Sichuan Road & Bridge Bundle

Who Really Controls Sichuan Road & Bridge Company?

Unraveling the ownership structure of a major player in China's infrastructure sector is crucial for understanding its strategic direction. The Sichuan Road & Bridge SWOT Analysis reveals critical insights, but first, let's delve into the core of its control. Understanding who owns Sichuan Road & Bridge Company (SRBC) is key to grasping its future in a dynamic market.

This exploration of SRBC ownership will examine the influence of its parent company and the impact of being a state-owned enterprise in China. We'll investigate the evolution of its ownership, from its roots in the 1950s to its current status as a significant player in Chinese infrastructure. Discovering the details of SRBC ownership provides a valuable perspective on investment potential and strategic decision-making within the construction and engineering sector.

Who Founded Sichuan Road & Bridge?

The establishment of Sichuan Road & Bridge Company (SRBC) on December 28, 1999, marked a significant milestone, although its origins trace back to the 1950s. SRBC's formation was rooted in the No. 18 Military Road Engineering Team and the Bridge section of the Southwest Road Construction Bureau. This background highlights SRBC's deep connection to China's infrastructure development, particularly within Sichuan province.

SRBC's early ownership structure was inherently governmental, reflecting its designation as a provincial state-owned enterprise. The company's emergence as a leading state-owned entity in Sichuan province in 1998 set the stage for its future growth. This initial state-backed status played a crucial role in shaping the company's strategic direction and operational framework.

The company's evolution from its origins to its listing on the stock exchange reflects China's economic reforms and infrastructure development. The initial public offering (IPO) on March 25, 2003, was a pivotal moment in SRBC's history, transitioning it from a state-owned entity to a publicly traded company. This IPO allowed SRBC to raise capital for large-scale projects and expand its presence in the Chinese infrastructure market.

The initial public offering (IPO) of Sichuan Road & Bridge Company occurred on March 25, 2003, at an issue price of CNY 6.87 per share. The IPO offered 100 million shares, marking a significant step in the company's transition to a publicly listed entity. This event allowed SRBC to access capital markets and fuel its growth in the Chinese infrastructure sector. The early agreements and policies were governed by state policies, common for state-owned enterprises (SOEs) in China.

- SRBC's early ownership was primarily governmental, reflecting its status as a state-owned enterprise.

- The IPO in 2003 introduced public shareholders while maintaining state control.

- The founding team's vision was aligned with China's infrastructure development goals.

- The company's mandate included undertaking large-scale construction projects.

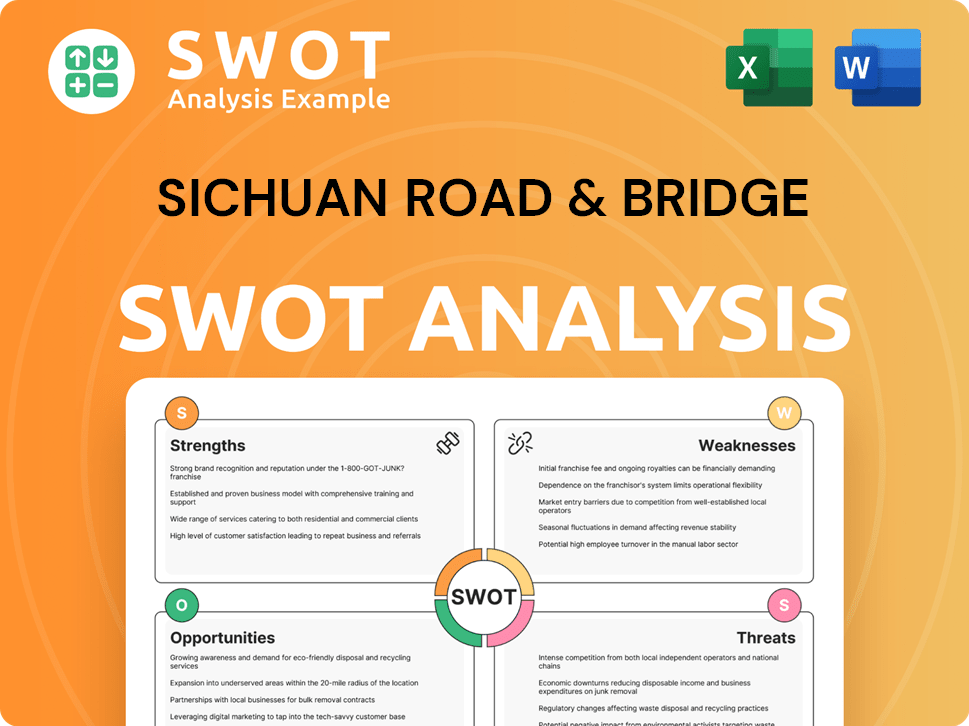

Sichuan Road & Bridge SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Sichuan Road & Bridge’s Ownership Changed Over Time?

The ownership structure of Sichuan Road & Bridge Company (SRBC) has been significantly shaped by its listing and subsequent developments. Initially listed on the Shanghai Stock Exchange in 2003, the company's ownership has been predominantly state-controlled. A pivotal moment occurred in 2012 with a major asset restructuring, transforming SRBC into a multinational state-owned conglomerate. This restructuring was crucial in shaping the company's current operational and strategic landscape.

The evolution of SRBC's ownership reflects the broader trends in Chinese infrastructure development and state-owned enterprise (SOE) reforms. The Sichuan State-Owned Assets Supervision & Administration Commission (SASAC) currently holds a substantial stake, underscoring the government's influence. Further consolidation of state control was evident in March 2025 with strategic reorganizations and share transfers. These changes highlight the ongoing role of the state in guiding SRBC's growth and investment decisions. Understanding the Target Market of Sichuan Road & Bridge provides additional insights into the company's strategic direction.

| Key Ownership Events | Date | Impact |

|---|---|---|

| Initial Public Offering (IPO) | 2003 | Listed on the Shanghai Stock Exchange, beginning of public ownership. |

| Asset Restructuring | 2012 | Transformed into a multinational state-owned conglomerate. |

| Share Transfer and Reorganization | March 2025 | Consolidated state-backed control. |

Beyond state ownership, institutional investors also play a significant role in SRBC's shareholding. As of October 2023, institutional investors held approximately 45% of the shares, while retail investors held around 35%. Key institutional players include China Investment Corporation and BlackRock. The company's market capitalization was approximately RMB 50 billion as of October 2023. These shifts in institutional holdings can signal market sentiment and influence stock performance.

SRBC's ownership is primarily state-controlled, with the SASAC holding a significant majority stake.

- SRBC is a subsidiary of Sichuan Railway Investment Group Co., Ltd. (SRIG).

- Institutional investors hold a substantial portion of the shares, influencing market dynamics.

- Recent share transfers and reorganizations have further solidified state control.

- Understanding the ownership structure is crucial for assessing the company's strategic direction and risk profile.

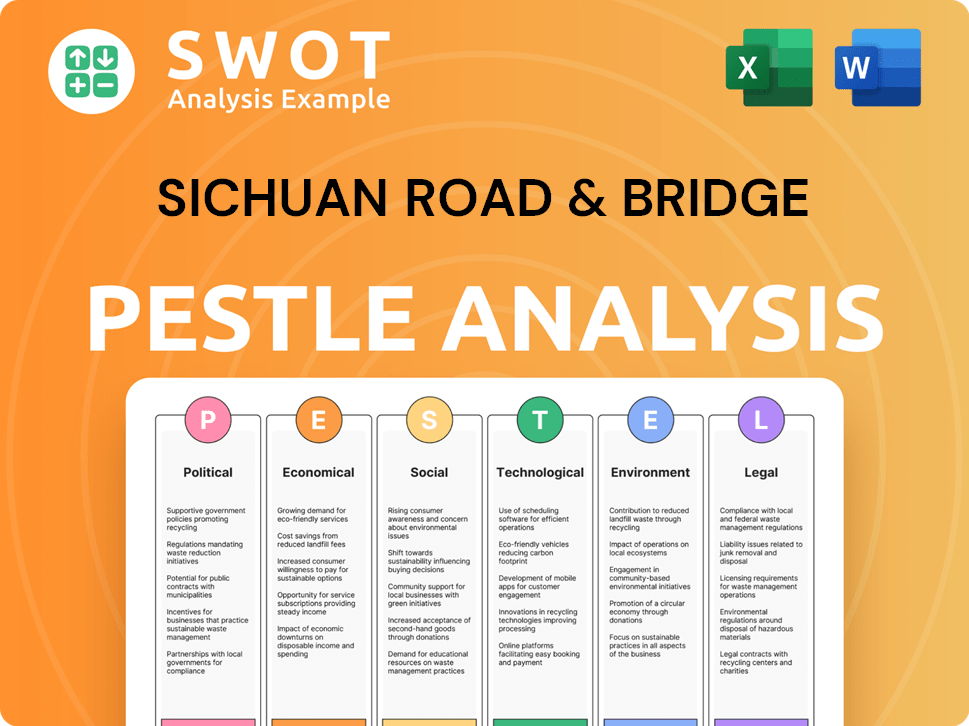

Sichuan Road & Bridge PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Sichuan Road & Bridge’s Board?

The current board of directors of the Sichuan Road & Bridge Company plays a critical role in its governance. The board operates under the significant influence of its state-owned parent entities. As of 2024, key executive board members include Huang Wei, Chairman, and Yang Yong, Vice Chairman. Sun Licheng is also listed as Chairman of the Executive Board as of 2024. Wang Xueling serves as Deputy General Manager. This composition likely reflects the company's ownership structure, with representatives from major state-backed shareholders.

The board's activities are integral to the strategic direction of the company. Recent board resolutions in June 2025, such as the approval of the acquisition of Chengdu Xinzhu Transportation Technology, demonstrate the board's active role in strategic moves. The board's decisions are heavily influenced by the controlling shareholders, ensuring alignment with the broader strategic objectives of the state-owned parent companies. This structure is typical of a State-owned enterprise China.

| Board Member | Title | Year |

|---|---|---|

| Huang Wei | Chairman | 2024 |

| Yang Yong | Vice Chairman | 2024 |

| Sun Licheng | Chairman of the Executive Board | 2024 |

| Wang Xueling | Deputy General Manager | 2024 |

Given that Sichuan State-Owned Assets Supervision & Administration Commission (SASAC) holds a dominant 73.82% of the shares, it exerts outsized control over the company's decision-making. Additionally, Sichuan Road & Bridge Group Co., Ltd. operates as a subsidiary of Sichuan Railway Investment Group Co., Ltd. This hierarchical structure implies that the parent entities, and by extension the provincial government, hold significant voting power and influence over the board's strategic and operational decisions. The substantial state ownership effectively grants controlling rights. For more insights into the company's growth strategy, you can refer to the article: Growth Strategy of Sichuan Road & Bridge.

The Sichuan Road & Bridge Company (SRBC) is significantly influenced by its state-owned parent companies, ensuring alignment with government objectives. The SASAC's substantial shareholding grants it considerable control over decision-making processes.

- State-owned entities have significant voting power.

- The board's decisions reflect the strategic goals of the parent companies.

- The company's legal structure reflects its government ties.

- SRBC is a key player in Chinese infrastructure.

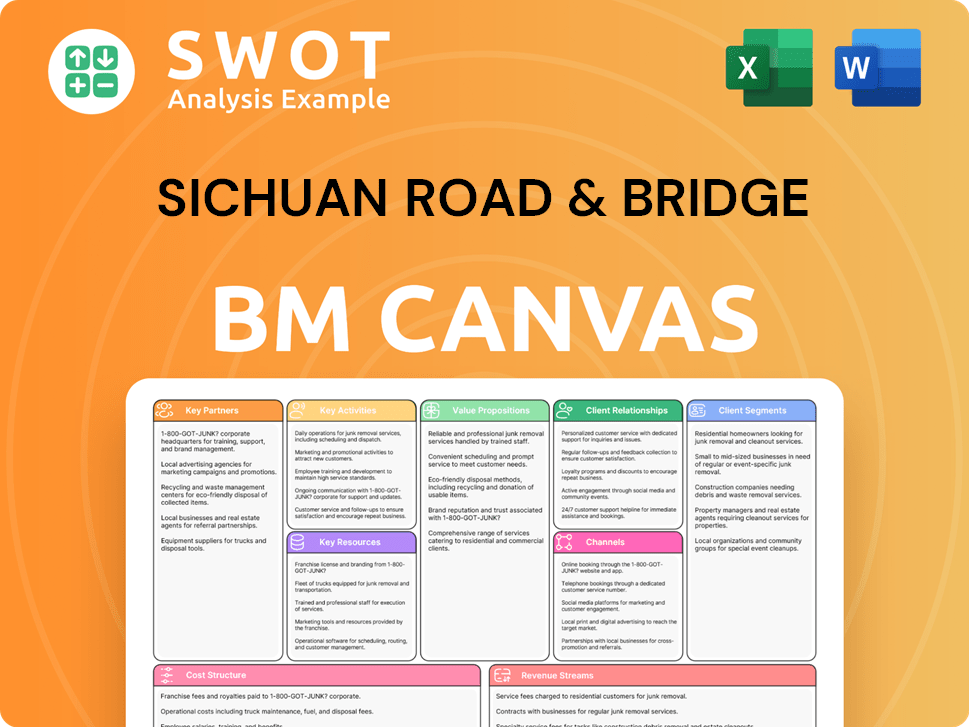

Sichuan Road & Bridge Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Sichuan Road & Bridge’s Ownership Landscape?

Over the past few years, Sichuan Road & Bridge Company (SRBC) has seen significant developments, particularly in its ownership structure. A major event in 2025 was the acquisition of Chengdu Xinzhu Transportation Technology. This move is designed to integrate maglev design patents and construction capabilities. This merger is expected to shift CNY 970 million (USD $139 million) from previous investments towards expansion, leveraging Chengdu Xinzhu's extensive patent portfolio in maglev technology.

The company's ownership remains largely state-controlled, with the Sichuan State-Owned Assets Supervision & Administration Commission holding a significant majority stake. This reflects a continuing commitment to state control and strategic alignment with national infrastructure goals. Recent announcements in December 2024 also addressed changes in commitments to horizontal competition by controlling shareholders. For more details on the company's background, you can explore the Brief History of Sichuan Road & Bridge.

| Ownership Category | Approximate Stake (as of late 2024) | Notes |

|---|---|---|

| Sichuan State-Owned Assets Supervision & Administration Commission | Majority | Primary state-owned shareholder. |

| Institutional Investors | Approximately 45% (as of October 2023) | Includes varied holdings from entities like China Investment Corporation and BlackRock. |

| Other | Remaining Percentage | Includes individual investors and other stakeholders. |

Industry-wide, there's a trend towards increased institutional ownership. As of October 2023, institutional ownership in SRBC was approximately 45%. While some institutional investors have increased their stakes, others have decreased theirs. This indicates diverse sentiments within the institutional landscape. The company's involvement in national initiatives, such as the Belt and Road Initiative, continues to shape its ownership appeal. Future ownership changes may include further strategic consolidations or investments aligned with China's green energy ambitions and urbanization acceleration.

SRBC is primarily state-owned, with the Sichuan State-Owned Assets Supervision & Administration Commission holding a majority stake.

The 2025 acquisition of Chengdu Xinzhu Transportation Technology is a key strategic move for SRBC.

Institutional ownership accounts for approximately 45% as of late 2023, with varied investor behavior.

Future ownership changes may involve further strategic consolidations in line with national goals.

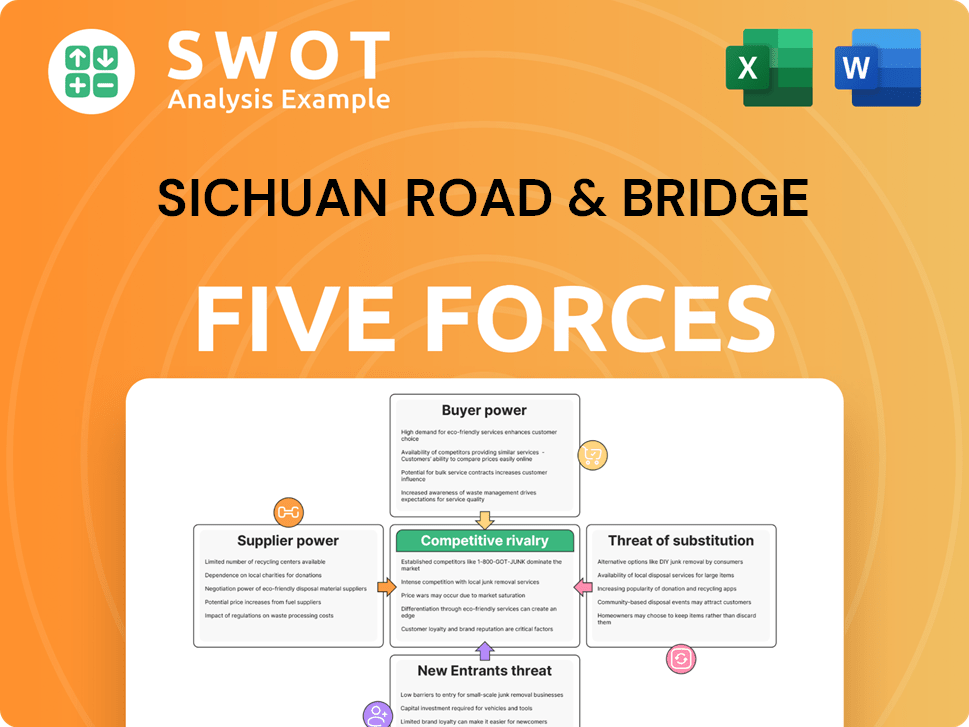

Sichuan Road & Bridge Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sichuan Road & Bridge Company?

- What is Competitive Landscape of Sichuan Road & Bridge Company?

- What is Growth Strategy and Future Prospects of Sichuan Road & Bridge Company?

- How Does Sichuan Road & Bridge Company Work?

- What is Sales and Marketing Strategy of Sichuan Road & Bridge Company?

- What is Brief History of Sichuan Road & Bridge Company?

- What is Customer Demographics and Target Market of Sichuan Road & Bridge Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.