Poongsan Holdings Bundle

Can Poongsan Holdings Conquer Tomorrow's Markets?

Poongsan Holdings, a titan in copper and defense, is at a pivotal moment, ready to reshape its market dominance with its ambitious Poongsan Holdings SWOT Analysis. Founded in 1968 by Jeon-Woo Ryu, the company has evolved from a non-ferrous metal and ammunition pioneer into a significant industrial force. Its strategic foresight and enduring legacy have positioned it for substantial future growth.

This analysis explores Poongsan Company's strategic vision, examining its business development plans and financial performance. The future prospects of Poongsan Holdings in the defense industry and its sustainable growth initiatives are key to understanding its long-term growth potential. We will delve into the company's market expansion plans and investment strategy analysis, providing insights into its competitive landscape and revenue growth drivers.

How Is Poongsan Holdings Expanding Its Reach?

The expansion initiatives of Poongsan Holdings are designed to strengthen its market position and diversify its revenue streams. The company's strategy focuses on two main areas: the defense sector and the non-ferrous metals division. These efforts are geared towards capitalizing on emerging opportunities and building a more resilient business model. For a deeper understanding of the company's structure, consider exploring the Owners & Shareholders of Poongsan Holdings.

In the defense sector, Poongsan is aiming to increase its global presence. This involves securing new government contracts and building stronger relationships with international defense organizations. The non-ferrous metals division is also a key area of focus, with the company exploring new product categories and enhancing its presence in high-growth industries. This includes developing specialized copper alloys for electric vehicles and renewable energy systems.

Poongsan's expansion plans include evaluating potential mergers and acquisitions. These strategic moves could provide access to new technologies, boost production capabilities, and increase market share. While specific timelines for these initiatives haven't been publicly detailed in recent reports, the company's strategic communications indicate a strong commitment to these growth avenues.

Poongsan Holdings is actively pursuing growth in the defense sector by increasing its export footprint. This includes targeting regions with heightened demand for advanced ammunition and defense components. The company is focusing on securing new government contracts and expanding relationships with international defense organizations to drive growth.

In the non-ferrous metals division, Poongsan is exploring opportunities to enter new product categories. The company aims to enhance its presence in high-growth industries like electric vehicles and renewable energy. This involves developing specialized copper alloys tailored to the evolving needs of these sectors.

Poongsan is considering mergers and acquisitions to gain access to new technologies and expand its production capabilities. These strategic moves are aimed at acquiring strategic market share. The company's commitment to these growth avenues is evident in its strategic communications, aiming for a diversified and resilient business model.

The ongoing geopolitical landscape has created opportunities for increased demand for conventional ammunition, which Poongsan is well-positioned to meet. The company is also focusing on developing high-conductivity materials for EV batteries and components for solar power systems. These efforts are critical for long-term growth.

Poongsan's expansion strategy focuses on the defense sector and the non-ferrous metals division. The company is targeting increased exports and developing specialized materials for high-growth industries. These initiatives are designed to enhance the company's market position and diversify its revenue streams.

- Focus on increasing export footprint in the defense sector, particularly in regions with high demand.

- Development of specialized copper alloys for electric vehicles (EVs) and renewable energy systems.

- Evaluation of mergers and acquisitions to gain access to new technologies and expand production.

- Strategic partnerships and alliances to support market expansion and product development.

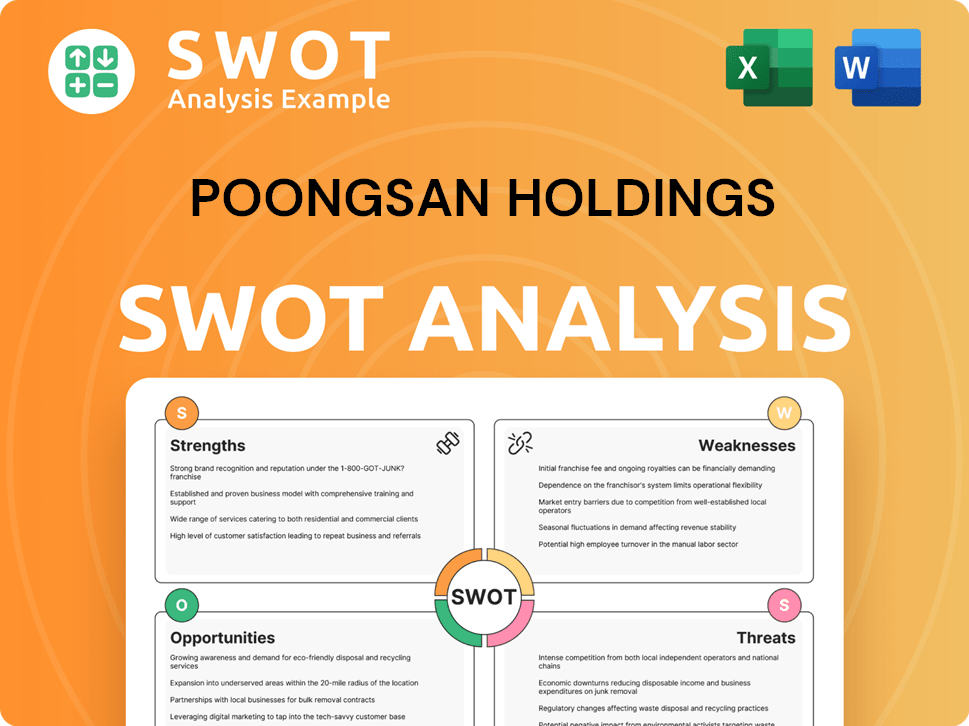

Poongsan Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Poongsan Holdings Invest in Innovation?

Poongsan Holdings is strategically focused on innovation and technology to drive its growth strategy and maintain a competitive edge. The company consistently invests in research and development (R&D) across its diverse operations. This commitment is aimed at enhancing the performance and efficiency of its products, including non-ferrous metals and ammunition.

A core element of Poongsan's approach involves developing advanced copper alloys. These alloys are designed to offer superior conductivity and strength, which is crucial for various industrial applications. Simultaneously, the company is focused on creating more precise and effective ammunition for defense purposes. These initiatives are central to the company's business development and long-term success.

The company's investment in R&D is ongoing, with a strategic focus on technological advancements. This commitment underscores its dedication to innovation as a key driver of its growth strategy. These efforts contribute directly to Poongsan's ability to offer higher-value products and maintain its market position. For more insights, explore Revenue Streams & Business Model of Poongsan Holdings.

Poongsan Holdings consistently invests in research and development to improve its products and processes. These investments are crucial for maintaining a competitive advantage and driving financial performance.

The company focuses on developing advanced copper alloys with superior properties. These alloys are essential for various industrial applications, enhancing product performance and efficiency.

Poongsan is integrating automation and smart manufacturing solutions. This includes the adoption of data analytics to improve operational efficiency and predictive maintenance.

The company explores the application of AI and IoT to streamline its supply chain and manufacturing workflows. This enhances efficiency and reduces operational costs.

Poongsan's technological advancements help it offer higher-value products. This approach helps the company maintain and strengthen its market position.

The company's continuous investment in R&D and strategic focus on technological advancements underscore its commitment to innovation. This is a core driver of its Poongsan future objectives.

Poongsan's technological initiatives are designed to enhance product quality, optimize processes, and improve overall efficiency. These efforts are crucial for sustainable growth strategy and long-term success.

- Advanced Materials: Development of new material compositions for lighter and stronger components.

- Automation: Integration of automation and smart manufacturing solutions in production facilities.

- Data Analytics: Adoption of data analytics for operational efficiency and predictive maintenance.

- AI and IoT: Exploration of AI and IoT to streamline supply chains and manufacturing.

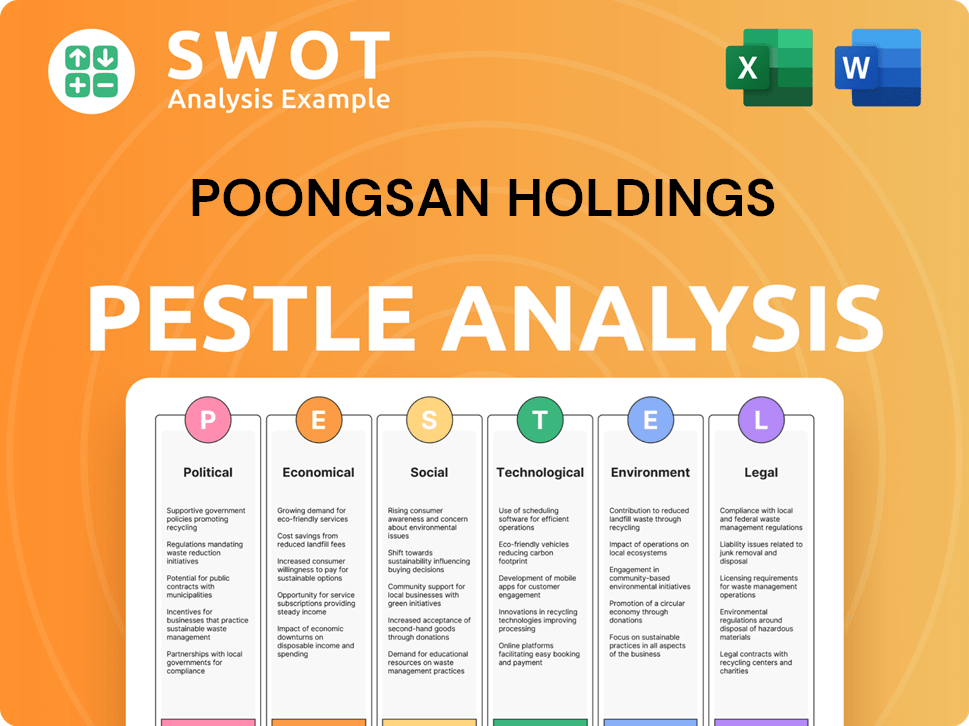

Poongsan Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Poongsan Holdings’s Growth Forecast?

The financial outlook for Poongsan Holdings is shaped by its strategic focus on sustainable growth, particularly within the copper and defense sectors. The company's financial performance in 2024 demonstrated resilience, providing a solid base for future expansion and investment. This financial stability is crucial for supporting the company's long-term goals and strategic initiatives.

In the first quarter of 2024, Poongsan Holdings reported a consolidated revenue of approximately KRW 934.9 billion (around USD 680 million), with an operating profit of about KRW 61.4 billion (roughly USD 44.7 million). The defense sector's contribution was significant, especially with increased export sales. The non-ferrous metals division also performed steadily, supported by stable copper prices. This balance between sectors provides a degree of financial stability.

Analysts generally anticipate stable revenue growth for Poongsan Holdings, driven by ongoing demand in the defense sector and a consistent market for copper products. The company's investment levels are expected to remain robust, supporting R&D and potential expansion projects. To learn more about the company's core principles, you can read about the Mission, Vision & Core Values of Poongsan Holdings.

The primary drivers for revenue growth include the defense sector's performance, particularly exports, and the stable demand for copper products. These sectors are expected to contribute consistently to the company's financial results. Poongsan Company is strategically positioned to capitalize on these opportunities.

Poongsan Holdings is expected to maintain robust investment levels. These investments will support ongoing R&D initiatives and potential expansion projects aimed at enhancing profitability margins. This investment strategy is key for Poongsan Future growth.

The long-term financial goals for Poongsan Holdings are centered on improving profitability margins and maintaining a healthy balance sheet. The company's consistent dividend payouts indicate a stable financial position. These goals are designed to support future strategic endeavors.

Strategic initiatives include a disciplined approach to capital allocation, prioritizing both growth and shareholder returns. This approach aligns with the company's plans for expansion and innovation. Business Development is a key focus.

Key financial metrics to watch include revenue growth, operating profit margins, and investment levels. These metrics will provide insights into the company's performance and its ability to achieve its strategic objectives. The company's financial outlook is positive.

- Revenue: Stable growth projected.

- Operating Profit: Focus on margin improvement.

- Investments: Continued robust spending on R&D and expansion.

- Dividends: Consistent payouts indicate financial stability.

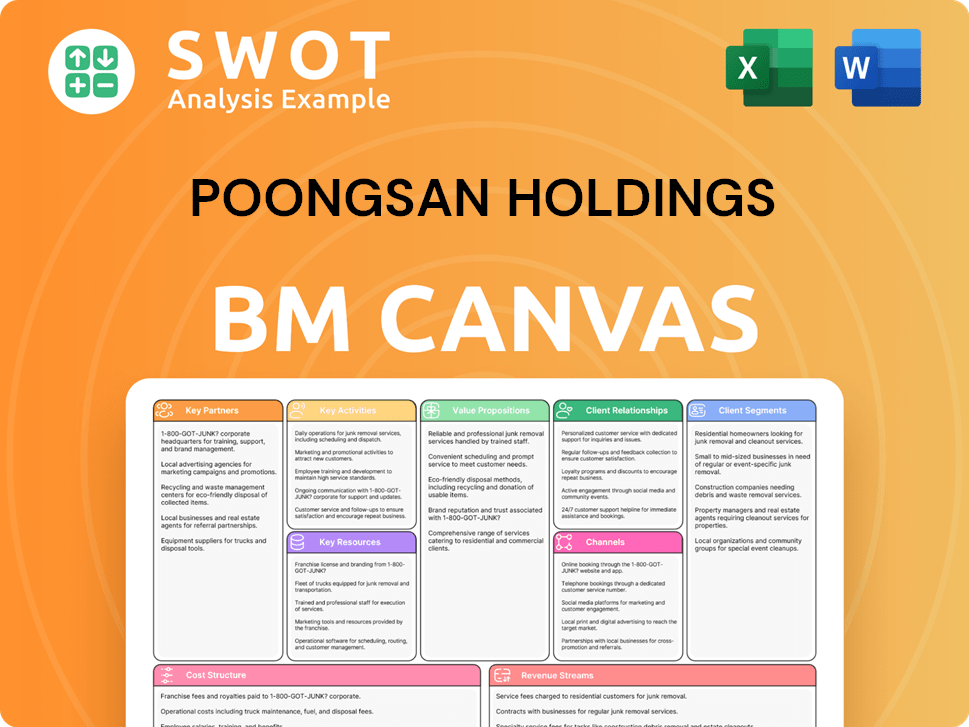

Poongsan Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Poongsan Holdings’s Growth?

The Poongsan Holdings faces several potential risks that could affect its Growth Strategy and future prospects. These challenges span market competition, geopolitical factors, and supply chain vulnerabilities. Understanding these risks is crucial for evaluating the Poongsan Company's long-term performance and investment potential.

Market dynamics, particularly in the non-ferrous metals sector, present significant risks. Global price fluctuations and the entry of new competitors could squeeze profit margins. The defense industry's sensitivity to geopolitical shifts and government policies adds another layer of uncertainty, potentially impacting sales and Business Development.

Supply chain disruptions, especially for essential raw materials like copper, also pose a considerable threat. Regulatory changes and technological advancements further complicate the landscape, necessitating proactive risk management and strategic adaptation. For a deeper dive into the company's marketing approach, explore the Marketing Strategy of Poongsan Holdings.

Increased competition in the non-ferrous metals sector and the defense industry can pressure profitability. New entrants and global price volatility can impact Financial Performance. The company must continually innovate and optimize its operations to maintain a competitive edge.

Geopolitical instability and changes in government defense budgets can affect demand. Export controls and shifts in international relations could also hinder Poongsan Future. These factors require careful monitoring and strategic flexibility.

Disruptions in the supply of raw materials, such as copper, can lead to increased costs. Delays in production can also negatively affect the company's output. Diversifying suppliers and building robust supply chain management is crucial.

Changes in environmental standards and international trade policies can impose new compliance burdens. These can also limit operational flexibility and increase costs. Staying ahead of regulatory shifts is essential.

Failure to keep pace with advancements in materials science and manufacturing processes can be detrimental. This can lead to a loss of competitiveness. Investing in R&D and embracing innovation is crucial.

Shortages of skilled labor or insufficient capital can hinder expansion plans. Efficient resource allocation and talent management are vital. Securing adequate funding for investments is also crucial.

Poongsan Holdings addresses these risks through diversification and risk management frameworks. Diversification across its core businesses provides a degree of insulation. Risk management includes scenario planning for various market and geopolitical events.

The company's long history suggests an ability to adapt to changing market conditions. It can navigate complex challenges through strategic foresight. This adaptability is key to long-term success.

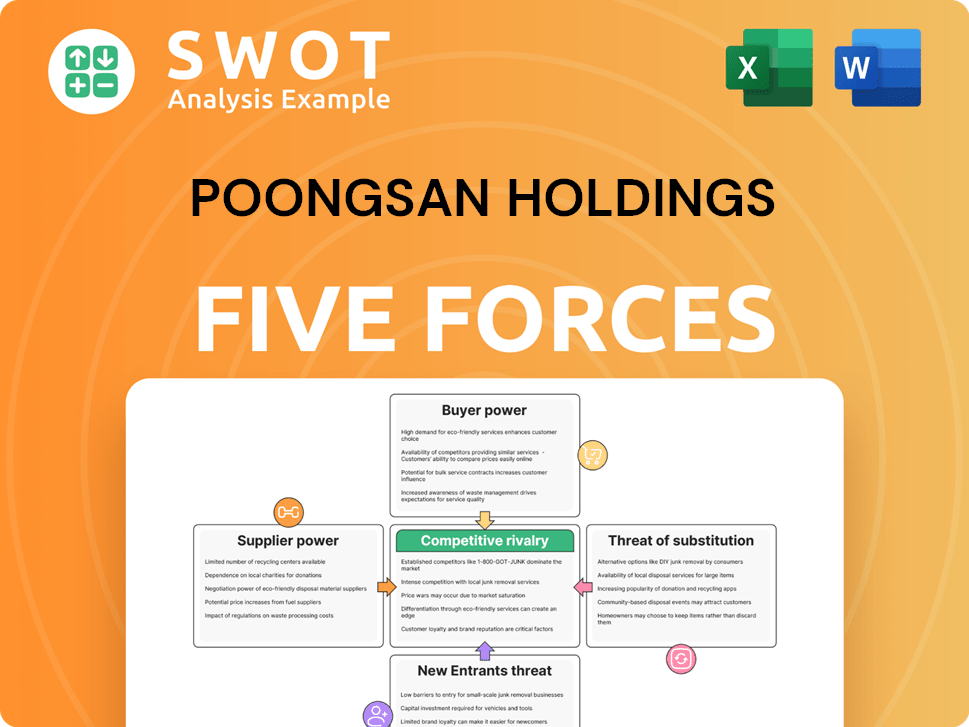

Poongsan Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Poongsan Holdings Company?

- What is Competitive Landscape of Poongsan Holdings Company?

- How Does Poongsan Holdings Company Work?

- What is Sales and Marketing Strategy of Poongsan Holdings Company?

- What is Brief History of Poongsan Holdings Company?

- Who Owns Poongsan Holdings Company?

- What is Customer Demographics and Target Market of Poongsan Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.