SimilarWeb Bundle

How Does Similarweb Thrive in the Digital Intelligence Arena?

In today's data-driven world, understanding the inner workings of market intelligence giants like Similarweb is paramount. This company is a powerhouse, providing invaluable insights into website traffic, app performance, and market trends, empowering businesses to make informed decisions. Similarweb transforms billions of daily digital interactions into actionable intelligence, fueling growth and competitiveness in the digital landscape.

With a reported 15% revenue increase in 2024, reaching $249.9 million, Similarweb demonstrates strong demand for its SimilarWeb SWOT Analysis and digital data solutions. Its ability to provide precise and actionable insights makes it an essential tool for businesses. Whether you're looking for a detailed Similarweb review, exploring Similarweb features, or conducting competitive analysis, this analysis will provide a comprehensive understanding of this industry leader.

What Are the Key Operations Driving SimilarWeb’s Success?

The core function of the digital intelligence platform is to provide comprehensive web analytics services, data, and insights into website traffic and performance. This helps businesses understand their competitors, analyze market trends, and develop effective digital strategies. The platform serves various customer segments, including marketers, business strategists, sales professionals, and researchers.

The value proposition centers on empowering businesses with data-driven insights to optimize customer acquisition, improve monetization, and gain a competitive edge. By providing detailed data on website traffic, user engagement, and audience demographics, the platform enables informed decision-making. This helps businesses to understand their market position and identify growth opportunities.

The operational processes involve sophisticated technology development and data analysis. The platform analyzes billions of digital interactions daily from millions of websites and applications. This data is converted into actionable insights, powered by artificial intelligence to ensure accuracy and reliability. The platform's design focuses on user-friendly interfaces and customizable reporting tools.

The platform continuously collects and processes vast amounts of data from the web. This data includes website traffic, user behavior, and market trends. This data is then analyzed using AI to provide accurate and reliable insights.

The platform offers user-friendly interfaces and customizable reporting tools. These tools make complex data accessible and actionable for businesses of all sizes. Users can easily generate reports and visualizations to understand their data.

The platform leverages artificial intelligence to enhance data accuracy and provide real-time insights. This enables users to monitor digital performance across a global scale. The AI algorithms ensure the reliability of the data and analytics.

The platform helps users gain a competitive advantage through detailed competitive analysis. It provides improved market transparency and enables quick reactions to market changes. This allows businesses to stay ahead of their competitors.

The company's operations are distinguished by comprehensive data coverage and an AI-driven platform. This allows for real-time monitoring and analysis of digital performance globally. The focus is on delivering actionable insights to improve competitive analysis and market transparency.

- Continuous data collection and processing from millions of websites.

- Development of user-friendly interfaces and customizable reporting tools.

- AI-powered analytics for accurate and reliable data insights.

- Partnerships and distribution networks to integrate insights into user workflows.

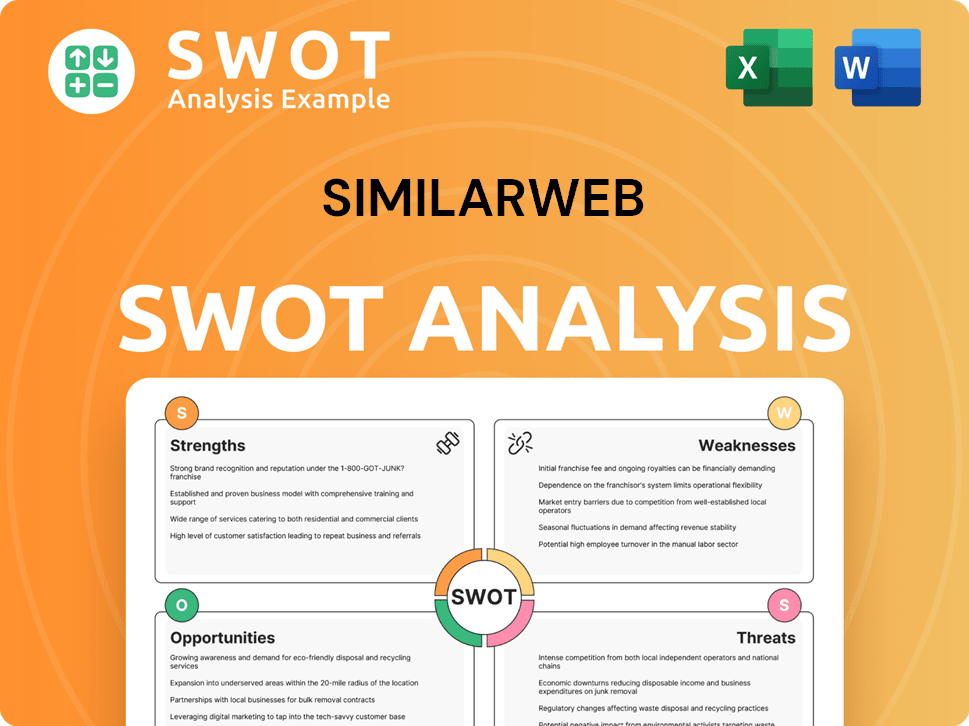

SimilarWeb SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does SimilarWeb Make Money?

The primary revenue stream for Similarweb is through Software-as-a-Service (SaaS) subscriptions. These subscriptions provide access to its digital intelligence solutions. The company's financial performance is closely tied to its ability to attract and retain customers who pay for these services.

For the full year 2024, Similarweb's total revenue reached $249.9 million, reflecting a 15% increase from the previous year. In the first quarter of 2025, the company reported total revenue of $67.1 million, a 14% increase compared to Q1 2024. This growth demonstrates a consistent upward trend in revenue generation.

Similarweb's monetization strategy focuses on subscription tiers tailored to different business needs. The company has also expanded its offerings through strategic acquisitions. These moves aim to enhance data capabilities and create new revenue opportunities, further solidifying its position in the market.

A significant portion of Similarweb's revenue comes from enterprise customers. As of Q3 2024, a small percentage of clients contribute a substantial amount to the company's annual recurring revenue (ARR). The company's focus on customer retention and expansion is evident through its dollar-based net retention rates.

- As of Q3 2024, 395 clients, representing 7.44% of the total customer count, contribute over $100,000 annually in subscription fees, accounting for 60% of the company's ARR.

- The dollar-based net retention rate for customers with ARR over $100,000 was 107% in Q1 2024, 109% in Q2 2024, increasing to 111% in Q3 2024, and 112% in Q4 2024.

- The overall dollar-based net retention rate was 101% in both Q3 and Q4 2024.

- Multi-year subscriptions comprised 45% of its overall ARR as of September 30, 2024.

- The company is focused on driving operating efficiency to achieve profitable growth and sustain positive free cash flow throughout 2024 and beyond.

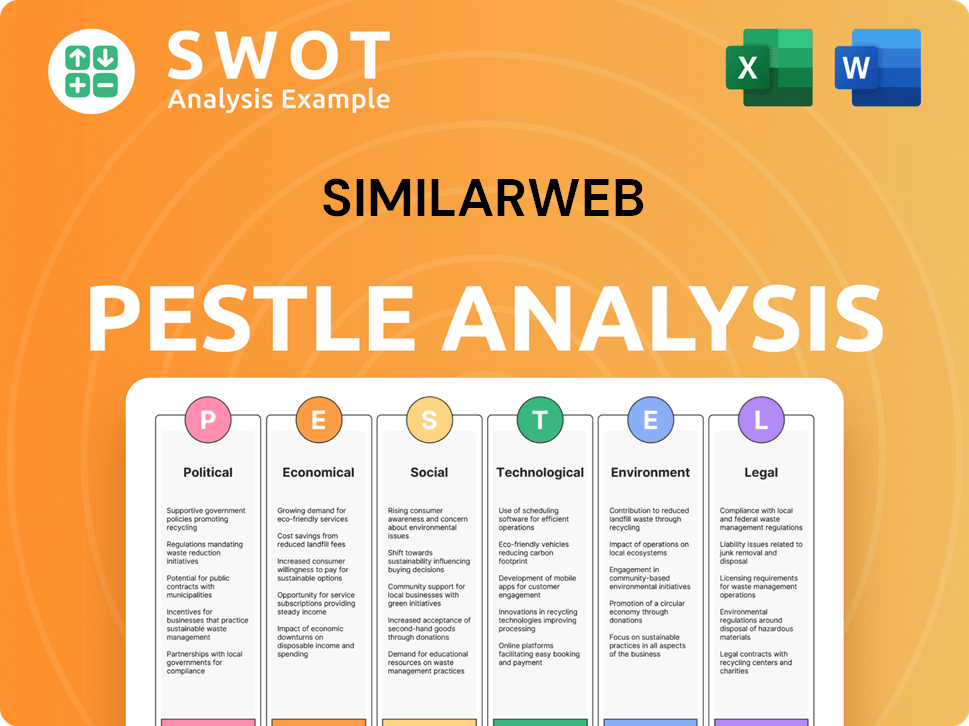

SimilarWeb PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped SimilarWeb’s Business Model?

This chapter explores the key milestones, strategic moves, and competitive advantages of Similarweb. The company has demonstrated significant growth and financial performance, marked by strategic acquisitions and the launch of new products. Similarweb's comprehensive data coverage and AI-driven platform provide businesses with valuable insights for making informed decisions in the digital landscape.

Similarweb's journey is highlighted by its ability to adapt to market changes and leverage technology to stay ahead of the competition. By integrating diverse datasets and utilizing AI, Similarweb offers a robust platform for website analytics, competitive analysis, and market research. This approach allows the company to provide actionable insights that drive business success.

The company's focus on innovation and customer satisfaction has positioned it as a leader in the industry. Through continuous development and strategic partnerships, Similarweb continues to enhance its offerings and expand its reach, solidifying its position in the market.

Similarweb achieved positive free cash flow for the first time as a public company in Q4 2023, generating $3.5 million. This positive trend continued into Q1 2024 ($9.7 million), Q2 2024 ($6 million), and Q3 2024. The company reached its first full fiscal year of non-GAAP operating profit and free cash flow in 2024.

In Q1 2024, Similarweb acquired Admetricks, a digital ad intelligence provider. The acquisition of 42matters AG, an app intelligence provider, occurred in Q2 2024. The company launched new products and features, including App Intelligence, AI Chatbot data, and new AI Agents in Q1 2025.

Similarweb's competitive advantages stem from its comprehensive data coverage, AI-based platform, and real-time monitoring capabilities. The platform provides detailed insights into website traffic, user engagement, and audience demographics. The company's ability to integrate diverse data sets, including web and app intelligence, and leverage AI for enhanced insights, allows it to adapt to new trends.

Similarweb's customer base reached 4,844 by the end of Q1 2024, a 16% increase year-over-year. As of Q3 2024, the customer base further grew to 5,308, marking a 21% increase year-over-year. This growth demonstrates the increasing demand for its services.

Similarweb offers a robust platform for website analytics and competitive analysis. It provides detailed insights into website traffic, user engagement, and audience demographics. The platform's AI-driven approach ensures accuracy and reliability, giving businesses a competitive edge. For a deeper understanding of the company's strategic direction, consider reading about the Growth Strategy of SimilarWeb.

- Website analytics: Provides comprehensive data on website traffic and user behavior.

- Competitive analysis: Enables businesses to analyze their competitors' strategies and performance.

- Market research: Offers insights into industry trends and market opportunities.

- Similarweb features: Includes various tools for SEO, lead generation, and more.

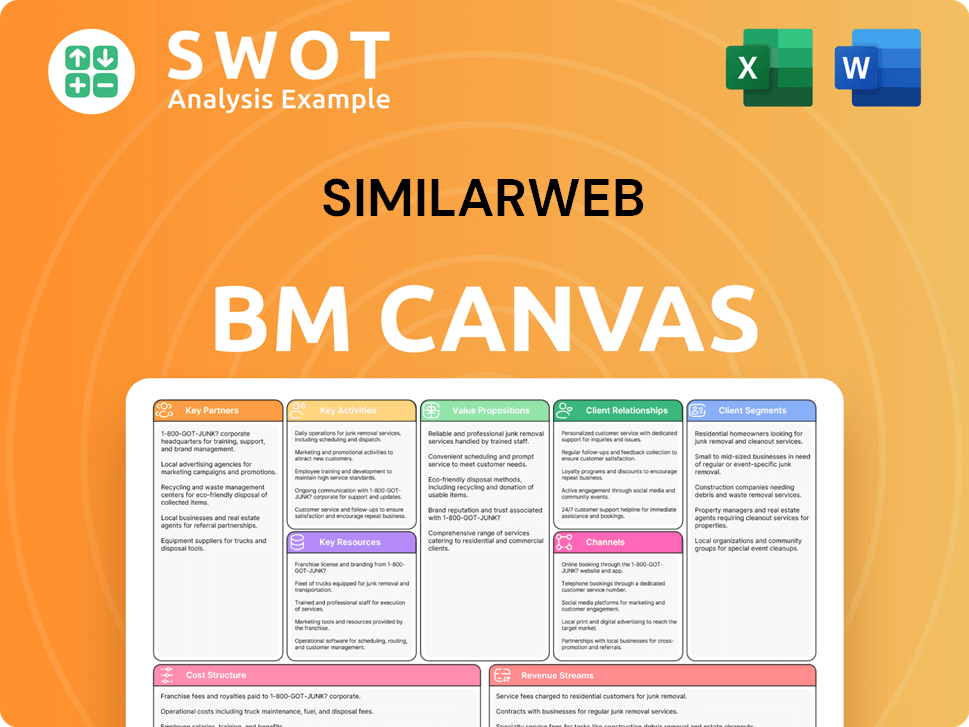

SimilarWeb Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is SimilarWeb Positioning Itself for Continued Success?

Similarweb holds a strong position in the digital intelligence market, recognized as a leading platform for web and mobile app traffic insights. It shows strong online visibility through high organic traffic and keyword rankings. As of Q3 2024, the company had 5,308 customers, with 395 enterprise customers contributing significantly to its annual recurring revenue.

Despite this, Similarweb faces potential short-term challenges, including increased investments in R&D and go-to-market teams, along with foreign exchange headwinds. In Q1 2025, the company reported a non-GAAP operating loss of $(1.3) million, contrasting with a $2.8 million profit in Q1 2024. The Q1 2025 revenue of $65.6 million was below the $76 million consensus, with analysts projecting an $18 million net loss in 2025 and breakeven delayed until 2026.

Similarweb is a key player in the website analytics and competitive analysis space. Its comprehensive data and insights help businesses understand market trends and competitor strategies. The platform's strong market presence is supported by its ability to provide detailed website traffic analysis and industry analysis, making it a valuable tool for various business functions.

The company faces risks related to increased spending on R&D and go-to-market activities, which may pressure short-term profitability. Foreign exchange fluctuations also pose a challenge, given its global revenue base. Additionally, questions about the effectiveness of sales execution and the timing of returns on increased spending could impact its financial performance.

Similarweb aims to achieve profitable growth and expand its digital data capabilities by investing in AI and enhancing product offerings. The company anticipates continued revenue growth, with full-year 2024 revenue guidance between $249.0 million and $250.0 million. For 2025, total revenue is projected to be between $285 million and $288 million, representing approximately 15% year-over-year growth.

Strategic initiatives include integrating AI solutions, supporting consumer behavior insights, and providing data for Large Language Model (LLM) training. The company is focused on achieving its long-term profit and free cash flow targets, with accelerated growth expected in the second half of 2025. Further insights into the platform's strategic approach can be found in an article about the Marketing Strategy of SimilarWeb.

The company's financial performance is closely watched. The Q1 2025 revenue was $67.1 million, below the consensus. For the full year 2024, revenue guidance is in the range of $249.0 million to $250.0 million. 2025 total revenue is expected to be between $285 million and $288 million, representing approximately 15% year-over-year growth.

- Q1 2025 Revenue: $67.1 million

- Full Year 2024 Revenue Guidance: $249.0 - $250.0 million

- Full Year 2025 Revenue Projection: $285 - $288 million

- 2025 Net Loss Projection: $18 million

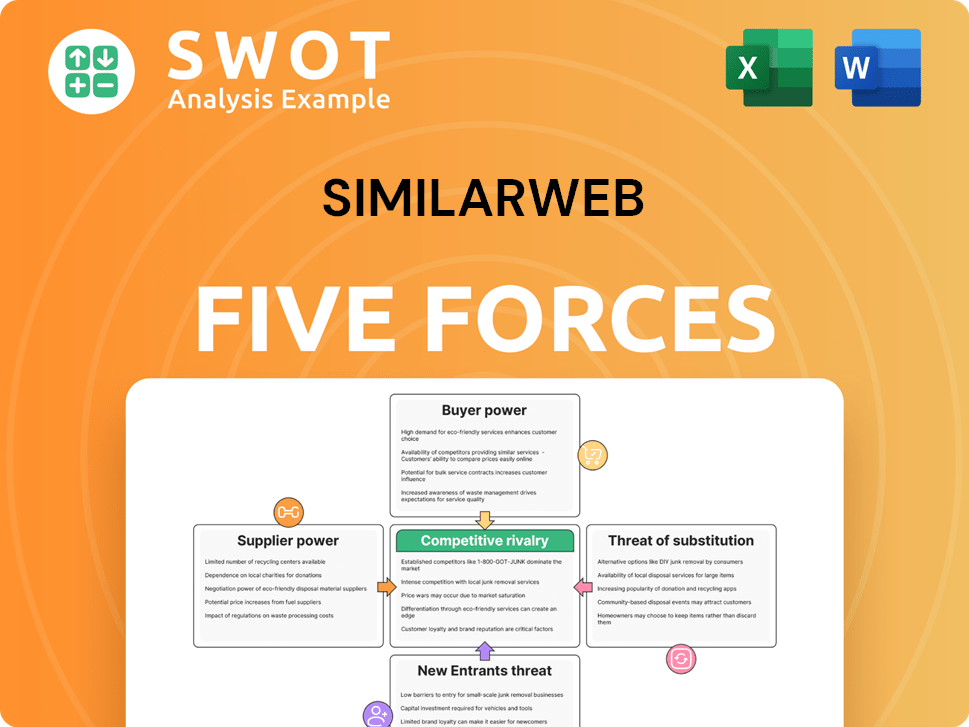

SimilarWeb Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SimilarWeb Company?

- What is Competitive Landscape of SimilarWeb Company?

- What is Growth Strategy and Future Prospects of SimilarWeb Company?

- What is Sales and Marketing Strategy of SimilarWeb Company?

- What is Brief History of SimilarWeb Company?

- Who Owns SimilarWeb Company?

- What is Customer Demographics and Target Market of SimilarWeb Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.