Roots Canada Bundle

How is Roots Canada Shaping Its Future?

Roots Canada, a beloved Canadian brand since 1973, has evolved from its wilderness-inspired roots into a global lifestyle icon. From its iconic leather goods to its expanding apparel line, Roots Company has consistently demonstrated its commitment to quality and a deep connection with its customers. This exploration delves into the Roots Canada SWOT Analysis, examining its journey and future prospects within the competitive Canadian retail landscape.

With a strong foundation built on direct-to-consumer sales and a proven track record of revenue growth, Roots Canada is strategically positioned for continued success. This analysis will uncover Roots' growth strategy, exploring its expansion plans, market analysis, and financial performance, including its online sales strategy. Understanding Roots Canada's future plans requires a close look at its brand awareness, customer demographics, and sustainability initiatives, as the company navigates the complexities of international expansion and the ever-changing retail environment.

How Is Roots Canada Expanding Its Reach?

The Roots Company is actively pursuing several strategic expansion initiatives to fuel its future growth. These efforts are focused on both deepening its presence in existing markets and diversifying its product offerings. The company's approach includes significant investments in its retail footprint and a strong emphasis on expanding its activewear category, all while leveraging its Canadian heritage.

A key aspect of the Roots Canada growth strategy involves enhancing its retail presence. This includes renovating existing stores and selectively opening new locations in key markets. For example, the flagship store on Robson Street in Vancouver is undergoing a major renovation, with a planned reopening by summer. This highlights the company's commitment to maintaining a strong presence in premium retail destinations. Further renovations are also underway in high-traffic locations like Vaughan Mills and Champlain Mall.

In addition to physical retail, Roots Canada is strategically expanding its product offerings, particularly in the activewear category. This segment has demonstrated sustained double-digit growth, becoming a core part of the brand's identity and future growth strategy. This focus allows the company to leverage its heritage of comfort while catering to the increasing consumer demand for versatile and comfortable apparel. The company expects continued growth in its activewear and core fleece collections in 2025.

Focuses on renovating existing stores and opening new locations. The Robson Street flagship in Vancouver is undergoing a major renovation. Renovations are also happening at Vaughan Mills and Champlain Mall.

Emphasizes expanding the activewear category, which has shown double-digit growth. Activewear includes items like leggings, tracksuits, sports bras, and bike shorts. This strategy leverages the brand's comfort heritage.

Maintains over 100 partner-operated stores in Asia. Has an e-commerce presence in over 70 countries. Focuses on enhancing the omnichannel customer experience to maximize international potential.

Plans to launch pop-up stores in unique locations. These stores will test new markets and evolve the store experience. This strategy will help in understanding the market.

Internationally, Roots maintains a significant presence with over 100 partner-operated stores in Asia and an e-commerce presence in over 70 countries. While specific new international market entry plans for 2024-2025 were not detailed, the company's existing global reach and focus on enhancing omnichannel customer experience indicate a continued effort to maximize its international potential. The company's commitment to its Canadian foundation, including designing everything in Toronto and supporting local brands, underpins its global growth, aiming to foster national pride while expanding its reach. For a deeper understanding of the competitive environment, consider reviewing the Competitors Landscape of Roots Canada.

Roots Canada is focusing on several key expansion strategies to drive future growth, including retail enhancements, product diversification, and international market optimization.

- Store Renovations: Investing in existing stores like the Robson Street flagship.

- Product Line Expansion: Growing the activewear category.

- International Growth: Leveraging existing global presence and e-commerce.

- Pop-Up Stores: Testing new markets and enhancing the store experience.

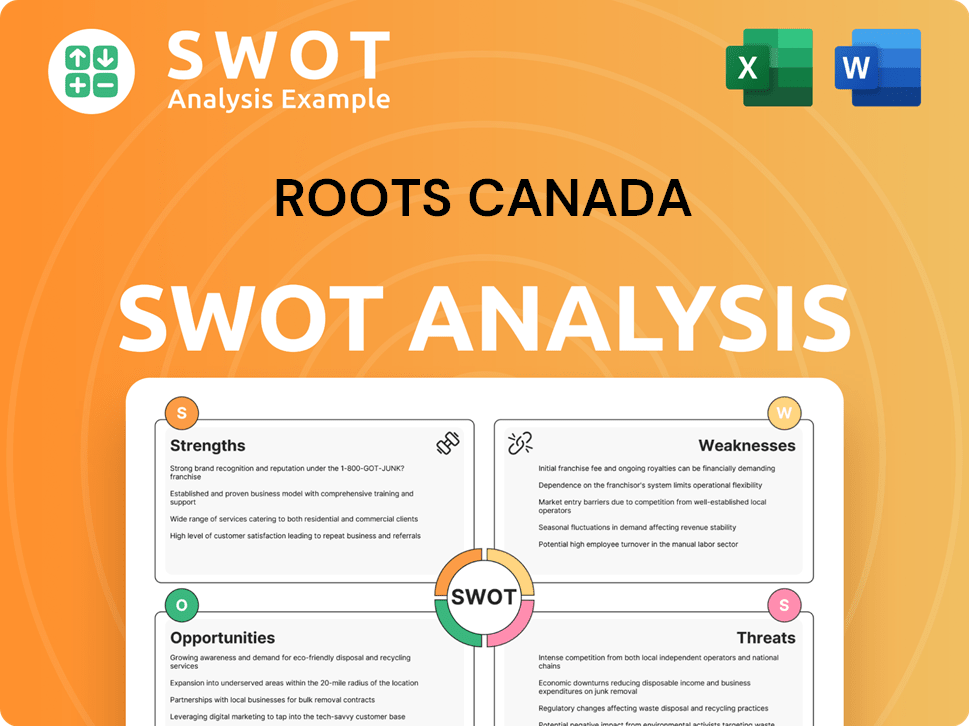

Roots Canada SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Roots Canada Invest in Innovation?

The Revenue Streams & Business Model of Roots Canada company is actively focusing on innovation and technology to enhance its market position and drive growth. This involves a strong emphasis on digital transformation and improving the omnichannel customer experience. The strategy aims to meet evolving consumer behaviors and navigate the changing retail landscape effectively.

A key component of this strategy involves enhancing the e-commerce platform and digital engagement to boost conversions both online and in physical stores. While specific details about research and development investments or the adoption of cutting-edge technologies like AI or IoT are not extensively detailed in recent reports, the company prioritizes delivering quality, innovation, and value to its customers. This approach is crucial for the long-term success of the Roots Canada.

The company's commitment to product innovation is evident in the success of new product collections, particularly in adult activewear. This product development is supported by efforts to improve product costing and reduce discounting, contributing to gross margin expansion. This focus on product development and operational efficiency is a core element of the Roots Company's growth strategy.

Focus on improving the e-commerce platform and digital engagement.

Driving conversion rates both online and in physical stores.

Successful new product collections, especially in adult activewear.

Efforts to improve product costing and reduce discounting.

Partnerships aligned with company values.

Focus on diversity, equity, and inclusion.

Partnership with the Nature Conservancy of Canada (NCC).

Protecting and conserving Canadian habitats.

The company has expanded its partnerships to align with its values, focusing on diversity, equity, and inclusion, as well as sustainability.

- In 2024, the company expanded its partnership with the BlackNorth Initiative, sponsoring the 'Athletes on Track' program for 2024-2025, supporting Black student-athletes.

- In September 2024, a three-year partnership was announced with the Nature Conservancy of Canada (NCC) to protect and conserve Canada's habitats.

- These collaborations enhance brand perception and contribute to long-term growth objectives.

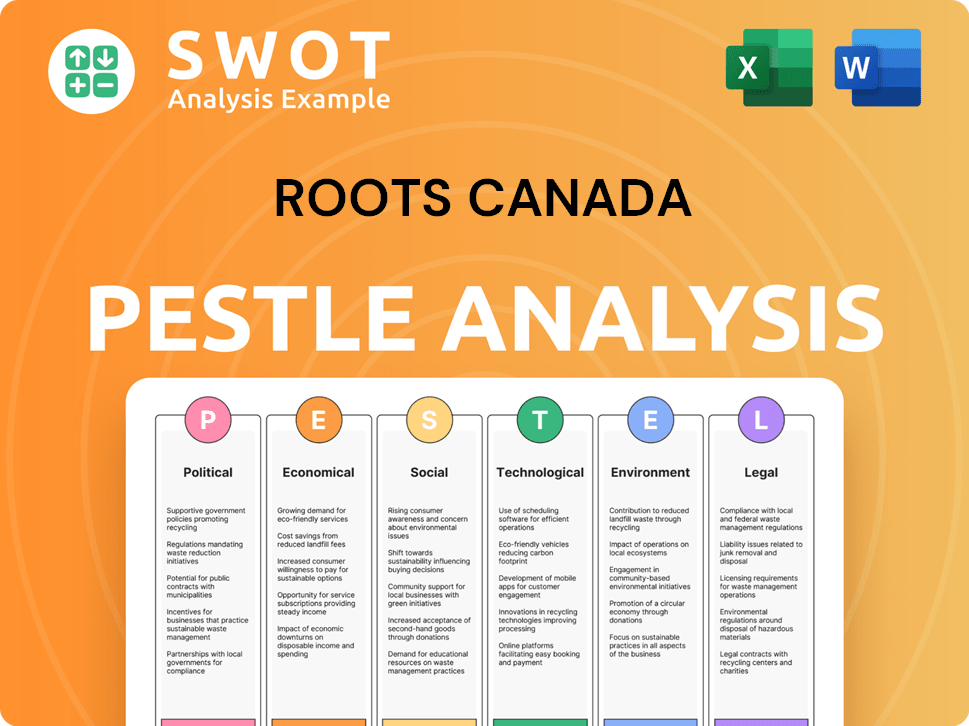

Roots Canada PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Roots Canada’s Growth Forecast?

Roots Canada's financial performance in fiscal year 2024 (ended February 1, 2025) shows a strategic focus on sustainable growth. The company has navigated a challenging retail environment, demonstrating resilience through its direct-to-consumer (DTC) channels and strategic cost management. Owners & Shareholders of Roots Canada should find the financial results encouraging, especially given the company's initiatives in brand expansion and market analysis.

The fourth quarter of fiscal 2024 saw Roots Canada achieve a 2.4% increase in total sales, reaching $110.8 million. This growth was primarily driven by the strong performance of its DTC segment, which includes both corporate retail stores and e-commerce. The company's ability to adapt to changing consumer behaviors and invest in digital innovation has been pivotal in maintaining its market share analysis.

Roots Canada's financial outlook for fiscal 2025 and beyond is positive, with projected revenue growth and improvements in earnings per share (EPS). The company's strategic investments in marketing and digital innovation are expected to drive continued momentum. The focus on DTC comparable sales growth and the reduction of net debt indicate a commitment to financial health and sustainable expansion.

Total sales increased by 2.4% to $110.8 million. DTC sales rose 3.6% to $101.2 million, with comparable sales growing by 7.5%. Gross profit reached $68.0 million, a 7.2% increase.

Gross margin improved by 270 basis points to 61.3%. Adjusted EBITDA grew by 9.1% to $25.3 million. Adjusted Net Income for Q4 2024 was $16.0 million, up 9.6%.

Total sales for the full year were $262.7 million. Adjusted net income grew by 41.1% to $6.0 million. Free cash flow was $39.4 million.

Net debt was significantly reduced by 56.7% to $7.4 million. The leverage ratio is less than 0.4x. Low double-digit DTC comparable sales growth observed in the first eight weeks of Q1 2025.

Roots Canada's future plans include continued investment in marketing and digital innovation to drive revenue growth. The company anticipates significant improvements in EPS by FY2026. Brand Expansion and market analysis are key components of their growth strategy.

- Focus on Direct-to-Consumer (DTC) channels.

- Strategic marketing and digital innovation investments.

- Continued expansion and brand awareness efforts.

- Financial performance driven by cost management and improved margins.

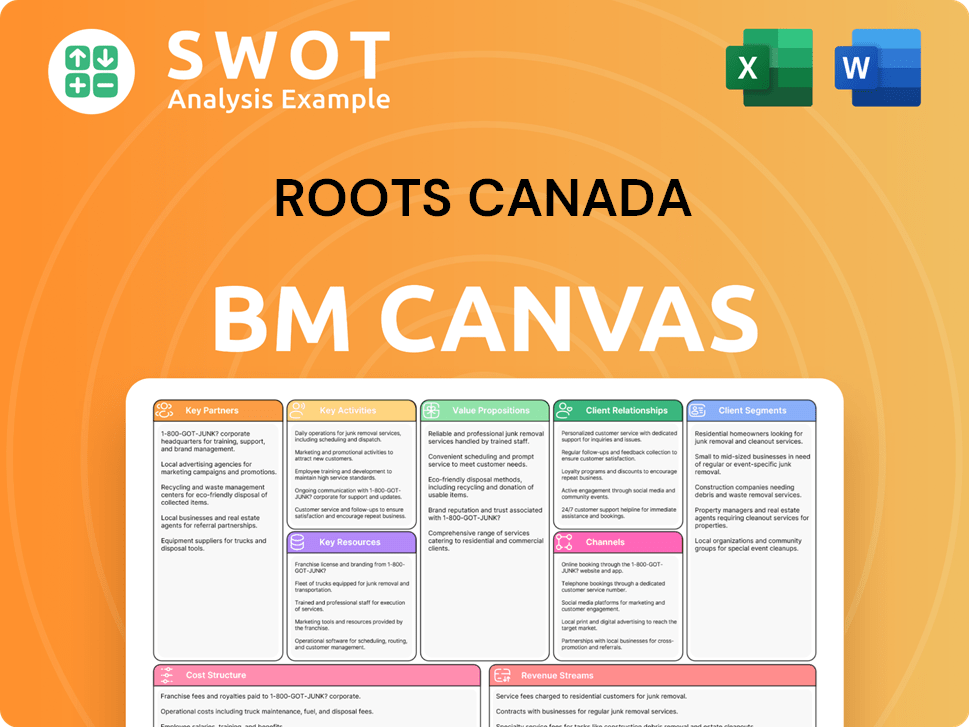

Roots Canada Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Roots Canada’s Growth?

The success of Roots Canada and its Growth Strategy faces potential risks. The retail sector's competitive nature, alongside economic uncertainties, presents considerable hurdles. Addressing these challenges requires strategic agility and robust operational planning.

Roots Company must navigate supply chain vulnerabilities and fluctuating consumer confidence to maintain its growth trajectory. Internal factors, like past sales declines, also require careful management. Proactive measures and adaptation are crucial for sustained success.

The company's ability to maintain its brand image and customer loyalty is also key in this competitive landscape. Roots Canada needs to stay ahead of trends and consumer preferences to ensure long-term viability and growth.

Increased competition within the Canadian retail sector poses a significant risk. Other brands offer similar products, potentially at lower prices. Roots Canada must differentiate itself through its brand and high-quality products to maintain its market share.

Disruptions in the supply chain can severely impact Roots Company. Delays in sourcing, manufacturing, or distribution could lead to lost sales and customer dissatisfaction. Strong supplier relationships and effective inventory management are essential.

Economic uncertainties and fluctuating consumer confidence can affect Roots Canada's sales and margins. The weakening global economy and shifts in consumer preferences towards sustainability require the company to adapt its product offerings. Currency fluctuations also pose a challenge.

Roots Company has faced profit and sales declines in the past, with decreases in wholesale segment sales. Maintaining the positive trend from recent Q4 2024 results is critical. The company focuses on digital innovation, operational efficiencies, and brand engagement to address these risks.

Changing consumer preferences, particularly towards sustainability and ethical practices, require Roots Canada to adapt its product offerings. The company must align with these trends to remain competitive and maintain brand relevance. Adapting to these changes is crucial for Roots Canada's future.

Currency fluctuations, despite hedging strategies, can impact Roots Canada's costs. The company uses derivative financial instruments to manage its exposure to foreign exchange rates and interest rates. Effective management of these financial risks is essential for maintaining profitability.

Roots Canada employs various strategies to mitigate these risks. These include investing in digital innovation, enhancing operational efficiencies, and focusing on brand engagement. The company's approach to Brand Expansion involves careful planning to navigate market challenges effectively.

Roots Company uses derivative financial instruments to manage its exposure to foreign exchange rates and interest rates. These measures help to stabilize financial performance amidst economic volatility. The use of these instruments is part of the overall Market Analysis and risk management strategy.

For more insights into the Roots Canada market, consider analyzing the Target Market of Roots Canada. This can help to understand the customer base and tailor strategies to address the challenges and opportunities in the retail sector.

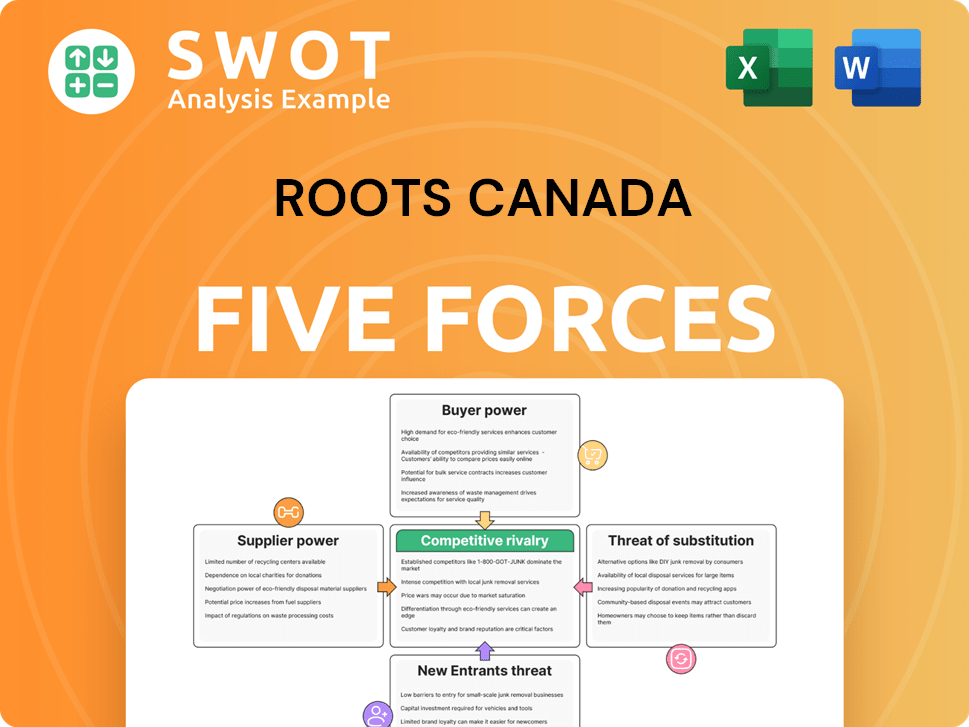

Roots Canada Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Roots Canada Company?

- What is Competitive Landscape of Roots Canada Company?

- How Does Roots Canada Company Work?

- What is Sales and Marketing Strategy of Roots Canada Company?

- What is Brief History of Roots Canada Company?

- Who Owns Roots Canada Company?

- What is Customer Demographics and Target Market of Roots Canada Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.