Reece Bundle

Who Really Owns Reece Group?

Understanding the ownership of a company is crucial for investors and stakeholders alike. The evolution of Reece SWOT Analysis, a leading distributor of plumbing and HVAC supplies, from a small Australian hardware store to a global player offers a compelling case study in corporate ownership dynamics. Knowing who owns Reece Company is key to understanding its strategic direction, financial performance, and future prospects. This exploration delves into the ownership structure of Reece Group, revealing the key players and their influence.

From its humble beginnings in 1920, Reece Group's ownership has undergone significant transformations, reflecting its growth and expansion. This analysis examines the Reece ownership structure, including the role of the founding family, institutional investors, and public shareholders. Uncovering the answers to questions like "Who owns Reece?" and "Is Reece Company publicly traded?" provides valuable insights into the company's governance and market position. This article will explore the Reece Company history, its major shareholders, and how these elements have shaped its success.

Who Founded Reece?

The story of the Reece Company began in 1920, when Harold Reece established a hardware store in Caulfield, Melbourne, Australia. Initially, the ownership was entirely private, with Harold Reece holding 100% of the equity. His vision was to create a reliable source for plumbing and hardware supplies, specifically catering to tradespeople.

During its early years, the ownership of the Reece Group remained firmly within the Reece family. There is no publicly available information on early angel investors or external backers during this foundational period, suggesting a sole proprietorship model at its inception. This concentrated ownership structure allowed for swift decision-making and a clear strategic path.

As the business expanded, profits were likely reinvested to fuel expansion. Early agreements regarding ownership would have been internal family arrangements, not subject to public disclosure given the private nature of the company. This approach aligned with the founding team's vision of a customer-centric distribution business.

Harold Reece's hardware store in Caulfield, Melbourne, marked the beginning of the company.

The initial ownership structure was a sole proprietorship, with Harold Reece holding all equity.

Ownership remained within the Reece family during the early expansion phases.

There is no evidence of external investors or significant outside capital during the early years.

Profits were likely reinvested to support the company's expansion.

Ownership agreements were internal family matters, not publicly disclosed.

Understanding the early ownership structure of the Reece Company is crucial for grasping its subsequent growth trajectory. The initial focus on family ownership and reinvestment of profits set the stage for the company's future expansion. For more details, you can explore the Growth Strategy of Reece.

- Harold Reece founded the company in 1920.

- Initially, it was a sole proprietorship.

- Ownership remained within the family for many years.

- No external investors were involved in the early stages.

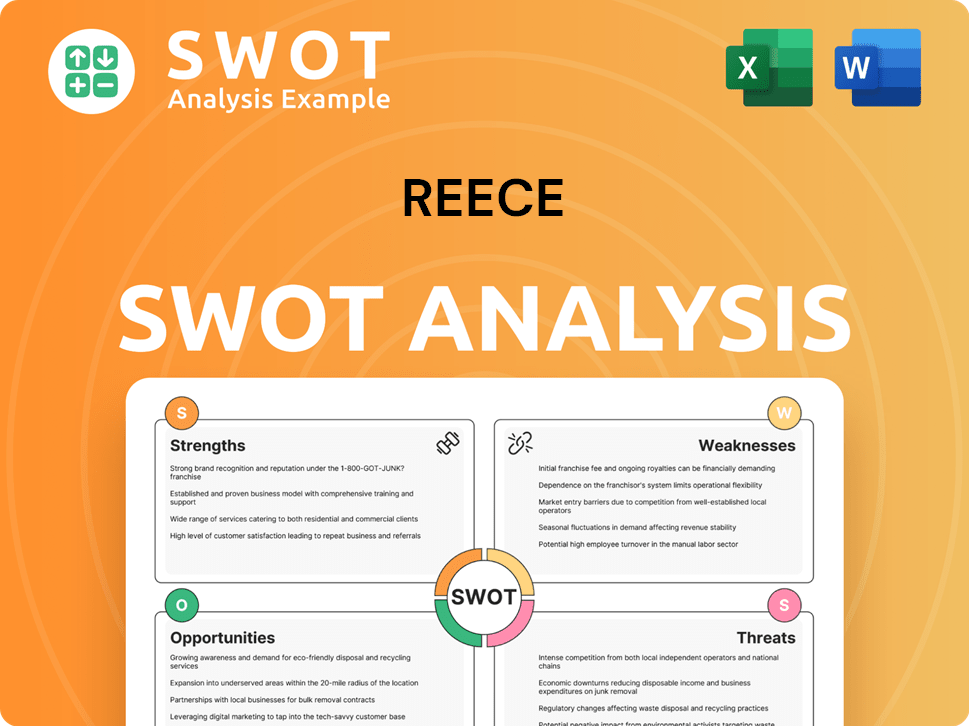

Reece SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Reece’s Ownership Changed Over Time?

The evolution of Reece Limited's ownership is a story of transition from private family control to a publicly traded entity. The initial public offering (IPO) in 1969, when the company was known as HV Reece Ltd, marked a crucial change. While the precise initial market capitalization at the time of the IPO is not readily available, this move opened the door to wider investment and expansion. This shift allowed for greater access to capital, which has been instrumental in funding the company's growth over the decades.

Despite the move to become a public company, the Wilson family, descendants of Harold Reece, has maintained a significant controlling interest in Reece Limited. As of early 2025, the Wilson family, mainly through entities like the Wilson Family Trust, remains the largest shareholder. This enduring family control distinguishes Reece from many other publicly listed companies. This concentrated ownership structure has provided a degree of stability, allowing the company to pursue long-term growth initiatives.

| Event | Impact on Ownership | Year |

|---|---|---|

| Initial Public Offering (IPO) | Transition from private to public ownership; broadened investor base | 1969 |

| Wilson Family's Continued Stake | Maintained significant control; ensured family influence | Ongoing (through 2025) |

| Acquisition of MORSCO | Increased shareholder base; brought in new capital | 2018 |

Beyond the Wilson family, major stakeholders include institutional investors, mutual funds, and index funds. Large fund managers hold significant shares, reflecting Reece's inclusion in Australian equity indices. The acquisition of MORSCO in the United States in 2018, a strategic move, brought in new capital, though without significantly diluting the Wilson family's control. For more details on the competitive environment, one can refer to the Competitors Landscape of Reece.

The Wilson family holds a significant controlling stake in Reece Limited, even after the IPO. Institutional investors also play a major role in the company's ownership structure.

- The Wilson family's influence has been consistent.

- Institutional investors hold a substantial portion of the free float.

- The acquisition of MORSCO in 2018 impacted the shareholder base.

- Reece's ownership structure balances family control with public market participation.

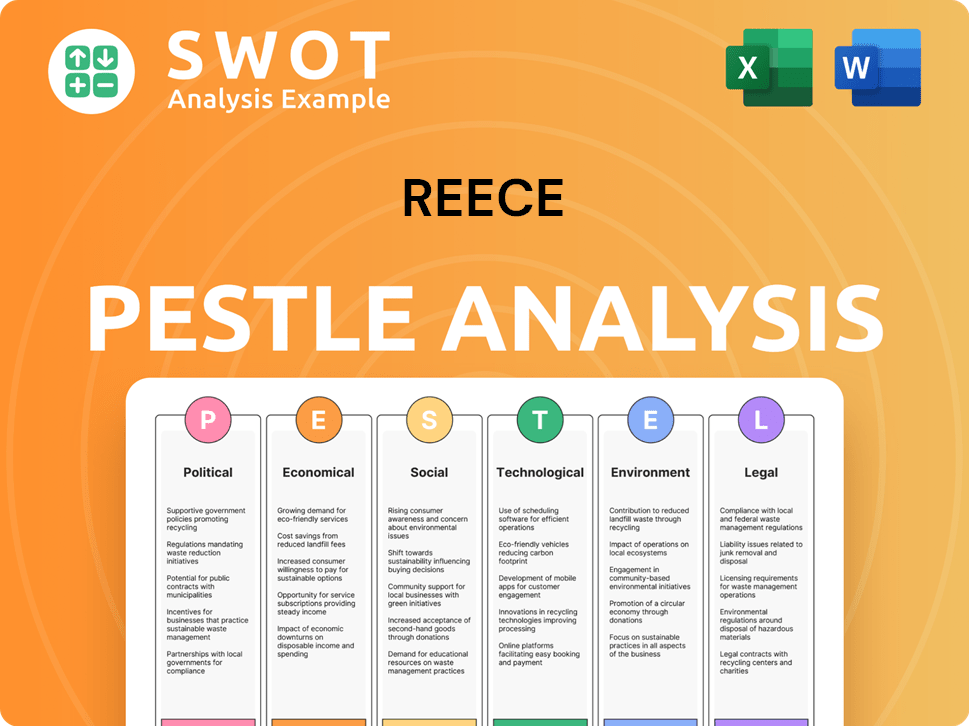

Reece PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Reece’s Board?

The current Board of Directors of the Reece Group reflects a blend of family representation and independent expertise. As of late 2024 and early 2025, the board typically includes members of the Wilson family, who represent the significant founding family ownership stake, alongside independent non-executive directors. For instance, Peter Wilson, a member of the founding family, serves as the Executive Chairman, highlighting the family's continued influence. Other board members bring diverse backgrounds in finance, retail, and international business, fulfilling independent roles to ensure robust governance practices. This structure helps to balance the long-term vision of the family with the strategic oversight provided by independent directors.

The composition of the board ensures a mix of perspectives, crucial for navigating the complexities of the plumbing and HVAC-R industries, where the Target Market of Reece is focused. This blend is vital for strategic decision-making, particularly concerning expansion and market adaptation. The presence of independent directors helps in maintaining transparency and accountability, which are essential for sustaining investor confidence and ensuring the long-term success of the company.

| Board Member | Role | Background |

|---|---|---|

| Peter Wilson | Executive Chairman | Founding Family, Leadership |

| Independent Directors | Various | Finance, Retail, International Business |

| Other Members | Various | Diverse Experience |

Reece Limited operates predominantly under a one-share-one-vote structure, which is common for Australian listed companies. The substantial block of shares held by the Wilson family gives them significant voting power, allowing them to influence key decisions, including board appointments and strategic direction. This concentrated ownership means that while formally one-share-one-vote, the practical influence of the Wilson family is considerable. There have been no widely publicized recent proxy battles or activist investor campaigns against Reece Limited.

The Wilson family's significant shareholding allows them to influence key decisions. The one-share-one-vote structure is standard, but the family's stake provides considerable practical influence.

- One-share-one-vote structure.

- Wilson family holds a substantial block of shares.

- No recent proxy battles or activist campaigns.

- Board composition balances family and independent directors.

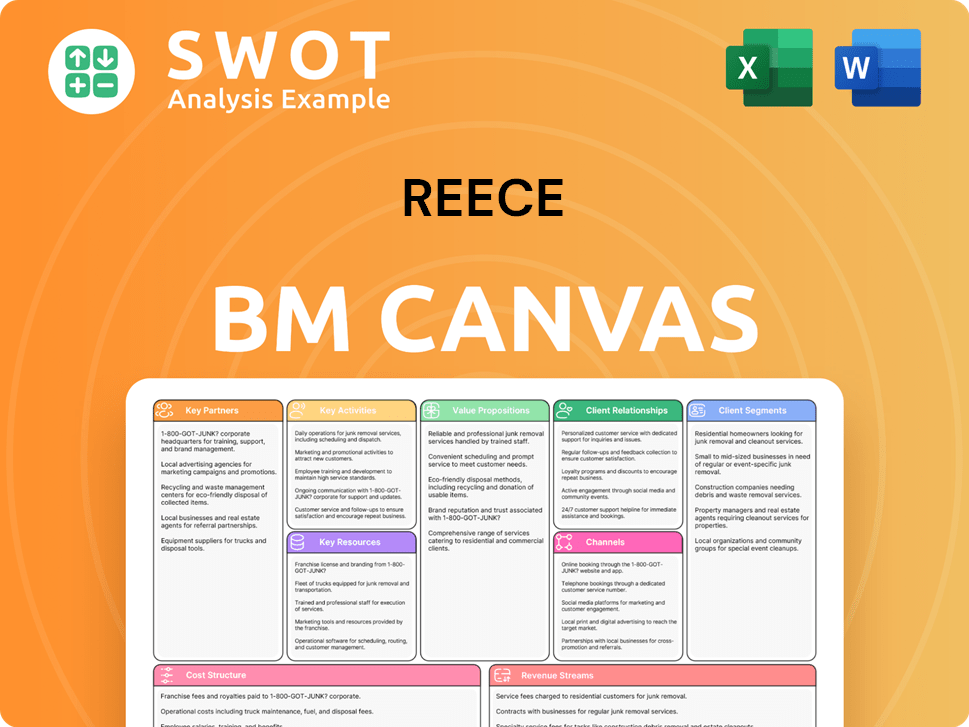

Reece Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Reece’s Ownership Landscape?

Over the past few years, the ownership of the Reece Group has seen a steady evolution. This reflects its established market position and the stable control maintained by the Wilson family. While specific details on share buybacks or secondary offerings in late 2024 or early 2025 would be found in recent financial reports, the company has focused on organic growth and strategic acquisitions, such as the ongoing integration of its US operations (MORSCO). There haven't been major leadership changes that have significantly altered the ownership structure, as the Wilson family continues to play a central role. New strategic investors, if any, would typically be institutional funds adjusting their portfolio allocations.

Industry trends, such as increased institutional ownership, impact Reece Company differently due to the Wilson family's enduring control. While institutional ownership of Reece Australia shares has likely increased as the company has grown and been included in more indices, this hasn't led to significant founder dilution in terms of control. The company's stable ownership structure contrasts with trends seen in other sectors. There have been no public statements about potential privatization or significant changes in the Wilson family's ownership stake, suggesting a continuation of the current structure. The focus remains on operational expansion and market leadership across Australia, New Zealand, and the United States, particularly within Reece Plumbing and related sectors.

| Aspect | Details | Recent Trends (2024-Early 2025) |

|---|---|---|

| Ownership Stability | Wilson Family Control | Continued strong influence, no significant dilution. |

| Institutional Ownership | Growing, but not at the expense of founder control. | Increased due to company growth and index inclusion. |

| Strategic Actions | Focus on organic growth and acquisitions. | Ongoing integration of US operations (MORSCO). |

The Reece ownership structure remains relatively stable, with the Wilson family maintaining a significant stake. This stability is a key characteristic of the company, distinguishing it from some other firms where founder control diminishes more rapidly. For more detailed information about the company, you can refer to the article about Reece Group.

The Wilson family continues to hold a significant portion of the company's shares.

Institutional ownership has likely grown over time, reflecting the company's expansion.

The company's strategy involves organic growth and strategic acquisitions.

Reece Company aims to maintain its leadership position in its core markets.

Reece Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Reece Company?

- What is Competitive Landscape of Reece Company?

- What is Growth Strategy and Future Prospects of Reece Company?

- How Does Reece Company Work?

- What is Sales and Marketing Strategy of Reece Company?

- What is Brief History of Reece Company?

- What is Customer Demographics and Target Market of Reece Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.