Videocon Bundle

Who Were Videocon's Customers, and Why Does it Matter?

Understanding Videocon SWOT Analysis and its customer demographics is crucial for any business, especially in the fast-paced consumer electronics sector. Videocon, a once-dominant player in India, provides a compelling case study. Founded in 1979, the company aimed to provide affordable electronics to a burgeoning middle class.

This analysis explores the Videocon company's target market and market segmentation strategies. We'll examine the demographic breakdown of Videocon customers, including age range, income levels, and geographic location. Ultimately, this investigation sheds light on how understanding the consumer profile impacts a company's success and longevity, especially when facing market shifts and intense competition.

Who Are Videocon’s Main Customers?

Understanding the Competitors Landscape of Videocon involves analyzing its primary customer segments. The company, historically a major player in the Indian consumer electronics market, primarily focused on the business-to-consumer (B2C) sector. Its success was built on catering to a broad demographic within India.

The core customer demographics for Videocon primarily consisted of middle-income to upper-middle-income families. These families were spread across urban, semi-urban, and rural areas, reflecting the widespread distribution of Videocon's products. The company's strategy was to offer a range of products that appealed to different economic strata, from basic models to more advanced appliances.

The target market for Videocon's televisions and basic home appliances, such as refrigerators and washing machines, often included first-time buyers or those upgrading from older models. This segment typically fell within the age range of 25-55, with a strong emphasis on value for money and product durability. The company's market segmentation aimed to capture a significant portion of the Indian consumer electronics market by offering affordable and reliable products.

Videocon's market segmentation strategy focused on affordability and reliability to attract a wide consumer base. This approach allowed them to capture a significant share of the Indian consumer electronics market. The company's product range catered to diverse income levels across different geographic locations.

The consumer profile of Videocon's target market included middle-income families seeking value. These consumers were often looking for durable and reliable electronics. They were found across various regions, reflecting the company's wide distribution network.

The age range of Videocon's consumers for core products like TVs and appliances was typically between 25 and 55 years old. This demographic often represented first-time buyers or those upgrading their existing appliances. This segment valued affordability and long-term reliability.

Videocon's target market was spread across urban, semi-urban, and rural areas in India. The company's extensive distribution network enabled it to reach consumers in various regions. This broad geographic reach was key to its market share.

Videocon's product range catered to different demographics, with basic appliances targeting value-conscious consumers and premium products aimed at more affluent buyers. The introduction of mobile phones and higher-end appliances expanded the company's reach. This strategy aimed to capture a broader market share.

- Televisions and Basic Appliances: Targeted first-time buyers and those upgrading, focusing on affordability and durability.

- Mobile Phones: Appealed to a younger, tech-savvy demographic.

- Higher-End Appliances: Aimed at more affluent urban consumers.

- Air Conditioners and Refrigerators: Focused on consumers seeking premium features and performance.

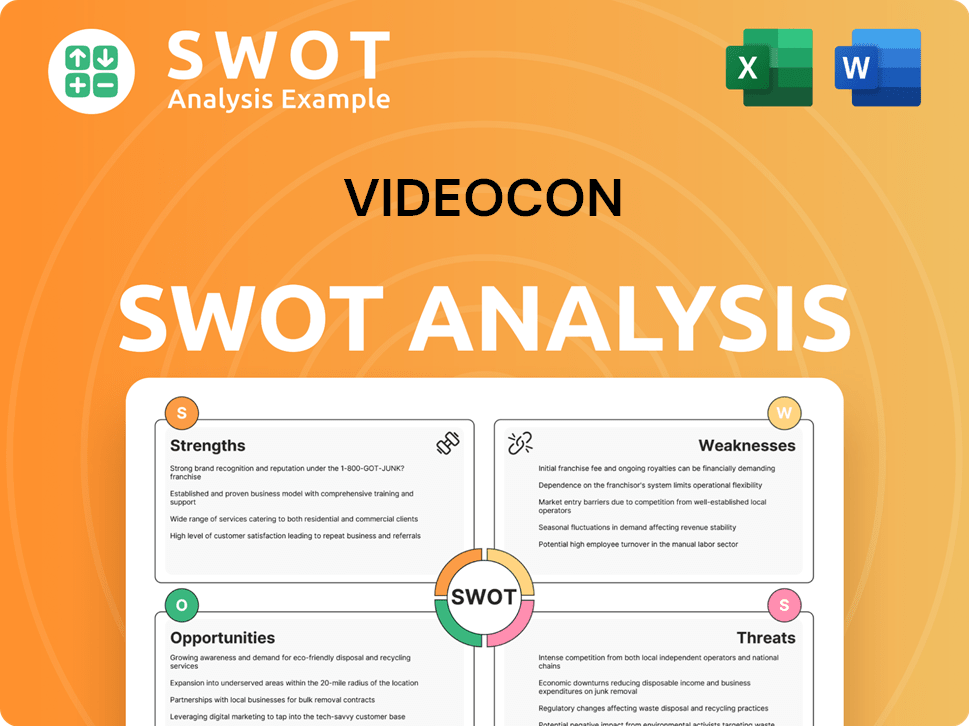

Videocon SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Videocon’s Customers Want?

Understanding the customer needs and preferences of the Videocon company is crucial for effective market segmentation and product development. The company's success hinged on its ability to cater to the specific demands of its target market, primarily in India. This involved a deep dive into the demographic and psychographic profiles of its consumers.

The primary drivers for purchasing Videocon products were practicality, affordability, and a desire for modern conveniences. Consumers sought reliable and durable appliances, making it a significant investment for many households. The psychological aspects played a role, as owning modern appliances often symbolized an improved quality of life and social status.

The company aimed to solve common problems, such as the need for energy-efficient appliances suitable for the Indian climate. While specific recent data is limited due to the company's operational status, historically, Videocon focused on features like power savings and robust build quality to meet local needs. This approach helped the company align its offerings with the specific needs of its customer base.

Customers needed appliances that were affordable and reliable. They also looked for products that offered energy efficiency and were suitable for the Indian climate. Reliability and longevity were key decision-making factors for consumers.

Purchasing decisions were heavily influenced by the price, durability, and the availability of after-sales service. For many consumers, buying appliances was a significant investment, making reliability a critical factor. The aspiration for a better quality of life also drove purchasing behavior.

Historically, Videocon focused on features like power savings and robust build quality. They tailored products to meet local conditions, such as refrigerators with larger vegetable compartments and washing machines for varied fabrics. This helped the company to cater to the specific requirements of its customer base.

Owning modern appliances was often linked to an improved quality of life and social status. Consumers sought products that could enhance their lifestyle and reflect their aspirations. This desire for a better lifestyle influenced purchasing decisions.

The company adapted its marketing and product features to meet local preferences. This included emphasizing energy efficiency and durability. This approach helped Videocon to stay relevant in the competitive market.

While recent data is limited, historically, Videocon would have used customer feedback to influence product development. This ensured that products met the specific needs and preferences of the target market. This helped to improve customer satisfaction.

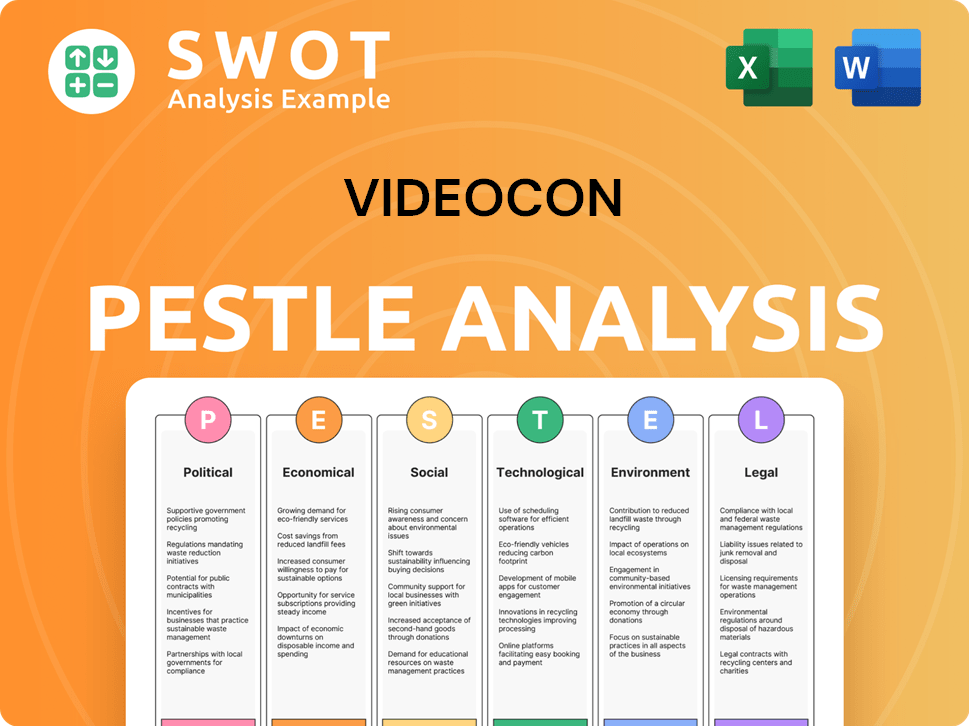

Videocon PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Videocon operate?

The primary geographical market for the Videocon company was India. It aimed for widespread distribution across the country, targeting various areas to maximize its reach. This strategy was crucial for establishing a strong presence and brand recognition in a diverse market.

Key markets included metropolitan cities, Tier 2 and Tier 3 cities, and increasingly, semi-urban and rural regions. This broad approach helped the company cater to a wide range of consumers. The company's focus on localizing its offerings and marketing campaigns was essential for success in the diverse Indian market.

The company's strategy involved understanding variations in consumer preferences, buying power, and cultural nuances across different states and regions. Marketing campaigns were adapted to local languages and festivals. A widespread service network was also a crucial element in establishing its presence across the vast Indian landscape.

The company segmented its market based on geography, targeting different regions within India. This included metropolitan areas, smaller cities, and rural areas. This segmentation allowed for tailored marketing and product distribution strategies.

A robust distribution network was essential for reaching consumers across India. This network included retail outlets, service centers, and partnerships with local distributors. The extensive network supported the company's wide market presence.

The company adapted its marketing and product offerings to suit local preferences and cultural nuances. This included using local languages in advertising and tailoring products to meet regional needs. The localization strategy aimed to enhance consumer engagement.

A widespread service network supported the company's products, providing maintenance and repair services across different regions. This network enhanced customer satisfaction and built brand loyalty. The service network played a crucial role in the company's market strategy.

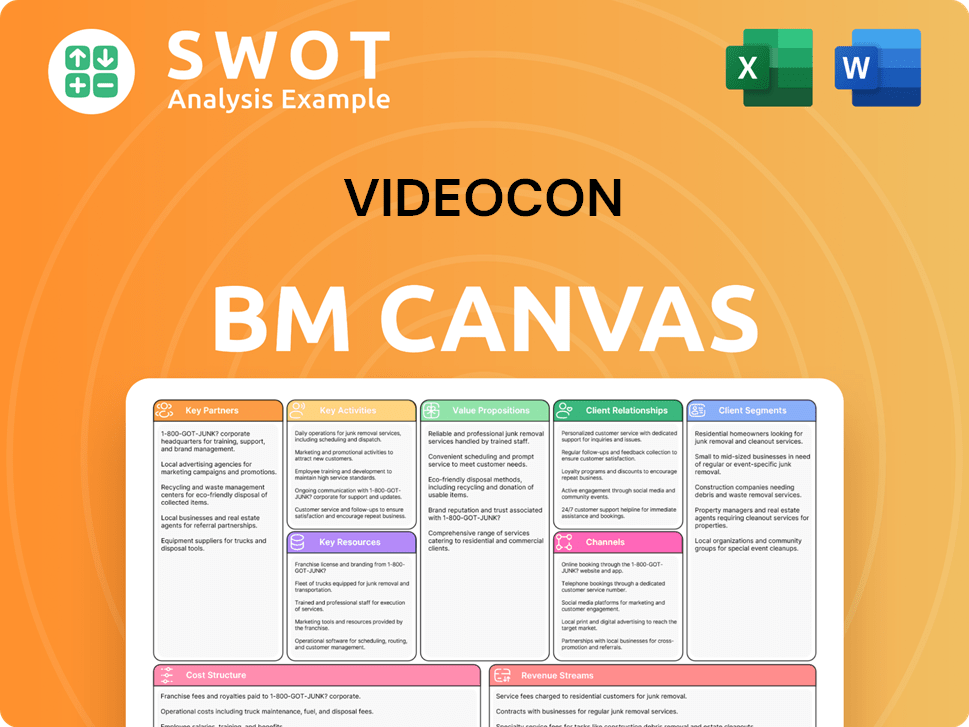

Videocon Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Videocon Win & Keep Customers?

Historically, the customer acquisition and retention strategies of the company involved a blend of traditional and digital marketing approaches. The company utilized television commercials, print media, and billboards for brand awareness across India. With the growth of digital media, online advertising, social media campaigns, and potential influencer marketing would have been employed to reach a younger, more digitally engaged audience. These methods aimed to build brand recognition and attract a diverse customer base.

Sales tactics included a strong presence in multi-brand retail outlets, exclusive brand stores, and partnerships with large format electronics retailers, offering competitive pricing and financing options. These strategies were designed to make products accessible and attractive to a wide range of consumers. Customer retention was crucial, focusing on after-sales service, warranty programs, and the availability of spare parts, essential for consumer durables.

The company likely employed customer relationship management (CRM) systems to segment customers, understand purchasing behaviors, and tailor marketing campaigns. While specific details on successful acquisition campaigns or innovative retention initiatives in the 2024-2025 timeframe are not available, the company's past strategies would have aimed to build customer loyalty through reliable product performance and efficient service. However, the company's ultimate insolvency indicates that its customer acquisition and retention strategies, along with other business factors, were insufficient to compete in the market.

Traditional advertising methods like television commercials, print media, and billboards were used to build brand awareness. These methods were important for reaching a broad audience across India. This approach aimed to establish a strong brand presence in the market.

The company likely engaged in online advertising, social media campaigns, and influencer marketing to reach a younger, more digitally native audience. This strategy was aimed at capturing a significant portion of the market. Digital marketing was key to staying competitive.

Sales tactics included a strong presence in multi-brand retail outlets, exclusive brand stores, and partnerships with large format electronics retailers. Competitive pricing and financing options were also provided. This approach made products accessible and attractive to a wide range of consumers.

Customer retention strategies focused on after-sales service, warranty programs, and the availability of spare parts. This was crucial, especially for consumer durables. This approach was designed to build customer loyalty.

The company would have used customer relationship management (CRM) systems to segment customers and understand purchasing patterns. This would allow them to tailor marketing campaigns. Data analysis would have been vital for understanding customer behavior.

- CRM systems would have helped in segmenting the customer base.

- Data analysis would have been used to understand purchasing behaviors.

- Targeted marketing campaigns would have been developed based on data insights.

- The goal was to build customer loyalty through reliable product performance and efficient service.

For further insights into the company's marketing approach, you can refer to the Marketing Strategy of Videocon.

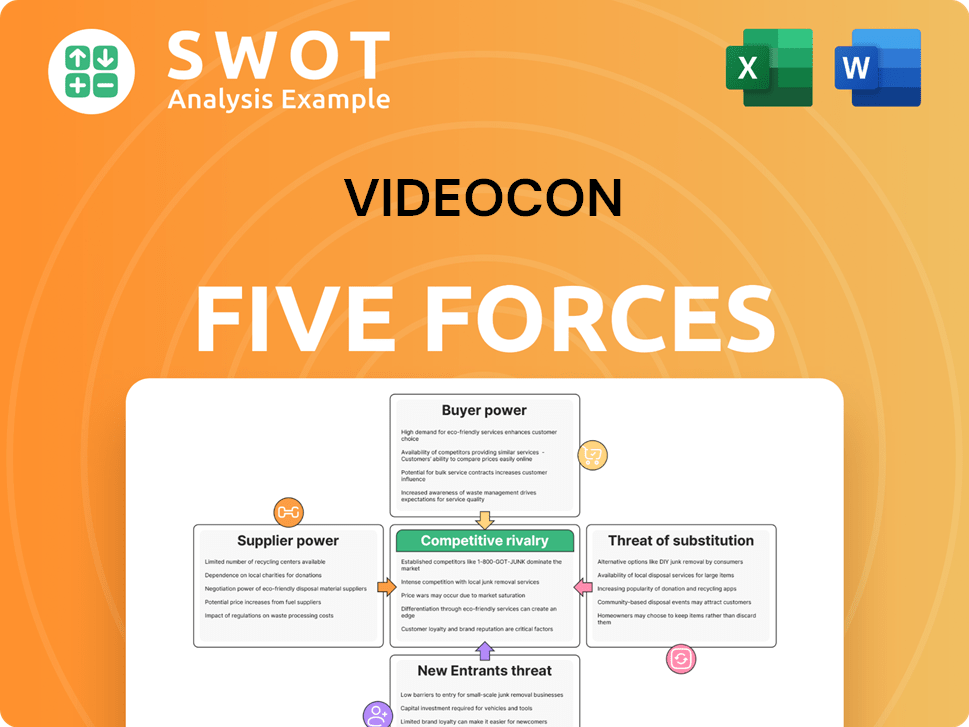

Videocon Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Videocon Company?

- What is Competitive Landscape of Videocon Company?

- What is Growth Strategy and Future Prospects of Videocon Company?

- How Does Videocon Company Work?

- What is Sales and Marketing Strategy of Videocon Company?

- What is Brief History of Videocon Company?

- Who Owns Videocon Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.