Sumitomo Bakelite Bundle

Can Sumitomo Bakelite Continue Its Ascent in the Materials Market?

Sumitomo Bakelite, a titan in plastics and related products, is currently navigating a dynamic materials industry landscape. The company's strategic acquisition of Asahi Kasei's film business in April 2024 highlights its commitment to reshaping its market position. This move is a key part of its Sumitomo Bakelite SWOT Analysis, signaling ambitions for portfolio expansion and sector dominance.

Founded in Japan in 1911, Sumitomo Bakelite has a rich history, and its future prospects are closely tied to its growth strategy. With a market capitalization of $2.03 billion USD as of May 2025, the Bakelite company analysis reveals a significant player poised for further expansion. This overview will delve into Sumitomo Bakelite's market, examining its expansion plans and acquisitions, and assessing its potential impact on the global chemical and materials landscape, including its sustainable growth initiatives.

How Is Sumitomo Bakelite Expanding Its Reach?

To drive future growth, Sumitomo Bakelite is actively pursuing various expansion initiatives. These initiatives are designed to diversify revenue streams and enhance the company's offerings. Strategic investments in new business areas and international expansion, particularly in the growing Chinese market, are key components of their growth strategy.

A significant move in this direction was the acquisition of a 90% stake in the film businesses of Asahi Kasei Pax, completed on April 1, 2024. This acquisition is part of the company's strategy to broaden its product portfolio and market reach. Furthermore, the company is focusing on international expansion, particularly in the growing Chinese market.

In October 2024, Sumitomo Bakelite (Suzhou) Co., Ltd., a group company in China, completed the construction of a new plant for epoxy resin molding compounds for encapsulating semiconductor devices. This plant is scheduled to begin full-scale mass production in 2025 and is designed to expand the total production capacity in Suzhou by 1.3 times. This expansion caters to traditional semiconductor applications as well as power devices, mobility, and advanced AI applications in China. Another new plant for phenolic molding compounds in Nantong, China, was completed in March 2024 and is scheduled to begin mass production in June 2024 to increase production capacity.

Sumitomo Bakelite is significantly expanding its manufacturing capacity in China. The new plants in Suzhou and Nantong are crucial for meeting the rising demand in the semiconductor and molding compound markets. These expansions are part of the company's broader strategy to strengthen its presence in Asia and capitalize on the region's economic growth.

The company is investing in new business areas, including functional membranes for hydrogen production. This initiative aims to achieve annual revenue of 100 billion yen in the future. Sumitomo Bakelite expects to establish production conditions by FY 2027 and mass production by FY 2030, demonstrating a long-term commitment to sustainable energy solutions.

The acquisition of the film businesses of Asahi Kasei Pax and the integration of Kawasumi Laboratories highlight Sumitomo Bakelite's strategic approach to growth. These moves are aimed at diversifying the product portfolio and expanding into the medical equipment market. The company continues to invest in increased production of molding compounds for mobility, anticipating growth in automotive electronics and hybrid electric vehicles (HEVs).

- The acquisition of the film businesses of Asahi Kasei Pax, completed on April 1, 2024, aims to diversify revenue streams.

- The new plant in Suzhou, China, will expand production capacity by 1.3 times, catering to various applications.

- The company is targeting 100 billion yen in annual revenue from functional membranes for hydrogen production.

- Investments in molding compounds for mobility reflect the anticipation of growth in automotive electronics.

These expansion plans and acquisitions demonstrate a proactive approach to securing Sumitomo Bakelite's future prospects. The company's focus on both geographical and product diversification, along with strategic investments in emerging technologies, positions it well for long-term growth and resilience in a dynamic market environment. These initiatives are crucial for the company's sustainable growth, as it navigates the challenges and opportunities in the global market.

Sumitomo Bakelite SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Sumitomo Bakelite Invest in Innovation?

The company's growth strategy heavily relies on innovation and technological advancements. This approach is crucial for maintaining a competitive edge and capitalizing on emerging market opportunities. Sumitomo Bakelite's commitment to R&D and digital transformation underscores its proactive stance in adapting to evolving industry demands.

Sumitomo Bakelite's future prospects are closely tied to its ability to integrate cutting-edge technologies and develop innovative products. The company's focus on smart factories and sustainable practices positions it well to meet the demands of a rapidly changing global market. This strategic direction is essential for long-term success.

The company is actively pursuing the 'revamp of the corporate-wide digital core system to realize data-driven management' and 'research and development capability buildup by adopting Cutting-Edge informatics technologies'. This includes the formation of an MI (Materials Informatics) promotion project to drive the introduction and development of MI.

Sumitomo Bakelite is transforming its manufacturing processes into smart factories. This involves introducing automated systems across its global locations, aiming for full automation of condition setup tasks.

The new plant in Suzhou, China, completed in September 2024, utilizes process automation and AI-driven process monitoring. It also fully adopts electricity from renewable energy sources.

The new phenolic molding compounds plant in Nantong, China, will implement process automation and AI/IoT-based process monitoring. Energy efficiency measures are also a key focus.

Sumitomo Bakelite has developed COPLUS, a new cyclo olefin polymer product. COPLUS offers high heat resistance and transparency, expanding its adoption in AI semiconductor applications and automotive sectors.

The company is experiencing increasing global customer inquiries for heat dissipating materials. This indicates strong growth potential in this area.

In April 2025, Sumitomo Bakelite announced the development of a medical device packaging mono-material film that is easy to recycle. This highlights its commitment to sustainability.

Sumitomo Bakelite Co., Ltd. received a Gold Medal in the EcoVadis Sustainability Assessment in February 2025. This underscores the company's commitment to sustainable practices.

- The company's focus on smart factories, process automation, and renewable energy aligns with global sustainability trends.

- The development of new products like COPLUS and the mono-material film demonstrates a commitment to innovation.

- The EcoVadis Gold Medal highlights the company's dedication to environmental and social responsibility. For a deeper dive into the competitive landscape, check out the Competitors Landscape of Sumitomo Bakelite.

Sumitomo Bakelite PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Sumitomo Bakelite’s Growth Forecast?

In fiscal year 2024, Sumitomo Bakelite demonstrated robust financial performance, achieving record-breaking revenue and business profit. The company's strategic initiatives and market positioning contributed to its success. This performance sets a positive tone for future growth and expansion.

For FY2024, the company reported revenue of 304.8 billion yen, marking a 6.1% increase year-on-year. Business profit also saw a significant rise, reaching 30.8 billion yen, a 12.3% increase. The profit attributable to owners of the parent was 19.3 billion yen in the same period.

Looking at the broader picture, Sumitomo Bakelite's earnings in 2024 (TTM) were $0.21 billion USD, with current earnings reported at $1.96 billion USD. This financial health provides a solid foundation for future investments and strategic growth initiatives. The company's commitment to innovation and market expansion is evident in its recent performance and future projections.

Sumitomo Bakelite achieved record revenue of 304.8 billion yen and business profit of 30.8 billion yen in FY2024. This represents a 6.1% and 12.3% increase, respectively, demonstrating strong financial health and effective business strategies. These results reflect the company's ability to capitalize on market opportunities and maintain profitability.

The company's earnings in 2024 (TTM) were $0.21 billion USD, with current earnings reported at $1.96 billion USD. This strong financial position supports the company's future growth plans, including investments in new technologies and market expansion. The positive financial outlook is a key indicator of the company's potential for sustained success.

Sumitomo Bakelite anticipates a growth rate of approximately 7% for semiconductor encapsulants in the next fiscal year. This positive outlook reflects the company's strong position in the electronics industry and the increasing demand for its products. This growth is a key factor in the company's overall Sumitomo Bakelite growth strategy.

The company aims to raise company-wide revenue to 500-600 billion yen, with a major project in hydrogen membrane production targeting 100 billion yen in annual revenue. This ambitious target underscores the company's commitment to expanding its market presence and diversifying its product offerings. These targets are central to the Sumitomo Bakelite future prospects.

The Bakelite market is projected to reach USD 3.63 billion in 2025 and grow at a CAGR of greater than 3.5% to reach USD 4.31 billion by 2030. Sumitomo Bakelite plans to conduct necessary growth investments, including mergers and acquisitions, while also providing shareholder returns. This strategic approach ensures the company's long-term sustainability and competitiveness.

- Investing in mergers and acquisitions to expand its portfolio.

- Focusing on shareholder returns while monitoring cash position.

- Capitalizing on the growing Bakelite market.

- Exploring opportunities in the automotive sector.

Sumitomo Bakelite Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Sumitomo Bakelite’s Growth?

The growth strategy of Sumitomo Bakelite faces several potential risks and obstacles that could affect its future. These challenges include market competition, regulatory changes, geopolitical risks, and supply chain vulnerabilities. Understanding these hurdles is crucial for assessing the company's ability to achieve its expansion plans and maintain a strong market position.

Competition from alternative materials and emerging technologies presents a continuous challenge in the Bakelite market. Additionally, the company must navigate evolving regulations, particularly in China, which require investments in environmental protection and energy efficiency. These factors, along with geopolitical uncertainties, necessitate proactive risk management and strategic adaptation.

Internal resource constraints, including human capital, also pose risks. The company must address these multifaceted challenges to ensure sustainable growth and capitalize on its investment opportunities. Furthermore, the impact of global economic trends and the company's research and development focus are crucial for its long-term success.

The Bakelite market is highly competitive, with alternative materials and new technologies constantly emerging. This requires continuous innovation and adaptation to maintain a competitive edge. The company needs to stay ahead of these developments to retain its market share and drive growth.

Stringent safety and environmental regulations, particularly in China, necessitate significant investments. Compliance with these regulations requires advanced equipment and energy-efficient operations. These changes can impact operational costs and require proactive strategic planning.

Geopolitical tensions and reciprocal tariffs, especially between the U.S. and China, can affect sales volumes. These factors can lead to minor losses due to delays in passing costs to selling prices. The company must implement strategies to mitigate these risks.

Fluctuations in raw material prices and supply chain disruptions pose significant risks. The company has identified raw materials supply problems and price fluctuations as a major concern for fiscal 2024. Effective supply chain management is crucial.

Rapid advancements in digital technologies, such as generative AI, require quick adoption of innovations. The company must invest in digital skills and foster a culture of digital agility. This is essential to remain competitive in the market.

Human capital risk and other resource limitations can hinder growth initiatives. The company recognizes the importance of addressing these constraints to support its expansion plans. Strategic workforce development is key to overcoming these challenges.

To mitigate these risks, Sumitomo Bakelite employs several strategies. These include diversifying its product portfolio, expanding into new applications, and optimizing supply chains. The company also utilizes a structured risk management framework, identifying and preparing for major risks such as disasters and information security incidents. For more details, you can explore the Brief History of Sumitomo Bakelite.

The company focuses on diversifying its product portfolio and expanding into new applications, such as AI semiconductor applications and hydrogen production membranes. This strategy helps reduce reliance on existing markets. In 2024, the company is investing in R&D to support new product development.

Strategic measures include expanding sales, relocating production, and optimizing supply chains to mitigate tariff-related effects. These initiatives aim to improve operational efficiency and reduce costs. The company actively monitors market trends to adapt its strategies.

Sumitomo Bakelite employs a structured risk management framework to assess and prepare for potential risks. This includes identifying eight major risks for fiscal 2024, such as disasters, accidents, and product quality issues. This proactive approach helps minimize negative impacts.

The company focuses on improving digital skills across its workforce and fostering a culture of digital agility. This enables the company to respond quickly to technological shifts and maintain a competitive advantage. Training programs are a key part of this strategy.

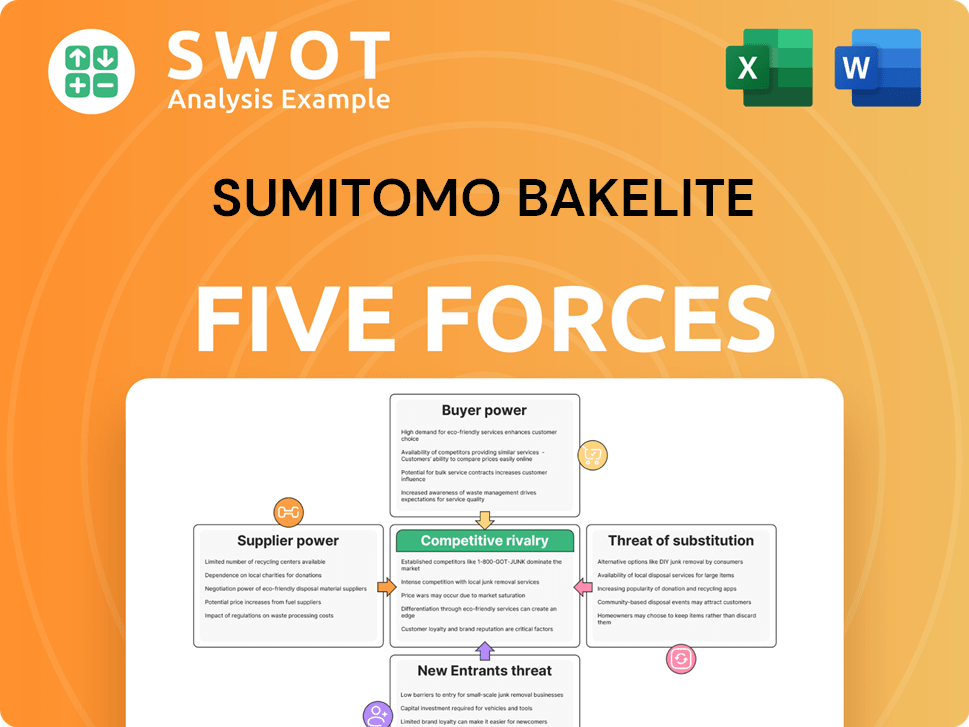

Sumitomo Bakelite Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sumitomo Bakelite Company?

- What is Competitive Landscape of Sumitomo Bakelite Company?

- How Does Sumitomo Bakelite Company Work?

- What is Sales and Marketing Strategy of Sumitomo Bakelite Company?

- What is Brief History of Sumitomo Bakelite Company?

- Who Owns Sumitomo Bakelite Company?

- What is Customer Demographics and Target Market of Sumitomo Bakelite Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.