Roots Canada Bundle

Who Really Owns Roots Canada?

Unraveling the Roots Canada ownership structure is key to understanding its market strategy and future. From its humble beginnings to its current status as a publicly traded entity, the story of Roots is a fascinating journey of brand evolution. This exploration will delve into the pivotal moments that shaped Roots' ownership, revealing the key players and their influence on this iconic Canadian brand.

Understanding the Roots company's ownership is crucial for investors and anyone interested in the Roots brand. This includes the Roots history, the transition from private to public ownership, and the individuals and entities that shape its direction. This analysis offers insights into the Roots ownership, providing a comprehensive view of the company's evolution and current status.

Who Founded Roots Canada?

The story of Roots Canada began in 1973, rooted in the vision of Michael Budman and Don Green. These two founders, inspired by the Canadian wilderness, particularly Algonquin Park, established a brand that would become synonymous with Canadian style and outdoor living. Their initial focus was footwear, setting the stage for the company's early success and expansion.

Early ownership of the Roots company was primarily held by Budman and Green, who were committed to a direct-to-consumer model and Canadian craftsmanship. The brand quickly gained momentum, achieving a significant valuation within its first six months. This period laid the foundation for the Roots brand's growth, with the founders maintaining strong control over the company's direction.

The Kowalewski family and their Boa Shoe Company were instrumental in the early manufacturing of Roots' defining footwear. The first store opened in Toronto in August 1973, and within months, the company acquired the Upin and Ipin Company to establish its own leather factory. By the end of 1973, Roots had stores in Toronto, Vancouver, Montreal, and several U.S. locations.

Michael Budman and Don Green, the founders of Roots, were the driving force behind the company's early vision. Their focus on Canadian inspiration and craftsmanship set the brand apart.

The initial focus was on footwear, specifically the 'negative-heel' shoe, which was a key element of the brand's early identity. The Kowalewski family's Boa Shoe Company manufactured these shoes.

Roots quickly expanded its retail presence, opening stores across Canada and the U.S. within its first year. This rapid growth was a testament to the brand's early appeal.

The acquisition of the Upin and Ipin Company allowed Roots to establish its own leather factory, ensuring control over production and quality. The Kowalewski family produced 2,000 pairs of footwear weekly within a year.

Within six months of its inception, Roots was valued at a million dollars, indicating the rapid market acceptance and financial success of the brand. The founders maintained significant control, even turning down an offer to sell half the company to clothing giant Dylex Limited.

The founders' wives, Denyse Tremblay (Don Green's wife) and Diane Bald (Michael Budman's wife), were also integral to the company's early growth, with Denyse being one of the first salespersons and Diane designing retail stores.

The early days of Roots Canada were defined by the vision of its founders, a focus on quality, and a commitment to the Canadian identity. The Roots ownership structure, initially centered on Budman and Green, allowed for a hands-on approach to building the brand. The company's rapid expansion and early valuation highlight the successful implementation of their strategy.

- Roots was founded in 1973 by Michael Budman and Don Green.

- The initial focus was on footwear, particularly the 'negative-heel' shoe.

- The company expanded rapidly, opening stores across Canada and the U.S.

- The founders maintained significant control and turned down offers to sell.

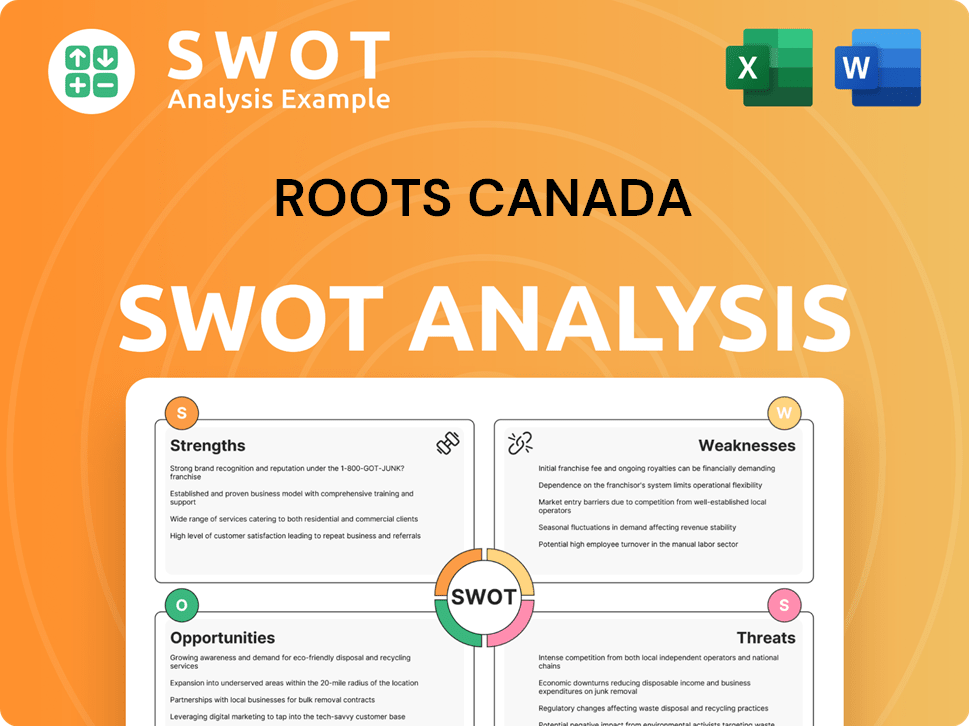

Roots Canada SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Roots Canada’s Ownership Changed Over Time?

The Roots Canada company's ownership structure has seen significant changes over time. In 2015, a major shift occurred when Searchlight Capital Partners LP, a U.S. private investment firm, acquired a majority stake in the company. While the financial details of the acquisition weren't disclosed, founders Michael Budman and Don Green maintained a minority ownership. This move was aimed at supporting Roots' expansion plans, especially internationally.

Subsequently, Roots Corporation went public on the Toronto Stock Exchange (TSX: ROOT) in September 2017. As of June 13, 2025, the market capitalization of Roots Canada is approximately $98.3 million. Institutional investors, such as Dimensional International Small Cap Value ETF (DISV) and Dimensional International Small Cap ETF (DFIS), hold shares. For instance, as of June 6, 2025, these ETFs held a total of 352 shares. Other significant shareholders include Kernwood Ltd., Maxam Capital Management Ltd., and Arrow Capital Management, Inc. The shift to a publicly traded company has diversified the ownership base, influencing Roots' strategic focus on market presence and financial performance.

| Ownership Event | Date | Details |

|---|---|---|

| Searchlight Capital Partners Acquisition | 2015 | Acquired majority stake; founders retained minority stake. |

| Initial Public Offering (IPO) | September 2017 | Roots Corporation listed on the Toronto Stock Exchange (TSX: ROOT). |

| Current Ownership | June 2025 | Searchlight Capital Partners holds majority stake; diversified ownership including institutional investors. |

These changes in Roots ownership have transformed the Roots brand from a founder-controlled entity to a publicly traded company. The current Roots Canada ownership structure reflects this evolution, with a mix of institutional and private investors. The Roots products continue to be sold across various retail locations, and the company's financial performance is now closely tied to its public market standing. Understanding the Roots history provides context for its current strategic direction and market position.

Roots Canada's ownership has evolved significantly, starting with the sale to Searchlight Capital Partners and culminating in its public listing.

- Searchlight Capital Partners acquired a majority stake in 2015.

- The company went public on the TSX in September 2017.

- Institutional investors now hold significant shares.

- Founders maintain a minority stake.

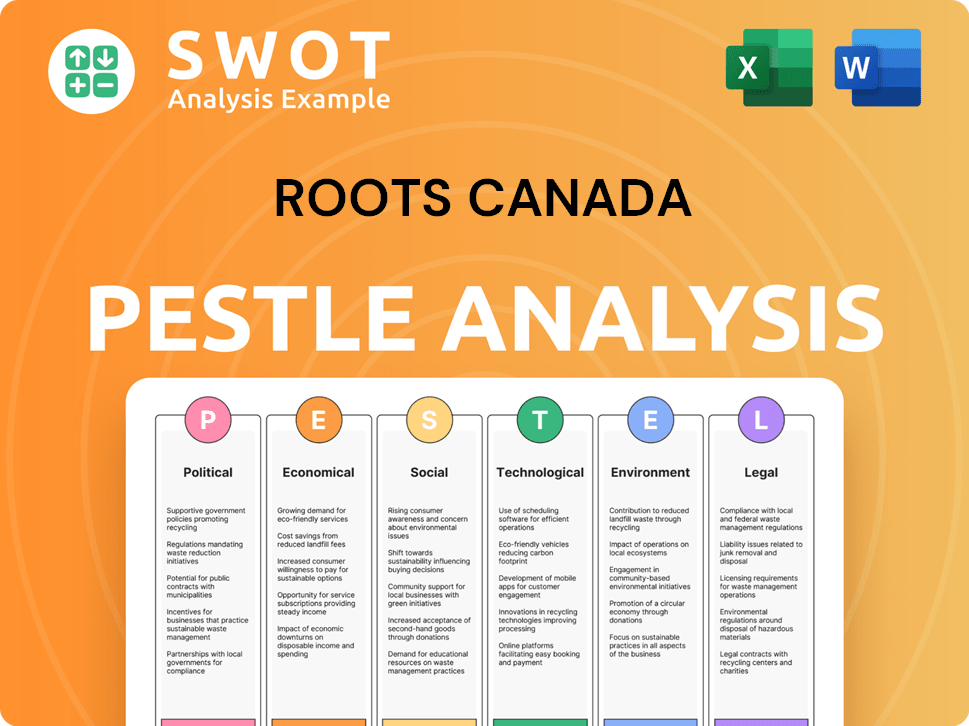

Roots Canada PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Roots Canada’s Board?

The Board of Directors of Roots Corporation oversees the company's strategic direction and governance. While specific details of the board members and their affiliations for 2024-2025 are not fully available in the provided search results, it's confirmed that the current board is 'fully Canadian.' Meghan Roach is the President and Chief Executive Officer, a role she assumed in May 2020. Leon Wu serves as the Chief Financial Officer. Understanding the current Roots Canada company profile helps to understand the company's governance.

Roots Corporation operates with a one-share-one-vote structure for its common shares, as indicated by its public listing on the Toronto Stock Exchange (TSX: ROOT). There is no specific information regarding dual-class shares or special voting rights that would grant outsized control to particular individuals or entities beyond their shareholding. The company's share repurchase program, or normal course issuer bid (NCIB), allows it to repurchase up to 1,347,118 common shares, approximately 10% of its 'public float,' during the 12-month period ending April 10, 2026. In Q1 2025, Roots repurchased 115,300 shares for $0.3 million under this program, which can influence the distribution of voting power.

Roots Corporation's governance structure emphasizes a Canadian-led board and a straightforward one-share-one-vote system. The company's share repurchase program is ongoing, impacting the outstanding shares.

- The board is comprised of Canadian members.

- Roots uses a one-share-one-vote structure.

- The company is actively repurchasing shares.

- Meghan Roach is the CEO.

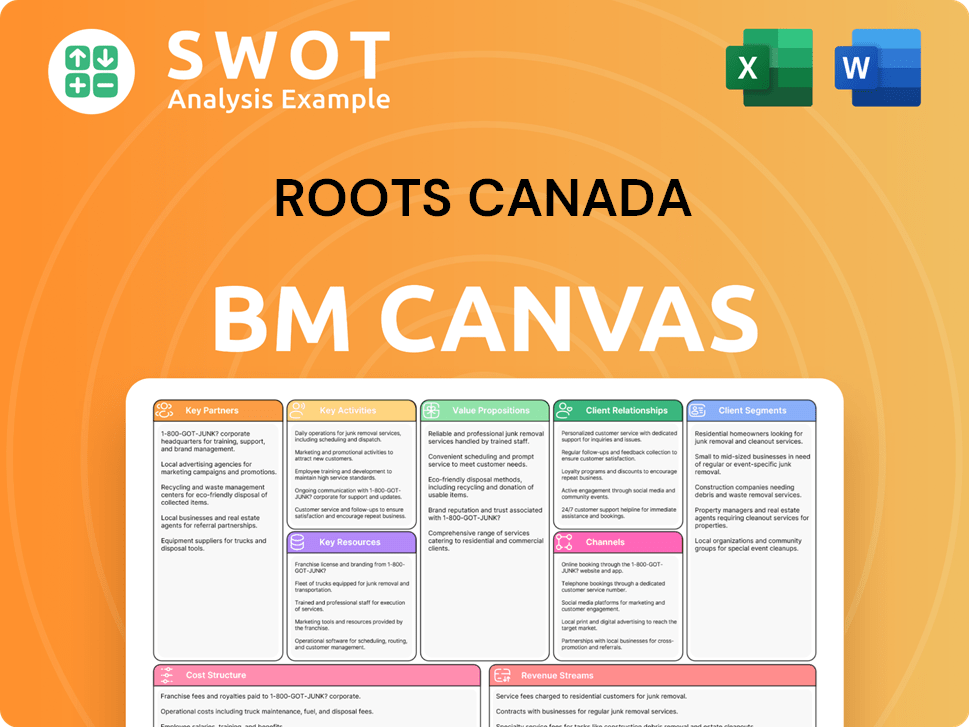

Roots Canada Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Roots Canada’s Ownership Landscape?

Over the past few years, the Roots Canada company has shown a focus on improving its financial performance. In Q1 2025, the company saw sales increase by 6.7% to $40.0 million compared to $37.5 million in Q1 2024. Direct-to-consumer (DTC) sales also grew, increasing by 10.2% to $34.6 million. Furthermore, the net loss for Q1 2025 improved to ($7.9) million from ($8.9) million in Q1 2024. These figures reflect a positive trend in the company's financial health.

Regarding Roots ownership, the company has been actively repurchasing its common shares through a normal course issuer bid (NCIB). This program, effective until April 10, 2026, allows for the repurchase of up to 1,347,118 shares, approximately 10% of the public float. In Q1 2025, 115,300 shares were repurchased for $0.3 million. This strategy can increase the ownership concentration among existing shareholders.

| Metric | Q1 2024 | Q1 2025 |

|---|---|---|

| Sales ($ millions) | $37.5 | $40.0 |

| DTC Sales ($ millions) | N/A | $34.6 |

| Net Loss ($ millions) | ($8.9) | ($7.9) |

The leadership of Roots Canada has remained consistent, with Meghan Roach as CEO since May 2020. The company is also investing in artificial intelligence to improve customer experience. Industry trends, such as increased institutional ownership, are also evident. For more insights into the company's strategic direction, consider exploring the Growth Strategy of Roots Canada.

The NCIB program allows Roots to repurchase shares. This can boost shareholder value. In Q1 2025, shares worth $0.3 million were repurchased. This reduces the total shares outstanding.

Meghan Roach has been CEO since May 2020. This provides continuity. The company is also investing in AI. This aims to improve the customer experience.

Roots reported increased sales in Q1 2025. DTC sales also showed growth. The net loss improved year-over-year. This indicates positive financial momentum.

The founders retained a minority stake after the sale. Institutional ownership is also visible. The company is publicly traded.

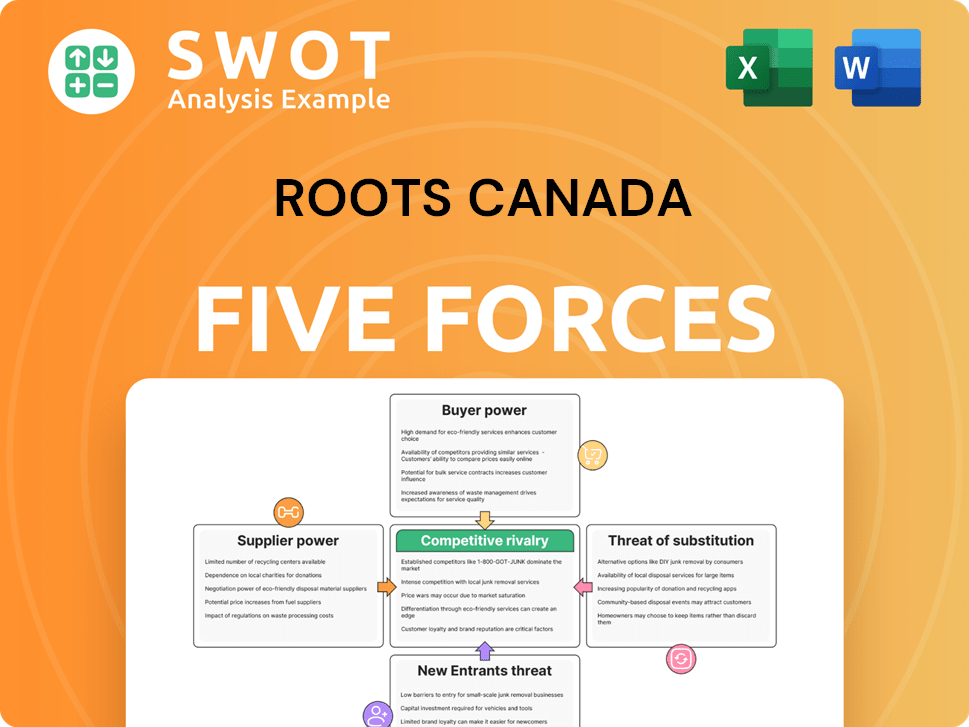

Roots Canada Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Roots Canada Company?

- What is Competitive Landscape of Roots Canada Company?

- What is Growth Strategy and Future Prospects of Roots Canada Company?

- How Does Roots Canada Company Work?

- What is Sales and Marketing Strategy of Roots Canada Company?

- What is Brief History of Roots Canada Company?

- What is Customer Demographics and Target Market of Roots Canada Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.