Skechers USA Bundle

Can Skechers Continue Its Winning Streak?

From its humble beginnings in 1992, Skechers U.S.A., Inc. has transformed into a global powerhouse in the footwear industry. This journey, marked by innovative designs and strategic expansion, showcases a compelling Skechers USA SWOT Analysis of its growth strategy. But what does the future hold for this footwear giant?

This analysis delves into Skechers' remarkable Skechers growth strategy, examining its Skechers business model and impressive Skechers financial performance. We'll explore its Skechers market analysis, including Skechers expansion plans in Europe and other international market opportunities, to understand its Skechers future prospects. Furthermore, we will investigate the impact of Skechers footwear industry trends and Skechers new product development on its continued success.

How Is Skechers USA Expanding Its Reach?

The Skechers growth strategy is heavily focused on global expansion and diversifying its distribution channels. This approach is designed to increase market share and strengthen the company's presence worldwide. The company's strategic initiatives include opening new stores and expanding its direct-to-consumer (DTC) business.

Skechers USA plans to open between 150–170 new company-owned stores in 2025, with a focus on high-growth regions. These regions include EMEA (Europe, Middle East, and Africa) and Latin America. This expansion is a key part of Skechers' future prospects.

The company's global footprint is already significant, as international sales accounted for 57.7% of total sales in 2024. The first quarter of 2025 showed continued growth in international sales, with a 7.2% increase overall. EMEA sales surged by 13.0%, and the Americas region saw a 7.3% increase, highlighting the effectiveness of its expansion efforts.

Skechers market analysis indicates strong potential in underserved markets. The company is strategically entering new markets, such as Argentina, with its first store opening there. This expansion into new regions is a crucial part of its growth strategy.

Skechers business model includes a strong emphasis on DTC channels, including e-commerce and retail stores. This strategy enhances customer engagement and boosts profitability. DTC sales increased by 19.2% in 2024.

Skechers financial performance is supported by selective brand licensing, which expands reach without significant capital investment. As of December 31, 2024, the company had 25 active licensing agreements. This strategy helps to broaden the brand's presence.

To support its growing global reach and operational efficiency, Skechers continues to invest in distribution capacity. Planned expansions are underway in North America, China, and Europe. These investments are vital for supporting the company's expansion plans.

Skechers' expansion initiatives are multifaceted, focusing on both geographical and channel diversification. The company is committed to sustainable growth through strategic investments and partnerships. This approach aims to capitalize on Skechers international market opportunities.

- Opening 150–170 new company-owned stores in 2025.

- Expanding DTC sales, which grew by 17.3% in Q1 2024, reaching $829.9 million.

- Strategic brand licensing agreements.

- Investing in distribution capacity in key regions.

Skechers USA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Skechers USA Invest in Innovation?

The foundation of the Skechers growth strategy lies in its commitment to innovation and technology. This approach is crucial for staying competitive in the dynamic footwear market. Skechers USA consistently invests in research and development to create new designs and incorporate advanced technologies into its products, ensuring they meet evolving consumer needs.

Digital transformation is another key area where Skechers focuses on enhancing its customer experience and operational efficiency. This includes improvements to its website, mobile apps, and customer loyalty programs. The strategic use of technology supports Skechers' business model, allowing it to adapt to market changes and maintain a strong market position.

By combining comfort, technology, and strategic partnerships, Skechers aims to maintain its competitive edge. This strategy supports its financial performance and positions the company for continued growth in both domestic and international markets.

Skechers' dedication to innovation is reflected in its significant investments in research and development. In 2024, the company increased its R&D spending to approximately $125 million, demonstrating a 10% increase from the previous year. This investment is crucial for developing new products and enhancing existing ones, driving Skechers' future prospects.

- Skechers holds over 150 patents, showcasing its commitment to innovation.

- The 'Comfort Technology' product line, including Hands Free Slip-ins and Arch Fit shoes, highlights Skechers' focus on comfort and technology.

- Strategic collaborations with material science companies aim to create sustainable and high-performance footwear.

- The company's digital transformation strategy includes enhancing website features and mobile apps.

The company's focus on technology and innovation is a key driver of its success, as detailed in Revenue Streams & Business Model of Skechers USA. This approach supports Skechers' market analysis and allows the company to adapt to changing consumer preferences and industry trends.

Skechers USA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Skechers USA’s Growth Forecast?

Skechers has demonstrated robust financial health, driven by strong sales and strategic initiatives. The company's performance reflects effective management and adaptability in a dynamic market. This financial overview highlights key aspects of Skechers' financial outlook, including revenue, earnings, and strategic investments.

The company's financial success is a result of its strong brand presence and effective market strategies. Skechers' ability to maintain and grow its market share is a testament to its operational efficiency and consumer appeal. For a deeper understanding of the company's ownership structure, you can explore Owners & Shareholders of Skechers USA.

Skechers' financial outlook for 2025 indicates continued growth and strategic investments. The company's focus on expanding its distribution network and enhancing its product offerings positions it well for sustained success in the competitive footwear market.

Skechers achieved record annual sales of $8.97 billion in 2024, marking a 12.1% year-over-year increase. For the twelve months ending March 31, 2025, revenue reached $9.129 billion, reflecting a 10.66% increase year-over-year. This growth is a key indicator of Skechers' strong market position and effective strategies.

In the first quarter of 2025, Skechers reported record sales of $2.41 billion, a 7.1% increase compared to Q1 2024. This strong start to the year sets a positive tone for the company's financial performance and future prospects. Skechers' market analysis shows a steady increase in sales.

Skechers projects sales growth of 8.1% to 9.2% for 2025, anticipating revenue between $9.7 billion and $9.8 billion. These projections reflect the company's confidence in its growth strategy and its ability to navigate macroeconomic challenges. Skechers' expansion plans in Europe are a key part of this strategy.

Diluted EPS for 2024 increased by 19% to $4.16, driven by record annual sales and improved gross margins. The company expects 2025 EPS to be between $4.30 and $4.50. This growth in EPS demonstrates Skechers' ability to increase profitability. Skechers' stock price forecast 2024 is positive.

Gross margins increased slightly by 2.5% to 53.20% in 2024 due to lower costs per unit. This improvement in gross margins reflects efficient cost management and operational excellence. Skechers' marketing strategies for footwear have contributed to this increase.

Skechers plans significant capital expenditures of approximately $600 million to $700 million in 2025. These investments will support strategic initiatives, including distribution capacity, new stores, and corporate offices. The company aims to fund these expenditures through available cash and borrowings.

As of December 31, 2024, Skechers had $1.12 billion in cash and equivalents. This strong cash position provides financial flexibility for investments and future growth. The company's financial performance reflects effective management.

The planned capital expenditures highlight Skechers' commitment to expanding its infrastructure and market presence. These investments are crucial for supporting the company's long-term growth strategy. Skechers' retail store expansion is a key focus.

Key drivers of revenue growth include new product development, international market opportunities, and online sales growth. Skechers' performance footwear innovations and brand awareness campaigns also contribute to its success. Skechers' digital transformation strategy is also a key factor.

Skechers' market analysis indicates a strong position in the footwear industry, with opportunities for further expansion. The company's business model is designed to adapt to changing market trends. Skechers' competitive landscape analysis shows a strong position.

While the company faces macroeconomic headwinds and foreign exchange risks, Skechers' financial performance remains robust. The company's strategies are designed to mitigate the impact of economic downturns. Skechers' sustainability initiatives also play a role.

Skechers' future prospects are positive, with continued growth expected in both revenue and earnings. The company's focus on innovation, expansion, and operational efficiency positions it well for long-term success. Skechers' international market opportunities are significant.

Skechers USA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Skechers USA’s Growth?

The success of Skechers USA hinges on navigating several potential risks and obstacles. These challenges range from intense competition in the footwear market to broader macroeconomic factors that could affect consumer spending and international sales. Understanding these hurdles is crucial for assessing Skechers' ability to achieve its growth objectives.

Market competition, especially from established giants, presents a significant challenge. Furthermore, the company faces supply chain vulnerabilities and the impact of global trade policies. External pressures, such as economic downturns and currency fluctuations, add complexity to Skechers' strategic planning and financial performance.

The footwear market is highly competitive, with formidable rivals like Nike and Adidas possessing greater resources for marketing, distribution, and financial backing. This competitive landscape puts pressure on Skechers, particularly in a price-sensitive market where price wars and discount-driven sales are common. Skechers' business model must adapt to these conditions to maintain its market position.

Skechers faces intense competition from larger companies like Nike and Adidas, which have more resources. This competition affects Skechers' ability to gain market share and maintain profitability. The Skechers market analysis must account for these competitive pressures.

A significant portion of Skechers' footwear is manufactured in foreign countries, mainly China and Vietnam, creating supply chain risks. Disruptions in these areas can severely impact production and sales. The Skechers business model is affected by these supply chain dependencies.

New tariffs on Chinese imports could increase costs, potentially leading to higher prices for consumers. This impacts the Skechers financial performance. The company must carefully manage these cost pressures to remain competitive.

Macroeconomic uncertainty, including the potential impact of tariffs, has led Skechers to withdraw its full-year sales and profit forecasts. This uncertainty complicates strategic planning. The Skechers stock price forecast 2024 may be impacted by these factors.

Skechers caters to a value-conscious consumer base, making it vulnerable to changes in consumer spending. Inflation and economic downturns can negatively impact sales. The Skechers impact of economic downturn should be considered.

A strong U.S. dollar can reduce revenue from international markets. This currency risk impacts revenue from Europe, China, and Latin America. The

Skechers is actively managing these risks through diversification of its supplier base, negotiating with vendors on foreign exchange rates, and optimizing sourcing to minimize tariff impacts. The

New tariffs could potentially increase the price of mid-range sneakers by $18 to $20. This could affect consumer demand and Skechers' pricing strategy. The

Mitigation Strategies

Tariff Impact

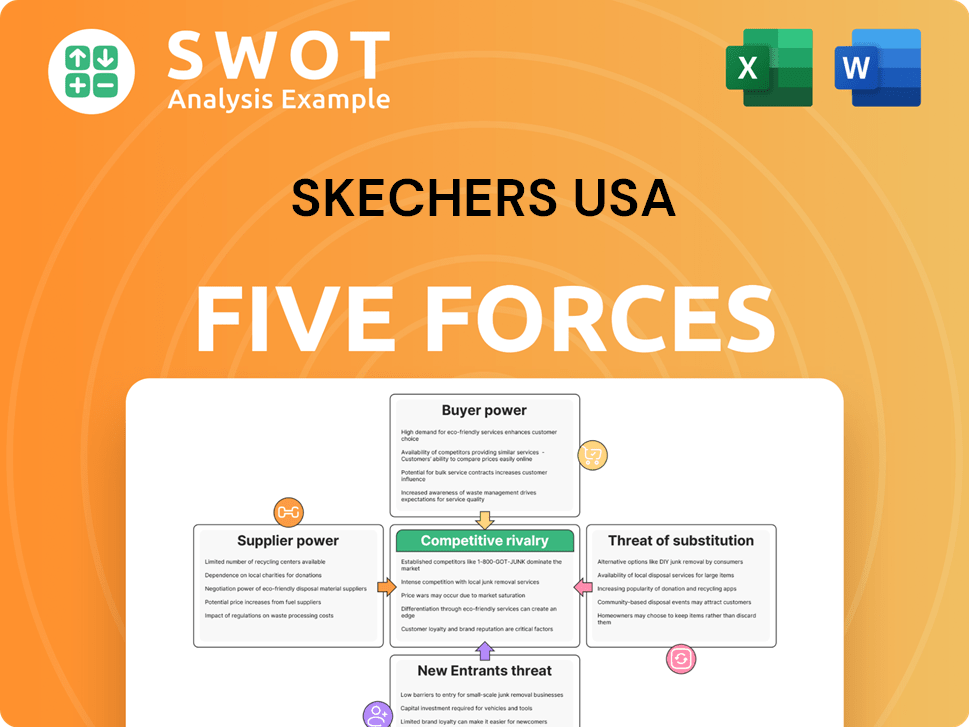

Skechers USA Porter's Five Forces Analysis

Related Blogs

- What are Mission Vision & Core Values of Skechers USA Company?

- What is Competitive Landscape of Skechers USA Company?

- How Does Skechers USA Company Work?

- What is Sales and Marketing Strategy of Skechers USA Company?

- What is Brief History of Skechers USA Company?

- Who Owns Skechers USA Company?

- What is Customer Demographics and Target Market of Skechers USA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.