Reece Bundle

Can Reece Company Sustain Its Century-Long Growth?

From its humble beginnings in 1920, Reece Limited has evolved into a global leader in plumbing and HVAC-R distribution. With a rich history rooted in providing exceptional tools and expert advice, Reece has strategically expanded its footprint, most notably with a significant move into the US market. This Reece SWOT Analysis will help you understand the company's strengths and weaknesses.

This exploration delves into the Reece Company growth strategy, examining its ambitious international expansion, particularly within the lucrative US market, and assessing its Reece Company future prospects. We'll dissect the Reece company analysis, including its Reece business model, market position, and how it navigates challenges like market fluctuations and competitive pressures. Understanding Reece Group's strategic acquisitions and its ability to adapt to market changes is crucial for investors and strategists alike, offering insights into its long-term growth outlook and potential for sustained success.

How Is Reece Expanding Its Reach?

The expansion initiatives of the company are primarily focused on strengthening its presence in existing markets, especially the United States, and strategically pursuing mergers and acquisitions. This Reece Company growth strategy includes both organic growth and strategic acquisitions to enhance its market position.

The US market is viewed as a significant long-term growth platform, offering considerable potential due to its size, which is approximately seven times larger than the Australian market. This focus underlines the company's commitment to expanding its footprint and capturing a larger share of the market. This strategy is designed to leverage the company's existing strengths while adapting to the specific dynamics of the US market.

In FY24, the company expanded its US branch network by adding 15 new branches and undertaking four refurbishments, bringing the total US store count to 243. This organic growth strategy in the US aims to replicate the success of its dense branch network in Australia and New Zealand, which currently boasts 661 branches. This approach reflects a commitment to both expanding its physical presence and optimizing its existing infrastructure.

The US market is a key focus for the company's expansion. The company added 15 new branches in FY24, bringing the total to 243. This expansion is part of a long-term strategy to increase market share.

The company is diversifying its revenue streams by focusing on the repair and renovation market. This segment currently accounts for about 20% of US revenue. The aim is to reduce earnings volatility.

In Australia and New Zealand, the company added 6 net new stores and completed 15 refurbishments in FY24. A new distribution center was opened in New Zealand in April 2024.

The company has engaged in bolt-on acquisitions in Australia and New Zealand. Two acquisitions were completed in the half-year ending December 31, 2024, to support long-term growth.

The company's expansion strategy includes both organic growth and strategic acquisitions. This approach is designed to increase market share and diversify revenue streams. This strategy is a key part of the company's overall plan for the future.

- Expanding the US branch network.

- Increasing focus on the repair and renovation market.

- Investing in the branch network in Australia and New Zealand.

- Strategic acquisitions to support long-term growth.

Reece SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Reece Invest in Innovation?

The Reece Company growth strategy heavily relies on innovation and technology to enhance its core operations and broaden its product offerings. This approach is essential for maintaining a competitive edge in the market. The company consistently invests in product development and digital transformation, which is a key component of its strategic vision.

By embracing cutting-edge technologies, the company aims to improve operational efficiency and elevate the customer experience. This focus on technological advancements and innovation is a core element of their long-term strategy. This approach is critical for achieving sustained growth and solidifying its market position.

The Reece Group is committed to leveraging technology and innovation to drive sustained growth. This commitment is evident in its investment in product development and digital transformation. The company's strategic priorities for its 2030 vision include a strong focus on digital capabilities within Australia and New Zealand.

In FY24, the company launched new products like Flowtite and Thermann Smart Electric in Australia and New Zealand. The Thermann Smart Electric also won an Innovation Award in December 2024.

In May 2025, the company introduced SensR, an advanced refrigeration monitoring system. This shows the company's commitment to innovation in its product lines.

In April 2025, the Milli product received a 2025 iF Design Award. This highlights the company's leadership in design and innovation within the industry.

The company is prioritizing digital capabilities within Australia and New Zealand as part of its strategic plan. This focus is crucial for enhancing customer experience and streamlining operations.

Leveraging technology for operational efficiency is a key strategic priority. This helps the company improve its internal processes and reduce costs.

The company's strategic priorities support its 2030 vision of being the trade's most valuable partner. This vision is driven by innovation and customer-focused solutions.

The company's approach involves a blend of product innovation, technological integration, and a strong focus on digital capabilities. These initiatives are designed to ensure the company's continued success and market leadership. For more insight into the company's target market, you can read about the Target Market of Reece.

- Investment in product development to offer competitive advantages.

- Embracing cutting-edge technologies to enhance operational efficiency.

- Prioritizing digital capabilities in Australia and New Zealand.

- Focusing on customer experience through innovative solutions.

Reece PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Reece’s Growth Forecast?

The financial outlook for the Reece Group reveals a complex picture. Recent reports indicate a dip in sales revenue and net profit after tax (NPAT) for the half-year ending December 31, 2024. This downturn is primarily attributed to the softer housing construction markets in both Australia and the US, which are anticipated to persist in the short term. Despite these challenges, the company is actively pursuing its Reece Company growth strategy.

For the first half of FY25, Reece Group invested in business expansions, including two acquisitions in Australia and New Zealand, and the addition of 32 new branches globally. This commitment to growth, even amidst market headwinds, underscores the company's long-term strategic vision. The company's financial performance review highlights its resilience and proactive approach to market dynamics.

Looking at the full year ended June 30, 2024, Reece Group demonstrated a 3% increase in sales revenue, reaching AU$9.1 billion. Adjusted EBIT rose by 2% to AU$681 million, and adjusted net profit after tax increased by 3% to AU$416 million. The US market significantly contributes to revenue, with US sales revenue in FY24 at A$5.3 billion, exceeding the A$3.8 billion in Australia and New Zealand. This illustrates the importance of its international expansion strategy.

Sales revenue decreased by 3% to AUD 4,402 million for the half-year ending December 31, 2024. Earnings before interest and tax (EBIT) fell by 17% to AUD 305 million during the same period.

The company invested in two acquisitions in Australia and New Zealand. It added 32 new branches globally in the first half of FY25, indicating a proactive approach to Reece Company future investment plans.

Sales revenue reached AU$9.1 billion, up 3% year-on-year. Adjusted EBIT increased by 2% to AU$681 million. Adjusted net profit after tax rose by 3% to AU$416 million.

Analysts forecast Reece to grow earnings and revenue by 9.6% and 4.8% per annum, respectively. EPS is expected to grow by 10% per annum. The company's valuation is considered high, trading at over 31.3x P/E for FY25 and 27.9x for FY26.

Despite the challenges, Reece Group maintains a strong financial position. Net debt increased to $646 million at the end of December 2024, due to lower operating cash flow and increased investment in growth. However, the business remains well-capitalized with a net leverage ratio of 0.8x. The company's ability to adapt to market changes is crucial for its long-term success.

- The company's market position in the US is a key driver for growth.

- The company faces challenges related to softer housing markets.

- The company's strategic acquisitions and mergers are part of its expansion.

- The company's digital transformation strategy is important.

Reece Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Reece’s Growth?

The Marketing Strategy of Reece faces several potential risks and obstacles, particularly due to the cyclical nature of the housing and commercial construction sectors. The company's growth strategy is directly affected by market dynamics, especially in its key operating regions. Understanding these challenges is crucial for assessing the future prospects of the company.

A significant near-term obstacle is the subdued demand in both the Australian and US housing markets. Factors such as mortgage rates and affordability significantly influence these markets. This situation has already impacted the company's financial performance, with a reported drop in revenue and net profit in the first half of FY25. The company anticipates that housing activity will remain soft in 2025.

Market competition, especially in the US waterworks market, poses a new and uncertain risk to the growth trajectory. The company's market position in the US is smaller compared to its strong presence in Australia and New Zealand. Regulatory changes, such as potential tariff impacts, also present risks, although the company is well-positioned to offset most of these impacts through pricing strategies.

The cyclical nature of the housing market in both Australia and the US presents a major risk. Subdued demand, influenced by mortgage rates and affordability, can directly impact the company's revenue and profitability. The company's performance is closely tied to the health of these markets.

Competition, especially in the US waterworks market, poses a considerable risk. The company faces greater competitive threats from established and larger brands in the US. Maintaining and growing market share in a competitive environment is a key challenge.

Regulatory changes, such as potential tariff impacts, and broader economic factors add to the risks. While the company aims to mitigate these impacts through pricing, these factors can still affect profitability. Economic downturns can further exacerbate these risks.

Supply chain vulnerabilities and technological disruptions are ongoing considerations. While not detailed in recent examples, the company's investment in its branch network and digital transformation suggests a proactive approach to mitigating these risks. Adapting to technological changes is crucial.

Market volatility directly impacts the company’s performance. The company's strategy to build its presence in the less cyclical repair and renovation market is a deliberate effort to reduce earnings volatility associated with new builds. This diversification helps manage market fluctuations.

Concentration in specific geographic markets, such as Australia and the US, adds risk. Economic downturns in these regions can significantly impact the company's overall performance. Diversification into new markets can help mitigate these risks.

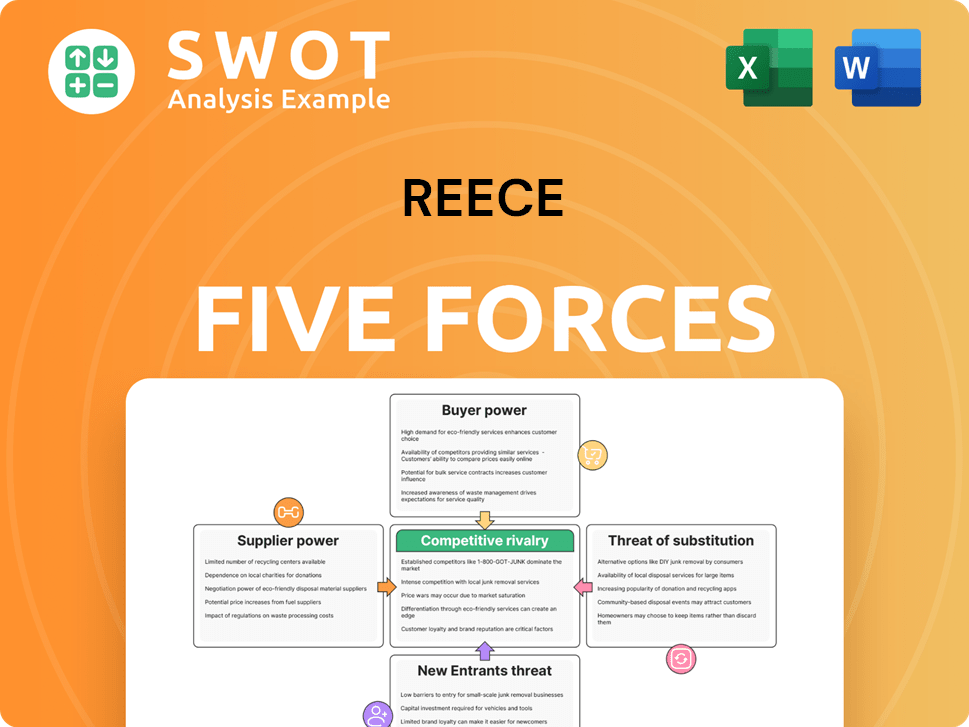

Reece Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Reece Company?

- What is Competitive Landscape of Reece Company?

- How Does Reece Company Work?

- What is Sales and Marketing Strategy of Reece Company?

- What is Brief History of Reece Company?

- Who Owns Reece Company?

- What is Customer Demographics and Target Market of Reece Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.