Poongsan Holdings Bundle

How Does Poongsan Holdings Dominate Copper and Defense Markets?

Founded in 1968, Poongsan Holdings has evolved from a copper alloy producer to a major player in both the copper and defense sectors. Its success, highlighted by its dominance in the global coin blank market and a surge in defense sales, demonstrates a potent sales and marketing approach. This analysis dives deep into the strategies driving Poongsan's impressive financial performance, including a notable net income increase in Q1 2025.

Understanding Poongsan Holdings' Poongsan Holdings SWOT Analysis is crucial to grasping its strategic maneuvers within volatile markets. This exploration will dissect the company's sales and marketing challenges, target market segments, and marketing campaign examples, offering insights into its competitive advantage and financial performance. We'll examine how Poongsan leverages its sales growth strategies and digital marketing initiatives to build brand awareness and maintain its position.

How Does Poongsan Holdings Reach Its Customers?

The sales and marketing strategy of Poongsan Holdings centers on a diversified approach, leveraging direct sales teams and a robust global network to reach its varied customer base. This strategy is critical for the company's financial performance. Poongsan's business plan includes strategic expansions and partnerships to enhance market penetration and maintain a competitive advantage. The company's focus on both domestic and international markets requires a well-structured sales approach.

Poongsan's sales channels are structured to support its diverse product offerings, ranging from fabricated non-ferrous metals to defense products. The company's market analysis reveals a strategic emphasis on business-to-business (B2B) sales, particularly in the industrial and defense sectors. This approach is supported by a network of subsidiaries, affiliates, and key partnerships, which are essential for Poongsan's sales growth strategies.

The company's sales strategy involves direct sales teams and a global network of subsidiaries and affiliates. This structure supports the distribution of fabricated non-ferrous metal products and defense items. The company's international sales expansion is facilitated through overseas offices and partnerships, ensuring broad market coverage. For more details, explore the Target Market of Poongsan Holdings.

Fabricated non-ferrous metal products are distributed through subsidiaries across Korea, the U.S., China, Southeast Asia, and the Pacific Rim. Domestic sales are supported by offices in Taegu and Busan. Overseas export offices are located in Taipei, Kuala Lumpur, and Shanghai.

Defense product plants in Busan and Angang supply ammunition to domestic and international markets. Sporting and commercial ammunition are primarily exported globally. Key partnerships and exclusive distribution deals are crucial for growth.

In February 2025, Poongsan signed a KRW 358.5 billion ammunition supply contract with Hanwha Aerospace. Significant deals with the Defense Acquisition Program Administration (DAPA) and Hyundai Rotem Co. have also been secured.

Geopolitical conflicts, such as the Russo-Ukrainian war, have significantly boosted sales in the defense division. The U.S. is Poongsan's largest ammunition export destination, with the Middle East and Europe also being major markets.

Poongsan's defense business achieved sales of 1.18 trillion won in 2024, surpassing the 1 trillion won threshold for the first time. The company's sales forecasting methods are influenced by geopolitical trends and strategic partnerships.

- Direct sales teams are a primary channel for both fabricated metals and defense products.

- A global network of subsidiaries and affiliates supports international distribution.

- Key partnerships and exclusive distribution deals are crucial for market penetration.

- Geopolitical events significantly impact sales, especially in the defense sector.

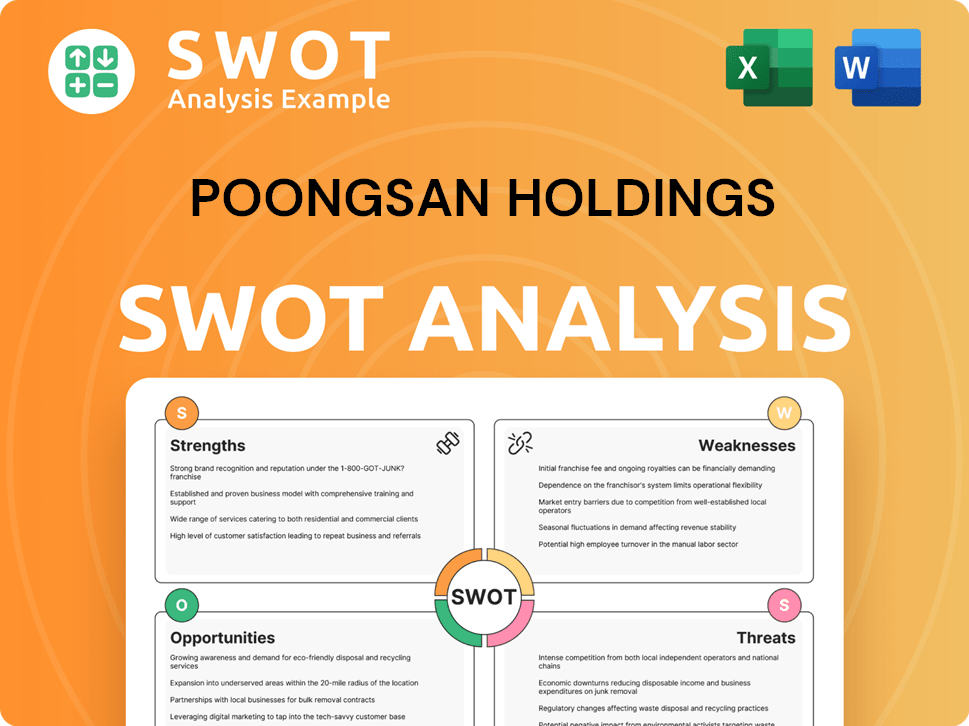

Poongsan Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Poongsan Holdings Use?

The marketing tactics of Poongsan Holdings Company are primarily geared towards B2B engagement, focusing on the copper and defense industries. Their approach emphasizes building awareness, generating leads, and driving sales through direct relationships and industry presence. The company strategically leverages its technical expertise, product quality, and reliability to gain a competitive edge.

Poongsan's Poongsan Holdings sales strategy and Poongsan Holdings marketing strategy are tailored to its specialized markets. They focus on direct engagement and industry-specific events to drive sales. The company also emphasizes its established reputation and strategic partnerships to maintain its leadership position.

While specific details on digital marketing tools are not extensively publicized, the company's approach highlights innovation and specialized product capabilities to attract industrial clients. Additionally, strategic partnerships with global companies are formed to develop a broader range of higher-quality products and expand export markets. For more insights, you can explore the Growth Strategy of Poongsan Holdings.

Poongsan aggressively invests in R&D to increase sales of high value-added copper products, such as thin plates and coin blanks. This Poongsan Holdings business plan highlights innovation.

The company forms strategic partnerships with prominent global companies. These partnerships aim to develop a broader range of higher-quality products and expand its export markets.

Poongsan's marketing leverages its reputation for quality and its fully integrated production system. This includes all steps from raw materials to finished goods.

Participation in defense exhibitions, such as DX Korea 2024 and MSPO 2024, is a crucial marketing tactic. These events showcase a wide variety of military-purpose ammunition.

The surge in demand for military ammunition due to global geopolitical conflicts acts as a significant market driver. This inherently raises awareness and demand for Poongsan's defense products.

The company's focus on ethical management and transparent reporting contributes to its overall corporate image. This enhances Poongsan Holdings competitive advantage.

Poongsan's marketing tactics include direct engagement, industry-specific events, and leveraging its established reputation. These strategies help drive sales and maintain its market position. Understanding these tactics is crucial for a comprehensive Poongsan Holdings market analysis.

- Direct Engagement: Building relationships with clients.

- Industry-Specific Events: Participating in defense exhibitions.

- Reputation and Partnerships: Leveraging its established reputation and strategic alliances.

- Focus on Quality: Highlighting product quality and reliability.

- R&D Investments: Investing in research and development for innovative products.

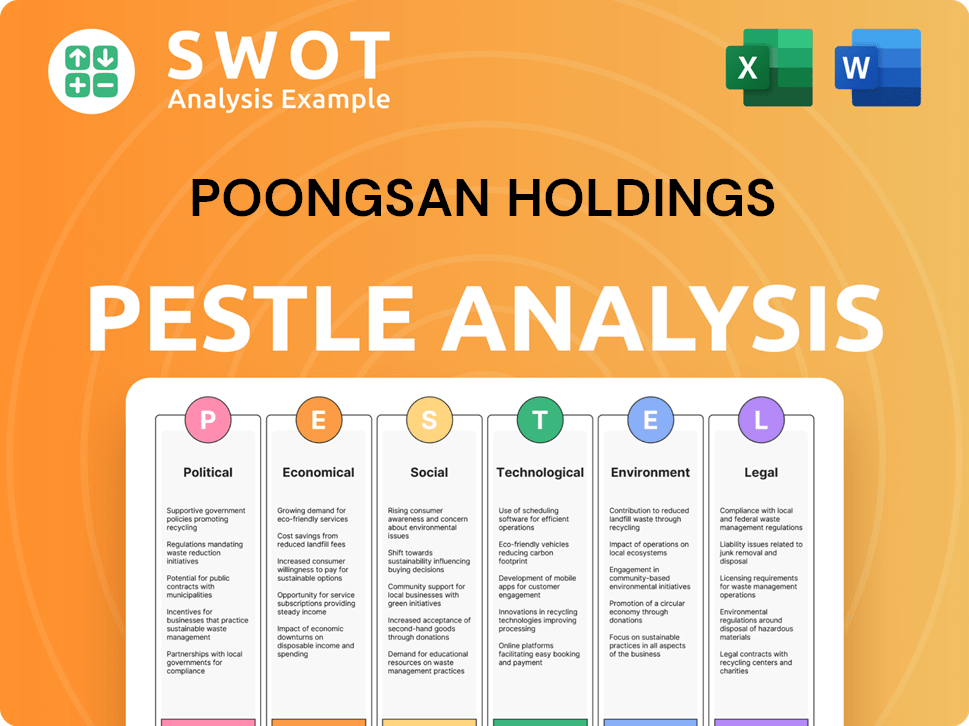

Poongsan Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Poongsan Holdings Positioned in the Market?

Poongsan Holdings positions its brand based on its core competencies, particularly its expertise in non-ferrous metal processing and its significant role in the defense industry. The company differentiates itself through a long-standing reputation for quality, innovation, and reliability within highly technical and demanding sectors. Its primary message centers on being a fundamental building block for modern industries and national defense, supplying crucial materials and products globally. Understanding the Competitors Landscape of Poongsan Holdings is key to grasping its market positioning.

In the non-ferrous metal sector, Poongsan is positioned as one of the world's largest manufacturers of fabricated copper and copper alloy materials. It supplies a wide array of value-added products, including specialized copper alloys such as PMC 102, PMC102M, PMC26, and PMC90, which are used in semiconductor and electronic parts. This appeals to industries that prioritize advanced materials and precision. The company's dominance in the global coin blank market, holding over 50% market share and exporting to over 70 countries as of 2023, further solidifies its world-class supplier status in this niche.

In the defense sector, Poongsan is recognized as a well-known ammunition manufacturer, producing a wide range of ammunition from small to large caliber, used by militaries worldwide. The brand appeals to its target audience—governments and defense organizations—through its integrated production system, which ensures competitive product quality, pricing, and delivery. Poongsan's contribution to Korea's self-sufficiency in national defense also reinforces its brand as a reliable and strategic partner. The company's Poongsan Holdings sales strategy focuses on maintaining this strong market position.

Poongsan's positioning in the non-ferrous metals market is strengthened by its ability to supply specialized copper alloys. These alloys are crucial for the semiconductor and electronics industries. The company's Poongsan Holdings market analysis reveals the importance of these advanced materials.

In the defense sector, Poongsan focuses on providing a comprehensive range of ammunition. This includes small to large caliber ammunition for global military use. This strategy ensures competitive product quality, price, and delivery.

Brand consistency is maintained across specialized divisions. This emphasizes precision, advanced technology, and a commitment to quality. This consistency helps in building brand awareness.

Poongsan's commitment to ethical management and sustainability initiatives also plays a role in its overall brand perception. These initiatives are part of the Poongsan Holdings marketing strategy.

Poongsan's long history and significant market share in its core businesses indicate a strong and established brand identity within its industrial and defense segments. The company's Poongsan Holdings business plan is built on this foundation.

The company's target markets include industries that require advanced materials and precision. The company's Poongsan Holdings target market segments are clearly defined. The focus is on supplying essential materials and products globally.

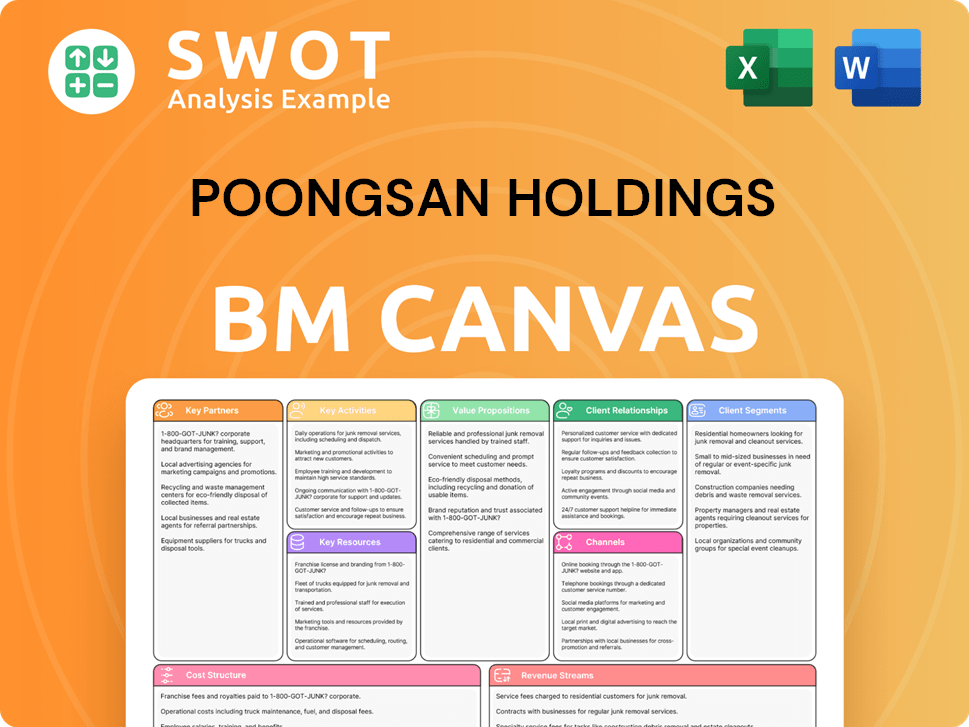

Poongsan Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Poongsan Holdings’s Most Notable Campaigns?

For the purposes of this discussion, 'campaigns' for Poongsan Holdings Company are less about typical consumer marketing and more about the strategic initiatives and significant contracts that drive its business. These campaigns are crucial for maintaining its market position and achieving growth in its copper and defense sectors. A key element involves securing large-scale ammunition supply contracts, especially in response to global events.

One defining 'campaign' is centered on the company's role in supplying ammunition, particularly during periods of increased global demand. This strategy is reflected in its strong financial performance. The company's focus on innovation and adapting to global trends has been key in solidifying its position in both copper and defense sectors. This approach is evident in its financial results and strategic decisions.

Poongsan Holdings' Poongsan Holdings sales strategy and Poongsan Holdings marketing strategy are deeply intertwined with its ability to secure and fulfill large contracts, especially within the defense industry. The company’s Poongsan Holdings business plan prioritizes strategic investments in R&D and market expansion to capitalize on global opportunities.

In January 2023, Poongsan secured contracts totaling 574.8 billion won ($465 million) with three Korean defense companies. This surpassed its total defense sales for 2020-2021. These deals underscore Poongsan's ability to capitalize on global demand for ammunition.

Continuous investment in research and development (R&D) within its fabricated non-ferrous metal division is another key campaign. This effort aims to increase sales of high value-added copper products. The company is focused on maintaining its position as a leading supplier of coin blanks, exporting to over 70 countries.

Poongsan's defense business achieved sales of 1.18 trillion won in 2024, marking the first time it surpassed the 1 trillion won threshold. This significant increase highlights the effectiveness of its strategic campaigns and market responsiveness. This growth is a testament to its Poongsan Holdings financial performance.

Poongsan holds over 50% of the global coin blank market as of 2023. This dominant position reflects its commitment to innovation and its ability to meet the evolving needs of its customers. Poongsan's success is evident in its Poongsan Holdings competitive advantage.

These campaigns are critical components of Poongsan's overall strategy. The company's ability to adapt to global trends and its focus on innovation are key to its success. To learn more about the company's beginnings, you can explore the Brief History of Poongsan Holdings.

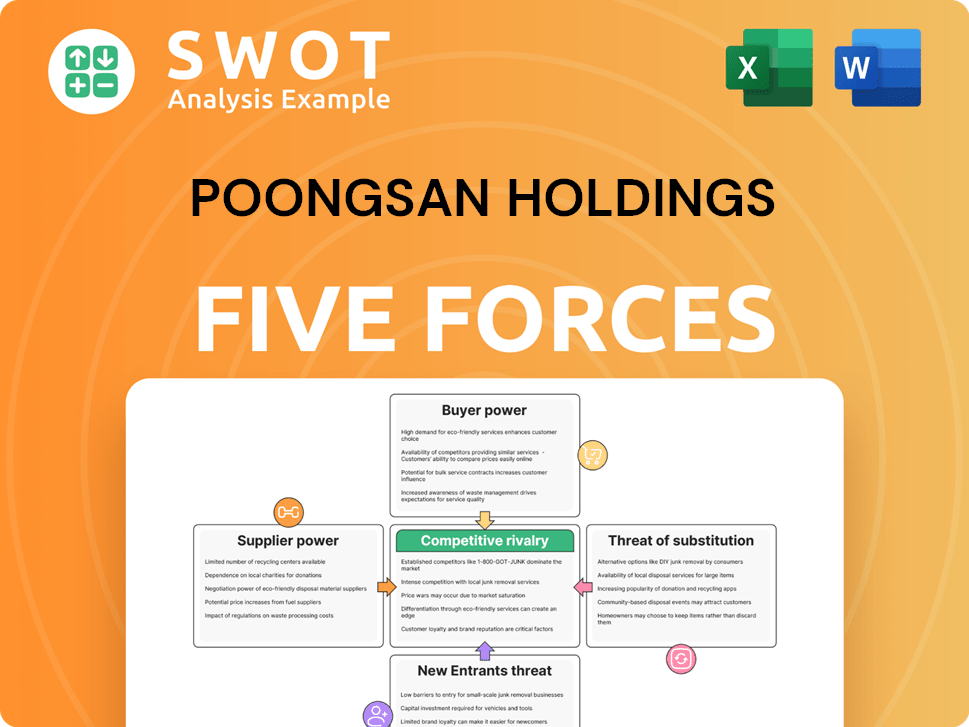

Poongsan Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Poongsan Holdings Company?

- What is Competitive Landscape of Poongsan Holdings Company?

- What is Growth Strategy and Future Prospects of Poongsan Holdings Company?

- How Does Poongsan Holdings Company Work?

- What is Brief History of Poongsan Holdings Company?

- Who Owns Poongsan Holdings Company?

- What is Customer Demographics and Target Market of Poongsan Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.