PTT Global Chemical Bundle

Can PTT Global Chemical Company Navigate Petrochemical Volatility?

Facing a turbulent global market, PTT Global Chemical Public Company Limited (PTTGC), the powerhouse behind Thailand's petrochemical sector, is constantly evolving. The company's recent financial performance, including a significant net loss in 2024, underscores the dynamic challenges within the PTT Global Chemical SWOT Analysis. However, a promising recovery in Q1 2025 signals potential resilience and strategic adaptation.

This exploration delves into the core of how PTTGC, a major player in the chemical manufacturing and petrochemical industry, operates. We'll dissect PTT Global Chemical's financial performance, from its complex company structure to its diverse PTTGC products and services. Understanding how PTTGC operates its plants and manages its supply chain is key to grasping its future plans and impact on the Thai economy.

What Are the Key Operations Driving PTT Global Chemical’s Success?

PTT Global Chemical (PTTGC) operates as a fully integrated petrochemical and refining company, creating value through its diverse product portfolio and strategic ventures in green chemicals. The company serves a wide array of customers across various sectors, including packaging, automotive, and construction. Its core operations encompass manufacturing, sourcing, and distribution, with a strong emphasis on technological advancements and sustainable solutions.

The value proposition of PTT Global Chemical Company lies in its ability to deliver essential materials and offer market differentiation through sustainable solutions. This is achieved through a combination of operational excellence, a focus on high-value and low-carbon businesses, and a commitment to continuous innovation. The company's strategic advantages, such as a feedstock cost advantage and a robust supply chain, further enhance its ability to provide value to its customers and stakeholders.

The company's commitment to sustainability is evident in its development of environmentally friendly innovations, such as bioplastic resins and projects like producing muconic acid from non-edible biomass. These initiatives align with global trends towards eco-friendly products and contribute to the company's long-term growth and competitiveness. For further insights, consider exploring the Growth Strategy of PTT Global Chemical.

PTTGC produces a variety of petrochemical products, including aromatics, olefins, polymers (like polyethylene), and EO-based performance chemicals. These products are essential for various industries, supporting the company's revenue streams. The company’s product range caters to diverse customer needs, enhancing its market position within the petrochemical industry.

A key competitive advantage for PTT Global Chemical is its use of gas (ethane) in olefins production. This gives the company a significant cost advantage, making it one of the few petrochemical companies in Asia with this benefit. This advantage is further bolstered by its strategic relationship with PTT Public Company Limited, ensuring a stable supply of gas feedstock.

PTTGC's supply chain benefits from its close proximity to suppliers and customers, enhancing operational efficiency. The company emphasizes technology development and innovation to improve product quality and competitiveness. This approach supports its commitment to sustainability and helps it meet evolving market demands. The company’s operational excellence is a key driver of its success within the chemical manufacturing sector.

PTTGC is committed to developing environmentally friendly innovations, such as bioplastic resins. It is also exploring projects like producing muconic acid from non-edible biomass for eco-friendly nylon-6,6. These initiatives reflect the company's focus on high-value and low-carbon businesses, aligning with global sustainability trends. This strategy helps PTTGC differentiate itself and meet the increasing demand for sustainable products.

PTTGC's "Holistic Optimization" approach and focus on sustainable solutions translate into several key benefits for customers and stakeholders. The company provides a diverse range of essential materials and differentiates itself through eco-friendly products. Continuous operational excellence and strategic partnerships contribute to its competitive edge.

- Diverse product portfolio catering to various industries.

- Feedstock cost advantage through the use of gas (ethane).

- Commitment to sustainability and eco-friendly innovations.

- Strong supply chain and operational efficiency.

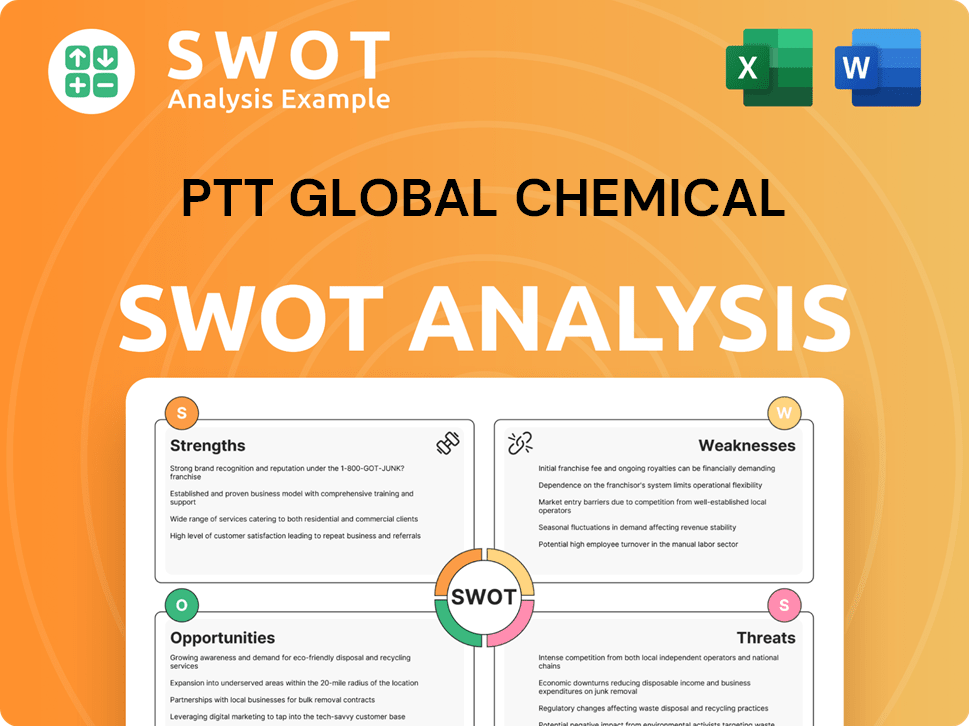

PTT Global Chemical SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does PTT Global Chemical Make Money?

PTT Global Chemical Company (PTTGC) generates revenue mainly from producing and distributing petrochemical products. The company's operations span several segments, including Upstream, Intermediates, Polymers and Chemicals, Bio & Circularity, and Performance Chemicals. This diversified approach allows PTTGC to tap into various market opportunities within the petrochemical industry.

In 2024, PTT Global Chemical reported total sales revenue of Baht 604,045 million, a 2% decrease compared to the previous year. This decline was primarily due to lower revenues from the Upstream business, influenced by decreased prices of petroleum products and aromatics. However, the company showed stability in Q1 2025, with total sales revenue of Baht 132,547 million, remaining consistent with Q4 2024. As of March 31, 2025, the trailing twelve-month (TTM) revenue stood at $16.8 billion USD.

PTTGC employs various monetization strategies to leverage its integrated operations and diverse product portfolio. These strategies include direct product sales across its segments, focusing on high-value products (HVP), and expanding into high-value businesses (HVB). For insights into the ownership and shareholders, you can read more at Owners & Shareholders of PTT Global Chemical.

PTT Global Chemical Company uses several strategies to generate revenue and enhance profitability. These strategies include direct product sales, focusing on high-value products (HVP), and expanding into high-value businesses (HVB). The company's approach also involves an 'Asset Light' strategy and cost-reduction initiatives.

- Direct Product Sales: Revenue is generated through the sale of petrochemical products across various segments.

- High-Value Products (HVP) and Businesses (HVB): The company invests in HVP and expands into HVB to improve profitability. An example is the investment in allnex, a global coating resins firm.

- Asset Light Strategy: This strategy aims to unlock up to Baht 30 billion from non-core assets during 2H25-2026. The proceeds are intended for deleveraging and maintaining investment-grade credit ratings. The planned sale of Vencorex's US and Thailand assets is expected by the second half of 2025.

- Cost Reduction Initiatives: PTTGC is actively pursuing cost reduction initiatives, targeting a reduction of THB 5.5 billion for 2025 through revenue enhancement and cost reduction initiatives.

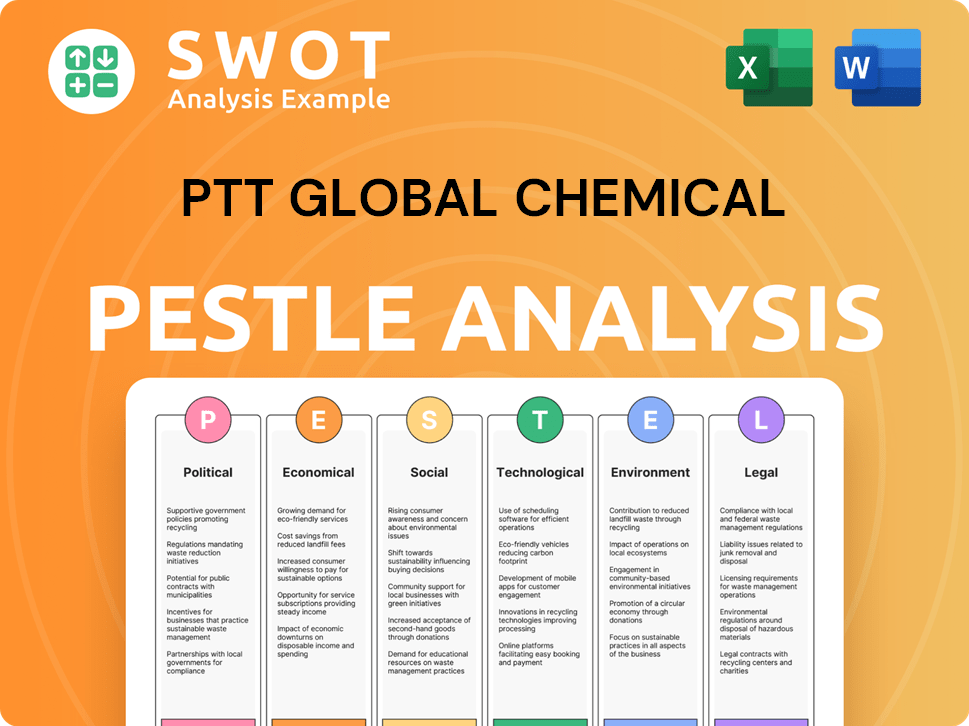

PTT Global Chemical PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped PTT Global Chemical’s Business Model?

PTT Global Chemical Company (PTTGC) has been navigating significant strategic shifts and challenges in the dynamic petrochemical industry. These moves are designed to strengthen its business and mitigate risks in a fluctuating market. The company's recent actions reflect a proactive approach to adapting to market changes and improving operational efficiency.

One of the most notable strategic moves includes a portfolio transformation aimed at streamlining operations. This involves restructuring and strategic adjustments within its joint ventures. The company is also focusing on asset optimization and efficiency improvements to enhance its financial performance. These initiatives are part of a broader strategy to ensure long-term sustainability and competitiveness.

The company's strategic focus on financial health includes an 'Asset Light' strategy. This initiative aims to unlock up to Baht 30 billion from selected non-core assets by 2026. The proceeds will be directed towards deleveraging and maintaining investment-grade credit ratings. This approach aligns with the broader strategy of reshaping its petrochemical and refining assets.

PTTGC restructured Vencorex Group. The company approved a business withdrawal plan for PTT Asahi Chemical Company Limited (PTTAC), a joint venture in the Acrylonitrile and Methyl Methacrylate business, resulting in a provision for restructuring expenses of Baht 2,836 million in 2024. The termination of PTTAC's operations is set for January 1, 2025. PTTGC anticipates an additional Baht 5.0 billion in net profit in 2025 due to the absence of losses from these operations.

The company initiated an 'Asset Light' strategy to unlock up to Baht 30 billion from selected non-core assets by 2026. Proceeds will be directed towards deleveraging and maintaining investment-grade credit ratings. PTTGC has set an ambitious annual efficiency improvement target, raising it from THB 4.5 billion to THB 5.5 billion in 2025 through revenue enhancement and cost reduction initiatives. In Q1 2025, the company realized THB 800 million in savings, with an additional THB 1 billion expected in Q2 2025 and THB 2.7 billion in 2H25.

PTTGC benefits from its strategic relationship with the PTT Group, providing a competitive cost structure through access to gas as a feedstock in olefins production. The company is one of the few petrochemical companies in Asia with this feedstock cost advantage. PTTGC is embracing technology and innovation, utilizing generative AI like Microsoft Copilot for internal processes. The company's commitment to sustainability, with a goal of achieving net-zero greenhouse gas emissions by 2050, further differentiates it in the market.

Future plans include further streamlining operations and enhancing efficiency. PTTGC aims to continue its focus on sustainability and technological advancements. The company is also working towards achieving its net-zero greenhouse gas emissions target by 2050. For more insights, you can explore the Competitors Landscape of PTT Global Chemical.

PTTGC's strategic moves include significant financial adjustments and operational enhancements. The company is focused on cost reduction, efficiency improvements, and strategic partnerships to maintain a competitive edge. These efforts are designed to ensure long-term growth and profitability.

- Restructuring expenses of Baht 2,836 million in 2024.

- Anticipated Baht 5.0 billion increase in net profit in 2025.

- Efficiency improvement target raised to THB 5.5 billion in 2025.

- Q1 2025 savings of THB 800 million.

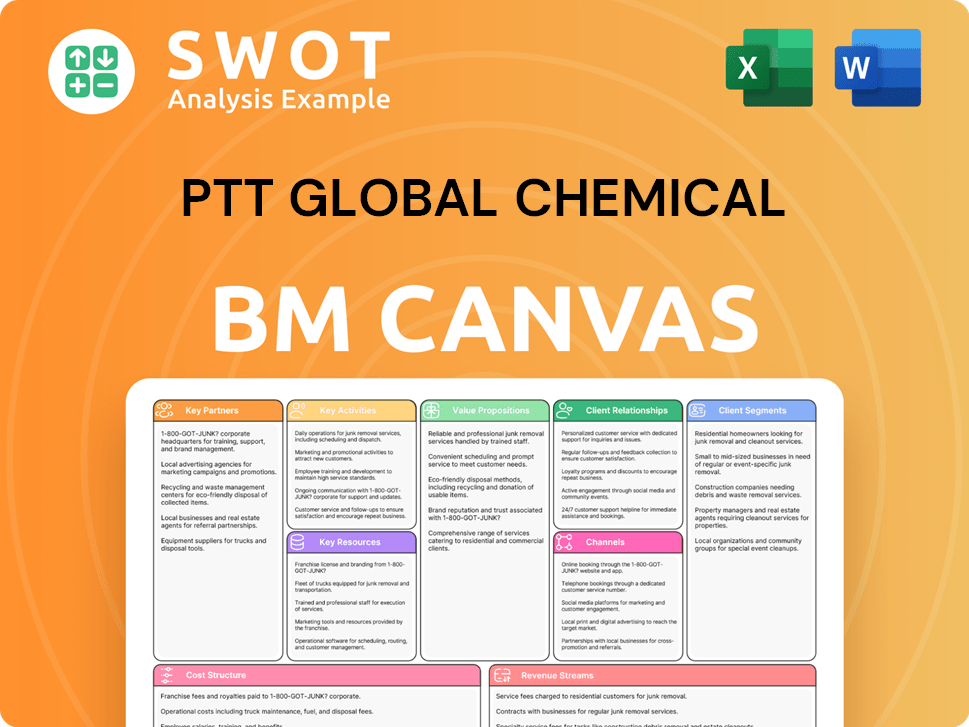

PTT Global Chemical Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is PTT Global Chemical Positioning Itself for Continued Success?

PTT Global Chemical Company (PTTGC) holds a leading position in Thailand's petrochemical sector. As the largest ethane-based producer and a core part of the PTT Group, PTTGC operates fully integrated petrochemical and refinery operations. However, the company faces challenges within the global petrochemical industry.

The petrochemical industry is currently experiencing headwinds, including economic uncertainties, oversupply, and geopolitical tensions. These factors impact PTTGC's operations, necessitating strategic responses to maintain and enhance its market position and financial performance. The company actively navigates these complexities to ensure sustainable growth and profitability.

PTTGC is Thailand's largest ethane-based petrochemical producer. It is the core petrochemical arm of the PTT Group. The company has fully integrated petrochemical and refinery operations.

The petrochemical industry faces economic uncertainty and oversupply, particularly from China. The chemical trough cycle is expected to persist until 2026-2027. Geopolitical conflicts and trade tensions also pose risks.

PTTGC aims for a business turnaround with 'Holistic Optimization'. The company is expanding into high-value and low-carbon businesses. They plan to increase ethane feedstock to 38% in 2025.

PTTGC is focusing on cost restructuring and strengthening competitiveness. They are advancing Bio & Circularity business models and reinforcing Map Ta Phut as a Specialty Hub. The company is targeting a debt-to-EBITDA ratio below four times.

PTT Global Chemical is actively pursuing strategic initiatives to navigate industry challenges and improve financial performance. These initiatives include cost optimization and expansion into high-value and low-carbon businesses. The company aims to achieve a debt-to-EBITDA ratio below four times.

- Holistic Optimization to restructure costs and boost competitiveness.

- Expansion into high-value and low-carbon businesses, including Bio & Circularity.

- Increasing ethane feedstock proportion to 38% by 2025.

- Offloading non-core assets worth approximately Baht 30 billion by 2026.

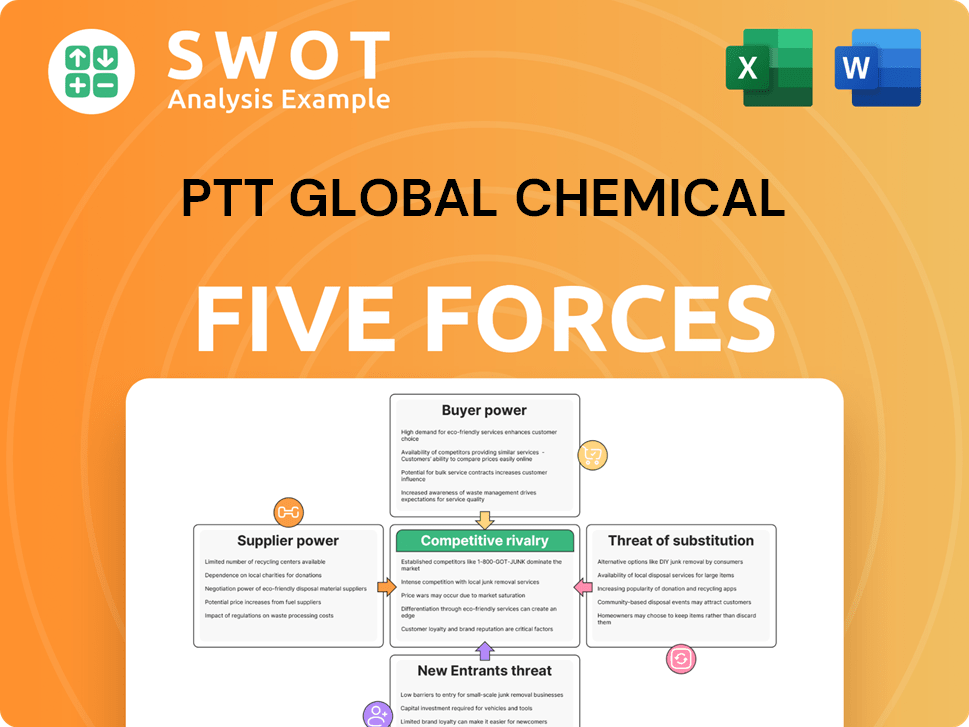

PTT Global Chemical Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of PTT Global Chemical Company?

- What is Competitive Landscape of PTT Global Chemical Company?

- What is Growth Strategy and Future Prospects of PTT Global Chemical Company?

- What is Sales and Marketing Strategy of PTT Global Chemical Company?

- What is Brief History of PTT Global Chemical Company?

- Who Owns PTT Global Chemical Company?

- What is Customer Demographics and Target Market of PTT Global Chemical Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.