Videocon Bundle

Can Videocon Rise Again?

Once a titan of the Indian consumer electronics market, Videocon Industries Limited now faces a critical juncture. From pioneering color TVs to a vast array of appliances, its journey has been marked by both triumphs and tribulations. But what does the future hold for a company navigating the complexities of corporate insolvency?

This Videocon SWOT Analysis offers a deep dive into the challenges and opportunities that lie ahead. Understanding the Videocon growth strategy is crucial, especially in light of its past financial performance and current market position. We will explore the Videocon future prospects, examining its potential for innovation and expansion within the Indian market, while considering the Videocon business model and the impact of its past diversification plans.

How Is Videocon Expanding Its Reach?

Given the current state of Videocon Industries Limited, which is undergoing a Corporate Insolvency Resolution Process (CIRP), the usual growth strategies such as entering new markets or launching new products are not applicable. The company's primary focus is on navigating the insolvency resolution process. This process involves regular meetings of the Committee of Creditors (CoC) to address the ongoing financial situation.

The 48th meeting of the CoC was scheduled for April 4, 2025, which underscores the continuous efforts to manage the insolvency. The company's operations are mainly centered around managing its existing assets and resolving its financial obligations under the guidance of a Resolution Professional. Any 'expansion' in this context is limited to the successful resolution of its debt and the potential for a new owner to revitalize its business segments.

Historically, the company's business segments included consumer electronics, home appliances, and oil and gas. The future prospects of the company are therefore heavily dependent on the outcome of the insolvency resolution process. The success of this process will determine whether the company can be restructured and potentially re-enter the market, or if its assets will be liquidated.

The main priority for Videocon is to resolve its outstanding debts through the CIRP. This involves negotiating with creditors and restructuring financial obligations. The resolution process is critical for determining the company's future.

Managing existing assets effectively is another key aspect of the current strategy. This includes maintaining the value of assets and potentially selling off some to meet financial obligations. The efficient management of assets is crucial during the insolvency process.

A successful resolution could lead to the company being acquired or restructured, which could revitalize its business segments. This could involve new investment and a renewed focus on consumer electronics, home appliances, or other sectors. The future depends on the outcome of the CIRP.

During the resolution process, Videocon may explore strategic partnerships or alliances to strengthen its position. These partnerships could provide access to new technologies, markets, or resources. Such alliances could be crucial for future growth.

The future prospects of Videocon are closely tied to the success of its insolvency resolution. The Revenue Streams & Business Model of Videocon highlights the company's historical operations. The potential for future growth depends on the restructuring and recapitalization efforts.

- Successful Debt Resolution: A key factor is the ability to resolve outstanding debts.

- Potential for New Ownership: The company's future could be shaped by new ownership.

- Market Re-entry: Re-entering the consumer electronics or other markets is a possibility.

- Strategic Restructuring: Restructuring the company's operations and assets is essential.

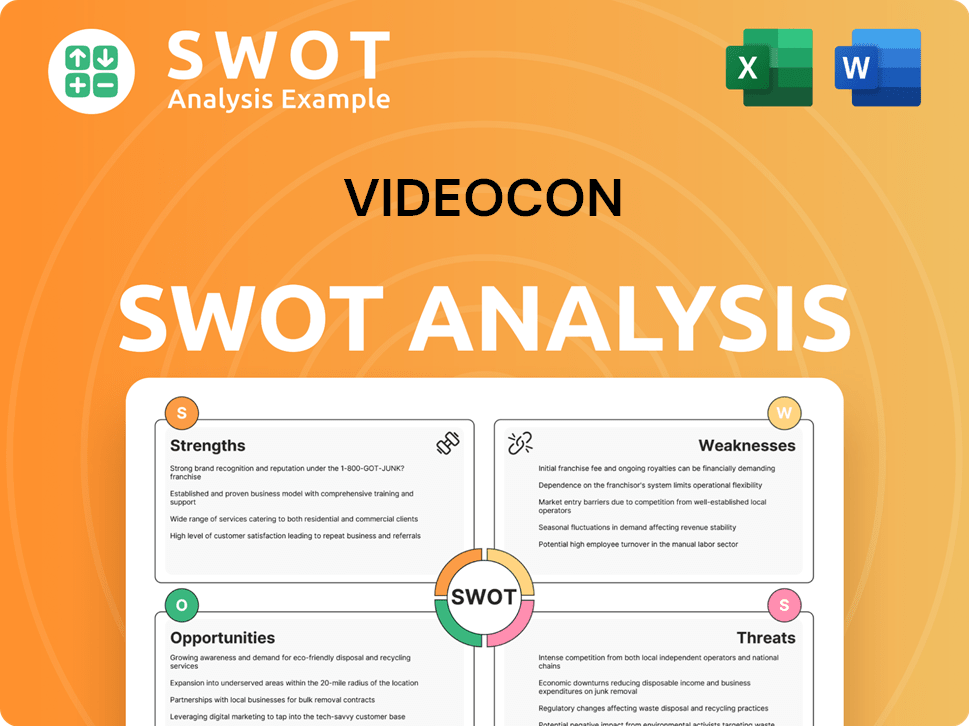

Videocon SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Videocon Invest in Innovation?

Currently, the innovation and technology strategy of Videocon Industries Limited is heavily influenced by its corporate insolvency resolution process. The company, as it stands, is not in a position to make significant investments in research and development or pursue major technological advancements. The primary focus is on resolving its financial issues and restructuring the business.

Historically, Videocon did invest in research and development (R&D). It had an R&D center dedicated to developing new products and processes. The company introduced technologies like 'Liquid Luminous Technology' in televisions to enhance picture quality and brought innovations to washing machines, such as tilt drum facilities. These past efforts demonstrate a commitment to innovation, but the current situation has shifted the priorities.

The ongoing insolvency proceedings, including numerous meetings of the Committee of Creditors (CoC), such as the 48th meeting held on April 4, 2025, highlight that the company's immediate operational focus is on resolution rather than on significant R&D investments or new technological breakthroughs. The financial constraints and the nature of the insolvency process mean that large-scale digital transformation, automation, or the adoption of cutting-edge technologies are not currently driving Videocon's strategy. This is a critical factor when considering the Owners & Shareholders of Videocon and the company's future.

The insolvency proceedings have significantly curtailed Videocon's ability to invest in innovation and technology. The company's financial resources are primarily directed towards meeting the requirements of the insolvency resolution process. This situation limits the scope for adopting new technologies or developing innovative products. Any future innovation and technology strategy would likely depend on the outcome of the insolvency and the strategic direction of any potential acquirer. This is a key consideration for anyone assessing the Videocon growth strategy.

- Limited R&D Investment: The company is unable to allocate substantial funds to research and development.

- Focus on Resolution: The primary goal is to resolve the financial issues, not to pursue technological advancements.

- Digital Transformation Stalled: Large-scale digital transformation initiatives are not currently feasible.

- Future Dependent on Acquirer: The future technology strategy hinges on the plans of the entity that acquires the company.

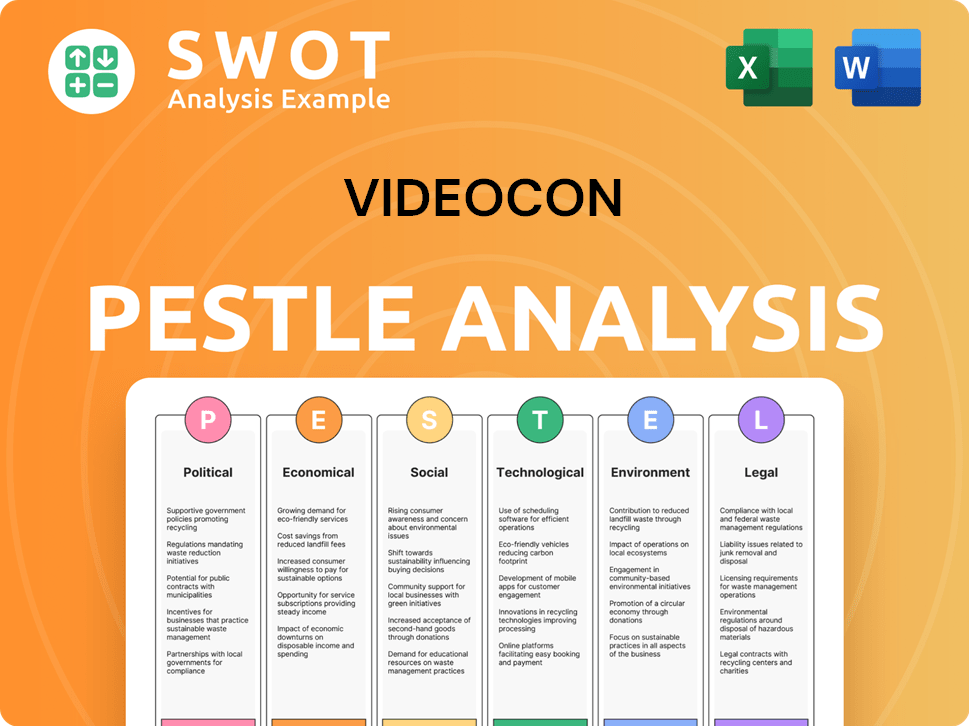

Videocon PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Videocon’s Growth Forecast?

The financial outlook for Videocon Industries Limited is heavily influenced by its ongoing Corporate Insolvency Resolution Process (CIRP). This process, initiated in June 2018, has significantly shaped the company's financial performance and future prospects. The resolution process's outcome will determine the company's future direction and any potential for a turnaround.

As of March 31, 2024, the company reported a trailing 12-month revenue of approximately $76.8 million. In fiscal year 2024, the total revenue was approximately 651.22 crore INR. The financial data reflects the challenges Videocon faces, particularly with its debt burden and the need for a successful resolution plan.

The company's operating income decreased by 17.2% year-on-year in FY24, although its operating profit increased by 220.5% year-on-year. However, operating profit margins fell to 11.2% in FY24 from 2.9% in FY23, and net profit margins declined from 901.3% in FY23 to 1283.2% in FY24. The net profit for the year grew by NA year-on-year. The financial performance shows the impact of the CIRP on the company's profitability and operational efficiency.

In FY24, the company's total revenue was approximately 651.22 crore INR. Operating income decreased by 17.2% year-on-year. The financial data provides insights into the company's current standing.

The CIRP, initiated in June 2018, is a crucial factor. The NCLT approved Vedanta Group's bid in June 2021, but it was later scrapped by the NCLAT in January 2022. The ongoing legal battles and creditor meetings are critical to the company's future.

The Supreme Court's refusal to halt lenders from dealing with foreign oil and gas assets indicates the complexities of debt resolution. The 48th Committee of Creditors meeting was scheduled for April 4, 2025, highlighting the ongoing efforts to resolve the debt.

The liquidation value was insufficient to cover financial creditors' debt, resulting in a nil liquidation value for equity shareholders. This means shareholders will not receive any payment. This situation underscores the financial distress.

The future financial performance and long-term goals depend on the CIRP's successful conclusion and any subsequent strategic direction. The Brief History of Videocon offers a look at the company's past.

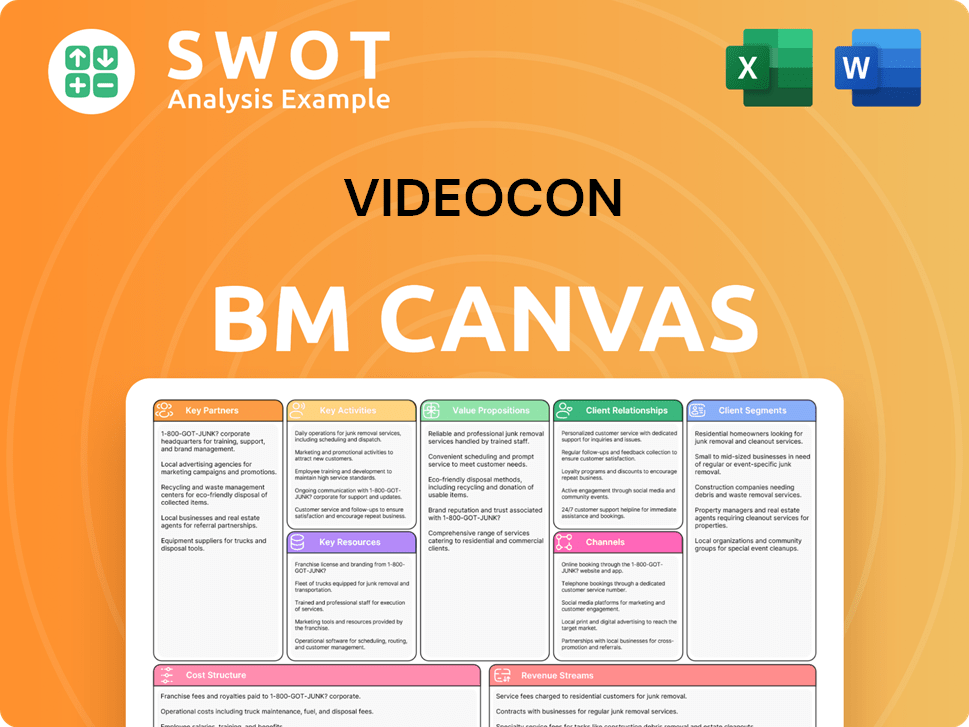

Videocon Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Videocon’s Growth?

The potential risks and obstacles facing Videocon Industries Limited are substantial, primarily due to its ongoing Corporate Insolvency Resolution Process (CIRP). This process, initiated in June 2018, presents the most immediate and significant challenge to the company's future. The extended duration of the insolvency proceedings, including frequent meetings of the Committee of Creditors (CoC), underscores the complexity and difficulty in achieving a viable resolution.

A major hurdle has been the failure of acquisition attempts and the unresolved nature of the company's debt, which involves admitted claims exceeding Rs 61,773 crore. Legal entanglements, such as the Supreme Court's rulings regarding foreign assets, further complicate the situation. These factors collectively create a highly uncertain environment, significantly impacting the company's ability to strategize and operate effectively.

Even if Videocon were to emerge from insolvency, it would face intense competition in the consumer electronics and home appliances sector. Established players like Samsung, Sony, and LG dominate the market. Additionally, the company must navigate regulatory changes, supply chain vulnerabilities, and rapid technological advancements, including AI and IoT. The company's ability to adapt and innovate is severely constrained by its current financial and operational limitations.

The ongoing CIRP is the most critical challenge. The 48th CoC meeting was scheduled for April 4, 2025, highlighting the prolonged nature of the resolution process. The complex legal and financial issues involved, including the handling of assets, create significant uncertainty for stakeholders.

Failed bids, such as the one by Vedanta Group in 2021, demonstrate the difficulty in reaching a consensus among creditors. The NCLAT's rejection of the Vedanta bid in January 2022, due to the substantial haircut it imposed on banks, underscores the challenges. This impacts the Videocon growth strategy.

If the company emerges, it will face stiff competition from established brands. The consumer electronics market is highly competitive, with major players holding significant Videocon market share. This makes future prospects challenging.

Rapid advancements in AI and IoT pose a continuous threat. The company's limited capacity for R&D and digital transformation restricts its ability to adapt. This impacts the Videocon future prospects.

Limited manpower and operational resources lead to delays in regulatory disclosures. Managing even routine operations is challenging during the CIRP. This impacts Videocon financial performance.

The Supreme Court's rulings on foreign assets further complicate the situation. These legal issues create uncertainty. Understanding these issues is crucial for any Videocon company analysis.

Changes in regulations and vulnerabilities in the supply chain pose risks. The consumer electronics industry is subject to frequent regulatory changes. Supply chain disruptions, as seen in recent years, can significantly impact operations. These factors influence Videocon's business model.

Internal resource constraints, including manpower and operational limitations, cause delays. These challenges impede the company's ability to function efficiently. Addressing these issues is vital for Videocon's strategies for overcoming competition.

The ongoing CIRP and related issues impact the Indian economy. The financial difficulties faced by the company have broader implications. Understanding these impacts is crucial for a comprehensive Videocon company analysis. For more insights, you can read about the Marketing Strategy of Videocon.

The current state of the company presents limited investment opportunities. The high level of uncertainty related to the insolvency proceedings makes it difficult to assess future prospects. Any potential investor must carefully consider the challenges faced by Videocon's current market position.

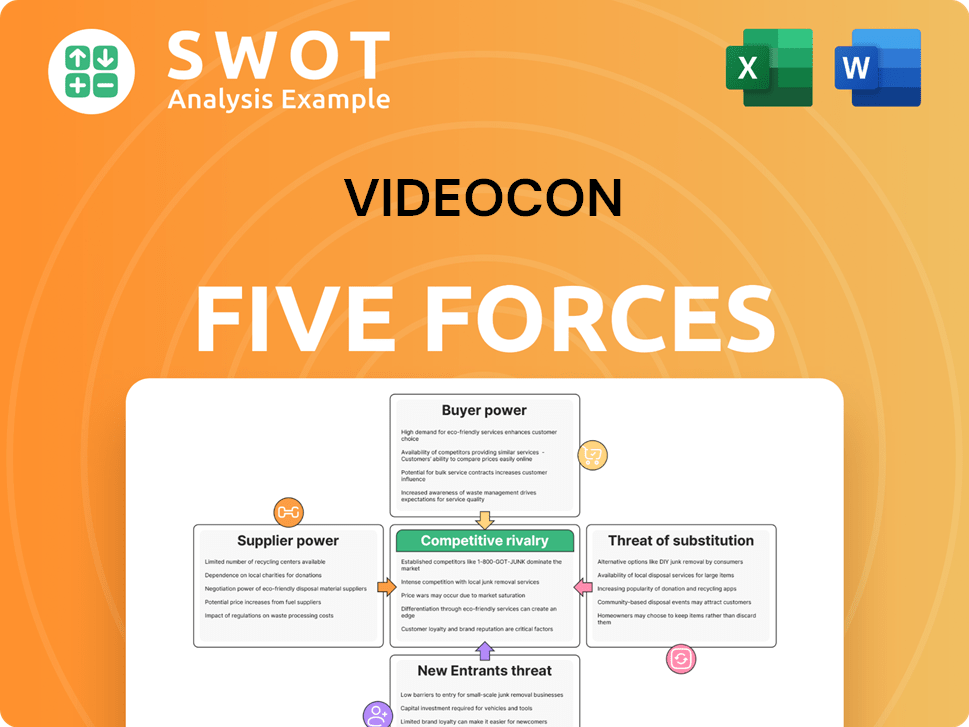

Videocon Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Videocon Company?

- What is Competitive Landscape of Videocon Company?

- How Does Videocon Company Work?

- What is Sales and Marketing Strategy of Videocon Company?

- What is Brief History of Videocon Company?

- Who Owns Videocon Company?

- What is Customer Demographics and Target Market of Videocon Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.