Turkish Airlines Bundle

How Does Turkish Airlines Soar Above the Competition?

Turkish Airlines, the flag carrier of Turkey, isn't just flying; it's thriving, reporting impressive financial gains and expanding its global reach. With a staggering network spanning hundreds of destinations, the airline has become a major player in the aviation industry. This success story, fueled by strategic growth and robust financial management, offers valuable insights for anyone interested in the airline industry.

This exploration of Turkish Airlines SWOT Analysis will unravel the intricacies of Turkish Airlines operations, from its expansive route network to its impressive cargo division, Turkish Cargo. We'll examine how the airline has navigated global challenges to achieve remarkable financial results. Whether you're curious about flying with Turkish Airlines, its services, or the airline industry in Turkey, this analysis provides a comprehensive overview of its business model and future prospects.

What Are the Key Operations Driving Turkish Airlines’s Success?

Turkish Airlines creates value by offering extensive passenger and cargo services. It connects diverse cultures and economies globally, serving various customer segments. As of June 2024, the airline flies to 352 destinations across multiple continents and operates in 131 countries, more than any other airline.

The airline's operations include fleet management and its main hub at Istanbul Airport (IST). IST dominates the local market with an 80% capacity share. In 2024, two-thirds of all passengers used IST for connecting flights. Logistics are supported by Turkish Cargo, which operates a fleet of 24 freighters and serves 82 cargo destinations.

The airline's strategic location, bridging Europe, Asia, and Africa, makes it a key global transfer hub. This is combined with a focus on high-quality service and expansion, including new international destinations launched in 2024. This approach has resulted in accolades, such as being named 'Best Airline in Europe' by Skytrax for the ninth time in 2024. You can learn more about the company's origins in the Brief History of Turkish Airlines.

As of December 2024, the Turkish Airlines fleet comprised 492 aircraft. The airline plans to expand its fleet to 515-520 aircraft by the end of 2025. This expansion supports the airline's growing network and service offerings.

Turkish Airlines cargo operations are a significant part of its business model. Turkish Cargo utilizes a fleet of freighters and belly capacity in passenger aircraft. The airline's cargo services are enhanced by SmartIST, one of the world's largest air cargo facilities.

The airline's core capabilities translate into benefits for customers. Turkish Airlines offers extensive connectivity, recognized by its Guinness World Record for flying to the most countries. The airline differentiates itself through its broad reach and service quality.

Istanbul Airport (IST) is a crucial hub for Turkish Airlines. IST facilitates significant transfer traffic, with a large percentage of passengers connecting to other routes. The strategic location of IST helps the airline to serve as a global transfer hub.

Turkish Airlines operations are unique due to its strategic geographical location and focus on service. The airline continues to expand its network with new destinations. This expansion and service quality contribute to its market position.

- Extensive global network with flights to numerous countries.

- Focus on high-quality service and customer satisfaction.

- Strategic hub location at Istanbul Airport (IST).

- Continuous expansion through new destination launches.

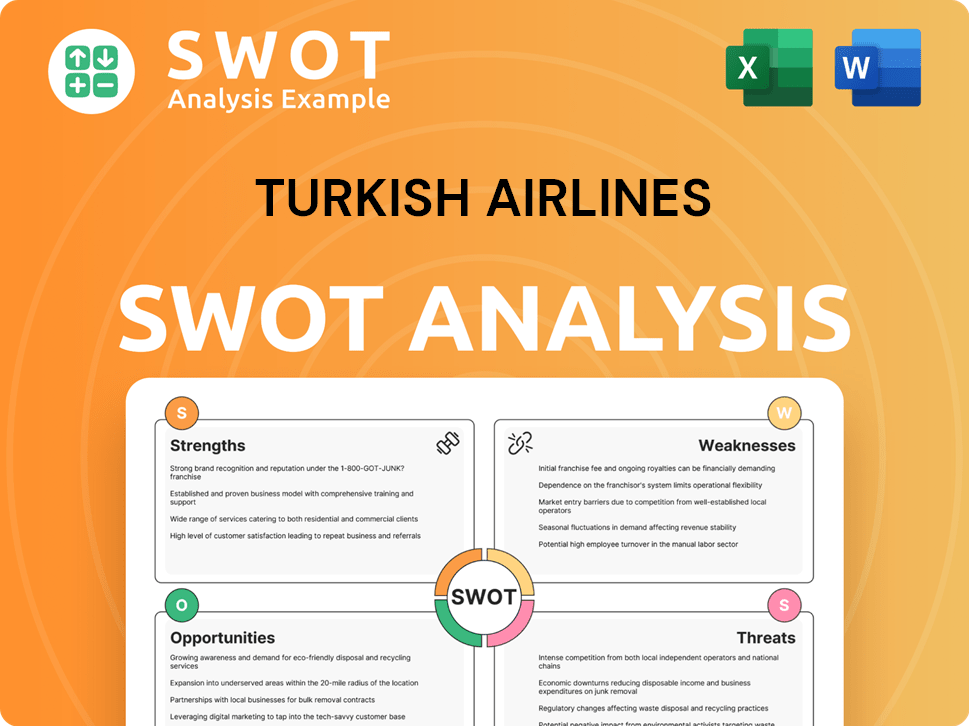

Turkish Airlines SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Turkish Airlines Make Money?

Turkish Airlines' revenue streams are primarily driven by passenger and cargo services. The airline's ability to adapt and innovate in its revenue generation is key to its financial performance. This includes strategic financial management and the introduction of new services.

In 2024, the airline reported total revenues of $22.7 billion, showing an 8.2% year-on-year increase. This growth highlights the airline's strong market position and effective revenue management strategies. The airline carried a total of 83.4 million passengers in 2024.

Cargo operations, a significant revenue stream, experienced remarkable growth. Turkish Cargo saw a 35% increase in revenue, reaching $3.5 billion in 2024, up from $2.6 billion in 2023. This surge was supported by a more than 20% increase in cargo volumes, reaching over 2 million tonnes. Cargo revenue contributed 15.4% to total revenue in 2024, up from 12% in 2023.

To enhance revenue generation, Turkish Airlines has implemented several innovative strategies. These include the launch of 'Turkish Airlines Holidays' and the use of tiered pricing within its frequent-flyer program. For more insights into how the company is growing, consider reading about the Growth Strategy of Turkish Airlines.

- Turkish Airlines Holidays: This platform offers comprehensive booking services, creating new revenue opportunities.

- Miles&Smiles Program: Tiered pricing and cross-selling through the frequent-flyer program.

- Strategic Financing: Securing $1.8 billion in aircraft financing in 2024, including the first airline outside China to secure financing in Chinese Yuan.

Turkish Airlines PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Turkish Airlines’s Business Model?

The journey of Turkish Airlines has been marked by significant milestones, strategic maneuvers, and a strong competitive edge within the airline industry in Turkey. In 2024, the airline expanded its global footprint, adding new routes and resuming flights to key destinations. These moves, coupled with operational efficiencies, have enabled the airline to navigate challenges and maintain a strong market position.

Strategic moves, such as the implementation of simultaneous triple runway operations at Istanbul Airport, have enhanced operational capacity. Despite facing geopolitical tensions and economic uncertainties, Turkish Airlines has demonstrated resilience, achieving strong financial results. The airline's focus on expanding its fleet and enhancing its services reflects a commitment to growth and sustainability.

Turkish Airlines' competitive advantages are rooted in its extensive global network, brand strength, and operational efficiency. The airline's strategic hub at Istanbul Airport facilitates significant transfer traffic, while its commitment to sustainability further strengthens its position. These factors, combined with a focus on customer experience, enable Turkish Airlines to maintain its position as a leading global carrier.

In 2024, Turkish Airlines launched flights to Melbourne, Sydney, and Santiago, Chile, expanding its reach to 131 countries and 299 international destinations. The airline resumed flights to Benghazi in January 2025. A major operational achievement was the implementation of Europe's first simultaneous triple runway operations at Istanbul Airport, increasing air traffic movement capacity by 25%.

Turkish Airlines responded to operational and market challenges, including geopolitical tensions and aircraft production bottlenecks, with flexibility and efficiency. While passenger revenue growth was 4% under intensifying competition, cargo revenue surged by 35%. The airline is focused on fleet expansion, aiming for a fleet of 515-520 aircraft by the end of 2025 and an 800-strong fleet by 2033.

Turkish Airlines' competitive advantages include its strong brand, recognized as a '5-Star Global Airline' by APEX and 'Best Airline in Europe' by Skytrax. Its extensive global network, serving more countries than any other airline, provides a significant edge. The airline benefits from economies of scale due to its large and expanding fleet, which grew by 12% to 492 aircraft in 2024, despite production delays. For more insights, check out the Competitors Landscape of Turkish Airlines.

Despite operational challenges, Turkish Airlines reported a $2.4 billion net profit from main operations in 2024. The airline's cargo revenue surged by 35%, demonstrating its ability to capitalize on market opportunities. The airline's financial performance reflects its operational efficiency and strategic adaptability in a dynamic market environment.

Several factors contribute to Turkish Airlines' success, including its strategic hub in Istanbul, an expanding fleet, and a focus on sustainability. The airline's extensive network and brand reputation also play crucial roles.

- Extensive Global Network: Serving more countries than any other airline.

- Strategic Hub: Istanbul Airport facilitates significant transfer traffic.

- Fleet Expansion: Growing its fleet to meet increasing demand.

- Sustainability: Investments in fuel-efficient aircraft and sustainable aviation fuel.

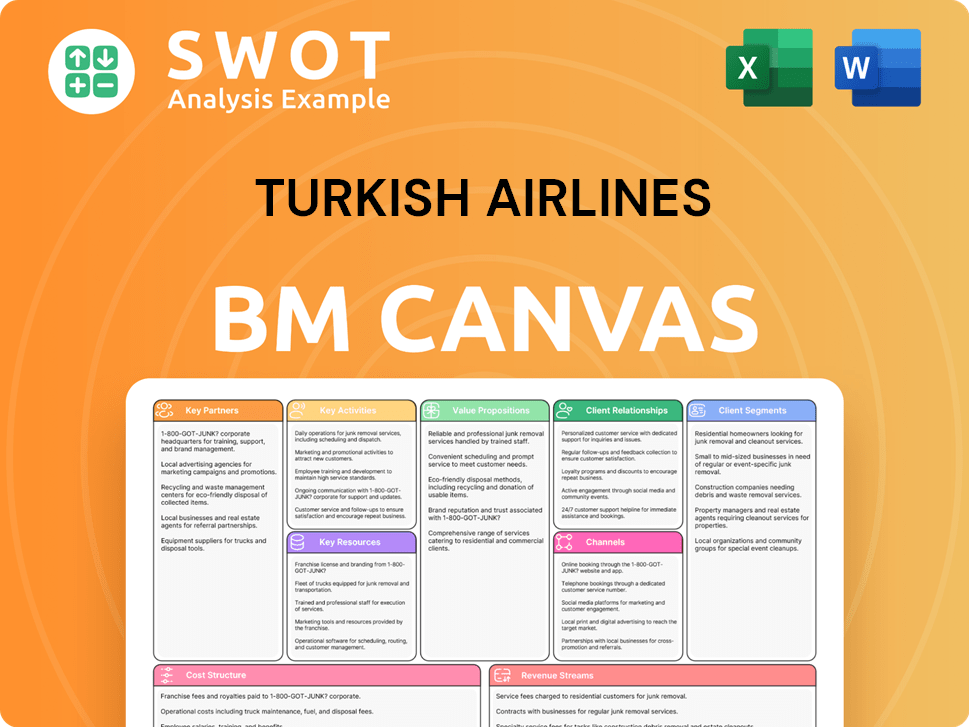

Turkish Airlines Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Turkish Airlines Positioning Itself for Continued Success?

The airline maintains a robust position in the global aviation market, operating in more countries than any other airline. It ranks as the 12th largest carrier by capacity, and 9th by Available Seat Kilometers (ASKs) due to longer sector lengths. In 2024, its cargo division became the world's third-largest air cargo carrier by volume, highlighting its significant presence in the freight sector. Its frequent-flyer program and service quality contribute to strong customer loyalty.

However, the airline faces various risks, including geopolitical tensions and macroeconomic uncertainty, which can influence demand. Aircraft production bottlenecks and engine issues, such as those with Pratt & Whitney's Geared Turbofan (GTF) engines, have caused capacity constraints. Intensifying market competition also affects passenger yields. Rising costs, as evidenced by a Q1 2025 net loss of approximately $47 million despite a 20% revenue increase, and currency fluctuations pose additional financial risks to Owners & Shareholders of Turkish Airlines.

The airline is a major player in the airline industry in Turkey, operating in more countries than any other airline. It ranks among the top carriers globally, particularly in terms of capacity and cargo volume. Customer loyalty is boosted through its frequent-flyer program and service quality.

The company faces risks from geopolitical tensions, macroeconomic uncertainty, and aircraft production bottlenecks. Intensifying market competition and rising costs, including currency fluctuations, impact profitability. Financial performance in Q1 2025 showed a net loss despite increased revenue.

The airline plans fleet expansion, aiming for 515-520 aircraft by the end of 2025 and over 800 by 2033. Passenger capacity is projected to grow by 6-8% in 2025. The focus is on cost management, revenue optimization, and operational efficiency.

Strategic initiatives include fleet expansion to over 800 aircraft by 2033, and passenger capacity growth. The airline is focusing on cost management and revenue optimization to mitigate financial impacts. The company aims to double aircraft and passenger numbers by 2033.

The airline aims to double its aircraft and passenger numbers by 2033. It targets revenues exceeding $50 billion, while also focusing on social responsibility and sustainability. Leadership emphasizes strengthening Turkey's position in global aviation.

- Fleet Expansion: Aiming for over 800 aircraft by 2033.

- Capacity Growth: Projected passenger capacity increase of 6-8% in 2025.

- Financial Targets: Targeting revenues exceeding $50 billion by 2033.

- Sustainability: Commitment to social responsibility and sustainable practices.

Turkish Airlines Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Turkish Airlines Company?

- What is Competitive Landscape of Turkish Airlines Company?

- What is Growth Strategy and Future Prospects of Turkish Airlines Company?

- What is Sales and Marketing Strategy of Turkish Airlines Company?

- What is Brief History of Turkish Airlines Company?

- Who Owns Turkish Airlines Company?

- What is Customer Demographics and Target Market of Turkish Airlines Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.