Ralph Lauren Bundle

How Does the Ralph Lauren Company Thrive in the Fashion World?

Ralph Lauren, a titan in the Ralph Lauren SWOT Analysis, continues to define luxury lifestyle with its iconic brand. The company's recent financial results, including a robust fiscal 2025 performance, highlight its enduring appeal and strategic prowess. From innovative collections to global expansion, understanding the inner workings of Ralph Lauren is key to appreciating its sustained success.

This exploration delves into the heart of the Ralph Lauren Company, examining its Ralph Lauren business model and how it navigates the competitive fashion industry. We'll uncover the secrets behind its impressive Ralph Lauren financial performance, from its diverse Ralph Lauren brand strategy to its innovative product offerings. Whether you're curious about how Ralph Lauren designs clothes or its Ralph Lauren supply chain, this analysis provides a comprehensive overview of this leading apparel company and its place among luxury brands.

What Are the Key Operations Driving Ralph Lauren’s Success?

The Ralph Lauren Company creates value through a multi-channel approach, offering high-quality products that embody a luxurious lifestyle. The Ralph Lauren business model focuses on apparel, accessories, and home furnishings, targeting upper-middle to upper-class consumers who value classic style and luxury. The company's offerings are designed to provide timeless elegance and meticulous attention to detail, blending sport-inspired aesthetics with contemporary advancements.

Operationally, Ralph Lauren designs and produces its products, then markets and sells them through various channels. The company's supply chain is globally diversified, including manufacturing facilities across multiple continents. This diversified sourcing helps mitigate risks and enhances supply chain agility. The company is committed to sustainability within its supply chain, with goals for sustainably sourced materials and reduced water use.

Distribution networks include wholesale operations and a robust retail segment. The retail segment encompasses company-owned full-price and outlet stores, concession-based shop-within-shops, and e-commerce websites. Ralph Lauren has been expanding its direct-to-consumer business to enhance control over pricing, inventory, and marketing. This omni-channel approach, combined with personalized in-store experiences and exclusive offers, makes Ralph Lauren's operations unique and effective compared to competitors.

The core products include apparel, footwear, accessories, home furnishings, and fragrances. The target market consists of upper-middle to upper-class individuals who value classic style, quality, and luxury. These products are designed for timeless elegance and meticulous attention to detail.

The supply chain is globally diversified, with manufacturing in multiple countries. The company aims for 100% sustainably sourced key materials by 2025. There is a 20% reduction target in total water use across operations and the value chain by 2025.

Distribution includes wholesale operations and a robust retail segment. The retail segment encompasses company-owned stores, outlet stores, and e-commerce. Direct-to-consumer business is expanding to enhance control.

The retail business generates a significant portion of revenue, approximately 66% in fiscal 2024. The company operates nearly 600 company-operated stores worldwide and about 700 concession shops as of fiscal 2024. The e-commerce strategy focuses on enhancing the direct-to-consumer experience.

The Ralph Lauren Company's operational strategy is centered around a multi-channel approach, ensuring a strong presence across various distribution networks. This approach, combined with a focus on sustainability and direct-to-consumer expansion, positions the company well within the fashion industry.

- Global supply chain with diversified manufacturing locations.

- Commitment to sustainable sourcing and environmental targets.

- Expansion of direct-to-consumer channels to enhance customer experience.

- Retail business accounted for 66% of fiscal 2024 revenue.

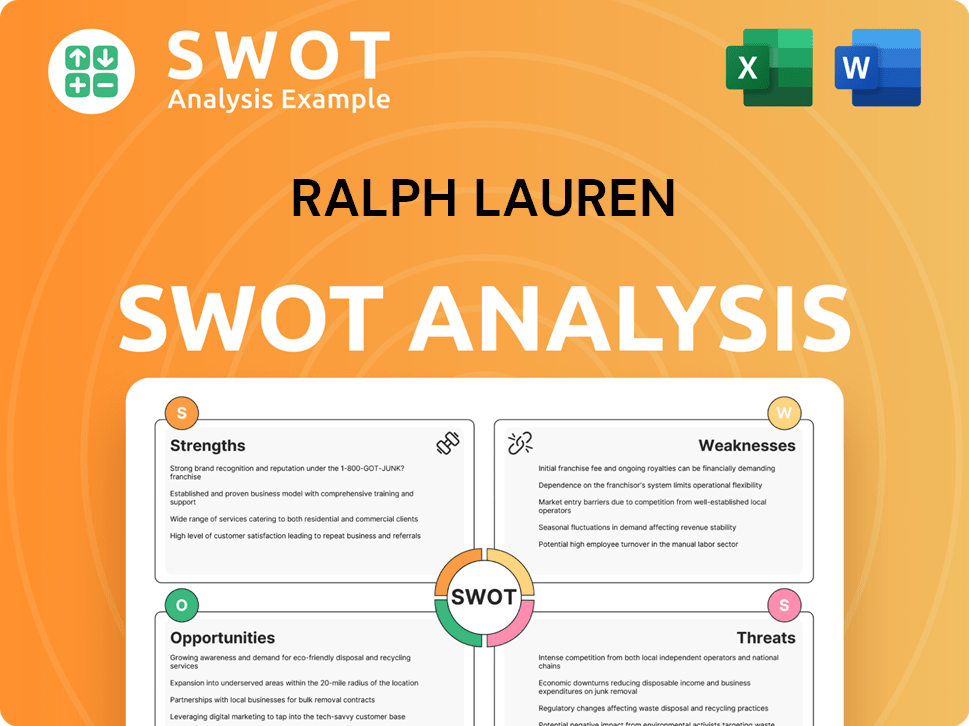

Ralph Lauren SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ralph Lauren Make Money?

The Ralph Lauren Company generates revenue through a multifaceted approach, primarily centered on selling its diverse product lines across various distribution channels. This strategy includes direct-to-consumer sales, wholesale operations, and licensing agreements, ensuring a broad market reach and diversified income streams. The Ralph Lauren business model is built on a foundation of premium branding and a strong global presence.

The company's financial performance reflects its strategic initiatives and market positioning. For the fiscal year 2025, Ralph Lauren reported total revenue of $7.1 billion, demonstrating the company's robust financial health and market resilience. The Ralph Lauren Company continues to adapt and innovate within the competitive fashion industry.

The retail segment is a significant revenue driver for Ralph Lauren, accounting for approximately 66% of the fiscal 2024 revenue. This segment encompasses sales from company-owned full-price and outlet stores, concession-based shops, and e-commerce platforms, showcasing the brand's direct engagement with consumers. The company's direct-to-consumer comparable store sales globally increased by 13% in the fourth quarter of fiscal 2025, and by 10% for the full fiscal year, reflecting strong pricing power and high single-digit growth in Average Unit Retail (AUR).

The Ralph Lauren Company employs several strategies to generate revenue and maintain its position as one of the leading luxury brands. These strategies include expanding its retail presence, optimizing wholesale operations, and leveraging licensing agreements. The company's approach ensures a diversified revenue base and supports its growth initiatives. Understanding the Target Market of Ralph Lauren is crucial for its continued success.

- Retail Segment: This includes sales from company-owned stores, outlet stores, and e-commerce platforms. Direct-to-consumer sales saw significant growth, with global comparable store sales increasing by 13% in Q4 fiscal 2025.

- Wholesale Operations: Sales to department stores and specialty stores worldwide contribute significantly. While wholesale revenue saw a slight decline in Q2 fiscal 2025, North America wholesale revenue grew by 1% in Q4 fiscal 2025.

- Licensing Agreements: Ralph Lauren earns revenue by licensing its brand names to other companies for the manufacture and distribution of certain product categories. This strategy allows the brand to extend its reach without managing all operations directly.

- Geographical Expansion: Sales growth in Q4 fiscal 2025 was led by Europe (up 12% on a reported basis and 16% in constant currency), followed by Asia (9% increase on a reported basis and 13% in constant currency), and North America (6% increase).

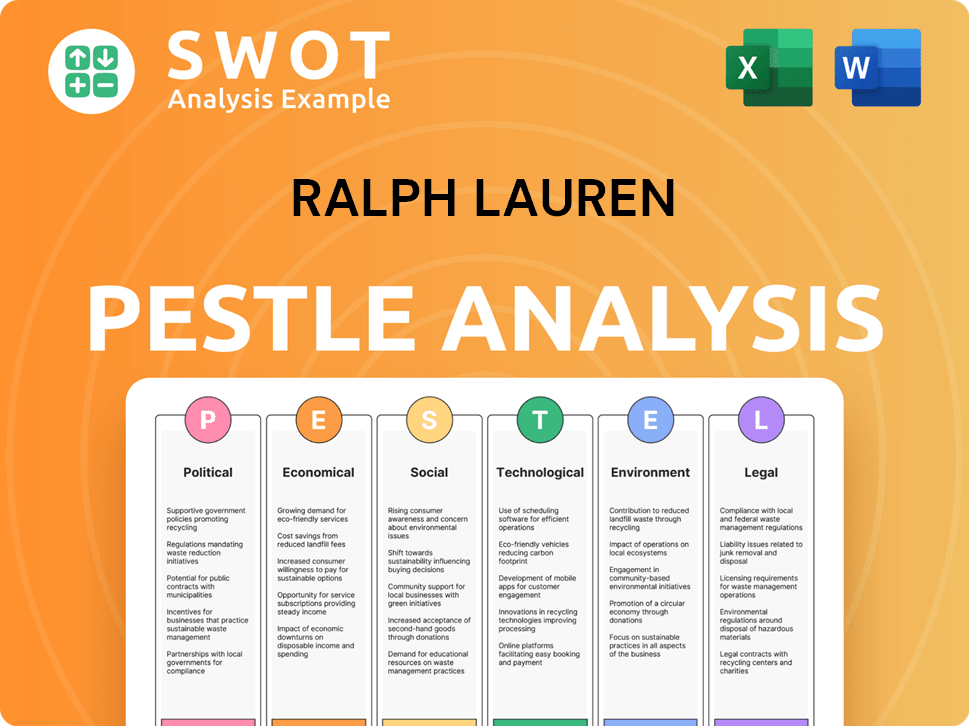

Ralph Lauren PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Ralph Lauren’s Business Model?

The Ralph Lauren Company has navigated a path marked by significant milestones and strategic shifts, solidifying its position in the fashion industry. Its consistent focus on brand elevation and digital expansion has been pivotal. The company has proactively expanded its direct-to-consumer business and streamlined operations to enhance control over pricing and inventory, leading to notable gross margin improvements. This focus on strategic moves has been key to its success.

Operational challenges, including supply chain disruptions, have been addressed through strategic diversification. The Ralph Lauren Company has diversified its sourcing footprint, reducing its reliance on specific regions for production. Investments in production facilities across multiple continents have enhanced its supply chain agility and resilience. These efforts are a testament to the company's adaptability.

The Ralph Lauren business model is built on a strong brand identity synonymous with luxury and sophistication. This brand recognition, cultivated over nearly 57 years, attracts a loyal customer base willing to pay a premium. The company's diverse product range, effective marketing strategies, global presence, and commitment to sustainability further bolster its competitive edge. For more insights, explore the Growth Strategy of Ralph Lauren.

The company has consistently focused on brand elevation and digital expansion. It has reduced its exposure to U.S. department stores and off-price channels. These strategic moves have driven improvements in gross margins.

The company has diversified its sourcing footprint to mitigate supply chain risks. It has invested in production facilities across multiple continents. These moves enhance supply chain agility and resilience.

The Ralph Lauren Company benefits from a strong brand identity and a diverse product range. Effective marketing strategies and a global presence contribute to its competitive advantage. The company's commitment to sustainability also strengthens its position.

The company continues to explore technology integration to enhance customer experience. It leverages customer data to drive innovation and refine marketing strategies. Plans include expanding its digital presence and optimizing its supply chain.

The company is focused on expanding its digital presence and optimizing its supply chain. Ralph Lauren plans to open 250 stores through 2025, with a focus on smaller U.S. cities and international markets. These initiatives are designed to drive continued growth and enhance shareholder value.

- The company's strategic initiatives include expanding its digital presence.

- It is focused on optimizing its supply chain for greater efficiency.

- The company plans to open new stores, focusing on strategic locations.

- These efforts are geared towards sustained growth and market leadership.

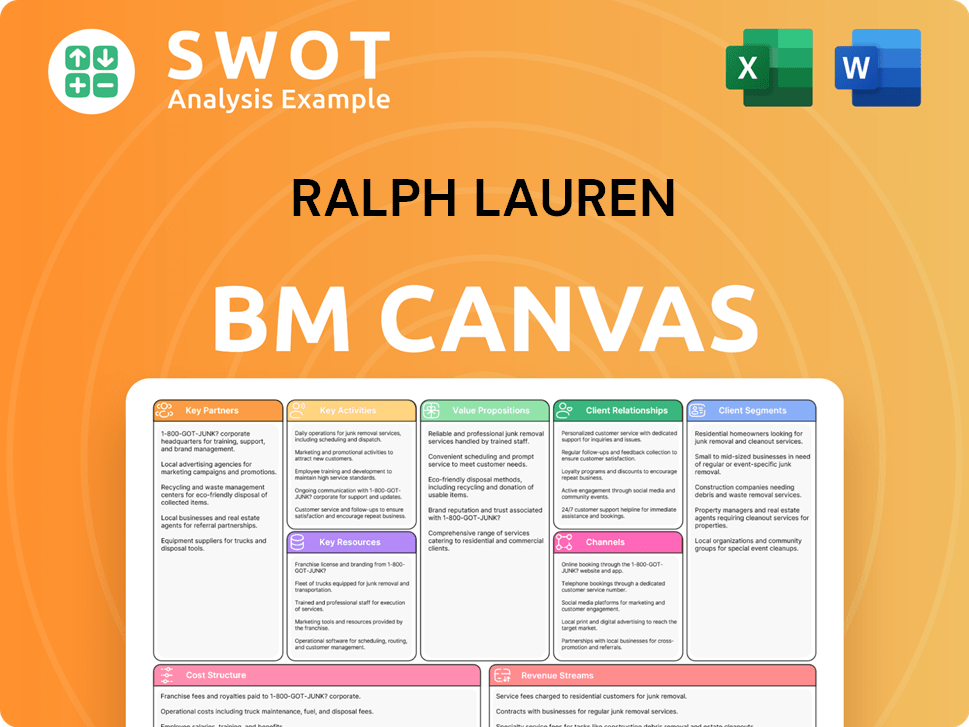

Ralph Lauren Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Ralph Lauren Positioning Itself for Continued Success?

The Ralph Lauren Company holds a strong position in the luxury fashion industry, known globally for its classic and timeless designs. Its brand strength and loyal customer base contribute to its competitive standing against rivals. The Ralph Lauren business model benefits from a global reach, with operations spanning North America, Europe, and Asia.

Despite its solid foundation, Ralph Lauren faces several risks, including macroeconomic uncertainty and shifts in consumer preferences. The company must continually adapt to fast fashion trends and navigate potential policy shifts impacting international trade. Furthermore, regional headwinds, like a projected sales decline in North America, present challenges.

The Ralph Lauren Company is a leading player in the fashion industry, recognized for its iconic brand and quality products. Its global presence is extensive, with over 13,000 retail locations worldwide. In fiscal 2025, Asia accounted for 9% of total sales, highlighting its growth potential.

The company faces risks from macroeconomic uncertainty and changing consumer preferences. Potential policy shifts and increased competition also pose challenges. A projected low-to-mid-single-digit sales decline in North America for fiscal 2026 presents a regional headwind.

The future outlook is shaped by strategic initiatives aimed at sustaining and expanding profitability. The company forecasts low-single-digit net revenue growth on a constant currency basis for fiscal 2026. This includes anticipated high-single-digit revenue growth in the first quarter of fiscal 2026.

Key initiatives include continued investment in its brand, digital expansion, and supply chain optimization. The company aims to grow its direct-to-consumer sales to 75% of total sales by fiscal 2035. The company plans to continue expanding its physical footprint, with an expectation of directly operating just over 700 stores by the end of fiscal 2034.

The Ralph Lauren Company is focused on long-term growth through strategic initiatives, including expanding its digital presence and optimizing its supply chain. These efforts are aimed at enhancing control over pricing and brand positioning. This forward-looking approach, emphasizing brand elevation and global expansion, positions Ralph Lauren to sustain its ability to make money in the evolving luxury lifestyle market.

- Direct-to-consumer sales are targeted to reach 75% by fiscal 2035.

- The company anticipates low-single-digit net revenue growth for fiscal 2026.

- The company expects to operate over 700 directly operated stores by the end of fiscal 2034.

- The company expects modest operating margin expansion for fiscal 2026.

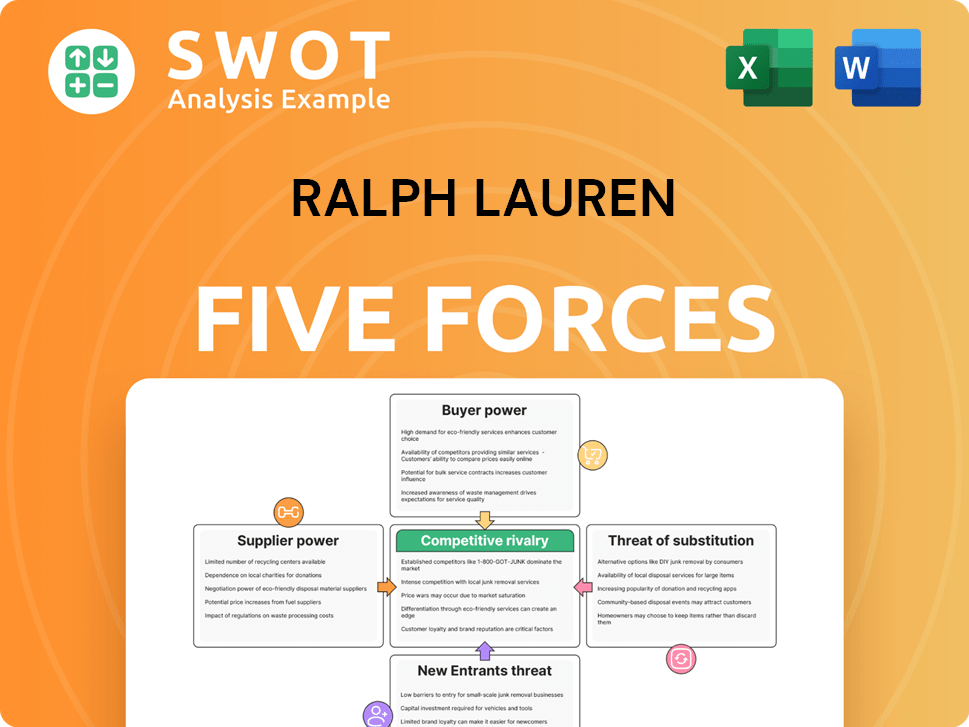

Ralph Lauren Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ralph Lauren Company?

- What is Competitive Landscape of Ralph Lauren Company?

- What is Growth Strategy and Future Prospects of Ralph Lauren Company?

- What is Sales and Marketing Strategy of Ralph Lauren Company?

- What is Brief History of Ralph Lauren Company?

- Who Owns Ralph Lauren Company?

- What is Customer Demographics and Target Market of Ralph Lauren Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.