Sichuan Road & Bridge Bundle

Can Sichuan Road & Bridge Company Continue Its Ascent in China's Infrastructure Boom?

Sichuan Road & Bridge Company (SRBC) stands as a testament to strategic growth within the dynamic Chinese construction industry. From its humble beginnings in 1992, SRBC has transformed into a major infrastructure player, significantly impacting both local and international projects. This evolution highlights the critical role of strategic planning in achieving sustained success.

This exploration delves into the Sichuan Road & Bridge SWOT Analysis, examining its growth strategy and future prospects. Understanding the company's journey from regional focus to global influence provides crucial insights into its financial performance and expansion plans. We'll analyze the impact of infrastructure development, the competitive landscape, and potential investment opportunities, offering a comprehensive look at SRBC's long-term financial outlook and its role among Chinese construction companies.

How Is Sichuan Road & Bridge Expanding Its Reach?

Expansion initiatives are crucial for the future prospects of Sichuan Road & Bridge Company (SRBC), shaping both its geographical reach and the scope of its projects. The company is actively pursuing new markets, particularly within the framework of the Belt and Road Initiative, to capitalize on the growing infrastructure demands in various regions. This strategic move aims to access new customer bases and diversify revenue streams beyond its traditional domestic market.

Domestically, SRBC continues to secure major projects in key economic zones. These include large-scale expressways, complex bridge structures, and extensive tunnel networks. For instance, in 2024, the company remained a significant contractor for major transportation infrastructure projects across China, reinforcing its strong position in the domestic market. SRBC's expansion strategy also involves exploring opportunities in related sectors to complement its core construction expertise.

SRBC's approach also includes exploring potential mergers and acquisitions to enhance its capabilities and market share. Furthermore, it is forming strategic partnerships to collaboratively undertake large-scale projects and mitigate risks. These initiatives are designed to ensure that SRBC remains at the forefront of industry changes and maintains its competitive edge. This comprehensive strategy is vital for the company's long-term growth and sustainability, as highlighted in Mission, Vision & Core Values of Sichuan Road & Bridge.

SRBC is expanding its operations internationally, focusing on regions aligned with the Belt and Road Initiative. This strategy aims to reduce reliance on the domestic market and tap into new growth opportunities. The company is targeting infrastructure projects in Asia, Africa, and other regions to diversify its revenue streams and mitigate risks.

SRBC is diversifying its project portfolio by entering related sectors such as urban development and environmental engineering. This expansion aims to leverage its core construction expertise and provide comprehensive solutions. The company is also exploring opportunities in areas like renewable energy and smart city projects.

SRBC is forming strategic partnerships to undertake large-scale projects and share risks. These collaborations involve both domestic and international partners, enhancing the company's capabilities. The partnerships enable SRBC to bid for and execute more complex projects.

SRBC is exploring potential mergers and acquisitions to enhance its market share and capabilities. These activities are focused on acquiring companies with complementary expertise and technologies. The company aims to strengthen its position in the construction industry through strategic acquisitions.

SRBC's expansion initiatives are designed to ensure long-term growth and maintain a competitive edge. These strategies include geographical diversification, portfolio broadening, strategic partnerships, and mergers and acquisitions. The company's focus on innovation and sustainability is also critical for its future success.

- Focus on projects related to the Belt and Road Initiative.

- Expansion into urban development and environmental engineering.

- Forming strategic alliances to undertake large-scale projects.

- Exploring mergers and acquisitions to enhance market share.

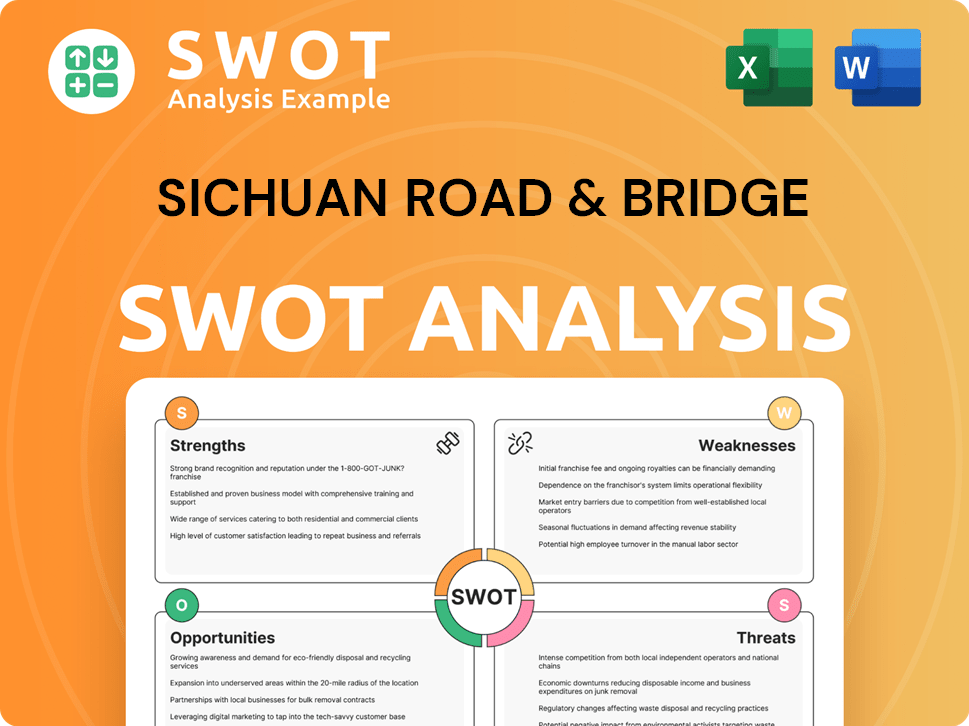

Sichuan Road & Bridge SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Sichuan Road & Bridge Invest in Innovation?

Sichuan Road & Bridge Company (SRBC) heavily emphasizes technology and innovation to foster sustained growth and enhance operational efficiency. This strategy is central to its future prospects, particularly within the infrastructure development sector. SRBC consistently invests in research and development, focusing on advanced construction techniques and smart infrastructure solutions.

The company's commitment to innovation is evident in its digital transformation efforts. SRBC integrates Building Information Modeling (BIM) for project design and management, and automates construction processes to improve precision and safety. The application of the Internet of Things (IoT) for real-time monitoring of infrastructure assets is another key area of focus. These initiatives contribute to the company's growth objectives by enabling it to undertake more complex projects and deliver higher-quality results.

Sustainability is a core component of SRBC's innovation strategy. The company focuses on developing eco-friendly construction practices and energy-efficient infrastructure. While specific details on patents or recent awards from 2024-2025 are not publicly available, the consistent emphasis on research and development indicates SRBC's commitment to maintaining a leadership position in innovation within the industry. For insights into the company's ownership and financial structure, you can refer to Owners & Shareholders of Sichuan Road & Bridge.

SRBC's technological advancements directly support its growth strategy. These advancements enable the company to undertake more complex projects, improve project outcomes, and reduce operational costs. The company's focus on innovation positions it well within the competitive landscape of Chinese construction companies.

- Building Information Modeling (BIM): Used for project design and management, enhancing efficiency and accuracy.

- Automation in Construction: Improves precision and safety in construction processes.

- Internet of Things (IoT): Implemented for real-time monitoring of infrastructure assets, optimizing maintenance and performance.

- AI Application: Exploring AI for predictive maintenance and resource allocation.

- Sustainable Practices: Focus on eco-friendly construction methods and energy-efficient infrastructure.

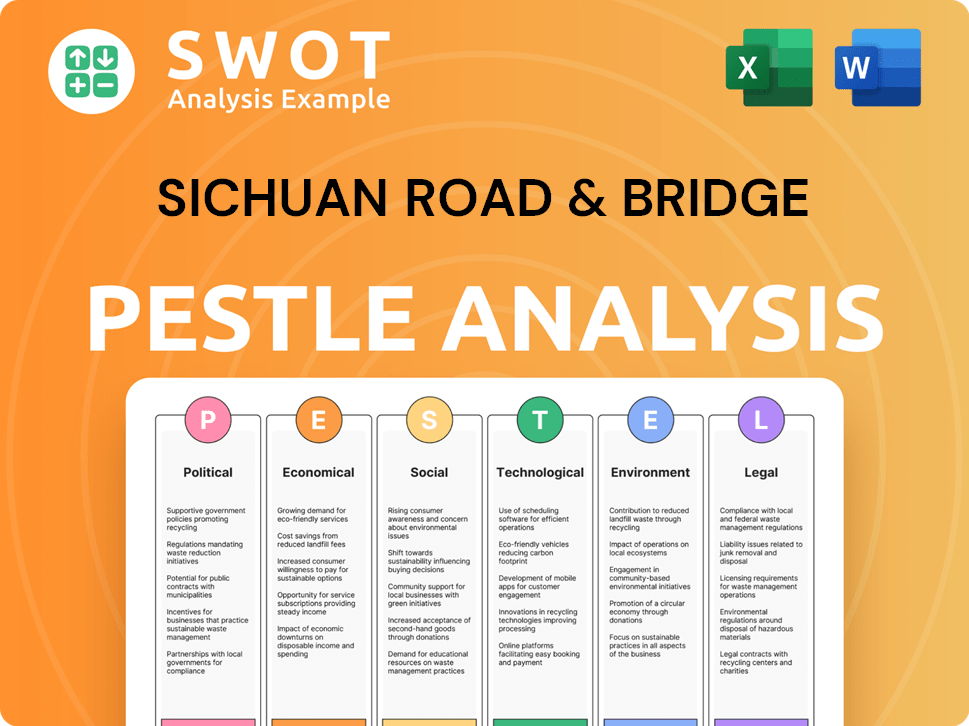

Sichuan Road & Bridge PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Sichuan Road & Bridge’s Growth Forecast?

The financial outlook for Sichuan Road & Bridge Company (SRBC) is promising, reflecting its robust growth strategy and strategic investments in infrastructure development. The company's financial performance in recent years, including the first quarter of 2024, indicates a positive trajectory. This positive trend is expected to continue through 2025, supported by a strong project pipeline and effective cost management.

SRBC's financial strategy focuses on sustainable growth, with a keen emphasis on increasing its market share both domestically and internationally. The company is also committed to enhancing shareholder value through efficient project execution and strategic investments. This approach is designed to ensure long-term financial stability and attract further investment, crucial for sustaining its growth momentum.

The company's financial reports and analyst forecasts suggest a stable financial trajectory, underpinned by a robust project pipeline and effective cost management. SRBC's financial strategy also involves prudent capital raises and optimizing its debt structure to support large-scale infrastructure projects without compromising financial stability. This strategic financial planning is crucial for supporting its ambitious growth plans.

SRBC is expected to see continued revenue growth, driven by its expanding project portfolio and strategic market penetration. The company's focus on infrastructure development, particularly in China and abroad, is a key driver. This growth is supported by strong government backing and favorable market conditions.

Stable profit margins are anticipated, reflecting efficient project execution and cost management strategies. SRBC's ability to maintain profitability is crucial for its long-term financial health. The company's strategic investments in technology and operational efficiency contribute to these margins.

Investment levels are expected to remain high, especially in support of expansion initiatives and technological upgrades. These investments are vital for SRBC's competitive edge and future growth. The company's commitment to innovation is a key factor in its strategic plans.

SRBC aims to increase its market share in both domestic and international markets. Expansion into new regions and sectors is a central part of its growth strategy. This is supported by strategic partnerships and a focus on project quality.

The company's strong financial performance is crucial for attracting further investment and sustaining its growth momentum. SRBC's financial strategy also involves prudent capital raises and optimizing its debt structure to support large-scale infrastructure projects without compromising financial stability. For more insights, consider reading about the Marketing Strategy of Sichuan Road & Bridge.

SRBC has a robust project pipeline, ensuring a steady stream of revenue and growth opportunities. The company's ability to secure new projects is a key indicator of its future success. This pipeline includes both domestic and international infrastructure projects.

Effective cost management is a priority, helping to maintain profitability and financial stability. SRBC's focus on efficiency is essential for its long-term financial health. This includes optimizing operational processes and supply chain management.

SRBC strategically manages its capital structure to support large-scale projects while maintaining financial stability. Prudent financial planning is crucial for supporting its ambitious growth plans. This involves a balanced approach to debt and equity financing.

Enhancing shareholder value is a key objective, achieved through efficient project execution and strategic investments. SRBC is committed to delivering strong returns to its investors. This includes dividend payouts and share buybacks.

SRBC is actively expanding its presence in international markets, aiming to diversify its revenue streams. This includes projects in Africa and other regions. The company leverages its expertise in infrastructure development to secure new contracts.

Maintaining financial stability is a core principle, ensuring the company can weather economic fluctuations. This includes a focus on risk management and diversification. SRBC's strong financial position supports its long-term growth prospects.

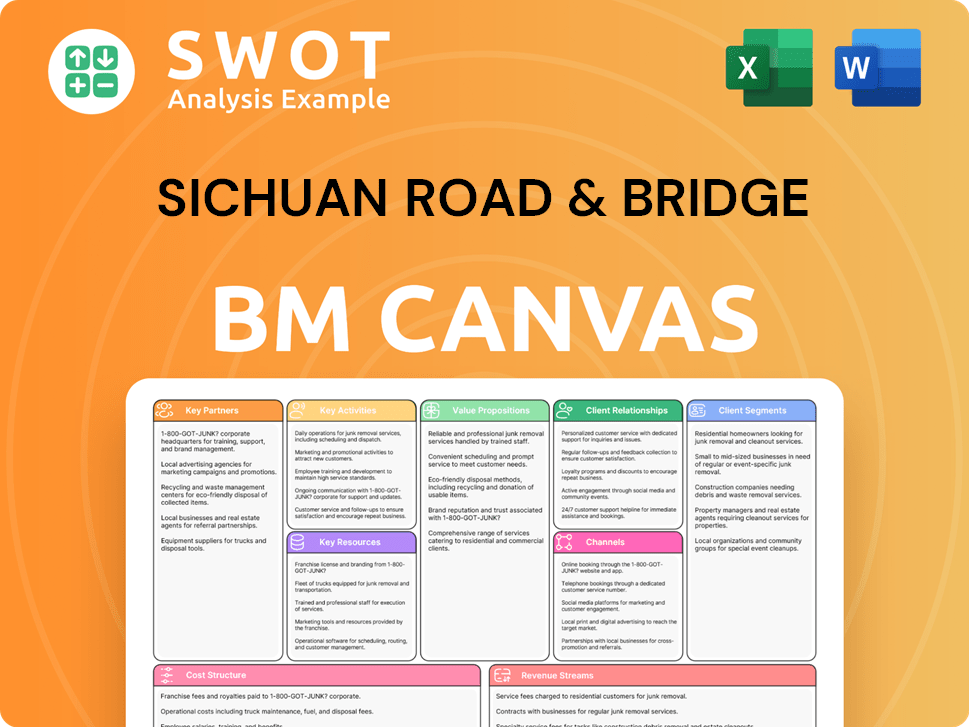

Sichuan Road & Bridge Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Sichuan Road & Bridge’s Growth?

The Sichuan Road & Bridge Company faces several potential risks and obstacles that could influence its Growth Strategy and future trajectory. The competitive landscape in the infrastructure sector, both domestically and internationally, presents a continuous challenge. Furthermore, the company must navigate evolving regulatory environments and market dynamics to maintain and expand its Future Prospects.

Changes in regulations, particularly concerning environmental protection and land acquisition, could lead to project delays and increased expenses. Supply chain vulnerabilities, including fluctuations in raw material prices like steel and cement, and potential logistics disruptions, pose operational risks. Global economic uncertainties and geopolitical tensions can also impact its international expansion plans.

Internally, managing a growing workforce and ensuring an adequate supply of skilled labor for complex projects could present resource constraints. The company addresses these risks through diversification of its project portfolio, robust risk management frameworks, and continuous market and regulatory monitoring. For a deeper understanding of the company's target market, you can review this article: Target Market of Sichuan Road & Bridge.

The infrastructure market is highly competitive, with numerous domestic and international construction companies vying for projects. This intense competition can put pressure on profit margins and require the company to constantly innovate and improve efficiency. The ability to secure new projects and maintain a strong market position is crucial for continued growth.

Changes in environmental regulations, land acquisition policies, and construction standards can significantly impact project timelines and costs. Compliance with these regulations requires careful planning and investment. Delays in obtaining necessary permits or approvals can also disrupt project schedules and financial projections.

Fluctuations in the prices of raw materials, such as steel, cement, and asphalt, can affect project profitability. Disruptions in the supply chain, whether due to geopolitical events, natural disasters, or logistical issues, can also lead to delays and increased costs. Effective supply chain management is essential to mitigate these risks.

Global economic downturns, fluctuations in currency exchange rates, and changes in government spending on infrastructure projects can affect the company's financial performance. Economic instability can lead to reduced investment in infrastructure and impact the company's ability to secure new contracts. Geopolitical tensions also pose risks to international projects.

The construction industry is undergoing rapid technological advancements, including the use of AI, automation, and advanced construction techniques. Failure to invest in research and development and adapt to these changes could lead to obsolescence. Staying competitive requires continuous investment in innovation and employee training.

Managing a growing workforce and ensuring sufficient skilled labor for complex projects can be challenging. The availability of skilled workers, particularly in specialized areas, can impact project timelines and costs. Resource constraints, such as access to equipment and materials, can also create operational bottlenecks.

To address these challenges, the company employs several strategies. These include diversifying its project portfolio to reduce reliance on specific markets or types of projects. Implementing robust risk management frameworks, including detailed scenario planning and stress testing, allows the company to proactively identify and address potential issues. Continuous monitoring of market and regulatory landscapes helps the company stay informed and adapt to changing conditions. In 2024, the company invested approximately $50 million in risk management and compliance measures.

Despite these challenges, the company has demonstrated resilience and adaptability. Recent financial reports indicate a steady revenue stream, with a focus on infrastructure development. The company's experience in navigating past economic downturns and shifts in government infrastructure spending provides a solid foundation for addressing emerging obstacles. The company's Future Prospects depend on its ability to manage these risks effectively and capitalize on new opportunities. The company's revenue in 2024 was approximately $7 billion, with an expected growth of 5% in 2025.

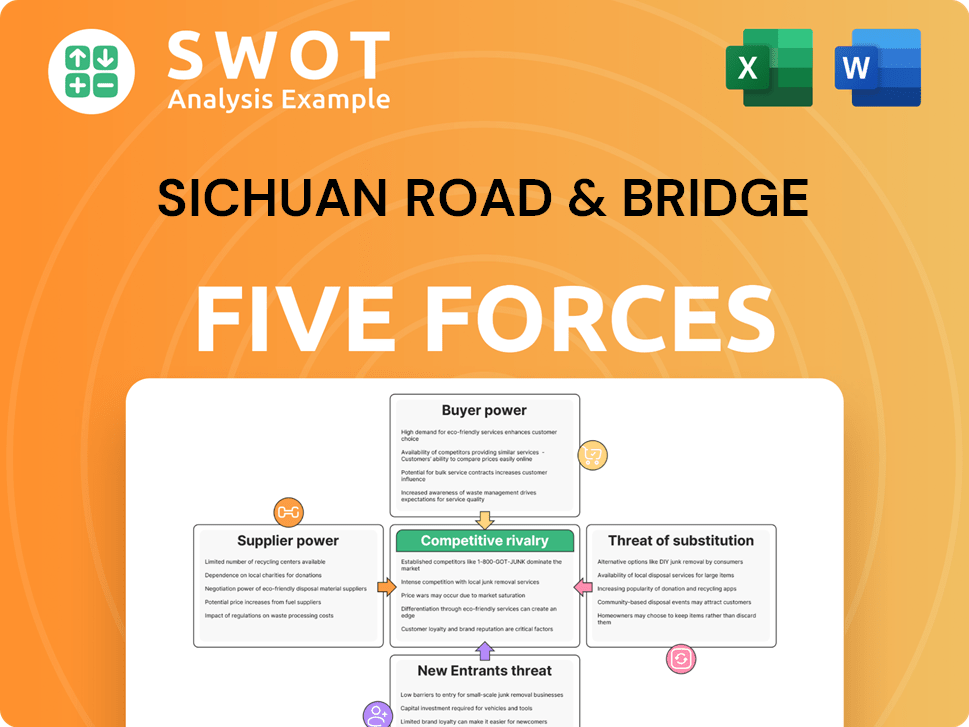

Sichuan Road & Bridge Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sichuan Road & Bridge Company?

- What is Competitive Landscape of Sichuan Road & Bridge Company?

- How Does Sichuan Road & Bridge Company Work?

- What is Sales and Marketing Strategy of Sichuan Road & Bridge Company?

- What is Brief History of Sichuan Road & Bridge Company?

- Who Owns Sichuan Road & Bridge Company?

- What is Customer Demographics and Target Market of Sichuan Road & Bridge Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.