SimilarWeb Bundle

Can Similarweb Conquer the Digital Intelligence Realm?

Similarweb, a prominent player in the web analytics arena, is charting its course in a rapidly evolving digital landscape. Founded in 2009, the company has evolved from a website traffic analysis tool to a comprehensive digital intelligence platform. This deep dive explores Similarweb's SimilarWeb SWOT Analysis, growth strategy, and future prospects, offering a detailed market analysis of its position.

Understanding Similarweb's growth strategy is crucial for grasping its potential in the competitive intelligence sector. The company's success hinges on its ability to innovate and adapt to the ever-changing digital environment. This analysis will delve into Similarweb's market share analysis, competitive landscape, and future revenue projections, providing insights for investors and businesses alike. The insights will cover how to use Similarweb for SEO, its pricing and plans, and its overall investment potential.

How Is SimilarWeb Expanding Its Reach?

The company is actively pursuing an aggressive growth strategy through various initiatives aimed at expanding its market presence and enhancing its product offerings. This involves entering new product categories, launching innovative services, and strategically acquiring companies to broaden its capabilities. These efforts are designed to solidify its position in the competitive landscape of web analytics and competitive intelligence.

A key aspect of this expansion involves strategic acquisitions to enhance its capabilities. The acquisition of 42matters AG in 2024 significantly boosted its presence in the app analytics market. This move allowed for a more unified approach to web and app insights, redefining digital intelligence. The company continues to evolve its offerings to meet the changing needs of its customers.

The company's strategy is also reflected in its customer base growth. The number of customers increased by 19% year-over-year to 5,767 as of March 31, 2025. This growth underscores the effectiveness of its growth strategy and its ability to attract and retain customers. The company's focus on providing comprehensive data solutions has been a key driver of its success.

In 2024, the company acquired 42matters AG, a Swiss app intelligence provider. This acquisition significantly expanded the company's capabilities in the rapidly growing app analytics market. It enhanced its app data offering, allowing for a more unified web and app insight.

In early 2025, the company introduced its Ad Intelligence Suite. This suite provides comprehensive analysis of ad performance. It tracks activity across publishers and advertisers, offering valuable insights for digital marketers.

The company is launching App Intelligence as a standalone solution with added functionality. This makes it easier to uncover key app insights. This initiative aims to provide more comprehensive data solutions to customers.

Shopper Intelligence is receiving a major upgrade with new datasets and expanded market coverage. Additional retailers are being added to provide more comprehensive insights. This upgrade aims to enhance the value of the offering.

The company's commitment to expanding its services is evident in its recent acquisitions and product launches. In March 2025, the company acquired The Search Monitor, enhancing its paid search and affiliate marketing solutions. Furthermore, the company has expanded its digital visibility to include AI Chatbots, like ChatGPT, in April 2025. These moves are part of a broader strategy to provide comprehensive market analysis and competitive intelligence to its customers. For more information on the company's business model, you can read about the Revenue Streams & Business Model of SimilarWeb.

The company's financial performance reflects its successful expansion initiatives. The company's customer base grew significantly, indicating strong market demand. The company's ability to retain high-value customers is a positive sign for future growth.

- Customer base increased by 19% year-over-year to 5,767 as of March 31, 2025.

- Customers with an Annual Recurring Revenue (ARR) of $100,000 or more grew by 9% to 411 in the same period, contributing 61% of the total ARR.

- The dollar-based net retention rate for customers with ARR of $100,000 or more was 111% in Q1 2025, an increase from 107% in Q1 2024.

- Overall, the net retention rate was 101% in Q1 2025, up from 98% in Q1 2024.

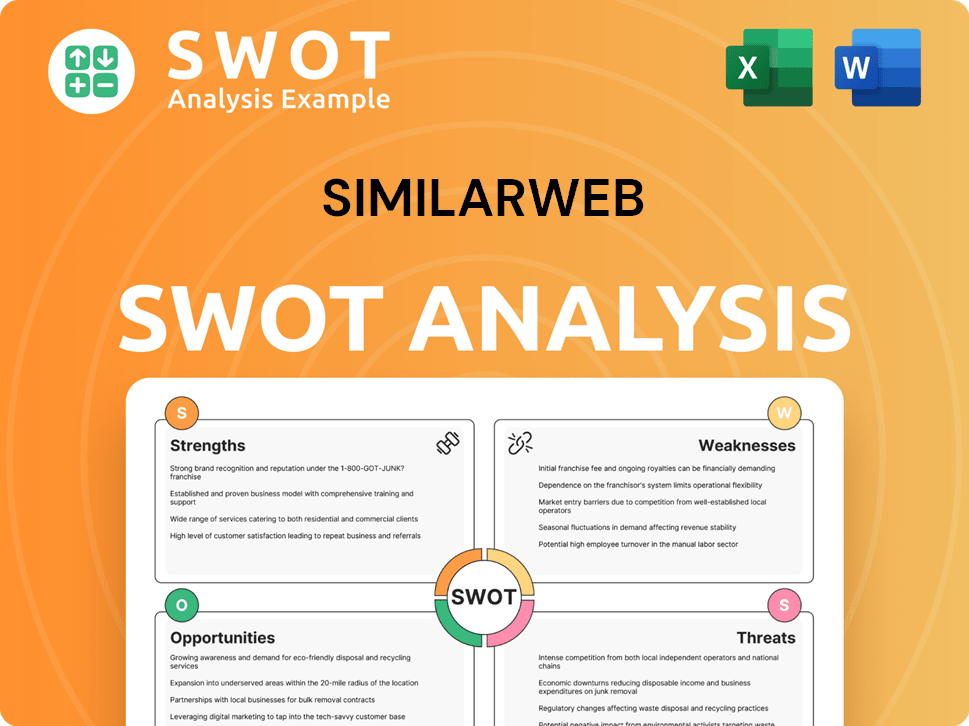

SimilarWeb SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does SimilarWeb Invest in Innovation?

The innovation and technology strategy of Similarweb is central to its sustained growth. The company consistently invests in artificial intelligence (AI) and expands its data capabilities. This approach is designed to provide users with more actionable insights and stay ahead in the competitive landscape.

Similarweb's commitment to research and development (R&D) is evident in its increasing investments, particularly in AI. This focus allows the company to improve data accuracy, expand coverage, and offer advanced digital intelligence solutions. These efforts are critical for maintaining its position in the web analytics market.

The company's strategic investments in technology and innovation are designed to enhance its data accuracy and coverage. These advancements contribute to the goal of providing smarter, faster, and more actionable data to its customers. This helps drive the overall growth strategy.

Similarweb leverages AI to enhance its offerings. The company introduced AI-powered competitive alerts and SAM (AI Sales Assistant) in 2024. In 2025, it further expanded its AI offerings with AI Agents.

R&D investments are a core component of Similarweb's strategy. In Q1 2025, GAAP R&D investment increased to $18.0 million, and non-GAAP R&D investment increased to $15.9 million. For the full year 2024, R&D expenses were $56 million.

Similarweb consistently enhances its data accuracy and coverage. In 2024, it improved traffic and engagement estimates. The company also released a new version of its data estimation technology in Q2 2024.

The platform integrates AI Chatbot traffic data, providing visibility into queries and referral data from these rapidly growing sources. This integration enhances the scope of web analytics.

The company plans to increase investments in R&D for 2025 to capitalize on AI opportunities. Customers are beginning to train large language models (LLMs) with Similarweb's data.

The company's technological advancements contribute to providing smarter, faster, and more actionable data. These enhancements support Similarweb's growth strategy and market analysis.

Similarweb's innovation strategy is designed to maintain its competitive edge in the market. The company's investments in AI, R&D, and data accuracy are critical for its future prospects. This approach allows Similarweb to offer valuable insights to its customers. For more information on the competitive landscape, check out this article on Competitors Landscape of SimilarWeb.

Similarweb's focus on technology and innovation is driving its growth, particularly in the areas of AI and data capabilities. The company's commitment to R&D is evident in its increasing investments, which are designed to enhance data accuracy and coverage.

- AI-powered competitive alerts and SAM (AI Sales Assistant) for sales strategy refinement.

- Launch of AI Agents powered by comprehensive digital data for marketing and sales teams.

- Integration of AI Chatbot traffic data for enhanced web analytics.

- Improved traffic and engagement estimates and expanded coverage across key metrics.

- Continued investment in R&D to capitalize on AI opportunities, including LLM training.

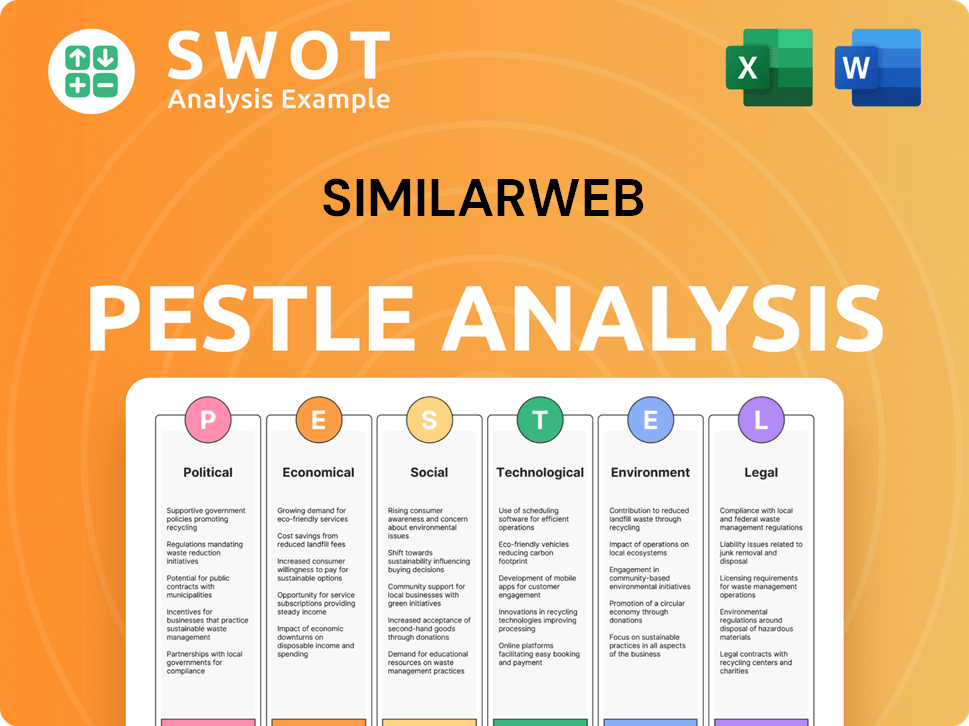

SimilarWeb PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is SimilarWeb’s Growth Forecast?

The financial outlook for Similarweb in 2025 points towards continued growth, driven by strategic investments in sales and research and development. The company's focus on expanding its go-to-market organization and R&D efforts is designed to fuel further expansion in the latter half of 2025 and beyond. This approach reflects a commitment to strengthening its market position and enhancing its offerings in the web analytics and competitive intelligence space.

Similarweb's revenue projections for 2025 suggest a positive trajectory, with an anticipated increase in total revenue. The company's ability to generate positive free cash flow, as demonstrated in Q1 2025, highlights its financial stability and operational efficiency. These factors contribute to a positive outlook for the company's future prospects and its ability to execute its growth strategy effectively.

For the full fiscal year 2025, Similarweb projects total revenue to be between $285 million and $288 million, representing an approximate 15% growth year-over-year. The company's performance in Q1 2025, with a total revenue of $67.1 million, aligns with this growth trajectory. Furthermore, the company's strategic investments in sales and R&D, totaling approximately $20 million, are aimed at accelerating growth and enhancing its competitive position.

Similarweb anticipates total revenue between $285 million and $288 million for 2025, reflecting a 15% year-over-year increase. This follows a 15% increase in 2024, where total revenue reached $249.9 million. The company's Q1 2025 revenue was $67.1 million, a 14% increase compared to Q1 2024.

In Q1 2025, the GAAP operating loss was $(9.3) million, or (14)% of revenue, while the non-GAAP operating loss was $(1.3) million. For the full year 2025, Similarweb estimates a non-GAAP operating profit between $1 million and $4 million. These figures reflect the company's financial performance and its focus on achieving profitability.

Similarweb achieved its sixth consecutive quarter of positive free cash flow in Q1 2025, reaching $4.4 million. As of March 31, 2025, cash and cash equivalents totaled $59.6 million. The remaining performance obligations (RPO) also increased by 18% year-over-year to $252.7 million, indicating a strong financial position.

The company plans to invest approximately $20 million in sales and R&D for 2025. This includes $15 million for expanding the go-to-market organization and $5 million for R&D initiatives. These investments are designed to drive growth in the latter half of 2025 and beyond, supporting the company's mission and core values.

Similarweb's financial outlook for 2025 is marked by continued revenue growth and strategic investments. The company's focus on expanding its go-to-market organization and R&D efforts is designed to fuel further expansion.

- Projected 2025 revenue: $285 million to $288 million (approx. 15% growth).

- Q1 2025 revenue: $67.1 million (14% increase year-over-year).

- Non-GAAP operating profit for 2025: $1 million to $4 million.

- Q1 2025 free cash flow: $4.4 million (sixth consecutive quarter).

- RPO as of March 31, 2025: $252.7 million (18% year-over-year increase).

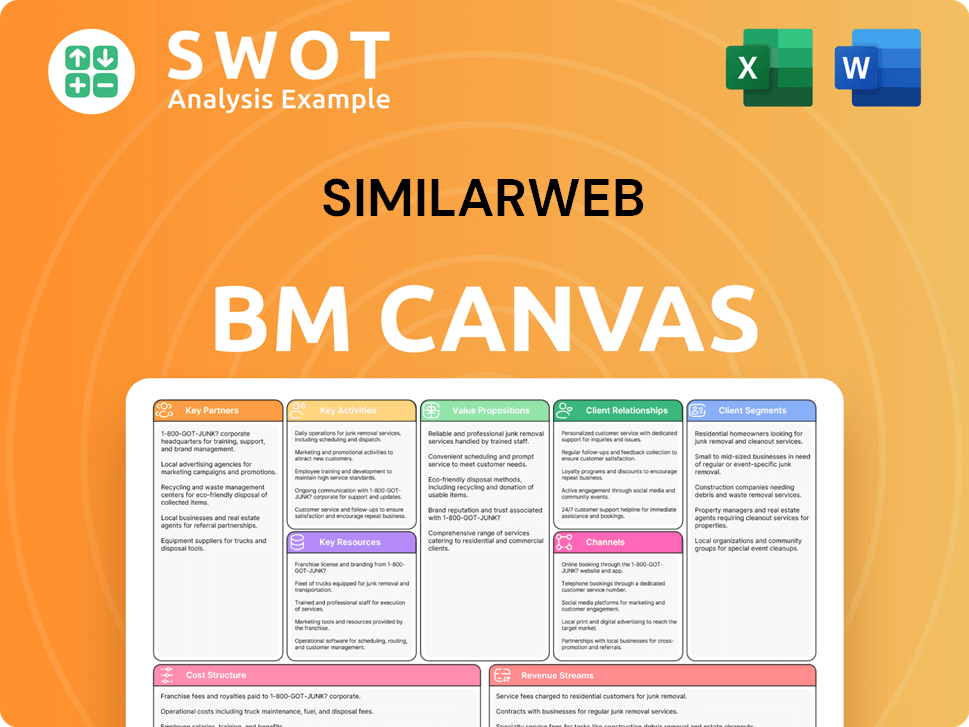

SimilarWeb Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow SimilarWeb’s Growth?

The growth strategy of Similarweb faces several potential risks and obstacles. These challenges primarily revolve around market competition, the effectiveness of increased investments, and the quick evolution of technology, especially in AI. Understanding these risks is crucial for evaluating the Marketing Strategy of SimilarWeb and its future prospects.

The digital intelligence market is highly competitive, with numerous tools offering competitor analysis and market intelligence. Similarweb's ability to maintain its market position and achieve its growth objectives depends on its ability to adapt to the changing market landscape and continue to innovate. The company must also effectively manage its resources to ensure that investments yield the expected returns.

Technological advancements, particularly in AI, present both opportunities and risks. The company must continuously adapt and integrate AI-driven solutions to stay competitive. Failure to do so could impact Similarweb's competitive position in the market. The company's growth strategy must incorporate these technological advancements to remain relevant and competitive.

The digital intelligence market is intensely competitive. Similarweb faces competition from various companies providing market and competitive intelligence, including those focusing on tracking changes across all digital channels. This competitive landscape requires Similarweb to continually innovate and differentiate its offerings.

Similarweb plans to increase investments, including an additional $20 million in 2025, primarily for expanding its sales force and R&D. The risk is whether these investments will yield the anticipated acceleration in revenue growth. The company's stock experienced a significant drop after its Q4 2024 earnings report.

Rapid advancements in AI pose both opportunities and challenges. Similarweb must continuously adapt and integrate AI-driven solutions to stay competitive. The evolving nature of AI tools and their impact on industries requires constant monitoring and strategic adjustments.

While Similarweb is recognized for its accessible market data and user-friendly interface, it has limitations in providing granular, niche data. Competitors might exploit these limitations. The company's ability to provide comprehensive and detailed data is crucial for its competitive advantage.

The digital intelligence market is subject to fluctuations and changing customer demands. Economic downturns or shifts in digital marketing practices could impact Similarweb's revenue. The company must remain flexible and responsive to market changes to maintain its growth trajectory.

Expanding the sales force and R&D efforts can present operational challenges. Managing a growing workforce and ensuring effective R&D outcomes are critical for success. The company's operational efficiency impacts its ability to achieve its growth strategy.

Similarweb operates in a competitive market, facing rivals that offer similar services. The company's ability to maintain a competitive edge depends on its continuous innovation and data accuracy. The Marketing Strategy of SimilarWeb must focus on differentiating itself from competitors.

The company's financial performance is a key factor in its future prospects. The success of its investments and its ability to manage costs will affect its profitability. Similarweb must demonstrate strong financial results to maintain investor confidence and achieve its growth strategy.

The rapid advancements in AI require Similarweb to adapt quickly. The company's ability to integrate AI-driven tools and stay ahead of the curve is essential for its long-term success. Continuous investment in R&D is crucial for maintaining its competitive advantage.

Changes in market dynamics, including economic fluctuations and shifts in digital marketing practices, can impact Similarweb. The company must be agile and responsive to these changes to maintain its growth trajectory. The company's ability to adapt to market trends is essential.

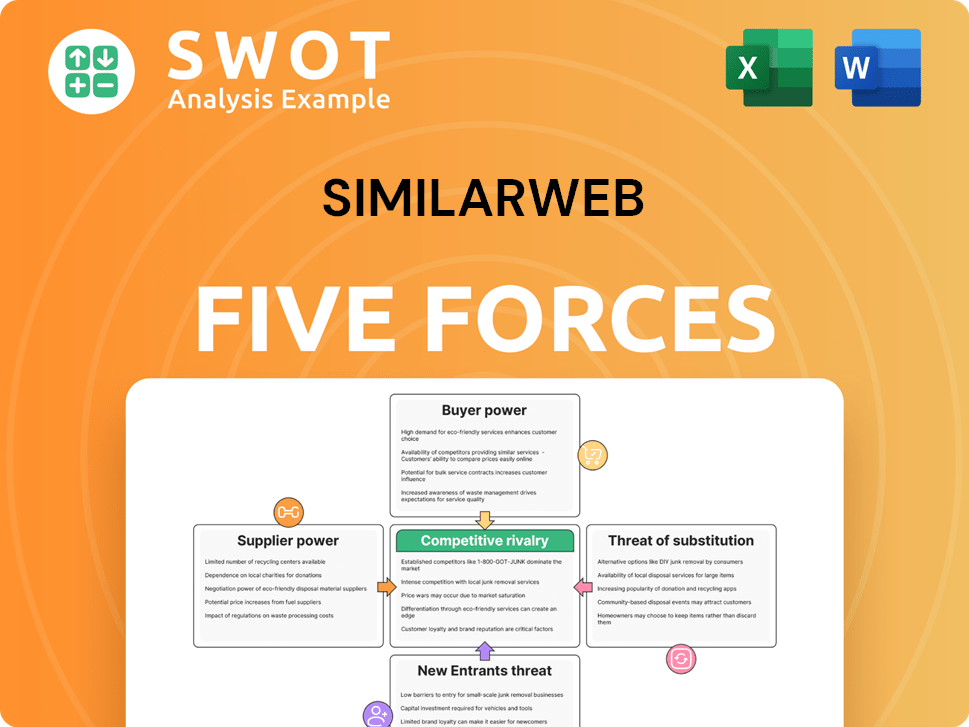

SimilarWeb Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SimilarWeb Company?

- What is Competitive Landscape of SimilarWeb Company?

- How Does SimilarWeb Company Work?

- What is Sales and Marketing Strategy of SimilarWeb Company?

- What is Brief History of SimilarWeb Company?

- Who Owns SimilarWeb Company?

- What is Customer Demographics and Target Market of SimilarWeb Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.