Renmin Tianli Group, Inc Bundle

What Happened to Renmin Tianli Group?

Delve into the intriguing history of Renmin Tianli Group, Inc., a former NASDAQ-listed agricultural entity based in China. This company, once a player in the hog breeding and pork product market, offers a compelling case study. Explore how Renmin Tianli Group, Inc SWOT Analysis can provide insights into its strategic decisions.

Understanding the Company operations of Renmin Tianli and its evolution is crucial for anyone interested in investment strategies within the agricultural sector. Examining its Business model and shifts, including forays into real estate, reveals the complexities of navigating market dynamics. This analysis provides valuable lessons for investors and business strategists alike, especially those interested in Renmin Tianli Group and its past financial performance.

What Are the Key Operations Driving Renmin Tianli Group, Inc’s Success?

The core operations of Renmin Tianli Group, Inc. historically revolved around two primary segments: Hog Farming and Retail. This structure underpinned the company's business model, focusing on the production and sale of high-quality hog products within the Chinese market. Understanding these operations is crucial for anyone considering investment strategies related to Renmin Tianli Group.

The Hog Farming segment was central to Renmin Tianli's operations. This involved the breeding, raising, and selling of both breeder hogs and market hogs. The company also engaged in the retail of specialty processed black hog pork products through various channels, including supermarkets and online platforms. The company's focus on premium products was a key element of its value proposition.

Renmin Tianli Group's operations included owning and managing multiple commercial hog farms. A significant aspect of their business was the exclusive right to breed and sell black hogs in a specific region, allowing them to command higher retail prices. This strategic focus on premium products and exclusive rights shaped the company's approach to the market. For a detailed look at the company's growth strategy, you can refer to Growth Strategy of Renmin Tianli Group, Inc.

Renmin Tianli Group managed hog farms in Wuhan and Enshi Prefecture. They focused on breeding and raising hogs for both breeding and meat purposes. The company's operations included genetic and nutritional research to improve production.

The company sold specialty processed black hog pork products through supermarkets, retail outlets, and online channels. This diversification helped them reach a broader customer base. The focus was on premium, high-quality pork products.

Renmin Tianli Group aimed to provide premium hog products to the Chinese market. Their focus on quality and exclusivity set them apart. This approach was designed to attract customers willing to pay a premium for superior products.

The company targeted the Chinese market with its hog products. They utilized both traditional and online retail channels. This strategy allowed them to reach a wide range of consumers.

Renmin Tianli Group's operations were characterized by a focus on high-quality hog production and premium product sales. The company's business model included both breeding and retail segments, targeting the Chinese market. The exclusive rights to breed black hogs in a specific region were a key differentiator.

- Breeding and Raising Hogs: Focused on producing both breeder and market hogs.

- Retail Sales: Sold products through supermarkets, retail outlets, and online channels.

- Exclusive Rights: Held exclusive breeding rights in Enshi Autonomous Prefecture.

- Premium Products: Aimed to provide high-quality, premium hog products.

Renmin Tianli Group, Inc SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Renmin Tianli Group, Inc Make Money?

Understanding the revenue streams and monetization strategies of Renmin Tianli Group, Inc is crucial for grasping its business model. The company's approach to generating income evolved, primarily focusing on hog farming but also exploring diversification through strategic investments.

Historically, the core of Tianli Group's financial performance revolved around its hog farming segment. This included the sale of both breeder hogs and market hogs, which constituted the primary source of revenue. Additionally, the company expanded its offerings to include specialty processed black hog pork products.

Due to the company's operational cessation and delisting, specific recent financial data for 2024-2025 is unavailable. However, historical information provides insights into its revenue generation.

The main revenue source for Renmin Tianli was the sale of breeder hogs and market hogs.

The company also generated revenue from selling specialty processed black hog pork products.

These products were distributed through various retail channels, including supermarkets and online platforms.

In January 2019, Renmin Tianli aimed to diversify its revenue streams through an equity transfer agreement.

This involved acquiring a 40% equity interest in Dalian Lianhui Hotel Co., Ltd.

Dalian Lianhui Hotel Co., Ltd. operates a boutique hotel and retail spaces.

The company's financial strategy included a primary focus on hog farming, with sales of breeder and market hogs as the main revenue drivers. Additional revenue was generated through the sale of processed pork products, distributed via retail channels. The company also pursued diversification through investments, such as the acquisition in the hotel sector.

- Hog Farming: Sales of breeder and market hogs.

- Processed Pork Products: Distribution through supermarkets and online platforms.

- Strategic Investments: Acquisition of equity in Dalian Lianhui Hotel Co., Ltd. to diversify into the hotel and retail sectors.

Renmin Tianli Group, Inc PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Renmin Tianli Group, Inc’s Business Model?

Understanding the trajectory of Renmin Tianli Group, Inc. involves examining its key milestones, strategic moves, and competitive advantages. A pivotal moment was its initial public offering and listing on the NASDAQ, which provided access to public capital for expansion. The company's journey reflects attempts to adapt to market dynamics and diversify its business interests.

Strategic decisions significantly shaped the company's path. These included acquisitions aimed at increasing production capacity, such as the 2011 Letter of Intent to acquire an 11th hog farming operation. Securing exclusive rights to breed and sell black hogs in the Enshi Autonomous Prefecture was another strategic move, designed to capitalize on premium product offerings and drive revenue growth. These moves highlight the company's efforts to strengthen its market position and explore opportunities for profitability.

The company's competitive edge was primarily rooted in its hog breeding operations and exclusive rights for certain premium hog products before its operational cessation. However, the company also attempted to diversify its business model to address operational and market challenges. These strategic shifts aimed to broaden its revenue base and tap into higher-growth industries.

The initial public offering (IPO) and NASDAQ listing were significant milestones, providing access to capital. The company pursued strategic growth through acquisitions to expand its production capacity. Securing exclusive rights for premium hog products was another key move to boost revenues.

Acquisitions were a core strategy for expanding production capacity. Securing exclusive rights for premium hog products aimed to increase revenue and profitability. The company attempted business model pivots to diversify into higher-growth industries. For more details, you can read about the Growth Strategy of Renmin Tianli Group, Inc.

Prior to its operational cessation, the company's competitive edge came from its hog breeding operations. Exclusive rights for premium hog products provided a market advantage. Attempts to diversify into new sectors aimed to broaden the revenue base and address market challenges.

The company aimed to diversify beyond hog farming. This included ventures into equipment manufacturing and real estate. These moves were attempts to address market challenges and expand revenue streams. The diversification strategy reflects an effort to adapt to changing market conditions.

Renmin Tianli Group's journey involved strategic moves to expand operations and diversify its business model. The company aimed to leverage exclusive rights for premium products. These efforts reflect attempts to adapt to market dynamics and achieve sustainable growth.

- IPO and NASDAQ listing provided access to capital.

- Acquisitions and exclusive rights were key strategic moves.

- Diversification into new sectors was an attempt to broaden the revenue base.

- The company's competitive edge stemmed from its hog breeding operations.

Renmin Tianli Group, Inc Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Renmin Tianli Group, Inc Positioning Itself for Continued Success?

The current industry position of Renmin Tianli Group, Inc. is characterized by the cessation of its operations and its delisting from the NASDAQ stock exchange. While specific market share figures during its operational phase are unavailable, the company was involved in the Chinese agricultural sector, specifically hog farming. This means that Renmin Tianli Group is no longer a going concern in the market.

Several risks could have significantly impacted Renmin Tianli. These risks, inherent in the agricultural sector, include livestock disease outbreaks, fluctuations in feed prices, changes in consumer preferences, and evolving government regulations. The company's diversification into other sectors, such as real estate and hotel operations, introduced additional risks associated with those areas. For more information about the company, you can read Owners & Shareholders of Renmin Tianli Group, Inc.

Renmin Tianli Group was previously involved in hog farming in China. The company is no longer listed on the NASDAQ. Specific market share data is not available due to the cessation of operations.

The company faced risks common in agriculture, such as disease outbreaks and feed price volatility. Diversification into real estate and hotels added risks specific to those sectors. Government regulations and consumer preferences also posed challenges.

As the company has ceased operations and been delisted, there is no active future outlook to discuss. There are no current strategic initiatives or ongoing business plans. The company's history serves as a case study of the challenges in dynamic markets.

The primary business model involved hog farming. Diversification into real estate and hotel operations was attempted. The company's financial performance is unavailable due to its current status.

Given that Renmin Tianli Group is no longer operational and delisted, there are no current investment strategies. Investors should consider the risks associated with the agricultural sector and diversification strategies.

- Review the company's past performance.

- Analyze the risks involved in the agricultural sector.

- Assess any diversification strategies employed.

- Consider the impact of government regulations.

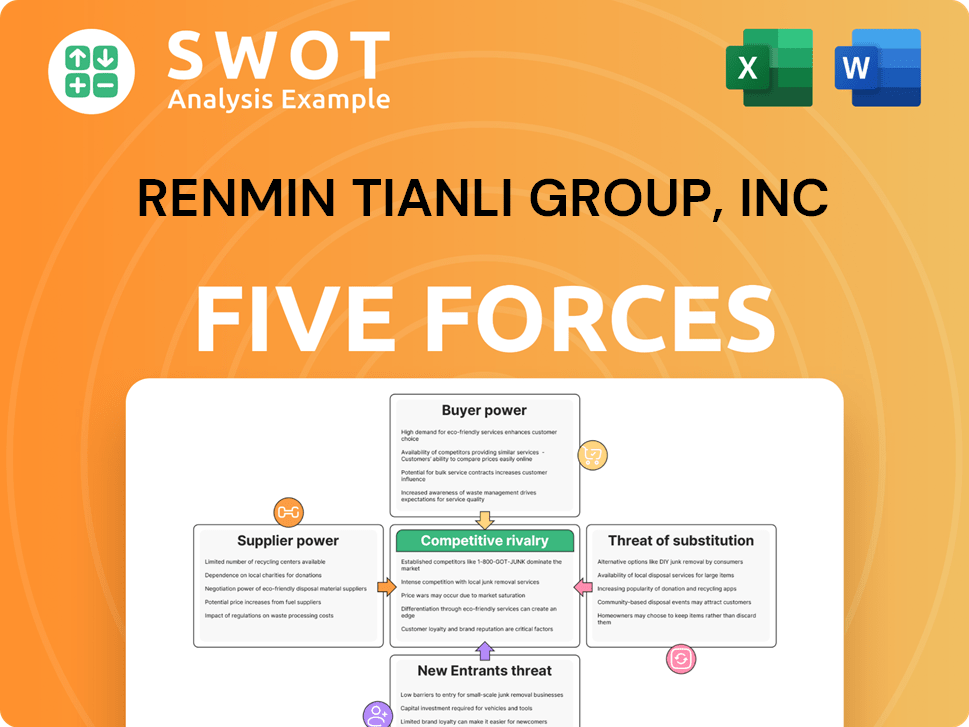

Renmin Tianli Group, Inc Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Renmin Tianli Group, Inc Company?

- What is Competitive Landscape of Renmin Tianli Group, Inc Company?

- What is Growth Strategy and Future Prospects of Renmin Tianli Group, Inc Company?

- What is Sales and Marketing Strategy of Renmin Tianli Group, Inc Company?

- What is Brief History of Renmin Tianli Group, Inc Company?

- Who Owns Renmin Tianli Group, Inc Company?

- What is Customer Demographics and Target Market of Renmin Tianli Group, Inc Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.