PTT Global Chemical Bundle

Can PTT Global Chemical Navigate the Petrochemical Maze and Thrive?

Founded in 2011, PTT Global Chemical (PTTGC) has rapidly become a major player in the global chemical industry, aiming to be a leader in Asia. This article delves into PTTGC's ambitious growth strategy, dissecting its current market position and future trajectory. We'll explore how PTTGC is adapting to challenges and capitalizing on opportunities within the evolving petrochemical landscape.

Facing headwinds like oversupply and economic slowdown, PTT Global Chemical's PTT Global Chemical SWOT Analysis reveals the company's strategic initiatives. The company's resilience, demonstrated by improved Q1 2025 EBITDA, hints at the success of its multi-faceted growth strategy. This includes expansion, innovation, and robust financial management, all crucial for sustainable success in the competitive chemical industry. Understanding PTT Global Chemical's future prospects requires a deep dive into its strategic goals and market analysis.

How Is PTT Global Chemical Expanding Its Reach?

PTT Global Chemical (PTTGC) is actively pursuing a growth strategy focused on portfolio transformation and enhancing its competitiveness within the chemical industry. This involves a strategic shift towards high-value and low-carbon businesses to capitalize on emerging market trends. The company's expansion initiatives are designed to strengthen its market position and drive sustainable growth.

A key element of PTTGC's strategy includes bolstering its presence in the specialty chemicals market, particularly through its allnex business. This involves expanding production capacity and distribution networks in high-growth markets to meet increasing demand. Furthermore, PTTGC is reinforcing its position as a Specialty Hub for Southeast Asia, centered in Map Ta Phut.

In addition, PTTGC is advancing its Bio & Circularity business models, which aim to provide sustainable solutions across various industries. These initiatives are part of a broader effort to adapt to evolving market demands and promote environmentally responsible practices. The company's strategic moves are a testament to its commitment to long-term growth and sustainability.

PTTGC is increasing its production capacity, especially through its allnex business. The expansion includes its largest plant in Zhejiang, China, and a new facility in Mahad, India. The Mahad facility is expected to be completed by Q3 2026, enhancing production capabilities and distribution across high-growth markets.

The company is reinforcing Map Ta Phut as the Specialty Hub for Southeast Asia. This strategic move aims to centralize and optimize its specialty chemical operations in the region. This hub will support the company's growth in the specialty chemicals market.

PTTGC is advancing its Bio & Circularity business models to offer sustainable solutions across various industries. This initiative reflects the company's commitment to environmental responsibility and adapting to market demands. These models are designed to promote sustainability and reduce environmental impact.

A significant step to enhance competitiveness is the ethane supply agreement with PTT, projected to increase ethane flow by 20% in 2025. This agreement leverages ethane as a cost-efficient feedstock, reducing long-term costs without major infrastructure changes. This will improve the company's cost structure.

To further enhance its financial flexibility, PTTGC is implementing an 'Asset Light' strategy. This involves unlocking up to 30 billion Baht from selected non-core assets. The proceeds will be directed towards deleveraging and maintaining investment-grade credit ratings. This includes reorganizing and terminating operations for entities like Vencorex Group and PTT Asahi Chemical Company Limited (PTTAC). An expected accounting gain from deconsolidation of approximately 30-40 million euros is anticipated in Q2 2025 from Vencorex, with positive contributions from asset sales expected from 2025 onwards. These strategic financial moves support the company's long-term growth and financial stability.

PTTGC is focusing on financial optimization through asset sales and strategic partnerships. The company aims to improve its financial position and support future investments. These initiatives are essential for maintaining financial health and pursuing growth opportunities.

- Asset Light Strategy: Unlocking up to 30 billion Baht from non-core assets.

- Deconsolidation Gains: Expected accounting gain of 30-40 million euros from Vencorex in Q2 2025.

- Investment-Grade Credit Ratings: Proceeds from asset sales will be used for deleveraging.

- Strategic Partnerships: Leveraging existing resources and partnerships to drive growth.

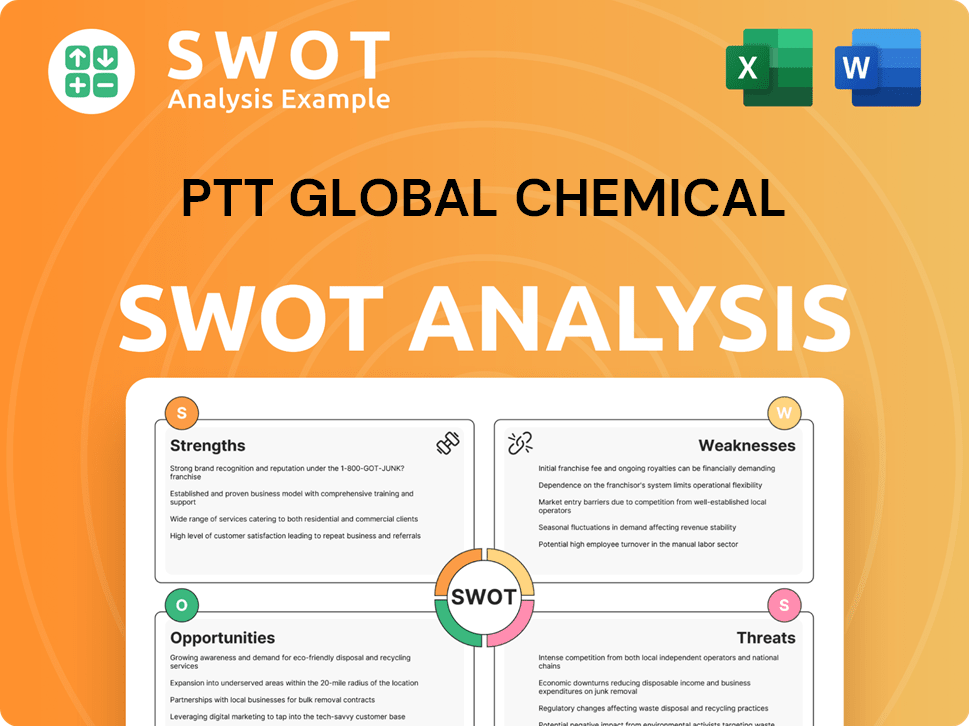

PTT Global Chemical SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does PTT Global Chemical Invest in Innovation?

PTT Global Chemical (PTTGC) is strategically leveraging innovation and technology to fuel its sustained growth within the dynamic chemical industry. This approach is deeply intertwined with the company's commitment to digital transformation and sustainability, positioning it for long-term success. The company's focus on these areas is crucial for navigating the complexities of the market and achieving its ambitious goals.

A core aspect of PTTGC's strategy involves significant investments in cutting-edge technologies. These investments are designed to boost production efficiency, expand the use of renewable energy sources, and enhance overall operational capabilities. By embracing technological advancements, PTTGC aims to optimize its processes and remain competitive in the global market. This commitment is reflected in its strategic partnerships and internal initiatives.

The company's commitment to sustainability is evident in its goal to achieve net-zero carbon emissions by 2050. This long-term target is supported by a medium-term goal of reducing emissions by 20% by 2030. These environmental targets are integrated into the company's overall growth strategy, demonstrating a commitment to responsible business practices and a proactive approach to climate change. The company's sustainability efforts are crucial for its long-term viability and positive impact on the environment.

In December 2024, PTTGC formalized a collaboration with KBC Advanced Technology Pte Ltd. This partnership is designed to accelerate digital transformation through 'The Intelligent Digital Technology Collaboration Program'.

The collaboration will utilize advanced process simulation technologies, advanced analytics, and Artificial Intelligence (AI). The goal is to optimize the entire value chain and improve decision-making processes.

PTTGC has implemented Microsoft Copilot to streamline internal processes. This has significantly reduced the time spent on tasks such as meeting minute-taking and action item assignments.

An internal generative AI system, built with Azure OpenAI Service, has improved document analysis. This has saved employees a full workday, enhancing productivity.

These technological advancements are essential for improving operational efficiency. They also enable faster service delivery and provide more insightful market analysis for customers. These initiatives contribute to the company's overall growth.

PTTGC's commitment to sustainability, including reducing emissions, is a key aspect of its innovation strategy. This approach supports the company's long-term vision and market positioning.

PTTGC's innovation strategy is multifaceted, focusing on partnerships, internal AI implementation, and sustainability initiatives to drive growth. These strategies are designed to enhance operational efficiency, improve decision-making, and meet environmental targets.

- Digital Transformation: Partnering with KBC Advanced Technology Pte Ltd to accelerate digital transformation and optimize the value chain.

- AI Implementation: Utilizing Microsoft Copilot and an internal generative AI system to streamline processes and improve document analysis.

- Sustainability: Committing to net-zero carbon emissions by 2050 and reducing emissions by 20% by 2030, integrating environmental goals into the business strategy.

- Operational Efficiency: Improving production efficiency through technology and expanding the use of renewable energy sources.

- Market Analysis: Providing more insightful market analysis for customers.

For a deeper understanding of the company's market approach, explore the Target Market of PTT Global Chemical.

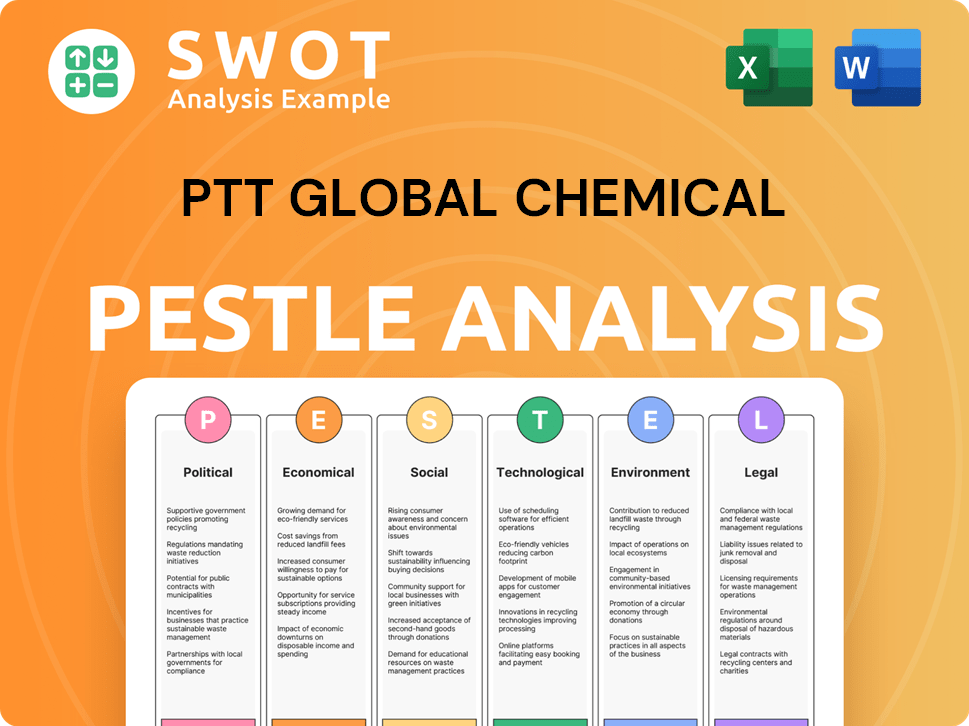

PTT Global Chemical PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is PTT Global Chemical’s Growth Forecast?

The financial outlook for PTT Global Chemical (PTTGC) presents a picture of recovery and strategic realignment in the chemical industry. The company faced a net loss in 2024, primarily due to challenges in its refinery business and the petrochemical market's oversupply. However, the company's growth strategy focuses on strengthening its financial position and improving operational efficiency.

PTTGC's future prospects are tied to several key initiatives. The company is focused on streamlining operations, reducing costs, and capitalizing on growth opportunities in the specialty chemicals segment. These efforts are designed to improve profitability and create long-term value for shareholders. The company's strategic goals include expanding its market presence and investing in sustainable practices.

The company's financial health is a critical factor in its future. PTTGC's commitment to maintaining its investment-grade credit ratings and reducing adjusted debt levels demonstrates its focus on financial stability. For more insights, you can explore the Brief History of PTT Global Chemical.

PTTGC anticipates a net profit of 2,830 million Baht in 2025. This marks a significant turnaround from the losses experienced in 2024. The company's strategic goals include improving profitability and creating long-term value.

Further growth is projected, with net profits of 7,836 million Baht in 2026 and 9,665 million Baht in 2027. These forecasts reflect the company's long-term vision and strategic goals. The company is focused on streamlining operations, reducing costs, and capitalizing on growth opportunities.

Sales revenue in Q1 2025 was 132,547 million Baht, slightly down from Q1 2024. However, adjusted EBITDA reached 5,377 million Baht, more than double the previous quarter. This growth is a result of the company's strategic goals.

PTTGC has raised its annual efficiency improvement target for 2025 to 5.5 billion Baht. This is achieved through revenue enhancement and cost reduction initiatives. The company's focus is on strategic goals.

PTTGC maintains a strong financial position with approximately 650 billion Baht in cash and cash equivalents. The company's total long-term debt is 226 billion Baht, with an average loan life of 5.99 years. The company's strategic goals include reducing adjusted debt.

- The company aims to reduce adjusted debt to approximately 210 billion Baht in 2025.

- Further reduction to around 200 billion Baht is targeted for 2026.

- These efforts are part of PTTGC's strategic goals.

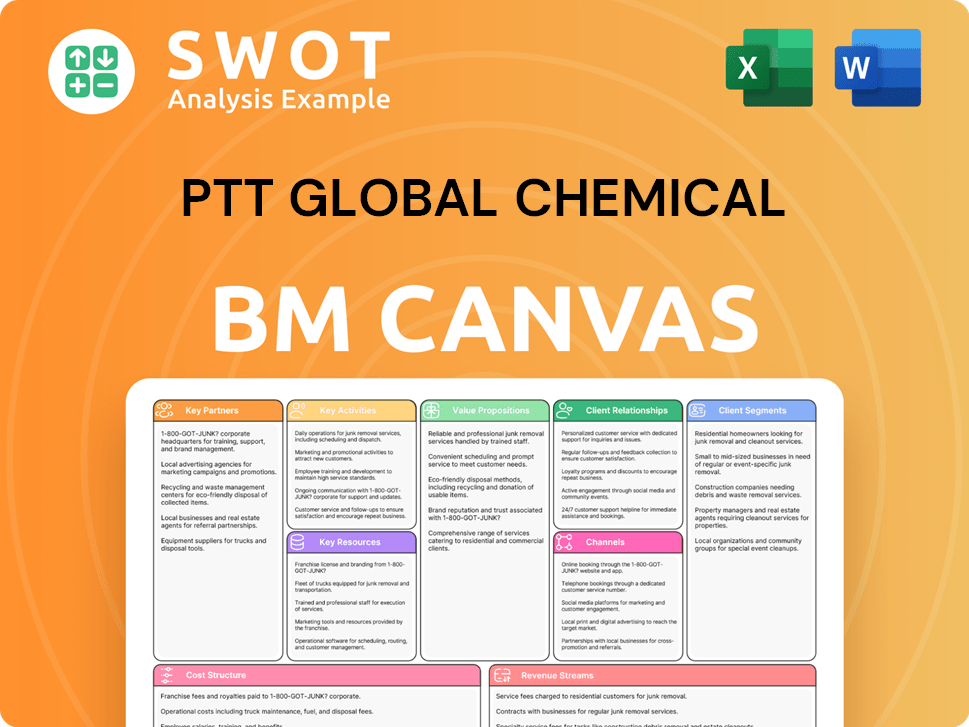

PTT Global Chemical Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow PTT Global Chemical’s Growth?

The path of PTT Global Chemical's (PTTGC) growth is fraught with potential risks and obstacles that could impact its Growth Strategy and future prospects. The company navigates a complex landscape shaped by industry-specific challenges, economic uncertainties, and evolving regulatory environments. Addressing these risks is crucial for PTTGC to achieve its strategic goals and maintain its competitive position in the Chemical Industry.

One of the primary challenges for PTT Global Chemical stems from the prolonged downturn in the petrochemical sector. This downturn is largely due to oversupply and weak demand, particularly from China. The situation is expected to persist, potentially extending the chemical trough cycle until 2026-2027. Additionally, regulatory changes, such as the adoption of a single pooled gas price in Thailand, pose a significant risk to the company's financial performance.

Geopolitical instability and trade tensions also contribute to the uncertainty. Conflicts in regions like the Middle East and the ongoing US-China trade war can disrupt supply chains and affect demand for manufactured goods. These external factors necessitate a proactive risk management approach to safeguard PTT Global Chemical's operations and financial outcomes. Understanding the PTT Global Chemical company profile is essential to navigate these challenges effectively.

The petrochemical industry faces challenges from oversupply and subdued demand, especially from China. New capacities coming online and cost advantages of US ethane-based plants are expected to prolong the downturn until at least 2026-2027. This necessitates strategic adjustments to maintain profitability.

Regulatory changes, such as the adoption of a single pooled gas price in Thailand, pose a high risk to business performance. These changes can impact operational costs and require strategic adaptation. Staying informed about these changes is crucial.

Geopolitical conflicts, such as those in the Middle East and the US-China trade war, increase economic uncertainty. These events can disrupt supply chains and impact demand. A robust risk management framework is essential to mitigate these effects.

Softer refinery spreads are anticipated in 2025 due to slower motor demand recovery, excess refinery capacity, and an uptrend in global refined inventory. These factors could affect the profitability of refining operations. Strategic planning is needed.

The company faces challenges in its net-zero emissions goal, addressing decarbonization pathways. Aligning with international climate regulations is a significant undertaking. Strategic initiatives are necessary to reduce environmental impact.

The company aims to generate positive discretionary cash flows by curtailing non-essential capital expenditures and minimizing shareholder returns to reduce debt. This financial strategy is critical for long-term sustainability. Prudent financial management is key.

To effectively manage these risks, PTT Global Chemical employs a comprehensive risk management framework. This framework is based on COSO's Enterprise Risk Management Framework and ISO 31000:2018 guidelines. The company utilizes portfolio management to categorize businesses and establish operational strategies. Scenario analysis is conducted on various raw material price levels to assess potential impacts on the business plan and long-term strategy. Furthermore, PTT Global Chemical is actively addressing risks associated with its net-zero emissions goal, focusing on decarbonization pathways and compliance with international climate regulations. The company's commitment to its Mission, Vision & Core Values of PTT Global Chemical is crucial for sustainable Business Development.

PTT Global Chemical uses a comprehensive risk management framework based on COSO and ISO 31000:2018. This includes portfolio management to categorize businesses and establish operational strategies. Scenario analysis helps assess the impact of raw material price fluctuations on the business plan.

The company is addressing challenges in decarbonization pathways, aligning with international climate regulations. This includes efficiency-driven, portfolio-driven, and compensation-driven approaches. Recent actions include restructuring operations.

PTT Global Chemical aims to generate positive discretionary cash flows by curtailing non-essential capital expenditures. Minimizing shareholder returns is part of the strategy to reduce debt. These measures support financial stability.

Recent actions include restructuring Vencorex Group and PTT Asahi Chemical Company Limited (PTTAC) to enhance profitability. The goal is to eliminate losses from these operations and improve overall financial performance. This supports long-term Growth Strategy.

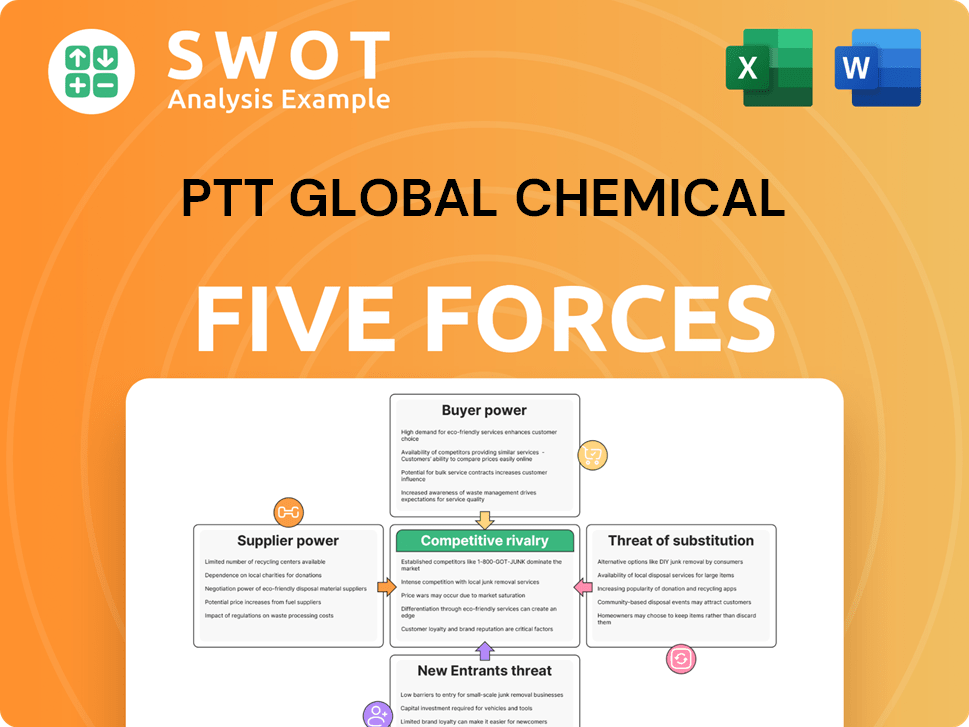

PTT Global Chemical Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of PTT Global Chemical Company?

- What is Competitive Landscape of PTT Global Chemical Company?

- How Does PTT Global Chemical Company Work?

- What is Sales and Marketing Strategy of PTT Global Chemical Company?

- What is Brief History of PTT Global Chemical Company?

- Who Owns PTT Global Chemical Company?

- What is Customer Demographics and Target Market of PTT Global Chemical Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.