QuikTrip Bundle

Can QuikTrip Continue to Dominate the Convenience Store Landscape?

The convenience store industry is undergoing a massive transformation, and QuikTrip is a key player in this evolution. Founded on the principles of exceptional customer service and operational excellence, QuikTrip has carved a significant niche in the market. This QuikTrip SWOT Analysis will explore the company's strategies for continued success.

This analysis of the QuikTrip company will examine its ambitious expansion plans, including potential new store opening announcements and real estate development strategy. We'll delve into how QuikTrip leverages technology for enhanced customer experiences and operational efficiency, alongside a review of its financial performance. Understanding QuikTrip's growth strategy and future prospects is crucial for anyone interested in the convenience store industry and business development.

How Is QuikTrip Expanding Its Reach?

The company's growth strategy is primarily driven by its calculated expansion initiatives. This involves focusing on organic growth within both new and existing geographical markets. The strategy emphasizes building new stores in growing suburban areas with high traffic, such as North Carolina, South Carolina, and Texas. This approach allows the company to strategically increase its market presence and cater to a wider customer base.

The company's expansion strategy is designed to access new customer demographics, particularly those seeking high-quality, convenient food options. This includes continuous refinement and expansion of its in-store food offerings. The company's commitment to organic growth, rather than mergers and acquisitions, underscores its dedication to maintaining its distinct operational model and culture. This approach allows for controlled growth and sustained brand identity.

The company's expansion strategy is centered on accessing new customer demographics and solidifying its market leadership. The company is actively expanding its presence in states like North Carolina, South Carolina, and Texas. These new stores often feature the 'Generation 3' layout, which includes larger kitchens for made-to-order food, more self-checkout kiosks, and an enhanced beverage selection.

The company's expansion strategy is heavily reliant on organic growth, focusing on building new stores in strategic locations. These locations often feature the 'Generation 3' layout, which includes larger kitchens for made-to-order food. The company's approach is designed to increase market presence and cater to a wider customer base, as seen with the QuikTrip expansion plans in Texas.

While not a dramatic product launch, the continuous refinement and expansion of QT Kitchens offerings represents a significant internal product development initiative. This includes fresh sandwiches, pizzas, and roller grill items, aiming to capture a larger share of the food service market. This diversification supports the company's long-term business goals.

The company's expansion strategy is driven by the desire to access new customer demographics. This strategy is particularly focused on those seeking high-quality, convenient food options. This approach aligns with current consumer demand for convenience and fresh options, which is a key component of the company's success.

The company's cautious approach to mergers and acquisitions, preferring organic growth, underscores its commitment to maintaining its distinct operational model and culture. This strategy allows for controlled growth and sustained brand identity. The company's focus on organic growth is a key factor in its QuikTrip competitive advantages analysis.

The company's expansion initiatives are multifaceted, encompassing geographical growth and product diversification. The company's focus is on organic growth, building new stores, and enhancing its food offerings. This strategy is designed to solidify its market leadership in the regions it serves, as detailed in a recent article about the company's growth. The company's expansion plans in Texas are a prime example of this strategy.

- Organic Growth: Prioritizing new store builds in strategic locations.

- Product Diversification: Expanding QT Kitchens offerings to capture a larger food service market share.

- Customer-Centric Approach: Targeting customers seeking high-quality, convenient food options.

- Operational Consistency: Maintaining a distinct operational model through organic growth.

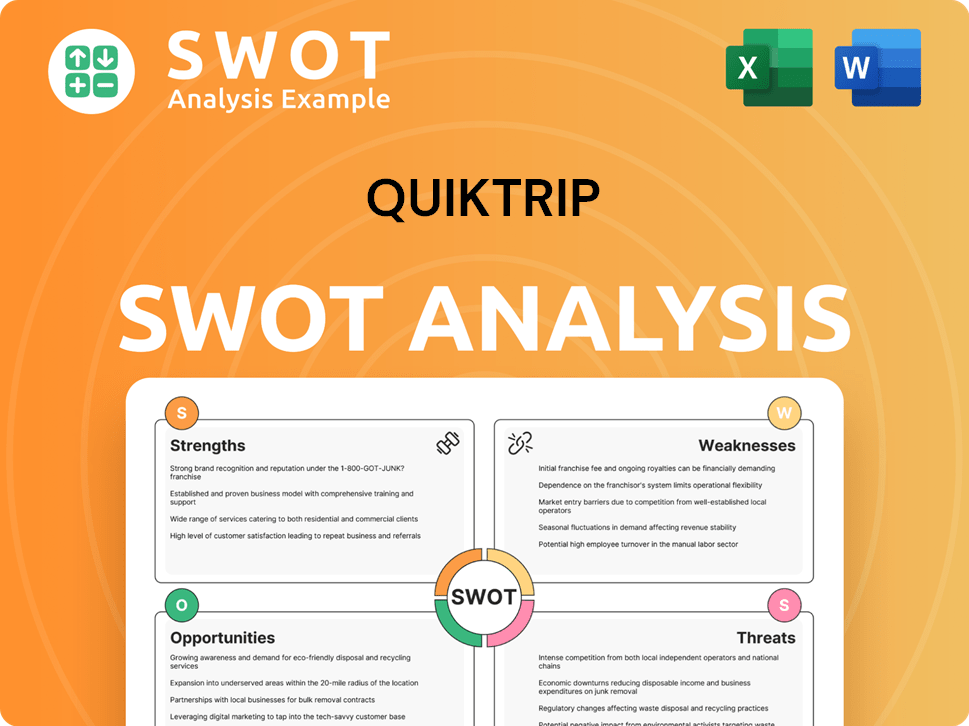

QuikTrip SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does QuikTrip Invest in Innovation?

The innovation and technology strategy of the company is central to its operational efficiency and customer experience. It consistently invests in technology to enhance its services and maintain a competitive edge within the convenience store industry. This approach supports its growth strategy and future prospects.

The company's focus on in-house technology development, including proprietary systems for point-of-sale and inventory management, is a key differentiator. This allows for streamlined operations and rapid service, which are critical in the fast-paced retail environment. The company's digital transformation efforts, such as the mobile app, further enhance customer engagement and loyalty.

The company's commitment to sustainability is also noteworthy. This includes adopting energy-efficient equipment and building designs in new stores. This aligns with evolving consumer values and contributes to long-term operational savings, demonstrating a holistic approach to business development.

The company develops its own point-of-sale systems and inventory management tools. This approach ensures streamlined operations and rapid service, which are essential for maintaining a competitive edge.

The company's mobile app allows customers to locate stores, view fuel prices, and access exclusive deals. This fosters customer loyalty and engagement, enhancing the overall customer experience.

The company has increased the deployment of self-checkout kiosks to speed up transactions. This allows employees to focus on food preparation and customer service, improving overall operational efficiency.

The company incorporates energy-efficient equipment and building designs in new stores. These initiatives contribute to long-term operational savings and align with evolving consumer values.

The company utilizes sophisticated internal systems and data analytics to optimize supply chains and manage inventory. This helps personalize customer interactions and improve operational efficiency.

The company's technology and innovation strategy is centered on improving operational efficiency. This includes streamlining processes and enhancing the overall customer experience.

The company's investment in technology and innovation is a key part of its strategy. To understand the company's customer base, it's helpful to read about the Target Market of QuikTrip. This focus on technology and efficiency supports the company's long-term business goals and competitive advantages.

The company's strategy includes in-house technology development, digital transformation, and automation to enhance operational efficiency and customer experience.

- Proprietary Systems: Development of point-of-sale and inventory management systems.

- Mobile App: Enhances customer engagement and provides access to exclusive deals.

- Automation: Implementation of self-checkout kiosks.

- Sustainability: Adoption of energy-efficient equipment and building designs.

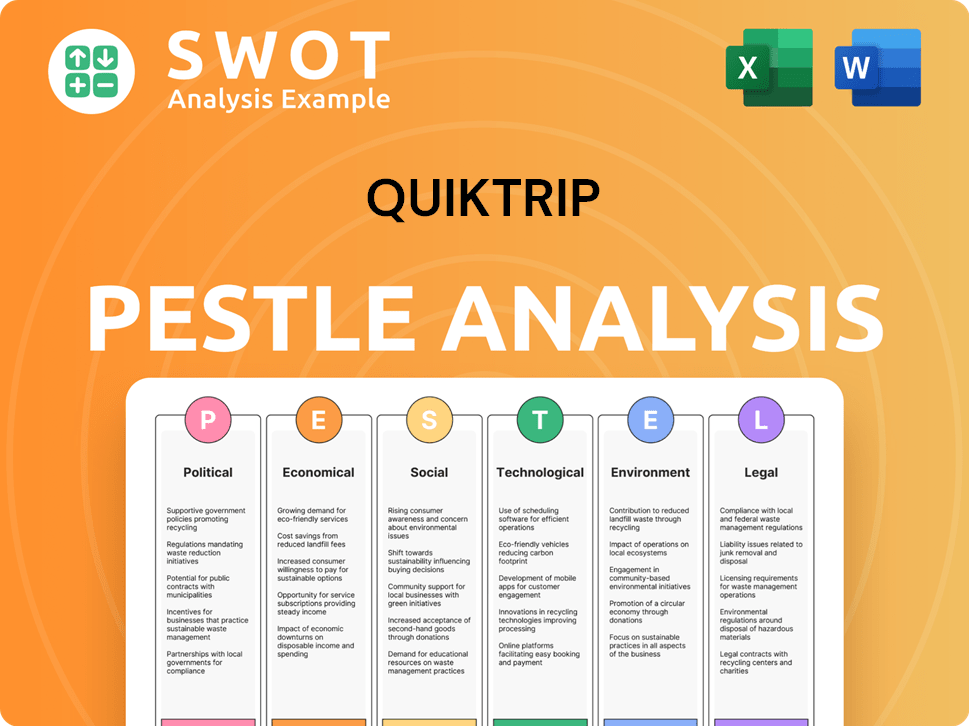

QuikTrip PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is QuikTrip’s Growth Forecast?

Understanding the financial outlook for QuikTrip requires looking at the convenience store industry and QuikTrip's specific strategies. As a privately held company, QuikTrip doesn't release detailed financial reports. However, industry analysis and market intelligence provide insights into its financial health and future potential. The company's consistent ranking among the top-grossing private companies in the United States highlights its strong financial performance within the convenience store industry.

QuikTrip's financial success is largely attributed to its operational efficiency, high sales volumes of fuel and in-store merchandise, and a profitable fresh food program. The company's strategy of reinvesting profits back into the business, particularly for new store construction and technology upgrades, shows its commitment to long-term sustainable growth. This approach, combined with a disciplined approach to capital allocation, allows for expansion without external financial pressures. For a deeper dive, consider reading about the Brief History of QuikTrip.

The company's financial model is self-sustaining, with no public funding rounds, indicating financial stability. This allows QuikTrip to focus on organic growth, expanding its footprint, and enhancing its offerings. This approach supports its QuikTrip growth strategy and contributes to its QuikTrip future prospects.

QuikTrip consistently ranks among the largest private companies in the U.S. in 2023, with estimated revenues around $11 billion. This strong revenue generation is a key indicator of its market position and operational efficiency within the convenience store industry.

QuikTrip's success is linked to its efficient operational model, which includes high sales volumes of fuel and in-store items. This efficiency contributes significantly to its financial performance and supports its business development.

While specific profit margins aren't public, QuikTrip's focus on employee retention and operational excellence suggests healthy profitability. The reinvestment of profits into new stores and technology indicates a commitment to retail expansion.

The company's financial strategy is built on sustained organic growth, funded by strong operational performance. This allows QuikTrip to expand its footprint and enhance offerings without external financial pressures, supporting its long-term goals and QuikTrip company analysis.

QuikTrip's financial health is supported by several factors that contribute to its success and future potential.

- Consistent revenue generation, with estimated annual revenues often exceeding several billion dollars.

- Efficient operations, including high sales of fuel and in-store merchandise.

- Reinvestment of profits into the business for long-term growth and retail expansion.

- A self-sustaining financial model that supports organic growth.

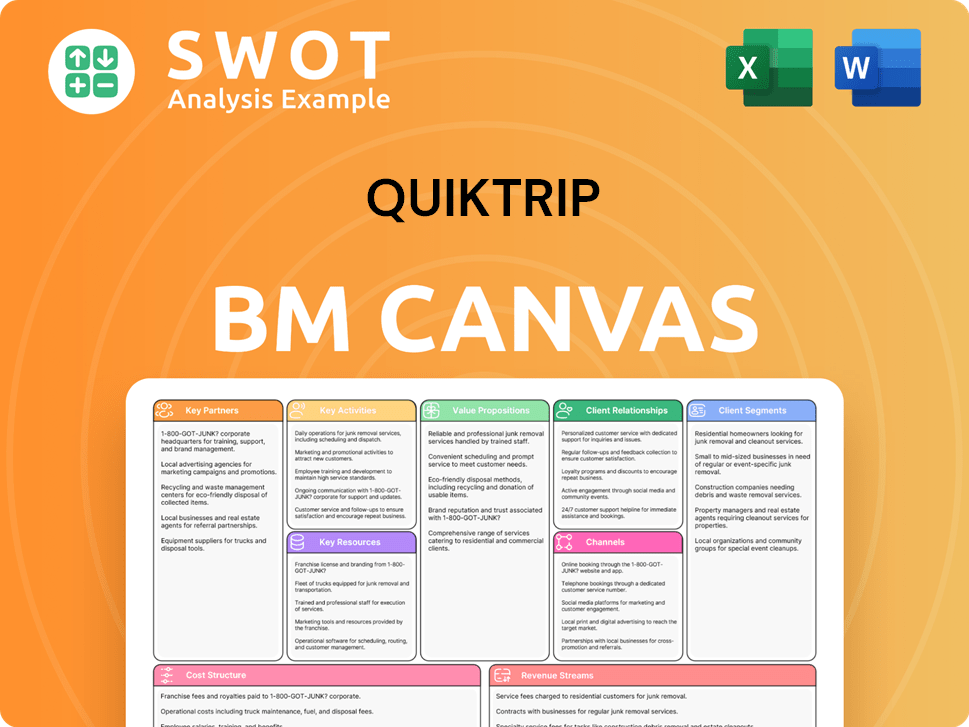

QuikTrip Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow QuikTrip’s Growth?

The convenience store and gasoline retail sector presents various risks and obstacles for companies like QuikTrip, impacting both their current operations and future growth. Intense competition, regulatory changes, and supply chain vulnerabilities are significant factors. Furthermore, the evolving landscape of the automotive industry poses a long-term challenge.

Competition is fierce in the convenience store industry. Established chains and new entrants constantly vie for market share. Regulatory compliance, especially concerning environmental standards for fuel storage and evolving labor laws, can lead to increased operational costs. Supply chain disruptions, highlighted by recent global events, also pose a persistent threat.

The shift towards electric vehicles (EVs) is a long-term disruption that could significantly impact QuikTrip's core gasoline retail business. Adapting to this change and ensuring a smooth transition is crucial for sustained success. Internal challenges, such as maintaining the company's unique employee-centric culture and high service standards during rapid expansion, must also be addressed.

The convenience store industry is highly competitive, with major players like Casey's General Stores and Circle K, alongside smaller regional and local competitors, all vying for market share. This competition extends beyond fuel sales to include food and beverage offerings, putting pressure on margins. The Competitors Landscape of QuikTrip reveals the intensity of this environment.

Changes in environmental regulations, particularly those concerning fuel storage and emissions, can lead to significant compliance costs. Evolving labor laws, including minimum wage increases and mandated benefits, can also impact operational expenses. These regulatory shifts require constant adaptation and investment.

Disruptions in fuel supply, food ingredients, and construction materials can hinder operations and expansion plans. Recent global events have underscored the fragility of supply chains. Building resilience through diversified sourcing and robust inventory management is crucial.

The rise of electric vehicles (EVs) poses a long-term threat to QuikTrip's core gasoline retail business. While the company is exploring EV charging solutions, the pace and scale of this transition remain uncertain. Successfully integrating EV charging infrastructure is vital for future relevance.

Maintaining QuikTrip's unique employee-centric culture and high service standards during rapid expansion is a key internal challenge. Employee retention and training are critical for sustaining quality as the company grows into new geographies. The company's ability to scale its culture will impact its future success.

Economic downturns or market shifts can negatively impact consumer spending and, consequently, QuikTrip's sales. The company's historically conservative financial management provides a buffer against unforeseen economic challenges. Diversification of product offerings can also help mitigate the impact of economic fluctuations.

QuikTrip mitigates these risks through several strategies. These include diversifying product offerings to reduce reliance on fuel sales, implementing robust supply chain management practices, and emphasizing employee training and retention to maintain service quality. The company's conservative financial approach also provides a buffer against economic uncertainties.

The convenience store industry is highly competitive. According to recent reports, the top four convenience store chains in the U.S. account for a significant portion of the market share, with QuikTrip consistently ranking among the leaders. Competition includes pricing strategies and enhanced customer service.

Adapting to the rise of EVs is crucial. QuikTrip is exploring the installation of EV charging stations at its locations. The speed and scale of this transition will significantly impact QuikTrip's future. Investments in technology and infrastructure are necessary for long-term sustainability.

QuikTrip's historically conservative financial management provides a buffer against economic downturns. Maintaining strong financial health allows the company to navigate unforeseen market shifts and invest in strategic initiatives. Strong financial performance is crucial for QuikTrip's long-term success.

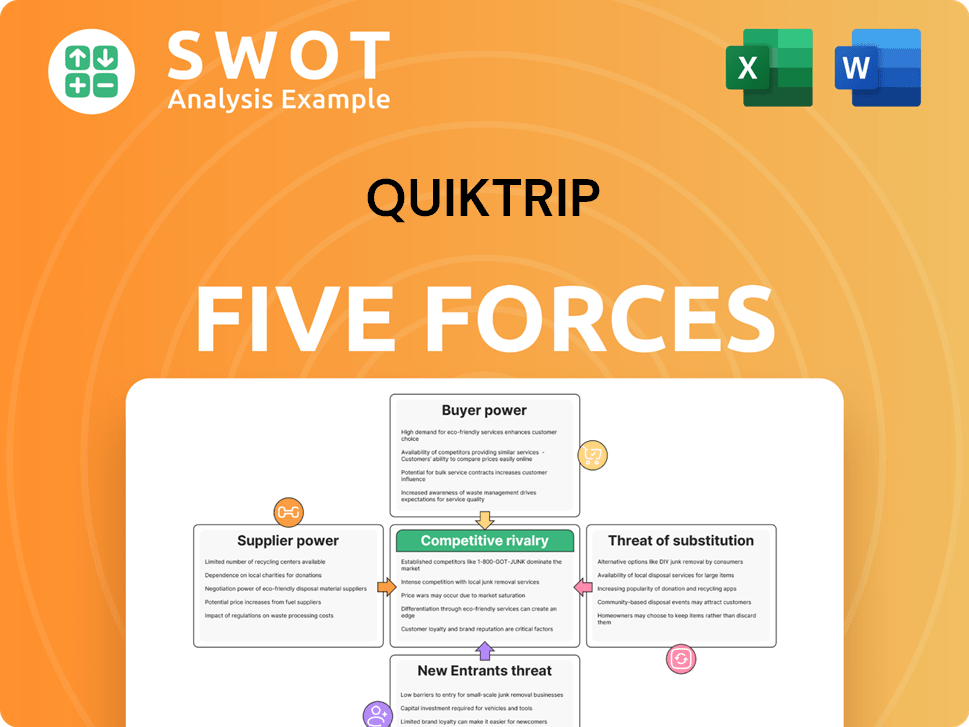

QuikTrip Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of QuikTrip Company?

- What is Competitive Landscape of QuikTrip Company?

- How Does QuikTrip Company Work?

- What is Sales and Marketing Strategy of QuikTrip Company?

- What is Brief History of QuikTrip Company?

- Who Owns QuikTrip Company?

- What is Customer Demographics and Target Market of QuikTrip Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.