TeamViewer Bundle

Who Really Owns TeamViewer?

Understanding a company's ownership is key to grasping its strategic moves and future potential. TeamViewer, a global leader in remote connectivity, has undergone a fascinating ownership journey since its inception in 2005. This exploration uncovers the TeamViewer SWOT Analysis, detailing how its ownership structure has shaped its path to becoming a publicly traded tech giant.

From its early days as a remote access software provider to its current status as a publicly listed company, the shifts in TeamViewer's ownership have been dramatic. The company's history includes a significant acquisition by Permira, which propelled it into the 'unicorn' status. This deep dive into the TeamViewer ownership will reveal the key players, from the founders to the major shareholders, and how these changes have influenced TeamViewer's parent company and its overall strategy. We will also explore the TeamViewer headquarters and its impact on the company's operations.

Who Founded TeamViewer?

The story of TeamViewer begins in 2005. It started with the development of its remote connectivity software. This software was the brainchild of the founder of Rossmanith GmbH, an IT service provider.

The initial goal was to simplify tasks such as software installations and reduce the need for travel to clients. This innovative idea quickly led to the establishment of TeamViewer GmbH, which would become the foundation of what is now TeamViewer SE. This marked the beginning of the journey for the company, setting the stage for future developments.

The company's initial business model played a crucial role in its early growth. Private users could use the software for free, while businesses needed to purchase a license. This dual-licensing approach likely influenced the early revenue generation and expansion of the company.

The original concept for the software was developed by the founder of Rossmanith GmbH. The primary goal was to enable remote software installations and reduce travel expenses. This initial focus on remote access and support set the stage for the company's future.

TeamViewer GmbH was spun off to focus on the remote connectivity software. This strategic move allowed the company to concentrate on developing and improving its core product. The spin-off was a key step in the evolution of the company.

In 2010, GFI Software acquired TeamViewer GmbH. While the exact details of the early equity split among founders and initial investors aren't public, the acquisition marked a significant change in the company's ownership structure. This acquisition played a role in the company's growth.

TeamViewer used a dual-licensing model from the start. Private users could use the software for free, while businesses needed to buy a license. This model helped generate early revenue and influenced the company's growth. This approach was key to the company's initial success.

Specific details about the initial equity split among founders and early investors are not available publicly. However, the company's evolution from an IT service provider's concept to a dedicated entity shows a strategic vision. The company's ownership structure has seen changes over time.

The company's history includes key milestones such as the acquisition by GFI Software. The ownership structure has evolved, reflecting changes in the tech industry. The company's journey has been marked by strategic decisions.

Understanding the TeamViewer ownership structure and its evolution provides insights into its growth. The company's history, including its TeamViewer history and TeamViewer acquisition by GFI Software, highlights the strategic decisions that shaped its path. While the exact details of early ownership remain private, the dual-licensing model and the spin-off from Rossmanith GmbH were crucial. The company’s current status as a publicly traded entity reflects its significant growth and market presence. As of 2024, the company continues to be a key player in the remote connectivity market, with its headquarters located in Göppingen, Germany. The company's journey from its inception to its current valuation showcases its adaptability and strategic vision. The TeamViewer parent company has seen various changes over time, reflecting its growth and market dynamics. The company's financial performance and TeamViewer company information are available through public filings, offering a view of its financial health and strategic direction. The company's evolution provides a case study in how a technology company can grow and adapt to market changes. The company's success is a testament to its ability to innovate and meet the evolving needs of its users. The company's journey from a concept to a global leader shows its commitment to its mission.

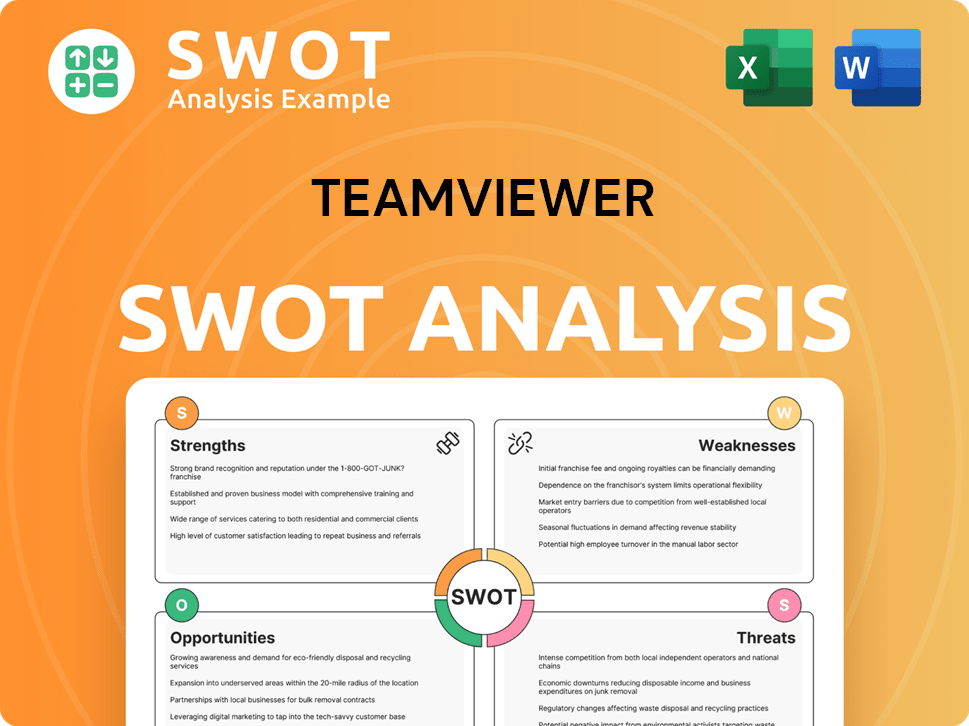

TeamViewer SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has TeamViewer’s Ownership Changed Over Time?

The evolution of TeamViewer ownership has been marked by significant changes since its inception. Initially, the company was privately held. A pivotal moment came in 2014 when Permira, a British private equity firm, acquired the company for approximately one billion US dollars. This TeamViewer acquisition by Permira was instrumental in expanding the company's global reach and product offerings. This acquisition set the stage for further developments in the ownership structure.

A major shift occurred with the Initial Public Offering (IPO) on the Frankfurt Stock Exchange on September 25, 2019. The IPO involved the offering of existing shares held by TigerLuxOne S.à r.l., a holding company primarily owned by funds advised by Permira. The IPO priced at EUR 26.25 per share, with Permira funds selling a 42% stake in the company. At the time of the IPO, the TeamViewer company valuation was approximately EUR 5.3 billion. This transition to a public company broadened the investor base and introduced new governance requirements.

| Event | Date | Details |

|---|---|---|

| Permira Acquisition | 2014 | Permira acquired the company for approximately $1 billion. |

| IPO | September 25, 2019 | Initial Public Offering on the Frankfurt Stock Exchange; Permira sold a 42% stake. |

| Current Ownership | December 31, 2024 - May 8, 2025 | Significant shareholders include Permira/TigerLuxOne S.à r.l., BlackRock, Inc., Norges Bank, The Vanguard Group, Inc., and Columbia Management Investment Advisers, LLC. |

As of December 31, 2024, the ownership structure of TeamViewer shows Permira/TigerLuxOne S.à r.l. as a significant stakeholder, holding 14.4% of the shares. Other major institutional investors include BlackRock, Inc. with 5.17% and Norges Bank with 3.33% as of January 2, 2025. The Vanguard Group, Inc. holds 3.23% as of April 29, 2025, and Columbia Management Investment Advisers, LLC holds 3.07% as of May 4, 2025. Amundi Asset Management SAS holds 3.05% as of May 8, 2024. Approximately 77.4% of the shares are in free float as of December 31, 2024. The company also holds treasury shares, amounting to 8.2% of the share capital as of December 31, 2024. For more insights into the company's strategic direction, consider reading about the Growth Strategy of TeamViewer.

The ownership of the company has evolved from private equity to a publicly listed company.

- Permira was a key player in the company's expansion and the IPO.

- The current shareholder structure includes significant institutional investors.

- The majority of shares are in free float, indicating a broad investor base.

- The company's history includes a significant acquisition and an IPO.

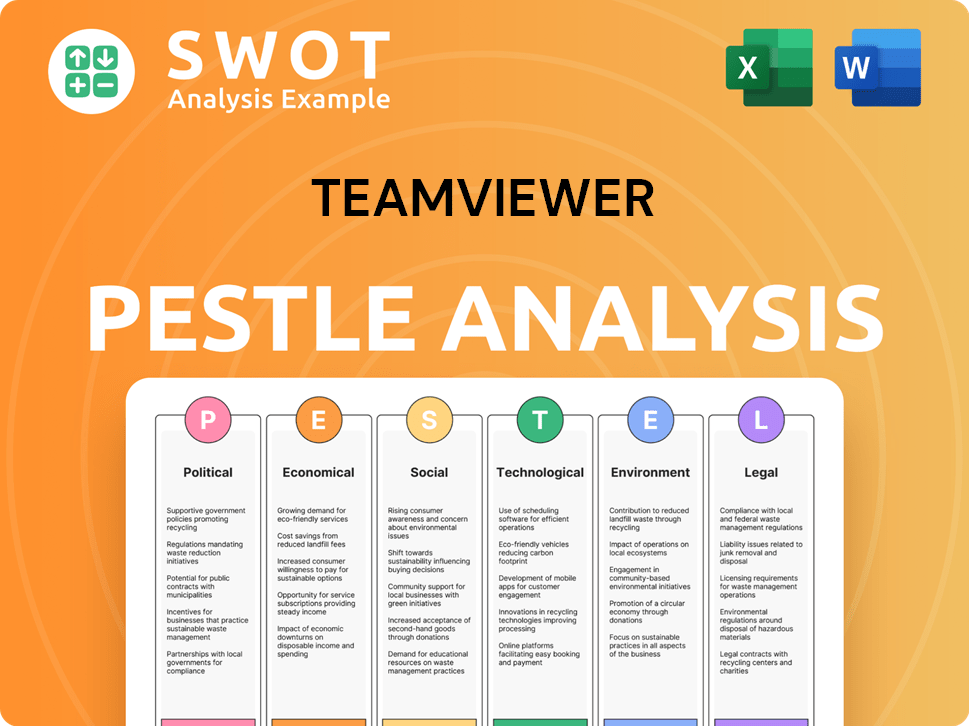

TeamViewer PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on TeamViewer’s Board?

The current leadership of the company includes Oliver Steil as the Chief Executive Officer and Chairman of the Executive Board. Ralf W. Dieter serves as the Chairman of the Supervisory Board, which is responsible for overseeing the company's management. In May 2025, shareholders approved James Jeffrey (Jeff) Kinder as an independent member of the Supervisory Board for a four-year term. This structure highlights the roles of key individuals in the company's governance and strategic direction.

The Supervisory Board ensures that the company's operations align with the interests of its shareholders and stakeholders. The board's composition and the appointment of independent members like Jeff Kinder are crucial for maintaining corporate governance standards and ensuring transparency in decision-making processes. The board's oversight helps to monitor the company's performance and guide its long-term strategy.

| Leadership Role | Name | Title |

|---|---|---|

| Chief Executive Officer | Oliver Steil | Chairman of the Executive Board |

| Chairman of the Supervisory Board | Ralf W. Dieter | |

| Independent Member of the Supervisory Board | James Jeffrey (Jeff) Kinder |

The company operates with a one-share-one-vote structure. As of December 31, 2024, Permira/TigerLuxOne S.à r.l. held 14.4% of the share capital, making them a significant shareholder. Other major institutional holders like BlackRock, Inc. and Norges Bank also hold notable percentages of voting rights. The company's own treasury shares, accounting for 7.67% as of January 2, 2025, do not have voting rights. The concentration of shares among institutional investors means that collective action from these stakeholders could influence major decisions and governance. This structure is crucial for understanding the dynamics of TeamViewer's target market and overall company strategy.

The ownership structure of the company is primarily influenced by institutional investors and significant shareholders. The company’s governance is shaped by the board of directors and the voting power of its shareholders. Understanding the ownership structure provides insights into the company's strategic direction and financial stability.

- Permira/TigerLuxOne S.à r.l. holds a significant share.

- BlackRock, Inc. and Norges Bank are also major institutional holders.

- The company's treasury shares do not carry voting rights.

- Collective action by major shareholders can influence decisions.

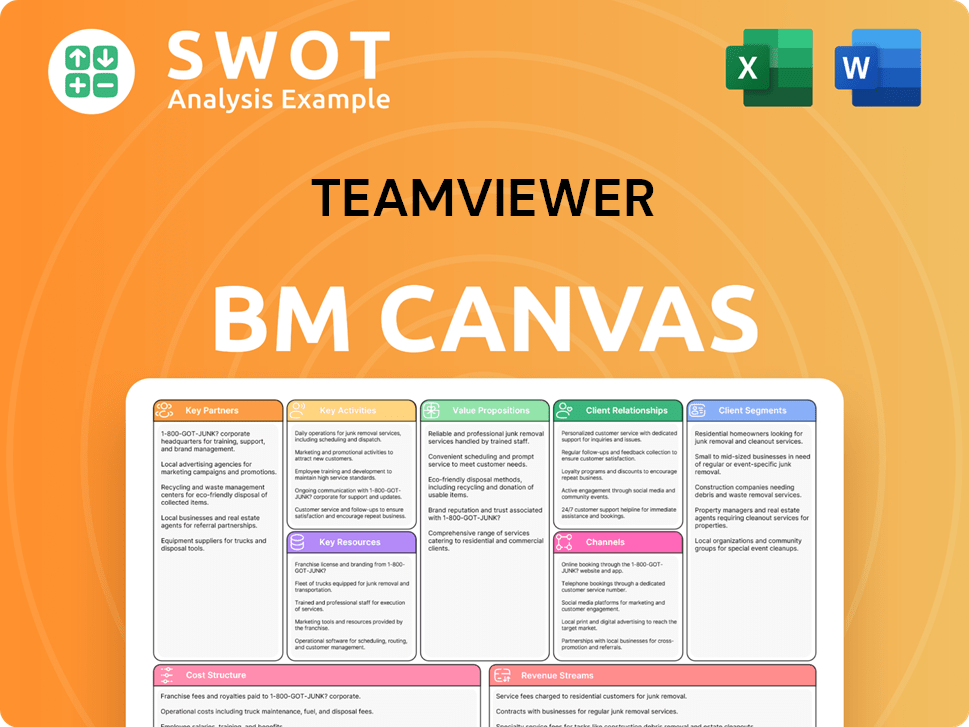

TeamViewer Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped TeamViewer’s Ownership Landscape?

Recent developments in TeamViewer ownership include significant capital management activities. In December 2023, a share buyback program was initiated, with a volume of up to EUR 150 million, which was completed in December 2024. The company repurchased a total of 10,785,155 shares under authorizations granted in May and June 2024 before the program's completion on December 13, 2024. Additionally, 4,000,000 shares acquired were canceled in August 2024, reducing the share capital from EUR 174,000,000.00 to EUR 170,000,000.00. These actions reflect a strategy to manage the company's capital structure and potentially increase shareholder value.

A major shift in TeamViewer's ownership landscape is the acquisition of 1E, a digital employee experience company, for $720 million (approximately €682 million). Announced in December 2024, this acquisition is set to conclude in early 2025, pending regulatory approvals. This is TeamViewer's largest acquisition to date and aims to broaden its service offerings and strengthen its market position. This expansion strategy is expected to drive double-digit revenue growth from 2027 onwards, supported by augmented reality and AI integration, as well as the expanded portfolio from the 1E acquisition. The company is also targeting a reduction in its leverage ratio to roughly 2.6x by the end of 2025.

| Metric | Details | Value |

|---|---|---|

| Share Buyback Program (2023-2024) | Total Volume | Up to EUR 150 million |

| Shares Repurchased | Total Number | 10,785,155 |

| Share Capital Reduction | August 2024 | From EUR 174,000,000.00 to EUR 170,000,000.00 |

| 1E Acquisition | Deal Value | $720 million (approx. €682 million) |

| Leverage Ratio Target | End of 2025 | Approximately 2.6x |

The acquisition of 1E and the ongoing share buyback programs indicate a proactive approach to enhancing TeamViewer's market position and capital structure. These moves align with industry trends towards strategic acquisitions and a focus on shareholder value. For more insights into the company's strategic direction, you can read about the Marketing Strategy of TeamViewer.

The program, launched in December 2023, repurchased over 10 million shares. The total volume was up to EUR 150 million.

The acquisition, valued at $720 million, aims to expand service offerings and market presence. It is expected to close in early 2025.

TeamViewer aims to achieve double-digit revenue growth from 2027 onwards. The company also targets a leverage ratio of approximately 2.6x by the end of 2025.

The company is a public company. The ownership is distributed among institutional investors and public shareholders.

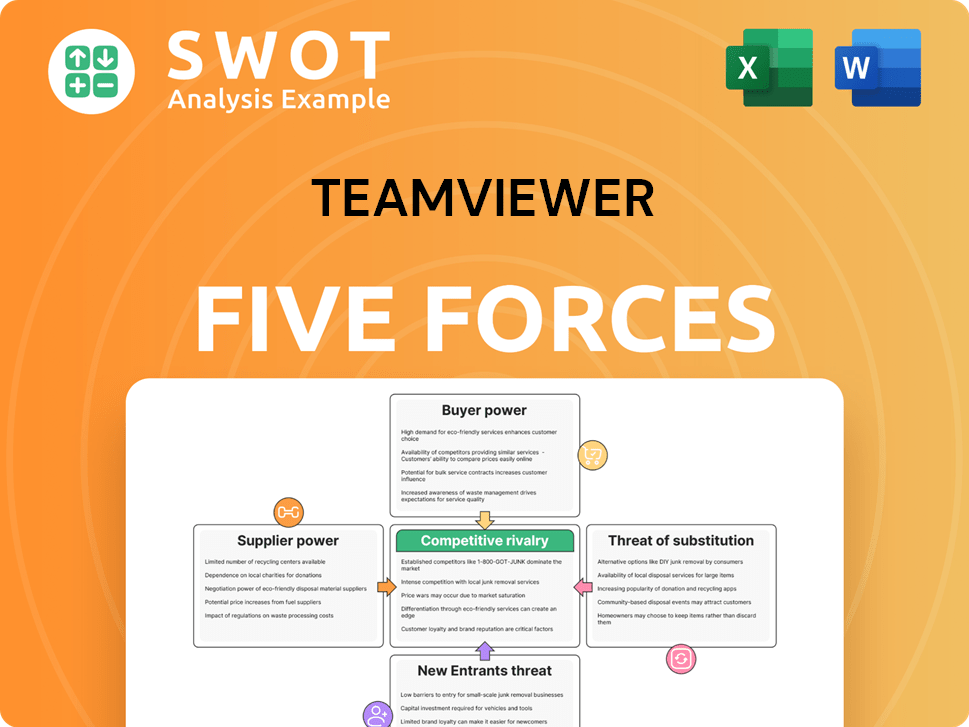

TeamViewer Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TeamViewer Company?

- What is Competitive Landscape of TeamViewer Company?

- What is Growth Strategy and Future Prospects of TeamViewer Company?

- How Does TeamViewer Company Work?

- What is Sales and Marketing Strategy of TeamViewer Company?

- What is Brief History of TeamViewer Company?

- What is Customer Demographics and Target Market of TeamViewer Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.