Turkish Airlines Bundle

Can Turkish Airlines Soar to New Heights?

Turkish Airlines has become a global aviation powerhouse, but what's next for this industry leader? From its humble beginnings in 1933, the airline has rapidly expanded, now serving an unparalleled network of destinations. This analysis explores the Turkish Airlines SWOT Analysis, and delves into the company's ambitious growth strategy and future prospects in a dynamic market.

Understanding Turkish Airlines' strategic goals is crucial for investors and industry observers alike. The airline's international expansion strategy, coupled with its focus on innovation, positions it for continued growth. This examination will provide insights into the airline's financial performance, market share analysis, and long-term business plan, offering a comprehensive view of its potential in the competitive aviation market, and its impact on the Turkish economy.

How Is Turkish Airlines Expanding Its Reach?

The expansion initiatives of Turkish Airlines are central to its growth strategy, focusing on fleet growth, network expansion, and increased passenger capacity. The airline's strategic goals include solidifying its position as a major global aviation hub. This growth is supported by significant investments in its fleet and route network, positioning it for sustained success in the competitive airline industry.

Turkish Airlines' future prospects are closely tied to its ability to execute these expansion plans effectively. The airline's focus on international expansion, particularly in underserved markets, is expected to drive passenger growth and increase its market share. Furthermore, the growth of Turkish Cargo will contribute significantly to the airline's overall revenue and profitability, enhancing its impact on the Turkish economy.

The airline's strategic goals are ambitious, aiming to capitalize on its geographical advantage and growing global demand for air travel. This approach is designed to strengthen its competitive advantage in the aviation market. For a broader perspective on the competitive environment, consider the Competitors Landscape of Turkish Airlines.

Turkish Airlines plans to increase its fleet to approximately 530 aircraft by the end of 2025, an 8-10% increase from the 492 aircraft at the end of 2024. This includes adding around 13-14 wide-body and 20 narrow-body aircraft in 2025. The long-term goal is to reach over 800 aircraft by 2033.

The airline currently flies to 352 destinations across 131 countries. New destinations for 2025 include Minneapolis (launched in April/May), Seville, and routes to Ouagadougou and Lusaka (planned for June 2025). Flights to Damascus resumed in January 2025.

Turkish Cargo experienced significant growth, with an annual cargo volume increase of over 20% in 2024. Cargo revenue rose by 35% from 2023, reaching $3.5 billion in 2024. This growth has positioned Turkish Cargo as the world's third-largest air cargo carrier.

The airline's international-to-international passenger numbers increased by 6.4% in 2024. The expansion strategy is expected to further drive passenger growth in 2025, supported by new routes and increased capacity.

The expansion strategy of Turkish Airlines is multifaceted, focusing on fleet, network, and cargo operations. These initiatives are designed to enhance its market position and financial performance. The airline’s strategic goals include significant fleet growth and an aggressive international expansion strategy.

- Fleet growth to approximately 530 aircraft by the end of 2025.

- Expansion to new destinations, including Minneapolis, Seville, Ouagadougou, and Lusaka.

- Continued growth in cargo operations, aiming to increase revenue and market share.

- Focus on increasing passenger capacity and international-to-international traffic.

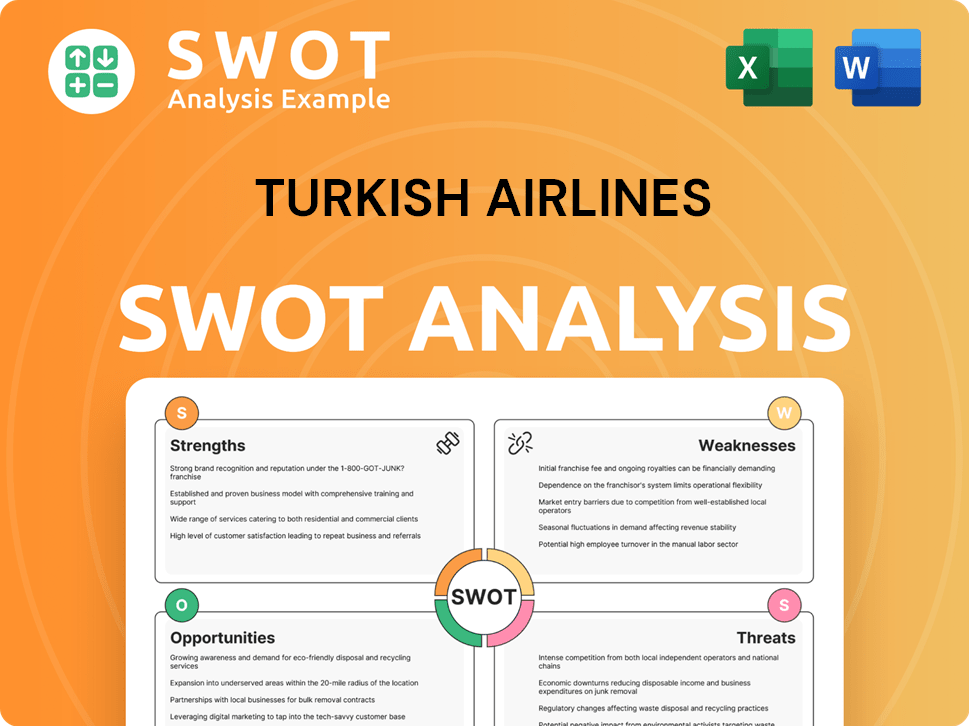

Turkish Airlines SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Turkish Airlines Invest in Innovation?

As part of its Turkish Airlines growth strategy, the company actively uses technology and innovation to improve its operations and promote sustainable growth. The airline's dedication to digital transformation is evident in its implementation of new passenger policies to enhance operational efficiency and safety. The central location of Istanbul Airport, which serves as a major global hub, is critical to the airline's operational efficiency and connectivity, which is a key component of its global growth strategy.

The airline's focus on technology is evident in its use of AI to improve efficiency and safety. This includes the use of AI to analyze real-time geopolitical data, allowing for quick adjustments to flight paths and risk assessments. Furthermore, a proprietary algorithm considers over 200 variables to determine the optimal risk-to-efficiency ratio for each flight. These technological advances contribute to operational efficiency and risk mitigation, supporting the airline's growth objectives and future prospects.

The airline's commitment to innovation is also demonstrated through its investment in cutting-edge technology to enhance security and communication. This includes a quantum encryption system for its communication channels, which has significantly reduced cybersecurity expenses. These advancements are integral to the Turkish Airlines long-term business plan.

The airline employs a sophisticated AI-driven system to analyze real-time geopolitical data. This allows for rapid adjustments to flight paths and risk assessments within minutes, enhancing safety and operational efficiency.

A dedicated team of former military strategists provides daily briefings on potential airspace risks. This proactive approach ensures that the airline can mitigate risks effectively and maintain operational integrity.

A proprietary algorithm factors in over 200 variables, including weather patterns and airspace congestion. This helps determine the optimal risk-to-efficiency ratio for each flight, optimizing both safety and operational performance.

The implementation of a cutting-edge quantum encryption system for communication channels has significantly reduced cybersecurity expenses. This enhances the security of sensitive data and communications.

These technological advancements contribute to significant operational efficiency gains. This supports the airline's growth objectives and enhances its competitive advantage in the aviation market analysis.

The technologies employed aid in effective risk mitigation. This ensures the safety of passengers and crew while also protecting the airline's assets and reputation.

These technological advancements, coupled with strategic planning, support the airline's expansion plans. To learn more about the company's broader strategies, consider reading about the Marketing Strategy of Turkish Airlines.

The airline's technology strategy focuses on operational efficiency, risk mitigation, and enhanced security, aligning with its Turkish Airlines strategic goals.

- AI-driven geopolitical analysis enables rapid adjustments to flight paths.

- A dedicated team of former military strategists provides daily airspace risk briefings.

- A proprietary algorithm optimizes flight efficiency and safety.

- Quantum encryption enhances communication security and reduces costs.

Turkish Airlines PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Turkish Airlines’s Growth Forecast?

In 2024, Turkish Airlines demonstrated robust financial health, reporting a net profit of $3.4 billion, a 17% increase from the previous year. The airline's total revenue reached $22.5 billion. The airline's strong performance reflects its effective Turkish Airlines growth strategy and its ability to capitalize on market opportunities.

Passenger revenue for the year reached $18.4 billion, a 4% increase, while cargo revenue saw a significant surge of approximately 35% to $3.5 billion. Additionally, the company has significantly reduced its debt, from $14 billion at the end of 2020 to $5.7 billion currently, a reduction of $8.3 billion. This financial discipline was recognized with a credit rating upgrade from Fitch to BB from BB- with a stable outlook in February 2025.

Looking at the Turkish Airlines future prospects, the airline anticipates passenger capacity to grow by 6-8% in 2025, with flat yields. The company has provided an EBITDA margin guidance of 22-24% for 2025 and plans a gross capital expenditure of $4.5 billion. This indicates a continued focus on expansion and operational efficiency.

Turkish Airlines achieved a net profit of $3.4 billion. Total revenues reached $22.5 billion. Passenger revenue was $18.4 billion, and cargo revenue was $3.5 billion. The airline's financial performance reflects its solid position in the Airline industry Turkey.

Earnings Before Interest, Tax, Depreciation, Amortization, and Rent (EBITDAR) totaled $5.7 billion with a margin of 25.3%. Debt was reduced from $14 billion to $5.7 billion. This demonstrates effective financial management and strengthens the airline's financial foundation.

Passenger capacity is expected to grow by 6-8%. The EBITDA margin guidance for 2025 is 22-24%. The airline plans a gross capital expenditure of $4.5 billion. These projections highlight the Airline expansion plans and strategic focus of the company.

Q1 2025 revenue grew by 20%, reaching 176.7 billion Turkish Lira (around $4.6 billion). A net loss of approximately $47 million (1.8 billion Turkish Lira) was reported. This was due to increased costs and market competition.

Despite the strong revenue growth in Q1 2025, Turkish Airlines reported a net loss of approximately $47 million (1.8 billion Turkish Lira). This was primarily due to increased personnel costs (an increase of 12.1 billion Turkish Lira or $319 million), rising financial expenses (a 36.3% jump to 16.165 billion Turkish Lira), and intensified market competition. For more insights into the company's ownership and stakeholders, explore Owners & Shareholders of Turkish Airlines.

Revenue in Q1 2025 grew by 20%, reaching 176.7 billion Turkish Lira. This demonstrates the airline's ability to generate strong revenue despite challenges. This growth is a key indicator of the Turkish Airlines market position.

A net loss of approximately $47 million (1.8 billion Turkish Lira) was reported in Q1 2025. This was impacted by higher costs and market competition. The loss highlights the challenges faced in the Aviation market analysis.

Soaring personnel costs increased by 12.1 billion Turkish Lira. Financial expenses rose by 36.3% to 16.165 billion Turkish Lira. These increased costs impacted the airline's profitability.

The airline significantly reduced its debt from $14 billion to $5.7 billion. This reduction strengthens the financial position of the airline. This is a critical element of the Turkish Airlines strategic goals.

Fitch upgraded the credit rating to BB from BB-. The outlook is stable. This upgrade reflects improved financial health and stability. This is a positive sign for the Turkish Airlines international expansion strategy.

EBITDAR margin in 2024 was 25.3%. This aligns with the carrier's long-term targets. This demonstrates the airline's operational efficiency and profitability.

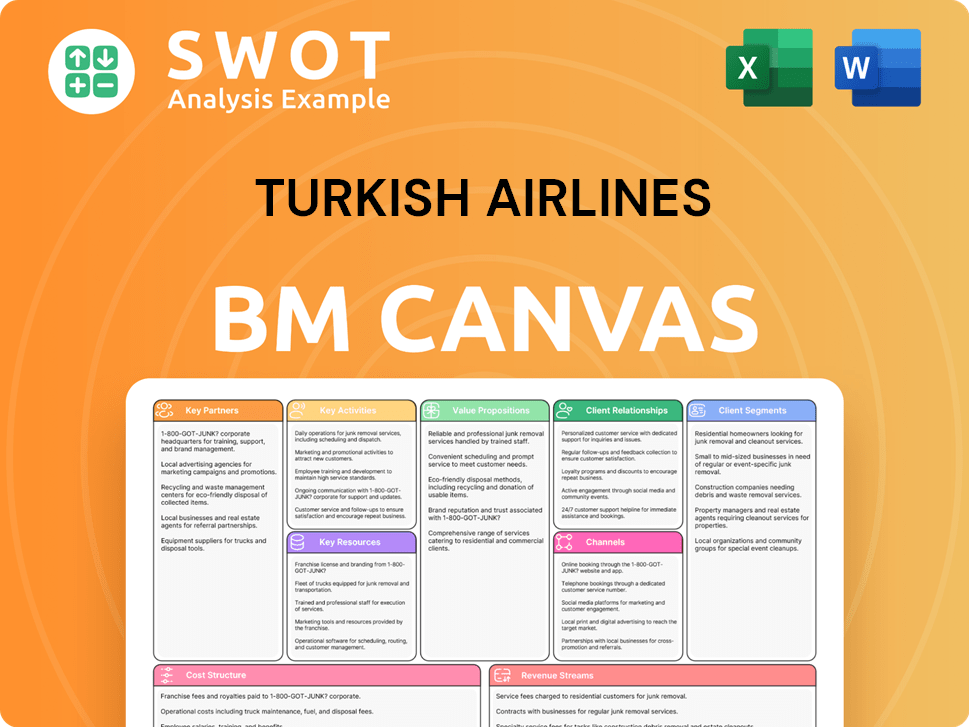

Turkish Airlines Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Turkish Airlines’s Growth?

The path forward for Turkish Airlines, while promising, is fraught with potential risks and obstacles. Several factors could impede the airline's ambitious growth plans and affect its financial performance. Understanding these challenges is crucial for evaluating the company's long-term viability and strategic positioning within the competitive aviation market.

The airline industry, including Turkish Airlines, is subject to fluctuating economic conditions, geopolitical instability, and operational disruptions. These elements can significantly influence passenger demand, operational costs, and overall profitability. Successfully navigating these challenges will be critical for Turkish Airlines to achieve its strategic goals and maintain its competitive edge.

The airline's expansion plans are also impacted by internal and external factors. Strategic planning, risk management, and adaptability are key to mitigating these challenges. For more information about the airline's core principles, you can review the Mission, Vision & Core Values of Turkish Airlines.

Increased competition within the airline industry in Turkey and globally poses a significant challenge. This can lead to price wars and increased capacity from rivals. The low single-digit growth in passenger revenue in 2024 and impact on profitability in Q1 2025 reflects the impact of this competition.

Geopolitical instability and macroeconomic uncertainty are persistent pressures. Political unrest, terrorism, and economic downturns can decrease passenger demand. Currency fluctuations and trade disputes can also negatively affect operating costs, especially fuel and maintenance expenses.

Supply chain issues, such as aircraft production bottlenecks and engine reliability problems, can limit capacity growth. The aviation industry is vulnerable to cyberattacks and IT outages. The Airbus supply chain attack in January 2023, carried out through a compromised employee account at Turkish Airlines, is an example of such risks.

Soaring personnel costs and rising financial expenses present challenges to profitability. Management addresses these risks through strategic cost management, revenue optimization, and financial risk mitigation. The airline’s significant debt reduction from $14 billion to $5.7 billion since 2020 demonstrates a commitment to financial discipline.

Operational risks include aircraft delivery delays and technical problems. The airline emphasizes flexible and strategic fleet planning to navigate these issues. Disruptions, such as those caused by engine problems or cyberattacks, can affect efficiency and capacity utilization.

Financial risks include currency fluctuations and debt management. The airline actively manages its exposure to currency fluctuations. Strategic financial planning and debt reduction are critical for maintaining financial stability and supporting long-term growth. For example, the airline's significant debt reduction since 2020.

The airline industry is subject to rapid changes, including shifts in demand and fuel prices. The airline must adapt to these changes to maintain profitability. These factors can influence the airline's financial performance and strategic plans. The airline must implement flexible strategies to mitigate these risks.

Geopolitical events can disrupt flight operations and impact passenger demand. The airline's Istanbul hub is particularly vulnerable to regional instability. The decision not to resume flights to Tel Aviv due to tensions is a direct example of the impact of geopolitical challenges on the airline's network. This can affect the airline's route network.

Turkish Airlines Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Turkish Airlines Company?

- What is Competitive Landscape of Turkish Airlines Company?

- How Does Turkish Airlines Company Work?

- What is Sales and Marketing Strategy of Turkish Airlines Company?

- What is Brief History of Turkish Airlines Company?

- Who Owns Turkish Airlines Company?

- What is Customer Demographics and Target Market of Turkish Airlines Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.