic shift is designed to enhance customer experiences and streamline operations, positioning the company for sustained growth within the evolving pet retail market. The company's approach reflects a broader trend in the pet industry, where technology plays an increasingly vital role in meeting the changing needs of pet owners.

The company has significantly invested in its digital infrastructure, establishing a robust e-commerce platform and an omnichannel marketing strategy. This integration allows customers to seamlessly transition between online and in-store experiences, improving convenience and driving sales. This approach is crucial in the current retail landscape, where consumers expect a unified and flexible shopping experience.

The company's commitment to innovation is evident in its strategic initiatives, including the enhancement of its loyalty program. This focus on technology and customer-centric strategies is key to its future prospects and overall company analysis.

The company has prioritized digital transformation, creating a strong e-commerce platform and an omnichannel marketing strategy. This allows customers to browse products online, check in-store inventory, and make purchases with options for pickup. Digital comparable sales growth neared 20% during the third quarter of 2024.

The company leverages artificial intelligence to enhance its loyalty program, Treat Rewards. Machine learning customizes offers based on individual buying habits, such as preferred dog food brands or grooming services. This has led to a 22% increase in offer activations in 2024.

The revamped Treat Rewards program features a three-tier structure (member, bestie, and VIPP) based on annual spend. Perks include points, discounts, and freebies. Membership in the Treat Rewards program has grown from 67 million to 75 million since its relaunch.

The company is investing in sustainability, using technology to track and reduce its environmental impact. In 2024, the company reduced emissions intensity and total energy usage by 18%, and water usage by 1%. The company completed its first investment in renewable energy in November 2024 with an agreement to install solar power at its Phoenix, Arizona distribution center.

The company's omnichannel approach integrates physical stores with its digital presence, allowing customers to shop seamlessly across channels. This strategy enhances the customer experience and drives sales. This is a critical component of the company's Mission, Vision & Core Values of Petsmart.

Over 90% of transactions are linked to a Treat Rewards account, highlighting the program's importance to bottom-line performance. AI helps determine the optimal timing and sequence for outreach, which led to a 22% increase in offer activations in 2024.

The company's innovation strategy focuses on digital transformation, AI-driven personalization, and sustainability initiatives. These strategies support the company's growth and enhance customer experience. The company's approach reflects its commitment to adapting to the evolving retail pet market.

- Digital Transformation: A robust e-commerce platform and omnichannel marketing strategy.

- AI-Driven Personalization: Using machine learning to customize offers and enhance the loyalty program.

- Sustainability Initiatives: Utilizing technology to track and reduce environmental impact.

- Loyalty Program: Enhancements to the Treat Rewards program, increasing customer engagement.

- Data Analytics: Leveraging data to make informed decisions and improve operational efficiency.

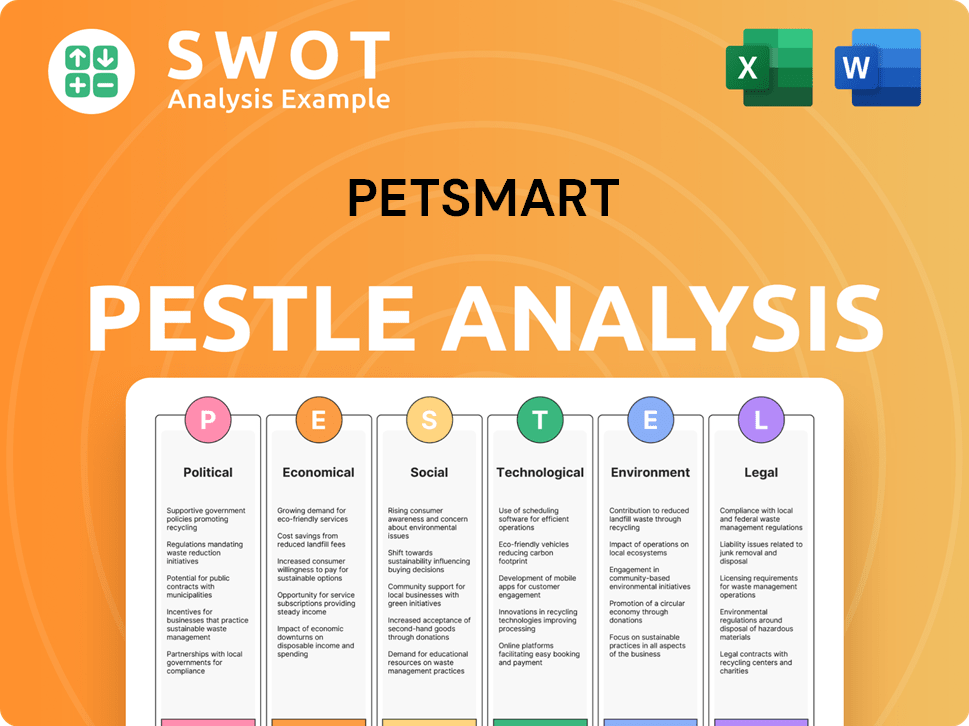

Petsmart PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Petsmart’s Growth Forecast?

The financial outlook for the company reveals a mixed picture for 2024 and 2025, influenced by trends in the pet retail sector. S&P Global Ratings projects an adjusted EBITDA margin of approximately 16% for both years. This projection reflects the company's efforts to navigate a challenging environment, balancing growth with profitability.

The company's credit protection metrics have shown some deterioration. The S&P Global Ratings-adjusted leverage increased to 4.3x as of the third quarter of 2024, compared to 3.7x at the end of fiscal year 2023. This increase indicates rising financial pressures, which the company is actively addressing through strategic initiatives. Understanding the Revenue Streams & Business Model of Petsmart can provide additional context to these financial dynamics.

The company's performance in the first nine months of 2024 did not meet expectations, with both revenue and S&P Global Ratings-adjusted EBITDA expected to decrease for the year. This downturn is due to a combination of factors, including softer industry demand, changing consumer preferences, and increased competition. The company is responding to these challenges with strategic adjustments.

Comparable store sales declined by 4.4% in the most recent quarter, and by 4.7% year-to-date through October 27, 2024. This decline shows the impact of consumers consolidating shopping trips due to value and convenience considerations. This impacts the overall Petsmart growth strategy.

The shift towards online sales, which approached 20% in digital comparable sales during Q3 2024, has also affected margins due to higher fulfillment costs. This trend is a significant factor in the Petsmart future prospects. The company is working to optimize its online sales strategy.

The sales mix shifting towards less profitable consumables has impacted margins. The S&P Global Ratings-adjusted EBITDA margin compressed by 260 basis points year over year to just under 17% for the trailing 12 months ending October 27, 2024. This compression highlights the need for the company to adjust its Petsmart business model.

Despite these pressures, the company generated approximately $300 million in free operating cash flow (FOCF) year-to-date in 2024, with expectations to build cash in the fourth quarter. Annual FOCF is forecasted to be around $400 million to $500 million. This demonstrates the company's ability to generate cash flow.

The company is making strategic investments to strengthen its value perception, including lowering prices on certain popular items. These investments will pressure near-term profitability. These initiatives are part of the company's plan to navigate the Retail pet market.

The Pet industry trends show a competitive environment. The company is addressing this by focusing on customer acquisition strategies and loyalty program benefits. The company is also looking at Petsmart expansion plans 2024.

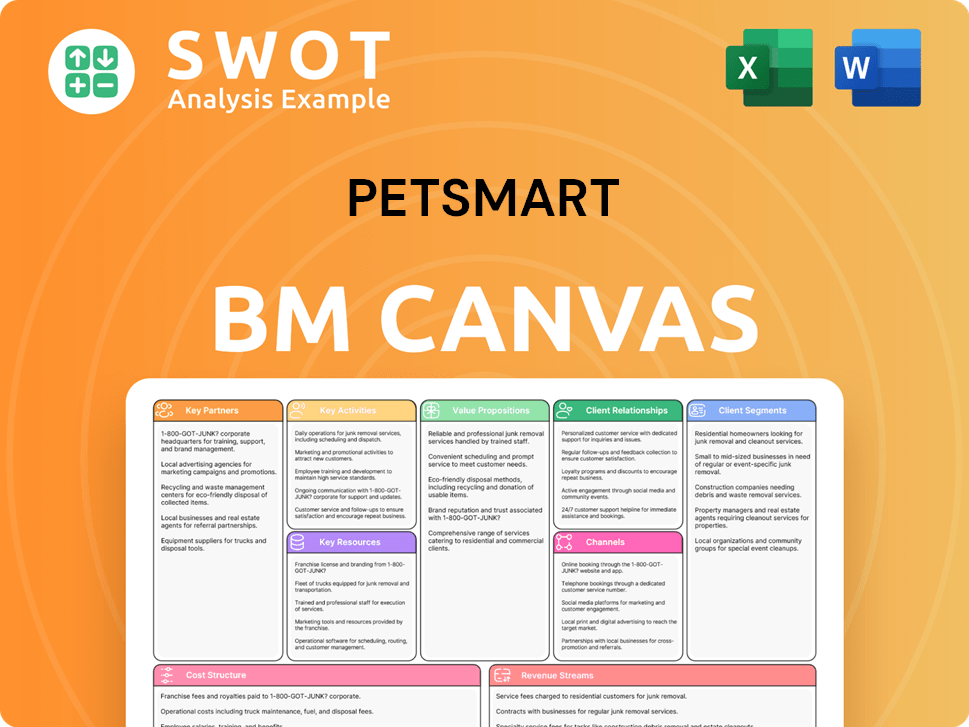

Petsmart Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Petsmart’s Growth?

The path forward for PetSmart, like any major player in the retail pet market, is laden with potential risks and obstacles. These challenges range from intense competition to evolving consumer preferences and potential supply chain disruptions. A thorough understanding of these factors is crucial for evaluating the company's long-term viability and potential for growth.

One of the most significant hurdles for PetSmart is the highly competitive nature of the pet retail industry. The company faces stiff competition from both online retailers like Chewy and traditional competitors such as Petco. This competitive landscape, coupled with changing consumer behavior, presents ongoing challenges for the company. The shift towards online shopping and the increasing importance of convenience and cost savings are reshaping the market dynamics.

Furthermore, PetSmart's ability to adapt to changing consumer preferences is critical. The growing trend of online shopping for pet supplies offers greater variety and cost savings, which can draw customers away from brick-and-mortar stores. The company must also be prepared to meet the increasing demands of pet owners who are more conscious of product quality and variety. The company's success hinges on its ability to navigate these multifaceted challenges and capitalize on emerging opportunities. For more information on the company's customer base, check out this article about the Target Market of Petsmart.

The pet retail market is fiercely competitive. Online retailers, such as Chewy, and traditional competitors, like Petco, pose significant challenges. The presence of large retailers such as Amazon, Walmart, and Target further intensifies the competitive environment.

Consumers are increasingly turning to online shopping for pet supplies, drawn by greater variety and cost savings. Pet owners are also becoming more discerning about product quality and variety. Adapting to these evolving preferences is crucial for sustained growth.

While less pronounced for domestically sourced consumables, supply chain disruptions remain a risk. Regulatory changes, such as tariffs on animal-based ingredients, and animal welfare concerns can also create challenges. Proactive risk management is essential.

The cost of pet ownership, including veterinary care and prescriptions, is a significant concern for pet owners. In early 2025, 36% of pet owners cited cost as a reason for being less likely to add another pet. Addressing affordability is critical.

The shift to online channels can lead to higher fulfillment costs, affecting profitability. PetSmart has seen digital comparable sales growth, but managing these costs is crucial. A robust omnichannel strategy is essential to balance online and in-store sales.

Increased leverage, as S&P Global Ratings expects debt to EBITDA in the mid-4x area over the next 12 months, highlights the need for vigilant risk management. Performance challenges and economic conditions can exacerbate financial pressures. Diversification and strategic planning are important.

PetSmart employs various strategies to mitigate risks, including diversification of product offerings, risk management frameworks, and scenario planning. The company's Animal Welfare Policy, published in March 2025, reflects efforts to address animal welfare concerns. Management's proactive approach is crucial for navigating the complex market environment.

PetSmart experienced market share loss in 2024 due to soft industry conditions and stiff competition. The company's financial performance is closely tied to its ability to adapt to market dynamics and manage costs effectively. Monitoring key financial metrics is essential for assessing its long-term prospects.

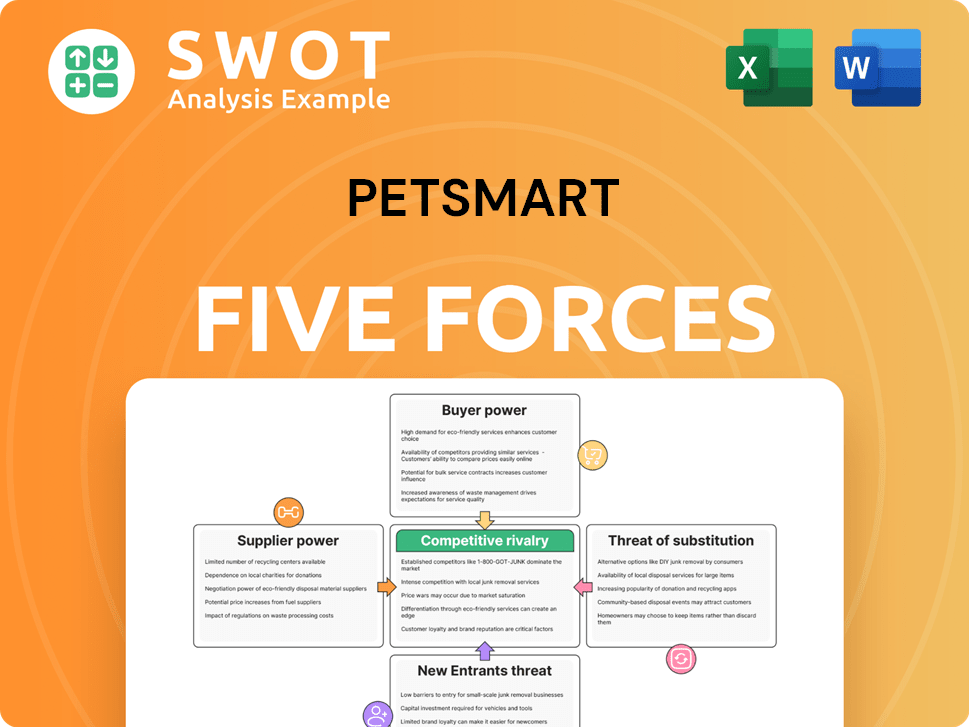

Petsmart Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Petsmart Company?

- What is Competitive Landscape of Petsmart Company?

- How Does Petsmart Company Work?

- What is Sales and Marketing Strategy of Petsmart Company?

- What is Brief History of Petsmart Company?

- Who Owns Petsmart Company?

- What is Customer Demographics and Target Market of Petsmart Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.