Revlon Bundle

Who Really Owns Revlon Now?

Revlon, a beauty industry icon since 1932, boasts a fascinating ownership journey that has shaped its destiny. From its revolutionary nail enamel to its global presence, Revlon's story is one of innovation, acquisition, and financial restructuring. Understanding Revlon SWOT Analysis is crucial to grasp its current standing.

The question of "Who owns Revlon?" is particularly pertinent given its recent emergence from bankruptcy. This pivotal event fundamentally reshaped the Revlon ownership landscape, impacting its strategic direction and financial health. This exploration will dissect the Revlon parent company, its major shareholders, and the forces driving the Revlon brand's future in a competitive market. Delving into Revlon's company history reveals the shifts in ownership that have determined its trajectory.

Who Founded Revlon?

The iconic beauty brand, Revlon, was born on March 1, 1932. The company's origins trace back to the vision of Charles Revson, Joseph Revson, and chemist Charles Lachman. Their combined efforts laid the foundation for what would become a global leader in the cosmetics industry.

The initial focus was on a revolutionary nail enamel, developed using pigments instead of dyes. This innovation allowed for a wider range of opaque shades, setting Revlon apart in the market. The early success of this product propelled the company's growth, leading to expansion and diversification in the years that followed.

The early ownership of Revlon was tightly held by its founders. Charles Revson, Joseph Revson, and Charles Lachman were the key figures in the company's initial structure and operations. Their roles were clearly defined, with Charles Revson as president, Joseph Revson as treasurer and general manager, and Charles Lachman as vice-president and technical advisor. This structure helped guide the company through its formative years.

Founded on March 1, 1932, during the Great Depression.

Charles Revson, Joseph Revson, and Charles Lachman.

A new type of nail enamel using pigments, offering a variety of opaque shades.

By 1937, polishes were sold in department stores and pharmacies. The company expanded its product line to include lipsticks in 1939.

Incorporated as the Revlon Nail Enamel Corporation.

Charles Revson as president, Joseph Revson as treasurer and general manager, and Charles Lachman as vice-president and technical advisor.

The early success of the Revlon brand is a testament to the founders' vision and the innovative nature of their products. By 1942, Revlon had become a multi-million dollar company, and by the end of World War II, it was among the top five beauty brands in the U.S. This early success set the stage for future growth and the evolution of the company's ownership. To understand the brand's current position, you can explore the Target Market of Revlon.

The company's initial product, the nail enamel, was a breakthrough, offering a wider range of shades than competitors. The introduction of matching lipsticks further solidified its market position.

- 1937: Revlon polishes sold in department stores and pharmacies.

- 1939: Expansion to include lipsticks.

- 1942: Revlon becomes a multi-million dollar company.

- Post-WWII: Among the top five beauty brands in the U.S.

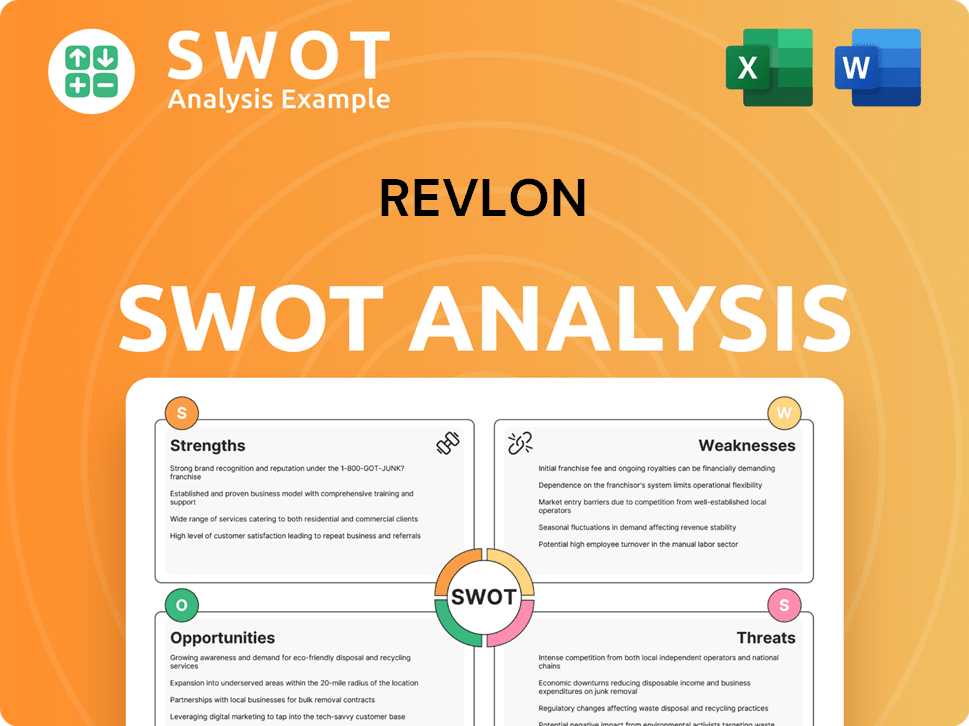

Revlon SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Revlon’s Ownership Changed Over Time?

The story of Revlon's ownership is one of dramatic shifts and significant financial events. Initially a public company listed on the New York Stock Exchange, the cosmetics giant saw a major change in 1985. Ronald Perelman's MacAndrews & Forbes launched a hostile takeover, acquiring the company for $2.7 billion, which translated to $58 per share. This acquisition, however, saddled the company with a substantial debt of $2.9 billion.

The ownership structure continued to evolve under Perelman's control, with MacAndrews & Forbes holding a majority stake. At one point, they controlled up to 75% of the voting power through their ownership of Class A and Class B common shares. As of March 5, 2025, MacAndrews & Forbes Holdings Inc., owned by Ronald Perelman, still maintained a significant majority stake of 67.19% in Revlon.

| Event | Year | Impact on Ownership |

|---|---|---|

| Initial Public Offering | 1955 | Revlon became a publicly traded company. |

| MacAndrews & Forbes Acquisition | 1985 | Ronald Perelman's company acquired Revlon in a leveraged buyout. |

| Chapter 11 Bankruptcy Filing | June 2022 | Led to a restructuring of the company's debt and ownership. |

| Emergence from Bankruptcy | May 2, 2023 | Former lenders took ownership, and Revlon became a private company. |

The most recent upheaval in the ownership structure occurred in June 2022 when Revlon filed for Chapter 11 bankruptcy. This was due to a heavy debt load of $3.5 billion, supply chain disruptions, and rising costs. The company emerged from bankruptcy on May 2, 2023, as a private entity. The former lenders, including Glendon Capital Management LP, King Street Capital Management, L.P., and others, now hold the majority of the reorganized equity. Revlon exited bankruptcy with approximately $1.5 billion in debt and $236 million in available liquidity. This restructuring significantly altered who owns Revlon, shifting control from previous shareholders to creditors.

Revlon's ownership has seen major changes, from public trading to a leveraged buyout and, most recently, a shift due to bankruptcy.

- MacAndrews & Forbes, controlled by Ronald Perelman, remains a significant shareholder.

- The bankruptcy restructuring led to former lenders gaining control.

- The company now operates as a private entity.

- The current ownership structure reflects a significant debt restructuring.

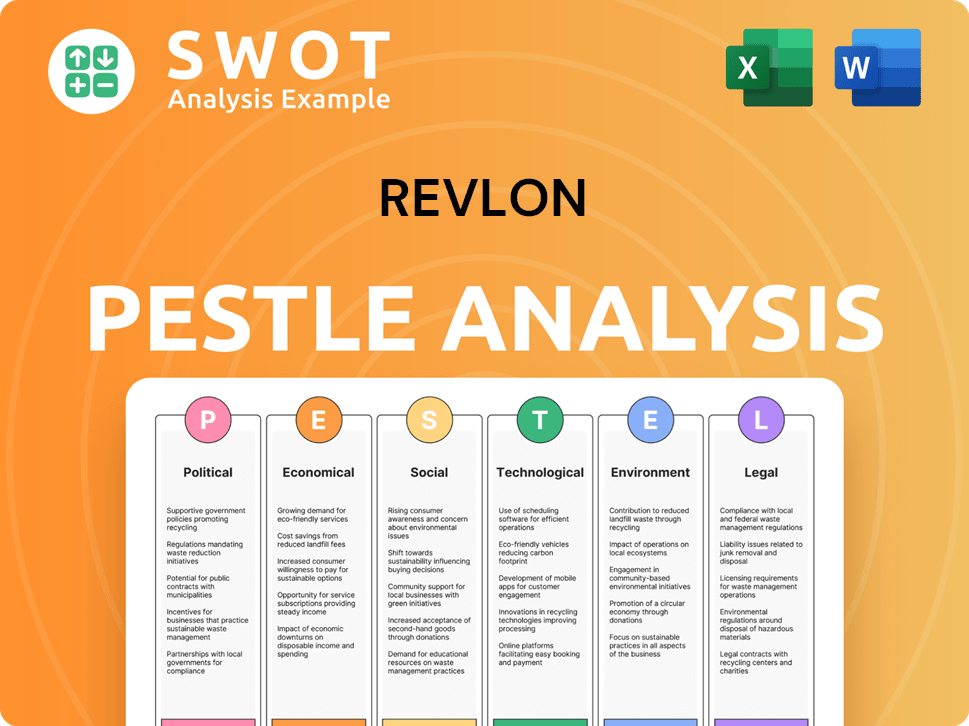

Revlon PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Revlon’s Board?

Following its emergence from Chapter 11 bankruptcy on May 2, 2023, the new Board of Directors of the company was established. This board is composed of senior executives with extensive experience in the global consumer, retail, and beauty industries. The current board is led by Executive Chair Elizabeth A. Smith, former Executive Chairman and CEO of Bloomin' Brands, Inc., and former Chair of the Federal Reserve of Atlanta.

Other notable board members include Martin Brok, former Global President and CEO of Sephora; Timothy McLevish, former Chief Financial Officer at Walgreens Boots Alliance, Inc.; Hans Melotte, former President of Starbucks' Global Channel Development; and Paul Pressler, Chairman of the Board of Directors of eBay, Inc. This shift in leadership reflects the company's transition and strategic direction following its restructuring.

| Board Member | Title | Previous Affiliation |

|---|---|---|

| Elizabeth A. Smith | Executive Chair | Bloomin' Brands, Inc. |

| Martin Brok | Board Member | Sephora |

| Timothy McLevish | Board Member | Walgreens Boots Alliance, Inc. |

| Hans Melotte | Board Member | Starbucks |

| Paul Pressler | Board Member | eBay, Inc. |

Prior to the bankruptcy, Ronald Perelman's MacAndrews & Forbes held significant control over the company's voting power. In 2010, MacAndrews & Forbes controlled 75% of the voting power through its equity ownership. With the company now a private entity owned by its former lenders, the voting structure has changed, with control now residing with this new ownership group. This change is a direct result of the restructuring process and the company's emergence from bankruptcy.

The question of 'Who owns Revlon?' has evolved significantly. After emerging from bankruptcy, the company is now privately held by its former lenders. This shift in ownership structure is a key aspect of the company's recent history.

- The company's ownership changed after its bankruptcy in 2023.

- The current owners are primarily former lenders.

- The board of directors now includes experienced executives.

- The voting power is now concentrated with the new owners.

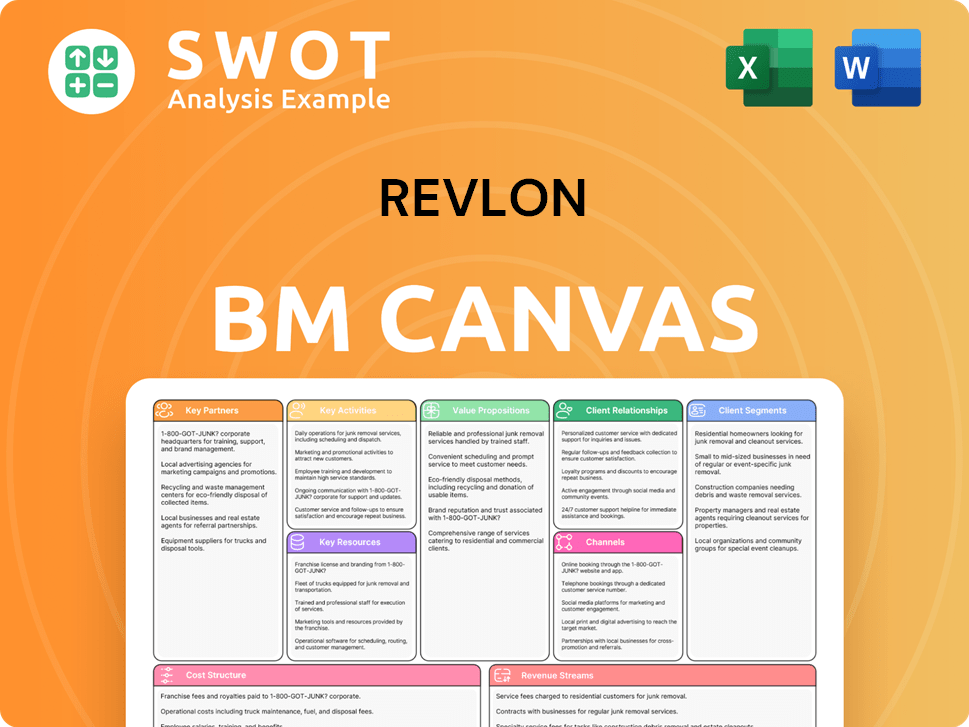

Revlon Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Revlon’s Ownership Landscape?

Over the past few years, the ownership structure of the Revlon has undergone significant transformation. The Revlon ownership shifted dramatically after its Chapter 11 bankruptcy filing in June 2022. This led to the elimination of over $2.7 billion in debt and a transition from a publicly traded entity to a privately held one. The company emerged from bankruptcy in May 2023, with ownership transferred to its former lenders.

This restructuring marked a departure from the previous majority ownership held by Ronald Perelman's MacAndrews & Forbes, which controlled approximately 85% of the company's stock before the bankruptcy. The shift in Revlon parent company reflects broader trends in the beauty industry, including consolidation and the influence of institutional investors. The company's focus is on strategic initiatives such as product innovation and digital marketing.

| Aspect | Details | Timeline |

|---|---|---|

| Bankruptcy Filing | Chapter 11 bankruptcy | June 2022 |

| Emergence from Bankruptcy | Transition to private ownership | May 2023 |

| Former Majority Owner | MacAndrews & Forbes (Ronald Perelman) | Prior to June 2022 |

| Debt Eliminated | Over $2.7 billion | During bankruptcy proceedings |

Recent developments include key leadership changes, with Michelle Peluso appointed as CEO in October 2024, succeeding Liz Smith. The company is also actively revitalizing its fragrance division, as seen with the April 2025 extension of its fragrance license with Juicy Couture. For further insights, explore the Growth Strategy of Revlon.

The bankruptcy significantly altered who owns Revlon, transferring control from public shareholders to lenders. This change reflects a shift towards a more private ownership model, impacting the company's strategic direction.

New leadership appointments, such as Michelle Peluso as CEO in October 2024, signal a focus on revitalizing the Revlon brand. These changes are crucial for navigating the evolving beauty market.

The company is concentrating on product innovation and expanding distribution channels. These initiatives are designed to enhance customer engagement, particularly through digital marketing.

Increased institutional ownership and a focus on clean beauty are shaping Revlon's strategies. These trends influence product development and marketing approaches within the beauty sector.

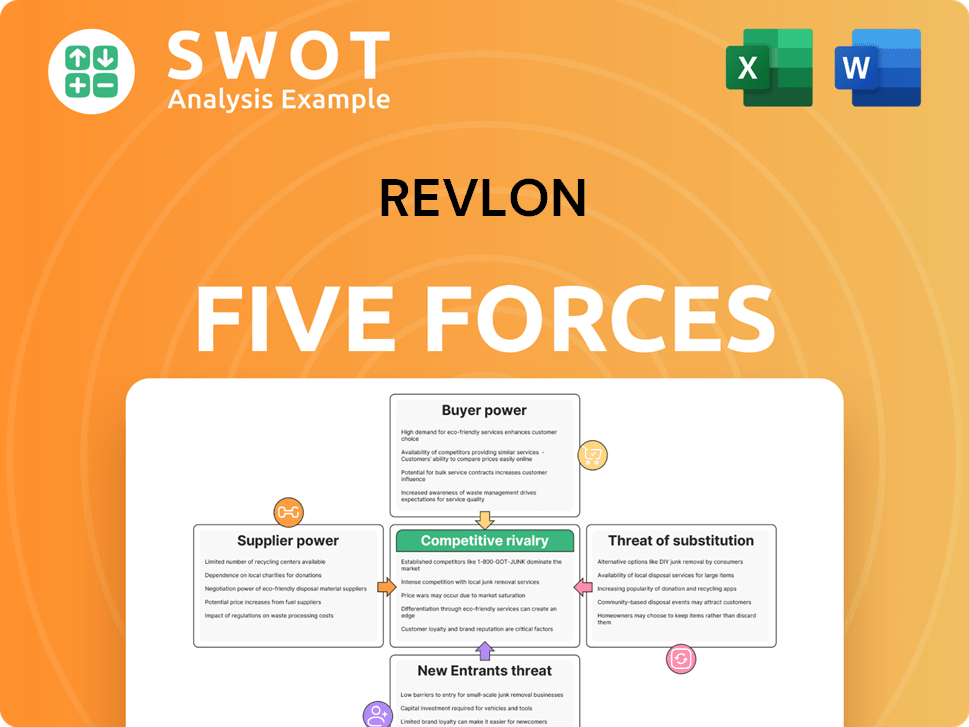

Revlon Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Revlon Company?

- What is Competitive Landscape of Revlon Company?

- What is Growth Strategy and Future Prospects of Revlon Company?

- How Does Revlon Company Work?

- What is Sales and Marketing Strategy of Revlon Company?

- What is Brief History of Revlon Company?

- What is Customer Demographics and Target Market of Revlon Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.