Petsmart Bundle

Who Really Calls the Shots at PetSmart?

Understanding the Petsmart SWOT Analysis is key to grasping its market position, but have you ever wondered who truly steers this pet care giant? Knowing the Petsmart company ownership structure is essential for investors, analysts, and anyone interested in the pet industry. The Petsmart ownership story is a fascinating tale of corporate evolution, acquisitions, and the influence of key players.

Delving into who owns Petsmart reveals critical insights into its strategic direction and financial health. From its founding in 1986 as PetFood Warehouse to its current status, the Petsmart parent company has seen significant shifts. This exploration will uncover the Petsmart history, the impact of the Petsmart acquisition by BC Partners, and the subsequent evolution of its ownership, providing a comprehensive view of this leading pet retailer.

Who Founded Petsmart?

The company, initially known as PetFood Warehouse, was established in 1986. The founders, Jim and Janice Dougherty, were the driving force behind its inception. Their vision was to create a large-format retail store specializing in pet supplies, offering a wide range of products at competitive prices. This marked the beginning of what would become a major player in the pet industry.

During its early stages, the Doughertys held a significant portion of the company's ownership. While the exact initial equity split isn't publicly detailed, their control was instrumental in shaping the company's initial growth and expansion. The early focus was on establishing a strong foundation for the business.

Early financial backing came from a blend of venture capital and private investors. These investors saw the potential in the growing pet care market. This funding was crucial for expanding beyond the initial locations. Standard agreements, such as vesting schedules and potential buy-sell clauses, were likely in place to align the interests of the founders and early investors.

Jim and Janice Dougherty founded the company in 1986.

The company's initial name was PetFood Warehouse.

The Doughertys maintained significant control in the early stages.

Early funding came from venture capital and private investors.

The founders aimed to create a one-stop shop for pet owners.

The focus was on growth and market penetration.

The initial ownership structure of the Petsmart company was primarily held by the founders, Jim and Janice Dougherty. Early financial support came from venture capital and private investors, which helped the company expand. The founders' vision of a comprehensive pet supply store was central to the company's early strategy. While the exact initial ownership split isn't detailed, the Doughertys' control was crucial for early growth. This period saw the establishment of the company's core business model and initial market presence.

- The company was founded in 1986.

- The founders, Jim and Janice Dougherty, held significant control.

- Early backing included venture capital and private investors.

- The focus was on creating a one-stop shop for pet owners.

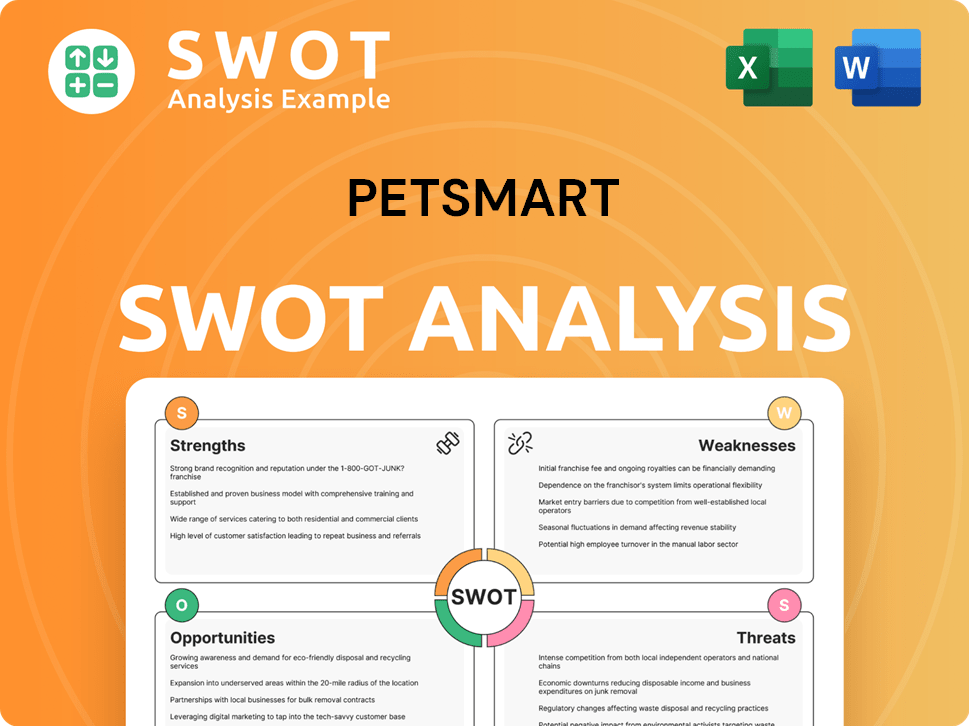

Petsmart SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Petsmart’s Ownership Changed Over Time?

The evolution of Petsmart ownership has been marked by significant shifts since its inception. Initially, the company went public in 1993, trading on the NASDAQ under the symbol 'PETM.' This initial public offering brought in public shareholders and institutional investors. During its time as a public entity, major players like asset management firms held substantial stakes, a common occurrence for large publicly traded corporations. This period saw the company expand its retail presence and service offerings, reflecting the dynamics of a publicly held entity.

A major turning point occurred in March 2015 when Petsmart was acquired by a group led by BC Partners, a private equity firm, for approximately $8.7 billion. This move took Petsmart private, delisting it from the NASDAQ. As of 2024-2025, BC Partners remains the primary owner and controlling stakeholder. The transition to private ownership allowed for strategic decisions focused on long-term growth, including the 2017 acquisition of Chewy.com, which was later spun off in an IPO in 2019. This shift has influenced the company's strategy, optimizing its physical stores, enhancing services, and integrating its pet care offerings.

| Ownership Phase | Key Event | Impact |

|---|---|---|

| Public (Pre-2015) | Initial Public Offering (1993) | Introduced public shareholders and institutional investors. |

| Private (2015-Present) | Acquisition by BC Partners (2015) | Delisted from NASDAQ; shift to private equity ownership. |

| Private (2015-Present) | Acquisition of Chewy.com (2017) | Strategic investment under private ownership, later spun off. |

Currently, the Petsmart parent company is primarily controlled by BC Partners. Other significant stakeholders include co-investors who participated in the BC Partners-led buyout. These co-investors may include other private equity funds, sovereign wealth funds, or large institutional investors. This structure allows for strategic decisions away from the short-term pressures of public markets, focusing on long-term initiatives. The shift to private equity has allowed for a focus on optimizing operations and expanding services, as highlighted in this article about Petsmart.

The ownership of Petsmart has evolved from public to private, with BC Partners as the current primary owner.

- Initial Public Offering in 1993.

- Acquisition by BC Partners in 2015 for approximately $8.7 billion.

- Focus on long-term strategic initiatives under private ownership.

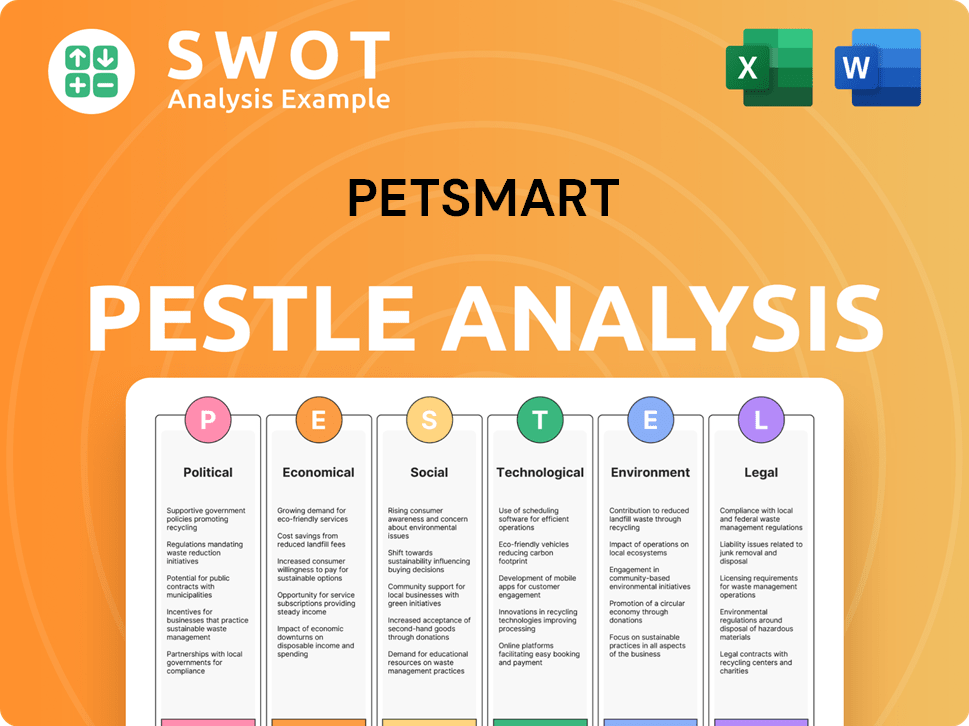

Petsmart PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Petsmart’s Board?

As a privately held entity, the current board of directors for the question of Who owns Petsmart, primarily reflects its ownership structure. The board is composed of representatives from BC Partners, the primary owner, along with independent directors possessing industry expertise. Key executives from the company also hold positions. While specific details on board members are not always publicly released for private companies, it's understood that BC Partners, as the controlling shareholder, holds a majority of board seats or exerts significant influence over appointments. This structure is typical for a company under private equity ownership, ensuring alignment with the goals of the primary investors.

The board's composition and influence are crucial for strategic decision-making. They oversee major capital expenditures and appoint leadership, reflecting the priorities of the owners. The governance structure is designed to maximize long-term value for the private equity investors, focusing on operational efficiency and strategic growth initiatives. This approach differs significantly from publicly traded companies, which are subject to different regulatory requirements and shareholder dynamics. For more insights into the customer base, consider reading about the Target Market of Petsmart.

| Board Member Category | Typical Representation | Influence |

|---|---|---|

| BC Partners Representatives | Majority | Significant control over strategic decisions and appointments. |

| Independent Directors | Minority | Provide industry expertise and oversight. |

| Key Executives | Variable | Offer operational insights and contribute to day-to-day management. |

The voting structure at a privately held company like Petsmart, under private equity ownership, is generally proportional to equity ownership. BC Partners, holding the largest equity stake, possesses the dominant voting power. This enables them to direct strategic decisions, approve significant capital expenditures, and appoint executive leadership. There are no publicly reported instances of dual-class shares or special voting rights that would grant disproportionate control to entities outside of the primary equity holders. As a private entity, Petsmart is not subject to proxy battles or activist investor campaigns in the same way a public company would be. Governance decisions are made internally by the board and the controlling shareholders, with a focus on maximizing long-term value for the private equity investors.

The board of directors at Petsmart is primarily influenced by its private equity ownership structure.

- BC Partners, as the primary owner, holds significant influence.

- The voting power is directly proportional to equity ownership.

- Governance decisions are made internally to maximize value for investors.

- The company is not subject to public market pressures.

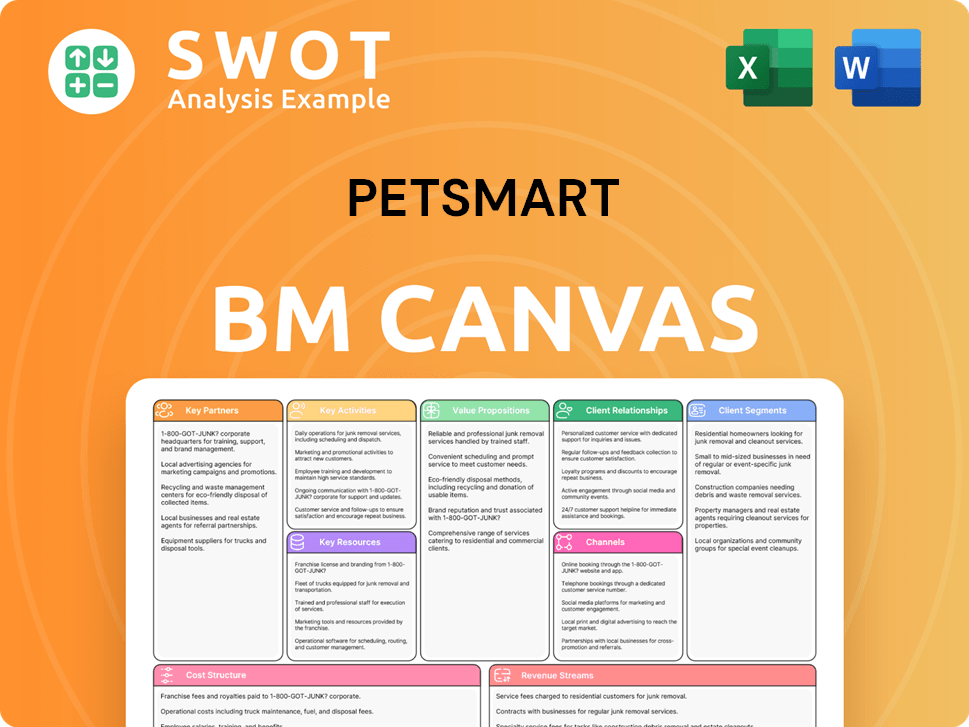

Petsmart Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Petsmart’s Ownership Landscape?

Over the past few years (2022-2025), the Petsmart company has maintained its private ownership structure under BC Partners, following the 2015 acquisition. This period has been marked by strategic initiatives aimed at optimizing the business and preparing for potential future moves, such as an initial public offering (IPO) or a sale. A significant development was the spin-off of Chewy.com, which Petsmart originally acquired. After taking Chewy public in 2019, Petsmart has decreased its stake, enabling the company to focus on its core operations while still benefiting from Chewy's growth.

The pet industry has seen trends like increased institutional ownership in public companies and continued private equity interest. Consolidation is also a key trend, with larger companies acquiring smaller specialized businesses. Petsmart, under BC Partners, has been actively positioning itself within this evolving landscape, emphasizing its integrated pet care model that combines retail, grooming, training, and veterinary services through Banfield Pet Hospital. Public statements from BC Partners and Petsmart leadership often highlight efforts to strengthen the company's market position, enhance customer experience, and explore growth opportunities within the robust pet care sector. There's ongoing speculation about a future IPO or sale, as private equity firms typically seek exit strategies to realize their investments.

| Aspect | Details | Data |

|---|---|---|

| Current Ownership | Private Equity | BC Partners |

| Key Subsidiary | Veterinary Services | Banfield Pet Hospital |

| Recent Strategic Move | Chewy.com Spin-off | 2019 |

For a deeper dive into the company's background, you can read a Brief History of Petsmart.

Petsmart's current ownership is held by the private equity firm, BC Partners. This ownership structure has been in place since the 2015 acquisition. The company continues to operate under this structure, with a focus on strategic initiatives.

A major strategic move was the spin-off of Chewy.com in 2019. Petsmart initially acquired Chewy. The company has since reduced its stake in Chewy, allowing it to focus on its core business.

The pet industry is seeing increased institutional ownership and consolidation. Larger companies are acquiring smaller ones. Petsmart is positioning itself to capitalize on these trends.

There is speculation about a potential IPO or sale in the future. Private equity firms typically seek exit strategies. Petsmart leadership is focused on enhancing customer experience.

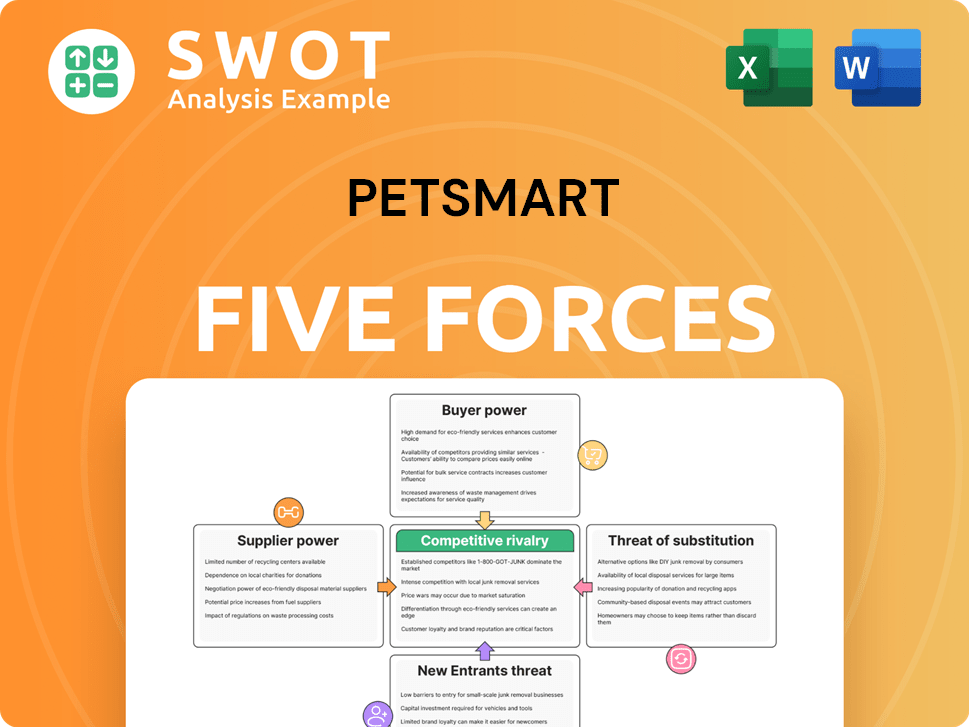

Petsmart Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Petsmart Company?

- What is Competitive Landscape of Petsmart Company?

- What is Growth Strategy and Future Prospects of Petsmart Company?

- How Does Petsmart Company Work?

- What is Sales and Marketing Strategy of Petsmart Company?

- What is Brief History of Petsmart Company?

- What is Customer Demographics and Target Market of Petsmart Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.