Tokyo Kiraboshi Financial Group Bundle

Can Tokyo Kiraboshi Financial Group Thrive in Today's Financial Climate?

In the dynamic Japanese financial market, understanding the Tokyo Kiraboshi Financial Group SWOT Analysis is crucial for investors and strategists alike. This deep dive explores the evolution of Tokyo Kiraboshi Financial Group, from its origins as a merger of regional banks to its current position as a key player. We'll analyze its growth strategy and the financial prospects that will shape its future.

Tokyo Kiraboshi Financial Group's journey, stemming from Kiraboshi Bank, reflects the changing landscape of the Japanese financial market. This analysis examines the company's strategic consolidation and its impact on business development. We will delve into the company profile, evaluating its growth initiatives and potential, providing insights into the future of Kiraboshi Bank in Japan and beyond.

How Is Tokyo Kiraboshi Financial Group Expanding Its Reach?

Tokyo Kiraboshi Financial Group is actively pursuing a robust growth strategy, focusing on several key expansion initiatives. These efforts are designed to strengthen its market position within the Tokyo metropolitan area and diversify its revenue streams. The company's strategic moves are aimed at enhancing profitability and achieving sustainable growth, as outlined in its 'Kiraboshi Transformation Plan 2025'.

The primary focus of the company's expansion strategy is to deepen its penetration within the Tokyo metropolitan area. This involves leveraging its existing branch network and customer base. The group is also exploring new service offerings tailored to the evolving needs of both individuals and small to medium-sized enterprises (SMEs).

The company is also looking to expand its digital channels to reach a wider customer base and enhance convenience, potentially through new online platforms or mobile banking solutions. While specific international expansion plans are not prominently detailed, the focus remains on strengthening its regional presence and offering a more comprehensive suite of services, including asset management and real estate solutions.

The company is concentrating on increasing its presence within the Tokyo metropolitan area. This involves optimizing its current branch network and customer relationships. This strategy aims to capture a larger share of the local market and offer tailored financial solutions.

The company is investing in digital platforms to broaden its customer reach. This includes developing new online and mobile banking solutions. These digital initiatives are designed to improve customer convenience and accessibility to financial services.

The group plans to strengthen its consulting functions for businesses. This includes providing comprehensive support beyond traditional banking services. The goal is to offer advice on business succession, M&A, and overseas expansion to support business growth.

The company is diversifying its service offerings to include asset management and real estate solutions. This expansion aims to provide a more comprehensive suite of financial products. This diversification is a key part of their growth strategy.

The company's strategic initiatives also include a focus on strengthening its consulting functions for businesses. This involves offering comprehensive support beyond traditional banking services, such as advice on business succession, M&A, and overseas expansion. These efforts are part of a broader strategy to enhance profitability and achieve sustainable growth. For a deeper understanding of the competitive environment, consider reading about the Competitors Landscape of Tokyo Kiraboshi Financial Group.

The financial prospects of Tokyo Kiraboshi Financial Group are closely tied to its expansion initiatives. These initiatives are designed to enhance its market position and diversify its revenue streams. The focus is on both organic growth within the Tokyo metropolitan area and strategic service diversification.

- Deepening market penetration in Tokyo through enhanced services.

- Expanding digital channels to improve customer reach and convenience.

- Strengthening business consulting services for SMEs.

- Diversifying service offerings to include asset management and real estate solutions.

Tokyo Kiraboshi Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Tokyo Kiraboshi Financial Group Invest in Innovation?

The Tokyo Kiraboshi Financial Group is actively embracing innovation and technology as key drivers for its growth strategy. This strategic shift is aimed at enhancing operational efficiency, improving customer experiences, and gaining a competitive edge in the Japanese financial market. The group's focus on digital transformation underscores its commitment to adapting to the evolving needs of its customers and the broader industry trends.

A significant part of their strategy involves investing in digital platforms and enhancing existing online banking services. This is designed to meet the demands of a customer base that increasingly prefers digital interactions. By streamlining internal processes and reducing costs through technology, the group aims to offer more accessible and convenient financial services, thereby attracting and retaining customers.

The company is also exploring advanced technologies to improve its risk management frameworks and data analytics capabilities. This approach allows for the development of more personalized financial products and services, which can further enhance customer satisfaction and loyalty. While specific details on research and development investments are not widely publicized, the strategic direction indicates a clear commitment to integrating technology across all operations.

Focus on developing new digital platforms and enhancing existing online banking services.

Aim to streamline internal processes and reduce costs through technological advancements.

Exploring advanced technologies to enhance risk management frameworks.

Improving data analytics capabilities to offer personalized financial products.

To contribute directly to growth objectives by expanding reach.

To improve service quality and maintain competitiveness in the financial sector.

Enhancing customer experience through digital platforms.

Offering more convenient and accessible financial services.

Utilizing technology to streamline internal processes.

Reducing operational costs to improve overall efficiency.

Integrating technology to remain competitive in the fast-evolving financial sector.

Adapting to the changing needs of customers and industry trends.

The Kiraboshi Bank is focusing on several key areas to leverage technology for business development and financial prospects.

- Digital Banking Platforms: Investing in new platforms and enhancing existing services to provide seamless customer experiences.

- Data Analytics: Utilizing data analytics to gain insights into customer behavior and market trends, enabling personalized product offerings.

- Risk Management Systems: Implementing advanced technologies to strengthen risk management frameworks and ensure regulatory compliance.

- Automation: Automating internal processes to improve efficiency, reduce costs, and enhance service delivery.

Tokyo Kiraboshi Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Tokyo Kiraboshi Financial Group’s Growth Forecast?

The financial outlook for Tokyo Kiraboshi Financial Group reflects a strong commitment to sustainable growth within the Japanese financial market. The group's strategic initiatives are designed to enhance profitability and deliver value to shareholders. This forward-looking approach is crucial for navigating the complexities of the financial sector and ensuring long-term success.

For the fiscal year ending March 31, 2025, Tokyo Kiraboshi Financial Group projects a consolidated ordinary profit of ¥17.5 billion and a consolidated net income attributable to owners of parent of ¥12.0 billion. These figures demonstrate the group's positive financial trajectory and its ability to generate consistent earnings. This performance builds on the results from the previous fiscal year, highlighting the effectiveness of its growth strategy.

The group's 'Kiraboshi Transformation Plan 2025' sets ambitious targets, including a consolidated ordinary profit of ¥20.0 billion by the fiscal year ending March 31, 2026. This plan underscores the company's focus on increasing shareholder returns and improving capital efficiency. These financial prospects are supported by ongoing efforts to optimize the business portfolio and expand digital capabilities.

For the year ended March 31, 2024, Tokyo Kiraboshi Financial Group reported a consolidated ordinary profit of ¥15.2 billion and a consolidated net income attributable to owners of parent of ¥11.5 billion. These results serve as a solid foundation for future growth. The group's ability to achieve these figures demonstrates its resilience and effective management.

The group is focusing on optimizing its business portfolio and enhancing consulting services. These efforts aim to diversify revenue streams and strengthen core banking operations. The group's strategic planning includes expanding digital capabilities to meet evolving market demands.

Digital transformation is a key component of Kiraboshi's growth strategy. By investing in digital capabilities, the group aims to improve customer experience and operational efficiency. This transformation supports the group's expansion plans and competitive analysis within the Japanese financial market.

A key objective of the 'Kiraboshi Transformation Plan 2025' is to increase shareholder returns. This commitment reflects the group's dedication to creating value for its investors. The group's investment strategy is designed to support this goal.

The future of Kiraboshi Bank in Japan is closely tied to its ability to adapt and innovate. The group's expansion plans include enhancing consulting services and expanding digital capabilities. The group is focused on sustainable efforts.

- Optimize business portfolio

- Enhance consulting services

- Expand digital capabilities

- Improve capital efficiency

Tokyo Kiraboshi Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Tokyo Kiraboshi Financial Group’s Growth?

The Tokyo Kiraboshi Financial Group faces several potential risks and obstacles that could influence its growth strategy and financial prospects. The competitive landscape in the Tokyo metropolitan area is highly saturated, with numerous financial institutions vying for market share. This intense competition demands continuous innovation and strategic adaptation to maintain and enhance its position within the Japanese financial market.

Regulatory changes and technological disruptions pose significant challenges. Compliance with evolving financial regulations, including those related to data privacy and anti-money laundering, can increase operational costs. Simultaneously, the rise of fintech companies necessitates ongoing investment in digital transformation to remain competitive. These factors require proactive risk management and strategic planning to navigate the dynamic environment successfully.

Internal resource constraints, such as the availability of skilled personnel in areas like digital transformation and cybersecurity, could hinder the effective implementation of strategic initiatives. The group must continuously invest in its workforce and technology to overcome these obstacles and achieve its business development goals. Understanding these risks is essential for evaluating the long-term viability and success of Tokyo Kiraboshi Financial Group.

The Tokyo metropolitan area is a highly competitive market for financial institutions. Several large and regional banks compete for customers, requiring Kiraboshi Bank to differentiate itself. Intense competition necessitates strategic initiatives and customer-centric approaches to maintain and grow its market share.

Changes in financial regulations can impose additional compliance burdens and operational costs. Regulations related to financial stability, data privacy, and anti-money laundering require continuous adaptation. Compliance is crucial for maintaining operational integrity and avoiding penalties.

The evolving interest rate environment in Japan can impact net interest margins. Fluctuations in interest rates affect the profitability of lending activities. Monitoring and adapting to interest rate changes are essential for financial performance.

Fintech companies and other non-traditional financial service providers pose a continuous challenge. Ongoing investment in innovation is necessary to remain competitive. Adapting to digital transformation is critical for future success.

Internal resource constraints, such as skilled personnel, can hinder strategic initiatives. Shortages in areas like digital transformation and cybersecurity can impact implementation. Investing in human capital development is crucial.

Economic trends significantly impact the financial performance and strategic planning of Tokyo Kiraboshi Financial Group. Factors such as inflation, changes in consumer spending, and shifts in the global economy can affect the group's profitability and growth potential. The group must monitor and adapt to these economic changes.

To mitigate these risks, Tokyo Kiraboshi Financial Group employs diversified service offerings and robust risk management frameworks. The group focuses on continuous investment in technology and human capital development to enhance its competitive position. Strengthening consulting capabilities is a key strategy for providing value-added services and differentiating itself from competitors. For additional insights into the group's approach, explore the Marketing Strategy of Tokyo Kiraboshi Financial Group.

Economic trends have a significant impact on the group's financial performance and strategic planning. Factors such as inflation, changes in consumer spending, and shifts in the global economy influence profitability and growth potential. The group must continuously monitor and adapt to these economic changes to ensure sustainable growth. The group's ability to adapt to these trends is critical for its long-term success.

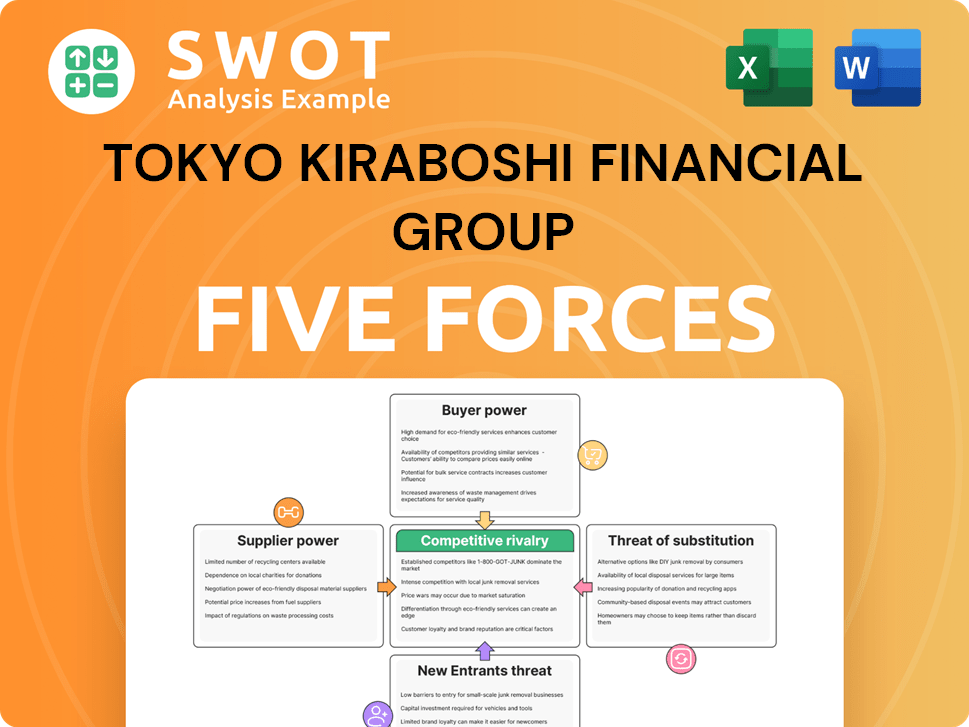

Tokyo Kiraboshi Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Tokyo Kiraboshi Financial Group Company?

- What is Competitive Landscape of Tokyo Kiraboshi Financial Group Company?

- How Does Tokyo Kiraboshi Financial Group Company Work?

- What is Sales and Marketing Strategy of Tokyo Kiraboshi Financial Group Company?

- What is Brief History of Tokyo Kiraboshi Financial Group Company?

- Who Owns Tokyo Kiraboshi Financial Group Company?

- What is Customer Demographics and Target Market of Tokyo Kiraboshi Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.