Revlon Bundle

Can Revlon Rebuild Its Beauty Empire?

Revlon, a name synonymous with beauty, has been on a rollercoaster ride, marked by both iconic success and recent financial struggles. Emerging from Chapter 11 bankruptcy in April 2023, the company is now charting a course for a revitalized future. This analysis dives deep into Revlon's Revlon SWOT Analysis to explore its ambitious Revlon growth strategy and assess its potential to thrive in the competitive cosmetics industry.

Understanding Revlon's journey requires a close look at its strategic initiatives and how it plans to navigate evolving beauty market trends. This exploration of the Revlon company analysis will examine its brand positioning strategy, product innovation strategy, and expansion plans, considering both the challenges and opportunities ahead. We'll also assess Revlon's financial performance and long term growth potential, providing actionable insights for investors and industry watchers alike.

How Is Revlon Expanding Its Reach?

The future growth of the company hinges on strategic expansion initiatives designed to capture new market share and diversify its revenue streams. Following its financial restructuring, the company is poised to pursue aggressive strategies in both geographical and product category expansion. This approach is crucial for the company's Revlon growth strategy and overall Revlon future prospects.

While specific detailed plans for 2025 are still emerging, the company's historical approach and industry trends suggest a focus on high-growth markets, particularly in Asia and Latin America, where the cosmetics industry continues to see robust demand. The company's ability to adapt to changing beauty market trends will be key to its success. Understanding the Revlon company analysis is essential for investors.

Product innovation and launches will also be central to the company's expansion. This includes developing new lines in high-demand categories such as clean beauty, personalized skincare, and gender-neutral products to cater to evolving consumer preferences. The company may also explore strategic partnerships or collaborations with influencers and smaller, agile beauty brands to tap into niche markets and leverage their unique appeal. Furthermore, e-commerce remains a critical channel for expansion, with the company likely investing further in its digital platforms and direct-to-consumer capabilities to enhance accessibility and consumer engagement. The company's restructuring has provided it with more financial flexibility to invest in these areas, aiming to regain market share and attract new customer segments.

The company is likely to prioritize expansion into high-growth markets, particularly in Asia and Latin America. These regions offer significant potential due to increasing disposable incomes and rising demand for beauty products. This strategy is part of the Revlon expansion plans international.

Focus on developing new product lines in trending categories like clean beauty, personalized skincare, and gender-neutral products. This includes exploring new formulations and packaging to meet evolving consumer preferences. This is a key part of the Revlon product innovation strategy.

The company may collaborate with influencers and smaller beauty brands to reach niche markets. These partnerships can provide access to new customer segments and leverage the unique appeal of these brands. This strategy can also influence Revlon brand positioning strategy.

Investing further in digital platforms and direct-to-consumer capabilities to enhance accessibility and consumer engagement. This includes improving website functionality and implementing targeted digital marketing campaigns. This is also a part of the Revlon digital marketing strategy.

The company's expansion strategy includes geographical diversification and product innovation. The company is focusing on adapting to changing consumer preferences and market trends, which is important for Revlon market share analysis 2024.

- Market Expansion: Targeting high-growth regions like Asia and Latin America.

- Product Development: Launching new lines in clean beauty and personalized skincare.

- Strategic Alliances: Collaborating with influencers and smaller beauty brands.

- Digital Focus: Enhancing e-commerce platforms and digital marketing efforts.

The company's ability to successfully execute these initiatives will be crucial for its Revlon long term growth potential. The company's journey, as detailed in Brief History of Revlon, shows its resilience and adaptability in the face of challenges. The company's Revlon competitive landscape analysis will be crucial for its future success. The company's Revlon challenges and opportunities are significant, but with the right strategies, it can regain market share and achieve sustainable growth. Understanding Revlon consumer behavior analysis is also essential.

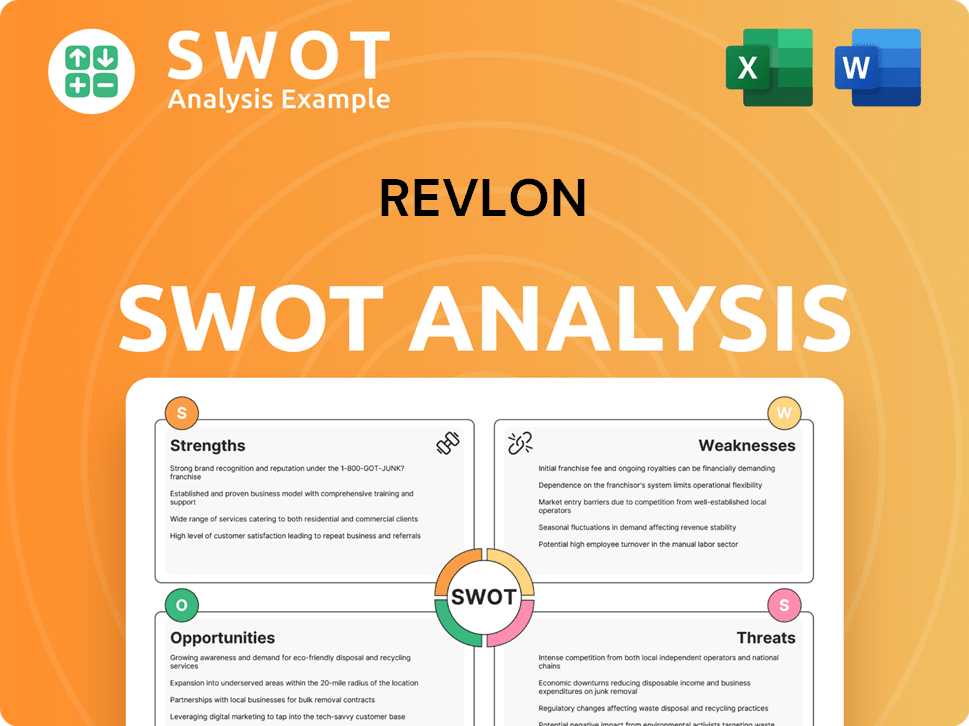

Revlon SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Revlon Invest in Innovation?

The future of the company, hinges significantly on its ability to innovate and harness technology. This approach aims to enhance product development, streamline manufacturing processes, and deepen consumer engagement. The cosmetics industry is dynamic, and staying ahead requires continuous adaptation and forward-thinking strategies.

The company's strategic focus on innovation and technology is crucial for navigating the competitive beauty market. This involves not only developing new products but also enhancing the overall consumer experience through digital platforms and sustainable practices. Understanding and responding to evolving consumer preferences is at the core of this strategy.

As of the latest reports, the company's specific R&D investment figures for 2025 are not yet fully available. However, it's expected that the company will align with broader industry trends, potentially increasing its R&D spending to develop cutting-edge formulations and smart beauty devices. The beauty market is projected to reach $716.6 billion by 2025, with an anticipated CAGR of 5.09% between 2024 and 2028. This growth underscores the importance of innovation.

Strengthening e-commerce platforms is a key focus. Utilizing data analytics to better understand consumer behavior is essential. Implementing AI for personalized product recommendations will also be crucial.

Automation in manufacturing and supply chain management is a key area. The goal is to improve efficiency and reduce costs. This will help the company to react more quickly to market changes.

Developing eco-friendly products and packaging is vital. Consumer demand for sustainable beauty options continues to rise. This is a critical aspect of the company's brand positioning.

The company must focus on creating new and innovative products. This includes staying ahead of beauty market trends. This also involves adapting to the evolving preferences of consumers.

Integrating technological advancements is key to maintaining a competitive edge. Innovative practices across operations are vital. This will drive sustained growth in the dynamic beauty market.

Enhancing consumer experience through digital platforms is important. Utilizing data analytics to understand consumer behavior is essential. Personalized product recommendations are a key strategy.

The company's ability to successfully integrate these technological advancements and innovative practices across its operations will be vital. The cosmetics industry is highly competitive, and continuous innovation is essential for maintaining market share and driving growth. For a deeper understanding of the competitive landscape, consider reading about the Competitors Landscape of Revlon. The company's strategic initiatives, including its product innovation strategy and digital marketing strategy, will be crucial for its long-term growth potential.

The company will likely invest in biotechnology, AI-driven personalization, and sustainable packaging. These areas are expected to see increased investment across the beauty industry. The company's approach to these trends will be crucial for its future prospects.

- R&D Investment: Anticipated increase in R&D spending to develop cutting-edge formulations and smart beauty devices.

- E-commerce Enhancement: Strengthening e-commerce platforms and leveraging data analytics for consumer insights.

- AI Integration: Implementing AI for personalized product recommendations and improved customer engagement.

- Automation: Automation in manufacturing and supply chain management to improve efficiency and reduce costs.

- Sustainability: Development of eco-friendly products and packaging to meet growing consumer demand.

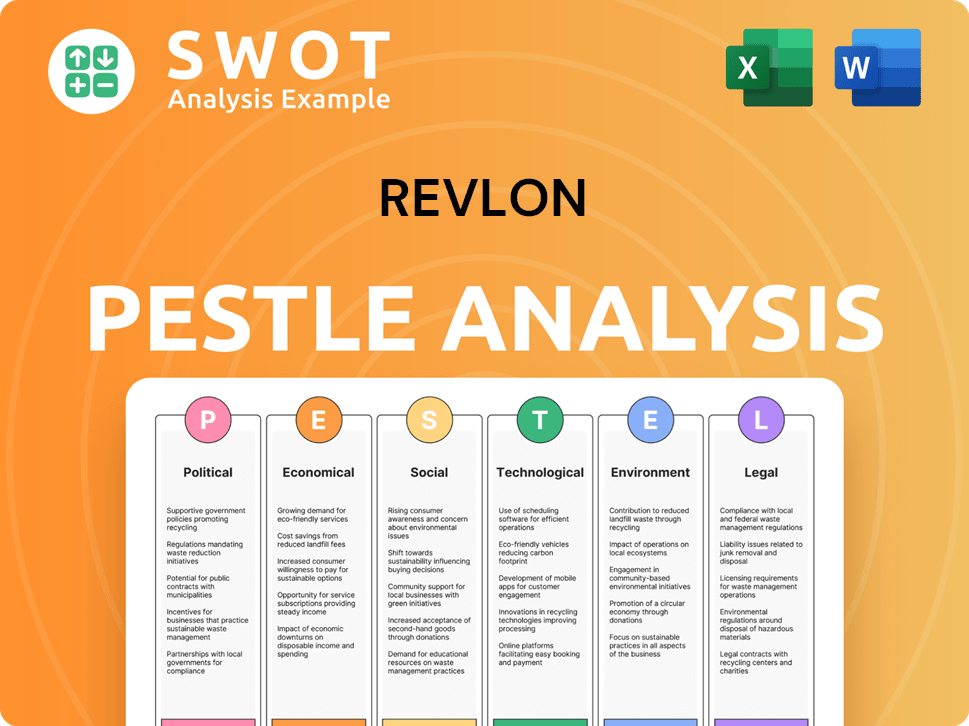

Revlon PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Revlon’s Growth Forecast?

Following its emergence from Chapter 11 bankruptcy in April 2023, the financial outlook for the company, is focused on stabilization and a return to profitable growth. The restructuring significantly reduced the company's debt by over $2.7 billion, providing a much healthier balance sheet. The company is now positioned to rebuild its brand presence and regain market share within the cosmetics industry.

The company's strategy involves a renewed focus on core brands and strategic expansion initiatives. While specific revenue targets and detailed financial projections for 2025 are not publicly available in granular detail, the company's focus will be on improving profitability and cash flow. Industry analysts generally anticipate a period of rebuilding, with gradual revenue growth driven by its renewed focus on core brands and strategic expansion initiatives. Understanding the Revenue Streams & Business Model of Revlon is key to grasping its financial strategy.

Investment levels are expected to be directed towards marketing, product innovation, and digital transformation to reignite consumer interest and capture market share. The company's ability to manage its operational costs effectively and improve its gross margins will be critical to its financial success. Post-restructuring, the company's financial narrative emphasizes a commitment to sustainable growth, aiming to generate consistent positive cash flow and ultimately enhance shareholder value.

The company's financial performance is expected to improve gradually as it implements its turnaround strategy. The focus is on reducing debt, improving profitability, and increasing market share. The company is aiming for sustainable growth in the competitive beauty market.

Market share analysis in 2024 will be crucial for assessing the effectiveness of the company's strategic initiatives. The company aims to regain lost market share by focusing on its core brands and product innovation. The competitive landscape includes established brands and emerging players.

Strategic initiatives include product innovation, digital marketing, and expansion into new markets. These initiatives are designed to drive revenue growth and enhance brand value. The company is focusing on consumer behavior analysis to tailor its strategies.

The product innovation strategy involves introducing new products and updating existing lines to meet consumer demand. The company aims to stay ahead of beauty market trends. This includes efforts to enhance brand positioning and cater to diverse consumer preferences.

The company faces challenges such as intense competition and changing consumer preferences. Opportunities exist in expanding into new markets and leveraging digital marketing. The ability to adapt to beauty market trends is key.

- Competition from established and emerging brands.

- Changing consumer preferences and beauty market trends.

- Opportunities in digital marketing and e-commerce.

- Potential for international expansion and new product lines.

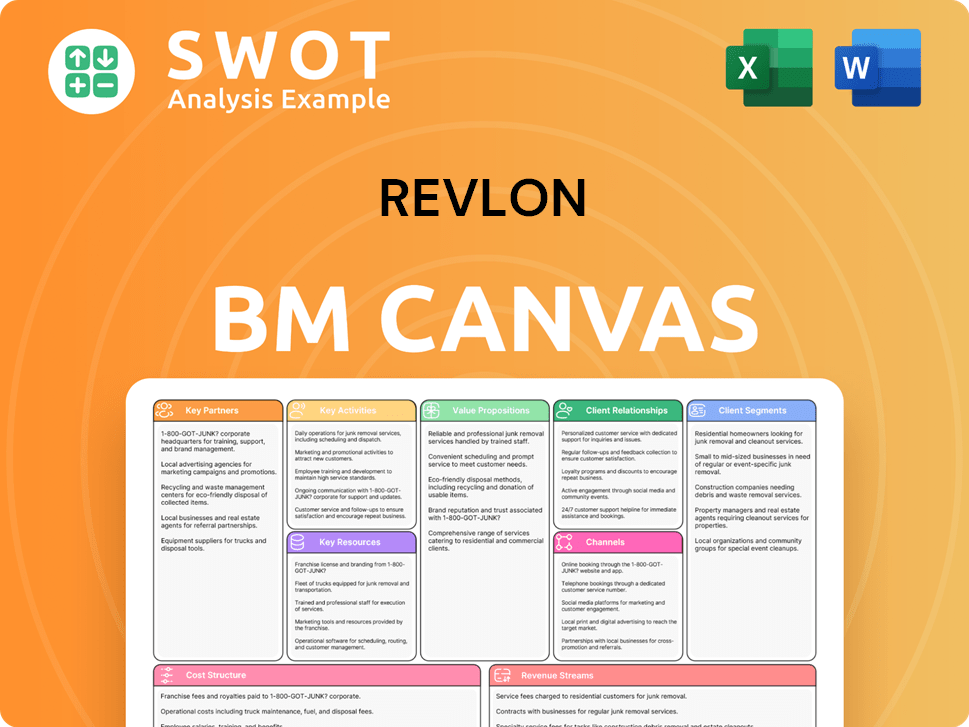

Revlon Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Revlon’s Growth?

The path forward for the company involves navigating a complex web of potential risks and obstacles. The company's ability to execute its growth strategy will be tested by various challenges, including intense competition and evolving consumer preferences. Understanding these potential pitfalls is crucial for assessing the company's long-term viability and investment potential, particularly in the dynamic cosmetics industry.

Several factors could impede the company's progress. These include market dynamics, regulatory changes, and internal operational constraints. The company must proactively address these challenges to maintain its competitive edge and achieve sustainable growth. A thorough understanding of these risks is essential for a comprehensive company analysis.

The company's future prospects are significantly influenced by its ability to mitigate these risks. The beauty market trends and shifts in consumer behavior add further complexity. The company needs to adapt quickly to stay ahead of the competition and capitalize on emerging opportunities. A robust strategic approach is essential for navigating these challenges effectively, especially given the company's recent emergence from bankruptcy.

The cosmetics industry is highly competitive, with numerous established global players, agile direct-to-consumer (DTC) brands, and celebrity-backed lines vying for market share. This environment puts constant pressure on pricing, product innovation, and marketing. The company faces the ongoing challenge of differentiating itself in a crowded marketplace, requiring a strong brand positioning strategy.

Changes in regulations, especially those concerning product safety and ingredient transparency, can impact product development timelines and market entry strategies. Compliance with evolving standards requires continuous investment in research and development, as well as rigorous testing protocols. The company must stay ahead of regulatory changes to avoid potential disruptions and maintain consumer trust.

Global supply chain disruptions, as seen in recent years, pose a continuous risk to production and distribution. These disruptions can lead to increased costs, product shortages, and delays in getting products to market. The company needs to develop resilient supply chain strategies to mitigate these risks, including diversifying suppliers and building robust inventory management systems.

Rapid advancements in technology, such as the rise of AI in personalized beauty and new e-commerce models, demand continuous adaptation and investment. The company needs to embrace digital marketing strategies and data analytics to stay competitive. Failure to innovate technologically could result in a loss of market share to more agile competitors.

Internal resource constraints, including challenges in talent acquisition and retention, particularly in specialized areas like digital marketing and data science, can hinder growth. Building a strong internal team and fostering a culture of innovation are essential for the company's success. Addressing these constraints requires strategic investment in human capital and effective talent management.

The company's financial performance is crucial for its long-term success. According to recent reports, the company's revenue in fiscal year 2023 was approximately $2.2 billion, a decrease compared to the previous year. This decline reflects the challenges faced within the competitive landscape and the need for a turnaround strategy. The company's ability to improve its financial performance will determine its future prospects, including its capacity to invest in product innovation and expansion plans.

To address these risks, the company is expected to focus on several key strategic initiatives. These include diversifying its product portfolio to appeal to a wider consumer base and mitigate the impact of market-specific trends. Implementing robust risk management frameworks is also crucial to identify and manage potential threats proactively. Agile scenario planning will enable the company to adapt quickly to changing market conditions and unexpected disruptions. The company's Mission, Vision & Core Values of Revlon can also help guide these strategies.

The company's emergence from bankruptcy provides an opportunity to streamline operations and implement more resilient strategies. This includes optimizing supply chains, reducing operational costs, and improving overall efficiency. By focusing on these areas, the company can enhance its financial performance and increase its competitiveness in the cosmetics industry. Recent acquisitions and divestitures may also play a role in reshaping the company's portfolio and focus.

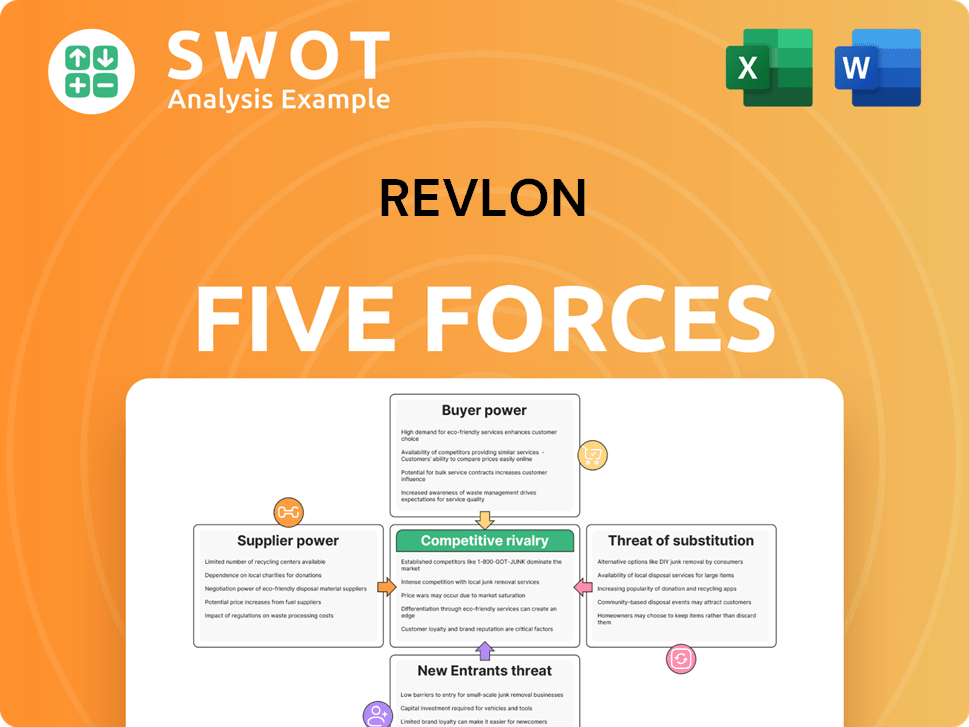

Revlon Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Revlon Company?

- What is Competitive Landscape of Revlon Company?

- How Does Revlon Company Work?

- What is Sales and Marketing Strategy of Revlon Company?

- What is Brief History of Revlon Company?

- Who Owns Revlon Company?

- What is Customer Demographics and Target Market of Revlon Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.