Vestis Retail Group Bundle

What Went Wrong for Vestis Retail Group?

The retail sector is a battlefield where survival hinges on strategic prowess and adaptability. Vestis Retail Group, once a promising player with brands like Eastern Mountain Sports and Sport Chalet, offers a cautionary tale. Understanding the Vestis Retail Group SWOT Analysis is crucial to grasping the complexities of its rise and fall, and the broader implications for retail company prospects.

This analysis delves into the growth strategy of Vestis Retail Group, examining its business model and the challenges it faced within the dynamic retail market trends. We will explore the factors contributing to its financial performance, the competitive landscape it navigated, and the ultimate outcome of its strategic initiatives. Analyzing Vestis Retail Group's journey provides valuable insights into business development and the critical importance of a resilient growth strategy for any retail company seeking long-term viability and success in the face of industry challenges.

How Is Vestis Retail Group Expanding Its Reach?

The expansion strategy of Vestis Retail Group, a retail company, centered on acquiring and integrating existing retail chains. This approach aimed to build a diverse portfolio of outdoor and athletic-focused retailers. The primary goal was to stabilize and improve the performance of acquired businesses, often those facing financial difficulties.

The company's strategy involved acquiring well-known brands. These acquisitions included Bob's Stores in 2008, EMS in 2012, and Sport Chalet in 2014. The acquisitions were part of a broader plan to establish a strong presence in the retail market, focusing on outdoor and athletic goods. This strategy was intended to create a robust and competitive retail entity.

However, the expansion efforts of Vestis Retail Group ultimately faced significant challenges. The company's plans were hindered by competitive pressures and financial difficulties. The acquired brands struggled to maintain profitability, leading to store closures and bankruptcy filings.

Vestis Retail Group focused on acquiring existing retail chains to expand its portfolio. This strategy aimed to integrate these businesses and improve their overall performance. The acquisitions included brands like Bob's Stores, EMS, and Sport Chalet, which were often facing financial instability at the time of purchase.

Despite the acquisition strategy, the acquired brands faced significant challenges. These challenges included intense competition in the retail market and financial pressures. The inability to secure necessary financing led to store closures and bankruptcy filings for several brands within the Vestis Retail Group.

In April 2016, Sport Chalet announced the closure of all its stores due to competitive pressures. In July 2024, Bob's Stores announced the permanent closure of all locations as part of a bankruptcy filing. Eastern Mountain Sports also filed for Chapter 11 bankruptcy in June 2024.

- In September 2024, Mountain Warehouse acquired the EMS brand, website, and seven profitable stores for $10 million.

- Mountain Warehouse plans to expand the company and open as many as 100 new stores in the coming years.

- The Vestis Retail Group's expansion efforts highlight the challenges of the retail market.

- The future of the acquired brands depends on strategic restructuring and market adaptation.

Vestis Retail Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Vestis Retail Group Invest in Innovation?

Given the eventual bankruptcy of Vestis Retail Group, detailed insights into its specific innovation and technology strategy during its final years are limited. However, understanding the broader trends in the retail and sports equipment sectors provides valuable context for analyzing potential strategies the company might have considered.

In today's retail environment, technology plays a crucial role in driving growth and enhancing customer experiences. This includes integrating digital and physical shopping experiences and leveraging data analytics for personalized marketing. The sports equipment market is also seeing significant technological advancements, particularly in materials and product engineering.

The company's ability to adapt to these trends would have been critical for its long-term prospects. Analyzing the competitive landscape and understanding the evolving needs of its customer base are essential for any retail company's success.

Retailers are increasingly blending physical and digital shopping experiences. This includes using interactive smart mirrors and augmented reality (AR) to enhance in-store experiences. In-store apps provide personalized promotions.

AI is used to quickly understand customer preferences. This enables retailers to tailor recommendations across e-commerce sites, social media, apps, and marketing channels. This is a key factor for a successful Marketing Strategy of Vestis Retail Group.

Streamlined checkout processes, including cashierless stores, are gaining traction. These are enhanced by AI and sensor technologies. This improves efficiency and customer convenience.

The global smart sports equipment market was valued at USD 3.14 billion in 2024. It is projected to grow at a CAGR of 10.7% from 2025 to 2030. This growth is driven by the adoption of Internet of Things (IoT) technology.

Sensor-embedded equipment allows athletes to monitor performance in real-time. This provides valuable data for training and improvement. This is a key area of innovation.

Consumers are increasingly demanding eco-friendly materials and ethical production. The outdoor apparel market is forecasted to grow by USD 7.30 billion during 2024-2029, with a CAGR of 6.4%. This trend is influencing the industry.

Technological investments are fueling growth in the outdoor apparel and sports equipment markets. These investments focus on materials and product engineering. The sports and leisure equipment industry is expected to reach USD 720 billion by 2025 and USD 1.2 trillion by 2035, with a CAGR of 5.6%.

- Smart wearables and IoT-enabled fitness devices are contributing to this growth.

- Companies like The North Face and Patagonia are recognized for producing high-performance, eco-friendly gear.

- These trends highlight the importance of innovation for retail company prospects.

- Understanding the Vestis Retail Group competitive landscape is crucial.

Vestis Retail Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Vestis Retail Group’s Growth Forecast?

The financial trajectory of Vestis Retail Group, especially before its bankruptcy, reveals significant challenges. The company's struggles highlight the volatile nature of the retail sector and the importance of robust financial planning and adaptability. A detailed Vestis Retail Group analysis is crucial for understanding the factors that led to its financial instability.

The company's financial woes culminated in a Chapter 11 bankruptcy filing in April 2016. This action underscored the critical need for effective business development strategies and the ability to navigate retail market trends. Understanding Vestis Retail Group's financial performance is essential for assessing the potential for future growth.

Despite these setbacks, the retail landscape continues to evolve, presenting both challenges and opportunities. The Revenue Streams & Business Model of Vestis Retail Group provides further insights into the company's operational structure and financial strategies.

In May 2016, Vestis Retail Group reported an operating loss of nearly $1 million on sales of $70.6 million. Both Bob's Stores and Eastern Mountain Sports experienced costs exceeding gross profits. Sport Chalet, while generating operating income, had a gross profit of only 20.6% of net sales.

For the fiscal year ending September 27, 2024, revenue decreased by 0.7% compared to fiscal year 2023. Adjusted EBITDA margin declined by 170 basis points, partly due to increased public company costs. Net cash from operating activities increased significantly, while free cash flow decreased.

Total principal debt outstanding as of September 27, 2024, was $1.16 billion. This represents a reduction of $337.5 million during fiscal year 2024. The company's ability to manage its debt is a key factor in its financial health.

The initial bankruptcy filing in April 2016 involved plans to sell Eastern Mountain Sports and Bob's Stores. However, in June 2024, SDI Stores, the parent company of Bob's Stores and Eastern Mountain Sports, filed for Chapter 11 bankruptcy again. Eastern Mountain Sports was later acquired by Mountain Warehouse.

The financial health of Vestis Retail Group is characterized by several key metrics. These numbers provide a snapshot of the company's performance and highlight areas of concern.

- Operating Loss (May 2016): Nearly $1 million.

- Revenue Decline (Fiscal Year 2024): 0.7%.

- Adjusted EBITDA Margin Decline: 170 basis points.

- Net Cash from Operating Activities (Fiscal Year 2024): Increased by 83.6% to $471.8 million.

- Free Cash Flow (Fiscal Year 2024): Decreased by 13.2% to $165.2 million.

- Total Principal Debt Outstanding (September 27, 2024): $1.16 billion.

Vestis Retail Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Vestis Retail Group’s Growth?

The collapse of Vestis Retail Group, a retail company, stemmed from a confluence of strategic and operational risks. The sporting goods and outdoor retail sectors presented a highly competitive environment, characterized by an oversupply of similar products. This, combined with the rise of online retailers and lower-cost alternatives, significantly impacted the financial health of brick-and-mortar stores, leading to significant challenges for Vestis Retail Group.

One of the major obstacles was the poor financial performance of Sport Chalet, which burdened the entire group with mounting debt and declining revenue. Its focus on high-priced products for a niche market did not translate to success for a chain of its size. Failures in online sales further contributed to the financial difficulties faced by Vestis Retail Group.

Vestis Retail Group's management attempted to mitigate these risks through restructuring and strategic reviews. Despite these efforts, the challenges persisted, ultimately leading to bankruptcy and changes in ownership. This highlights the persistent challenges in the retail sector, including the need for robust digital transformation and adaptation to evolving consumer preferences. For a detailed look at the company's foundational principles, consider exploring the Mission, Vision & Core Values of Vestis Retail Group.

The sporting goods market was oversaturated, with many stores selling similar products. This intense competition, coupled with the rise of online retailers, put significant pressure on brick-and-mortar stores. Vestis Retail Group analysis shows that this environment made it difficult for the company to differentiate itself and maintain profitability.

Sport Chalet's persistent financial struggles, marked by increasing debt and decreasing revenue, significantly burdened Vestis Retail Group. The company's business model, focusing on high-priced products, did not resonate with a broad customer base. Vestis Retail Group financial performance suffered as a result.

Ineffective online sales strategies further compounded the financial challenges faced by sporting goods retailers. The inability to establish a strong online presence meant that Vestis Retail Group missed out on a crucial growth avenue. The lack of a robust online platform hindered the company's ability to compete with digitally-focused rivals.

Despite attempts at restructuring and strategic reviews, Vestis Retail Group struggled to overcome its difficulties. The unique competitive pressures on Sport Chalet limited the financial flexibility of other brands like Eastern Mountain Sports (EMS) and Bob's Stores. Vestis Retail Group strategic initiatives were not enough to offset broader market trends.

The decision to file for Chapter 11 bankruptcy in 2016 was an attempt to separate the businesses and address the challenges. However, both Bob's Stores and EMS continued to face financial difficulties, leading to further bankruptcies and changes in ownership in 2024. Vestis Retail Group future outlook 2024 was significantly impacted by these events.

The retail sector faces persistent challenges, including the need for robust digital transformation and adaptation to evolving consumer preferences. Companies that failed to embrace e-commerce and adapt to changing customer behaviors struggled. Vestis Retail Group industry challenges were exacerbated by these factors.

Vestis Retail Group's market share diminished due to intense competition and changing consumer preferences. The company's inability to compete with online retailers and discount stores resulted in a loss of market share. This decline in market share directly affected Vestis Retail Group revenue growth.

The competitive landscape included numerous sporting goods retailers and online platforms, making it difficult for Vestis Retail Group to stand out. The presence of larger, more established competitors and the rise of e-commerce giants created significant challenges. Understanding the Vestis Retail Group competitive landscape is crucial.

The Vestis Retail Group investment potential was limited due to the company's financial difficulties and market challenges. Investors were hesitant to invest in a company facing such significant obstacles. The company's struggles impacted its ability to attract investment.

The Vestis Retail Group business model, which included a focus on brick-and-mortar stores and high-priced products, proved unsustainable in the changing retail environment. The company's business model failed to adapt to the rise of e-commerce and shifting consumer preferences. Analyzing the Vestis Retail Group business model is essential.

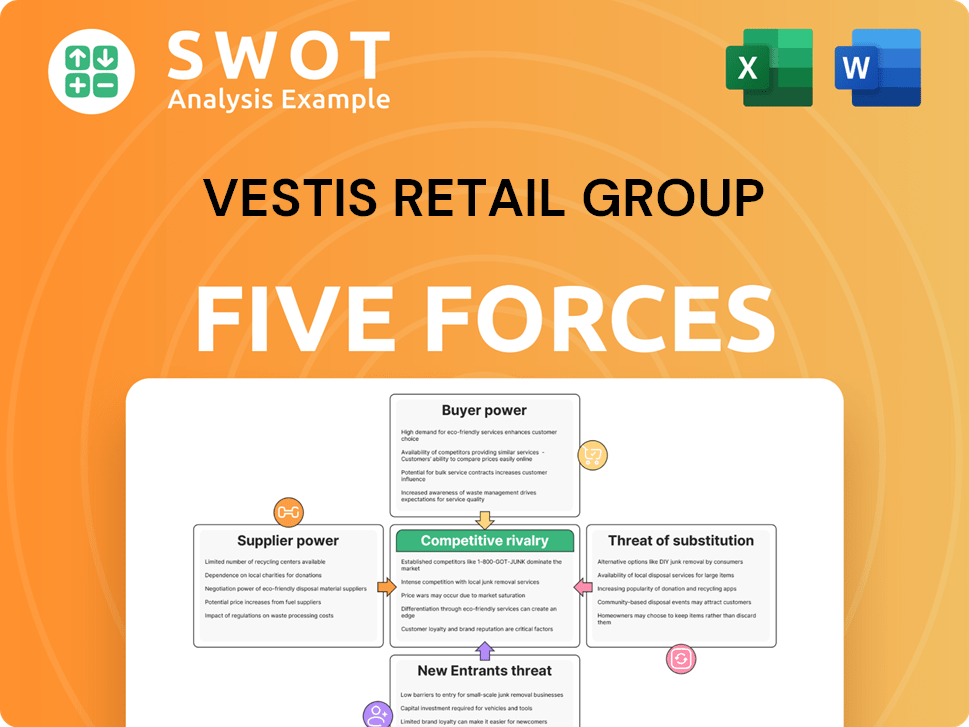

Vestis Retail Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vestis Retail Group Company?

- What is Competitive Landscape of Vestis Retail Group Company?

- How Does Vestis Retail Group Company Work?

- What is Sales and Marketing Strategy of Vestis Retail Group Company?

- What is Brief History of Vestis Retail Group Company?

- Who Owns Vestis Retail Group Company?

- What is Customer Demographics and Target Market of Vestis Retail Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.