Toyo Tire Bundle

How is Toyo Tire Company Steering its Future?

Toyo Tire Corporation, a global leader in tire manufacturing, is strategically navigating a dynamic automotive industry. From its roots in post-war Japan to its current multinational status, the company's journey is a compelling case study in strategic growth. This analysis explores Toyo Tires' Toyo Tire SWOT Analysis, market position, and future prospects.

Understanding Toyo Tires' growth strategy requires a deep dive into its market analysis and competitive landscape. The company's commitment to innovation, as seen in its research and development efforts, is crucial for its long-term goals. With the rise of electric vehicles, Toyo Tire Company is adapting its business model to capitalize on emerging investment opportunities and technological advancements, securing its place in the future of tire manufacturing.

How Is Toyo Tire Expanding Its Reach?

The expansion initiatives of Toyo Tire Corporation are designed to boost its market presence and diversify its revenue streams. These strategies are vital for achieving sustainable growth and capitalizing on emerging opportunities in the global tire market. The company's focus includes geographical expansion, product innovation, and the exploration of new business models.

A key aspect of Toyo Tires Growth Strategy involves increasing production capacity and broadening its geographical footprint. This includes strategic investments in manufacturing facilities and distribution networks to better serve existing markets and penetrate new ones. The company is also adapting its product offerings to meet evolving consumer demands and technological advancements in the automotive industry.

As the automotive industry evolves, Toyo Tire Company Future prospects are closely tied to its ability to adapt and innovate. This includes developing tires for electric vehicles (EVs) and expanding its presence in key markets. The company's strategic partnerships and commitment to research and development are also crucial for maintaining its competitive edge in the tire industry.

Toyo Tires is expanding its global presence, with a significant focus on the European and Middle Eastern markets. The Serbian plant, which started production in 2022, is expected to reach a full annual production capacity of approximately five million tires by the mid-2020s. This expansion aims to reduce logistical costs and improve delivery times, enhancing the company’s competitive advantage.

The North American market is a critical area for Toyo Tires Market Analysis and growth. The company is expanding its product offerings, particularly for light trucks and SUVs, a segment experiencing substantial growth. This strategic focus aims to capitalize on the increasing demand for these types of vehicles in the region.

Recognizing the shift towards electric vehicles, Toyo Tires is developing new tires specifically designed for EVs. These tires address unique requirements such as lower rolling resistance for extended range and enhanced durability to handle the heavier weight of EV batteries. This initiative is crucial for capturing a share of the growing EV market.

Toyo Tire Company Performance is also exploring new business models, such as subscription-based tire services and integrated mobility solutions, to diversify its revenue streams. Strategic partnerships with leading automotive manufacturers for original equipment (OE) fitments are also vital for securing future growth. These partnerships ensure that Toyo Tires are integrated into the latest vehicle models, enhancing brand visibility and sales.

Toyo Tire Prospects are also influenced by its ability to innovate and adapt to the changing market dynamics. The company's focus on EV tires, expansion in key markets, and strategic partnerships are all part of a comprehensive strategy to ensure long-term success. For more insights into the company's marketing approach, consider reading about the Marketing Strategy of Toyo Tire.

Toyo Tires' expansion strategy includes significant investments in production capacity and market reach. The Serbian plant's full capacity of five million tires annually by the mid-2020s represents a substantial increase in production capabilities. The company's focus on the North American market and EV-specific tire development demonstrates its commitment to adapting to market trends and consumer demands.

- Increased Production Capacity: Serbian plant to reach full capacity by mid-2020s.

- Market Focus: Expanding product offerings for light trucks and SUVs in North America.

- EV Tire Development: Launching tires tailored for electric vehicles.

- Strategic Partnerships: Collaborations with automotive manufacturers for OE fitments.

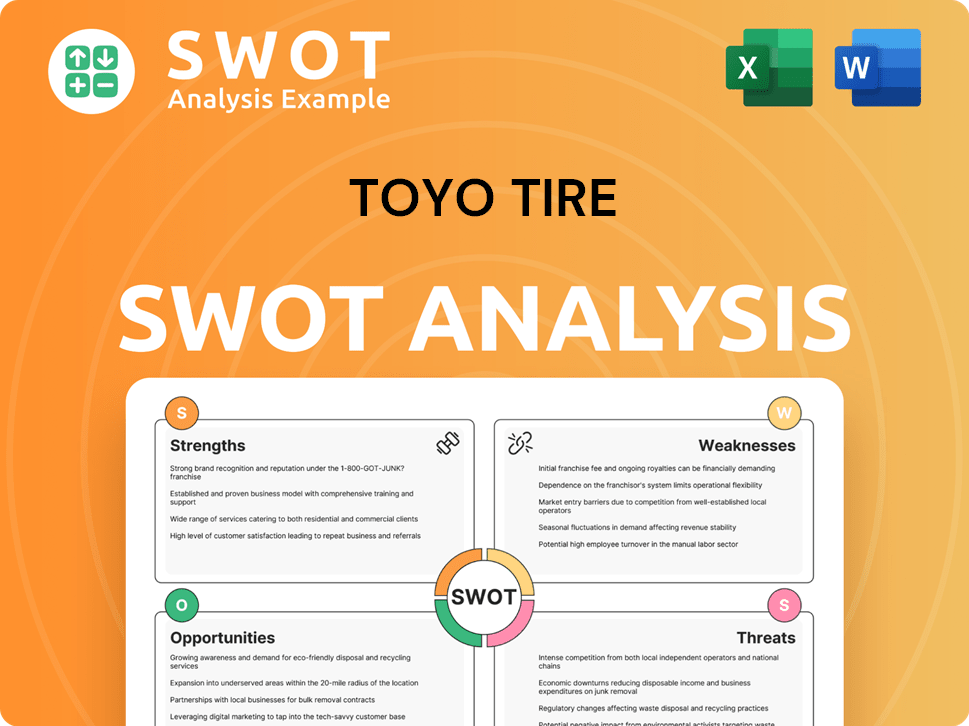

Toyo Tire SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Toyo Tire Invest in Innovation?

The growth strategy of Toyo Tire Corporation is heavily focused on innovation and technological advancements. The company consistently invests in research and development (R&D) to enhance tire performance, safety, and environmental sustainability. This commitment is vital for maintaining a competitive edge in the dynamic tire industry.

A key aspect of Toyo Tire's strategy is the development and application of proprietary technologies. This includes 'Nano Balance Technology,' which precisely controls rubber material structures at the nano-level. This technology is crucial for achieving optimal performance characteristics such as grip, fuel efficiency, and wear resistance. These innovations are central to their next-generation tire development efforts.

Toyo Tires is also embracing digital transformation to improve efficiency and quality. This involves integrating automation and data analytics into manufacturing processes. They are using AI for predictive maintenance in factories and optimizing production lines. Furthermore, the company is exploring the use of IoT sensors within tires to provide real-time data on tire pressure, temperature, and wear, potentially leading to new service offerings and enhanced safety features.

This technology allows for precise control of rubber material structures at the nano-level. It is a cornerstone of their next-generation tire development, enabling optimal performance characteristics like grip, fuel efficiency, and wear resistance.

Toyo Tires is integrating automation and data analytics into its manufacturing processes. This includes using AI for predictive maintenance and optimizing production lines. They are also exploring IoT sensors for real-time tire data.

Sustainability is a critical aspect of Toyo Tire's innovation strategy. They are focused on reducing the environmental impact of tire production and developing tires from more sustainable materials. This includes efforts to minimize waste and emissions.

Recent product launches, such as the Open Country A/T III, demonstrate the company's commitment to innovation. These products leverage advanced tread compounds and designs for improved off-road and all-terrain performance. This helps drive Toyo Tires sales growth forecast.

Toyo Tire consistently invests in research and development to enhance tire performance, safety, and environmental sustainability. This investment is key to maintaining a competitive edge and driving future growth. The company allocates a significant portion of its budget to R&D.

The company is adapting to market trends by focusing on the impact of electric vehicles and the future of tire manufacturing. This includes developing tires specifically designed for EVs and exploring new manufacturing processes.

Toyo Tires' technological advancements are crucial for its Toyo Tire Prospects and long-term goals. These advancements are driving the company's Toyo Tires Market Analysis and shaping its Toyo Tire Business Model.

- Nano-Technology: Precision control of rubber at the nano-level for enhanced performance.

- Digital Integration: AI-driven predictive maintenance and optimized production lines.

- IoT Sensors: Real-time data collection from tires for improved safety and new service offerings.

- Sustainable Materials: Development of tires using more sustainable materials to reduce environmental impact.

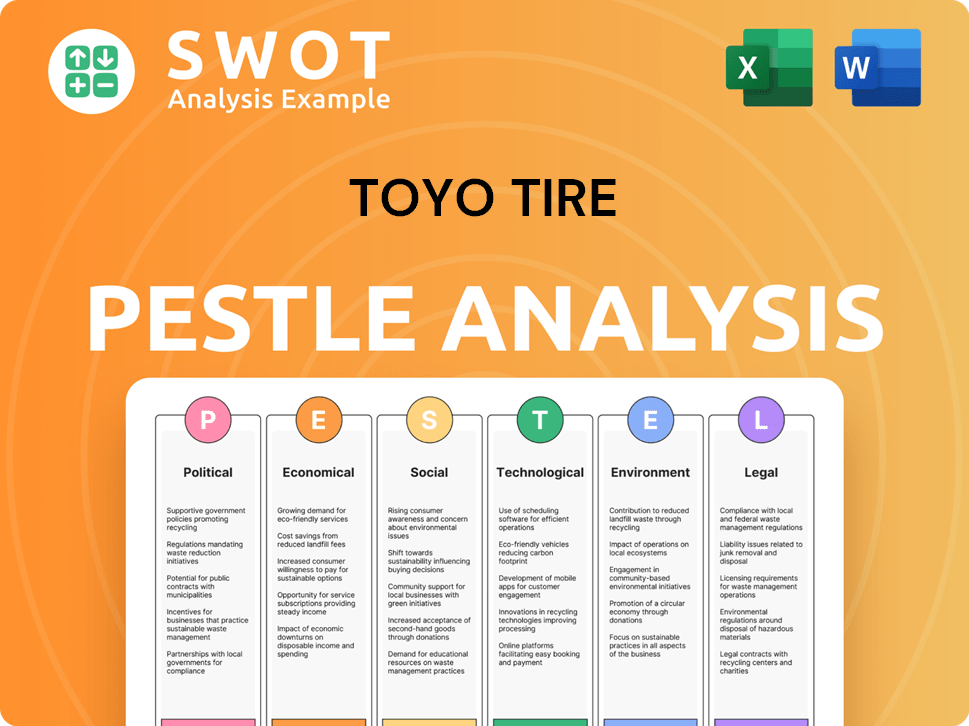

Toyo Tire PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Toyo Tire’s Growth Forecast?

The financial outlook for Toyo Tire Corporation is positive, with expectations of continued strong performance and growth. The company's strategic focus, coupled with investments in new production facilities, positions it well for the future. Their proactive approach to market expansion and product development is designed to drive sustainable growth and enhance shareholder value. This is a key element of the Mission, Vision & Core Values of Toyo Tire.

For the fiscal year ending December 31, 2024, the company anticipates net sales of ¥535.0 billion and an operating income of ¥52.0 billion. This projection highlights a commitment to increasing both revenue and profitability. This builds upon the solid results of 2023, where net sales reached ¥520.4 billion and operating income was ¥46.0 billion, demonstrating a consistent trajectory of financial improvement.

The company's mid-term business plan, 'Toyo Tire Group's Mid-Term Business Plan 2022-2025,' sets a target of achieving an operating profit margin of 10% by 2025. This goal underscores a strategic focus on operational efficiencies and a favorable product mix. Their financial strategy includes disciplined capital allocation, balancing investments in growth initiatives with returns to shareholders.

The company's financial strategy involves strategic market analysis to identify growth opportunities. This includes expanding its global presence and developing high-value-added products. These efforts are crucial for achieving sustainable growth and enhancing profitability.

Toyo Tire Company's performance is driven by its ability to adapt to market changes and invest in innovation. The company's sales growth forecast is supported by its expansion plans and new product development initiatives. These strategies are designed to strengthen its position in the competitive landscape.

The Toyo Tire business model is built on a foundation of innovation, quality, and customer satisfaction. The company's focus on research and development, technological advancements, and strategic partnerships supports its long-term goals. This model is designed to drive sustainable growth in the tire manufacturing industry.

The sales growth forecast for Toyo Tires is positive, driven by its expansion plans and new product development. The company's investments in new production facilities, particularly the Serbian plant, are expected to contribute significantly to sales volume. These initiatives are designed to capture market share and increase revenue.

A financial performance analysis reveals Toyo Tire's commitment to sustainable growth and profitability. The company's focus on disciplined capital allocation and shareholder returns reflects a strong financial strategy.

- The company's strategic investments in new production facilities are expected to contribute to sales volume.

- The company aims to achieve an operating profit margin of 10% by 2025.

- The company's financial narrative emphasizes sustainable growth driven by global market expansion.

- The company's consistent investment in R&D and manufacturing expansion suggests a robust internal cash flow generation.

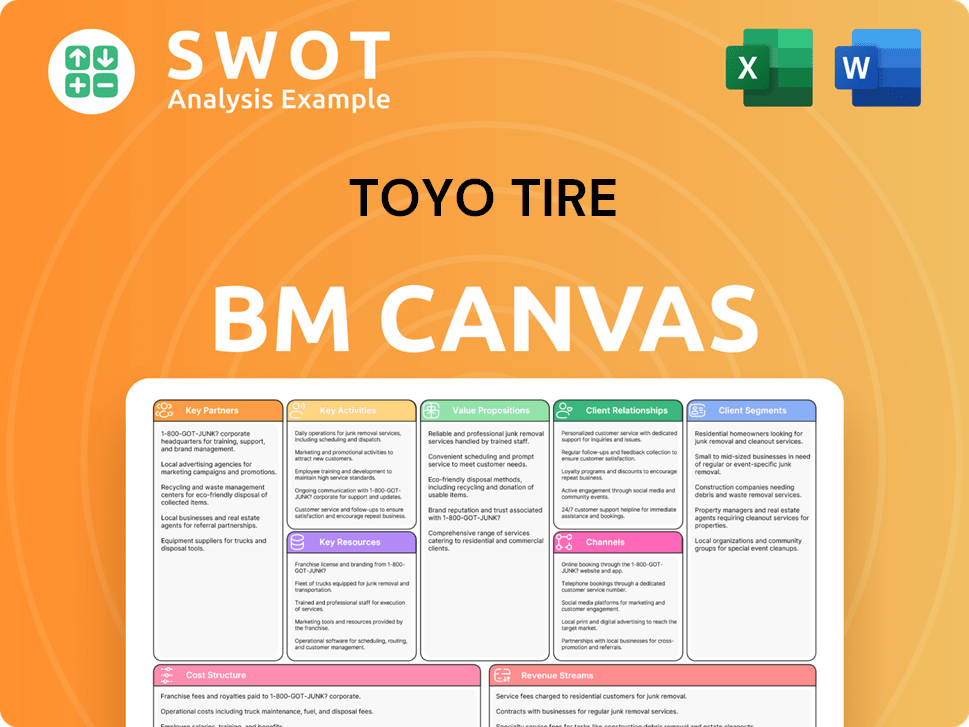

Toyo Tire Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Toyo Tire’s Growth?

The growth strategy of Toyo Tire Corporation faces several potential risks and obstacles. Intense competition, regulatory changes, and supply chain vulnerabilities present ongoing challenges. The company must navigate these complexities to achieve its goals effectively. Understanding these risks is crucial for assessing the company's future prospects.

Market dynamics, including technological disruptions and the evolving automotive industry, add to the complexity. Internal operational challenges, such as managing rapid expansion, also require attention. Toyo Tire's ability to adapt and mitigate these risks will significantly influence its performance.

Navigating these challenges requires proactive strategies and robust risk management. The company's approach to these issues will determine its success in the competitive global tire market. A deep dive into Target Market of Toyo Tire reveals further insights into its strategic positioning.

The tire industry is highly competitive, with major players like Michelin, Goodyear, and Bridgestone vying for market share. Emerging regional competitors also intensify the competition. This necessitates continuous innovation and cost efficiency to maintain a competitive edge, impacting Toyo Tires' market share trends.

Changes in environmental regulations and trade policies can significantly impact production costs and market access. Stricter emissions standards or new tariffs could increase operational expenses. Adapting to these changes requires proactive planning and investment in sustainable practices, influencing Toyo Tires' sustainability initiatives.

Fluctuations in raw material prices, such as natural rubber and crude oil derivatives, pose a significant risk. Disruptions due to geopolitical events or natural disasters can also impact the supply chain. Managing these vulnerabilities requires diversified sourcing and robust risk management frameworks.

Rapid advancements in autonomous driving, new tire materials, and electric vehicles require continuous innovation. Failing to keep pace with these advancements could lead to a loss of market share. Investment in research and development is crucial for staying competitive, impacting Toyo Tires' research and development.

Rapid expansion, especially at new facilities like the Serbian plant, requires effective operational management. Workforce integration and efficient production processes are critical to avoid inefficiencies. Effective management is crucial for achieving Toyo Tire's long-term goals.

Global economic fluctuations and currency exchange rate volatility can affect profitability and financial performance. Economic downturns can reduce demand for tires, impacting sales growth forecast. Managing these risks requires careful financial planning and strategic pricing strategies.

Toyo Tires addresses these risks through a diversified manufacturing footprint. Robust risk management frameworks and scenario planning are essential. The company has demonstrated resilience by implementing cost control measures and adjusting pricing strategies. These measures are crucial for Toyo Tire's future.

The automotive industry's shift towards electric vehicles presents both challenges and opportunities. The demand for specialized tires for EVs is increasing. Adapting to these changes is key for future growth. This impacts Toyo Tires' expansion plans in North America.

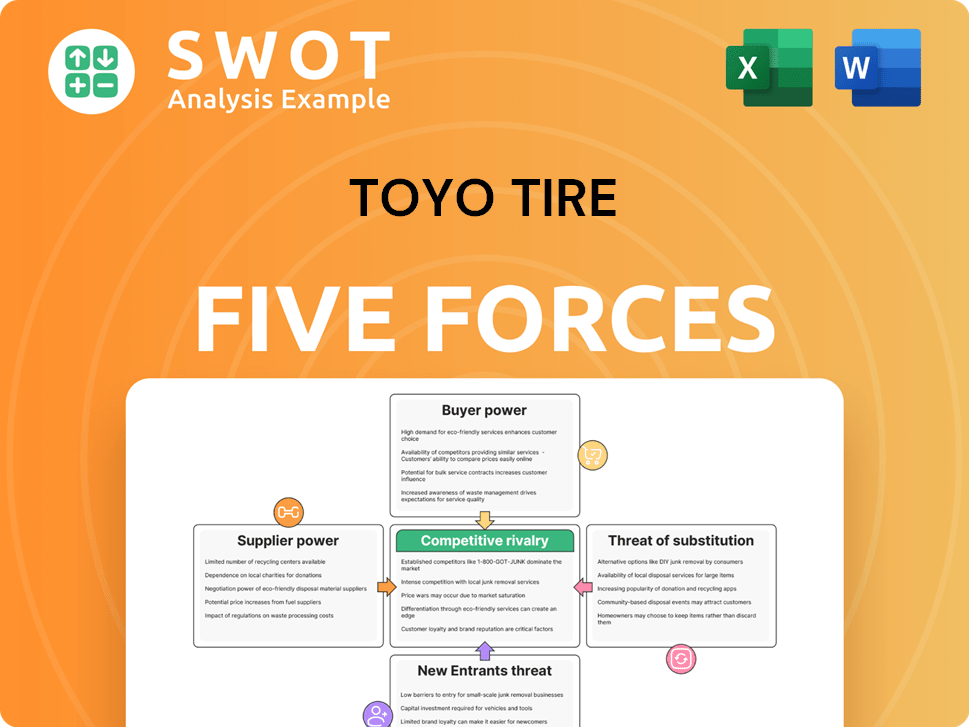

Toyo Tire Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Toyo Tire Company?

- What is Competitive Landscape of Toyo Tire Company?

- How Does Toyo Tire Company Work?

- What is Sales and Marketing Strategy of Toyo Tire Company?

- What is Brief History of Toyo Tire Company?

- Who Owns Toyo Tire Company?

- What is Customer Demographics and Target Market of Toyo Tire Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.