Singapore Airlines Bundle

Can Singapore Airlines Maintain Its Flight to Success?

From its humble beginnings in 1972, Singapore Airlines (SIA) has soared to become a global aviation leader, renowned for its exceptional service and luxurious offerings. This success story, built on a foundation of strategic foresight and commercial acumen, now faces the challenges and opportunities of a rapidly evolving Singapore Airlines SWOT Analysis. The airline's journey is a compelling case study in strategic planning and market adaptation.

This analysis delves into the growth strategy and future prospects of Singapore Airlines, examining its impressive performance in the airline industry. We'll explore its recent financial triumphs, including record-breaking profits and passenger numbers, while also considering the complexities of market analysis, strategic planning, and the dynamic global environment. Understanding SIA's approach to growth initiatives Singapore Airlines and its vision for the future of air travel Singapore provides valuable insights for investors and business strategists alike.

How Is Singapore Airlines Expanding Its Reach?

The Singapore Airlines is actively pursuing aggressive expansion initiatives to strengthen its global network and boost passenger capacity. These plans are particularly evident in its strategies for the 2025 Northern Summer operating season, running from March 30, 2025, to October 25, 2025. This expansion focuses on increasing flight frequencies to popular destinations and entering new markets, reflecting a proactive approach to the growth strategy within the airline industry.

The airline's strategic moves are designed to capture market share, diversify revenue streams, and cater to the growing demand for air travel. This is achieved through a combination of increased flight frequencies, new route launches, and strategic partnerships. These initiatives are key components of the Singapore Airlines future prospects, positioning the company for sustained growth and enhanced competitiveness.

These expansion efforts are part of a broader strategy to solidify its position in the market analysis and adapt to the evolving demands of the global travel landscape. The airline's focus on strategic planning and partnerships highlights its commitment to long-term growth and resilience in a dynamic industry. For more insights into the company's origins, consider reading the Brief History of Singapore Airlines.

The airline is increasing flight frequencies to several key destinations. London (Gatwick) services will increase to daily flights, bringing the total London services to five daily flights. Services to Rome will increase to five times a week, and direct flights to Barcelona will rise to five times weekly, while Milan will see a daily service.

In the Asia-Pacific region, flights to Adelaide will increase to 10 a week, and frequencies to Ho Chi Minh City will rise to thrice daily. Siem Reap will also see an increase to twice daily services. Additionally, the airline is expanding its mainland China network to cover seven cities and eight airports, with flight density gradually increasing to 98 flights per week.

A new daily route from Beijing (Daxing) to Singapore will start on November 11, 2024. Flights between Singapore and Seattle will increase to five times weekly from May 30, 2025. These new routes and increased frequencies demonstrate the airline's commitment to expanding its global footprint and catering to growing demand.

Following regulatory approval in July 2024, Garuda Indonesia and the airline will introduce joint fare products in the first quarter of 2025. All Nippon Airways (ANA) and the airline will begin operating revenue-sharing flights between Singapore and Japan from September 2025, with joint fare products available from May 2025. These partnerships aim to enhance route networks and improve customer offerings.

The expansion initiatives include increased flight frequencies, new route launches, and strategic partnerships. These efforts are designed to capture market share and diversify revenue streams. The airline is focused on enhancing its route network and improving customer offerings through these strategic moves.

- Increased London services to five daily flights.

- Expansion in the Asia-Pacific region with increased frequencies to key cities.

- New daily route from Beijing (Daxing) to Singapore starting November 11, 2024.

- Strategic partnerships with Garuda Indonesia and All Nippon Airways (ANA).

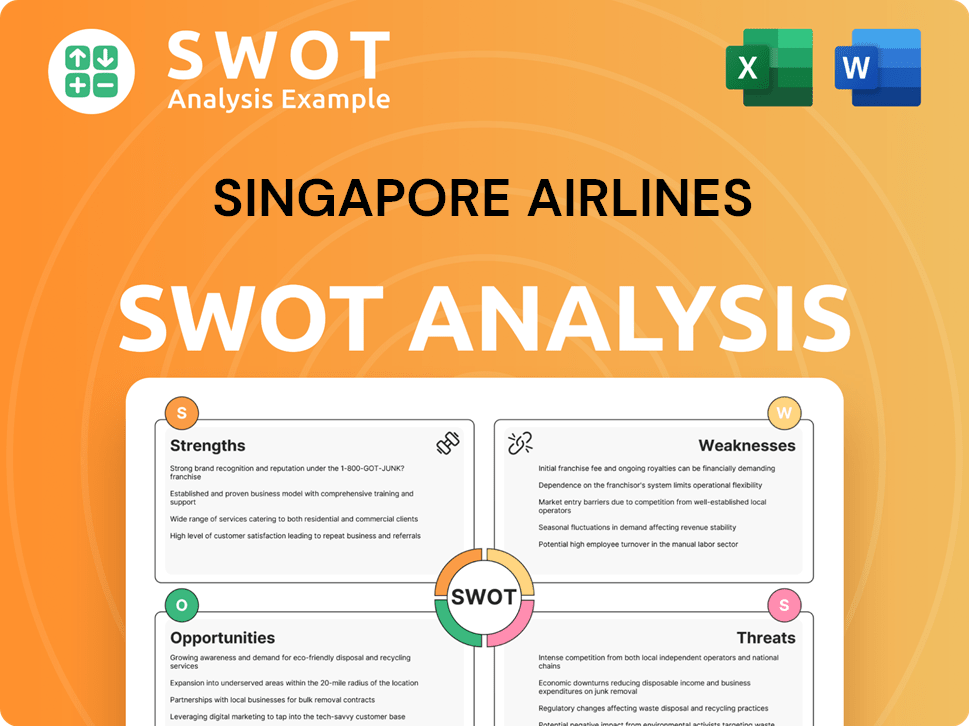

Singapore Airlines SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Singapore Airlines Invest in Innovation?

The Revenue Streams & Business Model of Singapore Airlines reveals how the company focuses on innovation and technology to drive its growth strategy. This approach is crucial for maintaining its competitive advantage in the dynamic airline industry. By embracing digital transformation and investing in cutting-edge technologies, the airline aims to enhance operational efficiency and provide superior customer experiences, securing its future prospects.

The core of the company's strategy involves leveraging technology to create seamless and personalized customer experiences. This includes revamping digital platforms, implementing advanced data analytics, and integrating AI solutions. These initiatives are designed to meet evolving customer expectations and streamline operations, ensuring the airline remains at the forefront of innovation.

The airline's commitment to innovation is evident in its partnerships and investments in digital capabilities. These efforts are geared towards enhancing customer service, optimizing processes, and improving overall efficiency. The airline's focus on digital transformation and technological advancements positions it well for sustained growth in the competitive market.

The airline has invested heavily in digital capabilities. This includes revamping its mobile application to offer real-time flight updates and personalized travel recommendations. The goal is to provide seamless and personalized customer experiences through intelligent digital solutions.

Advanced data analytics are used to improve operational efficiency. By analyzing data from flight operations, customer feedback, and maintenance records, the airline can predict and mitigate potential issues. This proactive approach enhances overall performance.

For cargo management, the airline adopted the iCargo platform. This digital solution scales online distribution and integrates seamlessly with partners. This enhances the efficiency of cargo operations.

The airline is collaborating with OpenAI to develop and implement advanced Generative Artificial Intelligence (GenAI) solutions. This partnership aims to improve customer servicing capabilities, streamline processes, and enhance operational efficiencies.

An enhanced AI-powered virtual assistant on the website will offer smarter, more personalized support. This helps customers plan, book, and manage their journeys. This improves the overall customer experience.

The budget subsidiary, Scoot, continues to invest in digital enhancements and automation. This includes a rearchitected website supporting hyper-personalization. This drives self-service capabilities and efficiencies.

The airline's technological initiatives focus on improving operational efficiency, enhancing customer experiences, and fostering a culture of continuous improvement. These efforts are crucial for its growth strategy and future prospects.

- AI-Powered Solutions: Implementing AI to enhance customer service and streamline processes.

- Data Analytics: Using data to optimize flight operations and predict potential issues.

- Digital Platforms: Revamping mobile applications and websites for personalized experiences.

- Cargo Management: Utilizing digital platforms like iCargo for efficient cargo operations.

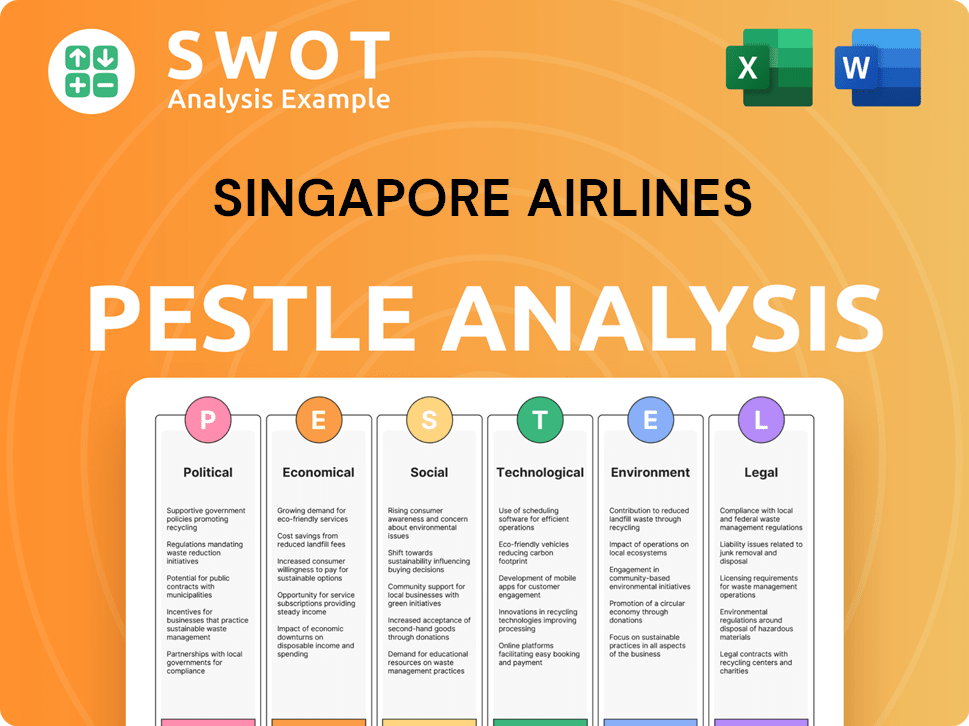

Singapore Airlines PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Singapore Airlines’s Growth Forecast?

The financial outlook for Singapore Airlines (SIA) reflects a complex interplay of record-breaking revenue and increased expenses. The SIA Group achieved a record net profit of US$2.78 billion for the financial year 2024/25, a 3.9% increase from the previous year. This positive result was significantly influenced by a one-time accounting gain of US$1.1 billion from the Air India-Vistara merger in November 2024, where SIA acquired a 25.1% stake in the newly enlarged Air India.

Overall revenue for the SIA Group reached a record US$19.54 billion in FY2024/25, marking a 2.8% year-on-year increase. This growth was fueled by strong demand in both passenger and cargo markets, alongside record passenger volumes. However, the group's operating profit decreased by 37.3% to US$1.71 billion due to rising expenditures. Non-fuel costs, in particular, increased by 11% because of capacity expansion and inflationary pressures. Passenger yields also decreased by 5.5% to 10.3 cents per revenue passenger-kilometer, reflecting intensified competition within the airline industry.

As of March 31, 2025, the Group's shareholder equity was US$15.7 billion. The board proposed a final dividend of 30 Singapore cents per share, bringing the total dividend for the year to 40 cents per share, or US$1.2 billion. This financial performance highlights the company’s resilience and strategic approach in navigating the challenges and opportunities within the dynamic airline industry.

Despite a decrease in operating profit, the SIA Group's revenue reached a record high of US$19.54 billion. This was driven by strong passenger and cargo demand. The net profit also saw a rise, reaching US$2.78 billion, supported by a one-time gain from the Air India-Vistara merger. These figures demonstrate the company's ability to capitalize on market opportunities.

Increased expenditure, especially in non-fuel costs, led to a decline in operating profit. Passenger yields also decreased due to heightened competition. The company is focusing on disciplined cost management to offset these pressures and maintain profitability. This approach is crucial for sustaining competitiveness.

The Group's shareholder equity stood at US$15.7 billion as of March 31, 2025. A final dividend of 30 Singapore cents per share was recommended, bringing the total payout for the year to 40 cents per share. This reflects the company's commitment to rewarding shareholders while maintaining a strong financial position.

Looking ahead, SIA anticipates sustained growth through its dual-brand strategy, strategic partnerships, and investments in fleet and technology. The company is well-positioned to capture future demand through disciplined cost management and its Asia-Pacific anchored diversified network. This strategic planning is vital for long-term success.

The airline industry faces macroeconomic uncertainty and geopolitical tensions, which impact operating margins. Intensified competition is also a key factor influencing financial performance. SIA's ability to adapt to these challenges is crucial for maintaining its market position. For a deeper dive into the competitive landscape, consider reading about the strategic planning of the company in this article: 0.

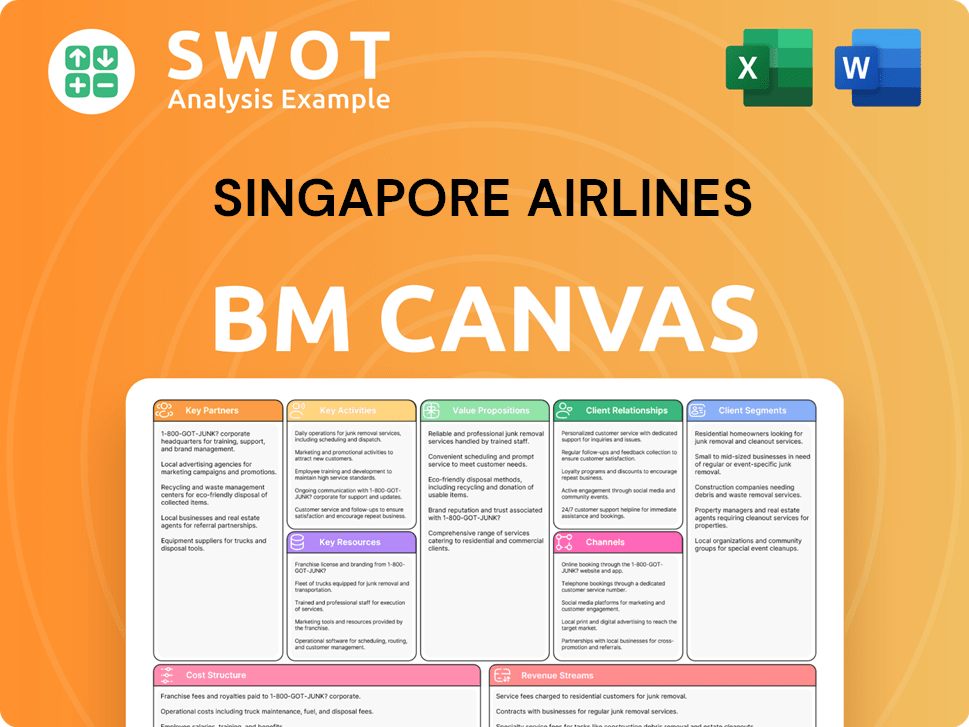

Singapore Airlines Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Singapore Airlines’s Growth?

The Singapore Airlines faces various potential risks and obstacles that could affect its Growth strategy and Future prospects. These challenges stem from both internal and external factors, requiring the company to adopt proactive measures to maintain its competitive edge in the dynamic Airline industry. Successful navigation of these risks is crucial for the company's long-term success and ability to execute its Growth initiatives Singapore Airlines.

Intensifying competition, fluctuating fuel prices, and geopolitical uncertainties are among the significant challenges. Moreover, supply chain disruptions and delays in aircraft deliveries can hinder the airline's operational efficiency and expansion plans. Understanding and addressing these risks through effective Strategic planning is vital for the airline's future.

Singapore Airlines operates in a competitive environment, facing pressure from both full-service airlines and low-cost carriers. The recovery in profits among most airlines is allowing route expansion to resume, increasing competition. According to a 2024 report, the global airline industry is expected to see a 5.2% increase in passenger traffic, intensifying competition further. This requires Singapore Airlines to maintain a strong Singapore Airlines competitive advantage through service excellence and strategic route planning.

Fluctuating fuel prices pose a significant risk, as fuel costs constitute a substantial portion of operating expenses. Sudden price surges can negatively impact profitability, even with hedging strategies. In 2024, jet fuel prices have shown a 10% volatility, affecting airline profitability.

Geopolitical tensions, trade disputes, and global economic uncertainties can impact consumer and business confidence. These factors affect both passenger and cargo demand. Economic downturns can lead to reduced travel, as seen during the 2020 economic crisis, where air travel demand dropped by over 60%.

Supply chain issues, including a shortage of spare parts, can lead to extended maintenance cycles and aircraft groundings. Delays in aircraft deliveries also pose a challenge. These disruptions increase costs and hinder expansion plans. Boeing's delays in aircraft deliveries have impacted several airlines, including Singapore Airlines, potentially affecting its expansion plans.

Singapore Airlines' reliance on international markets makes it susceptible to global events. The attractiveness of Singapore's Changi Airport as a transit hub faces competition from regional hubs. Any disruption in international travel or changes in transit patterns can significantly affect the airline's performance. The Impact of COVID-19 on Singapore Airlines highlighted this vulnerability, with international travel restrictions severely impacting its operations.

The rise of low-cost carriers (LCCs) in key markets puts pressure on passenger yields. LCCs often offer lower fares, attracting price-sensitive travelers. This competition requires Singapore Airlines to differentiate itself through superior service and premium offerings. The Singapore Airlines business model must adapt to compete effectively in this environment.

Implementing Singapore Airlines digital transformation initiatives can be complex. Cybersecurity threats and the need for significant investment in technology infrastructure are potential obstacles. Successful digital transformation is crucial for improving customer experience and operational efficiency. As highlighted in the article Mission, Vision & Core Values of Singapore Airlines, technology plays a key role in the airline's future.

To mitigate these risks, Singapore Airlines focuses on product leadership, service excellence, and investments in next-generation aircraft and new cabin products. Cost control measures and digitalized procedures are also implemented. Enhancing the Singapore Airlines customer experience is a key priority.

Strategic partnerships can help diversify revenue streams and expand market reach. Collaborations with other airlines and travel-related businesses can enhance competitiveness. These Singapore Airlines partnerships are essential for navigating the complex market. The airline's Singapore Airlines route network can be enhanced through these collaborations.

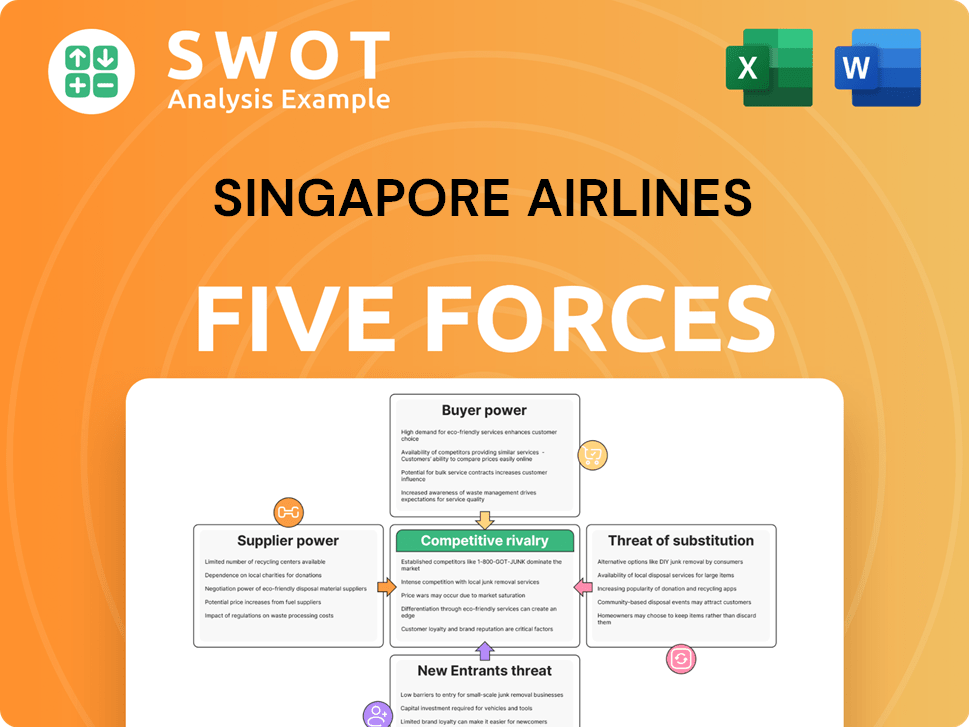

Singapore Airlines Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Singapore Airlines Company?

- What is Competitive Landscape of Singapore Airlines Company?

- How Does Singapore Airlines Company Work?

- What is Sales and Marketing Strategy of Singapore Airlines Company?

- What is Brief History of Singapore Airlines Company?

- Who Owns Singapore Airlines Company?

- What is Customer Demographics and Target Market of Singapore Airlines Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.