QuikTrip Bundle

Who Really Controls QuikTrip?

Understanding a company's ownership is crucial for investors and strategists alike. It dictates everything from strategic direction to financial performance. QuikTrip, a powerhouse in the convenience store industry, presents a fascinating case study in how ownership impacts a company's journey. Uncover the secrets behind QuikTrip SWOT Analysis and its enduring success.

From its humble beginnings, the QT company has grown into a retail giant, but who ultimately calls the shots? This exploration into QuikTrip ownership will reveal the key players, from the founders to the current leadership team. We'll examine the QuikTrip history, its headquarters, and the enduring impact of its ownership structure on its impressive market position. Discover the details of who owns QuikTrip and how this influences its future.

Who Founded QuikTrip?

The story of QuikTrip, a prominent name in the convenience store industry, began in 1958. The founders, Burt Holmes and Chester Cadieux, laid the groundwork for what would become a significant player in the retail sector. Their early vision and strategic decisions were crucial to the company's initial success and set the stage for its future growth.

The inspiration for QuikTrip came from Burt Holmes's observations of 7-Eleven stores, which he encountered during a trip to Dallas. Returning to Tulsa, Oklahoma, Holmes partnered with his former classmate, Chester Cadieux, to bring this concept to life. This partnership marked the beginning of the QT company.

The initial capital needed to launch the first QuikTrip store was $16,000. This seed money was raised through a combination of investments, with Cadieux and Holmes each contributing a significant portion. This early financial backing was essential for getting the business off the ground and establishing its presence in the market.

QuikTrip was founded in 1958 by Burt Holmes and Chester Cadieux in Tulsa, Oklahoma. The initial concept was inspired by 7-Eleven stores.

The first store required a $16,000 investment, with Cadieux and Holmes contributing a significant portion. Additional investors also provided capital.

Chester Cadieux, at age 26, was the first full-time employee and president. Burt Holmes also played a crucial role in the company's founding.

By 1962, QuikTrip had eight stores and sales of over $1 million. This early success was partly due to a focus on attracting quality employees.

The Cadieux family has maintained significant influence throughout QuikTrip's history. The company's ownership structure has been a key factor in its long-term strategy.

Initially, QuikTrip operated as a small grocery store. The business model evolved over time to include a wider range of products and services.

Understanding the early history of QuikTrip, including its founders and initial ownership, provides valuable context for its current operations. The company's early strategies, such as attracting quality employees with higher wages, played a crucial role in its initial success. The Cadieux family's continued influence highlights the importance of long-term vision in business. For more details on the company's financial model, consider reading about the Revenue Streams & Business Model of QuikTrip.

- Burt Holmes and Chester Cadieux co-founded QuikTrip in 1958.

- The initial investment for the first store was $16,000.

- Chester Cadieux served as the first president and full-time employee.

- By 1962, the company had eight stores and sales of over $1 million.

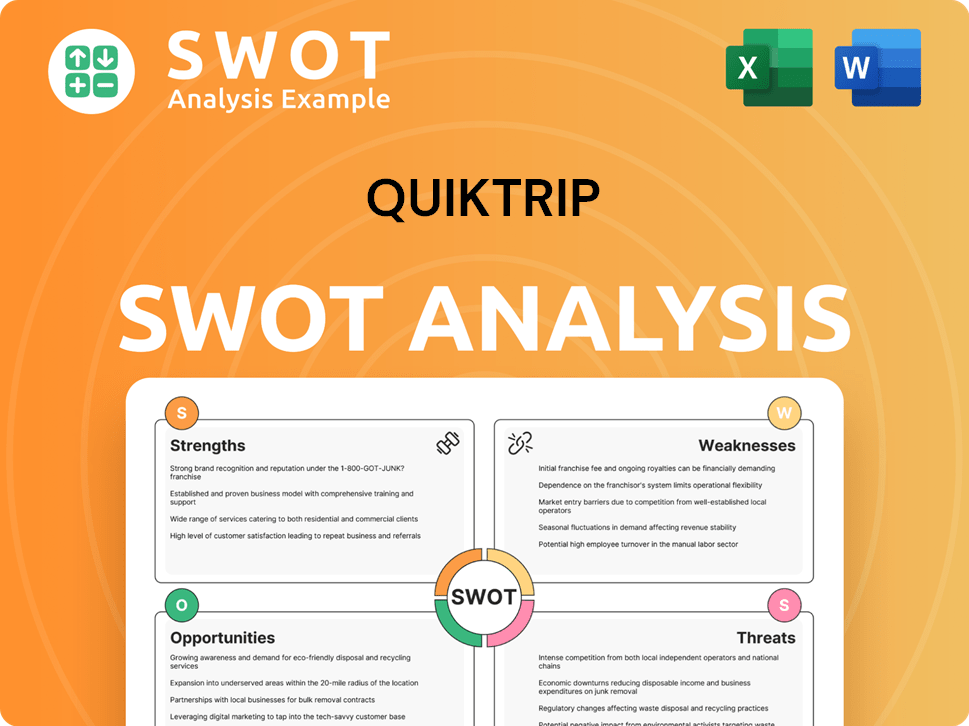

QuikTrip SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has QuikTrip’s Ownership Changed Over Time?

The QT company's ownership structure has remained consistent since its inception in 1958, maintaining its status as a privately held, family-owned business. This structure allows the owners to retain complete control over business operations, making decisions without external shareholder influence. This model has been key to the company's long-term strategic focus.

The Cadieux family has significantly influenced the company's ownership. Chester Cadieux, the co-founder, led the company for 44 years as president and CEO. His son, Chet Cadieux, succeeded him in 2002 as president and in 2006 as Chairman, continuing the family's legacy. This succession plan shows the family's enduring role in guiding the company's strategic direction. The company's history is marked by this family'centric approach to ownership and leadership.

| Key Aspect | Details | Impact |

|---|---|---|

| Founding | Founded in 1958 | Established the foundation for private, family ownership. |

| Leadership Succession | Chester Cadieux served as president and CEO for 44 years; Chet Cadieux succeeded him. | Ensured continuity of family control and strategic direction. |

| Employee Stock Ownership Plan (ESOP) | Approximately 20% owned by non-family members through an ESOP. | Provided employee benefits while maintaining family control through non-voting shares. |

Besides the Cadieux family, an employee stock ownership plan (ESOP) holds around 20% of the company. This plan has helped many employees become millionaires. However, these shares don't have voting rights, ensuring the Cadieux family retains voting power. This setup allows the company to avoid the strict regulations of the Securities and Exchange Commission (SEC) that public companies face. In FY 2024, the company's revenue was US$14.16 billion, and it was ranked as the 20th largest private company in America in 2024 by Forbes. This strong financial performance and private ownership let the company focus on long-term strategies without the pressure of short-term results.

The company is privately held and family-owned, ensuring direct control and strategic focus.

- The Cadieux family has maintained significant influence through leadership and ownership.

- An ESOP provides employee benefits without diluting family control.

- The company's private status allows it to avoid the pressures of public markets.

- The company's revenue in FY 2024 was US$14.16 billion.

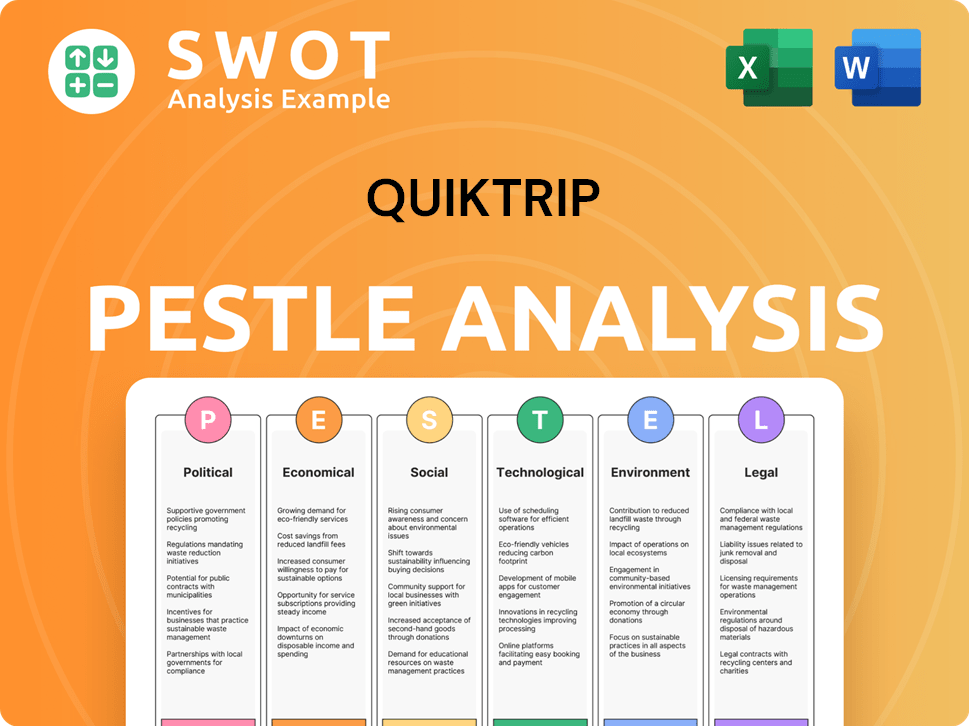

QuikTrip PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on QuikTrip’s Board?

Understanding the ownership of the QT company reveals a structure distinct from publicly traded corporations. The company's governance is primarily shaped by the Cadieux family, who have maintained significant control since its founding. This private status allows QuikTrip to operate without the stringent regulatory oversight typical of public companies, such as requirements for independent boards and detailed financial disclosures.

The current leadership of QuikTrip is held by Chet Cadieux, who serves as Chairman and CEO. While the full composition of the board of directors isn't publicly disclosed, the Cadieux family's influence is a core element of its governance. This structure supports a long-term strategic approach, free from the short-term pressures often faced by publicly listed companies. The ongoing family involvement ensures the company's direction aligns with the founders' vision.

| Role | Name | Details |

|---|---|---|

| Chairman and CEO | Chet Cadieux | Leads the company's strategic direction. |

| Vice Chairman of the Board | Bruce Morgan | Also serves as Chief Commercial Officer; board member of NATSO since 2024. |

| Other Board Members | Undisclosed | Details not publicly available. |

The voting structure at QuikTrip is designed to preserve family control. Approximately 20% of the company is owned by non-family members through an employee stock ownership plan (ESOP). However, these employee shares do not carry individual voting rights. Instead, all ESOP shares collectively count as a single vote. This arrangement prevents dilution of the Cadieux family's voting power, ensuring the company maintains its private status and can focus on long-term strategies. For more details on the company's background, consider reading about the company's history.

The Cadieux family maintains strong control over QuikTrip's leadership and strategic decisions.

- The company's private status allows it to avoid the regulatory burdens of public companies.

- Employee stock ownership does not dilute family voting power.

- Bruce Morgan, a key executive, serves on the board of NATSO.

- QuikTrip prioritizes long-term strategies due to its ownership structure.

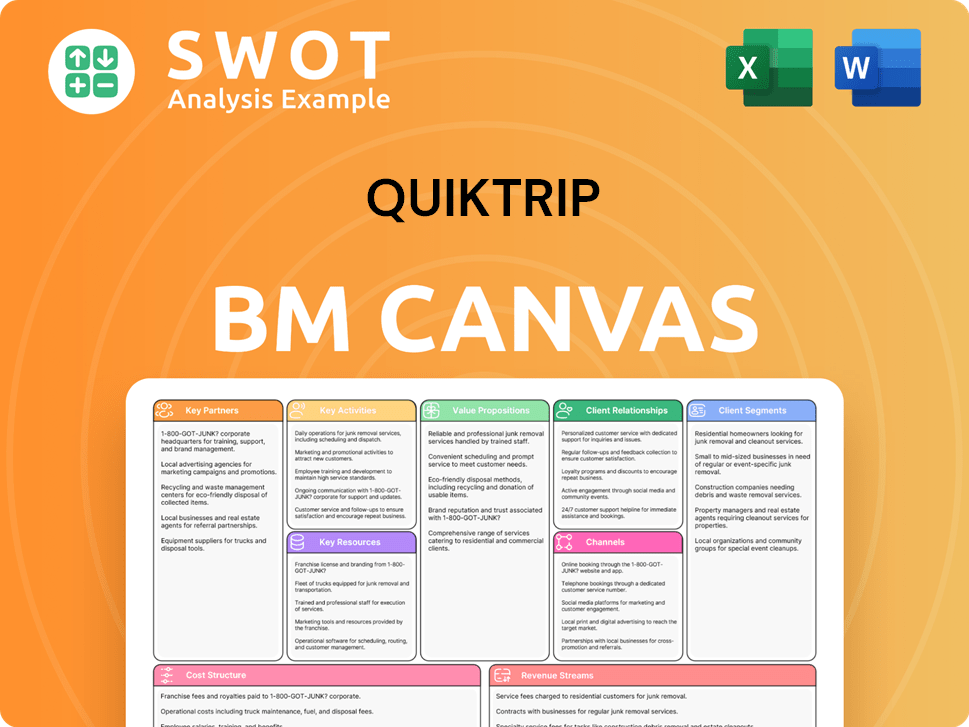

QuikTrip Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped QuikTrip’s Ownership Landscape?

In the past few years, the company has maintained its private ownership structure, primarily controlled by the Cadieux family. As of April 2025, the company operates a total of 1,155 locations across 17 states. This expansion included entering new states such as Ohio and Nevada in 2024, with plans to expand into Florida, Kentucky, and Indiana in 2025. The company reached a milestone of 1,000 stores in 2023. The company's footprint grew nearly 7% from 2023 to 2024. The employee stock ownership plan (ESOP) continues to hold approximately 20% of the company.

The company's revenue reached US$14.16 billion in FY 2024, reflecting consistent growth. In June 2024, the company demonstrated its long-term commitment to its properties by executing a new 10-year lease extension for a location in Decatur, GA. The company was ranked as the 20th largest private company in America by Forbes in 2024. The company's methodical approach to expansion and its commitment to its employees, through competitive pay and benefits, including the stock ownership plan, are key factors in its continued success.

The convenience store sector is seeing a rise in 'super regionals' like the company, Sheetz, Wawa, and Kwik Trip. These privately owned companies are known for their consistent offerings and strong execution. The company's strategic growth is reshaping the competitive landscape. Learn more about the company's approach in the Marketing Strategy of QuikTrip.

The company is primarily owned by the Cadieux family. Approximately 20% of the company is owned by employees through an ESOP. This structure allows the company to maintain control over its operations and strategic decisions without external shareholder pressures.

The company continues to expand its footprint, with 1,155 locations across 17 states as of April 2025. Recent expansions include entering Ohio and Nevada in 2024, with plans for Florida, Kentucky, and Indiana in 2025. The company reached 1,000 stores in 2023.

The company's revenue reached US$14.16 billion in FY 2024. The company was ranked as the 20th largest private company in America by Forbes in 2024. This demonstrates the company's strong financial health and consistent growth.

The convenience store sector sees the rise of 'super regionals' like the company. These companies are known for consistent offerings and strong execution. The company's strategic growth is reshaping the competitive landscape.

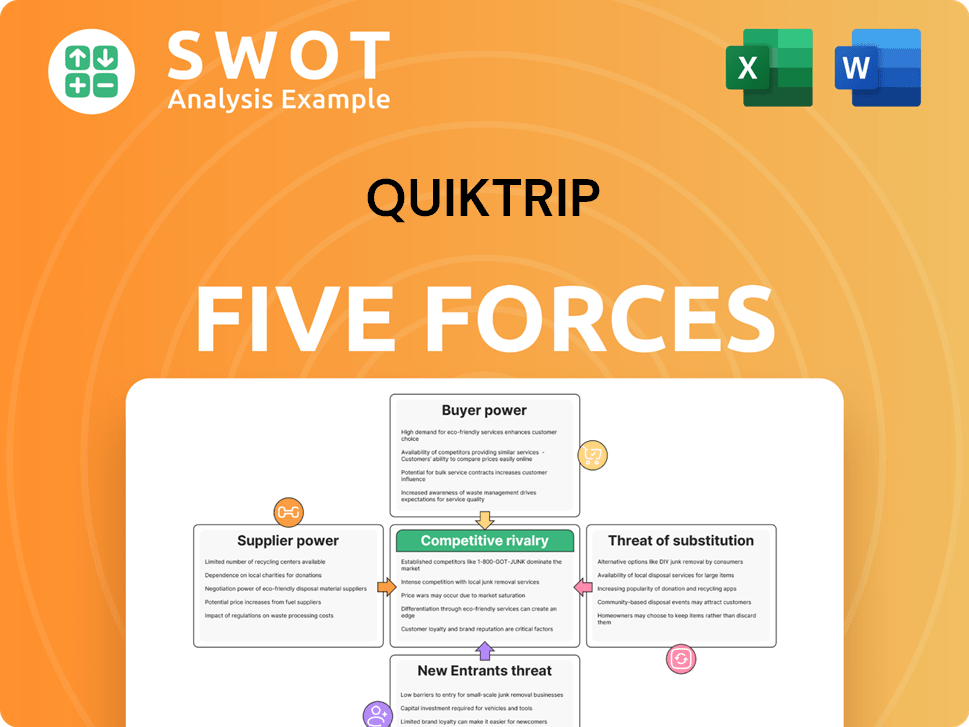

QuikTrip Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of QuikTrip Company?

- What is Competitive Landscape of QuikTrip Company?

- What is Growth Strategy and Future Prospects of QuikTrip Company?

- How Does QuikTrip Company Work?

- What is Sales and Marketing Strategy of QuikTrip Company?

- What is Brief History of QuikTrip Company?

- What is Customer Demographics and Target Market of QuikTrip Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.