Ralph Lauren Bundle

Can Ralph Lauren Maintain Its Luxury Legacy?

From a single line of ties to a global lifestyle empire, Ralph Lauren's journey is a masterclass in brand building. The company's enduring appeal lies in its ability to capture the essence of aspirational living. But what's the secret to its continued success in today's dynamic luxury fashion market?

This Ralph Lauren SWOT Analysis delves into the company's strategic initiatives, including brand expansion and digital transformation, to understand its future prospects. We'll examine how Ralph Lauren is navigating retail industry trends and its plans for international market expansion, providing a comprehensive Ralph Lauren company analysis. Furthermore, we'll explore the impact of economic downturns and the company's sustainability initiatives within the luxury fashion market.

How Is Ralph Lauren Expanding Its Reach?

The expansion initiatives of the company are largely guided by its 'Next Great Chapter: Accelerate' plan. This strategy focuses on elevating the brand, driving core offerings, and expanding in key cities. A core element of the company's growth strategy involves global expansion, particularly in high-growth markets like Asia, where the demand for luxury goods is increasing. This approach is vital for the company's future prospects and overall growth.

The company's initiatives also include a strong emphasis on direct-to-consumer (DTC) strategies and omnichannel approaches. These efforts aim to reach new customers, diversify revenue streams, and adapt to evolving consumer preferences. The company is working to enhance its digital ecosystem, which includes owned e-commerce platforms and wholesale digital accounts. This digital focus is a key part of the company's long-term vision.

The company's expansion strategy is also focused on physical retail, with new store openings and renovations in key cities worldwide. This includes a strategic approach to its retail presence in Greater China, focusing on key cities and enhancing its brand's visibility in the region. The company is also working to optimize its retail footprint, ensuring that its physical stores align with its overall brand strategy and customer expectations.

The company is actively expanding its physical presence in key cities globally. In fiscal year 2025, the company added 17 new stores to its global network, bringing the total to 238. This expansion is part of the company's strategy to increase its market share and brand presence worldwide. This expansion is a key part of the overall Competitors Landscape of Ralph Lauren.

The company's digital ecosystem, encompassing owned e-commerce platforms and wholesale digital accounts, grew in the high teens, led by Europe. Digital commerce in Asia increased by 29% and in Europe by 14% in Q3 Fiscal 2025. This digital focus is a key part of the company's long-term vision and its ability to adapt to changing consumer behaviors.

The company's expansion strategy includes several key initiatives aimed at driving growth and enhancing its market position. These initiatives are designed to capitalize on opportunities in key markets, improve customer engagement, and strengthen the brand's overall performance. The company's focus on these areas will be critical for its long-term success.

- Global retail expansion with new store openings in key cities.

- Growth in the direct-to-consumer (DTC) channel through digital platforms.

- Focus on high-growth markets, especially Asia.

- Enhancement of the digital ecosystem and omnichannel strategies.

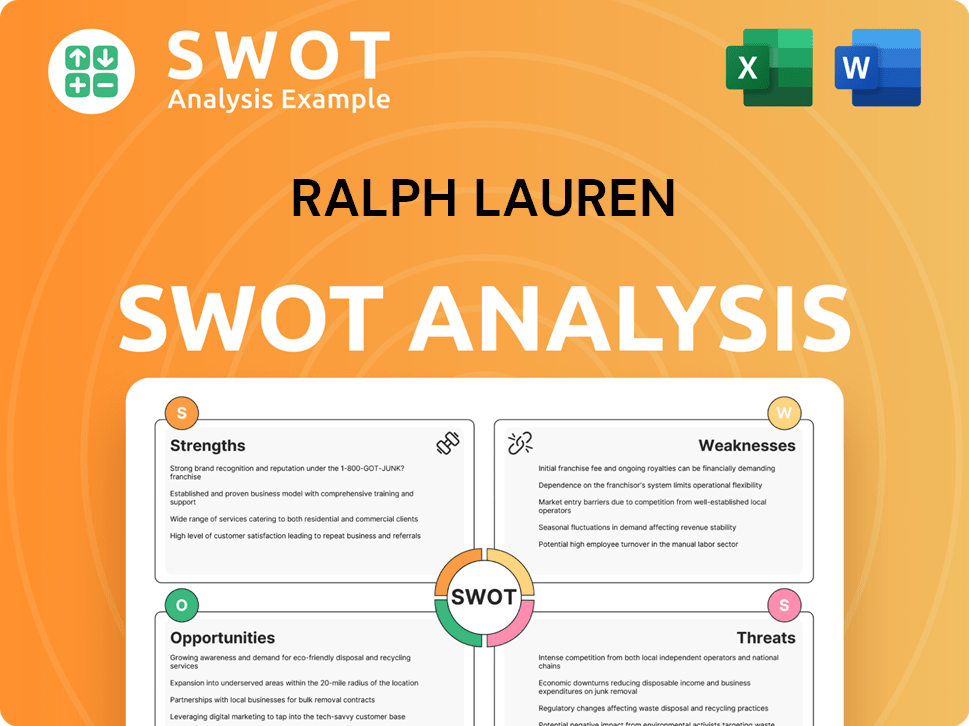

Ralph Lauren SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ralph Lauren Invest in Innovation?

The company is strategically leveraging innovation and technology to fuel its growth. This approach is a core component of the overall Ralph Lauren growth strategy, focusing on enhancing customer experiences and operational efficiency.

A key aspect of this strategy involves a multi-year digital transformation program launched in FY2024. This initiative aims to modernize core technology platforms and retail systems. The goal is to support long-term direct-to-consumer (DTC) growth and greater automation across various business functions.

A significant focus is on integrating artificial intelligence (AI) and data analytics to optimize pricing, streamline costs, and reduce discounts. This approach is part of the company's broader strategy to adapt to Ralph Lauren's future prospects within the evolving luxury fashion market.

In May 2025, the company appointed Naveen Seshadri as the new global chief digital officer. His role is pivotal in driving the digital transformation strategy. The focus is on building a unified digital ecosystem that connects e-commerce, in-store technology, and global consumer experiences.

AI is being used to optimize pricing and reduce discounts. Selective pricing actions are planned for Fall 2025 in North America and Japan. This strategy aims to enhance profitability and adapt to changing retail industry trends.

AI-powered predictive buying is used in 25% of the international DTC business. This helps in making more accurate inventory decisions. It also improves responsiveness to consumer demand, supporting Ralph Lauren company analysis.

The digital ecosystem has been instrumental in acquiring new customers. It also drives high engagement from younger demographics. This enhances brand expansion and supports long-term growth.

The 'Timeless by Design' strategy focuses on creating enduring products and minimizing environmental impact. By the end of 2025, the goal is to achieve 100% sustainably sourced key materials. The company aims to ensure 100% of its key production and packaging materials are recyclable or sustainably sourced.

As of 2024, 97% of cotton and 87% of polyester were sustainably sourced. The company is committed to reducing its environmental footprint. This includes achieving zero waste to landfill across its distribution centers by 2023.

The company has set ambitious goals for sustainability. These initiatives are part of a broader commitment to environmental responsibility and innovation. This includes reducing water use and developing eco-friendly products.

- Water Reduction: A 20% reduction in total water use across operations and the value chain is targeted by 2025.

- Earth Polo: This product is made from recycled plastic bottles.

- Cradle to Cradle Certified Products: Examples include the Denim Flag Trucker Jacket and Flag Cashmere Sweater.

- Partnerships: Collaborations with NFW (Natural Fiber Welding) for natural fiber recycling and Re-Verso™ for a cashmere recycling program.

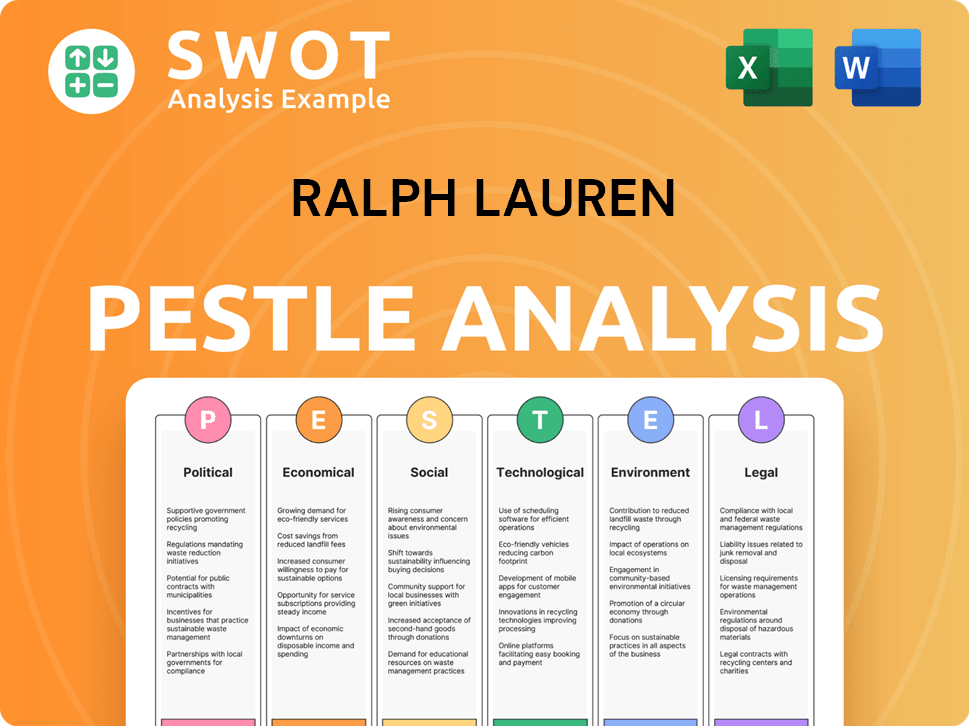

Ralph Lauren PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Ralph Lauren’s Growth Forecast?

The financial outlook for the company is positive, with the company demonstrating robust financial performance. The company's fiscal year 2025 results and future projections indicate a strong position within the luxury fashion market. The company's strategic initiatives and brand expansion efforts are expected to drive continued growth.

For fiscal year 2025, the company reported a revenue increase of 7% to $7.1 billion on a reported basis, and 8% in constant currency, surpassing expectations. Net income for fiscal 2025 was $743 million, or $11.61 per diluted share on a reported basis. The company's ability to navigate the retail industry trends and adapt to changing consumer behaviors is key to its success.

Looking ahead to fiscal 2026, the company projects net revenue growth in the low-single digits on a constant currency basis. This outlook reflects a cautious approach to the global operating environment. The company anticipates modest operating margin expansion, including tariffs. The company's focus on digital transformation and e-commerce is also expected to contribute to future growth.

Total revenue increased by 8.3% to $1.70 billion in Q4 Fiscal 2025. The gross profit margin expanded to 68.4% in Q3 Fiscal 2025, driven by favorable product mix and strong full-price demand. The company's financial performance analysis indicates a strong and stable financial position.

The company returned $625 million to shareholders through dividends and stock repurchases in fiscal 2025. The Board of Directors approved a 10% dividend increase and a $1.5 billion expansion of the existing share repurchase program. The company's strong balance sheet, with over $2 billion in cash and short-term investments, supports its growth strategy.

For the first quarter of fiscal 2026, revenues are expected to increase by high-single digits on a constant currency basis. Operating margin expansion is anticipated, primarily driven by gross margin improvements and modest operating expense leverage. The company's international market expansion plans are expected to contribute to revenue growth.

Analysts project EPS for fiscal year 2025 in the range of $11.74 to $13.57. Expectations for fiscal year 2026 range from $13.25 to $15.02, suggesting continued growth in profitability. The company's long-term business goals include sustainable growth and brand expansion.

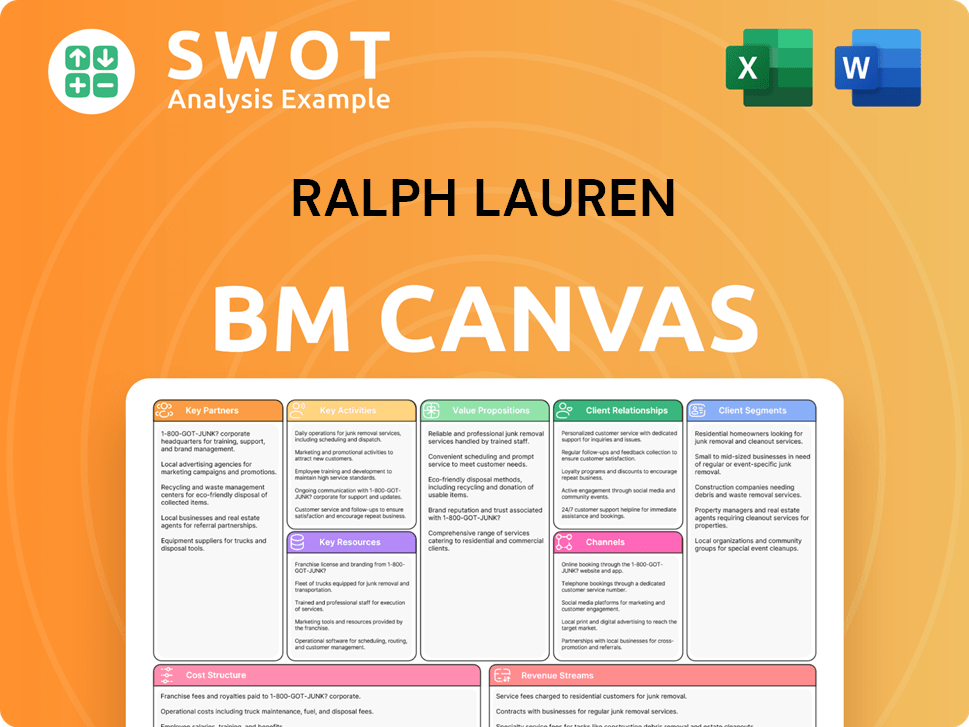

Ralph Lauren Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Ralph Lauren’s Growth?

The path to growth for the company is not without its challenges. Navigating the complex luxury fashion market and adapting to rapidly evolving consumer preferences are crucial. Understanding the potential risks and obstacles is essential for a comprehensive Ralph Lauren company analysis.

The company faces several strategic and operational risks that could affect its growth. From market competition to economic uncertainties, the company must address these challenges to maintain its market position. Effective risk management is vital for the company's long-term success.

Several factors could impede the company's growth trajectory. These include economic downturns, changing consumer preferences, and supply chain disruptions. Addressing these challenges effectively is crucial for the company's sustained success.

The luxury fashion market is highly competitive, with rivals vying for market share. Competition from premium and fast-fashion brands poses a significant challenge. Adapting to changing trends is crucial for maintaining a competitive edge.

Economic fluctuations can significantly impact consumer spending on luxury items. A recession or economic slowdown could lead to decreased sales and profitability. The company's reliance on affluent consumers makes it vulnerable to economic downturns.

Increased tariffs and trade regulations can lead to higher import duties. These can affect profitability, particularly given the company's global supply chain. Analysts have noted concerns about how tariff-induced cost increases may impact margins.

Supply chain issues, including delays and rising costs, can affect operational efficiency. Ethical sourcing problems can also impact product delivery. Effective supply chain management is essential for maintaining operational stability.

Changing consumer preferences and the need to adapt to emerging fashion trends are ongoing challenges. The company must innovate and evolve its offerings to stay relevant. Understanding and responding to these shifts is critical.

Maintaining a strong brand image and premium positioning is vital. The company must consistently elevate its brand to justify its price points. Strategic marketing and brand management are key to this.

The company employs various strategies to mitigate risks, including diversification. A focus on its core consumer base is also important. Diversifying product offerings and strengthening direct-to-consumer channels can help manage risks effectively.

Investing in digital transformation is crucial for reaching consumers. Enhancing e-commerce capabilities and digital marketing strategies are essential. This includes focusing on the future of the company's e-commerce.

The company's ability to innovate and execute its strategic initiatives is key to maintaining its market position and driving long-term growth. To understand the company's core values and mission, you can refer to Mission, Vision & Core Values of Ralph Lauren. The company's Ralph Lauren growth strategy involves navigating these risks to achieve its Ralph Lauren future prospects. The luxury fashion market is subject to fluctuations; the company must adapt to remain competitive.

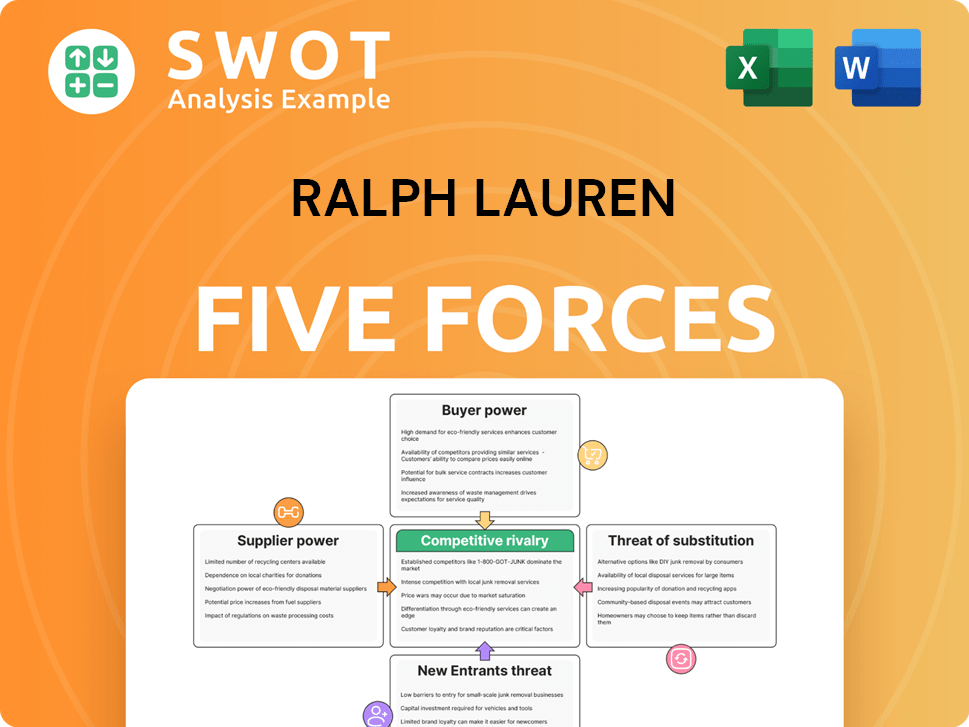

Ralph Lauren Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ralph Lauren Company?

- What is Competitive Landscape of Ralph Lauren Company?

- How Does Ralph Lauren Company Work?

- What is Sales and Marketing Strategy of Ralph Lauren Company?

- What is Brief History of Ralph Lauren Company?

- Who Owns Ralph Lauren Company?

- What is Customer Demographics and Target Market of Ralph Lauren Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.