Tootsie Roll Industries Bundle

Who Really Calls the Shots at Tootsie Roll Industries?

Delving into the ownership structure of Tootsie Roll Industries SWOT Analysis reveals more than just a list of shareholders; it unveils the very heart of its enduring success. Understanding who controls this iconic confectionery giant is crucial for anyone looking to navigate the market or simply appreciate the company's unique journey. From its humble beginnings to its current market presence, the story of Tootsie Roll is deeply intertwined with its ownership.

The Tootsie Roll ownership story, unlike many modern corporations, is a testament to family control, a rarity that has significantly shaped its strategic decisions. This family-owned aspect of the Tootsie Roll parent company is a key factor in its long-term vision and conservative approach to financial management. Understanding the Tootsie Roll history and the influence of key stakeholders offers valuable insights for investors and business strategists alike, especially if you are interested in the Tootsie Roll stock or the diverse Tootsie Roll brands.

Who Founded Tootsie Roll Industries?

The story of Tootsie Roll Industries begins with Leo Hirschfeld, an Austrian Jewish immigrant, who launched his candy business in New York City in 1896. While the exact initial ownership structure isn't fully documented, Hirschfeld's early work took place at a candy shop owned by Stern & Saalberg, where he held a senior position.

In 1917, the company's name evolved to The Sweets Company of America, and it was listed on the American Stock Exchange in 1919. However, Hirschfeld's tenure ended around 1920. The company faced financial challenges until a turning point in 1935.

Joseph Rubin & Sons of Brooklyn, a key supplier of paper boxes, acquired control of the struggling company. Bernard D. Rubin led the new management team, acquiring shares to gain control and revitalize the business. Under Rubin's leadership, Tootsie Roll Industries saw increased sales and profitability.

Leo Hirschfeld, the founder, started in 1896 in New York City. His early work was at Stern & Saalberg's candy shop.

The company became The Sweets Company of America in 1917. It was listed on the American Stock Exchange in 1919.

The company faced financial difficulties, leading to a change in ownership in 1935. Hirschfeld was no longer involved around 1920.

Joseph Rubin & Sons took control in 1935. Bernard D. Rubin led the company to profitability.

After Bernard Rubin's death in 1948, William B. Rubin became president. The Rubin family played a crucial role in the company's early success.

The founding vision of an affordable and durable candy was maintained. The Rubin family expanded on this vision.

The early ownership of Tootsie Roll Industries transitioned from its founder to a new management team under Bernard D. Rubin, who acquired shares to gain control. After Bernard Rubin's death, William B. Rubin took over. This transition highlights the importance of adapting to market challenges and maintaining the core values of the business. For more details, you can read about the Revenue Streams & Business Model of Tootsie Roll Industries.

The initial ownership was with Leo Hirschfeld.

- The company was listed on the American Stock Exchange in 1919.

- Joseph Rubin & Sons acquired control in 1935.

- Bernard D. Rubin led the company to profitability.

- William B. Rubin served as president after Bernard's death.

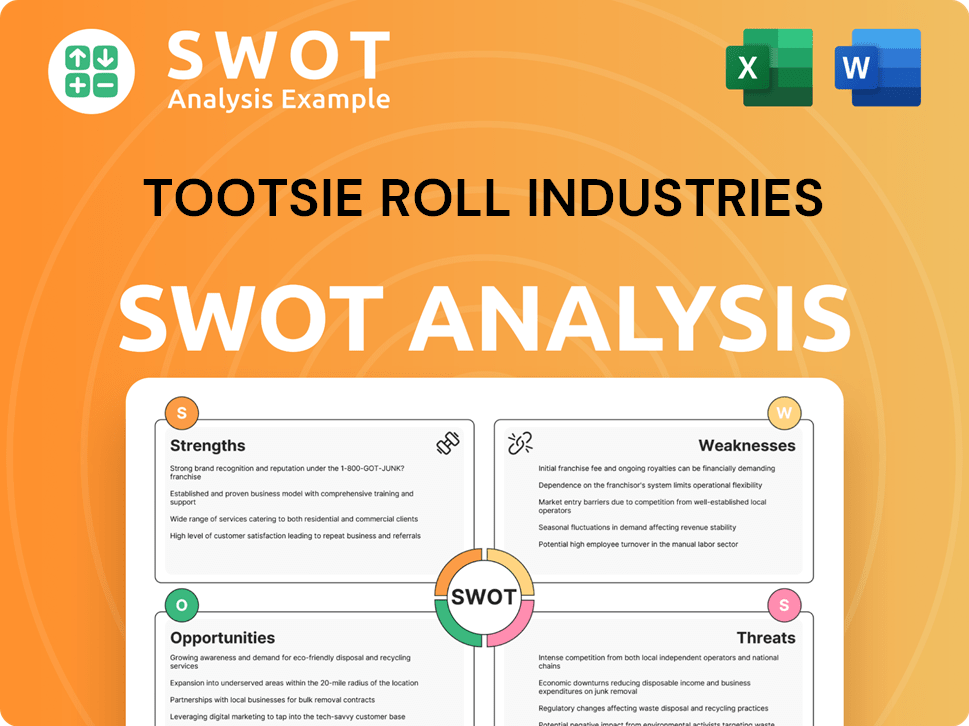

Tootsie Roll Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Tootsie Roll Industries’s Ownership Changed Over Time?

Tootsie Roll Industries, a publicly traded entity under the ticker symbol TR on the New York Stock Exchange (NYSE), features a dual-class ownership structure. This structure concentrates control significantly. As of May 2025, Ellen R. Gordon, the Chairwoman and CEO, holds a substantial stake. She owns approximately 57% of common stock and 82.8% of Class B shares, effectively granting her control over the company. Her estimated net worth is at least $856 million as of June 2025, with approximately 25,714,334 shares of Tootsie Roll Industries Inc. stock.

The ownership breakdown for the fiscal year 2024 shows that individual insiders, including Ellen Gordon, hold a significant majority, with approximately 65% to 76.02% ownership. Institutional ownership ranges from about 16% to 44.7%, including major investment firms, mutual funds, and pension funds. Retail ownership, representing shares held by individual investors, is around 17.1% to 27.12%. Major institutional shareholders as of March 2025 include Vanguard Group Inc. (2,152,076 shares), Blackrock Inc. (1,845,633 shares), and Allspring Global Investments Holdings LLC (1,242,619 shares). Vanguard Group Inc. increased its stake in Tootsie Roll by acquiring an additional 211,129 shares in December 2024, bringing their total holdings to 2,109,375 shares, representing a 5.12% stake. For more details, you can read a Brief History of Tootsie Roll Industries.

| Ownership Category | Approximate Ownership (Fiscal Year 2024) | Notes |

|---|---|---|

| Individual Insiders | 65% - 76.02% | Includes Ellen R. Gordon |

| Institutional Ownership | 16% - 44.7% | Major firms like Vanguard and Blackrock |

| Retail Ownership | 17.1% - 27.12% | Individual investors |

Key events have shaped the Tootsie Roll ownership structure. The Rubin family's acquisition of control in 1935 prevented potential bankruptcy and set the stage for future growth. The company adopted its current name, Tootsie Roll Industries, Inc., in 1966. Melvin Gordon, Ellen Gordon's husband, became CEO in 1968, leading a period of stability until 2015, when Ellen R. Gordon assumed the roles of Chairman and CEO. These changes have ensured continued family-led management, influencing a conservative financial approach and long-term strategic decisions, such as investing in plant expansions to meet demand and improve operational efficiencies, with plans to invest approximately $100 million over the next seven years.

Ellen R. Gordon's significant stake gives her effective control of the company.

- Family leadership has been a constant factor, influencing strategic decisions.

- Institutional investors hold a substantial portion of the shares.

- The dual-class structure concentrates voting power.

- The company's history is marked by family involvement and strategic acquisitions.

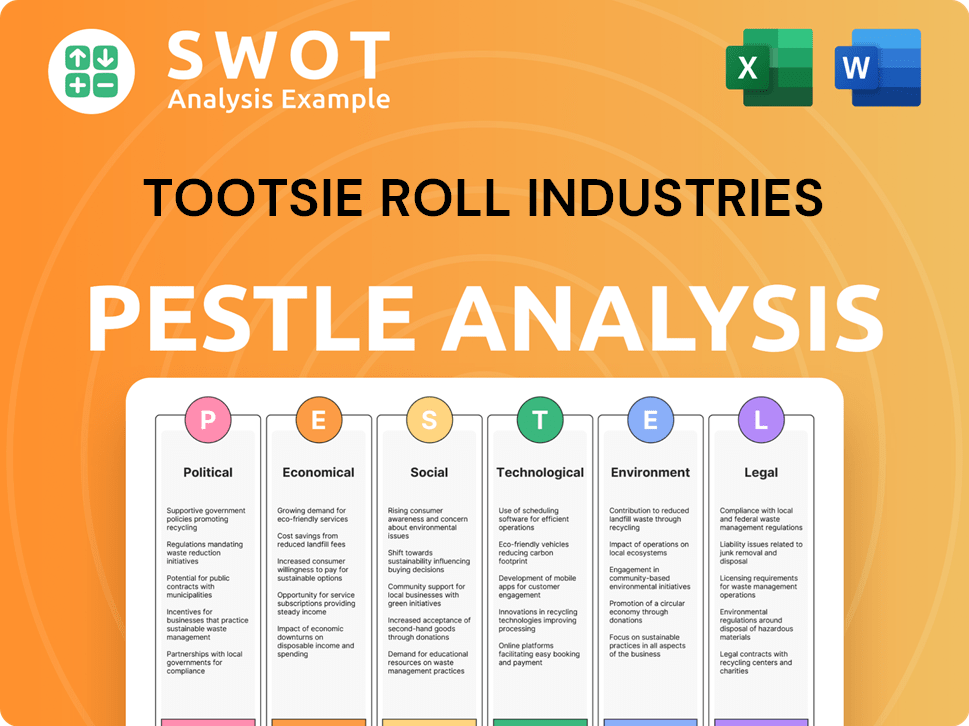

Tootsie Roll Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Tootsie Roll Industries’s Board?

The current Board of Directors of Tootsie Roll Industries plays a vital role in the company's governance. As of May 5, 2025, the board consisted of five elected members. These include Ellen R. Gordon, Virginia L. Gordon, Lana Jane Lewis-Brent, Michael A. Chodos, and Paula M. Wardynski. Michael Adam Chodos joined the board in January 2025 and was appointed to the Audit and Compensation Committees, bringing extensive experience in corporate finance, governance, and compliance. His appointment coincided with the departure of Barre A. Seibert, who resigned after two decades of service.

The board's decisions directly impact the company's financial and strategic direction. In 2024, all directors attended at least 75% of the Board and Committee meetings, with the exception of Mr. Seibert who attended 70%. The company operates with a dual-class share structure, which provides disproportionate voting power to certain shareholders. This structure effectively gives Ellen R. Gordon, the Chairwoman and CEO, significant control, as she owns approximately 57.1% of common stock and 82.8% of Class B shares.

| Board Member | Title | Affiliation |

|---|---|---|

| Ellen R. Gordon | Chairwoman and CEO | Tootsie Roll Industries, Inc. |

| Virginia L. Gordon | Director | Tootsie Roll Industries, Inc. |

| Lana Jane Lewis-Brent | Director | Tootsie Roll Industries, Inc. |

| Michael A. Chodos | Director | Tootsie Roll Industries, Inc. |

| Paula M. Wardynski | Director | Tootsie Roll Industries, Inc. |

The concentrated ownership, particularly the significant voting power held by Ellen Gordon, heavily influences company growth and policy. This structure has, in effect, prevented any recent proxy battles or activist investor campaigns. The board's action, such as the revocation of a prior action regarding nonqualified deferred compensation that resulted in an $11 million non-cash tax charge in the fourth quarter of 2024, highlights the board's direct impact on the company's financial and strategic direction. The dominance of the Gordon family in Tootsie Roll ownership ensures their vested interests significantly shape the company’s trajectory.

The Board of Directors includes key figures like Ellen R. Gordon, who holds significant voting power.

- The dual-class share structure gives disproportionate voting rights.

- Michael A. Chodos joined the board in January 2025, bringing expertise in finance.

- The board's decisions directly influence the company's financial and strategic direction.

- The Gordon family's influence is central to Tootsie Roll parent company control.

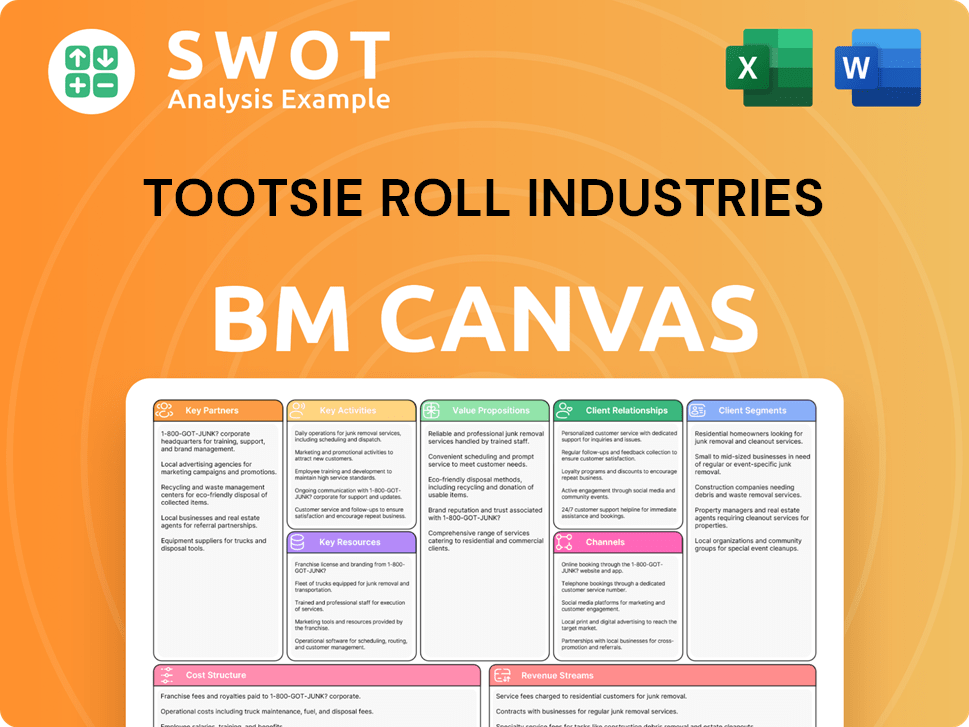

Tootsie Roll Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Tootsie Roll Industries’s Ownership Landscape?

Over the last few years, the ownership structure of Tootsie Roll Industries has remained stable, largely due to its family-led control. As of December 2024, Ellen R. Gordon, the Chairwoman and CEO, held a significant stake, controlling approximately 57% of the common stock and 82.8% of the Class B shares. This gives her substantial influence over the company. Insider holdings remained largely constant at 39.12% in March 2025, indicating a continued commitment from within the company.

The company's approach to share buybacks has also been consistent. In 2024, Tootsie Roll Industries repurchased and retired $13.5 million of its outstanding shares. This strategy helps reduce the number of shares available and can boost earnings per share. Recent quarterly buybacks include $6.47 million in Q1 2025 and $11.32 million in Q4 2024. The company has reduced its share count by millions since 2011 and anticipates an average annual decrease of 1% moving forward. Institutional investors have increased their holdings from 15.21% to 16.03% as of March 2025, showing continued confidence.

| Metric | Details | Date |

|---|---|---|

| Insider Holdings | 39.12% | March 2025 |

| Institutional Ownership | Increased from 15.21% to 16.03% | March 2025 |

| Share Buybacks (Q1) | $6.47 million | Q1 2025 (ending March 31, 2025) |

| Share Buybacks (Q4) | $11.32 million | Q4 2024 (ending December 31, 2024) |

Tootsie Roll ownership is largely influenced by the Gordon family's control, with Ellen Gordon leading the company, continuing the legacy of her late husband, Melvin Gordon. The company's focus remains on long-term growth through strategic investments, such as approximately $100 million over the next seven years for plant expansion. Despite a 6% decline in net sales for the full year 2024, reaching $715.5 million, and a 5% decrease in net earnings to $86.8 million, the company is focused on restoring margins through price adjustments and cost reductions. For more on the company's strategic direction, consider reading about the Growth Strategy of Tootsie Roll Industries.

Ellen R. Gordon is the current Chairwoman and CEO. The company's leadership has shown continuity, maintaining a consistent strategic direction.

Net sales reached $715.5 million, a 6% decrease. Net earnings were $86.8 million, a 5% decrease. The company is focused on margin recovery.

The company consistently repurchases shares, reducing the outstanding share count. In 2024, $13.5 million of shares were repurchased.

Tootsie Roll Industries is investing approximately $100 million over the next seven years for plant expansion to meet higher demand for certain products.

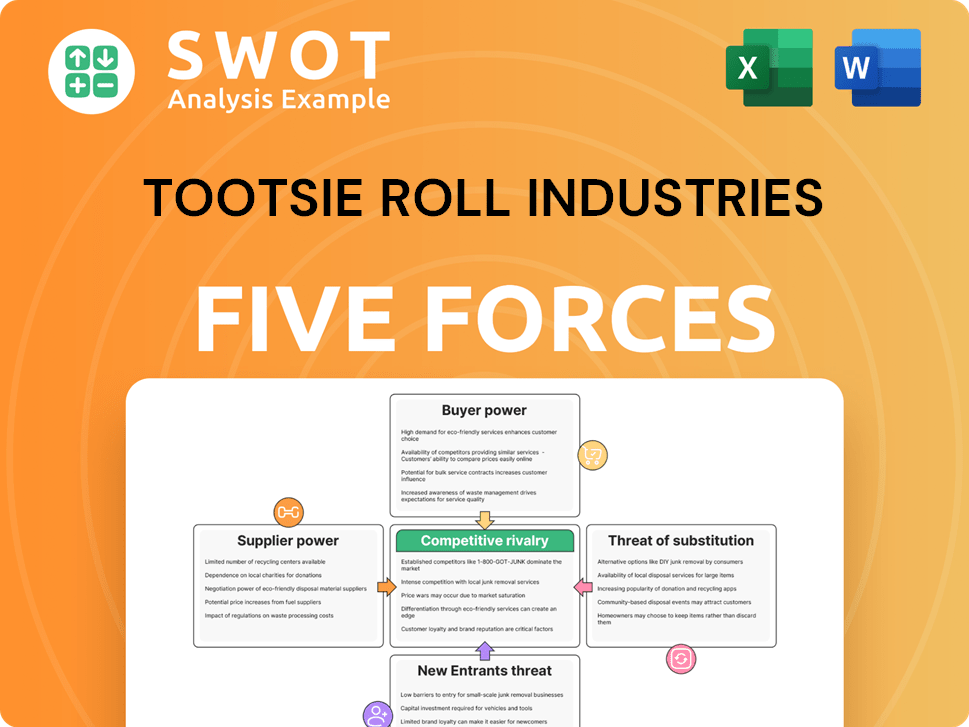

Tootsie Roll Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Tootsie Roll Industries Company?

- What is Competitive Landscape of Tootsie Roll Industries Company?

- What is Growth Strategy and Future Prospects of Tootsie Roll Industries Company?

- How Does Tootsie Roll Industries Company Work?

- What is Sales and Marketing Strategy of Tootsie Roll Industries Company?

- What is Brief History of Tootsie Roll Industries Company?

- What is Customer Demographics and Target Market of Tootsie Roll Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.