Pratibha Industries Bundle

What Went Wrong at Pratibha Industries?

Founded in 1982, Pratibha Industries company once stood as a prominent force in India's infrastructure landscape. Specializing in comprehensive solutions for urban projects, it handled everything from water management to transportation. But what led this industry leader to its current state of liquidation, and what lessons can we learn from its rise and fall?

This analysis explores the Pratibha Industries SWOT Analysis, its operational model, and the key events that shaped its trajectory. Understanding the Pratibha Industries projects, services, and history is crucial for grasping the complexities of the infrastructure sector. We'll examine the factors contributing to its decline, providing essential insights for investors and industry observers. The focus will be on "How does Pratibha Industries manage projects" and "What are the main services offered by Pratibha Industries" to provide a comprehensive overview of the company's operations.

What Are the Key Operations Driving Pratibha Industries’s Success?

Before its liquidation, the core business of Pratibha Industries focused on providing integrated infrastructure solutions. The company offered comprehensive services in water supply and environmental engineering, alongside urban infrastructure projects. This approach allowed the company to manage diverse projects, showcasing its operational capabilities. The company's history includes a range of projects, demonstrating its ability to handle complex infrastructure needs.

The main services offered by Pratibha Industries included laying water pipelines, constructing sewage treatment plants, and building water reservoirs. In the urban infrastructure segment, the company was involved in constructing and modernizing airports, railway stations, roads, and high-rise buildings. The scope of work for Pratibha Industries also covered mass housing projects and shopping malls, indicating a broad portfolio of construction projects.

The operational process of the Pratibha Industries company involved design, engineering, procurement, construction, and project management. This end-to-end service model provided clients with a single point of contact for their infrastructure needs. However, due to the company's current status, detailed insights into its supply chain, partnerships, and distribution networks are limited. As of February 2025, credit rating agencies like CRISIL Ratings have marked the company as 'Issuer Not Cooperating', which limits transparency.

The company's water infrastructure projects included laying water pipelines and building reservoirs. These projects were crucial for providing essential services to communities. The company's expertise in this area helped in developing sustainable water management solutions.

Urban infrastructure projects involved the construction and modernization of airports, railway stations, and roads. Pratibha Industries also worked on high-rise buildings and mass housing projects. These projects contributed to urban development and improved public amenities.

The company's operational process included design, engineering, and construction. It also managed procurement and provided project management services. This integrated approach ensured efficient project execution and client satisfaction.

The value proposition of Pratibha Industries was its ability to offer integrated infrastructure solutions. This approach provided clients with a single point of contact for complex projects. The company's extensive experience in various projects was a key differentiator.

Understanding the operational aspects of Pratibha Industries helps in appreciating its capabilities. The company's approach to project management and its diverse portfolio are essential elements. The company's current status, however, limits available information.

- Integrated Solutions: Offering end-to-end services for infrastructure projects.

- Diverse Portfolio: Undertaking projects in water supply, environmental engineering, and urban infrastructure.

- Project Management: Providing comprehensive project management services from design to completion.

- Industry Relationships: Established relationships within the industry, enabling the execution of complex projects.

For more details on the company's background and ownership, you can refer to the article Owners & Shareholders of Pratibha Industries.

Pratibha Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Pratibha Industries Make Money?

Historically, Pratibha Industries generated revenue through comprehensive infrastructure development projects. These projects included design, engineering, procurement, construction, and project management services, particularly in water and wastewater management and transportation engineering. The company's operations were centered around these large-scale infrastructure projects.

The primary revenue streams for Pratibha Industries company were derived from direct project fees and milestone-based payments. They may have also included long-term maintenance contracts, especially in sectors like water and wastewater management. The company's financial performance and Pratibha Industries projects were closely tied to these revenue sources.

The last reported annual revenue for Pratibha Industries was ₹440 crore as of March 31, 2019. However, this figure has seen a compounded annual growth rate (CAGR) of -65% in the last year, indicating a substantial decline in revenue. The company's financial health has deteriorated significantly.

Due to the company being under liquidation since February 2021, detailed and recent financial data is not publicly available. The 'Issuer Not Cooperating' status with credit rating agencies further restricts access to up-to-date financial information.

The company has declared zero dividends in both the current fiscal year (FY2024-2025) and the previous fiscal year (FY2023-2024). This reflects the severe financial distress of the company.

The ongoing liquidation process and investigations into alleged bank fraud of ₹4,957 crore suggest that the company's traditional revenue streams have been severely disrupted. The circumstances point to a complete cessation of regular business operations.

The liquidation and fraud allegations have critically impacted the company's ability to generate revenue. The primary revenue streams, which were once derived from infrastructure projects and Pratibha Industries services, are now non-existent.

- The company's current status indicates a complete disruption of its operational and financial activities.

- The lack of recent financial data and the "Issuer Not Cooperating" status make it difficult to assess the current financial standing.

- The investigation into alleged bank fraud of ₹4,957 crore further complicates the situation.

- For more insights, you can explore the Competitors Landscape of Pratibha Industries to see how it compares to other companies.

Pratibha Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Pratibha Industries’s Business Model?

Pratibha Industries Limited, a name in the construction sector, has a history marked by expansion and challenges. Incorporated in 1982, the company entered the civil construction industry in 1992. It later established a Public-Private Partnership (PPP) division in 2009, aiming to secure government contracts and broaden its service offerings.

The company's trajectory, however, took a significant turn. While Pratibha Industries once boasted a substantial order book, operational and market difficulties led to its current situation. The firm's journey is a case study in how economic pressures and legal issues can reshape a company's future, shifting its focus from growth to asset management.

The company's order book, as of May 2025, stood at approximately ₹6568 crore. This included projects in both water and infrastructure, as well as building segments. A notable order of ₹403 crore was received from Gujarat Water Infrastructure Ltd. for a 63 km pipeline. This points to the company's previous involvement in significant infrastructure projects.

Pratibha Industries' key milestones include its incorporation in 1982 and its expansion into civil construction in 1992. The establishment of a PPP division in 2009 further marked its strategic moves toward government contracts. The company's history reflects its attempts to grow within the infrastructure sector.

Strategic moves included establishing a PPP division to undertake government projects and expanding its service offerings. The securing of large orders, such as the ₹403 crore pipeline project, was part of its strategy. These moves aimed to capitalize on infrastructure development opportunities.

The company's competitive edge was once its experience in urban infrastructure projects and its ability to secure large contracts. However, the ongoing legal and financial challenges have significantly eroded these advantages. The current focus is on asset realization and addressing legal proceedings.

Pratibha Industries is currently in liquidation, following its admission into the Corporate Insolvency Resolution Process (CIRP) in February 2019. The liquidation order was passed in February 2021. The company’s assets are being sold through e-auctions.

A major challenge for Pratibha Industries is the ongoing investigation by the Directorate of Enforcement (ED) in a bank fraud case amounting to ₹4,957 crore. The ED's investigation, initiated based on a complaint by Bank of Baroda, alleges fraudulent transactions and circular trading. This has led to the freezing of bank balances and mutual funds worth ₹5.4 crore and the attachment of immovable properties worth ₹24.52 crore belonging to its promoter, Ajit Kulkarni.

- The ED conducted search operations in January and February 2025.

- The investigation has severely impacted the company's operations.

- The focus has shifted from strategic growth to asset realization.

- The legal proceedings are a significant factor in the company's current state.

Pratibha Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Pratibha Industries Positioning Itself for Continued Success?

The current market position of Pratibha Industries is severely distressed. The company has been under liquidation since February 2021, and its credit rating is 'CRISIL D/CRISIL D Issuer Not Cooperating' as of February 2025. This rating indicates a default or near-default status, alongside a lack of cooperation with rating agencies. The company's last reported revenue was ₹440 crore as of March 31, 2019.

The risks faced by Pratibha Industries are substantial. The primary risks stem from the ongoing liquidation process and a ₹4,957 crore bank fraud investigation by the Enforcement Directorate (ED). The ED has frozen assets and attached properties related to the case in January and February 2025. Numerous court proceedings related to insolvency and liquidation are ongoing in 2024 and 2025.

Pratibha Industries is in a critical situation due to its liquidation status. The company's operations have been severely impacted, leading to a decline in its market presence. The financial distress has significantly limited its ability to compete or secure new projects.

The company faces significant risks, including the ongoing liquidation and a major bank fraud investigation. These factors have led to asset freezes and attachments, creating substantial legal and financial challenges. The situation is further complicated by multiple court proceedings.

The future outlook for Pratibha Industries is extremely challenging. With assets being auctioned off to repay creditors, the company's ability to sustain or expand its operations is highly improbable. The stock is considered a high-risk investment, with expectations of a significant drop in share price. Read more about the Growth Strategy of Pratibha Industries.

As of May 31, 2024, the company had only 23 employees. This is a sharp decline from previous years, reflecting the operational difficulties and the ongoing liquidation process. The reduced workforce indicates a significant contraction in its operational capacity.

The primary challenges for Pratibha Industries include navigating the liquidation process, addressing the bank fraud investigation, and resolving ongoing legal proceedings. These issues significantly impact the company's ability to generate revenue and maintain operations.

- Liquidation Proceedings: The company's assets are being sold to repay creditors.

- Fraud Investigation: The ED's investigation and asset attachments pose significant legal and financial risks.

- Financial Performance: The company's last reported revenue was from 2019, indicating a prolonged period of financial distress.

- Market Perception: The 'CRISIL D' rating reflects the high-risk nature of investing in the company.

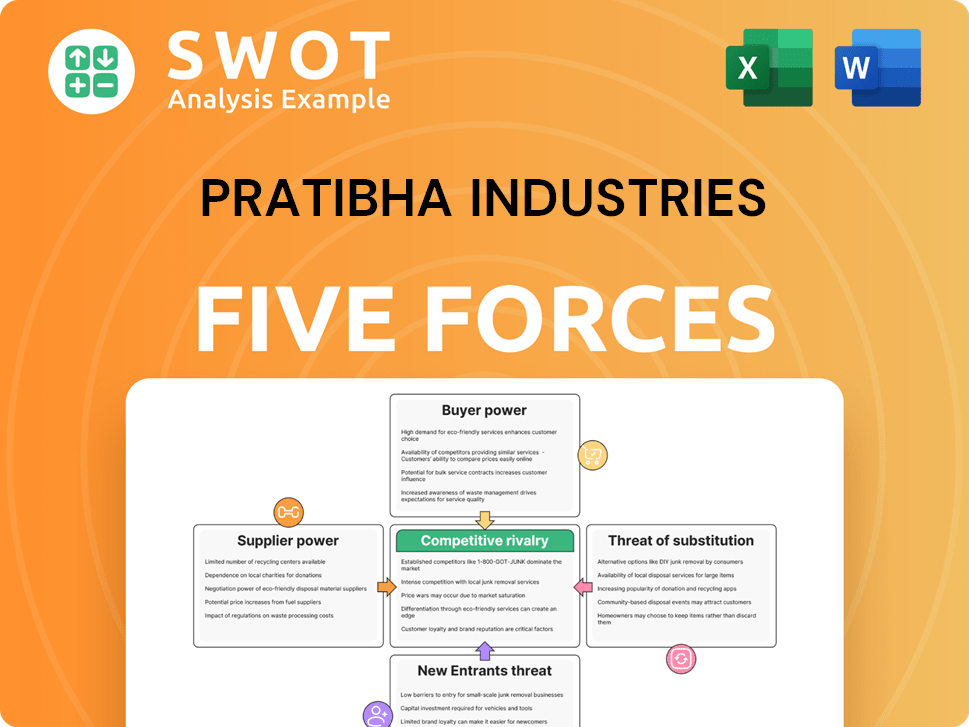

Pratibha Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Pratibha Industries Company?

- What is Competitive Landscape of Pratibha Industries Company?

- What is Growth Strategy and Future Prospects of Pratibha Industries Company?

- What is Sales and Marketing Strategy of Pratibha Industries Company?

- What is Brief History of Pratibha Industries Company?

- Who Owns Pratibha Industries Company?

- What is Customer Demographics and Target Market of Pratibha Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.