Renmin Tianli Group, Inc Bundle

What Happened to Renmin Tianli Group, Inc.?

Founded in 2005 with ambitions in Chinese agriculture, Renmin Tianli Group, Inc. (now BIQI International Holding Corporation) once aimed to cultivate a strong presence in the market. From hog farming to processed pork, the company initially charted a course focused on agricultural operations. However, a significant shift in strategy, including an investment in a boutique hotel, marked a potential turning point.

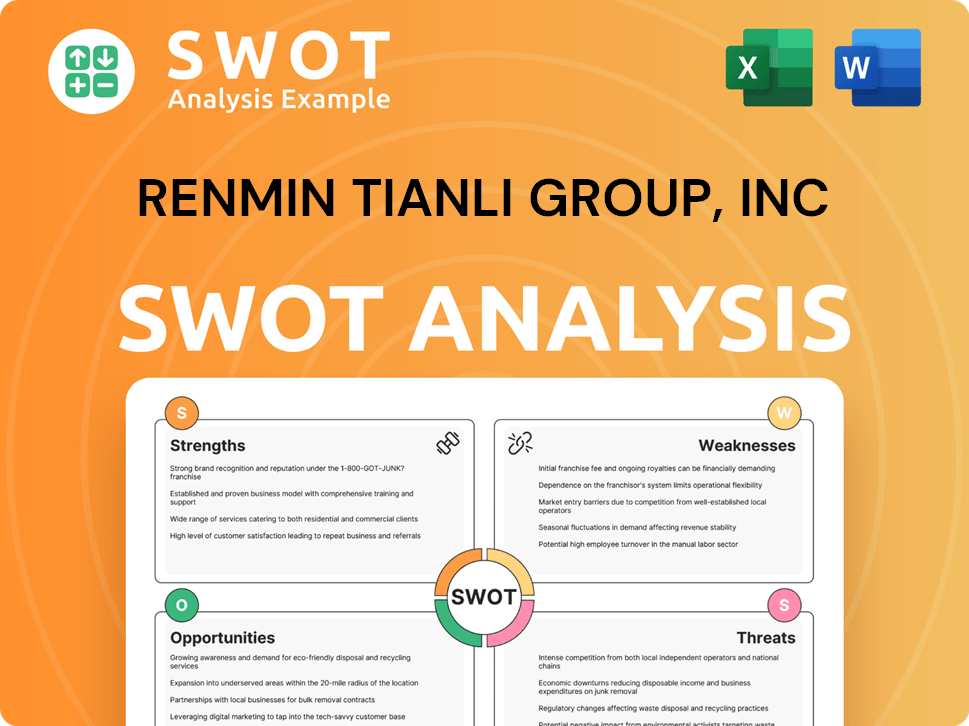

This Renmin Tianli Group, Inc SWOT Analysis delves into the company's historical growth strategy and the implications of its current status. Given the company's potential delisting and apparent cessation of operations, understanding its past initiatives is crucial for analyzing its trajectory. This analysis provides a comprehensive Company Analysis, exploring the factors that shaped its journey and what investors can learn from its rise and potential fall, offering insights into Business Development and Investment Opportunities.

How Is Renmin Tianli Group, Inc Expanding Its Reach?

The historical Growth Strategy of Renmin Tianli Group, Inc. centered on expanding its agricultural operations within China, particularly in the hog farming sector. This involved increasing production capacity and broadening market reach for various hog products, including breeder hogs and processed pork. The company's focus was on establishing and operating commercial farms to meet the growing demand for pork products in the region.

Renmin Tianli Group aimed to increase its production capacity to approximately 130,000 hogs annually. This expansion was primarily focused on the Wuhan and Enshi Prefecture areas of Hubei Province. The company's strategic approach included both organic growth through farm operations and inorganic growth via acquisitions and partnerships.

Future Prospects for Renmin Tianli Group will likely depend on its ability to adapt to market changes and diversify its business. The company's past expansion initiatives provide a foundation for future growth, but it will need to navigate challenges such as changing consumer preferences, market competition, and potential regulatory changes. Understanding the Marketing Strategy of Renmin Tianli Group, Inc is crucial for assessing its potential.

In April 2018, Renmin Tianli Group acquired a 10% stake in Youyang County Jinzhu Forestry Development Co. Ltd., a move into bamboo cultivation and processing. This diversification strategy suggests a broader approach to business development beyond its core hog farming operations. This indicates an effort to explore additional revenue streams and mitigate risks associated with relying solely on the agricultural sector.

In July 2014, the company acquired an 88% equity interest in Hubei Hang-ao Servo-valve Manufacturing Technology Co., Ltd. This acquisition shows the company's interest in entering the manufacturing sector. The move reflects a strategic decision to diversify its business portfolio and reduce its reliance on agriculture.

In 2011, Renmin Tianli Group entered exclusive agreements with local hog farming cooperatives in Enshi Autonomous Prefecture. These agreements granted the company the sole legal right to breed and sell black hogs in the region for five years. This initiative aimed to boost revenues, profits, and brand recognition.

In January 2019, the company acquired a 40% equity interest in Dalian Lianhui Hotel Co., Ltd., indicating a shift towards non-agricultural ventures. This late move into the hospitality sector suggests an effort to diversify its business interests and explore new growth opportunities. This diversification could potentially provide additional revenue streams.

Renmin Tianli Group has undertaken several strategic initiatives to expand its operations and diversify its revenue streams. These initiatives include acquisitions, partnerships, and investments in various sectors. The company's ability to adapt to market trends and leverage its resources will be crucial for its long-term success.

- Focus on hog farming expansion in key regions like Wuhan and Enshi Prefecture.

- Acquisition of Youyang County Jinzhu Forestry Development Co. Ltd. to diversify into forestry.

- Acquisition of Hubei Hang-ao Servo-valve Manufacturing Technology Co., Ltd. to enter the manufacturing sector.

- Exclusive agreements with local hog farming cooperatives to boost brand recognition and revenues.

- Investment in Dalian Lianhui Hotel Co., Ltd. to diversify into the hospitality sector.

Renmin Tianli Group, Inc SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Renmin Tianli Group, Inc Invest in Innovation?

The innovation and technology strategy of Renmin Tianli Group, Inc. centered on enhancing its core hog breeding and production operations. This approach involved investments in genetic, breeding, and nutritional research. The goal was to improve the quality and quantity of its hog products.

While specific details about R&D investments or the use of advanced technologies like AI or IoT are limited in publicly available information, the focus on genetic and breeding research suggests an internal development approach. This strategy aimed to maintain a competitive edge in the hog market. The company also explored digital channels for sales, selling specialty processed black hog pork products online.

However, there is no recent information (2024-2025) available to suggest ongoing innovation or technology initiatives, given the company's current operational status. For more information on the company's ownership and structure, you can refer to Owners & Shareholders of Renmin Tianli Group, Inc.

Renmin Tianli Group invested in genetic research to improve hog breeding. This research aimed to enhance the quality of the hogs.

The company focused on breeding programs to improve hog production. These programs were designed to ensure the growth of healthy hogs.

Nutritional research was a key part of Renmin Tianli Group's strategy. This research aimed to improve the health and growth of the hogs.

The company used digital channels to sell its products. Specialty processed black hog pork products were sold online.

The focus on research and breeding aimed to give the company a competitive edge. This helped in maintaining the quality of hog products.

There is limited public information about recent innovation initiatives. No recent data (2024-2025) is available regarding ongoing projects.

Renmin Tianli Group's approach to technology and innovation centered on enhancing its core business. This involved research and development in areas like genetics and nutrition to improve hog production. The company also explored digital channels for product distribution.

- Genetic Research: Focused on improving hog breeds.

- Breeding Programs: Aimed to ensure healthy hog growth.

- Nutritional Research: Designed to enhance hog health.

- Digital Sales: Used online platforms for product sales.

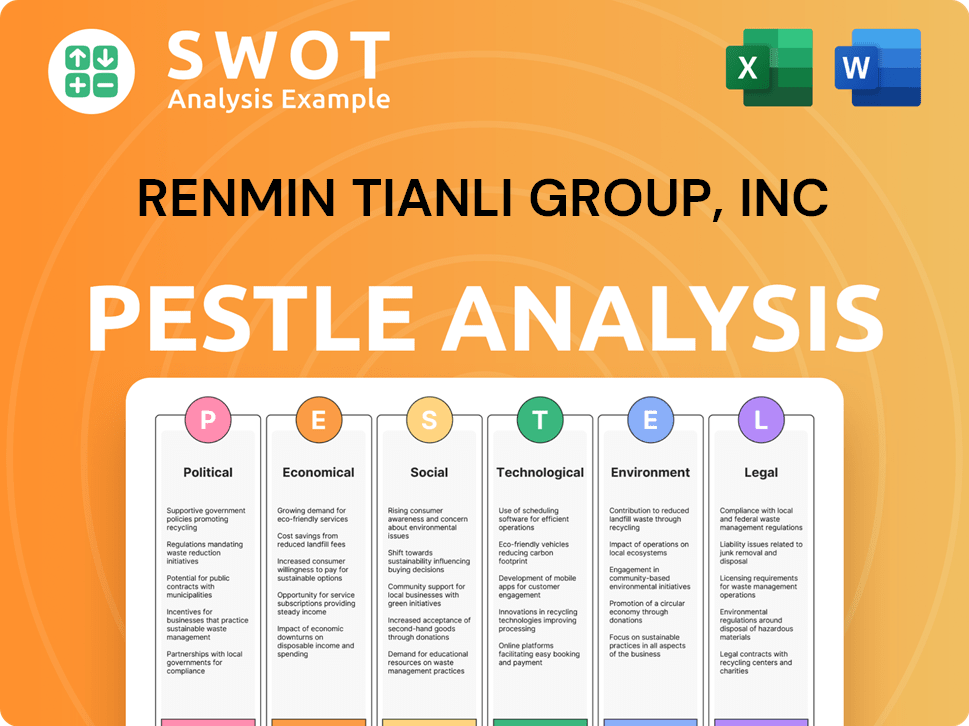

Renmin Tianli Group, Inc PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Renmin Tianli Group, Inc’s Growth Forecast?

The financial outlook for Renmin Tianli Group, Inc., now operating as BIQI International Holding Corporation, is significantly impacted by its ceased operations and delisting from NASDAQ. Due to this inactive status, there is no available current financial data for 2024 or 2025 regarding revenue targets, profit margins, or investment levels for the company.

Historical financial data from when it operated as Aoxin Tianli Group shows a trailing twelve-month revenue of $26.4 million as of September 30, 2018, with a net loss of $2.3 million for the same period. However, this information does not reflect the current financial standing of Renmin Tianli Group, Inc. due to its delisting and operational changes.

Publicly available information from 2024 and 2025 predominantly relates to other entities with similar names, such as Tianli Holdings Group Limited. This company, involved in manufacturing and financial services, reported an overall revenue of RMB548.0 million (approximately $76 million USD) and a net loss of RMB153.4 million (approximately $21.3 million USD) for the year ended December 31, 2024. It's crucial to note that these figures do not apply to Renmin Tianli Group, Inc.

Renmin Tianli Group's financial narrative is one of discontinuity because of its delisting and apparent cessation of operations. There is no current financial data available for the company.

The last reported financial data, from 2018, shows a revenue of $26.4 million. The company also reported a net loss of $2.3 million for the same period. This data is not current.

Other entities with similar names, such as Tianli Holdings Group Limited, have reported financial results. For the year ended December 31, 2024, this company reported approximately $76 million USD in revenue and a net loss of approximately $21.3 million USD. However, these figures do not apply to Renmin Tianli Group, Inc.

Given the current status of Renmin Tianli Group, Inc., a financial outlook for its future growth is not feasible. The company's financial narrative is one of discontinuity.

Due to the company's current status, there are no current investment opportunities in Renmin Tianli Group, Inc. Investors should consider the lack of available financial data.

An industry analysis is not possible for Renmin Tianli Group, Inc. due to its inactive status. The company is not currently participating in the market.

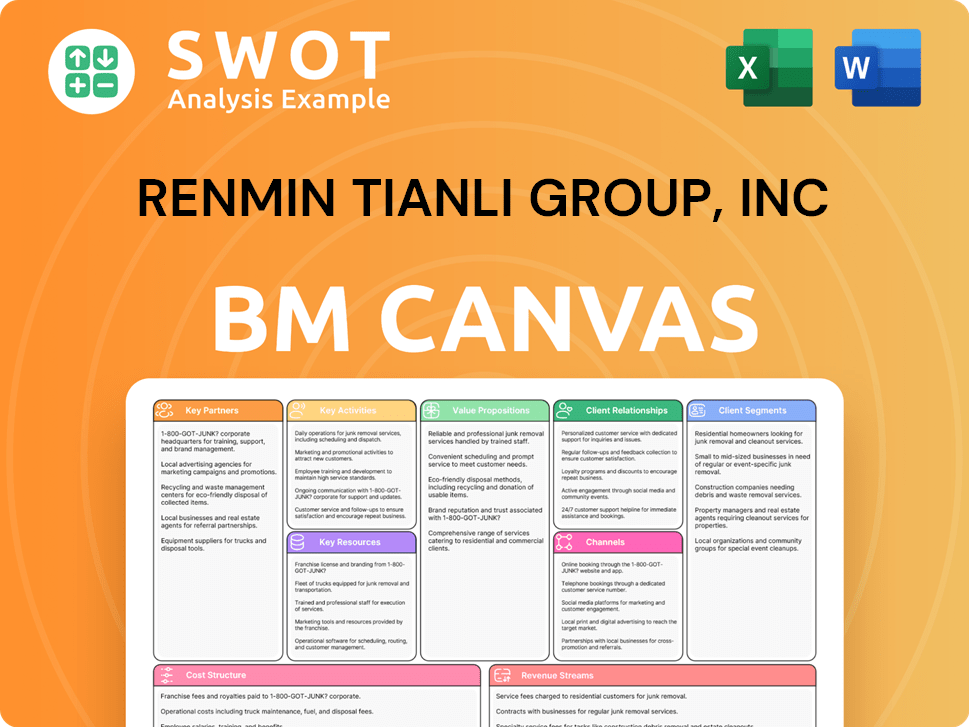

Renmin Tianli Group, Inc Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Renmin Tianli Group, Inc’s Growth?

The primary risk and obstacle for Renmin Tianli Group, Inc., was its operational cessation and subsequent delisting from the NASDAQ. The reasons behind the halt are not fully detailed in recent public records (2024-2025). However, the situation highlights the significant challenges the company faced.

Historical context suggests that the agricultural sector in China, where the company operated, is subject to market competition, disease outbreaks, and fluctuating costs. Regulatory changes in the Chinese agricultural sector could also have presented significant hurdles to the company's operations.

The diversification into the hotel industry in 2019, while intended to mitigate risks, introduced new complexities. The name change to BIQI International Holding Corporation and the shift towards an investment holding company suggests an attempt to adapt. However, this did not prevent the delisting, and the lack of current financial filings (2024-2025) indicates the failure to overcome existing obstacles.

The agricultural sector in China is highly competitive, with numerous domestic and international players. The company faced significant risks related to livestock diseases, which can severely impact production and profitability. Fluctuations in the costs of raw materials, such as feed and veterinary supplies, also affected the company's financial performance. These factors, common in the agricultural industry, created instability.

Changes in Chinese agricultural regulations could have imposed additional costs or restrictions on the company's operations. The shift to an investment holding company and diversification into the hotel industry in 2019 introduced new operational complexities. The transition required expertise in a different sector, which may not have been readily available. The company's delisting from the NASDAQ suggests that these challenges proved insurmountable.

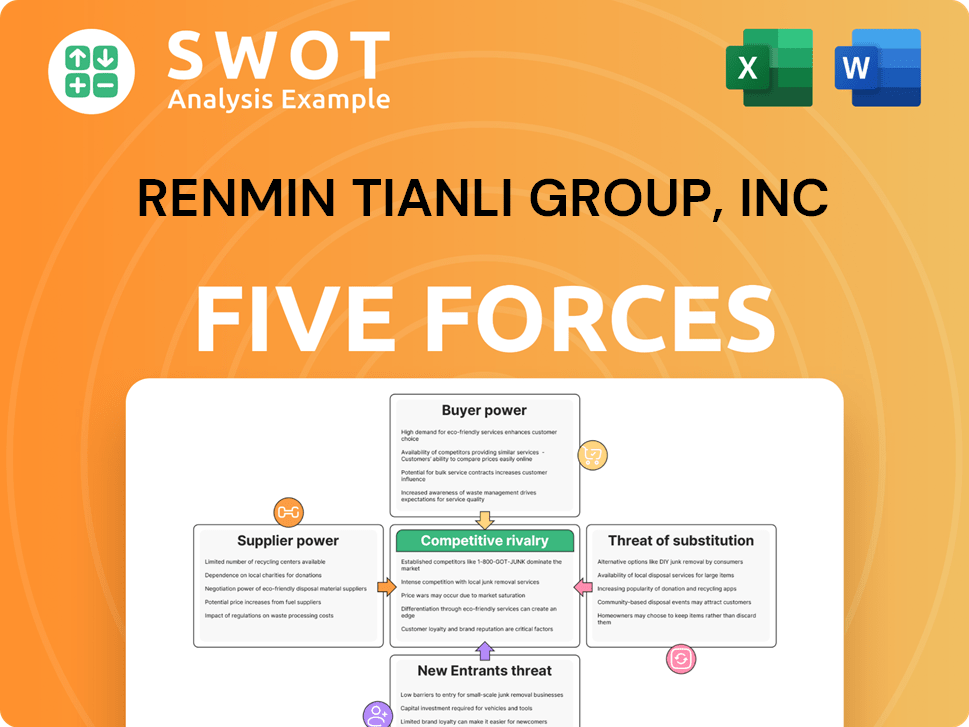

Renmin Tianli Group, Inc Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Renmin Tianli Group, Inc Company?

- What is Competitive Landscape of Renmin Tianli Group, Inc Company?

- How Does Renmin Tianli Group, Inc Company Work?

- What is Sales and Marketing Strategy of Renmin Tianli Group, Inc Company?

- What is Brief History of Renmin Tianli Group, Inc Company?

- Who Owns Renmin Tianli Group, Inc Company?

- What is Customer Demographics and Target Market of Renmin Tianli Group, Inc Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.