Pratibha Industries Bundle

Can Pratibha Industries Rise Again?

Founded in 1982, Pratibha Industries Limited once stood as a prominent force in India's infrastructure development, specializing in comprehensive urban solutions. From water management to transportation, the company spearheaded numerous infrastructure projects, showcasing significant operational scale. However, the company's journey took a turn, leading to a liquidation process that began in February 2021.

This Pratibha Industries SWOT Analysis provides a crucial lens through which to view the company's current standing and future possibilities. Despite facing challenges, understanding the Pratibha Industries Growth Strategy and evaluating its Pratibha Industries Future is vital for stakeholders. We delve into the implications of the liquidation process, potential asset sales, and strategic decisions that will shape the company's trajectory, providing a detailed Company Analysis and insights into its Business Development potential within the landscape of Infrastructure Projects.

How Is Pratibha Industries Expanding Its Reach?

The current state of Pratibha Industries is heavily influenced by its ongoing liquidation process. The company's primary focus is on asset sales to generate value for stakeholders, rather than pursuing traditional growth strategies or expansion initiatives. This situation significantly impacts any potential for new projects or market entries.

The Corporate Insolvency Resolution Process (CIRP) began in February 2019, and the company was ordered into liquidation in February 2021. This means that the company is essentially being wound down, and its assets are being sold off to pay its debts. The liquidator, Mr. Avil Menezes, appointed in July 2023, is managing this process.

The primary objective of the liquidator is to maximize the recovery for creditors and other stakeholders. This involves selling the company's assets through various means, including e-auctions. The suspension of trading of Pratibha Industries shares on the Bombay Stock Exchange and National Stock Exchange since November 26, 2018, further highlights the company's current financial distress.

The liquidator is actively involved in selling the company's assets. This includes e-auctions for various properties and the sale of the 100% stake in the Far Eastern Mining Construction Company Joint Venture (FEMC Pratibha JV). The e-auction for FEMC Pratibha JV was scheduled for September 16, 2024.

While Pratibha Industries had secured contracts in Sri Lanka in 2018, the current focus is not on new market entries or product launches. The liquidation process takes precedence, and any future expansion is contingent on the outcome of asset sales and the resolution of the insolvency proceedings.

The shares of Pratibha Industries have been suspended from trading on the Bombay Stock Exchange and National Stock Exchange since November 26, 2018. This suspension reflects the company's financial difficulties and the ongoing liquidation process.

Given the liquidation status, the future outlook for Pratibha Industries is uncertain. The success of the liquidation process and the recovery of assets will determine the outcome for stakeholders. For a deeper understanding of the competitive environment, see the Competitors Landscape of Pratibha Industries.

The primary focus is on the liquidation process, with asset sales being the main activity. Any potential for Pratibha Industries Growth Strategy and future projects hinges on the liquidation's outcome. The suspension of share trading and the ongoing insolvency proceedings indicate the challenges faced by the company. The Pratibha Industries Future depends on the success of asset sales and the resolution of the insolvency proceedings.

- Asset Sales: The liquidator is conducting e-auctions to sell the company's assets.

- Market Entry: No new market entries or product launches are planned due to the liquidation.

- Share Trading: Shares are suspended from trading on major stock exchanges.

- Future Outlook: Dependent on the liquidation process and asset recovery.

Pratibha Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Pratibha Industries Invest in Innovation?

Given that Pratibha Industries Limited is currently undergoing liquidation, its innovation and technology strategy has shifted dramatically. The focus is now on resolving financial challenges and managing asset sales rather than on developing new technologies or expanding its infrastructure projects. This situation significantly alters the company's approach to growth strategy and its future prospects.

Historically, as an infrastructure development company, Pratibha Industries would have relied heavily on technology across various aspects of its operations. This would have included design, engineering, procurement, construction, and project management, particularly for water and wastewater management, transportation engineering, and pre-engineered buildings. However, with the company in liquidation since February 2021, the emphasis on these areas has ceased.

The current status of Pratibha Industries means that there is no recent public information available regarding research and development (R&D) investments, digital transformation initiatives, or the adoption of cutting-edge technologies such as artificial intelligence (AI) or the Internet of Things (IoT). The company's ability to compete in the infrastructure market has been severely compromised by its financial distress.

The primary objective is to manage the sale of assets to satisfy creditors. This involves legal and financial processes, rather than technological advancements or business development.

There is no active investment in innovation or technology. Any prior initiatives are likely dormant or being liquidated as part of the asset sales. The company's future outlook is constrained by these circumstances.

Pratibha Industries is not undertaking new infrastructure projects. The focus is on completing existing projects and managing the financial implications of project closures.

The liquidation process affects employees, creditors, and shareholders. The value of the company's stock and investment potential are significantly impacted.

The company is subject to legal and financial procedures related to liquidation, including asset valuation, debt settlement, and distribution of proceeds.

The challenges include managing debt and resolving legal issues. Opportunities are limited to the successful sale of assets and the potential recovery for creditors.

The future of Pratibha Industries is tied to the liquidation process. The company's ability to generate revenue growth or expand its market share is severely limited. The focus is on financial performance during liquidation and the final distribution of assets.

- Asset Sales: The primary activity involves selling off assets to generate funds.

- Debt Settlement: Proceeds from asset sales are used to pay off creditors.

- Legal Compliance: The company must adhere to all legal requirements related to liquidation.

- Stakeholder Impact: The outcomes of the liquidation process determine the returns for shareholders and creditors.

Pratibha Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Pratibha Industries’s Growth Forecast?

The financial outlook for Pratibha Industries is severely constrained by its ongoing liquidation process. The company's entry into liquidation, ordered in February 2021, followed an unsuccessful attempt to secure a resolution plan during the Corporate Insolvency Resolution Process (CIRP), which began in February 2019. The Owners & Shareholders of Pratibha Industries face a challenging financial landscape.

As of March 31, 2019, Pratibha Industries reported a revenue of ₹440 crore. However, the company has admitted liabilities exceeding ₹8,300 crore to its financial creditors. This substantial debt burden and the liquidation status significantly impact the company's financial health.

Credit ratings reflect the distressed financial state of Pratibha Industries. CRISIL Ratings continues to classify the ratings as 'CRISIL D/CRISIL D Issuer Not Cooperating' as of February 21, 2025, due to a lack of information from the issuer, indicating a high risk of default.

The current market price of Pratibha Industries Ltd is approximately ₹0.7 per share as of May 29, 2025. This low valuation reflects the company's financial difficulties and liquidation status. The stock's performance is under significant pressure.

Projections indicate a negative trend for the company's stock price. Some analyses suggest a potential drop to ₹0.000001 INR. This highlights the severe financial challenges and the impact of the liquidation process on shareholder value.

The liquidator is actively involved in selling assets to realize value for creditors. This includes an e-auction for various assets and a 100% stake in a joint venture, scheduled for September 16, 2024. These efforts are crucial in the liquidation process.

The company has not declared any dividends in the current or previous fiscal years (FY2024-2025 and FY2023-2024). This reflects the company's financial distress and its focus on asset liquidation rather than shareholder returns.

Pratibha Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Pratibha Industries’s Growth?

The current state of Pratibha Industries presents significant risks and obstacles to any future growth strategy. The company's ongoing liquidation process, initiated in February 2021, severely limits its operational capacity. The financial strain from substantial liabilities and legal issues further compounds these challenges, making any turnaround or expansion highly improbable.

A major impediment is the considerable debt burden. The company faces admitted liabilities exceeding ₹8,300 crore, owed to financial creditors. This massive debt load significantly restricts its ability to secure funding for new projects or investments, hindering any potential for revenue growth and market share expansion.

Recent legal and regulatory actions add to the complexity. The Enforcement Directorate (ED) froze assets worth ₹5.4 crore in January 2025, linked to a ₹4,957 crore bank loan fraud case. This investigation, coupled with the company's downgraded credit ratings, highlights the severe financial distress and lack of investor confidence, impacting its ability to undertake infrastructure projects or pursue business development.

The company has been under liquidation since February 2021, which severely restricts its ability to operate and pursue new projects. This ongoing process is a major obstacle to any future growth plans, impacting its ability to compete in the competitive landscape.

Pratibha Industries faces admitted liabilities of over ₹8,300 crore. This substantial debt burden limits its access to funding and resources necessary for business development and infrastructure projects. The financial performance is severely impacted.

The Enforcement Directorate's investigation and asset freeze, related to a ₹4,957 crore bank loan fraud case, pose significant risks. These legal issues create uncertainty and damage the company's reputation, affecting its investment potential.

The company's credit ratings have been downgraded to 'CRISIL D/CRISIL D Issuer Not Cooperating' as of February 21, 2025. This reflects a lack of cooperation and a deterioration in its credit risk profile, making it challenging to secure future financing.

The shares of Pratibha Industries have been suspended from trading on the Bombay Stock Exchange and National Stock Exchange since November 2018. This lack of market access further limits any potential for raising capital or attracting investors.

The National Company Law Tribunal (NCLT) is actively involved in the insolvency proceedings, including dismissing appeals and directing fresh auctions. This ongoing oversight adds complexity and uncertainty to the company's future outlook.

The substantial admitted liabilities of over ₹8,300 crore severely limit access to funding and hinder the ability to undertake new infrastructure projects. This financial strain directly impacts the company's capacity for revenue growth and market share expansion. The company's financial performance is negatively affected.

The ongoing liquidation process and the Enforcement Directorate's investigation create significant operational challenges. These factors disrupt business development efforts and make it difficult to compete in the competitive landscape. The future outlook is significantly impacted.

The credit rating downgrade and the trading suspension on the stock exchanges negatively impact market perception and investor confidence. These factors make it challenging to attract new investment or secure financing for any potential expansion plans. The company's investment potential is diminished.

The legal issues surrounding the bank loan fraud case and the involvement of the Enforcement Directorate introduce substantial legal and regulatory risks. These risks can lead to further financial penalties and reputational damage, impacting any efforts towards business development. Read more about Marketing Strategy of Pratibha Industries.

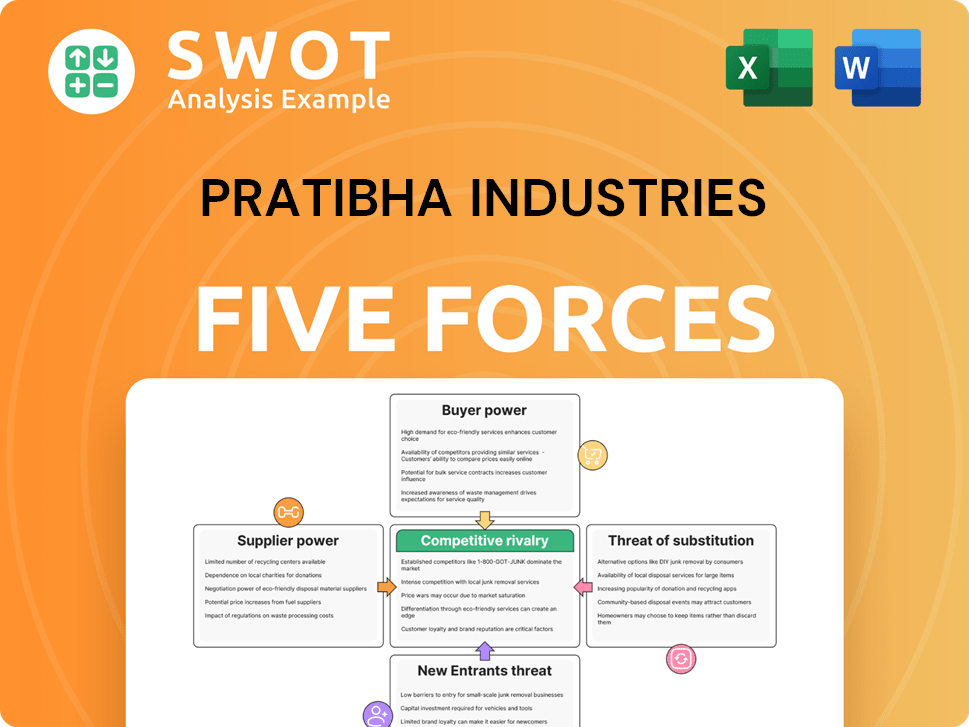

Pratibha Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Pratibha Industries Company?

- What is Competitive Landscape of Pratibha Industries Company?

- How Does Pratibha Industries Company Work?

- What is Sales and Marketing Strategy of Pratibha Industries Company?

- What is Brief History of Pratibha Industries Company?

- Who Owns Pratibha Industries Company?

- What is Customer Demographics and Target Market of Pratibha Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.