Traeger Bundle

How Does the Traeger Company Sizzle?

Traeger, Inc. (NYSE: COOK) isn't just selling grills; it's selling an outdoor cooking revolution. As the undisputed leader in wood pellet grills, Traeger has transformed backyard barbecues with its innovative approach. In 2024, the Traeger SWOT Analysis revealed the company's robust financial performance, with impressive revenue figures.

This deep dive will explore how Traeger, the maker of exceptional Traeger grills and Traeger smoker models, operates, examining its core strategies, revenue streams, and competitive advantages. Understanding the intricacies of the Traeger company is vital for anyone looking to understand the dynamics of the outdoor cooking market. Whether you're curious about how Traeger grill features work or want to know about Traeger grill price range, this analysis provides valuable insights.

What Are the Key Operations Driving Traeger’s Success?

The core operations of the [Company Name] center around its wood pellet grills, offering a comprehensive outdoor cooking system. This system uses all-natural hardwood pellets to provide a distinctive smoky flavor and versatile cooking capabilities. The company caters to a wide customer base, from casual backyard grillers to gourmet home chefs, all seeking consistency and ease of use with their grilling experience.

The value proposition of the [Company Name] lies in its ability to deliver a convenient and flavorful grilling experience. By integrating smart technology into its grills, the company offers precise temperature control and ease of use. This, combined with the distinctive wood-fired flavor, sets the [Company Name] apart from traditional charcoal or gas grills, making it a preferred choice for many.

The operational processes supporting the [Company Name]'s offerings include sourcing and manufacturing, technology development, logistics, sales channels, and customer service. The company primarily relies on contract manufacturers, with a significant portion of its grills sourced from China, although efforts are underway to diversify production. The focus on innovation, particularly with smart technology, enhances the user experience and cooking performance of the Traeger grills.

The [Company Name] outsources manufacturing to contract manufacturers. Currently, about 80% of its grills are sourced from China and 20% from Vietnam. The company aims to reduce its reliance on Chinese production by 2026 to mitigate tariff impacts. This strategy highlights the importance of supply chain diversification for the Traeger company.

The company's smart grills feature Wi-Fi connectivity (WiFIRE®), touchscreen controls, integrated meat probes, and remote monitoring via mobile apps. These features enhance the user experience and cooking performance. The incorporation of AI-based smoke regulation systems further demonstrates the company's commitment to innovation in the wood pellet grills market.

The company distributes its products through various sales channels, including retail partnerships. The company also explores wholesale channels to stabilize demand for certain product lines. This multi-channel approach is crucial for reaching a broad customer base and ensuring product availability for pellet smokers.

Customers benefit from precise temperature control, ease of use, and the distinctive wood-fired flavor. These features differentiate the [Company Name] from traditional grills. The company's focus on convenience and flavor enhances the overall grilling experience, making it attractive to a wide range of users of BBQ grills.

The [Company Name] distinguishes itself through its pioneering role in the wood pellet grill category and its continuous innovation, particularly in smart technology integration. This approach provides a differentiated and convenient grilling experience. For more details on the company's strategic growth, you can read about the Growth Strategy of Traeger.

- Pioneering Wood Pellet Grill Category: The company was one of the first to popularize wood pellet grills.

- Smart Technology Integration: Features like WiFIRE® and remote monitoring enhance user experience.

- Focus on Flavor and Convenience: The company emphasizes the unique wood-fired flavor and ease of use.

- Multi-Channel Distribution: The company uses various sales channels to reach a broad customer base.

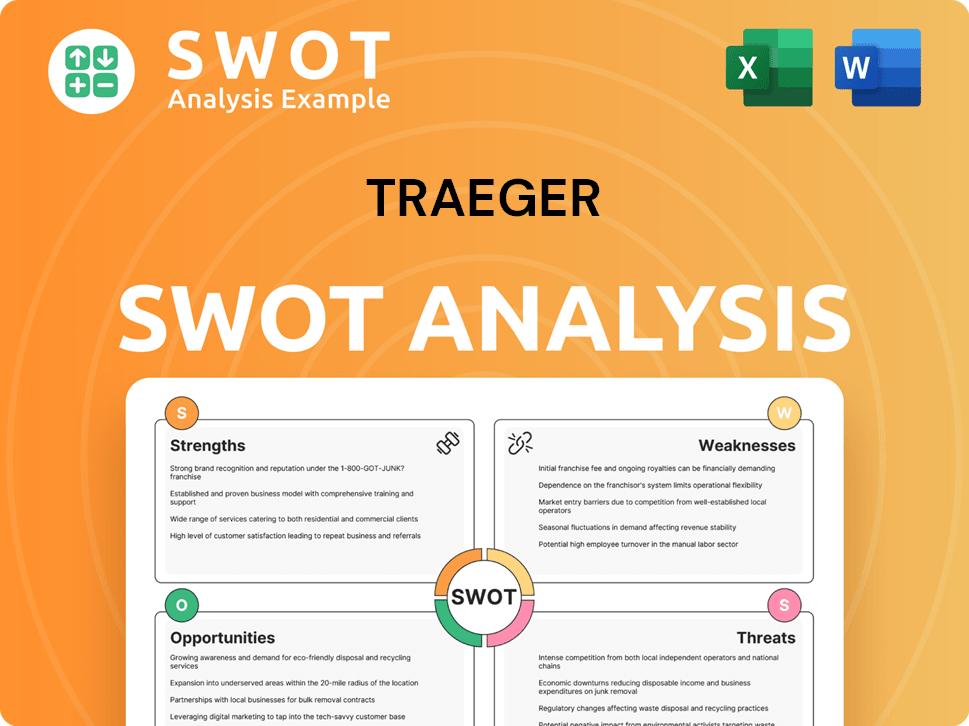

Traeger SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Traeger Make Money?

The [Company Name] generates revenue through a multi-faceted approach, primarily centered on its wood-fired grills and related products. This includes the sale of grills, consumables like wood pellets, and various accessories. The company's financial performance reflects a dynamic interplay between these revenue streams, influenced by product launches, market trends, and strategic pricing adjustments.

In the first quarter of fiscal year 2025, the total revenue for [Company Name] was $143.3 million. This represented a slight decrease of 1.1% compared to the same period in the previous year. The company's financial strategy focuses on maximizing revenue across its product lines while adapting to market demands and operational costs.

The company's revenue streams are diverse, with each segment contributing differently to the overall financial performance. Understanding these streams is crucial for assessing the company's market position and growth potential. The following sections detail the major revenue streams and their contributions.

In Q1 FY25, [Company Name] saw varied performance across its revenue streams. Grill revenues increased, while consumables and accessories experienced declines. These shifts highlight the company's evolving market dynamics and strategic focus.

- Grill Revenues: Increased by 12.8% to $86.7 million, driven by higher unit volumes and new product introductions like the Woodridge series. Grills accounted for approximately 60.5% of total revenue.

- Consumables Revenues: Decreased by 6.1% to $30.3 million due to lower unit volumes, partially offset by higher average selling prices of wood pellets. Consumables represented about 21.1% of total revenue.

- Accessories Revenues: Experienced a significant decrease of 26.6% to $26.3 million, primarily due to lower sales of MEATER smart thermometers. Accessories contributed approximately 18.4% to total revenue.

For the full fiscal year 2024, [Company Name]'s total revenues were $604.1 million. Grill revenues were $324.7 million, consumables were $119.3 million, and accessories were $160.1 million. The company's financial strategy includes strategic pricing adjustments and a focus on recurring revenues to offset costs and maintain profitability. You can learn more about [Company Name]'s business tactics in the Growth Strategy of Traeger.

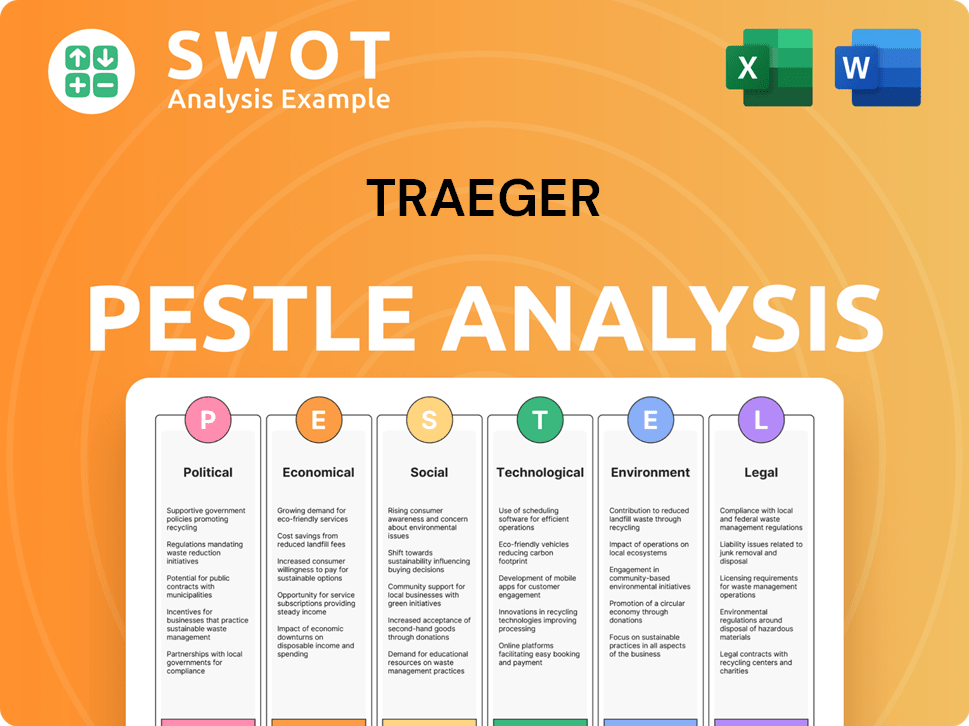

Traeger PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Traeger’s Business Model?

The journey of the [Company Name] has been marked by significant milestones, strategic moves, and a focus on maintaining its competitive edge in the wood pellet grill market. From pioneering the wood pellet grill to adapting to market changes, the company's history reflects its commitment to innovation and customer satisfaction. Understanding these elements provides insight into the company's current position and future prospects.

Key to [Company Name]'s success has been its ability to innovate and respond to market dynamics. This includes the development of new products and the implementation of strategies to mitigate challenges. The company's focus on brand strength, technology leadership, and operational efficiency has helped it to differentiate itself in the competitive landscape of BBQ grills and pellet smokers.

The company's strategic decisions, from product launches to supply chain adjustments, are crucial for its growth. These moves demonstrate the company’s adaptability and its ability to navigate economic uncertainties and changing consumer preferences. The following sections will explore these aspects in detail, providing a comprehensive overview of the company's operations and competitive advantages.

A significant milestone for [Company Name] was the development and patenting of the first wood pellet grill in 1985, which provided the company with a twenty-year market exclusivity. More recently, the launch of the Woodridge series in Q1 2025 contributed to a 12.8% increase in grill revenues. The company also launched MEATER 2 Plus, a smart thermometer, which saw strong holiday season sales.

To address challenges, including macroeconomic uncertainty and tariffs, [Company Name] has implemented several strategic moves. These include supply chain adjustments, such as cost negotiations with contract manufacturers and diversifying production outside of China, with an expected reduction in Chinese production by 2026. The company has also initiated cost reduction efforts, including deferring non-essential expenditures and reducing hiring.

The company continues to adapt to new trends by investing in product innovation, brand building, and exploring global expansion opportunities. The Woodridge launch in Canada and MEATER distribution in the UK exemplify its efforts to expand its market presence. This shows how the company is constantly evolving to meet the demands of the market.

The company faces challenges such as macroeconomic uncertainty and tariffs, with approximately 50% of its cost of goods sold exposed to tariffs. To mitigate these, [Company Name] has implemented strategies like supply chain adjustments and cost negotiations. The company is also working on diversifying production outside of China to reduce reliance on a single source.

- Supply chain adjustments to reduce costs.

- Diversifying production locations.

- Strategic pricing increases.

- Cost reduction efforts, including reduced hiring.

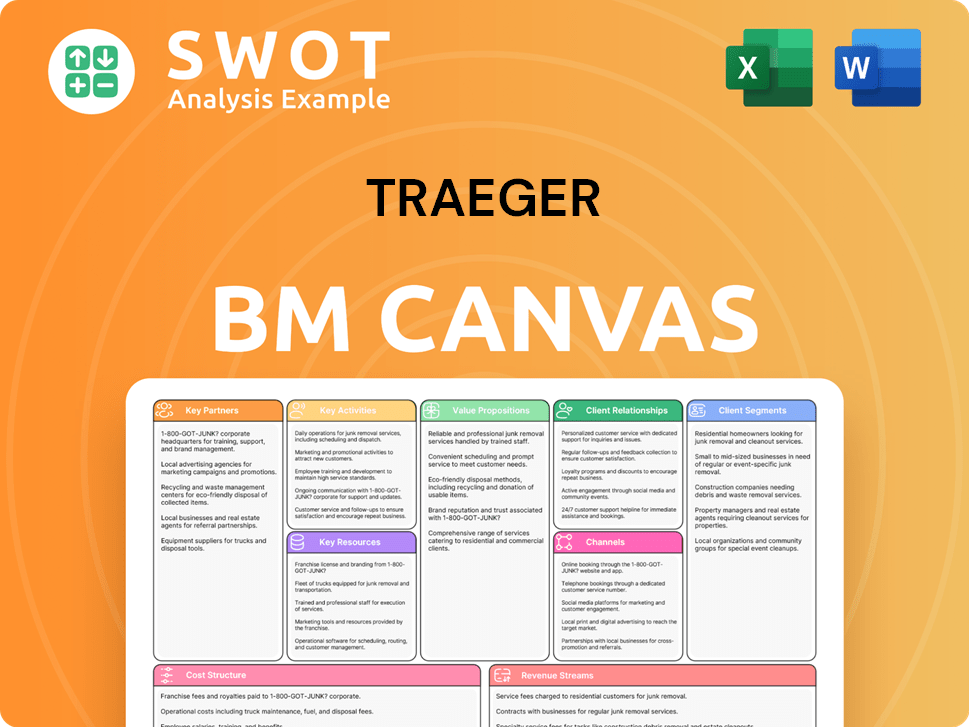

Traeger Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Traeger Positioning Itself for Continued Success?

The Traeger company holds a significant position in the outdoor cooking market, particularly as the originator of wood pellet grills. As of March 2024, the company held a 10% dollar share of the U.S. BBQ grill market, placing it third behind Weber (21%) and Blackstone (13%). This demonstrates strong brand recognition, especially in the sub-$1,000 grill segment, indicating consumer willingness to invest in premium products even during economic uncertainty.

However, the

Traeger is a leader in the wood pellet grill market. Its brand recognition is strong, particularly in the sub-$1,000 grill category. The company's market position is third in the BBQ grill market in the US, behind Weber and Blackstone.

Key risks include tariff exposure, particularly a 45% tariff on grills sourced from China. Seasonal sales dependence and limited international presence pose challenges. The accessories segment, such as the MEATER smart thermometer line, has experienced declines due to competition.

The company is implementing strategic initiatives, including supply chain adjustments and cost reduction efforts. It is also focused on stabilizing the MEATER business and investing in product innovation. Despite withdrawing its 2025 financial guidance, the company is focused on long-term growth.

Supply chain diversification outside China by 2026. Cost reduction measures and strategic pricing actions are underway. Emphasis on stabilizing the MEATER business. Continued investment in product innovation and brand building.

The company is working to strengthen its balance sheet. The leverage ratio improved to 4.8x in Q1 2025 from 13.9x in Q1 2023. Traeger aims to sustain growth by continuing innovation and building brand awareness while managing the business in a dynamic environment.

- Supply chain diversification is a key strategy.

- Cost reduction and strategic pricing are essential.

- Focus on innovation and brand building is ongoing.

- Financial health improvement is a priority.

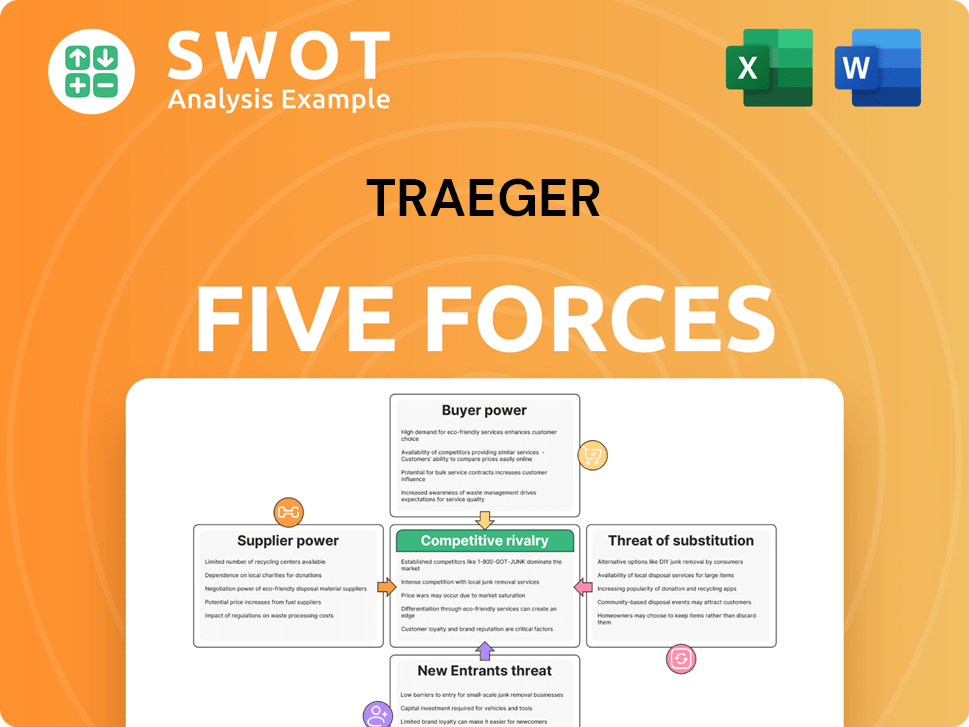

Traeger Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Traeger Company?

- What is Competitive Landscape of Traeger Company?

- What is Growth Strategy and Future Prospects of Traeger Company?

- What is Sales and Marketing Strategy of Traeger Company?

- What is Brief History of Traeger Company?

- Who Owns Traeger Company?

- What is Customer Demographics and Target Market of Traeger Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.