Traeger Bundle

Can Traeger Continue to Sizzle in the Outdoor Cooking Market?

Traeger, Inc. revolutionized backyard grilling with its innovative wood pellet grills, transforming how people cook outdoors. From its inception in 1985, the company has become a category leader, achieving significant financial milestones. Understanding the Traeger SWOT Analysis is key to grasping the company's current standing and future potential.

This analysis dives into Traeger's growth strategy, exploring its impressive financial performance, including the substantial revenue generated in fiscal year 2024. We'll dissect the outdoor cooking industry's evolving landscape, examining market trends and the competitive dynamics that will shape Traeger's future prospects. Furthermore, we will examine Traeger's expansion plans, product development, and how it aims to maintain its market share against competitors, making it a key area for investors and business strategists alike.

How Is Traeger Expanding Its Reach?

To understand the future of the grilling market, it's essential to examine Traeger's growth strategy. The company is actively pursuing several expansion initiatives to drive future growth, focusing on both product diversification and geographical reach. This approach aims to solidify its position in the outdoor cooking industry and capitalize on emerging grilling market trends.

A key element of Traeger's strategy involves broadening its product portfolio. This expansion is designed to attract a wider customer base and cater to evolving outdoor cooking preferences. By introducing new products and entering new categories, Traeger aims to maintain its competitive edge and drive sales growth.

Geographical expansion is another area of focus for Traeger. Although recent financial reports show challenges in international markets, the company remains committed to growing its presence globally. Strategic partnerships and brand activations are also playing a crucial role in increasing brand awareness and engaging consumers.

In April 2025, Traeger launched the Flatrock 2 Zone, expanding into the griddle category. This move diversifies offerings beyond wood pellet grills. The company also introduced the new Woodridge series of wood pellet grills in January 2025 to celebrate 40 years of innovation. These launches aim to attract new customers and cater to evolving outdoor cooking preferences.

Traeger aims to focus on recurring revenue and international markets. Despite challenges, the company is committed to expanding its global footprint. 'Rest of World' revenues decreased by 46.5% in Q1 2025, and 38.6% in Q4 2024, indicating the need for strategic adjustments.

Traeger is engaging in strategic partnerships to boost brand awareness. Collaborations include partnerships with Made In for a limited-release braiser and Bulleit Frontier Whiskey for a holiday video series. These partnerships help increase brand awareness and engage consumers.

The company is emphasizing recurring revenue streams. This approach aims to create a more stable and predictable revenue model. This focus is a key component of Traeger's long-term financial strategy.

Traeger's expansion strategy includes product diversification, geographical expansion, and strategic partnerships. These initiatives are designed to drive growth and strengthen its market position. The company is also focused on recurring revenue streams to ensure financial stability. For more details on the company's core values, consider reading about the Mission, Vision & Core Values of Traeger.

- Product launches to broaden its portfolio.

- Focus on international markets despite recent setbacks.

- Strategic partnerships to increase brand awareness.

- Emphasis on recurring revenue streams.

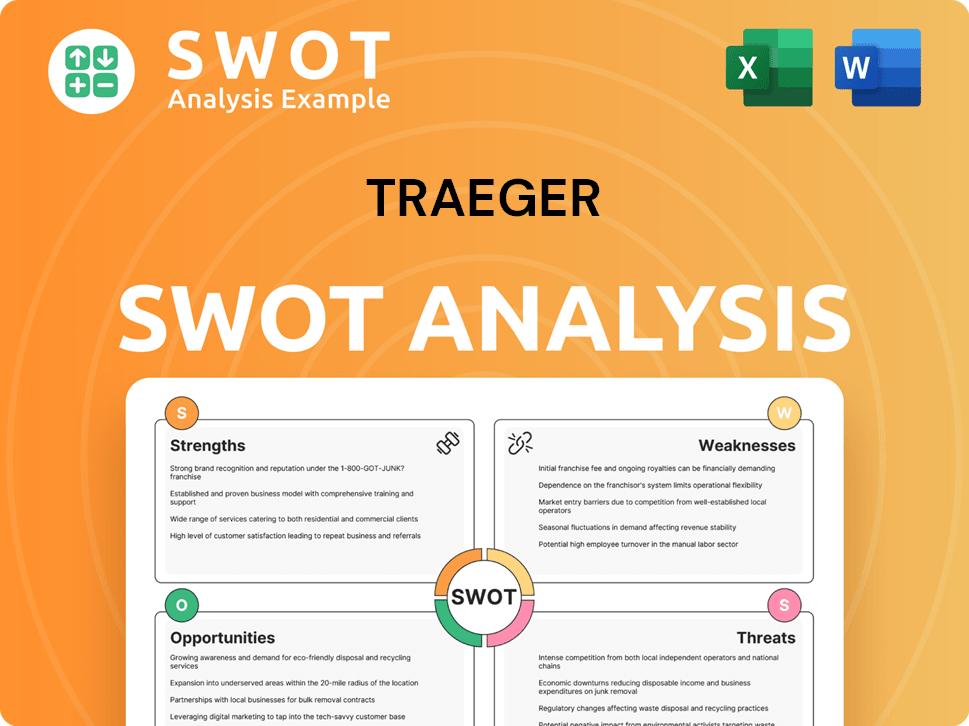

Traeger SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Traeger Invest in Innovation?

The company's approach to innovation and technology is central to its Traeger growth strategy. By integrating technology into its products, the company aims to enhance user experience and maintain its competitive edge in the outdoor cooking industry. This focus on technological advancement is a key factor in understanding the Traeger future prospects.

The company's commitment to innovation is demonstrated through its continuous product development and digital content offerings. This strategy is designed to provide added value to customers and foster a strong community around the brand, which supports its growth objectives. Understanding these initiatives is crucial for a comprehensive Traeger company analysis.

The company leverages technology to maintain its leadership and drive sustained growth in the outdoor cooking market. The wood pellet grills are Internet of Things (IoT) devices, allowing users to program, monitor, and control their grills remotely through the Traeger app. This digital integration enhances the user experience and provides a connected cooking platform.

The integration of IoT in wood pellet grills allows for remote control and monitoring via the Traeger app. This feature provides a seamless and enhanced grilling experience, setting the company apart in the grilling market trends.

The successful launch of new product series, like the Woodridge series in early 2025, highlights the strength of their product development engine. This continuous introduction of new products demonstrates ongoing investment in innovation.

The company offers a library of digital content, including instructional recipes and videos, and live-streaming cooking classes through its 'Traeger Kitchen Live' series. These initiatives contribute to growth objectives by providing added value to customers and fostering a community around the brand.

While specific R&D investment figures for 2024-2025 are not explicitly detailed, the consistent introduction of new and improved products, like the Flatrock 2 Zone griddle, demonstrates ongoing investment in innovation.

The company's commitment to innovation is evident in its continuous product development, with new features and improvements regularly introduced to enhance the grilling experience. This focus on technological advancements is a key aspect of the company's strategy.

The digital content and live cooking classes are designed to engage customers and provide them with valuable resources. This approach helps build brand loyalty and supports the company's growth objectives. For further insights, check out Owners & Shareholders of Traeger.

The company's innovation strategy focuses on integrating technology, continuous product development, and creating a strong community. These elements are crucial for understanding the Traeger company market share and its position within the outdoor cooking industry. The company's ability to adapt and innovate will be key to its Traeger's expansion plans.

- IoT integration in grills enhances user experience.

- Continuous product development, like the Woodridge series, drives growth.

- Digital content and live classes build community and brand loyalty.

- Ongoing investment in innovation supports future growth.

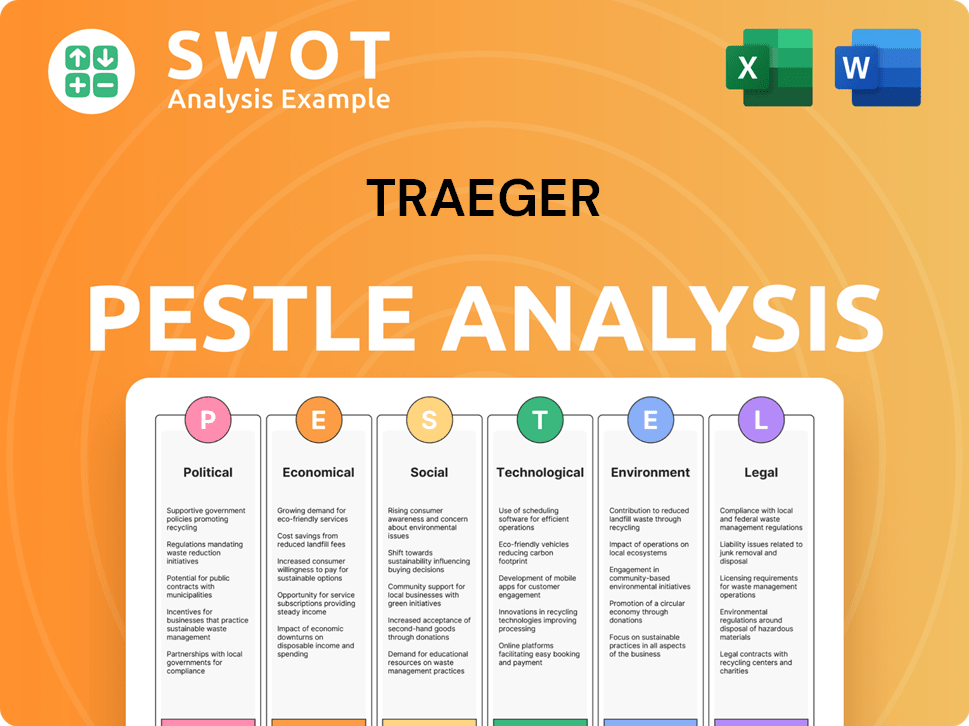

Traeger PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Traeger’s Growth Forecast?

The financial landscape for the company reflects a period of strategic adjustments and resilience. The company's focus is on achieving long-term profitable growth, navigating both market challenges and opportunities within the grilling market. The company's performance in late 2024 and early 2025 demonstrates a commitment to adapting to evolving market dynamics.

For the full year 2024, total revenues slightly decreased, yet the company saw positive trends in specific segments. Grill revenues, for instance, experienced an increase driven by higher unit volumes. This indicates a sustained demand for the company's core products despite broader economic pressures. The company's strategic initiatives are aimed at strengthening its position within the outdoor cooking industry.

The company's financial results for 2024 and early 2025 reveal a mixed picture. While total revenues saw a slight decrease in 2024, there were improvements in other key areas. The company's strategic moves, including pricing adjustments and cost-cutting measures, are designed to enhance financial stability and support future growth. Understanding the Target Market of Traeger is crucial for assessing the company's potential.

Total revenues for 2024 were $604.1 million, a slight decrease of 0.3% compared to the prior year. However, grill revenues saw an 8.5% increase, reaching $324.7 million, driven by unit volume growth. This growth highlights the continued consumer interest in wood pellet grills.

The company achieved significant gross margin expansion in 2024, reaching 42.3%, up from 36.9% the previous year. This improvement reflects effective cost management and strategic pricing strategies. This is a key factor in the company's overall financial health.

The net loss significantly improved to $34.0 million in 2024, compared to $84.4 million in 2023. This reduction showcases the effectiveness of the company's operational and financial strategies. This improvement is a positive sign for the company's long-term prospects.

Adjusted EBITDA rose by 34.1% to $81.9 million in 2024, demonstrating improved profitability. This growth in EBITDA is a positive indicator of the company's operational efficiency and financial performance. This is a key measure of the company's financial health.

In Q1 2025, total revenues decreased by 1.1% to $143.3 million. Grill revenues continued to grow, increasing by 12.8% to $86.7 million. The company is focused on navigating market challenges and capitalizing on opportunities within the grilling market.

- Gross margin in Q1 2025 was 41.5%, slightly down from 43.2% in Q1 2024.

- Adjusted EBITDA in Q1 2025 was $22.5 million, compared to $24.4 million in the same period last year.

- Strategic pricing increases, cost reduction initiatives, and inventory management are being implemented.

- The company withdrew its financial guidance for fiscal 2025 due to macroeconomic uncertainty.

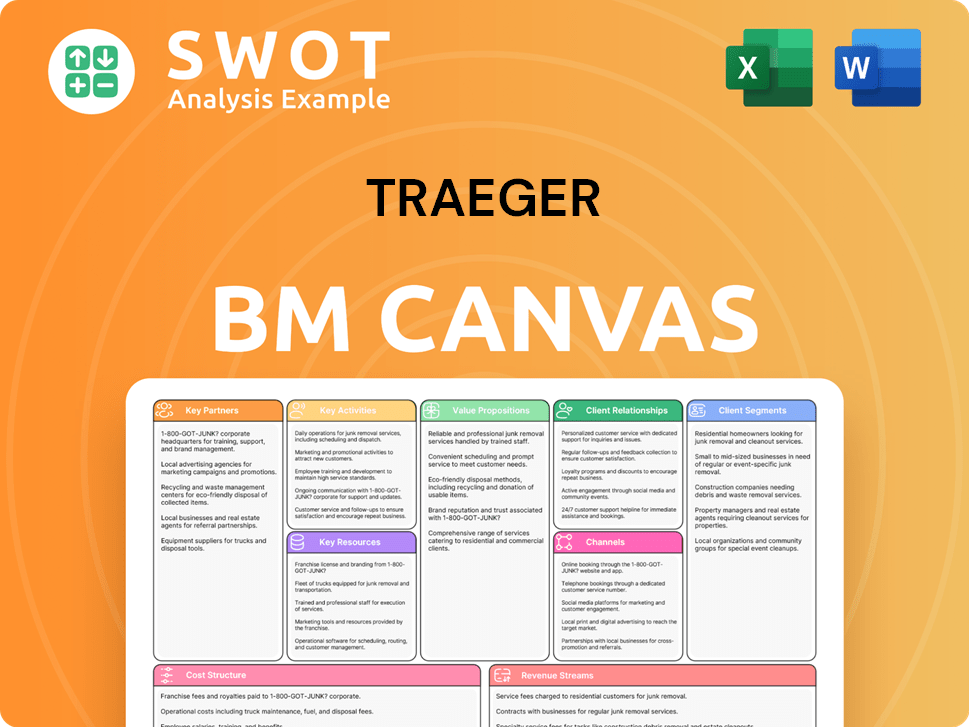

Traeger Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Traeger’s Growth?

The growth strategy of the company faces several risks and obstacles. The uncertain economic climate, including rising interest rates and inflation, poses a significant challenge. These factors can impact consumer spending on discretionary items like grills, potentially affecting the company's financial performance.

A major risk is the potential impact of tariffs on the company's products. A significant portion of the company's cost of goods sold is exposed to tariffs, as most of its grills are sourced from China and Vietnam. This could lead to gross margin contraction, impacting profitability. The accessories segment also faces challenges, including increased competition and higher advertising costs.

To address these risks, the company is implementing mitigation strategies. These strategies include strategic pricing increases, cost reduction initiatives, and supply chain optimization. The company is also carefully managing inventory levels to align with sell-through data.

The company's growth strategy is vulnerable to macroeconomic conditions. Rising interest rates, inflation, and shifts in consumer confidence can all negatively affect demand for its products. This uncertainty led the company to withdraw its financial guidance for fiscal year 2025.

Tariffs pose a significant risk, with approximately 50% of the cost of goods sold exposed. New tariffs could increase costs and reduce gross margins. S&P Global Ratings forecasts a decline of about 260 basis points due to these tariffs.

The accessories segment, including products like MEATER smart thermometers, faces challenges. Increased competition and higher advertising costs are impacting this segment. Accessories revenue declined by 26.6% in Q1 2025.

Supply chain issues, including sourcing from China and Vietnam, create vulnerability. Potential disruptions and tariff implications can increase costs and reduce efficiency. The company is actively working to optimize its supply chain to mitigate these risks.

The outdoor cooking industry is competitive, with various companies vying for market share. Competition in the accessories market is increasing, affecting sales and profitability. The company needs to innovate and differentiate to maintain its market position.

Effective inventory management is crucial to avoid overstocking and associated costs. The company is adjusting purchase orders and reassessing plans based on sell-through data. This helps to align inventory levels with actual demand, reducing financial risk.

To address these risks, the company is implementing several strategies. Strategic pricing adjustments are being considered to offset increased costs. Cost reduction initiatives include streamlining organizational structure and workforce reductions. Supply chain optimization aims to improve efficiency and reduce expenses.

The company's financial performance is subject to these risks. The impact of tariffs and economic conditions could affect gross margins and overall profitability. Careful management of expenses and inventory is essential to maintaining financial health. For more information on the company's business model, see Revenue Streams & Business Model of Traeger.

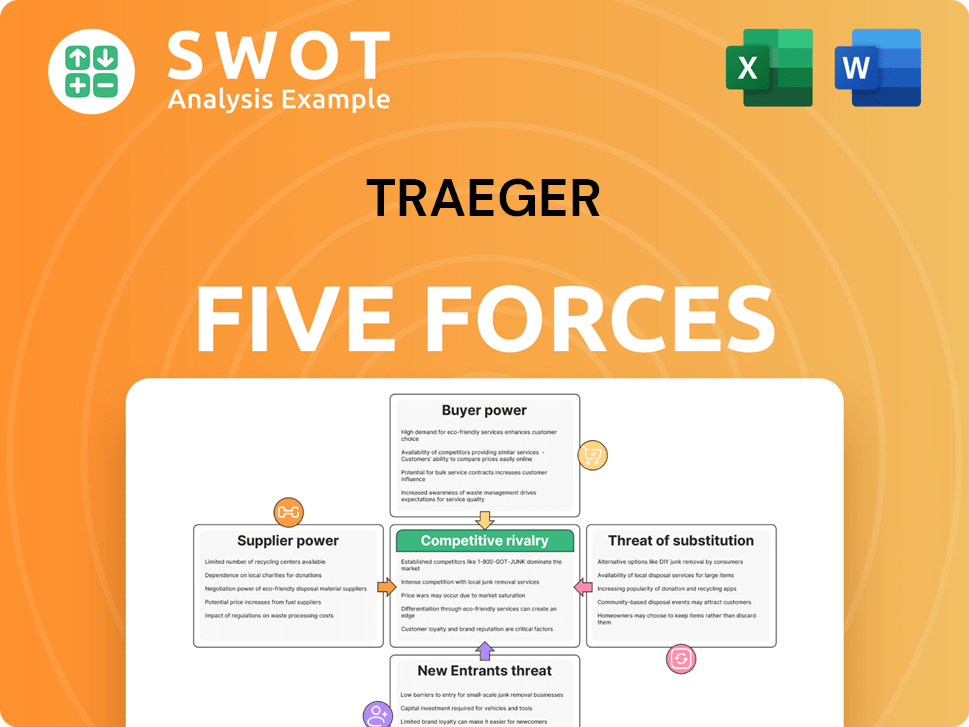

Traeger Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Traeger Company?

- What is Competitive Landscape of Traeger Company?

- How Does Traeger Company Work?

- What is Sales and Marketing Strategy of Traeger Company?

- What is Brief History of Traeger Company?

- Who Owns Traeger Company?

- What is Customer Demographics and Target Market of Traeger Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.