Sealed Air Bundle

Can Sealed Air Bubble Up Its Future?

From its humble beginnings with Bubble Wrap, Sealed Air has evolved into a global packaging powerhouse. With $5.4 billion in sales in 2024 and a presence in 117 countries, the company's journey is a testament to its adaptability and innovative spirit. But what does the future hold for this packaging giant?

This article dives deep into the Sealed Air SWOT Analysis to explore the company's ambitious Sealed Air growth strategy and uncover its Sealed Air future prospects. We'll examine its Sealed Air company financial performance, market share analysis, and strategic initiatives, including its focus on Sealed Air sustainable packaging solutions and expansion into emerging markets. Prepare to gain actionable insights into the Sealed Air business model and how this leader in protective packaging plans to navigate the evolving landscape, including the impact of e-commerce and the drive for Sealed Air environmental initiatives.

How Is Sealed Air Expanding Its Reach?

The Sealed Air growth strategy is primarily focused on expanding its business within its two key segments: Food and Protective packaging. This strategic direction aims to capitalize on market opportunities and drive sustained growth. The company's approach involves targeted initiatives to enhance its market position and financial performance.

A key element of the Sealed Air future prospects involves accelerating momentum in the Food segment. This is achieved by expanding into higher-growth end markets. The Protective segment is also a focus, with efforts to stabilize the business and drive volume growth through enhanced customer focus and portfolio rebalancing. These strategies are designed to adapt to changing market dynamics and strengthen the company's overall competitiveness.

The company's strategic initiatives are designed to capture new customers and diversify revenue streams, building on the Food segment's organic growth, which saw a 5% increase in Q4 2024 driven by volume growth across regions. The company is also focused on winning back market share, particularly in e-commerce, where it was impacted by the shift to paper void fill. The company plans to consolidate its footprint by closing two plants by the end of 2025 to improve efficiency.

The Food segment focuses on expansion into higher-growth end markets. Solutions like case-ready and fluids packaging are key. This expansion strategy aims to capture new customers and diversify revenue streams, supporting the overall Sealed Air growth strategy.

The Protective segment is working to stabilize the business and drive volume growth. This includes enhancing customer focus and rebalancing the portfolio. The company is also becoming more 'substrate-agnostic' in consumer-facing end markets like e-commerce.

A key area of focus is the e-commerce market, where the company is working to regain market share. This involves commercializing fiber mailer offerings and growing its auto-bagging equipment business. The Sealed Air market analysis shows a need to adapt to changing trends.

The company plans to consolidate its footprint by closing two plants by the end of 2025. This initiative aims to improve operational efficiency and reduce costs. These actions are part of the broader strategy to enhance financial performance.

The Sealed Air growth strategy involves several key initiatives. These include expansion in the Food segment and stabilization in the Protective segment. The company is also focusing on operational efficiency through plant closures.

- Expanding into higher-growth end markets within the Food segment.

- Enhancing customer focus and rebalancing the portfolio in the Protective segment.

- Becoming more 'substrate-agnostic' in consumer-facing end markets.

- Commercializing fiber mailer offerings and growing the auto-bagging equipment business.

- Consolidating its footprint by closing two plants by the end of 2025.

For a deeper understanding of the company's target market, consider reading about the Target Market of Sealed Air. The company's strategic moves are also influenced by the impact of e-commerce and a focus on Sealed Air sustainability, including Sealed Air sustainable packaging solutions.

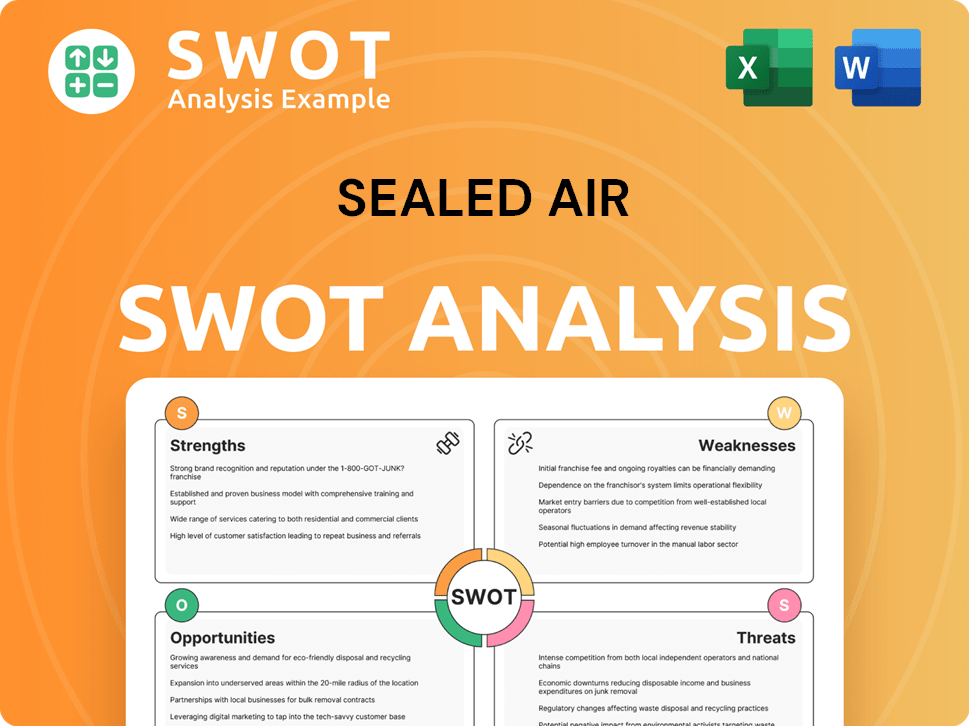

Sealed Air SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Sealed Air Invest in Innovation?

The innovation and technology strategy of a company is crucial for its long-term success, especially in a dynamic industry like packaging. A company's approach to innovation, including its investments in research and development, new product development, and technological advancements, significantly influences its market position. This strategy also encompasses the integration of digital solutions, automation, and sustainability initiatives, all of which are vital for meeting evolving customer needs and staying ahead of competitors.

A key element of a company's growth strategy is its commitment to sustainability. This involves creating packaging solutions that are recyclable, reusable, and incorporate recycled or renewable content. Furthermore, the company's focus on automation and equipment solutions provides value to customers by boosting packaging efficiency and reducing labor costs. This commitment to innovation, technology, and sustainability positions the company to meet the future demands of the packaging industry.

The company's vision includes becoming a world-class, digitally-driven company that automates sustainable packaging solutions. This involves significant investments in research and development to create new materials, packaging designs, and automated systems that address evolving market demands and sustainability goals. The company's strategic investments in innovation and technology are designed to drive sustained growth and maintain a competitive edge in the market. For more insights into the company's overall approach, consider exploring the Marketing Strategy of Sealed Air.

The company is focused on digital transformation to enhance operational efficiency and customer experience. This includes implementing digital tools across various processes, from supply chain management to customer service. Digital transformation is a key driver of innovation, allowing the company to respond faster to market changes and customer needs.

Automation is a core component of the company's technology strategy, aimed at increasing efficiency and reducing costs. The company invests in automated packaging systems and equipment solutions for its customers. These solutions help reduce labor headcount and improve packaging processes.

Sustainability is a key focus, with ambitious goals for recyclable or reusable packaging and the use of recycled or renewable content. The company aims to design and advance 100% of its packaging solutions to be recyclable or reusable by 2025. The company is also working towards net-zero carbon dioxide emissions by 2040 across its operations (Scopes 1 and 2).

Significant investments in research and development are made to create new materials, packaging designs, and automated systems. These investments are crucial for addressing evolving market demands and sustainability goals. The company focuses on innovation in packaging materials and designs.

The company continuously develops new products to meet changing customer needs and market trends. This includes the development of innovative packaging solutions that are both functional and sustainable. New product development supports the company's growth strategy and market share.

The company provides equipment solutions that enhance packaging efficiency and reduce labor costs for customers. These solutions create a strong value proposition by streamlining packaging processes. Equipment solutions contribute to the company's competitive advantage.

The company has set ambitious sustainability targets, demonstrating a strong commitment to environmental responsibility. These targets and achievements highlight the company's progress and dedication to sustainable practices.

- 100% of packaging solutions designed to be recyclable or reusable by 2025.

- Aiming for an average of 50% recycled or renewable content across all packaging solutions.

- 60% post-consumer recycled content in packaging solutions.

- Net-zero carbon dioxide emissions by 2040 across operations (Scopes 1 and 2).

- Reduce absolute Scope 1 and 2 GHG emissions by 46% by 2030 from a 2019 base year.

- In 2021, solutions designed for recyclability accounted for approximately 50% of the material weight sold.

- Recycled or renewable content made up 19% of the material weight sold in 2021.

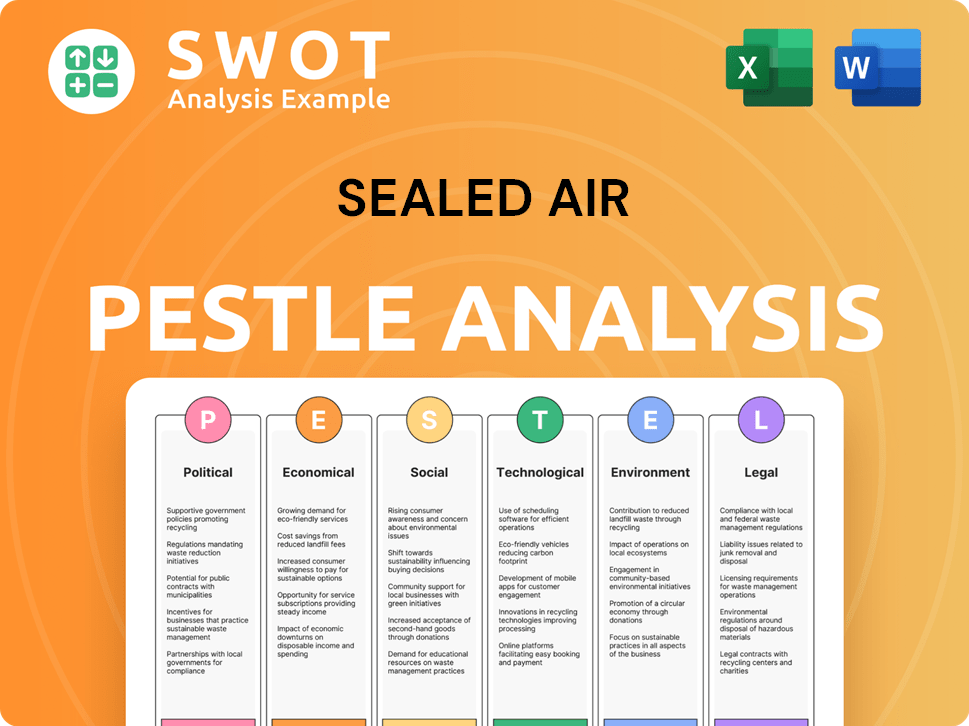

Sealed Air PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Sealed Air’s Growth Forecast?

The financial outlook for the Sealed Air company in 2025 anticipates net sales between $5.1 billion and $5.5 billion. This forecast represents a constant currency change of -4% to +3% compared to the $5.4 billion in sales reported for 2024. This outlook provides a glimpse into the Sealed Air future prospects and its strategic direction.

In the first quarter of 2025, the company reported $1.3 billion in revenue, a 4% decrease as reported, but only a 2% decline in constant currency year-over-year. Despite these challenges, the company's adjusted EBITDA reached $276 million, a 2% increase in constant currency, with adjusted EPS at $0.81, up 9% in constant currency. This performance indicates resilience and strategic adaptation within the Sealed Air business model.

For the full year 2024, Sealed Air company financial performance showed net sales of $5.39 billion, a 2% decrease from 2023. Net earnings were $270 million, a decrease from $339 million in 2023. The company is also focused on strengthening its balance sheet, aiming for a net debt to adjusted EBITDA ratio of approximately 3.0x by 2026. This financial discipline is a key aspect of the Sealed Air growth strategy.

Sealed Air projects adjusted EBITDA to range from $1.075 billion to $1.175 billion for 2025. Adjusted EPS is expected to be between $2.90 and $3.30. These figures underscore the company's financial expectations for the coming year, reflecting its strategic planning and market positioning.

The company anticipates free cash flow to be between $350 million and $450 million in 2025. This projection is crucial for understanding the company's financial health and its ability to invest in future growth initiatives and Sealed Air new product development.

In 2025, Sealed Air plans to allocate approximately 42% of its capital to debt reduction, which amounts to around $250 million. Another 36% will be directed towards capital expenditures, totaling $220 million, and 20% will be allocated to dividends, equating to $120 million. This strategic allocation highlights the company's focus on financial stability and shareholder value.

Analysts generally hold a bullish outlook on Sealed Air company stock forecast, with price targets ranging from $29 to $54. They anticipate earnings and revenue growth of 13.6% and 2.1% per annum, respectively. This positive sentiment reflects confidence in the company's strategic direction and market position.

In Q1 2025, the Food segment experienced organic growth, while the Protective segment saw an 8% decline in organic sales. This divergence in performance highlights the varying dynamics within Sealed Air's different business segments and the importance of tailored Sealed Air growth strategy in packaging.

Sealed Air is committed to Sealed Air sustainable packaging solutions and environmental initiatives. This focus is becoming increasingly important in the packaging industry, driving innovation and aligning with consumer and regulatory demands. This commitment also influences the company's long-term Sealed Air future prospects in food industry.

The financial performance and future prospects of Sealed Air company are influenced by several factors.

- Revenue fluctuations due to market conditions and segment performance.

- Strategic capital allocation towards debt reduction, capital expenditures, and dividends.

- Analyst expectations and stock price targets.

- The impact of Sealed Air growth strategy acquisitions and innovation in packaging solutions.

- The company's response to the Sealed Air company competitive landscape. For more details, you can review the Competitors Landscape of Sealed Air.

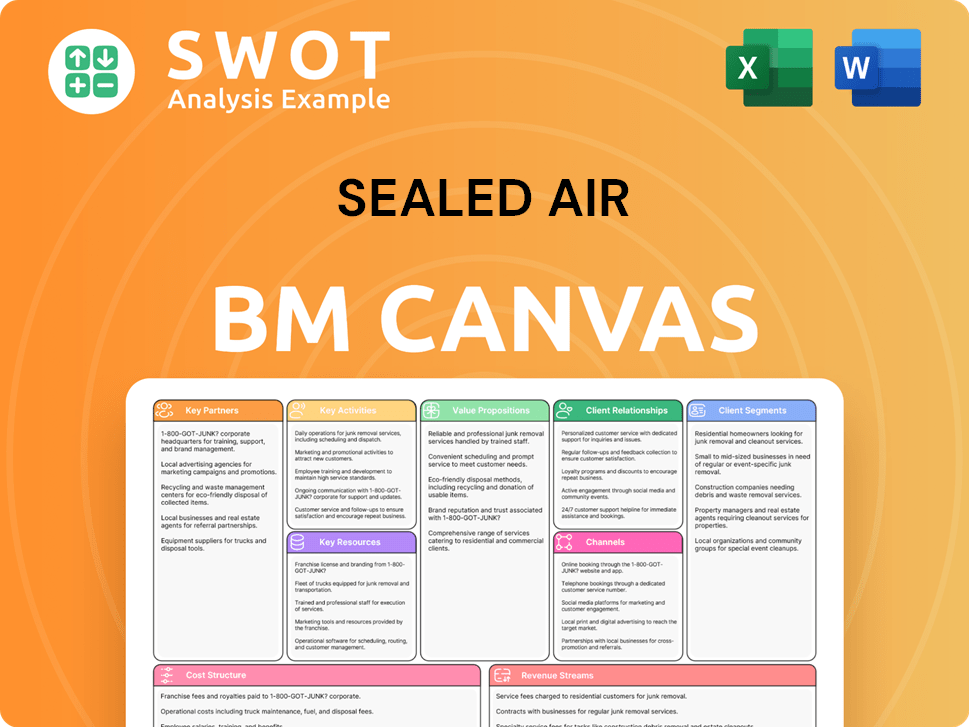

Sealed Air Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Sealed Air’s Growth?

The strategic outlook for the Sealed Air growth strategy faces several hurdles. These challenges include market volatility, particularly in key sectors like the US beef market, and shifting consumer behaviors. The company must navigate these issues while also addressing internal operational adjustments and external competitive pressures.

One of the significant challenges for Sealed Air company is the persistent decline in its Protective segment. This segment's performance is crucial, and stabilizing it is vital for overall financial health. The company's ability to adapt to changing market demands and regulatory environments will be critical for its Sealed Air future prospects.

Furthermore, Sealed Air is contending with intense competition and potential regulatory changes related to packaging materials. Supply chain vulnerabilities and the impact of tariffs add to the complexity. Management's focus on cost reduction, operational optimization, and a smooth leadership transition are essential strategies to mitigate these risks.

Fluctuations in the US beef market and shifts in consumer confidence pose significant risks. These factors can directly impact demand for packaging solutions. The company must proactively manage its exposure to these market dynamics to maintain stability.

The Protective segment faces persistent volume declines, potentially marking its fourth consecutive year of decrease by 2025. This decline is largely due to the shift away from plastic packaging, especially in e-commerce. Addressing this trend is crucial for Sealed Air company financial performance.

Intense competition in the packaging industry adds to the challenges. Sealed Air must differentiate itself through innovation, sustainability, and cost-effectiveness. The competitive landscape requires continuous adaptation and strategic positioning to maintain market share.

Potential regulatory changes concerning packaging materials present another risk. These changes can impact the company's product offerings and require adjustments to comply with new standards. Staying ahead of these changes is vital for long-term success.

Supply chain disruptions can impact the availability of raw materials and the ability to deliver products on time. Diversifying suppliers and implementing robust supply chain management strategies are crucial to mitigate these risks. These vulnerabilities can affect the company's operational efficiency and profitability.

The recent appointment of Dustin Semach as President and CEO marks a significant leadership transition. Ensuring a smooth transition and effective execution of strategic initiatives will be crucial. A stable leadership team is essential for navigating these complex challenges.

Sealed Air is focusing on cost reduction and operational optimization, including closing two plants by the end of 2025. These efforts aim to improve efficiency and reduce expenses. These measures are important for enhancing profitability and competitiveness in the market.

The company is committed to Sealed Air sustainable packaging solutions and diversification into fiber-based solutions. This strategy aims to mitigate risks associated with changing consumer preferences and environmental regulations. These initiatives are key to long-term sustainability and market relevance.

The growth of e-commerce has significantly impacted the packaging industry, creating both opportunities and challenges. Sealed Air must adapt its products and services to meet the evolving needs of the e-commerce sector. Understanding the Sealed Air impact of e-commerce is crucial for strategic planning.

Analyzing the Sealed Air market share analysis 2024 and understanding the Sealed Air company competitive landscape are critical for strategic decision-making. The company must continually assess its position relative to competitors and adjust its strategies accordingly. Maintaining a strong market position is essential for sustained growth.

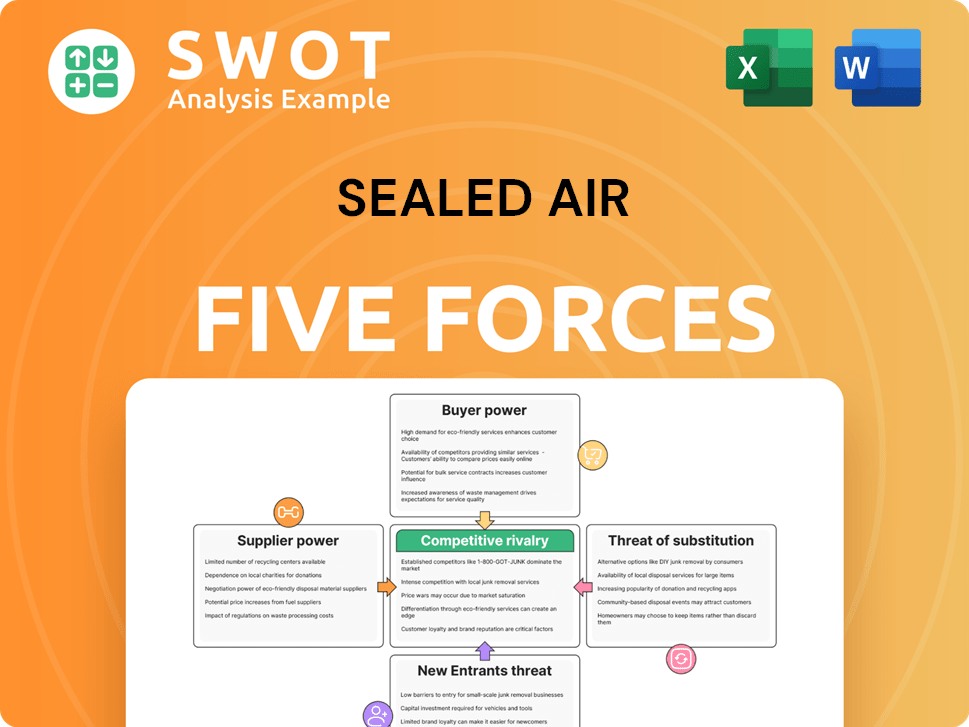

Sealed Air Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sealed Air Company?

- What is Competitive Landscape of Sealed Air Company?

- How Does Sealed Air Company Work?

- What is Sales and Marketing Strategy of Sealed Air Company?

- What is Brief History of Sealed Air Company?

- Who Owns Sealed Air Company?

- What is Customer Demographics and Target Market of Sealed Air Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.