TeamViewer Bundle

Can TeamViewer Continue to Dominate the Remote Access Landscape?

TeamViewer, a pioneer in remote connectivity, has fundamentally altered how we interact with technology from afar. Initially conceived in 2005, the company quickly evolved from a startup to a major player in the remote access software market. Today, TeamViewer's global presence and diverse user base highlight the importance of a solid growth strategy in a constantly changing tech environment. This analysis explores the TeamViewer SWOT Analysis to understand its position.

This deep dive into TeamViewer will examine its strategic initiatives for expansion, ongoing innovation, and financial planning to ensure future success. We'll explore its market share, competitive advantages, and how it plans to capitalize on emerging market trends. Understanding TeamViewer's business model, revenue streams, and user base growth is crucial for evaluating its long-term potential and making informed decisions about its future prospects.

How Is TeamViewer Expanding Its Reach?

TeamViewer's TeamViewer Growth Strategy centers on aggressive expansion initiatives designed to boost its market presence and diversify revenue streams. The company is actively pursuing growth by entering new geographical markets, especially in regions experiencing rapid digital transformation and a growing need for remote work solutions. This approach involves adapting its offerings to meet specific regional demands and forming strategic partnerships with local distributors.

A crucial element of TeamViewer's Future Prospects involves product expansion, focusing on enhancing its core offerings and developing new solutions to address emerging enterprise needs. This includes augmented reality (AR) applications for frontline workers and advanced IoT device management. TeamViewer is also exploring innovative business models, such as subscription-based services and tiered offerings, to cater to a wider range of customers from small businesses to large enterprises.

These initiatives are geared towards acquiring new customer bases, strengthening its position in existing markets, and staying ahead of evolving industry trends. The company's strategic focus on innovation and market expansion is aimed at sustaining its competitive edge in the rapidly evolving remote access software market. To understand more about how TeamViewer generates income, you can read about the Revenue Streams & Business Model of TeamViewer.

TeamViewer is targeting high-growth regions to expand its global footprint. This includes focusing on areas with increasing digital transformation and remote work adoption. The strategy involves tailoring solutions to meet specific regional needs and building partnerships with local distributors and resellers to enhance market penetration.

The company is committed to enhancing its core remote access and support offerings. TeamViewer is also developing new solutions for the enterprise segment, such as augmented reality (AR) applications for frontline workers, and IoT device management. These innovations aim to capture a larger share of the industrial and enterprise markets.

TeamViewer actively seeks strategic partnerships to broaden its market reach and enhance its service offerings. Collaborations with technology providers and industry-specific partners are crucial for expanding its customer base and providing integrated solutions. These partnerships help in reaching new customer segments and improving market penetration.

TeamViewer is exploring new business models, including subscription-based services and tiered offerings. This diversification strategy aims to cater to a wider range of customer segments, from small businesses to large enterprises. The tiered pricing models provide flexibility and cater to various customer needs and budgets.

TeamViewer's expansion strategies include geographical expansion, product innovation, strategic partnerships, and business model diversification. These strategies are designed to drive growth and maintain a competitive edge in the market. The company's focus remains on providing comprehensive remote connectivity solutions.

- Geographical Expansion: Targeting high-growth markets globally.

- Product Innovation: Developing new solutions for the enterprise segment, including AR and IoT.

- Strategic Partnerships: Collaborating with technology providers and industry partners.

- Business Model Diversification: Implementing subscription-based services and tiered offerings.

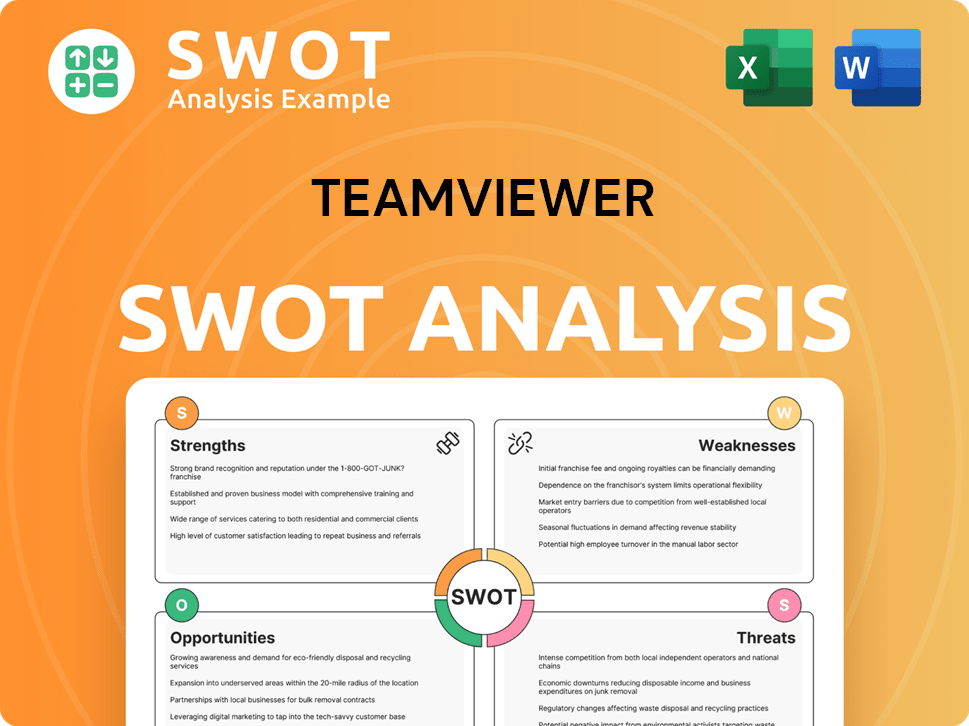

TeamViewer SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does TeamViewer Invest in Innovation?

The growth strategy of the company is deeply intertwined with its innovation and technology initiatives. This approach involves significant investments in research and development (R&D) to enhance existing products and develop new, advanced solutions. The company's focus on technological advancements ensures it remains competitive in the rapidly evolving remote access software market.

A key part of the company's strategy is the integration of technologies like Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT). These technologies are used to improve the intelligence, efficiency, and security of its remote connectivity platforms. The continuous evolution of its software-as-a-service (SaaS) capabilities demonstrates its commitment to digital transformation.

The company's dedication to sustainable innovation is also evident in its design of solutions that meet current demands while contributing to a sustainable digital ecosystem. The emphasis on its 'Innovation Hub' and strategic partnerships underscores its commitment to staying at the forefront of innovation in remote connectivity, aiming to secure new patents and industry recognition.

The company is actively integrating AI to offer predictive insights for IT support. This includes automating routine tasks to improve user experience and operational efficiency. These advancements are crucial for enhancing the company's competitive advantage.

The company continuously optimizes its cloud infrastructure and expands its SaaS capabilities. This is essential for providing scalable and reliable services to its growing user base. This ensures the company remains competitive in the cloud computing market.

The company focuses on sustainable innovation, designing solutions that meet current demands while contributing to a more sustainable digital ecosystem. This approach is increasingly important as environmental concerns grow. This strategy aligns with broader industry trends.

The company emphasizes its 'Innovation Hub' and partnerships with technology leaders. These collaborations are crucial for staying at the forefront of remote connectivity innovation. Strategic partnerships are key to expanding market reach.

The company prioritizes security features to protect user data and ensure secure remote access. This includes implementing advanced encryption and authentication protocols. Strong security measures build trust with customers.

The company provides robust support for mobile devices, allowing users to access and manage devices remotely from anywhere. This feature enhances user convenience and flexibility. Mobile support is essential in today's environment.

The company's commitment to innovation is further supported by its strategic partnerships and continuous investment in R&D. These efforts are designed to maintain its competitive edge and drive future growth. For more insights into the company's core values and mission, read about the Mission, Vision & Core Values of TeamViewer.

The company's technology strategy focuses on several key areas to enhance its products and services, driving its growth strategy. These advancements are crucial for maintaining its market position and attracting new customers. The company's commitment to innovation is evident in its continuous efforts to improve its offerings.

- AI Integration: Implementing AI for predictive IT support and automation.

- Cloud Infrastructure: Optimizing cloud infrastructure for scalability and reliability.

- SaaS Capabilities: Expanding SaaS offerings to meet evolving customer needs.

- Security Enhancements: Strengthening security features to protect user data.

- Mobile Support: Improving mobile device support for enhanced accessibility.

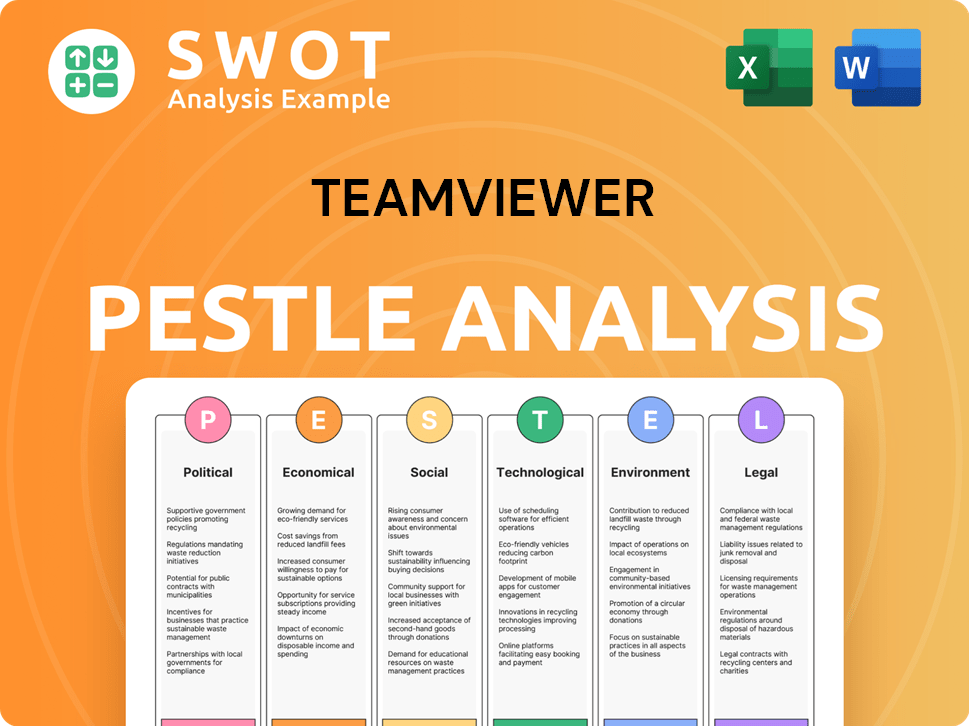

TeamViewer PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is TeamViewer’s Growth Forecast?

The financial outlook for the company is positive, reflecting its ambitious growth strategy. The company has consistently shown strong financial performance, driven by a growing customer base and recurring revenue from its subscription model. Recent financial reports highlight a focus on increasing profitability and cash flow generation, enabling further investments in R&D and strategic initiatives. A comprehensive Brief History of TeamViewer provides additional context to its financial journey.

For the fiscal year 2024, the company projected revenue between EUR 620 million and EUR 630 million, indicating a steady growth trajectory. The company aims to achieve a mid-term adjusted EBITDA margin of above 40%, showcasing its commitment to operational efficiency and profitability. This financial strategy also involves optimizing capital allocation to support both organic and inorganic growth.

The company's strong balance sheet and consistent cash flow provide a solid foundation for funding its future growth ambitions and delivering value to its shareholders. The company's financial strategy includes optimizing capital allocation to support both organic growth through product development and inorganic growth through potential mergers and acquisitions.

The company's revenue is expected to grow steadily. The projected revenue for 2024 is between EUR 620 million and EUR 630 million. This growth reflects the success of its business model and expansion efforts.

The company aims for a mid-term adjusted EBITDA margin above 40%. This target demonstrates a commitment to operational efficiency. Achieving this margin will support reinvestment in growth initiatives.

The company focuses on optimizing capital allocation. This involves supporting organic growth through product development. It also includes inorganic growth through potential mergers and acquisitions.

The company benefits from a strong balance sheet and consistent cash flow. This financial stability provides a solid foundation. It supports future growth and shareholder value creation.

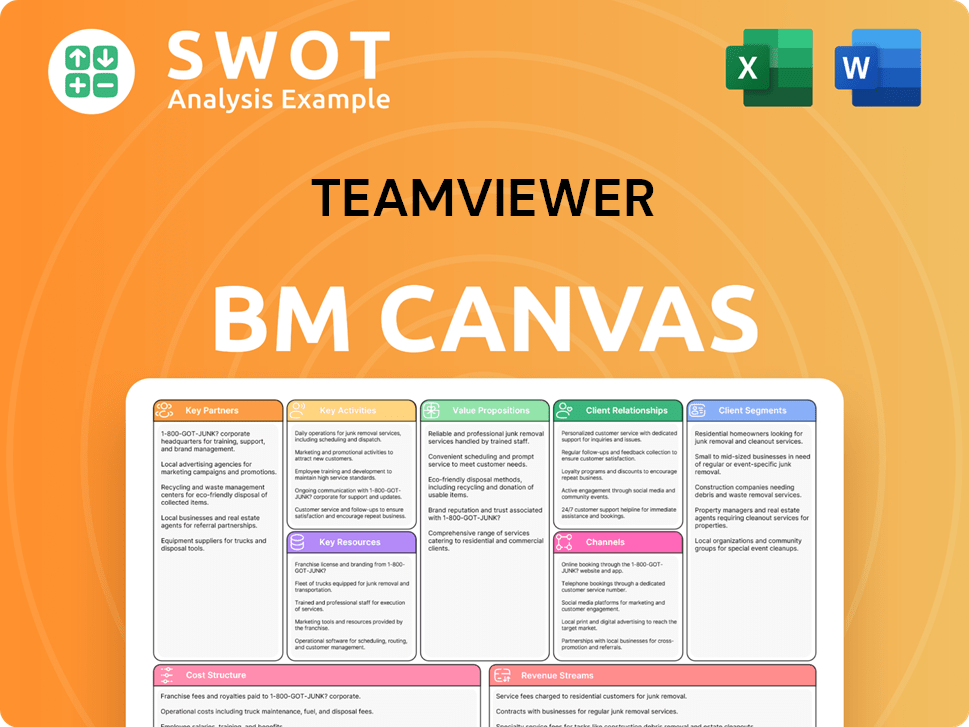

TeamViewer Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow TeamViewer’s Growth?

The path forward for TeamViewer, despite its promising TeamViewer Growth Strategy, is not without potential pitfalls. Several factors could impede its progress, including intense competition within the remote access software market and the need to constantly adapt to evolving technological landscapes. Understanding these challenges is crucial for a comprehensive TeamViewer Company Analysis.

Market dynamics and internal challenges pose significant risks. Regulatory shifts, particularly regarding data privacy, could affect its global operations. Furthermore, managing rapid expansion while maintaining product quality and customer satisfaction presents internal hurdles.

The competitive landscape is crowded, which could impact TeamViewer Market Share. The company must continuously innovate to keep pace with rivals and maintain its position. Additionally, external factors like economic fluctuations could indirectly influence its performance, especially if they affect the spending of its customer base.

The remote access software market is highly competitive, featuring established players and emerging startups. Competition can lead to price wars and reduced profit margins. Maintaining a competitive edge requires continuous innovation and differentiation.

Rapid technological advancements pose a constant threat. The company must stay ahead of trends like cloud computing and AI to avoid obsolescence. Failure to adapt could lead to a loss of market share to more agile competitors.

Changes in data privacy regulations, such as GDPR and CCPA, can create compliance burdens. Non-compliance can result in hefty fines and damage to the company's reputation. Navigating complex regulatory landscapes is crucial for international operations.

As a remote access provider, the company is a prime target for cyberattacks. Data breaches can erode customer trust and lead to significant financial losses. Investing in robust security measures is essential to protect its user base.

Economic downturns can lead to reduced IT spending and slower growth. The company's revenue could be negatively affected if customers cut back on subscriptions or delay upgrades. Diversifying its customer base can mitigate this risk.

Managing rapid growth can strain internal resources and processes. Maintaining product quality and customer satisfaction while scaling up operations is a significant challenge. Investing in talent and efficient systems is vital.

The company should diversify its product offerings to reduce reliance on a single revenue stream. Investing in robust cybersecurity measures and data protection protocols is essential. Furthermore, developing strong customer relationships and providing excellent support can help mitigate the impact of negative reviews.

The company should regularly analyze its TeamViewer Competitors, such as AnyDesk, to identify strengths and weaknesses. Monitoring market trends and customer feedback helps inform product development and strategic decisions. This proactive approach is key to staying ahead of the competition.

Collaborating with other tech companies can expand its market reach and product capabilities. Strategic partnerships can provide access to new technologies and customer bases. These alliances are essential for long-term growth and resilience.

Continuous innovation in Remote Access Software is crucial. Investing in R&D and exploring new technologies like AI and cloud computing can create new features. The company should consistently update its offerings to meet evolving customer needs.

For example, according to Statista, the global market for remote access software was valued at approximately $4.6 billion in 2023 and is projected to reach $7.9 billion by 2028, growing at a CAGR of around 11.4%. This growth indicates significant opportunities, but also intensifies competition. To better understand the TeamViewer Future Prospects, consider the company's customer base, as discussed in TeamViewer's Target Market, which is critical for its success.

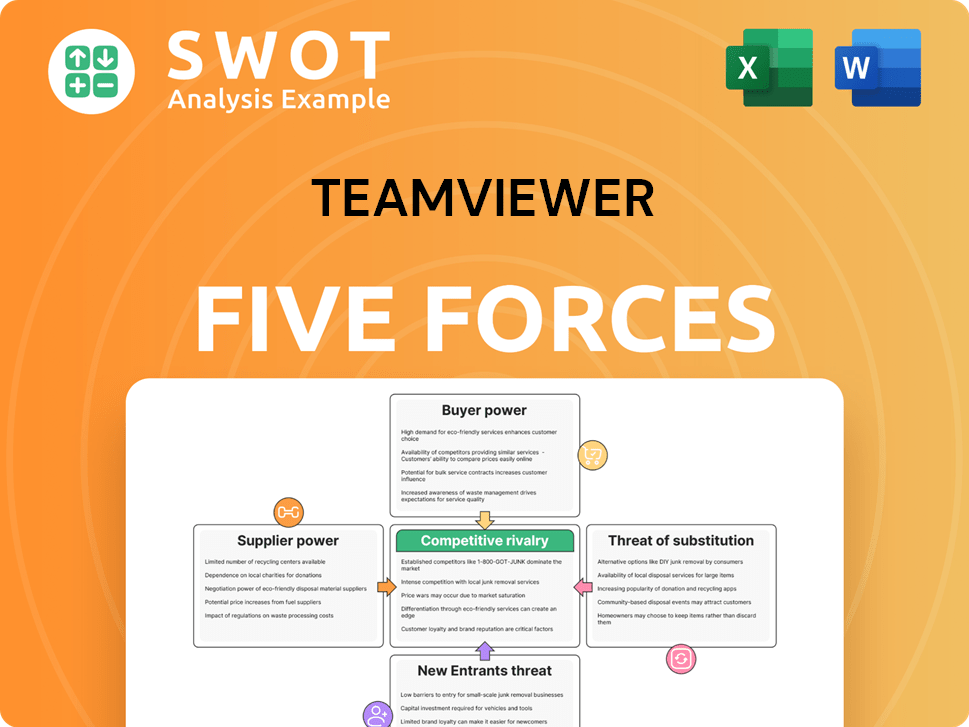

TeamViewer Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TeamViewer Company?

- What is Competitive Landscape of TeamViewer Company?

- How Does TeamViewer Company Work?

- What is Sales and Marketing Strategy of TeamViewer Company?

- What is Brief History of TeamViewer Company?

- Who Owns TeamViewer Company?

- What is Customer Demographics and Target Market of TeamViewer Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.