Tootsie Roll Industries Bundle

Can Tootsie Roll Industries Maintain Its Sweet Success?

From its humble beginnings in 1896, Tootsie Roll Industries SWOT Analysis has become a confectionery behemoth, but what does the future hold for this iconic candy company? This analysis delves into the Growth Strategy and Tootsie Roll Future, exploring how Tootsie Roll Industries plans to navigate the ever-changing Confectionery Market.

This exploration of Tootsie Roll Industries examines its current market position, competitive landscape, and the challenges it faces, including rising costs and the need for innovation. We'll dissect the company's strategic initiatives, including expansion plans and new product development, to understand how Tootsie Roll Industries aims to secure its place in the future. Ultimately, this Candy Company Analysis provides insights into the Business Outlook for investors and stakeholders alike.

How Is Tootsie Roll Industries Expanding Its Reach?

The Revenue Streams & Business Model of Tootsie Roll Industries focuses on strategic expansion primarily through investments in manufacturing and product diversification. This approach is crucial for the long-term growth strategy of the company, especially in the dynamic confectionery market.

A key aspect of the company's expansion strategy involves significant investments in its manufacturing infrastructure. This includes a substantial investment of approximately $97.7 million by Charms, a subsidiary, to expand its factory for Blow Pops production. This investment is designed to meet rising demand and enhance operational efficiency.

These expansion initiatives are indicative of a broader strategy to adapt to changing consumer preferences and market dynamics. The company's focus on optimizing existing production capabilities and diversifying its product offerings, particularly in non-chocolate lines, is a direct response to fluctuating commodity prices and consumer demands.

The company is strategically investing in its manufacturing operations. A significant portion of this involves the expansion of the factory where Blow Pops are manufactured, with an investment of around $97.7 million. This investment is aimed at increasing production capacity and improving operational efficiencies.

Tootsie Roll Industries is focusing on diversifying its product lines, especially by strengthening its non-chocolate brands. This strategic shift helps the company manage the challenges of fluctuating cocoa prices and evolving consumer preferences. The company aims to ensure long-term growth and stability through this diversification.

The company's expansion plans are largely funded from internal sources, with most expenditures expected in 2025 and 2026. This approach indicates a commitment to sustainable growth and financial prudence. The focus on optimizing existing operations and strategic investments positions the company well within the competitive confectionery market.

- The expansion of the Blow Pops factory is a key initiative.

- The company is focusing on increasing production capacity.

- The financial strategy emphasizes internal funding.

- The company is responding to market challenges.

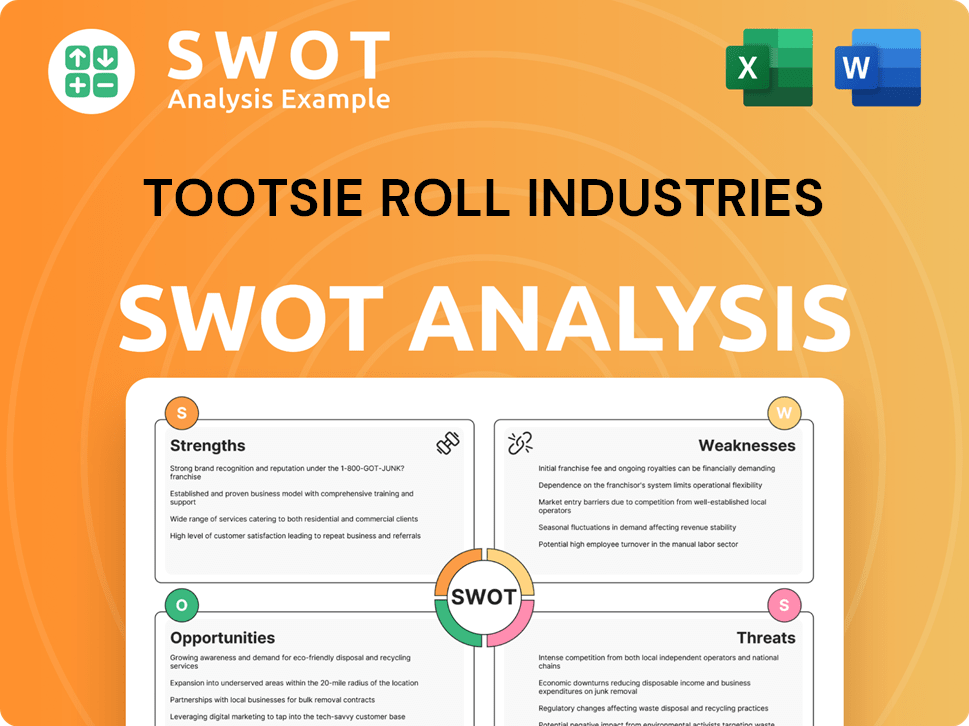

Tootsie Roll Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Tootsie Roll Industries Invest in Innovation?

The innovation and technology strategy of Tootsie Roll Industries focuses on enhancing operational efficiency and product quality through strategic investments. These investments are crucial for sustaining growth and meeting the evolving demands of the confectionery market. The company's approach emphasizes continuous improvement in manufacturing processes and a commitment to sustainable practices.

Tootsie Roll Industries strategically invests in technology to boost production efficiency and optimize its operations. These efforts are designed to strengthen its market position and ensure long-term viability. These investments are a key aspect of the company's growth strategy, enabling it to adapt to market changes and maintain a competitive edge.

The company's commitment to technological advancements and sustainability is central to its long-term growth strategy. These initiatives are designed to improve operational efficiency, manage costs, and address environmental impacts. By focusing on these areas, Tootsie Roll Industries aims to secure its future in the confectionery industry.

In 2022, Tootsie Roll Industries invested $6.2 million in manufacturing technology. This investment led to a 17.3% increase in production efficiency across its facilities. These upgrades are part of an ongoing effort to improve operations.

The company plans a significant plant expansion, allocating approximately $100 million over the next seven years. This expansion will include new machinery, equipment, and infrastructure improvements. These enhancements are designed to boost operational efficiencies and product quality.

Tootsie Roll Industries protects its major trademarks in the United States, Canada, Mexico, and numerous other countries. This protection is vital for safeguarding brand identity and market position. Protecting trademarks is a key component of the company's long-term strategy.

In 2024, a sustainable uniform shirt initiative was implemented, diverting nearly 1.8 million 20oz plastic bottles from landfills and oceans. In 2025, the company engaged a consultant to prepare its first climate-related financial risk report, aligning with the Task Force on Climate-Related Financial Disclosures (TCFD) framework. These initiatives demonstrate a commitment to environmental responsibility.

Tootsie Roll Industries integrates innovation and technology to drive its Growth Strategy. These efforts are essential for maintaining a competitive edge in the Confectionery Market. The company's focus on operational improvements and sustainability is crucial for its Tootsie Roll Future. For more insights, you can read about the Marketing Strategy of Tootsie Roll Industries.

Tootsie Roll Industries leverages technology and sustainability to enhance its operational efficiency and manage environmental impacts. These initiatives contribute to the company's long-term growth and market competitiveness.

- Manufacturing Technology Upgrades: Investments in automation and new equipment to increase production efficiency.

- Plant Expansion: A multi-year, $100 million investment to improve infrastructure and operational capabilities.

- Sustainable Practices: Implementation of initiatives like the sustainable uniform shirt program to reduce environmental impact.

- Climate-Related Financial Risk Report: Preparation of a TCFD-aligned report to address climate-related financial risks.

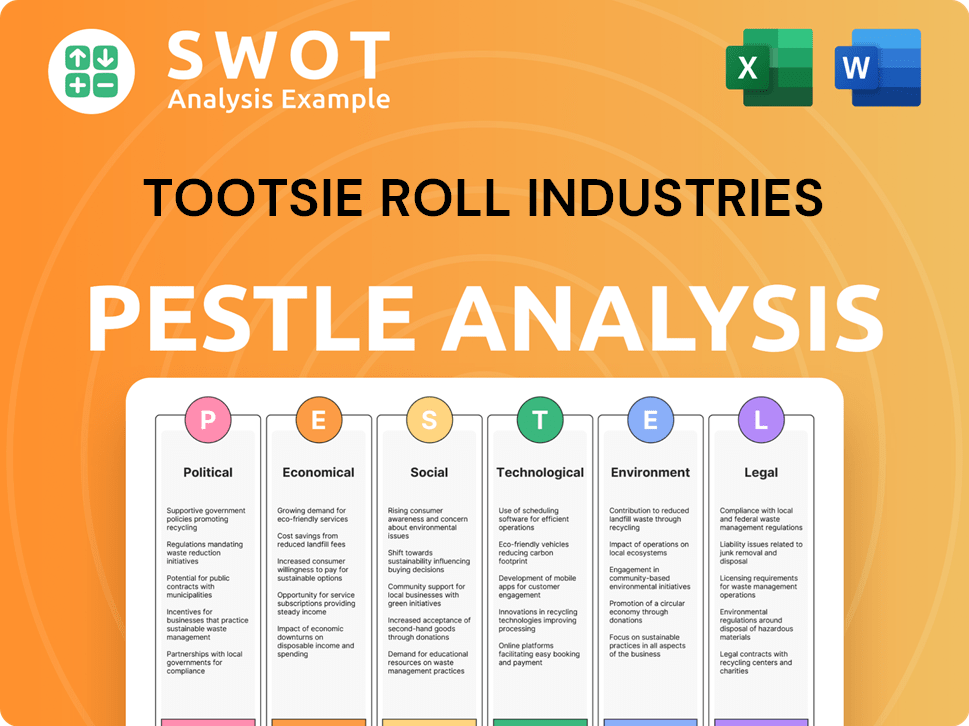

Tootsie Roll Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Tootsie Roll Industries’s Growth Forecast?

The financial landscape for Tootsie Roll Industries reflects a period of adjustment and strategic recalibration. Recent financial results indicate a need for the company to navigate challenges in the confectionery market while maintaining its financial health. The company’s performance in 2024 and early 2025 provides a clear picture of its current standing and future prospects.

For the full year 2024, Tootsie Roll Industries reported total revenue of $723.217 million. This figure represents a decrease compared to the previous year, primarily due to lower sales volumes and market resistance to price increases. In the first quarter of 2025, net product sales were $146.5 million, a 2.9% decrease year-over-year from $153.2 million in Q1 2024. The company's ability to adapt and innovate will be key to its future growth.

Despite the revenue challenges, Tootsie Roll Industries has demonstrated resilience in its financial management. The company's focus on cost reductions and operational efficiencies has helped maintain profitability. The confectionery market is competitive, but the company's strategic initiatives aim to strengthen its market position.

In 2024, net sales decreased by 6% to $715.5 million. This decline was influenced by various market factors. The Brief History of Tootsie Roll Industries provides context to the company's market position.

Net earnings also decreased by 6% to $86.8 million in 2024. However, excluding a non-cash tax charge, net earnings would have increased by 6% to $97.8 million. This shows the company's underlying profitability.

The gross profit margin improved to 35.0% in 2024, up from 33.4% in 2023. The operating margin as of May 2025 (TTM) was 17.54%. These improvements reflect effective cost management.

Tootsie Roll Industries ended 2024 with $429 million in cash and investments, net of interest-bearing debt. The company also repurchased $13.5 million of its shares and paid $25.5 million in dividends.

Looking ahead, the company anticipates higher cocoa and chocolate costs in 2025, potentially impacting margins. Management is focused on restoring margins through price adjustments and cost reductions. The company is also investing in plant expansions to meet demand and improve operational efficiencies.

- Analysts forecast an average of 3% earnings per share growth through 2030.

- This growth is expected to be driven by product innovation and share buybacks.

- The company's long-term strategy focuses on sustainable practices and market expansion.

- Ongoing acquisitions and new product development are key to the company's growth strategy.

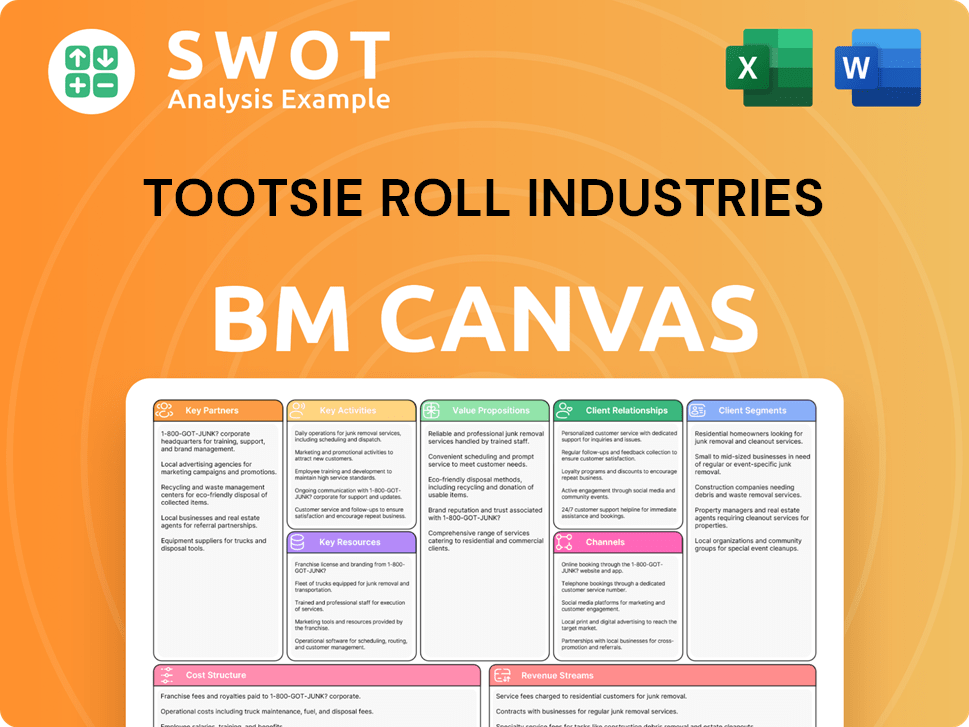

Tootsie Roll Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Tootsie Roll Industries’s Growth?

The Tootsie Roll Industries faces several significant risks that could impede its growth strategy and affect its Tootsie Roll future. The competitive nature of the confectionery market, coupled with rising input costs, presents ongoing challenges. The company must navigate these obstacles to maintain its market position and achieve its financial goals.

A key challenge is the intensely competitive domestic market, where Tootsie Roll Industries competes on brand recognition and pricing. Furthermore, the company confronts rising costs, especially for raw materials like cocoa and chocolate, which could negatively impact profit margins. Managing these costs and consumer price sensitivity are essential for sustained financial health.

Supply chain disruptions and regulatory changes also pose risks to Tootsie Roll Industries. The company must also consider the impact of environmental and climate change risks, such as adverse weather patterns, which could affect the cost and availability of ingredients. Cybersecurity risks, including cyber-attacks and data breaches, are also a concern given the company's reliance on computer systems for its business and supply chain.

The confectionery market is highly competitive, requiring Tootsie Roll Industries to maintain a strong brand presence. The company competes with numerous other confectionery businesses for shelf space and consumer attention. Market dynamics and consumer preferences are constantly evolving, necessitating innovation and effective marketing strategies.

Significant increases in input costs, particularly cocoa and chocolate, pose a major financial risk. As older supply contracts expire and new, higher-cost contracts become effective, profit margins may be squeezed. The company must manage these rising costs effectively to maintain profitability.

Supply chain vulnerabilities can disrupt the availability and cost of raw materials. Potential disruptions from natural disasters, pandemics, or geopolitical events could significantly impact operations. Maintaining a resilient supply chain is crucial for ensuring consistent product delivery.

Changes in regulations, such as those affecting food advertising and ingredient use, could adversely impact Tootsie Roll Industries. Environmental and climate change risks, including adverse weather, can affect ingredient availability and cost. Adapting to these changes is essential for long-term sustainability.

Cybersecurity risks, including cyber-attacks and data breaches, are a growing concern. As the company relies on computer systems for its business and supply chain, protecting its data and systems is critical. Implementing robust cybersecurity measures is essential for safeguarding operations.

Market risks related to commodity prices, interest rates, and foreign exchange can impact financial performance. Hedging strategies, such as commodity futures and foreign currency forward contracts, are used to mitigate these risks. Economic factors can significantly influence the company's financial outlook.

The Tootsie Roll Industries has a conservative financial approach and a long-term perspective to manage risks. The company focuses on operational improvements and expanding capabilities to meet consumer demands. This strategy aims to sustain its position in the competitive confectionery industry. You can read more about the company in this Candy Company Analysis. The company's market share and financial performance are crucial indicators of its success in navigating these challenges and achieving its Business Outlook.

To effectively manage these risks, Tootsie Roll Industries must implement several strategic measures. This includes proactive cost management, supply chain diversification, and innovative product development. Adapting to changing consumer preferences and regulatory environments is vital for long-term sustainability. These strategies are essential for ensuring the Tootsie Roll future.

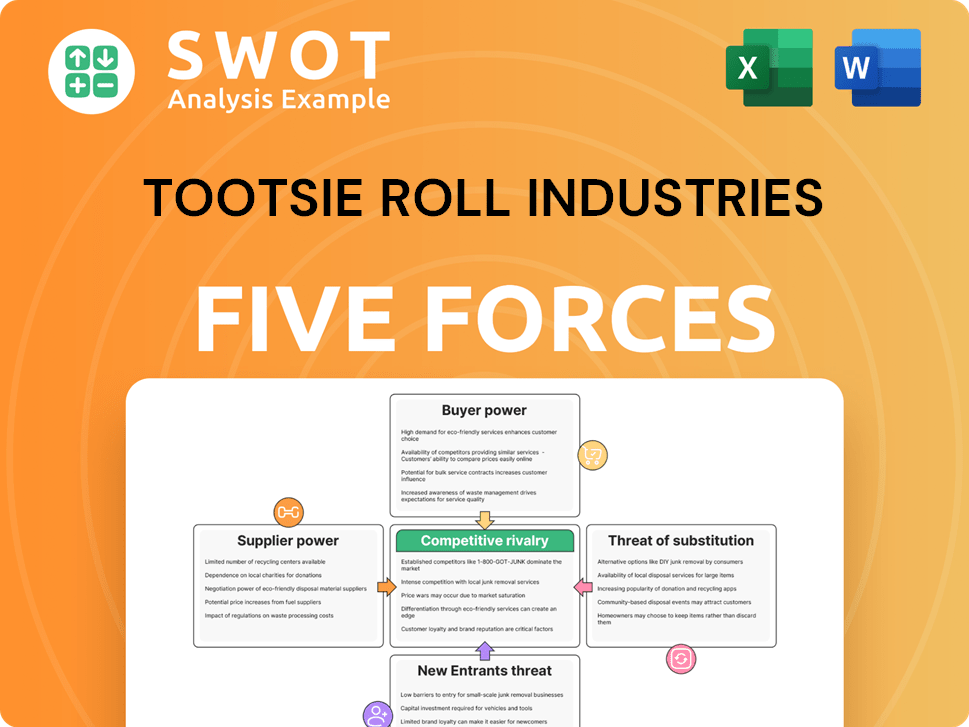

Tootsie Roll Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Tootsie Roll Industries Company?

- What is Competitive Landscape of Tootsie Roll Industries Company?

- How Does Tootsie Roll Industries Company Work?

- What is Sales and Marketing Strategy of Tootsie Roll Industries Company?

- What is Brief History of Tootsie Roll Industries Company?

- Who Owns Tootsie Roll Industries Company?

- What is Customer Demographics and Target Market of Tootsie Roll Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.